- Home

- »

- Drilling & Extraction Equipments

- »

-

Mining Chemicals Market Size, Share & Trends Report, 2030GVR Report cover

![Mining Chemicals Market Size, Share & Trends Report]()

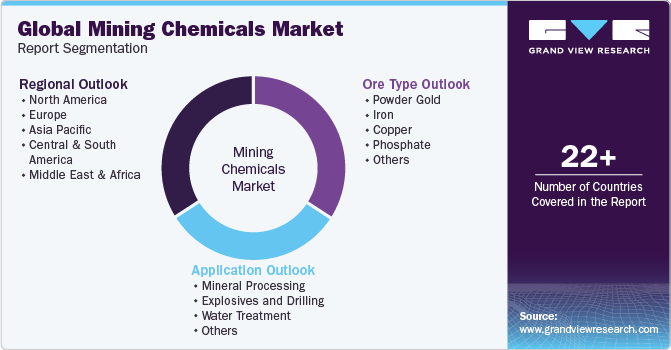

Mining Chemicals Market Size, Share & Trends Analysis Report By Ore Type (Powder Gold, Iron, Copper), By Application (Mineral Processing, Explosives & Drilling), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-329-4

- Number of Pages: 153

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Bulk Chemicals

Report Overview

The global mining chemicals market size was valued at USD 10.71 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is attributable to a growing demand for minerals in various end-user industries such as electronics, medical equipment, paints & coating, and others. According to a World Bank article published in March 2020, the production of minerals like graphite, cobalt, and lithium will grow by 500% by 2050, due to the growing demand for clean energy technologies. Thus, increasing demand for minerals boosts the demand for mining chemicals in the market.

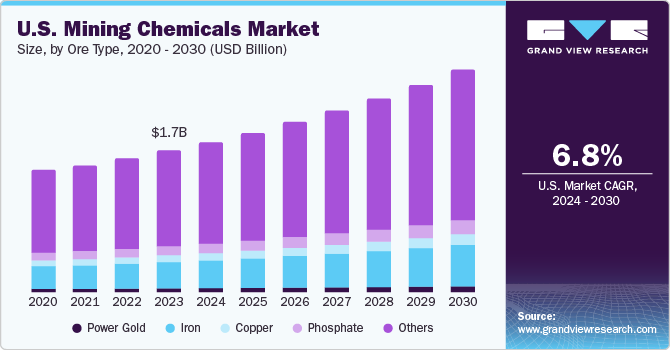

The demand for the product in North America is primarily driven by the increasing mining operations and mineral production in the U.S. and Canada. The coal industry is the key end-user of the product as it is highly reliable on coal for generating electricity. In the U.S., over 19.3% of electricity was generated from coal in 2020, as per the data by the U.S. Energy Information Administration.

In the coming years, digital mines are likely to utilize evolving digital technologies such as the Industrial Internet of things (IIoT). Purposively placed sensors that are connected to the internet can be used for the collection of data from mines in real time. They help in improving the efficiency of operations, reduce costs, and enhance safety. They also help in eliminating injuries and fatalities caused by high-energy environments. These factors are expected to create new opportunities for the mining industry over the forecast period

Raw materials such as nitric acid, mercury, sulfuric acid, cyanide, lead, and uranium are used in the manufacturing of mining chemicals. These chemicals are highly harmful and toxic to humans and the environment. As a result, they are regulated by several regulations by the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH); Industrial Chemicals Act; and OSPAR Convention.

Ore Type Insights

Iron ore type dominated the mining chemicals market with a revenue share of more than 18% in 2022. Its high share is attributable to the increasing demand for product with fewer impurities from the steel industry. The propelling demand for iron ore in various industries including petroleum and wastewater is expected to propel the growth.

The demand for iron ore is witnessing a rise globally, however, with decreasing reserves of high-grade iron ore, froth floatation is extensively used as a process intermediate. Froth floatation is used to remove the impurities from iron ore. Flotation of iron ore is done through two methods, namely direct floatation of iron oxides and reverse floatation of gangue minerals with depression of iron oxides. Reverse floatation is the most widely used method in iron route floatation.

Phosphate is another major ore segment after iron accounting for a high share owing to augmenting demand from cement industries across the globe coupled with growing phosphate mining activities in major economies including China, the U.S., Indonesia, Australia, and others.

Closely following behind, with the second largest revenue share globally is the vitamins product segment. Vitamins are as essential for animal growth as they are for humans. Vitamin deficiency can hinder the growth of animals and stop them from reaching their full potential.

Other products include carbonate oxides, sulfide, zinc, and aluminum. Depressants are used in zinc ore to increase the efficiency of the flotation process by inhibiting the interaction of the metal with the collector. Zinc is used in coatings to improve corrosion protection against white rust. The function of depressants is to prevent the flotation of the desired mineral from being floated. Thus, the rising application of the aforementioned ores in wastewater treatment activities is expected to positively impact the market growth.

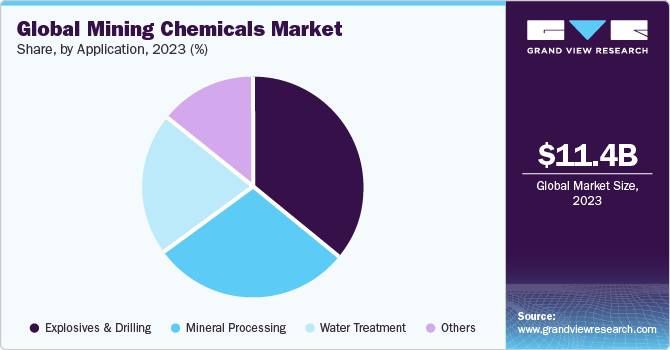

Application Insights

Explosives and drilling application dominated the market with a revenue share of more than 35% in 2022. This high share is attributable to the growing demand for minerals and metals leads. Rising minerals mining activities in the major economies are expected to drive the segment growth.

As per the World Bank report, the growing role of metals and minerals for a low-carbon future, green energy technologies necessary for achieving environmental sustainability are likely to fuel the demand for minerals and metals including zinc, aluminum, copper, lead, lithium, steel, silver, manganese, nickel, neodymium, silver, indium, and molybdenum.

Mineral processing is another major segment accounting for a revenue share of 28.8% in 2022. Growing demand for major commodities, including iron ore and copper, is driving the growth of the mineral processing market globally. The mining industry has witnessed a growth in the demand for technologies for processing complex minerals.

Furthermore, the major issues faced by mining companies include resource management, regulations regarding the use of water, and challenges associated with the need for reducing environmental impact. Water & wastewater treatment is crucial to abide by the regulations regarding the use of water and its environmental impact.

Water treatment systems are used in several mineral processing plants such as gold, copper, and others. The treatment of water used for processing leads to minimized corrosion & equipment blockage, improved water quality & flow, scaling, and lower chemical costs& dosages. The demand for water treatment in the mining industry is witnessed to grow considerably owing to rising concerns regarding the release of pollutants to natural water sources and the highly acidic nature of the mining water.

Regional Insights

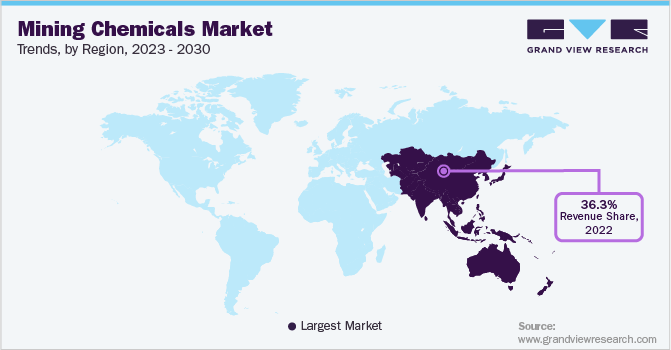

Asia Pacific region dominated the market with a revenue share of 36.3% in 2022. This high share is attributed to growing mineral processing activities in countries including India, China, and others which are projected to promote the utilization of the product in the region over the forecast period.

Additionally, China accounts for the largest market share in Asia Pacific as China is the largest producer of coal, gold, and other earth minerals. China has a large number of mines, which are going through improvements such as setting up new sewage treatment plants and the development of sewage and wastewater treatment plants.

Increasing foreign investments in emerging countries of Asia Pacific, including India and China, have contributed to the growth of the mining chemicals industry in the region. India has an abundance of natural reserves of coal, titanium, diamond, bauxite, and limestone.

Furthermore, the demand for mining chemicals in Central & South America is majorly driven by an increase in mining and mineral processing activities in countries such as Brazil, Colombia, Argentina, and Chile. The region majorly produces iron ore, copper, and ubiquitous gold. Expanding mining industry can be attributed to the large-scale foreign investments by private companies for exploration activities across the region.

The region is expected to witness significant growth on account of several existing and upcoming mining projects. Peru and Chile are anticipated to witness new opportunities in the mining sector over the forecast period. These factors are likely to fuel the demand for mining chemicals in the region.

Key Companies & Market Share Insights

The mining chemicals industry is immensely competitive owing to the presence of multinational companies that are involved in continuous R&D activities and local players. Companies such as Ashland, Sasol, BASF SE, and Dow dominate the market due to their extensive product portfolio catering to each application and global brand presence. These companies dominate the global mining chemicals industry with their extensive presence throughout the value chain.

The major companies are also focusing on signing partnership agreements with distributors, capacity expansions, and adopting different operational strategies to gain an edge in the competitive market space. Key players are focusing on expanding their business in the African region, due to growing gold mining activities in Ghana, South Africa, and Mali. For instance, Clariant is focusing on acquiring established distributors to enhance its market presence in the South African region. The players penetrating the market are focusing to enhance their product placement and in turn, capture a broader share in the regional market as well as global. Some prominent players in the global mining chemicals market include:

-

AECI Mining Chemicals

-

BASF SE

-

Ashland

-

Dow

-

Kimleigh Chemicals SA (Pty) Ltd (PTY) LTD

-

Cytec Solvay Group

-

Arkema

-

Clariant

-

Nowata

-

Kemira

-

Shell Chemicals

-

Quaker Chemical Corporation

-

Akzo Nobel N.V.

-

Solenis

-

Sasol

Mining Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.33 billion

Revenue forecast in 2030

USD 18.13 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ore type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Russia; Italy; China; India; Japan; South Korea; Argentina; Peru; Chile; Columbia; Saudi Arabia; Africa; South Africa; Ghana; Morocco; DRC; Zambia; Zimbabwe; Tanzania; Mali; Ivory Coast; Sudan

Key companies profiled

AECI Mining Chemicals; BASF SE; Ashland; Dow; Kimleigh Chemicals SA (Pty) Ltd (PTY) LTD; Cytec Solvay Group; Arkema; Clariant; Nowata; Kemira; Shell Chemicals; Quaker Chemical Corporation; Akzo Nobel N.V.; Solenis, Sasol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Mining Chemicals Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mining chemicals market report based on ore type, application, and region:

-

Ore Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder Gold

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Iron

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Copper

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Phosphate

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

Others

-

Collectors

-

Coatings

-

Flocculants

-

Grinding Aids

-

Solvent Extractants

-

Dust Suppressants

-

Defoamers

-

Antiscalants

-

Biocides

-

Lubricants

-

Frothers

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral Processing

-

Explosives and Drilling

-

Water Treatment

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Peru

-

Chile

-

Columbia

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Ghana

-

Morocco

-

DRC

-

Zambia

-

Zimbabwe

-

Tanzania

-

Mali

-

Ivory Coast

-

Sudan

-

-

Frequently Asked Questions About This Report

b. The global mining chemicals market size was estimated at USD 10.71 billion in 2022 and is expected to reach USD 11.33 billion in 2023.

b. The global mining chemicals market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 18.13 billion by 2030.

b. Asia Pacific dominated the mining chemicals market with a share of 36.3% in 2022. This is attributable to rising mineral processing and explosives & drilling sectors in the region.

b. Some key players operating in the mining chemicals market include Ashland Inc.; The Dow Chemical Company; Chevron Phillips Chemical Company LP; BASF SE; and ExxonMobil.

b. Key factors that are driving the mining chemicals market growth include increasing mining activities, rising emphasis on water & wastewater treatment, and increasing focus on the recovery of high-quality minerals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."