- Home

- »

- Advanced Interior Materials

- »

-

Lithium Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Lithium Market Size, Share & Trends Report]()

Lithium Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Carbonate, Hydroxide), By Application (Automotive, Consumer Electronics, Grid Storage, Glass & Ceramics), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-581-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium Market Summary

The global lithium market size was estimated at USD 32.38 billion in 2025 and is expected to reach USD 96.45 billion by 2033, growing at a CAGR of 14.5% from 2026 to 2033. Vehicle electrification is projected to attract a significant volume of lithium-ion batteries, which is anticipated to drive market growth over the forecast period.

Key Market Trends & Insights

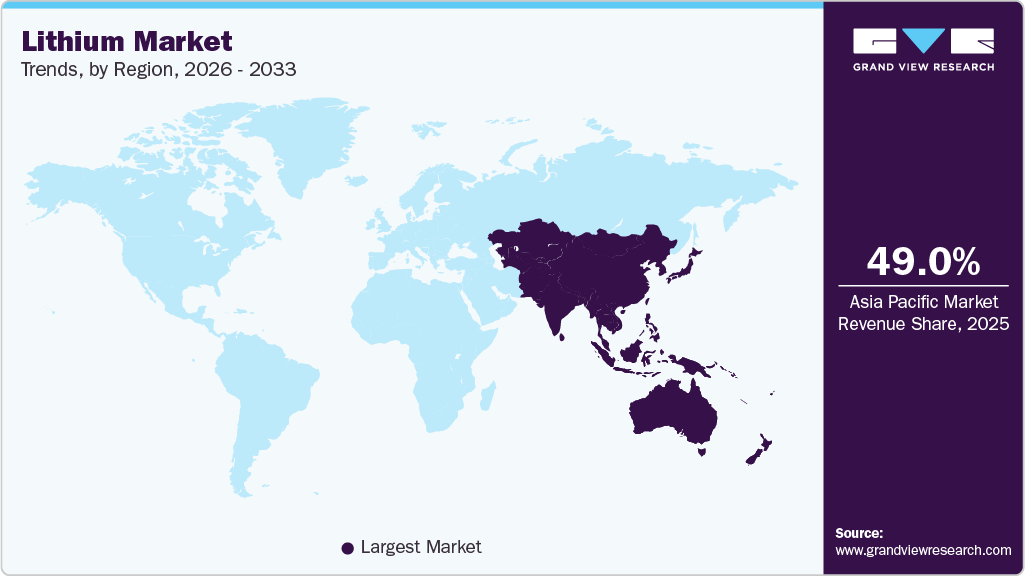

- Asia Pacific dominated the lithium market with the largest market revenue share of over 49% in 2025.

- The U.S. lithium market is booming, fueled by surging domestic EV sales.

- By product, carbonates accounted for the largest market revenue share of over 52.0% in 2025.

- By application, consumer electronics is anticipated to grow at the fastest CAGR over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 32.38 Billion

- 2033 Projected Market Size: USD 96.45 Billion

- CAGR (2026-2033): 14.5%

- Largest Market Region in 2025: Asia Pacific

The automotive application segment is expected to grow substantially, driven by stringent regulations imposed by government bodies on ICE automakers to reduce vehicle carbon dioxide emissions. This has shifted automakers' interest toward producing EVs, which is anticipated to benefit from the demand for lithium and related products.Government subsidies for EVs and investments in this space will likely be an additional booster to market growth. The U.S. holds significant importance in battery production after China, making it one of the key lithium-consuming countries in the world. As of 2024, the United States possesses substantial lithium resources, with estimates ranging from 14 million metric tons to 20-40 million tons, depending on new geological findings. Despite this, domestic lithium production remains limited. In 2024, the U.S. produced approximately 610 metric tons of lithium, accounting for about 0.3% of global production. This output is insufficient to meet the growing demand driven by the EV market.

The U.S. government is investing heavily in domestic lithium production. The U.S. Department of Energy (DOE) announced an investment of USD 25 million across 11 projects to advance materials, processes, machines, and equipment for domestic manufacturing of next-generation batteries. These projects will advance platform technologies upon which battery manufacturing capabilities can be built, enabling flexible, scalable, and highly controllable processes.

Recognizing the strategic importance of lithium, the U.S. Department of the Interior designated it as a critical mineral in 2018, a move that expedited the mine permitting process. This was highlighted by the approval of the Thacker Pass Lithium Mine by the Bureau of Land Management in January 2021. Operated by Lithium Nevada Corporation, this mine is poised to become the largest lithium supply source in the U.S., with projections indicating its capability to produce approximately 60 kilotons of battery-grade lithium carbonate annually by 2026.

The U.S. government is implementing measures to ensure a sufficient lithium supply to meet the increasing demand from various industries. In September 2023, an agreement worth USD 90 million was signed between Albemarle Corporation and the U.S. government to support domestic mining and production of lithium. The agreement's objective is to assist Albemarle in reopening its Kings Mountain, N.C., lithium mine, which is anticipated to commence operations between 2025 and 2030. Albemarle's Kings Mountain mine is expected to contribute to expanding domestic lithium production for the country's battery supply chain. Arkansas is sitting atop lithium reserves that could be vast enough to satisfy the entire world’s demand for EV batteries, according to the US Geological Survey (USGS).

Drivers, Opportunities & Restraints

The global lithium market is experiencing robust growth, driven by the escalating demand for lithium-ion batteries (LIBs) across various industries. This surge is primarily attributed to the increasing adoption of EVs, advancements in consumer electronics, and the expansion of renewable energy storage solutions.

Lithium-ion batteries are integral to powering EVs, offering high energy density and efficiency. For instance, General Motors (GM) and LG Energy Solution are developing lithium manganese-rich (LMR) battery technology for future EVs to enhance energy density and reduce costs. This innovation is expected to significantly improve the affordability and range of electric vehicles, thereby accelerating their adoption.

Lithium oxide serves as a flux in the glass and ceramics industry. Additionally, lithium is utilized to produce lubricants, where lithium stearate acts as a thickening agent, improving performance and durability. As the global emphasis on clean energy intensifies, lithium's pivotal role in energy storage systems, such as those used for solar and wind energy, further underscores its importance.

Energy storage systems (ESS) play a crucial role in decoupling energy production from consumption, facilitating the integration of renewable sources like solar and wind into the grid. Lithium-ion batteries (LIBs) have emerged as the dominant technology in ESS, accounting for over 75% of global electrochemical storage capacity in 2023. This dominance is attributed to their high energy density, long cycle life, and scalability, making them ideal for applications ranging from grid stabilization to EVs. The rapid adoption of EVs, driven by stringent emission regulations and advancements in battery technology, further propels the demand for LIBs. Innovations such as lithium manganese-rich (LMR) batteries are expected to enhance energy density and reduce costs, potentially offering over 400 miles of range per charge.

Product Insights

Carbonate segment held the revenue share of over 52.0% in 2025. Lithium Carbonate (Li2CO3) is the most stable inorganic compound used to form other compounds, such as LiOH and even pure metal. Carbonate products are also used in the treatment of bipolar disorder. This compound is also used in batteries and has several applications in the construction sector, including waterproofing slurries and adhesives. LiOH is a white hygroscopic crystalline material and an inorganic compound primarily used by battery manufacturers; it is commercially available as anhydrous and monohydrate.

It is used in transportation applications, such as manufacturing submarines and spacecraft. Rapid development in battery technologies propels demand for LiOH, thus driving market growth. Many automotive players are inclined to adopt LiOH for battery manufacturing, which is expected to benefit market growth positively.

For instance, in 2024, BMW strengthened its EV supply chain through strategic partnerships to secure lithium supplies. A notable development was BMW's agreement with Critical Metals Corp., which included a USD 15 million pre-payment for lithium hydroxide (LiOH) from the Wolfsberg Lithium Project in Austria. This arrangement underscores BMW's commitment to ensuring a stable supply of critical materials for EV production in Europe.

Application Insights

Automotive segment held the revenue share of over 41.0% in 2025. Automakers are accelerating the shift from internal combustion engines to battery-powered vehicles to meet fuel efficiency targets and reduce emissions. Lithium-ion batteries remain the preferred energy storage solution for electric cars due to their high energy density, longer driving range, and declining cost per kilowatt hour, directly translating into higher lithium demand from the automotive industry. In 2024, global electric vehicle sales reached record levels with about 17 million units sold, reflecting strong consumer and manufacturer adoption of electrified mobility. These sales accounted for more than 20 % of all new car sales worldwide, highlighting the automotive segment’s substantial contribution to lithium demand for battery production.

The consumer electronics application segment is anticipated to register the fastest revenue CAGR over the forecast period. The consumer electronics segment stands as the foundational pillar of the lithium-ion battery market, and its sustained growth is propelled by an ever-expanding and innovating array of portable devices. The primary driver remains the relentless consumer demand for greater mobility, connectivity, and functionality, which directly translates into a need for compact, high-energy-density power sources. Lithium-ion batteries, with their superior energy-to-weight ratio and rechargeability compared to older technologies, are uniquely positioned to meet this demand. From smartphones and laptops to tablets and wireless earbuds, the proliferation of these essential tools of modern life creates a vast, continuous replacement market.

Regional Insights

Asia Pacific Lithium Market Trends

Asia Pacific held over 49% revenue share in 2025 of the global lithium market. The Asia Pacific market is primarily driven by its strategic dominance of the EV battery supply chain, which is underpinned by decisive government mandates. China, as the regional and global leader, has implemented aggressive New Energy Vehicle (NEV) sales targets and consumer subsidies, creating a massive and guaranteed domestic market. This policy-driven demand is serviced by an integrated manufacturing ecosystem, exemplified by battery behemoths like CATL and BYD, which have constructed sprawling gigafactories and secured long-term lithium supply from mines worldwide to ensure feedstock for millions of batteries annually.

North America Lithium Market Trends

The North American lithium market is undergoing a transformative acceleration, primarily driven by a powerful combination of federal policy and a strategic push for energy independence and supply chain security. The landmark U.S. Inflation Reduction Act (IRA) of 2022 serves as the central catalyst, creating direct financial incentives for both EV adoption and the establishment of a domestic battery supply chain.

The U.S. lithium market is booming, fueled by surging domestic EV sales. Driven by federal policies like the Inflation Reduction Act's consumer tax credits, EV adoption has accelerated rapidly, with sales exceeding 2 million units in 2024. This demand from top-selling models like the Ford F-150 Lightning and Tesla Model Y compels automakers and battery manufacturers to invest heavily in domestic gigafactories, creating a self-reinforcing cycle of production and supply chain expansion.

Europe Lithium Market Trends

The European lithium market is being rapidly reshaped by the continent's aggressive green industrial policy and a surge in localized electric vehicle production. The overarching driver is the European Union's Green Deal and its 2035 ban on the sale of new internal combustion engine vehicles, which has created a regulatory imperative for automakers to electrify.

Latin America Lithium Market Trends

The Latin American lithium market is defined by its vast resource wealth and a pivotal strategic shift, as producing nations move beyond their traditional role as mere exporters of raw brine to capture greater value domestically. The primary growth driver is soaring global demand, but it is now increasingly mediated by assertive national industrial policies aimed at developing local battery supply chains. This is most pronounced in the "Lithium Triangle" of Argentina, Bolivia, and Chile, where governments are implementing varied models, from Argentina's more open investment approach to Chile's state-led public-private partnerships and Bolivia's fully nationalized control, to mandate on-site lithium processing and foster downstream industries like battery component manufacturing.

Key Lithium Company Insights

Some of the key players operating in the market include Albemarle, Ganfeng Lithium Co., Ltd., and Mineral Resources.

-

Albemarle’s lithium segment is developing lithium-based materials for various industries. The segment manufactures lithium carbonate, hydroxide, chloride, value-added lithium specialties, and reagents, including butyllithium and lithium aluminum hydride. In addition, the segment offers technical services such as handling reactive lithium products and customer recycling services for lithium-containing by-products obtained from synthesis with organolithium products, lithium metal, and other reagents.

-

Ganfeng Lithium Co., Ltd. serves various industries, including electric vehicles, pharmaceuticals, chemicals, energy storage, and 3C (Computer, Communication, and Consumer Electronics) products. The company can extract lithium from ore, brine, and recycled materials, offering more than 40 lithium and other metal compounds.

Key Lithium Companies:

The following are the leading companies in the lithium market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- Sigma Lithium

- Ganfeng Lithium Group Co., Ltd

- Pilbara Minerals

- Lithium Americas Corp

- Tianqi Lithium Australia

- Mineral Resources

- Core Lithium

- Galaxy Resources Limited

- Lithium Corporation

Lithium Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 37.50 billion

Revenue forecast in 2033

USD 96.45 billion

Growth rate

CAGR of 14.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; China; Japan; South Korea; India; Argentina; Brazil; UAE; Saudi Arabia

Key companies profiled

Albemarle Corporation; Sigma Lithium; Ganfeng Lithium Group Co., Ltd; Pilbara Minerals; Lithium Americas Corp; Tianqi Lithium Australia; Mineral Resources; Core Lithium; Galaxy Resources Limited; Lithium Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global lithium market report on the basis of product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Carbonates

-

Hydroxide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2021 - 2033)

-

Automotive

-

Consumer Electronics

-

Grid Storage

-

Glass & Ceramics

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2021-2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global lithium market size was estimated at USD 32.38 billion in 2025 and is expected to grow at a CAGR of 14.5% from 2026 to 2033.

b. The global lithium market is expected to grow at a compound annual growth rate of 14.5% from 2026 to 2033 to reach USD 96.45 billion by 2030.

b. The carbonate product segment dominated the market in 2025, with the largest share of over 52.0% in terms of revenue.

b. Some of the key vendors of the global Lithium market are Albemarle Corp., Ganfeng Lithium Co., Ltd., SQM S.A., Tianqi Lithium Corp., Livent Corp., Lithium Americas Corp., Pilbara Minerals, Orocobre Ltd., Pty. Ltd., Mineral Resources.

b. The global lithium market is experiencing robust growth, driven by the escalating demand for lithium-ion batteries (LIBs) across various industries. This surge is primarily attributed to the increasing adoption of electric vehicles (EVs), advancements in consumer electronics, and the expansion of renewable energy storage solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.