- Home

- »

- Nanoparticles

- »

-

Nano Calcium Carbonate Market Size & Share Report, 2030GVR Report cover

![Nano Calcium Carbonate Market Size, Share & Trends Report]()

Nano Calcium Carbonate Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Plastics, Rubber, Building & Construction), By Region (Asia Pacific, North America, Europe), And Segment Forecasts

- Report ID: GVR-1-68038-159-7

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

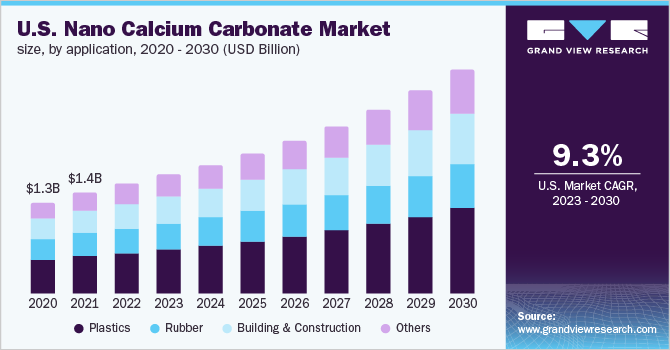

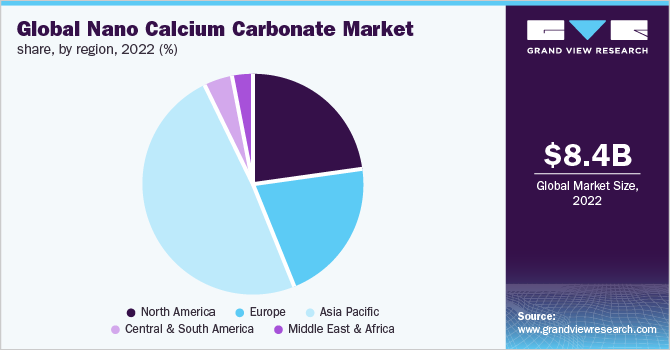

The global nano calcium carbonate market size was valued at USD 8.42 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030. This is attributed to the increasing demand for environmentally friendly plastic materials with low CO2 emissions, sealants in automotive components, and rising demand for additives. The industry is expected to grow in the coming years due to the increasing demand for high-performance and sustainable materials in various industries. Asia Pacific is the largest regional market for nano calcium carbonate due to the high demand from the plastics, rubber, and paint and coatings industries in countries, such as China, India, and Indonesia.

The markets in North America and Europe will also grow due to the increasing demand for lightweight and high-strength materials in the automotive and aerospace industries. Nano calcium carbonate is used as a filler and reinforcing agent in the plastics, rubber, and paints & coatings industries to improve the strength and performance of these materials. It is a natural material and its use can help reduce the carbon footprint of applications. This is driving the product demand in industries, such as construction and packaging, where sustainability is a key concern. The COVID-19 pandemic has had a mixed impact on the global market. The lockdown measures implemented to control the spread of the virus disrupted the supply chain and resulted in a decline in demand for certain applications.

On the other hand, the demand for certain applications, such as Personal Protective Equipment (PPE) and disinfectants, has increased due to the pandemic. Furthermore, the demand for the product in the food and pharmaceutical industries has been relatively stable, as these are essential industries that have continued to operate during the pandemic, which has boosted the demand for nano calcium carbonate in the healthcare, food & beverage, and medical sectors. Overall, the adverse impact of the COVID-19 pandemic has been mitigated by the stable demand for certain applications and industries mentioned above.

Application Insights

The plastics application segment dominated the industry in 2022 and accounted for the maximum share of 36.25% of the overall revenue. This is attributed to the product’s growing use in the plastics industry as it is a cheaper and more stable alternative to plastic resins, while also improving the physical properties of the finished application. Nano calcium carbonate, in particular, is a very fine, high-purity form of calcium carbonate that has a small particle size and a large surface area. This makes it an attractive choice for use in the plastic industry because it can improve the performance of the plastic in various ways, including increasing its strength, stiffness, and dimensional stability. Nano calcium carbonate is also commonly used as a filler material in the rubber industry.

It is used to improve the physical properties of rubber applications and to reduce the cost of the finished application by replacing more expensive rubber polymers. It can also improve the processing characteristics of the rubber, such as its flowability and moldability. It is typically used in small amounts, typically around 1-10% by weight, depending on the application. The growth of end-use industries is expected to further accelerate the market growth over the forecast period. The development of new processing technologies has made it possible to produce high-quality nano calcium carbonate with consistent particle size and high purity, which has increased its adoption in various industries. The increasing construction and infrastructure development in developing countries is driving the demand for building materials, which is in turn driving the growth of the industry.

Regional Insights

The Asia Pacific region dominated the industry in 2022 and accounted for the maximum share of more than 48.90% of the overall revenue. This is attributed to many factors such as this region has a large and growing demand for plastic and rubber applications, which is driving the demand for nano calcium carbonate as a filler material in these industries. Additionally, economic growth in the Asia Pacific region is also driving the demand for nano calcium carbonate, as a growing economy leads to increased consumption of goods that use nano calcium carbonate as a raw material. North America region is estimated to grow at a CAGR of 9.5% by 2030.

The region is home to a large and developed manufacturing sector, which contributes to the demand for nano calcium carbonate as a material used in the production of various goods. Furthermore, advances in technology may lead to the development of new applications for nano calcium carbonate, increasing its demand in the region. The demand for fortified food in North America region is also increasing especially after the COVID-19 pandemic. Nano calcium carbonate is used as a food additive to improve the nutritional content of food applications. The increasing demand for fortified food applications is also a major driving factor for the growth of the regional market.

Key Companies & Market Share Insights

The industry has many players offering a wide range of applications including different grades, sizes, and forms of nano calcium carbonate. Key players have a strong global presence and offer high-quality nano calcium carbonate applications. Companies also offer a range of applications that cater to different industries, including coatings, plastics, rubber, and paper. To gain a competitive edge, companies are offering high-quality applications at competitive prices and providing excellent customer service. The key players in the global nano calcium carbonate market are:

-

Chu Shin Chemical Co., Ltd.

-

Enping Yueyi Chemistry Industry Co., Ltd.

-

Fujian Sanmu Nano Calcium Carbonate Co., Ltd.

-

Guangdong Qiangda New Materials Technology Co., Ltd.

-

Imerys

-

Minerals Technologies, Inc.

-

Nanomaterials Technology Co., Ltd.

-

Shanghai Yaohua Nano-Tech Co., Ltd.

-

Hebei Lixin Chemistry Co., Ltd.

-

Omya AG

-

Yuncheng Chemical Industrial Co., Ltd.

Nano Calcium Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.14 billion

Revenue forecast in 2030

USD 17.66 billion

Growth rate

CAGR of 9.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; Czech Republic; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Israel; Iran; Egypt; Nigeria

Key companies profiled

Chu Shin Chemical Co., Ltd.; Enping Yueyi Chemistry Industry Co., Ltd.; Fujian Sanmu Nano Calcium Carbonate Co., Ltd.; Guangdong Qiangda New Materials Technology Co., Ltd.; Imerys; Minerals Technologies, Inc.; Nanomaterials Technology Co., Ltd.; Shanghai Yaohua Nano-Tech Co., Ltd.; Hebei Lixin Chemistry Co., Ltd.; Omya AG; Yuncheng Chemical Industrial Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nano Calcium Carbonate Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nano calcium carbonate market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Rubber

-

Building & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Czech Republic

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Israel

-

Iran

-

Egypt

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global nano calcium carbonate market size was estimated at USD 8.42 billion in 2022 and is expected to reach USD 9.14 billion in 2023.

b. The global nano calcium carbonate market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 17.66 billion by 2030.

b. Asia Pacific dominated the nano calcium carbonate market with a share of 48.95% in 2022. This is attributable to increased construction output and the growth of the automotive industry in the region.

b. Some key players operating in the nano calcium carbonate market include Mineral Technologies Inc., Imerys, Omya AG, Chu Shin Chemical Co., Ltd, Enping Yueyi Chemistry Industry Co., Ltd, Fujian Sanmu Nano Calcium Carbonate Co., Ltd, Guangdong Qiangda New Materials Technology Co., Ltd, Nanomaterials Technology Co., Ltd., Shanghai Yaohua Nano-Tech Co., Ltd, Hebei Lixin Chemistry Co., Ltd. and Yuncheng Chemical Industrial Co., Ltd.

b. Key factors driving the market growth include the growth of the construction sector as it is widely used as a raw material for manufacturing cement, adhesives, and sealants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.