- Home

- »

- Pharmaceuticals

- »

-

Nicotine Replacement Therapy Market Size Report, 2030GVR Report cover

![Nicotine Replacement Therapy Market Size, Share & Trends Report]()

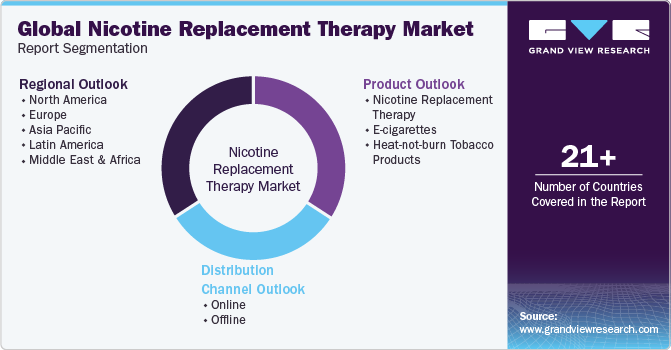

Nicotine Replacement Therapy Market Size, Share & Trends Analysis Report By Product (Nicotine Replacement Therapy, E-cigarettes, Heat-not-burn Tobacco Products), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-292-8

- Number of Report Pages: 82

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

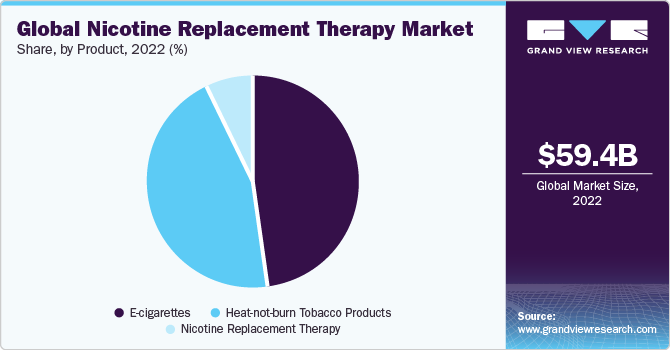

The global nicotine replacement therapy market size was valued at USD 59.4 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 16.3% from 2023 to 2030. The growth can be attributed to the growing number of technological advancements and the increasing number of people undergoing nicotine replacement therapy (NRT). Increasing awareness about the ill-effects of smoking is expected to be a key factor driving the market. The number of people who smoke is rising globally and has surpassed 1.1 billion. Owing to government initiatives such as the “affordable care act”, insurance regulations, and programs for awareness regarding the negative impact of smoking on health by provision of counseling, people are opting for smoking cessation therapies. In 2018, out of the 34.2 million people that smoke in America, 55% tried smoking cessation.

May 31st is celebrated as the No Tobacco Day and organizations such as the American Lung Association and the CDC work toward increasing awareness about the medical conditions that arise due to smoking. As per the NHS, 70% cases of lung cancer cases are a result of smoking. Furthermore, smokers are more prone to getting heart attacks. Annually, 480,000 people in the U.S. die because of smoking. The CDC runs a paid national campaign called the Tips From Former Smokers (Tips) to encourage healthcare providers to tell patients about the effects of smoking and support them in quitting smoking in safe ways.

Technological advancements in the nicotine replacement therapy segment are ongoing, which has led to a rise in the number of people switching to advanced products. Advancements like heat-not-burn products flavored chewing gums, and lozenges are expected to drive the adoption of NRT. The tobacco giants like British American Tobacco have come up with alternatives that are smokeless and less harmful. These advancements have a variable range of effectiveness and are accepted in society when compared to traditional cigarettes, thus driving their adoption and boosting the market growth.

However, the ban on e-cigarettes is one of the most crucial factors hindering the growth of the market. For instance, in September 2019, the Indian government banned the import, production, and sale of e-cigarettes. India is a nation with over 100 million smokers, and this could have been a great opportunity for market growth. In addition, other nations such as Mexico, Brazil, Malaysia, and Thailand have banned the use, import, and production of e-cigarettes in their countries. As of 2020, there are over 20 nations that have banned the use of e-cigarettes. This is expected to have a negative impact on the market growth.

Product Insights

The E-cigarettes segment dominated the market with the largest revenue share of over 45% in 2022. E-cigarettes are growing in popularity and are highly accepted in most countries. The abstinence rate of e-cigarettes is approximately 18%, which is higher than the average abstinence rate of 9.9% for other NRT products. According to the Centers for Disease Control and Prevention, in 2021, a fraction of approximately 1 in 20 adults were e-cigarette users, with a slightly elevated prevalence among men in comparison to women.

Among the age group of young adults, specifically those between 18 and 24 years old, the utilization of e-cigarettes was most noticeable, with 11% of individuals indicating their active consumption of these products. As per the Wiley Journal, in 2019, 17% of patients that combine patches with another form of NRT are able to quit smoking, while 14% are able to quit by using just one type of NRT. The report also suggested that higher nicotine concentration products (4 mg) are more likely to provide positive results than lower concentration (2mg) NRTs.

The heat-not-burn tobacco products segment is expected to grow at the fastest CAGR of 19.1% over the forecast period from 2023 to 2030 due to increasing product launches. An average heat-not-burn device needs tobacco sticks, plugs, a holder, a charger, and a capsule. The awareness amongst smokers regarding these products is high and over 25% want to try the product. Around 0.7% of adults in the U.S. are using HnB products, which constitute 2.7% of smokers.

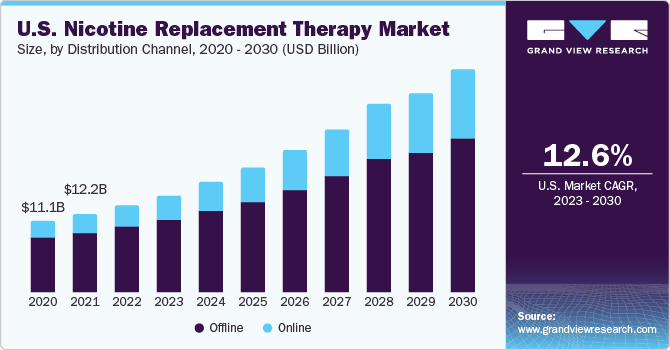

Distribution Channel Insights

The offline segment dominated the market with the largest revenue share of around 80% in 2022. The availability of NRT products including transdermal patches, gels, gums, e-cigarettes, and heated tobacco products in the retail chains, such as Walgreens and Walmart Stores, Inc., supports the segment growth. In addition, the tie-ups of hospitals with these chains contribute to the growth of the market space.

The online segment is expected to grow at the fastest CAGR of 19.4% over the forecast period from 2023 to 2030. The comfort, flexibility, and convenience provided by the online purchase of medications is a major factor driving the segment. In addition, the discounts offered by online pharmacies are expected to fuel segment growth.

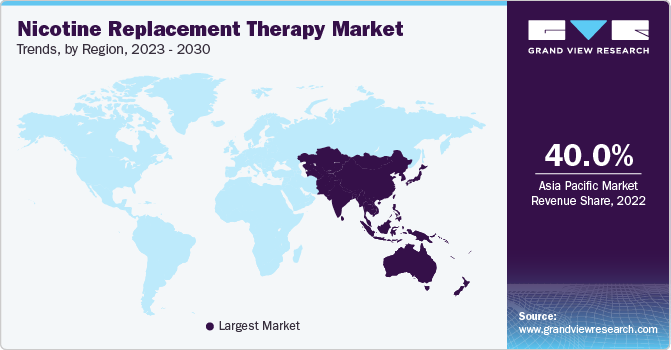

Regional Insights

Asia Pacific dominated the global nicotine replacement therapy market with the largest revenue share of over 40% in 2022 and is also expected to grow at the fastest CAGR of 18.3% over the forecast period from 2023 to 2030. This is attributed to the high demand for such products, increasing market opportunities, and rising competition between the big tobacco companies, especially in Japan, which makes the market very dynamic.

North America held a considerable market share in 2022. The burden of diseases associated with smoking and the increase in the number of favorable government initiatives, coupled with increasing adoption of e-cigarette and heated tobacco, is expected to positively impact the growth of the North American market. In April 2020, the U.S. FDA authorized the marketing and distribution of the IQOS Tobacco Heating System developed by Philip Morris Products S.A. The product is an electronic device that heats the prefilled tobacco sticks to generate the aerosols. Furthermore, in May 2019, GlaxoSmithKline plc. introduced mint-flavored nicotine lozenges Nicorette under over-the-counter product.

Key Companies & Market Share Insights

Market players implement various inorganic growth strategies, such as acquisitions, and organic growth strategies, such as the expansion of the product portfolio, to increase their market reach and presence. New product launches, along with technological advancements by market players, are expected to increase the competition in the market over the forecast period. Many of the major manufacturers are focusing on nicotine replacement research and innovation, which will help to expand their reach and attract a larger customer base. To strengthen their market positions, these suppliers use a variety of techniques, including donations, social work, spreading awareness, and product line expansion.

For instance, in January 2021, Johnson & Johnson Private Limited announced its donation of nicotine replacement therapy to the Ministry of Health of Jordan, facilitated through its partnership with the Access Initiative for Quitting Tobacco (AIQT). This significant donation, valued at approximately USD 800,000 in retail, is intended to provide substantial assistance to numerous Jordanian citizens and refugees in their endeavor to quit smoking amidst the challenges posed by the COVID-19 pandemic and in the post-pandemic period.

In addition, in July 2020, The World Health Organization along with its partners announced the launch of the Access Initiative for Quitting Tobacco to help the global community of 1.3 billion tobacco users in their quitting journey. Through the utilization of cutting-edge artificial intelligence technology, the initiative offers complimentary access to nicotine replacement therapy, while dispelling misconceptions surrounding the correlation between COVID-19 and tobacco use. Furthermore, the program assists individuals in crafting personalized strategies to effectively quit tobacco consumption.

Key Nicotine Replacement Therapy Companies:

- Cipla Inc.

- Pfizer Inc.

- GLENMARK PHARMACEUTICALS LTD.

- Fertin Pharma

- Philip Morris Products S.A.

- British American Tobacco plc

- Japan Tobacco Inc.

- Imperial Brands plc

- Johnson & Johnson Private Limited

Nicotine Replacement Therapy Market Report Scope

Report Attribute

Details

Market Size Value In 2023

USD 69.1 billion

Revenue Forecast In 2030

USD 198.7 billion

Growth rate

CAGR of 16.3% from 2023 to 2030

Base Year for Estimation

2022

Historical Data

2018 - 2021

Forecast Period

2023 - 2030

Report updated

November 2023

Quantitative Units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Product, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key Companies Profiled

Cipla Inc.; Pfizer Inc.; GLENMARK PHARMACEUTICALS LTD.; Fertin Pharma; Philip Morris Products S.A.; British American Tobacco plc; Japan Tobacco Inc.; Imperial Brands plc; Johnson & Johnson Private Limited

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs.

Global Nicotine Replacement Therapy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nicotine replacement therapy market report based on product, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nicotine Replacement Therapy

-

Inhalers

-

Gum

-

Transdermal Patches

-

Sublingual Tablets

-

Lozenges

-

Others

-

-

E-cigarettes

-

Heat-not-burn tobacco products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global nicotine replacement therapy market size was estimated at USD 59.4 billion in 2022 and is expected to reach USD 69.1 billion in 2023.

b. The global nicotine replacement therapy market is expected to grow at a compound annual growth rate of 16.3% from 2023 to 2030 to reach USD 198.7 billion by 2030.

b. E-cigarettes dominated the NRT market with a share of 47.99% in 2022. This is attributable to its large-scale usage and increasing adoption. These products are commonly adopted by younger consumers, although adoption is increasing steadily among middle-aged consumers.

b. Some key players operating in the NRT market include Pfizer Inc., British American Tobacco p.l.c., Cipla Inc., Glenmark, Imperial Brands, Japan Tobacco, Inc., Philip Morris Products S.A., Fertin Pharma, and Johnson & Johnson Services, Inc.

b. Key factors that are driving the nicotine replacement therapy market growth include a growing number of technological advancements and an increasing number of people undergoing nicotine replacement therapy.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."