- Home

- »

- Alcohol & Tobacco

- »

-

Tobacco Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Tobacco Market Size, Share & Trends Report]()

Tobacco Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cigarettes, Kretek), By Distribution Channel (Supermarket/Hypermarket, Online), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-412-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tobacco Market Summary

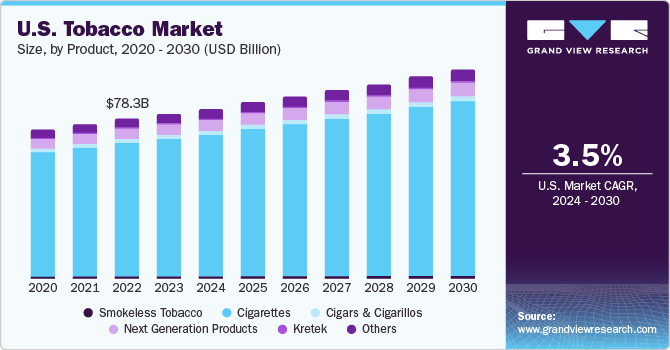

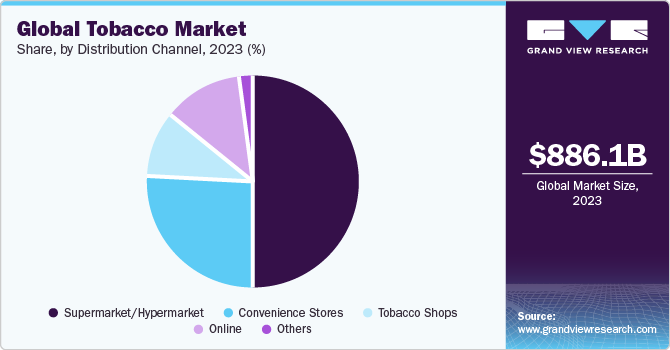

The global tobacco market size was estimated at USD 886.09 billion in 2023 and is projected to reach USD 1,049.87 billion by 2030, growing at a CAGR of 2.5% from 2024 to 2030, due to the rising tobacco consumption in the developing regions of Asia and Africa. The excessive marketing campaigns run by the major companies have also been a significant factor in sustaining the industry.

Key Market Trends & Insights

- Asia Pacific held a share of nearly 60.8% of the overall revenue in 2023.

- North America is projected to grow at a CAGR of 3.4% over the forecast period.

- Based on product, cigarettes accounted for the share of 81.6% of the overall revenue in the tobacco industry in 2023.

- Based on distribution channel, the supermarkets/hypermarkets led the market and accounted for the share of 50.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 886.09 Billion

- 2030 Projected Market Size: USD 1,049.87 Billion

- CAGR (2024-2030): 2.5%

- Asia Pacific: Largest market in 2023

- North America: Fastest growing market

The industry is witnessing a trend of new product launches, which intrigues consumers to consume tobacco and thereby drive market growth. The market continues to thrive due to various influential factors, persisting despite ongoing endeavors to diminish tobacco consumption and address its detrimental effects. A prominent force behind its resilience lies in the addictive properties of nicotine, a substance inherently present in tobacco products. Nicotine engenders a formidable combination of physical and psychological dependence, thereby fueling an enduring demand for tobacco among its existing users. A major factor contributing to the market's resilience is the significant global consumer base. Despite increasing awareness of the health risks associated with the product use, there are still millions of people worldwide who either choose to start smoking or struggle to quit. This large consumer base provides a consistent demand for tobacco products. In 2020, the World Health Organization reported that tobacco usage was prevalent among 22.3% of the global population. Specifically, it was found that 36.7% of men worldwide and 7.8% of women across the globe were tobacco users.

The addition of a new range of tobacco products shows a moderate increase in both the number of individuals who smoke and the percentage of people who try the new products. The use of several intriguing methods in the advertising strategy has resulted in considerable advancements and has proven to be a means of remaining competitive and sustaining market dominance. For instance, specific products are promoted and advertised more intensely to specific demographic, or racial groups. According to the Centers for Disease Control and Prevention (CDC) estimates, Marlboro, Newport, and Camel, whose marketing campaigns specifically targeted the youth, were the highest marketing spenders.

This led to them being the most preferred brand by the youth. Most people have seen tobacco as a significant part of their life, over the previous decade. The companies are spending huge amounts on marketing campaigns to offset the negative impacts faced by the tobacco industry due to increased health awareness among consumers. According to the Federal Trade Commission’s most recent Cigarette Report in 2021, the expenditure on cigarette advertising and promotion saw a slight rise from $7.84 billion in 2020 to $8.06 billion. The two most significant expenditure categories in 2021 were price discounts given to cigarette retailers, amounting to $6.01 billion, and price discounts provided to wholesalers, which totaled $917 million.

When these two categories are combined, they represent a substantial 86 percent of the overall spending in the industry. Tobacco consumption has been on the decline in developed and wealthy countries across the globe, due to the higher level of awareness among the population regarding the adverse effects of its consumption. To maintain demand in such countries, companies are introducing new products that are significantly less harmful than conventional products. The market has witnessed new nicotine products and this category has been dubbed as new, alternative, or novel tobacco. These items are now referred to as next-Generation Products (NGPs) by the tobacco control community.

Major companies have diversified their strategies to develop new product ranges under the NGP category. Phillip Morris International, for instance, has carried out several investments in heated tobacco products. The company is strongly focused on delivering smoke-free heated tobacco products, as it envisions this category to be a game changer in the industry.The IQOS technology is an integral part of Philip Morris's efforts to disrupt itself and become a smoke-free company by 2025. The product already accounted for 23.8% of the company's revenue in 2020. IQOS is a line of heated products developed by the corporation as part of its "heat-not-burn" promotion. Furthermore, Marlboro, a well-known cigarette brand, maintains its status as Philip Morris' best-selling product and accounts for an astounding 80% of the company's global sales each year

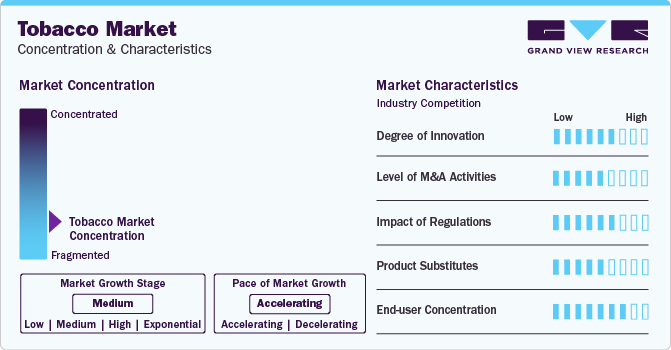

Market Concentration & Characteristics

In the tobacco industry, innovation encompasses a broad spectrum, ranging from product development to marketing strategies. This includes introducing new products that disrupt established markets and adopting fresh perspectives for engaging with consumers, especially newer generations of smokers. Companies often repurpose existing concepts for unique applications or develop entirely new and different solutions.

Several market players such as Philip Morris Products S.A., British American Tobacco, and Scandinavian Tobacco Group A/S, Incorporated are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations significantly impact the tobacco industry, affecting areas such as product development, marketing, and sales. Strict regulatory frameworks can influence product packaging, and advertising restrictions, and impose limitations on where tobacco products can be sold or used. This can lead to increased compliance costs and impact the overall market dynamics. Moreover, regulations such as public smoking bans and increased taxation on tobacco products aim to reduce tobacco consumption, thereby affecting industry revenues. Regulatory pressures also drive innovation in the industry as companies seek to adapt and comply with evolving legal standards.

Product substitutes for tobacco include nicotine replacement therapies like patches, gum, and lozenges, which help reduce cravings and withdrawal symptoms. Other alternatives include e-cigarettes and vaping products that deliver nicotine without combustion and non-nicotine options like herbal cigarettes. Smokeless tobacco products, such as snus or chewing tobacco, also serve as substitutes, though they carry their health risks. Additionally, pharmaceutical aids like varenicline and bupropion are prescribed to assist in quitting smoking. These substitutes vary in their effectiveness and health implications.

Product Insights

Cigarettes accounted for the share of 81.6% of the overall revenue in the tobacco industry in 2023. Cigarette consumption has remained stable due to the introduction of flavored and menthol cigarettes. It can also be attributed to the availability of small cigarettes that facilitate smaller amounts of tobacco consumption for smokers who wish to cut down on their smoking habit. Cigarettes have an inelastic demand, which is a major factor that has driven the segment growth despite the heavy taxation that has been levied across the globe.

The rising popularity of partying and pub culture among millennials and working-class communities has especially fueled the demand for flavored and unflavored cigarettes around the world in recent years. Furthermore, emerging economies, such as India and Thailand, are seeing a significant increase in cigarette demand as a result of the rising youth population in these countries. The market is expected to benefit greatly from the launch of NGPs, which is also expected to become the fastest-growing segment over the forecast period.

Next-generation products are anticipated to witness a significant CAGR over the forecast period. The growth of Next Generation Products (NGPs) in the tobacco industry is influenced by various important factors. These innovative offerings, such as tobacco heating products, vapor products, snacks, and e-cigarettes, are aimed at minimizing the health hazards traditionally linked to smoking. This is a significant appeal for today's health-conscious consumers who are seeking alternatives to conventional smoking methods that pose fewer health risks.

Distribution channel Insights

The supermarkets/hypermarkets led the market and accounted for the share of 50.3% in 2023. Consumers prefer these stores as they offer considerable discounts and offers and are present in close proximity to the users, this facilitates immediate demand fulfillment.

The online distribution channel is projected to grow at a significant CAGR from 2024 to 2030. This is owing to the accessibility and convenience offered by online channels. Purchasing tobacco products online allows customers to browse through a wide range of options, compare prices, and make purchases from the comfort of their own homes. This convenience factor has significantly contributed to the popularity of online channels, especially among busy individuals or those residing in remote areas with limited access to physical tobacco retailers.

Regional Insights

Asia Pacific held a share of nearly 60.8% of the overall revenue in 2023. Offline infrastructure improvements and extensive brand marketing campaigns by prominent companies in key markets, such as India, Bangladesh, China, and the Philippines, are likely to support market expansion in this region. In addition, companies are focusing on customers by introducing flavored cigarettes, which are widely popular among consumers, particularly youth and millennials.

North America is projected to grow at a CAGR of 3.4% over the forecast period owing to the availability and accessibility of tobacco products. The well-established distribution network ensures that these products are widely available in retail outlets, making it convenient for consumers to purchase them.

According to the 2023 National Youth Tobacco Survey, approximately 16.5% of high school students in the U.S. are consumers of at least one tobacco product, which includes e-cigarettes. According to Healio, in 2023, West Virginia had the highest smoking rate in the U.S., at 23.8%.

Key Tobacco Company Insights

-

Philip Morris Products S.A., Altria Group, Inc., British American Tobacco, and Imperial Brands, are some of the dominant players operating in the tobacco market.

-

In June 2023, Altria Group, Inc. completed its acquisition of NJOY Holdings, Inc. This acquisition marked a significant step in Altria's strategy to move beyond smoking, focusing on accelerating the adoption of smoke-free products such as NJOY ACE, a pod-based e-vapor product with FDA authorization. This move aligns with Altria's vision to transition adult smokers to potentially less harmful choices.

-

In February 2023, Scandinavian Tobacco Group A/S completed the acquisition of Alec Bradley Cigar Distributors Inc. and associated companies, which was a significant move for the company. This acquisition was part of their strategy to expand their product portfolio and strengthen their position in the cigar market

Key Tobacco Companies:

The following are the leading companies in the tobacco market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these tobacco companies are analyzed to map the supply network.

- Scandinavian Tobacco Group A/S

- Swedish Match AB

- Altria Group, Inc.

- KT&G Corp.

- Imperial Brands

- Philip Morris Products S.A.

- British American Tobacco

- Japan Tobacco Inc.

- China Tobacco

- ITC Ltd.

Tobacco Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 905.57 billion

Revenue forecast in 2030

USD 1,049.87 billion

Growth rate

CAGR of 2.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Bulgaria; Spain; Scandinavia; China; Japan; India; Indonesia; Malaysia; Argentina; Brazil; UAE; South Africa; Egypt;

Key companies profiled

Scandinavian Tobacco Group A/S; Swedish Match AB; Altria Group, Inc.; KT&G Corp.; Imperial Brands; Philip Morris Products S.A.; British American Tobacco; Japan Tobacco Inc.; China Tobacco.; ITC Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tobacco Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global tobacco market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smokeless Tobacco

-

Cigarettes

-

Cigars & Cigarillos

-

Next Generation Products

-

Kretek

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarket/Hypermarket

-

Convenience Stores

-

Tobacco Shops

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Bulgaria

-

Spain

-

Scandinavia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global tobacco market size was estimated at USD 886.09 billion in 2023 and is expected to reach USD 905.57 billion in 2024.

b. The global tobacco market is expected to grow at a compounded growth rate of 2.5% from 2024 to 2030 to reach USD 1,049.87 billion by 2030.

b. The cigarettes segment was valued at USD 722.27 billion in 2023 and is anticipated to reach USD 852.07 billion by 2030 at a CAGR of 2.4% during the forecast period. The rising health consciousness among the masses, along with the increasing demand for animal-sourced protein, is one of the key factors driving the market. Loin cut benefits greatly from dry aging. Also, these are the tenderest, juiciest, and the most flavorful.

b. Some key players operating in white spirits market Scandinavian Tobacco Group A/S; Swedish Match AB; Altria Group, Inc.; KT&G Corp.; Imperial Brands; Philip Morris Products S.A.; British American Tobacco; Japan Tobacco Inc.; China Tobacco.; ITC Limited

b. Key factors that are driving the market growth include the demand for market has been sustained by the addition of new smokers in the developing regions of Asia, and Africa. The excessive marketing campaigns run by the major companies have also been a significant factor sustaining the industry. The industry is witnessing a trend of new product launches which intrigues consumers to consume tobacco and thereby drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.