- Home

- »

- Advanced Interior Materials

- »

-

Limestone Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Limestone Market Size, Share & Trends Report]()

Limestone Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (High Calcium, Magnesian) By End-use (Building & Construction, Chemical, Agriculture, Chemical), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-021-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Limestone Market Summary

The global limestone market size was estimated at USD 79.18 billion in 2024 and is projected to reach USD 120.70 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. Growing investments in water treatment and purification activities are projected to provide push to the demand of limestone in coming years.

Key Market Trends & Insights

- Asia Pacific limestone market held the revenue share of almost 56% in 2024.

- India is expected to register the highest CAGR from 2025 to 2030.

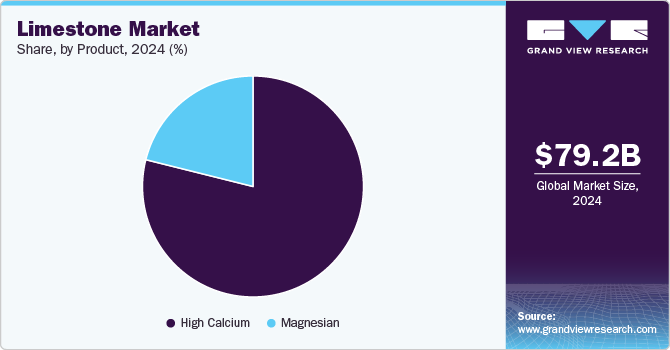

- By product, high calcium accounted for a revenue of USD 6,179,399.3 million in 2024.

- Magnesian is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD USD 79.18 Billion

- 2030 Projected Market Size: USD 120.70 Billion

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

In water treatment, limestone is added to soften the water by removing magnesium and calcium ions. The U.S. is known for the widespread presence of limestone quarries, which makes it self-sufficient and less import reliant.

Drivers, Opportunities & Restraints

Rising awareness and government policies for clean water and human health are anticipated to support the market growth over the said period. For instance, In February 2022 Environment Protection Agency (EPA) of the U.S. announced that they are planning to enforce the clean water and safe drinking water law to provide support to municipal wastewater treatment plants in the U.S. Such favorable policies are likely to benefit market growth over the coming year.

With rapid urbanization, especially in emerging economies, the construction industry’s demand for limestone in cement and concrete production continues to surge. Furthermore, the agricultural sector leverages limestone for soil pH correction and nutrient enhancement, driving additional growth. Environmental uses, like flue gas desulfurization, also offer opportunities as industries increasingly seek eco-friendly solutions to reduce sulfur emissions.

Despite its broad applications, the limestone market faces several challenges that could restrain growth. One major concern is the environmental impact of limestone extraction, which leads to habitat disruption and greenhouse gas emissions. Regulatory restrictions aimed at reducing environmental degradation add complexity and costs to mining operations. Additionally, fluctuating transportation costs and logistical challenges, especially for global exports, can hinder market expansion.

End-use Insights

Limestone is extensively used as a construction material as it adds both beauty and strength to the architecture of a project, hence it has been preferred by architects and builders over the past many years. It is used in concrete and cement, road base, and railroad ballast. For its application in the construction industry, the material is produced in various finishes, including brown, red, pink, cream, gold, and black, however, the pure limestone is nearly white in color.

Along with being useful in the construction of walls and floors of buildings in the construction industry, the material is utilized in furnaces, allowing the refining and manufacturing of steel as well as protecting the refractory lining of furnaces and converters. Limestone accounts for a share of around 27% in the composition of producing crude steel in a basic oxygen furnace and approximately 9% when using an electric arc furnace. According to the World Steel Association, 71.1% of crude steel was produced in a basic oxygen furnace in 2023.

Product Insights

The high calcium segment held a significant revenue share in 2024 due to its extensive use in steel production, environmental applications, and chemical industries. High in calcium carbonate, this product is sought after for its superior properties in applications requiring minimal impurities. As industries prioritize quality and purity, high-calcium limestone is positioned as a preferred material for applications like flue gas desulfurization, water treatment, and as a flux in steelmaking.

The magnesian limestone segment is expected to observe the fastest CAGR from 2025 to 2030, especially valued in construction and agricultural applications for its additional magnesium content. Known for improved soil structure and nutrient balance, it serves as a valuable soil conditioner in the agricultural sector. Its durability and strength make it a popular choice in construction, where it is used in building stone and aggregate production.

Regional Insights

Asia Pacific limestone market held the revenue share of almost 56% in 2024. Asia Pacific limestone market dominates the market on account of being the largest steel producer in the world and the growth of the construction sector in the developing economies of the region. Limestone is the preferred material for the production of cement, which is the key product required in the construction industry. Investments in the cement industry are projected to drive the demand for limestone over the coming years.

India limestone market benefits from rapid urbanization and government-led infrastructure projects, driving demand for cement and concrete. The agricultural sector also supports limestone used for soil conditioning, with high consumption driven by the country’s vast farming areas. The ongoing development of smart cities and industrial zones fuels further demand.

North America Limestone Market Trends

The North American limestone market is supported by infrastructure development, with limestone widely used in cement, aggregates, and environmental applications. Technological advancements in mining and production streamline operations, while environmental policies promote limestone usage in emissions control and water treatment across the region.

U.S. Limestone Market Trends

In the U.S. limestone market demand is driven by extensive use in construction, agriculture, and industrial applications. Environmental regulations play a role, especially in flue gas desulfurization and water treatment. The steady growth in residential and commercial construction provides a reliable base for limestone demand, keeping the market dynamic.

Europe Limestone Market Trends

The limestone market in Europe is shaped by a strong focus on environmental sustainability and stringent regulations. Key sectors include construction, water treatment, and flue gas desulfurization, with eco-friendly initiatives encouraging the use of limestone in reducing emissions. Innovation in limestone-based products for construction adds momentum to the market.

In Germany limestone market, the demand remains steady, particularly in the construction and environmental sectors. The country’s emphasis on green building practices increases the use of limestone in sustainable construction materials. Industrial applications, including steel production, further contribute to demand, positioning Germany as a leading market in Europe.

The limestone market in Russia is bolstered by its construction and mining industries, which require large quantities of limestone for cement and aggregate. The country's focus on infrastructure development across rural and urban areas sustains limestone consumption, with growing industrial demand adding stability to the market.

Key Limestone Company Insights

Some of the key players operating in the limestone market include Imerys, CARMUSE, Lhoist, and Holcim Group

-

Lhoist is a global leader in lime, dolime, and mineral production, with a diverse portfolio serving industries like steel, construction, and environmental management. Known for its focus on sustainable production, the company operates across Europe, the Americas, and Asia, bringing over a century of expertise in mineral solutions.

-

LafargeHolcim, now rebranded as Holcim Group, is a world-leading building materials provider, specializing in cement, aggregates, and concrete. With operations in over 70 countries, the company prioritizes sustainable building solutions, focusing on green construction technologies, waste reduction, and carbon footprint minimization.

Key Limestone Companies:

The following are the leading companies in the limestone market. These companies collectively hold the largest market share and dictate industry trends.

- CARMEUSE

- CEMEX S.A.B. de C.V

- GCCP Resources Limited

- Imerys

- Holcim Group

- Lhoist

- Mineral Technologies Inc.

- Mississippi Lime Company

- National Lime & Stone Company

Recent Developments

- In August 2023, Ambuja Cements Ltd announced the acquisition of Sanghi Industries Ltd. This has increased Ambuja Cement’s limestone reserves by more than one billion tons.

Limestone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.58 billion

Revenue forecast in 2030

USD 120.70 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK: China; Japan; India; South Korea; Indonesia; Bangladesh; Brazil

Key companies profiled

CARMEUSE; CEMEX S.A.B. de C.V; GCCP Resources Limited; Holcim Group; Mississippi Lime Company; Mineral Technologies Inc.; Imerys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Limestone Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global limestone market report based on the product, end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High Calcium

-

Magnesian

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Iron & Steel

-

Agriculture

-

Chemical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

South Korea

-

Bangladesh

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global limestone market size was estimated at USD 79.18 billion in 2024 and is expected to reach USD 84.57 billion in 2025.

b. The global limestone market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 120.70 billion by 2030.

b. Building & construction dominated the limestone market and accounted for a revenue share of more than 82.0% in 2024 on account of widespread applications of limestone in the construction sectors such as cement & concrete and road base.

b. Some of the key players operating in the limestone market include CARMEUSE, CEMEX S.A.B. de C.V, GCCP Resources Limited, Imerys, Holcim Group, Lhoist, Mineral Technologies Inc., Mississippi Lime Company, and National Lime & Stone Company.

b. The key factors driving the limestone market include growth in infrastructural developments and steel production in the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.