- Home

- »

- Biotechnology

- »

-

Oncology Based Molecular Diagnostics Market Report, 2033GVR Report cover

![Oncology Based Molecular Diagnostics Market Size, Share & Trends Report]()

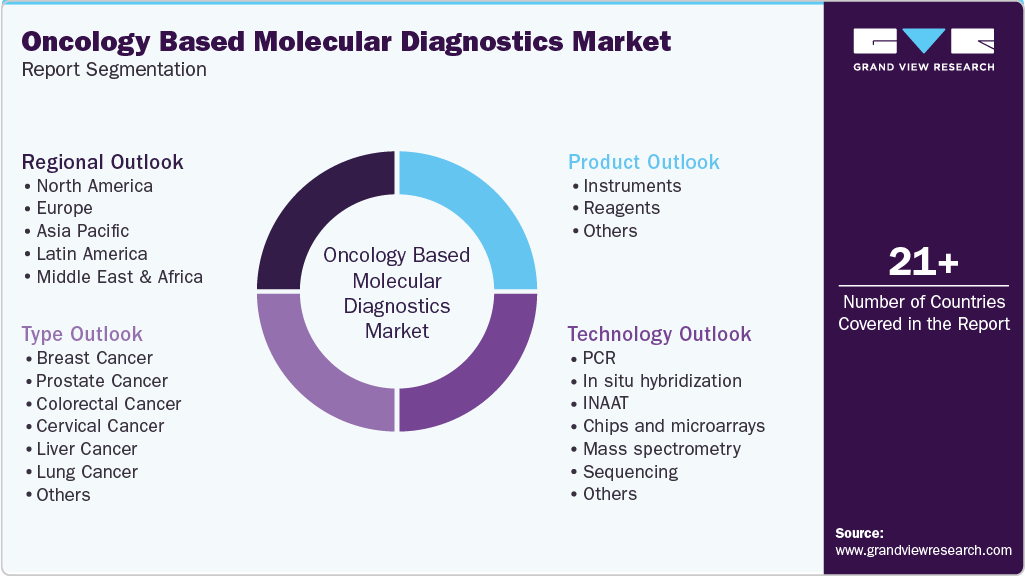

Oncology Based Molecular Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Breast Cancer, Lung Cancer), By Product (Instruments, Reagents), By Technology (PCR, Sequencing), By Region, And Segment Forecasts

- Report ID: 978-1-68038-699-8

- Number of Report Pages: 136

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oncology Based Molecular Diagnostics Market Summary

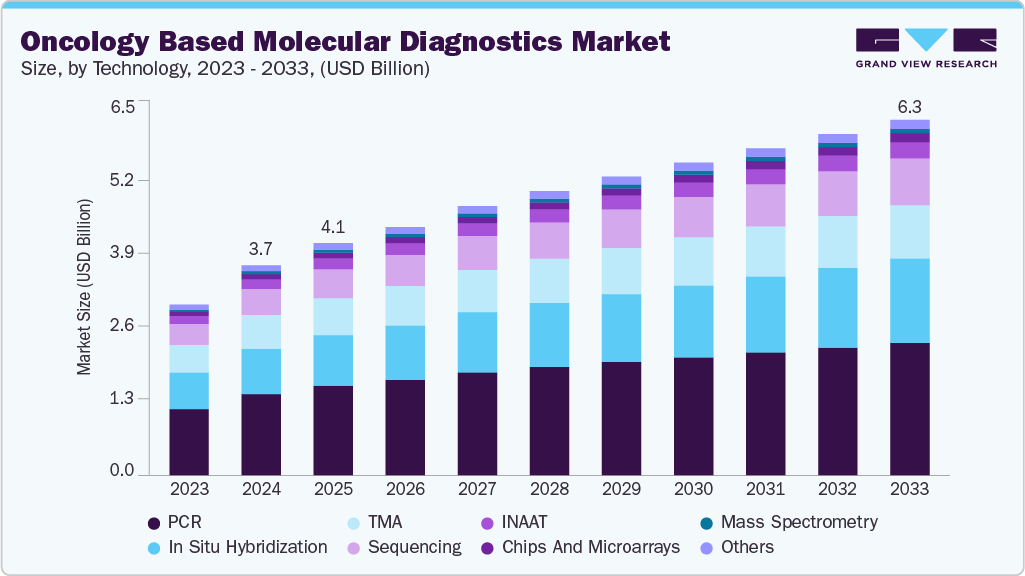

The global oncology based molecular diagnostics market size was estimated at USD 3.75 billion in 2024 and is projected to reach USD 6.35 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2033. This market supports the detection, prognosis, and monitoring of various cancers by identifying genetic mutations, gene expression patterns, and tumor-specific biomarkers through molecular techniques.

Key Market Trends & Insights

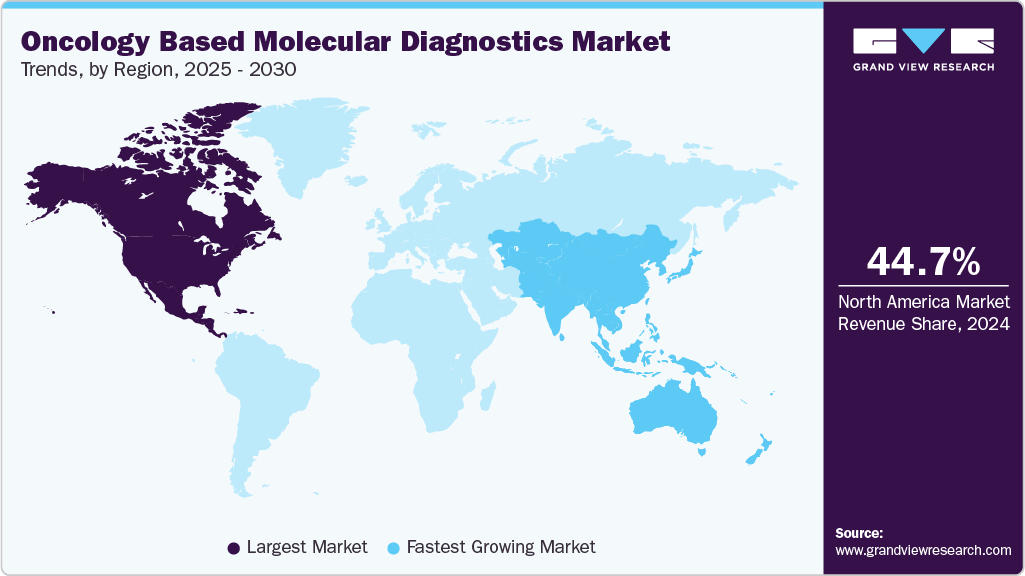

- North America dominated the oncology based molecular diagnostics market with the largest revenue share of 44.69% in 2024.

- The oncology based molecular diagnostics market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on type, the breast cancer segment led the market with the largest revenue share of 18.69% in 2024.

- Based on technology, the polymerase chain reaction (PCR) technology segment led the market with the largest revenue share of 38.65% in 2024.

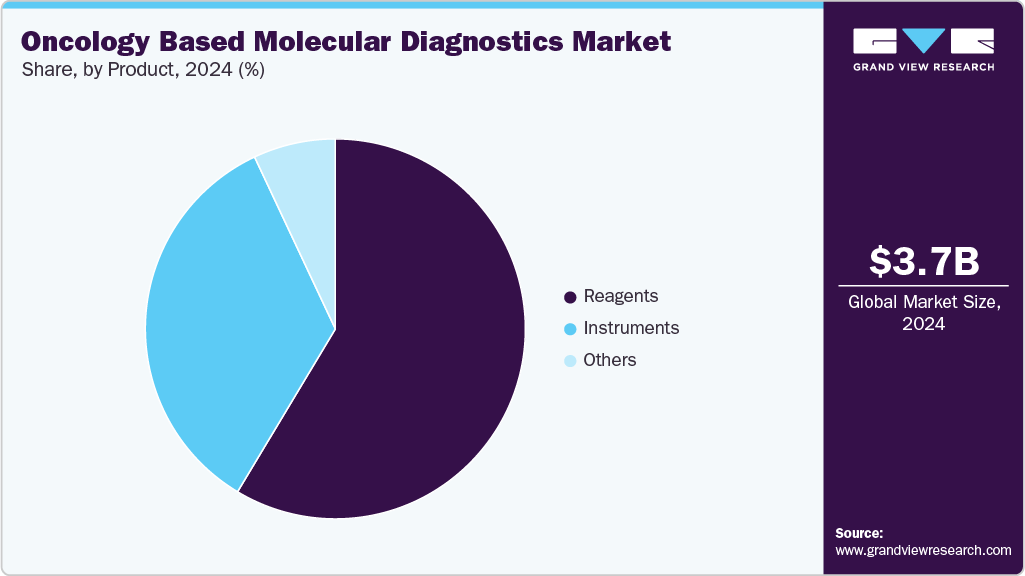

- Based on product, the reagents segment led the market with the largest revenue share of 58.61% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.75 Billion

- 2033 Projected Market Size: USD 6.35 Billion

- CAGR (2025-2030): 5.5 %

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growth is driven by the increasing global cancer burden, growing adoption of precision medicine, and continued innovation in diagnostic technologies such as PCR, NGS, and liquid biopsy platforms.

In addition, rising demand for early cancer detection and personalized therapeutic strategies contributes to market expansion across healthcare systems.

Oncology-based molecular diagnostics involve analyzing DNA, RNA, or proteins to detect cancer-related genetic alterations and guide clinical decisions. These tests help identify specific mutations, gene expressions, or biomarkers associated with various cancers, allowing for more accurate diagnosis, prognosis, and treatment selection. They are commonly used to detect breast, lung, colorectal, and prostate cancers.

These diagnostics play a key role in personalized medicine by helping match patients with targeted therapies and monitoring treatment response. Applications span across hospital labs, reference labs, and research institutions. With continuous improvements in technologies like PCR, next-generation sequencing (NGS), and liquid biopsy, these tests are becoming more efficient and accessible. With oncology care shifting toward individualized treatment, molecular diagnostics have become a critical component of cancer management.

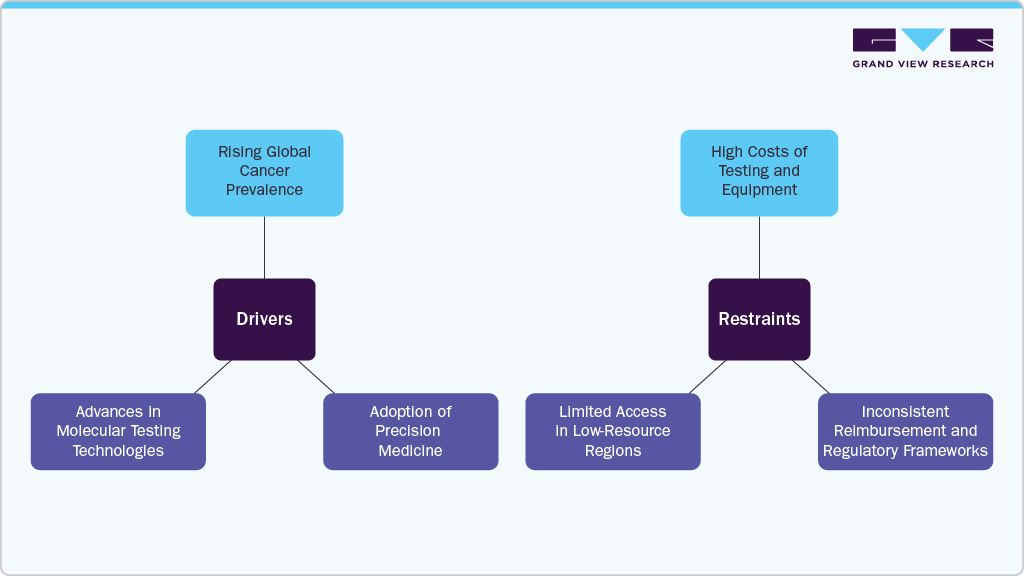

Market Drivers:

-

Rising Global Cancer Prevalence: Increasing incidence of cancer across populations is driving demand for early and precise diagnostic tools that can detect malignancies at a molecular level, improving outcomes and treatment planning.

-

Adoption of Precision Medicine: Growing reliance on targeted therapies has created a need for molecular diagnostics to identify genetic mutations and biomarkers, helping clinicians tailor treatment approaches based on individual tumor profiles.

- Advances in Molecular Testing Technologies: Continuous improvements in PCR, NGS, and liquid biopsy platforms are enhancing test sensitivity, turnaround times, and the ability to detect cancer-related mutations from non-invasive samples, making diagnostics more accessible.

Market Restraints

-

High Costs of Testing and Equipment: The elevated cost of molecular diagnostic tests, instruments, and consumables remains a barrier in resource-limited healthcare settings, especially where funding or reimbursement support is lacking.

-

Inconsistent Reimbursement and Regulatory Frameworks: Variability in regulatory approval timelines and limited reimbursement coverage in certain regions can delay product availability and discourage investment in new molecular tests.

- Limited Access in Low-Resource Regions: Many developing countries face infrastructure challenges, such as lack of specialized labs and trained professionals, which restrict the adoption of oncology-based molecular diagnostics.

Overall, the oncology-based molecular diagnostics market is growing as cancer cases rise and the need for personalized treatment becomes more important. New technologies are making testing faster and more accurate. However, challenges such as high costs, limited access, and uneven reimbursement may affect how widely these tests are used.

Market Concentration & Characteristics

Innovation is high, driven by the need for early detection, minimal invasiveness, and personalized oncology care. Advances in next-generation sequencing (NGS), digital PCR, and AI-powered data interpretation are improving diagnostic accuracy and clinical utility. Liquid biopsy, RNA sequencing, and tumor mutation burden profiling are expanding use cases across solid and hematologic cancers. Integration with cloud platforms and clinical decision support tools makes diagnostics more actionable in real-time oncology workflows.

M&A activity is moderately strong, with primary diagnostics and life science firms acquiring startups focused on tumor profiling, liquid biopsy, and bioinformatics. These deals strengthen oncology testing portfolios, integrate multi-omic capabilities, and accelerate access to proprietary platforms. Partnerships between diagnostic developers and pharmaceutical companies are also rising, particularly for companion diagnostics in targeted cancer therapies. M&A is a strategic route for expanding geographic reach and gaining a regulatory foothold.

Regulatory oversight is significant, particularly for diagnostics used in clinical oncology decisions. Agencies such as the U.S. FDA and EMA provide guidelines for test validation, biomarker use, and companion diagnostics approval. Regulatory bodies increasingly focus on analytical performance, clinical utility, and real-world evidence. While rigorous, frameworks such as IVDR in Europe and the FDA’s Breakthrough Devices Program can support innovation and speed market entry for novel oncology tests.

Product expansion is active, with ongoing development of tumor-specific panels, pan-cancer genomic tests, and companion diagnostics for new drug indications. Companies are launching broader panels assessing multiple mutations and solutions optimized for liquid biopsy and minimal residual disease (MRD) monitoring. Automation, shorter turnaround times, and integration with EMRs enhance usability in centralized labs and hospital settings. Expansion efforts also target direct-to-oncologist platforms and real-time molecular surveillance tools.

Regional expansion is progressing steadily, particularly in Asia-Pacific, Latin America, and Eastern Europe. Market players focus on increasing test availability in these regions through local partnerships, distributor networks, and region-specific regulatory approvals. While North America and Western Europe remain the largest markets, demand in emerging economies is rising due to increasing cancer incidence, improved healthcare access, and supportive national cancer screening programs.

Type Insights

The breast cancer segment led the market with the largest revenue share of 18.69% in 2024. This dominance is driven by rising global incidence and growing emphasis on early, personalized diagnosis. Molecular diagnostics play a pivotal role in identifying key biomarkers-such as HER2 and BRCA1/2 mutations-and in enabling targeted therapy decisions. Government screening initiatives, insurance coverage expansions, and patient preference for minimally invasive testing have further fueled adoption. An example is the World Health Organization’s Global Breast Cancer Initiative (GBCI), which aims to reduce global breast cancer mortality through early detection, timely diagnosis, and comprehensive treatment. The initiative encourages countries to strengthen diagnostic systems, including molecular tools, and targets a 25% reduction in breast cancer deaths by 2030 and 40% by 2040 among women under 70. Such efforts emphasize the expanding role of molecular diagnostics in improving access, accuracy, and treatment outcomes in breast cancer care.

The liver cancer and prostate cancer segments are expected to witness at the fastest CAGR during the forecast period, driven by rising incidence and increasing demand for early and precise diagnosis. In liver cancer, molecular diagnostics are being used to detect tumor-specific mutations and circulating DNA, particularly in high-risk populations with hepatitis or chronic liver conditions. For prostate cancer, genomic tests are helping differentiate between aggressive and slow-growing forms, aiding in more targeted treatment planning. These factors and the broader adoption of personalized therapy contribute to these segments' growing role in the oncology-based molecular diagnostics industry.

Technology Insights

The polymerase chain reaction (PCR) technology segment led the market with the largest revenue share of 38.65% in 2024, due to its established role in detecting cancer-specific genetic mutations with high sensitivity and speed. PCR remains a widely adopted technique in oncology diagnostics because of its cost-effectiveness, rapid turnaround time, and ability to amplify low levels of DNA or RNA from tumor samples. It is commonly used across various cancer types for early detection, treatment monitoring, and minimal residual disease assessment. Despite the emergence of newer technologies like next-generation sequencing (NGS), PCR continues to dominate clinical workflows due to its accessibility, scalability, and integration into routine diagnostic procedures across both high- and low-resource settings.

The sequencing segment is anticipated to witness at the fastest CAGR during the forecast period, driven by its ability to deliver comprehensive genomic insights for cancer diagnosis, treatment planning, and monitoring. Next-generation sequencing (NGS) enables simultaneous analysis of multiple cancer-related genes with high sensitivity, supporting more precise and personalized care.

In May 2025, England’s NHS became the first healthcare system to implement a liquid biopsy DNA blood test for lung and breast cancer, using ctDNA sequencing. This test provides results up to 16 days faster than traditional tissue biopsies and is expected to benefit around 15,000 lung and 5,000 breast cancer patients each year. Reducing the need for invasive procedures and enabling earlier access to targeted treatments highlights the growing clinical value of sequencing in oncology. Ongoing improvements in accuracy, speed, and data interpretation-along with broader reimbursement and global integration into clinical workflows-are positioning sequencing as a key driver of growth in the oncology-based molecular diagnostics market.

Product Insights

The reagents segment led the market with the largest revenue share by 58.61% in 2024, driven by their essential role in molecular diagnostic workflows across various cancer types. Reagents-such as enzymes, primers, probes, and buffers-are fundamental components used in techniques like PCR, NGS, and in situ hybridization. The growing number of diagnostic tests, increased test volumes in clinical laboratories, and the expansion of personalized oncology have contributed to consistent demand for high-quality reagents.

Reagents are also critical in ensuring test accuracy, sensitivity, and reproducibility, which are key in cancer detection and monitoring. As laboratories adopt more automated and high-throughput platforms, the need for specialized and compatible reagent kits rises correspondingly. Continued development of reagent formulations tailored for multiplexing, faster reaction times, and improved stability supports segment growth, reinforcing reagents as a core revenue contributor within the oncology-based molecular diagnostics market.

The reagents segment is anticipated to expand at the fastest CAGR of 5.7% over the forecast period, supported by growing test volumes and rising adoption of molecular assays in oncology. Continuous demand for high-performance reagents compatible with PCR and sequencing platforms is driving segment growth. In addition, innovations in reagent formulations are improving efficiency, accuracy, and scalability in cancer diagnostics.

Regional Insights

North America dominated the oncology based molecular diagnostics market with the largest revenue share of 44.69% in 2024, supported by well-established healthcare systems, high diagnostic awareness, and early integration of molecular tools in cancer management. The region benefits from widespread availability of PCR, NGS, and liquid biopsy platforms across clinical and research settings, enabling early detection, therapy selection, and monitoring.

Substantial investment in research, increasing demand for personalized oncology, and favorable reimbursement for molecular tests are driving continued growth. The region’s focus on innovation and streamlined diagnostic workflows positions it as a key contributor to global market expansion.

U.S. Oncology Based Molecular Diagnostics Market Trends

The oncology based molecular diagnostics market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by widespread clinical adoption, high cancer incidence, and strong focus on personalized medicine. A well-developed diagnostic infrastructure and access to advanced technologies such as NGS and liquid biopsy support early detection and precision treatment planning across various cancer types.

According to the American Cancer Society, over 2 million new cancer cases are expected to be diagnosed in the U.S. in 2025, underscoring the continued need for accurate and timely diagnostics. Ongoing public and private investment in molecular research, favorable reimbursement, and national screening guidelines are accelerating adoption. These factors reinforce the country’s leadership in driving growth and innovation within the oncology-based molecular diagnostics market.

Europe Oncology Based Molecular Diagnostics Market Trends

The oncology based molecular diagnostics market in Europe is witnessing steady growth, supported by rising cancer incidence, expanding national screening programs, and a growing shift toward personalized oncology care. Countries across Western Europe are actively incorporating molecular diagnostics into standard cancer pathways, particularly for breast, lung, and colorectal cancers. Increasing use of NGS and liquid biopsy technologies in hospitals and reference labs improves diagnostic precision and treatment planning. Supportive healthcare policies, funding for genomics research, and wider availability of advanced diagnostic infrastructure contribute to broader adoption across the region.

The UK oncology-based molecular diagnostics market is growing steadily, supported by strong cancer research infrastructure, early adoption of genomic testing, and a focus on personalized treatment. National initiatives promoting early detection and precision oncology drive demand for molecular tests across major cancer types. The growing use of technologies such as NGS and liquid biopsy in clinical practice improves diagnostic accuracy and guides targeted therapy decisions. Continued investment in genomics and supportive healthcare policies position the UK as a key contributor to regional growth in the oncology molecular diagnostics space.

The oncology based molecular diagnostics market in Germany shows strong growth European market, driven by a well-established healthcare system, structured cancer screening programs, and rising emphasis on personalized treatment. Molecular diagnostics are increasingly integrated into clinical workflows for early detection and targeted therapy guidance, particularly in breast, colorectal, and lung cancers. Ongoing advancements in sequencing technologies and the availability of centralized laboratory infrastructure support broader adoption. Continued investment in cancer research and precision diagnostics strengthens Germany’s role in advancing oncology molecular testing across Europe.

Asia Pacific Oncology Based Molecular Diagnostics Market Trends

The oncology based molecular diagnostics market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, driven by rising cancer incidence, growing awareness of early detection, and improving access to diagnostic technologies. Countries such as China, India, and Japan are investing in cancer control programs and expanding molecular testing capacity within hospitals and diagnostic labs. The adoption of technologies like PCR and NGS is increasing, supported by government funding, private sector partnerships, and the need for more precise treatment approaches. As healthcare infrastructure strengthens and demand for personalized oncology rises, the region is experiencing rapid market expansion.

The Japan oncology-based molecular diagnostics market is expanding gradually, supported by an aging population, strong emphasis on early cancer detection, and integration of precision medicine into clinical care. Molecular tests are increasingly used to guide treatment decisions in cancers such as gastric, lung, and breast, where early intervention significantly improves outcomes. The country’s robust healthcare infrastructure and government-backed cancer screening programs support adoption. Advancements in NGS and non-invasive testing methods like liquid biopsy further drive the shift toward personalized oncology in Japan.

The oncology based molecular diagnostics market in China represents a significant growth opportunity, supported by rising cancer burden, growing investment in precision medicine, and expanding access to diagnostic technologies. Government-backed health reforms and national cancer screening programs are accelerating the adoption of molecular testing in clinical settings. The country is increasingly investing in PCR and NGS-based platforms for early detection and targeted treatment. In addition, the development of local biotech companies and improved healthcare infrastructure are positioning China as a key player in driving regional and global market growth.

Latin America Oncology Based Molecular Diagnostics Market Trends

The oncology based molecular diagnostics market in Latin America is experiencing moderate, driven by increasing cancer incidence, improving healthcare access, and growing focus on early detection. Countries such as Brazil, Mexico, and Argentina are expanding cancer screening programs and investing in diagnostic infrastructure to support more accurate and timely diagnosis. The adoption of molecular tools like PCR and targeted sequencing is gaining traction in public and private healthcare systems. Affordability, local partnerships, and broader awareness of personalized treatment support gradual but steady market growth across the region.

The Brazil oncology-based molecular diagnostics market is expanding steadily, supported by rising cancer rates, improved diagnostic capabilities, and greater focus on early detection and precision treatment. Government-led healthcare initiatives and increased investment in public cancer programs are driving the adoption of molecular testing in hospitals and diagnostic centers. The growing availability of technologies such as PCR and targeted sequencing, combined with efforts to expand access in underserved areas, contributes to broader clinical use. Brazil’s commitment to strengthening cancer care positions it as a key growth market within Latin America.

Middle East and Africa Oncology Based Molecular Diagnostics Market Trends

The oncology based molecular diagnostics market in the Middle East and Africa region shows emerging growth, driven by rising cancer incidence, improving healthcare access, and growing awareness around early detection. Countries such as Saudi Arabia, the UAE, and South Africa are investing in cancer control strategies, expanding diagnostic infrastructure, and adopting molecular tools in tertiary care centers. While limited resources and uneven access persist, efforts to build capacity through public-private partnerships and government-led screening initiatives support broader adoption. The demand for accurate, non-invasive, and personalized cancer diagnostics is expected to continue rising across the region'

Key Oncology Based Molecular Diagnostics Company Insights

Some of the key players in the oncology-based molecular diagnostics industry are adopting various strategies to strengthen their position, such as expanding test menus, forming partnerships with healthcare providers, and investing in advanced technologies like NGS and liquid biopsy. These efforts aim to improve diagnostic accuracy, increase access to personalized cancer testing, and remain competitive in a market shaped by rising cancer burden, evolving clinical guidelines, and the growing emphasis on precision medicine.

Key Oncology Based Molecular Diagnostics Companies:

The following are the leading companies in the oncology based molecular diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Bayer AG

- BD

- Cepheid

- Agilent Technologies, Inc.

- Danaher

- Hologic, Inc.

- Qiagen

- F. Hoffmann-La Roche Ltd.

- Siemens

- Sysmex

Recent Developments

-

In December 2024, researchers at the Center for Genomic Regulation (CRG), Barcelona, developed a novel non-invasive diagnostic approach for early cancer detection. The method identifies unique chemical modifications in ribosomal RNA (rRNA) using portable nanopore sequencing. These signatures act as biomarkers for early-stage cancer, enabling rapid and cost-effective testing. This development holds strong relevance for the Oncology-Based Molecular Diagnostics Market, particularly in expanding the biomarker landscape and improving diagnostic accessibility.

-

In September 2024, researchers from Harvard Medical School introduced an advanced AI model, CHIEF, designed to perform diverse diagnostic tasks across 19 cancer types. This ChatGPT-like tool analyzes histopathology data to identify tumor origin, guide treatment selection, and predict patient survival. It demonstrated high accuracy across global datasets, marking a significant step in AI-integrated oncology diagnostics. The model enhances precision and clinical decision-making in cancer care. This innovation aligns closely with trends shaping the Oncology-Based Molecular Diagnostics Market.

-

In November 2023, Abbott received U.S. FDA approval for its molecular human papillomavirus (HPV) screening test under the Alinity m platform. The test enables high-throughput detection of high-risk HPV types linked to cervical cancer. This regulatory milestone expanded the company’s oncology-focused molecular diagnostics portfolio. The approval supports broader clinical adoption of molecular screening for early cancer detection. It highlights ongoing growth in the Oncology-Based Molecular Diagnostics Market.

Oncology Based Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.15 billion

Revenue forecast in 2033

USD 6.35 billion

Growth rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Bayer AG; BD; Cepheid; Agilent Technologies, Inc.; Danaher; Hologic, Inc.; Qiagen; F. Hoffmann-La Roche Ltd.; Siemens; Sysmex

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oncology Based Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global oncology based molecular diagnostics market report based on product, technology, type, and region:

-

Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Breast Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Liver Cancer

-

Lung Cancer

-

Blood Cancer

-

Kidney Cancer

-

Others

-

-

Product Outlook (Revenue, USD Million; 2021 - 2033)

-

Instruments

-

Reagents

-

Others

-

-

Technology Outlook (Revenue, USD Million; 2021 - 2033)

-

PCR

-

In situ hybridization

-

INAAT

-

Chips and microarrays

-

Mass spectrometry

-

Sequencing

-

TMA

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Reagents segment dominated the oncology based molecular diagnostics market with a share of 58.61% in 2024. This is attributable to the presence of large test volumes and an extensive portfolio of commercialized products.

b. Some key players operating in the oncology based molecular diagnostics market include Abbott Laboratories, Bayer Healthcare, Beckton Dickinson, Cepheid, Dako, Danaher Corporation, Gen Probe, Qiagen, Roche Diagnostics, Siemens, and Sysmex Corporation.

b. Key factors that are driving the market growth include the rising prevalence of various types of cancer, increased demand for technologically advanced diagnostics products, and rising awareness levels among patients and healthcare professionals for early detection.

b. The global oncology based molecular diagnostics market size was estimated at USD 3.75 billion in 2024 and is expected to reach USD 4.14 billion in 2025.

b. The global oncology based molecular diagnostics market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 6.35 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.