- Home

- »

- Clinical Diagnostics

- »

-

Polymerase Chain Reaction Market Size & Share Report, 2030GVR Report cover

![Polymerase Chain Reaction Market Size, Share & Trends Report]()

Polymerase Chain Reaction Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Conventional PCR), By Product (Instruments, Consumables & Reagents, Software & Services), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-188-0

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polymerase Chain Reaction Market Summary

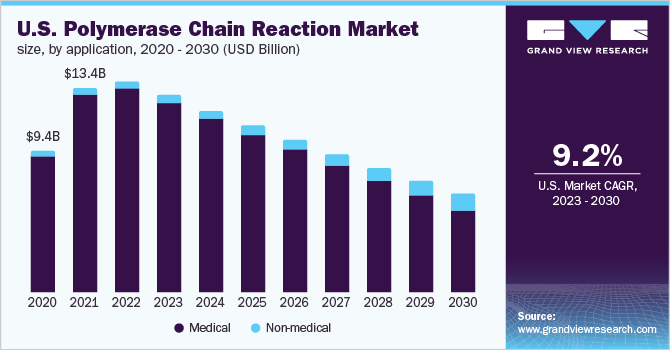

The global polymerase chain reaction market size was estimated at USD 36.84 billion in 2022 and is projected to reach USD 16.82 billion by 2030, growing at a CAGR of -9.3% from 2023 to 2030. A significant decline in the industry growth is anticipated to decrease the demand for diagnostic tests for COVID-19 infection during the forecast period.

Key Market Trends & Insights

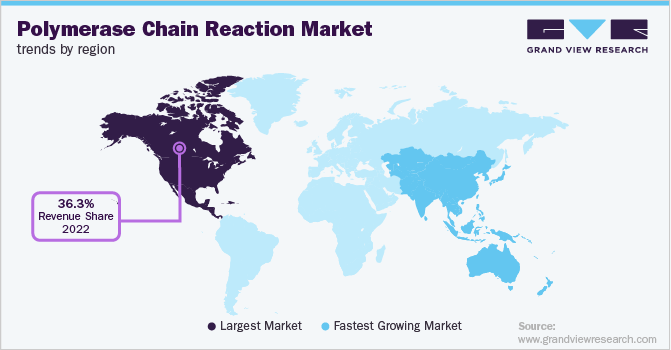

- In terms of region, North America held the largest revenue share of over 36.3% in 2022.

- Asia Pacific is one of the lucrative regions and is creating new opportunities for global leaders.

- By type, The others segment including dPCR, qPCR, and other novel technologies held the largest revenue share of over 96.5% in 2022.

- By application, The non-medical application segment is anticipated to expand at the fastest growth rate of 12.8% over the forecast period.

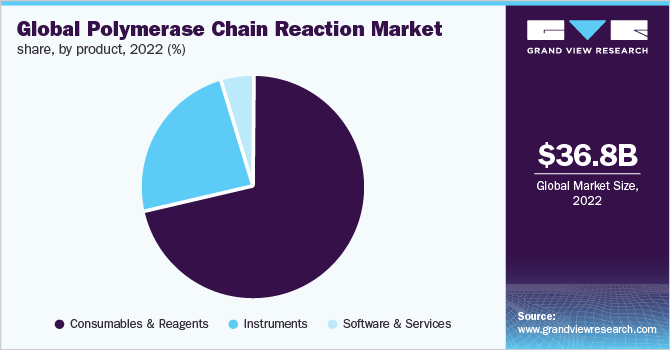

- By product, The consumables and reagents segment held the largest revenue share of over 71.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 36.84 Billion

- 2030 Projected Market Size: USD 16.82 Billion

- CAGR (2023-2030): -9.3%

- North America: Largest market in 2022

However, some of the key factors such as the rising application of polymerase chain reaction (PCR) in research and forensic laboratories and increasing demand for advanced diagnostics are anticipated to increase the demand for polymerase chain reaction tests. In addition, the launch of novel technologies and an increasing number of contract research organizations are likely to fuel the demand for PCR tests forward during the forecast period.

The COVID-19 outbreak has increased the industry grew exponentially in 2020 and 2021. The development of novel rt-PCR tests for the detection of SARS-CoV-2 infection and increasing research and development activities to study the disease have increased the introduction of technologically advanced PCR tests in the market. For instance, in June 2021, F. Hoffmann-La Roche Ltd. announced the U.S. FDA approval of Cobas SARS-CoV-2 nucleic acid test for the detection of asymptomatic and symptomatic persons at the point of care settings. Similarly, a large number of manufacturers received approval for novel PCR tests for the detection of SARS-CoV-2 infection across the globe. However, the decreasing demand for COVID-19 diseases in the coming years is anticipated to hamper the growth.

The increase in the prevalence of chronic and infectious diseases and genetic disorders is expected to boost the demand during the forecast period. According to the CDC, chronic diseases such as cancer and diabetes and chronic kidney and respiratory diseases such as asthma are accountable for 7 in 10 deaths in the U.S. each year. Furthermore, the number of patients suffering from congenital heart disease is increasing, requiring medical professionals to look for molecular diagnostic tools for accurate diagnoses. According to the CDC, congenital heart defects are the most common birth defects in the U.S., affecting approximately 1% of births every year. Thus, the increasing prevalence of diseases is increasing the demand for novel molecular diagnostic tests during the forecast period.

Moreover, increasing demand for point-of-care tests and self-tests is expected to drive the demand for polymerase chain reaction tests over the forecast period. Moreover, key market players are developing portable, fast, easy-to-use instruments for point-of-care settings. For instance, in July 2021, QuantuMDx announced the launch of the Q-POC system, which offers rapid POC molecular diagnostics advantageous for settings, such as ICUs, clinics, and birthing centers. Moreover, a large number of POC polymerase chain reaction tests have received approval in the last two years for the detection of COVID-19 disease.

The rising demand for prenatal genetic testing procedures owing to growing awareness regarding genetic disorders, such as cystic fibrosis, hemophilia, and thalassemia, is expected to propel the industry growth. In the early stages of pregnancy, fetal DNA present in the mother’s blood or the amniotic fluid can be analyzed to detect genetic defects before birth using qPCR and dPCR techniques. Possible genetic aberrations and fetuses with defective genes can then be treated during early pregnancy.

Technological advancements in PCR testing in terms of sensitivity, accuracy, efficiency, and cost-effectiveness are expected to increase the adoption of PCR tests in clinical diagnostics. The growing number of automated instruments and their easy availability are among the key factors expected to drive the market. In addition, improvements in technology and the consequent introduction of affordable and high-efficacy products are expected to drive the market.

Type Insights

The others segment including dPCR, qPCR, and other novel technologies held the largest revenue share of over 96.5% in 2022 and is anticipated to maintain their dominance over the forecast period. The introduction of technologically advanced PCR tests, increasing prevalence of targeted diseases, and application expansion of existing technologies are expected to drive the segment over the forecast period. Moreover, novel PCR has wide applications in the quantification of gene expression, pathogen detection, copy number variation, microarray verification, viral quantification, SNP genotyping, and microRNA analysis.

The conventional PCR segment is anticipated to witness significant growth of 4.5% during the forecast period. The growth of conventional PCR is augmented by the rising application of conventional PCR in food testing and safety and a surge in product launches. For instance, in April 2021, LGC Limited announced the launch of its end-point PCR test after obtaining the Emergency Use Authorization (EUA) from the U.S. FDA. The high testing capacity of 35,000 tests a day makes this one of the best-performing systems in the market.

Application Insights

The medical segment held the largest revenue share of over 96.9% in 2022 owing to the high adoption rate of PCR tests for clinical diagnostics and research activities to study diseases and drug development. Moreover, the growing application of PCR in the detection of SARS-CoV-2 infections and drug development and research activities is increasing the demand for tests. Furthermore, high precision of testing methods, increasing commercialization of qPCR and dPCR reagents for diagnostics, and increasing applications for disease diagnosis, monitoring, and treatment are fueling the market growth.

The non-medical application segment is anticipated to expand at the fastest growth rate of 12.8% over the forecast period. Increasing adoption of PCR techniques to test food and other consumables is expected to drive the segment during the forecast period. The food industry is adopting novel and reliable tests to reduce the risk of contamination and enhance food safety.

Product Insights

The consumables and reagents segment held the largest revenue share of over 71.4% in 2022 and is expected to maintain its dominance over the forecast period. The growth of the segment is attributed to the increased burden of infectious and chronic diseases, rising demand for consumables and reagents in various types of diagnostic assays, and a rise in product launches. For instance, in March 2021, PCR Biosystems announced an introduction of its IsoFast Bst Polymerase reagents that assist in robust, sensitive, and faster amplification of RNA and DNA.

The instruments segment held the second-largest revenue share in 2021 owing to the high penetration of PCR instruments in central laboratories and the increasing introduction of technologically advanced instruments in recent years. The software and services segment is anticipated to register the fastest growth rate during the forecast period owing to the rising strategic collaborations for the development and advancement of software.

Regional Insights

North America held the largest revenue share of over 36.3% in 2022 and is anticipated to maintain its position during the forecast period. The presence of favorable regulations and various initiatives about the advancements in healthcare infrastructure undertaken by the government, the high prevalence of diseases, and the presence of key players in the region are supporting the growth of the regional market. Furthermore, rising patient awareness regarding the availability of modern products for successful diagnosis is another factor contributing to the growth.

Asia Pacific is one of the lucrative regions and is creating new opportunities for global leaders. The untapped opportunities, high unmet clinical needs, and rising healthcare expenditure by Asia Pacific countries are encouraging global players to invest in the region. Moreover, the rising prevalence of various target diseases and technological advancements are likely to expand PCR demand during the forecast period. Furthermore, product launches by the local players in new markets to strengthen their presence are expected to boost the industry growth.

Key Companies & Market Share Insights

The industry is highly competitive due to the presence of a large number of regional and global players. The presence of a strong product portfolio and increasing investment in R&D activities are expected to help companies maintain their share in the market. Some prominent players in the global polymerase chain reaction market include:

-

Thermo Fisher Scientific Inc.

-

Danaher

-

Abbott

-

Bio-Rad Laboratories, Inc.

-

Agilent Technologies, Inc.

-

QIAGEN

-

F. Hoffmann-La Roche Ltd.

-

Stilla

-

Standard BioTools

-

Microsynth AG

Polymerase Chain Reaction Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.27 billion

Revenue forecast in 2030

USD 16.82 billion

Growth rate

CAGR of -9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Thermo Fisher Scientific Inc.; Danaher; Abbott; Agilent Technologies, Inc.; Stilla; Bio-Rad Laboratories, Inc.; QIAGEN; F-Hoffman-La Roche Ltd.; Standard BioTools; Microsynth AG

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Polymerase Chain Reaction Market Segmentation

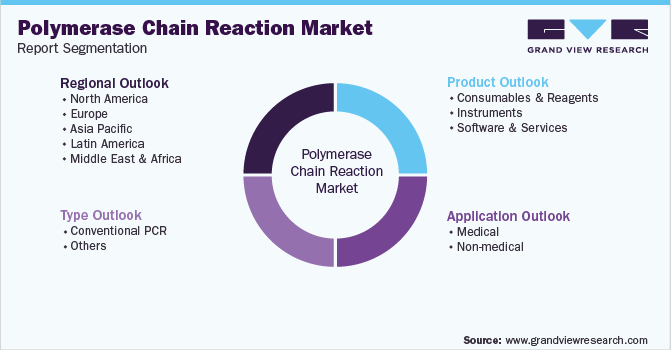

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymerase chain reaction market report based on type, product, application, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Conventional PCR

-

Others

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Consumables & Reagents

-

Instruments

-

Software & Services

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Medical

-

Clinical

-

Pathology Testing

-

Oncology Testing

-

Blood Screening

-

Others

-

-

Research

-

Forensics and Others

-

-

Non-medical

-

Food

-

Others

-

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polymerase chain reaction market size was estimated at USD 36.84 billion in 2022 and is expected to reach USD 34.27 billion in 2023.

b. The global polymerase chain reaction market is expected to witness a compound annual growth rate of -9.3% from 2023 to 2030 to reach USD 16.82 billion by 2030.

b. Increasing demand for advanced diagnostic techniques; rising number of CROs, forensic & research laboratories, prenatal genetic testing procedures, and the launch of novel technologies are expected to increase the demand for PCR tests over the forecast period.

b. Consumables & reagents held the largest PCR market share of 71.4% in 2022 due to significant demand for SARS-CoV-2 infection testing and the availability of technologically advanced tests for chronic and infectious diseases.

b. Some key players operating in the PCR market include Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Abbott Laboratories; Cepheid, Agilent Technologies; bioMérieux SA; GE Healthcare; Stilla; Microsynth AG; JN Medsys; and Fluidigm Corporation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.