- Home

- »

- Pharmaceuticals

- »

-

Peptide Therapeutics Market Size And Share Report, 2030GVR Report cover

![Peptide Therapeutics Market Size, Share & Trends Report]()

Peptide Therapeutics Market Size, Share & Trends Analysis Report By Application (Cancer, Metabolic Disorders), By Type (Generic, Innovative), By Type of Manufacturer, By Route of Administration, By Synthesis Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-179-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Peptide Therapeutics Market Size & Trends

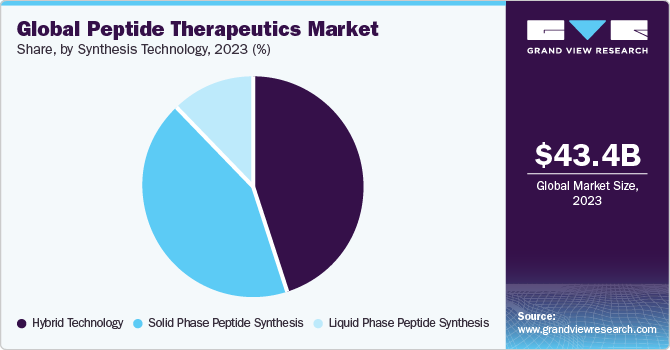

The global peptide therapeutics market size was estimated at USD 43.45 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030. The increasing prevalence of cancer and metabolic disorders such as osteoporosis, obesity, and diabetes is expected to boost the utilization of peptide therapeutics in the coming years. Rising number of pediatric patients suffering from these diseases, along with their widespread occurrence in low-income regions, necessitates the need for affordable and effective drugs.

Rise in the prevalence of multiple cancers and an increase in the need for appropriate treatment options are anticipated to drive the market growth. For instance, according to the International Agency for Research on Cancer (IARC), over 20.7 million new cancer cases are expected in 2023. Peptide therapeutics can treat cancer at an early stage, which can help improve disease management and reduce mortality. Increased demand for efficient and fast-acting therapeutics is expected to fuel market growth during the forecast period. Globally, cancer is a leading cause of death, accounting for 10 million deaths in 2020, or one in every six individuals. One-third of cancer-related deaths are attributed to smoking, high body mass index, alcohol abuse, obesity, and high cholesterol.

The market is anticipated to grow at a lucrative CAGR over the forecast period as companies focus on developing novel drugs. Players are engaged in extensive research and development (R&D) activities to develop treatments for target diseases and increase their market share. R&D in peptide therapeutics focuses on metabolic disorders, followed by oncology and infectious diseases. The regulations in peptide therapeutics are witnessing a shift toward stringent requirements regarding efficacy, safety, and quality standards for approval. Regulatory bodies, such as the FDA and EMA, are actively evaluating new guidelines to streamline the approval process for peptide therapeutics.

However, the limited capacity of solid-phase reactors hampers the purification of long peptides for chemical functionalization and swelling of resins. Increasing modifications and adding more unnatural amino acids have made synthesis more complex. The length, 3D conformational structures, and modified amino acid composition of some peptides in development are creating challenges in separation and purification.

Market Dynamics

Advancements in production processes of peptides are expected to drive the market growth. Manufacturers and suppliers are focused on developing new methods for synthesizing peptides. Improvement and automation of the purification process and lower waste generation are further driving the market growth. For instance, in March 2022, Creative Peptides introduced innovative peptide drug discovery services to speed the development of peptide therapeutics. Furthermore, researchers at academic and research institutes are working on the development of novel technologies to synthesize peptide therapeutics. In February 2023, researchers at Hokkaido University developed an innovative method to design and develop peptide antibiotics on a large scale to control antibiotic resistance.

Pharmaceutical industry is expected to experience significant growth in the coming years. Many companies are investing in the development of new drugs to stay competitive in market. These companies are conducting extensive research and development to create innovative drugs that offer better outcomes for patients with various diseases. Over the past few years, the number of clinical trials for these drugs has also increased, which is expected to further boost market growth. For instance, in June 2023, the Italian contract research organization (IRBM) and Merck & Co. Inc. signed a new agreement to continue their collaboration in the peptide therapeutics area. This agreement gives access to Merck's extensive resources and expertise in clinical trial design and execution.

Lack of awareness about peptide therapeutics, expensive manufacturing equipment, and limited availability or absence of professionals, especially in developing and underdeveloped countries, may adversely impact the adoption of such therapeutics. In addition, the complexity of recombinant peptides lowers the yield of peptide therapeutics due to insolubility issues. Hence, the increasing complexity of peptides can impede market growth.

Application Insights

In 2023, metabolic segment dominated the market with a revenue share of 37.80% as most of the peptides, currently in the pipeline and available in the market, are indicated for metabolic disorders. The most recent products approved for type 2 diabetes include Adlyxin (Lixisenatide), Ozempic (Semaglutide), and Xultophy (Insulin Degludec and Liraglutide). GLP-1 receptor is one of the most broadly developed peptides in the pipeline. GLP-1 receptor antagonists provide glycemic control with a low risk of hypoglycemia, which makes it an ideal choice for drug developers. Moreover, rising FDA approvals for treating metabolic diseases, such as obesity, are contributing to segment growth. For instance, in June 2021, Wegovy (semaglutide) injection for chronic weight management in adults with obesity received FDA approval.

Cancer segment is anticipated to register substantial growth during the forecast period, owing to factors such as increasing R&D activities pertaining to peptides employed in cancer treatment. Peptides can offer versatility for a successful drug discovery approach for cancer. Peptide-drug conjugates are an emerging targeted therapeutic, which enable increased tumor selectivity and penetration. An increasing number of research studies are being conducted globally to develop novel peptides for cancer treatment.

Type Insights

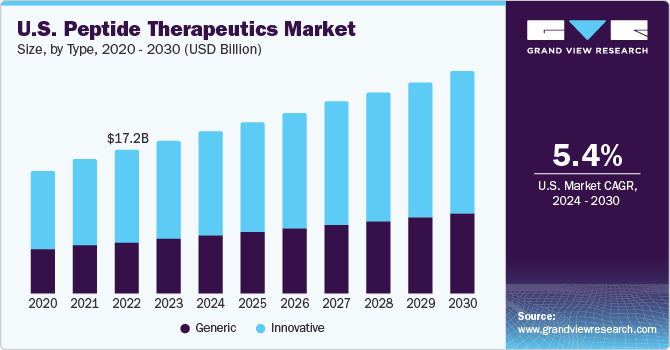

Innovative segment dominated the market in 2023 with a revenue share of over 61.69% owing to increased R&D investments by large pharmaceutical companies in the discovery and development of new drugs and high prescription rates. Field of innovative peptide therapeutics is driven by several key market drivers. Peptide therapeutics, with their high specificity and potential for targeted treatments, are gaining attention as a promising avenue for addressing complex diseases. This can be attributed to advancements in peptide synthesis, modification techniques, and delivery technologies, enabling the development of novel and more effective peptide-based drugs.

Generic segment is anticipated to register the fastest CAGR during the forecast period. The emergence of generic versions of peptide therapeutics represents a growing trend in the pharmaceutical industry. As patents for original peptide drugs expire, generic manufacturers develop bioequivalent alternatives, expanding patient access and potentially reducing healthcare costs. This trend aligns with the broader movement toward affordable and accessible healthcare solutions. For instance, over 70 peptide-based drugs are globally available, and several prescription-based peptide drugs, such as Byetta and Victoza, may approach generic status as their patents near expiration.

Type of Manufacturer Insights

In-house manufacturing segment held the largest revenue share of over 65.00% in 2023. Several factors, including greater control over production quality, cost-effectiveness, and intellectual property protection, drive this strategic shift. This trend is being fueled by rising demand for personalized and targeted therapies, where peptides play a crucial role due to their high specificity and low toxicity. As a result, pharmaceutical companies are investing in developing in-house peptide manufacturing capabilities to ensure a reliable supply chain and expedited development timelines. In-house manufacturing of peptide therapeutics is growing, propelled by the need for precision medicines and accelerated development timelines. This strategic approach enables pharmaceutical firms to maintain a competitive edge in a rapidly evolving therapeutic landscape.

Outsourcing manufacturing segment is anticipated to grow at the fastest CAGR during the forecast period. Peptide manufacturing is a complex procedure and it requires advanced technologies such as Solid-Phase Peptide Synthesis (SPPS), Liquid-Phase Peptide Synthesis (LPPS), or Hybrid for purification and synthesis of high-quality products, which results in high cost of manufacturing. In addition, increasing R&D funding and capital investments by key players through strategic agreements is anticipated to result in market growth. Furthermore, strategic initiatives by key industry players are creating attractive prospects within the market. For instance, CordenPharma expanded the peptide manufacturing capacity in its GMP API facility in Colorado, in July 2020.

Route of Administration Insights

Parenteral route of administration dominated the market in 2023 with a revenue share of over 84.18%. This is attributed mainly to the high adoption rate, faster delivery of drugs, and ease of application. The biopharmaceutical giants are continuously exploring new methods of drug delivery pertinent to peptides. Novel drug delivery technologies are now being assessed for efficacy with engineered molecules having advanced PEGylation in an attempt to improve drug delivery performance and patient compliance through better modes of drug delivery. Patient compliance and acceptability are major advantages of oral route of drug administration. However, enzymatic degradation that inhibits blood absorption of these drugs holds a major disadvantage.

Pulmonary route segment is anticipated to witness significant CAGR during the forecast period. Pulmonary drug delivery facilitates the systemic administration of peptides and proteins that are generally administered through parenteral routes. The ongoing research focusing on this delivery route is expected to result in breakthroughs in both formulation and device design, thereby improving the market landscape and patient benefits. It is crucial to integrate and coordinate research efforts in pulmonary drug administration. The challenges of traditional drug delivery methods have led to a rise in the number of advanced targeted drug delivery systems, with the pulmonary route gaining prominence for delivering peptides and related compounds to the lungs.

Synthesis Technology Insights

Liquid Phase Peptide Synthesis (LPPS) segment dominated the market in 2023 with a revenue share of over 45.02% owing to the rising demand for pure peptides for the development of efficient therapeutics. A series of advancements in LPPS technology is expected to drive market growth. For instance, the Tokyo University of Agriculture and Technology invested in the development of new technology suitable for solution-phase peptide synthesis. The conventional technology incorporated in LPPS relies on chemical synthesis occurring in biphasic miscible organic solution. Tokyo University of Agriculture and Technology has developed a new approach, namely, Peptune, which incorporates a new bridge chemistry that introduces steric constant via linker function. This approach serves to be a novel liquid-phase synthesis method that can be employed across delivery motives, diagnostics, and peptide therapeutics.

Hybrid technology segment is anticipated to witness the fastest CAGR over the forecast period owing to the associated advantages of being used with both types of technologies, i.e., LPPS and SPPS. Companies are investing in R&D to incorporate the benefits of both LPPS and SPPS and to provide a cost-effective and sustainable solution. The issue of high levels of impurities is addressed by hybrid technology for peptide synthesis, which is expected to create lucrative growth opportunities in the market. Moreover, the emerging significance of hybrid peptides in organic and biomolecular applications has contributed to the fastest CAGR of this segment. For instance, in 2019, a research study was conducted to explore the potential of peptide-oligonucleotide conjugates.

Regional Insights

North America dominated the market in 2023 with a revenue share of over 45.63% owing to the launch of effective products along with technologically advanced production facilities across the region. In addition, the increasing prevalence of diseases, such as cancer, cardiovascular disorders, respiratory diseases, infectious diseases, metabolic disorders, and others, is expected to drive market growth. For instance, according to the Cancer Atlas, cancer is the leading cause of death in Canada and the second leading cause of death after heart disease in the U.S., accounting for around 1.9 million new cases in the region every year. Cardiovascular diseases include stroke, heart disease, heart failure, and hypertension are among the major causes of death in the U.S.

Asia Pacific region is expected to experience a significant surge in growth in the coming years, owing to several factors such as unexplored opportunities, low raw material costs, an expanding pool of outsourcing service providers, a growing biotech sector, and higher investments in R&D. In addition, generic market is projected to register significant CAGR due to the expiration of new drug patents and reduced cost of raw materials. All these factors combined are expected to provide ample opportunities for growth in the region.

Key Companies & Market Share Insights

New product development and technological advancements are key strategies undertaken by major players to gain market position. Moreover, increasing collaborations for undertaking trials of new drugs are estimated to increase competitive rivalry.

-

In March 2023, Ono Pharmaceuticals and PeptiDream entered into a collaboration for drug discovery and development of Macrocyclic Constrained Peptide Therapeutics

-

In October 2023, Biosynth acquired Pepceuticals Limited, a British synthetic peptide manufacturer, and through this acquisition company aimed to strengthen its peptide division

Key Peptide Therapeutics Companies:

- Eli Lilly and Company

- Pfizer Inc.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Novo Nordisk A/S

- GlaxoSmithKline plc.

- Ironwood Pharmaceuticals, Inc.

- Radius Health, Inc.

- Ipsen Pharma

Peptide Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.43 billion

Revenue forecast in 2030

USD 66.41 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2021

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application; type; type of manufacturer; route of administration; synthesis technology; region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Eli Lilly and Company; Pfizer Inc.; Amgen Inc.; Takeda Pharmaceutical Company Limited; AstraZeneca; Teva Pharmaceutical Industries Ltd.; Sanofi; F. Hoffmann-La Roche Ltd; Novartis AG; Novo Nordisk A/S; GlaxoSmithKline plc.; Ironwood Pharmaceuticals, Inc.; Radius Health, Inc.; Ipsen Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peptide Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global peptide therapeutics market report based on application, type, type of manufacturer, route of administration, synthesis technology, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Metabolic Disorders

-

Cardiovascular Disorders

-

Respiratory Disorders

-

Gastrointestinal Disorders

-

Infectious Diseases

-

Pain

-

Dermatological Disorders

-

Neurological Disorders

-

Renal Disorders

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Generic

-

Innovative

-

-

Type of Manufacturers Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Parenteral Route

-

Oral Route

-

Pulmonary

-

Mucosal

-

Others

-

-

Synthesis Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solid Phase Peptide Synthesis (SPPS)

-

Liquid Phase Peptide Synthesis (LPPS)

-

Hybrid Technology

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The peptide therapeutics market size was valued at USD 43.45 billion in 2023 and is anticipated to reach USD 46.43 billion in 2024.

b. The peptide therapeutics market is expected to witness a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 66.41 billion by 2030.

b. Based on application, the metabolic diseases segment accounted for a share of 37.80% in 2023 due to the high prevalence of these disorders and the relatively higher number of products approved.

b. Some of the key players in peptide therapeutics market are Lilly; Pfizer Inc.; Amgen Inc.; Takeda Pharmaceutical Company Limited; AstraZeneca; Teva Pharmaceutical Industries Ltd.; Sanofi; F. Hoffmann-La Roche Ltd and Novartis AG amongst others.

b. North America held the largest share of 45.63% in 2023 due to the rise in awareness levels pertaining to peptide therapeutics products, increasing demand for diagnostics in cancer & other diseases, and the growing biotechnology industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."