- Home

- »

- Animal Feed and Feed Additives

- »

-

Amino Acids Market Size & Share, Industry Report, 2033GVR Report cover

![Amino Acids Market Size, Share & Trends Report]()

Amino Acids Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Essential, Non-essential), By Source (Plant-based, Animal Based, Chemical Synthesis, Fermentation), By Grade (Food Grade, Feed Grade), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-453-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Amino Acids Market Summary

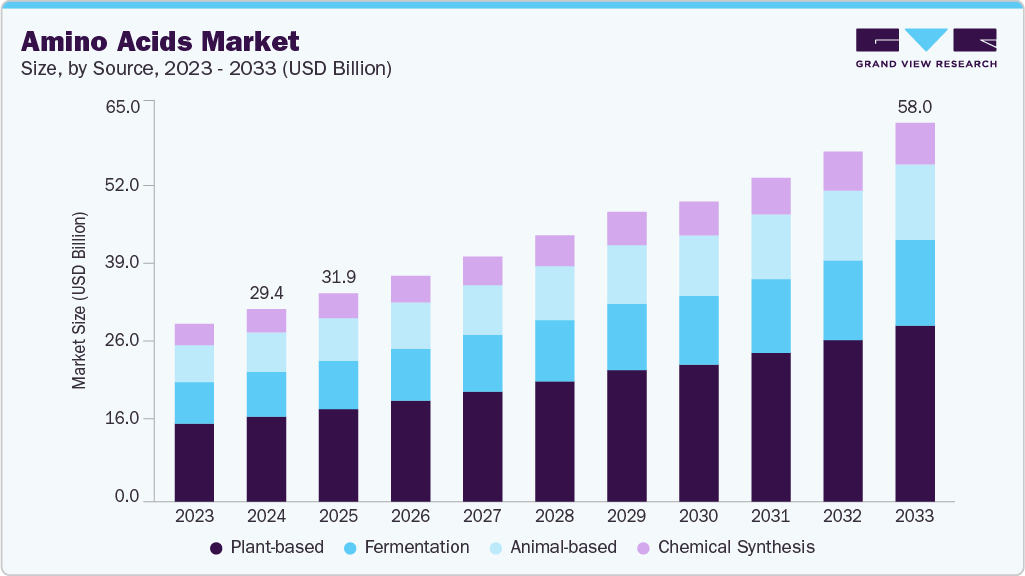

The global amino acids market size was estimated at USD 29,444.1 million in 2024 and is projected to reach USD 58,007.7 million by 2033, growing at a CAGR of 7.8% from 2025 to 2033. This is attributable to increased consumer spending capacity and growing awareness among individuals regarding healthy lifestyles and preventive care.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of 46.8% in 2024.

- By product, the essential amino acids market is expected to witness the fastest growth of 8.0% from 2025 to 2033.

- Non-essential amino acids dominated the market with a revenue share of 52.4% in 2024.

- By source, plant based dominated the amino acids market with a revenue share of 44.2% in 2024.

- By grade, pharma grade dominated the amino acids market with a revenue share of 39.1% in 2024.

- By end use, food & beverage dominated the amino acids market with a revenue share of 28.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 29,444.1 Million

- 2033 Projected Market Size: USD 58,007.7 Million

- CAGR (2025-2033): 7.8%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing region from 2025 to 2033

Amino acids are used in health supplements to reduce muscle pain, fatigue, and lower the risk associated with cardiovascular diseases. They are also gaining popularity in nutritional sports supplements. Many athletes prefer consuming Product-based supplements in the form of tablets, powders, and drinks for muscle growth. Nutraceutical Products are segmented into functional beverages, functional food, and dietary supplements. In the animal feed industry, the market is used as a bioactive supplement, as they offer several health benefits to animals. They are also used as critical ingredients in pet food Products and veterinary supplements to enhance food digestibility and thereby strengthen the immune system. Feed-grade products are in demand as their consumption improves the activities & health of animals and offers better joint mobility. The animal feed industry is expected to witness a high demand for feed-grade products owing to an aging pet population, unique dietary requirements, and specialized diets. The growing adoption of pets in agriculture across several countries is expected to drive the demand for pet food, in turn, driving the demand for the market in the pet food industry.

The rising global demand for nutraceutical and pharmaceutical Products. With increasing consumer awareness of preventive healthcare and healthier lifestyles, amino acids are being widely incorporated into dietary supplements and functional foods. They are recognized for benefits such as reducing muscle fatigue, supporting cardiovascular health, and promoting muscle growth-particularly among athletes through supplements in tablet, powder, or beverage form. The expanding nutraceuticals sector, driven by higher spending on organic and wellness-focused Products, is expected to significantly boost amino acid consumption across functional beverages, fortified foods, and dietary supplements.

Amino acids are increasingly utilized in Dietary Supplements and cosmetic Products due to their multifunctional benefits for skin health and appearance. Naturally present in the skin, they work with aquaporins, the body’s water transport channels, to distribute moisture effectively, supporting deep hydration and skin resilience. Some amino acids act as antioxidants or aid in the skin’s antioxidant Production, offering protection against free-radical damage and reducing signs of aging. Their humectant properties also make them excellent moisture retainers, helping to keep the skin soft and supple. Key amino acids such as arginine and histidine enhance hydration, while proline, glycine, and lysine boost collagen Production, improving skin elasticity and reducing the appearance of fine lines and wrinkles, driving their growing use in anti-aging and hydrating skincare formulations.

Raw materials used for amino acids Production, including soybean oilseeds, wheat, and corn, have been witnessing price volatility over the past few years. This trend is expected to continue over the forecast period owing to increasing consumption of raw materials for other food Production, resulting in limited supply for market Production. Short-term factors such as increasing energy prices are among the other hurdles leading to a shortage of raw materials for product production. In developing economies, manufacturers are often forced to create products from low-quality alternative ingredients such as cassava or sorghum. Such alternative ingredients are less digestible compared to corn and soybeans.

Market Concentration & Characteristics

Amino acids are anticipated to witness high demand from food and dietary supplement manufacturers due to increased consumer spending capacity and growing awareness among individuals regarding healthy lifestyles and preventive care. Amino acids are used in health supplements to reduce muscle pain and fatigue and lower the risk associated with cardiovascular diseases. They are also gaining popularity in nutritional sports supplements.

Many athletes prefer consuming amino acid-based supplements in the form of tablets, powders, and drinks for muscle growth. Nutraceutical Products are segmented into functional beverages, functional food, and dietary supplements. The key factor driving the growth of the nutraceuticals industry is the increased spending on organic and healthy food Products. This is expected to increase the consumption of amino acids in the nutraceuticals industry.

Key regions such as North America and the Asia Pacific have witnessed an upsurge in healthcare spending. In 2023, North America is projected to record the highest healthcare spending as compared to other regions, owing to the burgeoning aging population and prevalence of several diseases in the region. Furthermore, the growing aging population, expansion of the nutraceutical & pharmaceutical industry, and technological & clinical advancements. Increasing consumption of pharmaceutical and nutraceutical Products in developed economies is anticipated to surge the demand for amino acids over the forecast period.

However, one of the major restraints for the global amino acids market is the rising cost and limited availability of key raw materials such as corn, soybeans, and wheat. Increasing processing and transportation expenses have contributed to a raw material shortage, significantly impacting amino acid Production. Additionally, high energy costs and declining livestock production have intensified these challenges. In some developing regions, manufacturers are turning to lower-quality alternatives like cassava and sorghum, which offer lower digestibility compared to traditional sources, potentially compromising Product efficiency and quality.

Product Insights

The non-essential product segment dominated the market and accounted for the largest revenue share of 52.4% in 2024. This is attributed to the fact that non-essential amino acids are commonly used in animal feed to provide a balanced Product profile for the animal. Animal nutritionists formulate diets to meet the animal's nutrient requirements, including their protein needs. Amino acids are the building blocks of proteins, so it is essential to provide a balanced mix of both essential and non-essential in the animal's diet. This helps to ensure optimal growth, development, and health.

Essential amino acids based amino acids segment is expected to grow fastest with a CAGR of 8.0% from 2025 to 2033 during the forecast period The usage of essential amino acids is growing steadily across the world owing to surging demand for dietary supplements and sports nutrition Products, increasing number of patients suffering from chronic diseases, aging population, and rising awareness among consumers about the benefits of essential amino acids. Amino acids are essential for muscle growth and recovery. Hence, they are widely used in sports nutrition Products such as protein powders, bars, and shakes. Moreover, the growing trend of veganism and vegetarianism worldwide has led to the development of the plant-based market. This, in turn, is leading to the growth of the essential amino acids segment of the market worldwide.

Source Insights

Plant based sources dominated the market and accounted for the largest revenue share of 44.2% in 2024. This is attributed to the growing consumer awareness regarding natural and organic Products that is expected to drive the worldwide Production and consumption of plant-based. In addition, the augmented social awareness related to animal slaughter is expected to positively impact the demand for plant-derived. However, the Production of plant-based Products is limited owing to the lack of Production technology and the high capital cost required.

Fermentation-based amino acids segment is expected to grow at a CAGR of 7.5% from 2025 to 2033, due to increasing demand for sustainable and cost-effective production methods. Fermentation processes offer advantages such as reduced environmental impact, lower energy consumption, and consistent product quality. Additionally, rising consumer preference for natural and non-synthetic ingredients in food, pharmaceuticals, and animal feed is driving manufacturers to adopt bio-based production techniques.

Grade Insights

The pharma grade amino acids segment dominated the market and accounted for the largest revenue share of 39.1% in 2024. This dominance is primarily attributed to the growing demand for high-purity amino acids in pharmaceutical formulations, clinical nutrition, and biopharmaceutical production. Increasing prevalence of chronic diseases, rising geriatric population, and expanding use of amino acids in parenteral nutrition and drug manufacturing have further fueled the growth of this segment, ensuring its continued market leadership.

The feed grade segment is expected to grow at a CAGR of 8.1% from 2025 to 2033. This growth is driven by rising global meat consumption, increased focus on livestock health, and the need for efficient feed conversion. Amino acids such as lysine, methionine, and threonine are widely used to enhance animal growth and productivity. Moreover, growing demand for high-quality animal protein and sustainable farming practices is further boosting market expansion.

End Use Insights

Food & beverage end use dominated the market and accounted for the largest revenue share of 28.9% in 2024. Amino acids are used to increase the nutritive value of food Products. Products such as lysine and methionine are used in bread and soy Products, respectively. Increased demand for functional and nutritional food Products is anticipated to drive the segment over the forecast period. Amino acids are widely used in the nutraceutical industry as a dietary supplement for the treatment of muscle fatigue, muscle soreness, as well as to maintain cardiovascular health. According to the National Institute of Health of the Government of the U.S., amino acids, such as glutamine and cysteine, are used in immune support supplements to enhance the immune system of consumers. Glutamine is particularly effective for supporting the cells of the immune system, while cysteine can help increase levels of the antioxidant glutathione, which protects the immune system from damage. Moreover, amino acids, such as tyrosine and phenylalanine, are used in cognitive health supplements owing to their ability to support the Production of neurotransmitters, which are essential for the brain's functioning. They also help improve consumers' mood, memory, and cognitive performance.

The personal care & cosmetics segment is expected to grow at a CAGR of 8.4% from 2025 to 2033 during the forecast period, due to increasing consumer awareness regarding skin health and the benefits of amino acids in skincare formulations. Amino acids are widely used for their moisturizing, anti-aging, and skin-repairing properties. Additionally, the rising demand for clean-label, bio-based, and functional ingredients in cosmetics, along with expanding product innovations by major brands, is fueling segment growth.

Regional Insights

Asia Pacific amino acids market dominated the industry with a 46.8% share in 2024, driven by rising consumer spending, increased health awareness, and expanding end-use industries such as nutraceuticals, pharmaceuticals, Dietary Supplements, and cosmetics. Key countries like China and Japan are significantly boosting amino acid Production and exports, particularly in feed additives. In China, rising pork consumption and growing demand for dietary supplements, fueled by increasing health concerns and higher medical expenditure, are major growth drivers. The growing popularity of ready-to-drink (RTD) beverages is also contributing to increased demand for aspartame, thereby supporting the consumption of amino acids like aspartic acid. In India, plant-based amino acids are gaining traction due to religious preferences and their widespread use in pharmaceuticals and beauty Products. The region’s young and growing population, along with increasing lifestyle-related health concerns and demand for dietary supplements, is further accelerating market expansion.

The amino acids market in China held a substantial share of the APAC market in 2024, owing to its large population base, rapidly expanding middle class, and growing emphasis on health and wellness. The country is one of the leading global producers and exporters of amino acids, particularly feed-grade variants such as lysine, threonine, and methionine, which are extensively used in the livestock and poultry industries. With rising pork consumption, China being the world’s largest pork consumer, the demand for feed-grade amino acids continues to grow steadily. Additionally, China has seen a significant rise in the consumption of dietary supplements and functional foods, driven by increasing healthcare awareness, a rising aging population, and growing disposable incomes. This has led to a surge in demand for amino acids such as glutamine and arginine in the nutraceutical and pharmaceutical industries.

Europe Amino Acids Market Trends

The amino acids market in Europe held 21.8% of the global revenue share in 2024, driven by rising meat consumption and expanding livestock Production across key countries such as Germany, the UK, France, and Italy. The increasing adoption of animal feed additives enriched with essential amino acids like lysine, methionine, and threonine to enhance livestock growth and meat quality is a primary market driver. Europe, the world’s second-largest producer of compound feed, with Germany and France leading the segment, heavily consumes amino acids in poultry feed, which accounts for nearly one-third of the region’s feed market (Feed & Additive Magazine, 2022). In addition to feed, Europe’s well-established nutraceutical sector also fuels demand. Italy, for instance, has seen growing usage of amino acids in functional foods and infant nutrition, while simultaneously enforcing strict regulations to ensure safe dosage in supplements. Meanwhile, Spain is witnessing increased use of amino acids in dietary supplements, supported by strong investments in R&D and innovation by local manufacturers. These trends, along with Europe’s advanced regulatory environment and consumer shift toward health and wellness, are expected to propel the amino acids market in the region.

North America Amino Acids Market Trends

The amino acids market in North America secured 17.4% of the global market in 2024, driven by strong demand from the animal feed and nutraceutical sectors. The U.S. and Canada are major producers of animal feed, with the U.S. ranking among the largest global feed producers and exporters in 2022. Increased awareness regarding food safety, animal health, and disease prevention has boosted the consumption of amino acid-enriched feed in the region. However, strict regulations surrounding animal feed Production may pose challenges to market expansion. The nutraceutical industry is another key growth area, with the U.S. being one of the world’s largest consumers of dietary supplements. According to the Council for Responsible Nutrition (CRN), around 77% of Americans use supplements, with the 30-45 age group showing the highest adoption (81%). This rising focus on preventive healthcare and healthy living is expected to fuel demand for amino acid-based supplements. Additionally, Canada and Mexico are witnessing growing utilization of amino acids in pharmaceutical and nutraceutical formulations. Canada’s well-developed pharmaceutical sector, supported by key players such as SGS S.A., Thera-Plantes, Inc., and CK Ingredients, further contributes to the region's expanding amino acids market.

U.S. Amino Acids Market Trends

The amino acids market in the U.S. is witnessing steady growth driven by increasing demand across dietary supplements, pharmaceuticals, animal feed, and personal care industries. Consumers are becoming more health-conscious, leading to rising interest in amino acid-based sports nutrition and wellness products. The pharmaceutical sector is also a major contributor due to the growing use of amino acids in clinical nutrition and drug formulation. In animal nutrition, amino acids like lysine and methionine are gaining traction to improve feed efficiency and livestock health. Additionally, advancements in fermentation technologies and a shift toward sustainable, bio-based ingredients are shaping future market trends.

Middle East & Africa Amino Acids Market Trends

The amino acids market in the Middle East & Africa is experiencing strong growth, primarily driven by rising demand for aspartame in the food and beverage sector. Aspartame, composed of aspartic acid and phenylalanine, is widely used as a sugar substitute in packaged food and drinks. The increasing consumption of processed and convenience foods, along with a shift toward healthier dietary habits, is expected to boost demand for amino acid-based ingredients such as aspartame. Additionally, growing health consciousness among consumers has accelerated the uptake of dietary supplements, further driving amino acid usage across the region. Additionally, pharmaceutical development is another key driver, with countries such as the UAE, Saudi Arabia, and Iran investing in domestic drug manufacturing through supportive government initiatives. These efforts include easing market access for locally produced medicines and establishing new Production facilities. However, regulatory restrictions on animal-derived amino acids due to dietary preferences and religious considerations have limited their use, especially in supplements. Despite this, the increasing awareness around preventive healthcare, lifestyle-related disorders, and wellness trends is expected to support market growth in the region over the coming years.

Latin America Amino Acids Market Trends

The amino acids market in Latin America is witnessing steady growth, largely driven by the increasing consumption of meat and meat-based Products. Countries such as Brazil and Ecuador rank among the top meat consumers in the region, with Brazil being a global leader in meat Production and export. This rising demand for meat has intensified the focus on producing high-quality livestock, thereby boosting the use of feed additives, including essential amino acids like lysine and methionine, to enhance animal growth and health. Argentina and Ecuador also show substantial demand for amino acids across the animal feed, pharmaceutical, and nutraceutical sectors. Argentina, in particular, emphasizes the Production of disease-free meat and has achieved BSE-free status, which strengthens its meat export capabilities. To maintain livestock health and prevent outbreaks, the country increasingly incorporates amino acid-based feed additives into animal diets. These trends, along with the region's growing emphasis on food safety and livestock Productivity, are expected to further drive amino acid consumption in Latin America.

Key Amino Acids Companies Insights

Key players operating in the amino acids market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Amino Acids Companies:

The following are the leading companies in the amino acids market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Ajinomoto Co., Inc.

- AMINO GmbH

- MartinBauer

- CJ CheilJedang Corp.

- DAESANG

- dsm-firmenich.

- Evonik

- Fermentis Life Sciences

- Dacheng Biochemical Technology Group Co., Ltd.

- IRIS BIOTECH GmbH

- Meihua Holdings Group Co., Ltd.

- Novus International, Inc.

- Merck

- Wacker Chemie AG

Recent Developments

-

In October 2024, Evonik announced it is restructuring its keto and pharma amino acid business to focus on strategic core growth areas within its Health Care division. The company plans to discontinue keto acid Production in Hanau, Germany by the end of 2025, while exploring strategic options like partnerships or divestments for its sites in Ham (France) and Wuming (China). Despite the shift, Evonik will continue customer supply, emphasizing the growth potential of these amino acid businesses. The affected business generates around €100 million in annual revenue.

-

In June 2023, Novus International has rebranded to emphasize its commitment to "intelligent nutrition," highlighting innovative solutions for animal protein Production. As part of its expanded Product portfolio, Novus continues to offer amino acid-based feed additives like ALIMET, MHA, and MFP, all utilizing HMTBa-a precursor to L-methionine known for gut health and nitrogen-free benefits. These amino acid solutions support reProductive performance, nutrient utilization, and sustainable protein Production, reinforcing Novus’ focus on advanced, value-driven animal nutrition.

Amino Acids Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31,884.7 million

Revenue forecast in 2033

USD 58,007.7 million

Growth rate

CAGR of 7.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, grade, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; Italy; France; Spain; Russia; Turkey; Netherlands; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

ADM; Ajinomoto Co., Inc.; AMINO GmbH; MartinBauer; CJ CheilJedang Corp.; DAESANG; dsm-firmenich.; Evonik; Fermentis Life Sciences; Dacheng Biochemical Technology Group Co., Ltd.; IRIS BIOTECH GmbH; Meihua Holdings Group Co., Ltd.; Novus International, Inc.; Merck; Wacker Chemie AG

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Amino Acids Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global amino acids market report based on product, source, grade, end use, and region

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Essential

-

Histidine

-

Isoleucine

-

Leucine

-

Lysine

-

Methionine

-

Phenylalanine

-

Threonine

-

Tryptophan

-

Valine

-

-

Non-essential

-

Alanine

-

Arginine

-

Asparagine

-

Aspartic Acid

-

Cysteine

-

Glutamic Acid

-

Glutamine

-

Glycine

-

Proline

-

Serine

-

Tyrosine

-

Ornithine

-

Citrulline

-

Creatine

-

Selenocysteine

-

Taurine

-

Other Non-essential Products

-

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Plant-based

-

Animal-based

-

Chemical Synthesis

-

Fermentation

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Food Grade

-

Feed Grade

-

Pharma Grade

-

Other Grades

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Food & Beverage

-

Bakery

-

Dairy

-

Confectionery

-

Convenience Foods

-

Functional Beverages

-

Meat Processing

-

Infant Formulation

-

Other Food & Beverages

-

-

Animal Feed

-

Pet Food

-

Pharmaceuticals

-

Vaccine Formulation

-

Personal Care & Cosmetics

-

Dietary Supplements

-

Agriculture

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Italy

-

Spain

-

Turkey

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global amino acids market size was estimated at USD 29,444.1 million in 2024 and is expected to reach USD 31,884.8 million in 2025.

b. The amino acids market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 58,007.7 million by 2033.

b. The non-essential amino acids segment led the market and accounted for the largest revenue share of 52.6 % in 2024, for its use in animal feed to provide a balanced Product profile for the animal. Animal nutritionists formulate diets to meet the animal's nutrient requirements, including their protein needs.

b. Some of the key players operating in the amino acids market include ADM, Ajinomoto Co., Inc., AMINO GmbH, MartinBauer, J CheilJedang Corp., DAESANG, dsm-firmenich., Evonik, Fermentis Life Sciences, Dacheng Biochemical Technology Group Co., Ltd., IRIS BIOTECH GmbH, Meihua Holdings Group Co., Ltd., Novus International, Inc., Merck and Wacker Chemie AG.

b. The growth is attributed to the increased consumer spending capacity on amino acids and growing awareness among individuals regarding a healthy lifestyle and preventive care, including using health supplements to reduce muscle pain and fatigue and lower the risk associated with cardiovascular diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.