- Home

- »

- Biotechnology

- »

-

Peptide Synthesis Market Size, Share, Industry Report, 2033GVR Report cover

![Peptide Synthesis Market Size, Share & Trends Report]()

Peptide Synthesis Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Equipment, Reagents & Consumables), By Application (Therapeutics, Diagnosis), By Technology (Solid Phase Peptide Synthesis), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-697-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peptide Synthesis Market Summary

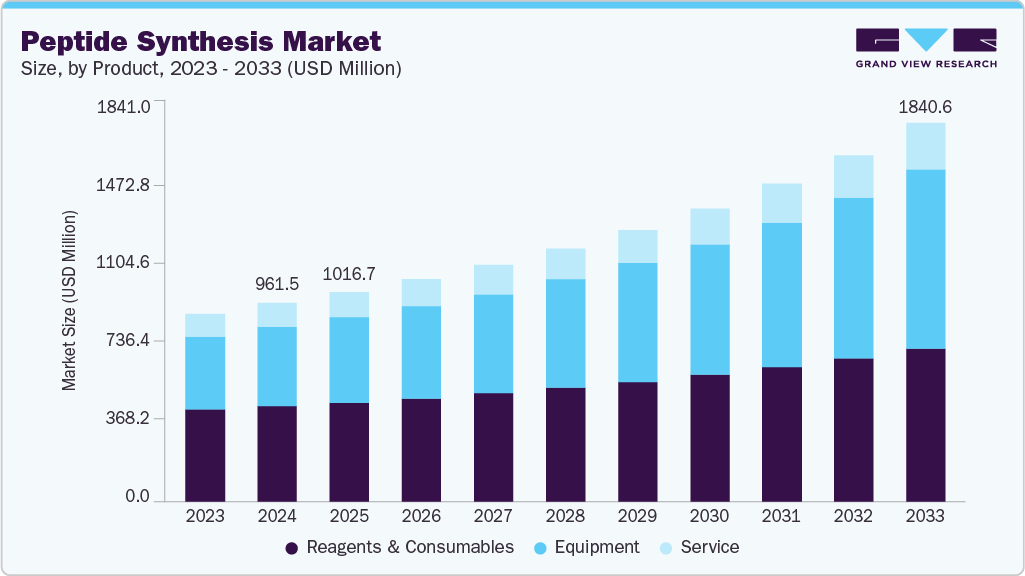

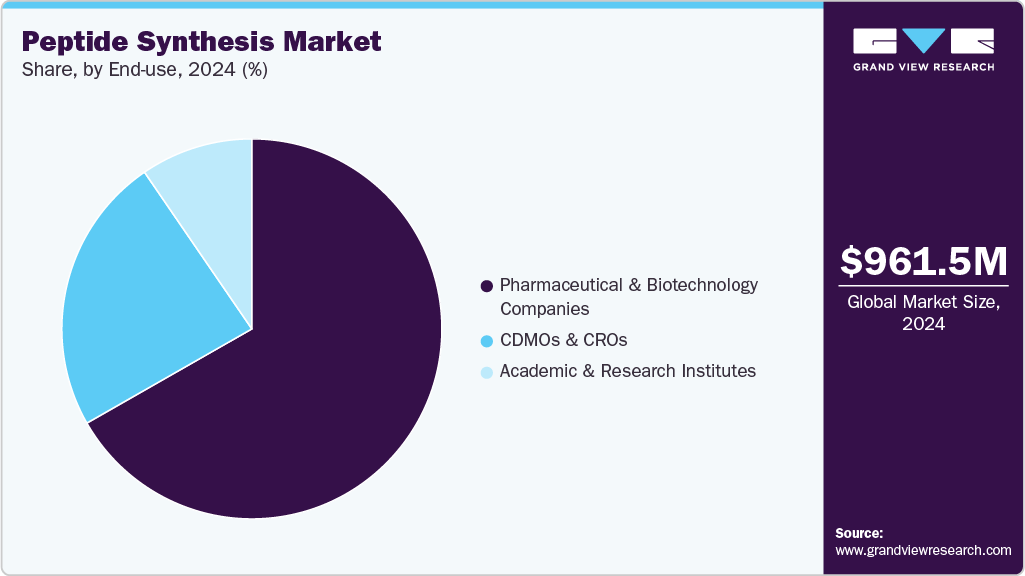

The global peptide synthesis market size was estimated at USD 961.5 million in 2024 and is projected to reach USD 1,840.6 million by 2033, growing at a CAGR of 7.71% from 2025 to 2033. This growth is driven by increasing demand for peptide-based therapeutics, advancements in synthesis technologies, and expanding applications across the pharmaceutical and biotechnology sectors.

Key Market Trends & Insights

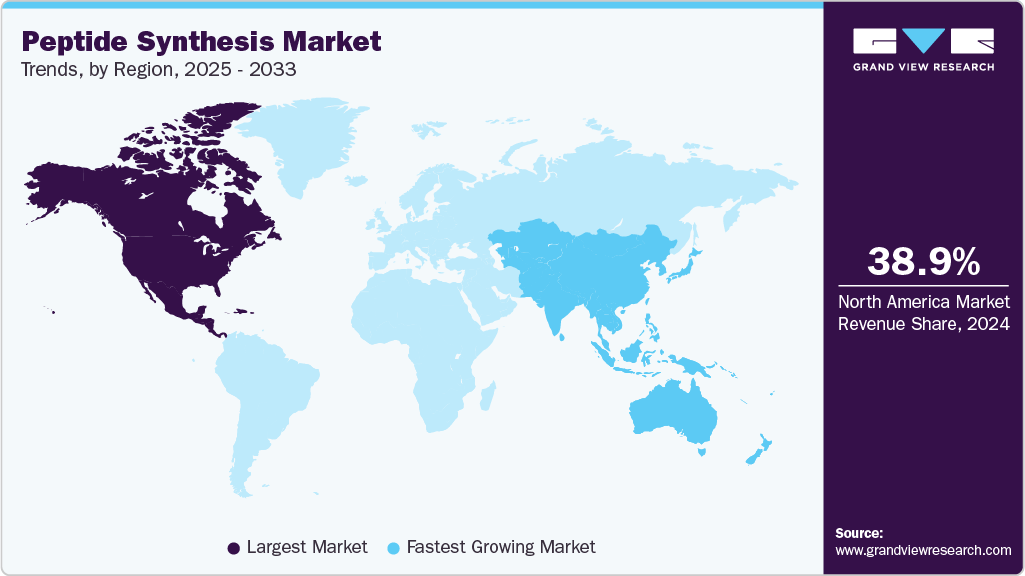

- North America peptide synthesis market held the largest share of 38.95% of the global market in 2024.

- The peptide synthesis market in the U.S. dominated the North American peptide synthesis market in 2024.

- Based on product, the reagents and consumables in the product segment dominated the peptide synthesis market with a revenue share of 47.97% in 2024.

- Based on technology, the liquid phase peptide synthesis (LPPS) segment dominated the peptide synthesis market with a revenue share of 44.04% in 2024.

- By application, the therapeutics segment dominated the market with a revenue share of 70.35% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 961.5 Million

- 2033 Projected Market Size: USD 1,840.6 Million

- CAGR (2025-2033): 7.71%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing Use of Peptide-Based TherapeuticsOne of the primary demand drivers in the peptide synthesis market is the increasing use of peptide-based therapeutics. Peptides offer a unique combination of high specificity, low toxicity, and strong biocompatibility. They are ideal candidates for treating various chronic and lifestyle-related diseases such as cancer, diabetes, obesity, and cardiovascular disorders. Advances in peptide stability, delivery systems, and reduced immunogenicity have led to a growing number of FDA-approved peptide drugs and a surge in clinical trials.

FDA-approved therapeutic peptides from 2019 to 2022

Peptide (Brand name and launch year)

Indication

Tirzepatide (Mounjaro, 2022)

Type 2 diabetes

Lutetium Lu-177 vipivotide tetraxetan (Pluvicto, 2022)

Prostate-specific membrane antigen (PSMA)-positive metastatic castration-resistant prostate cancer

Melphalan flufenamide (Pepaxto, 2021)

Multiple myeloma and amyloid light-chain amyloidosis

Voclosporin (Lupkynis, 2021)

lupus nephritis

Vosoritide (Voxzogo, 2021)

Achondroplasia

Pegcetacoplan (Empaveli, 2021)

Paroxysmal nocturnal hemoglobinuria

Dasiglucagon (Zegalogue, 2021)

Hypoglycemia in diabetics

Piflufolastat-F18 (Pylarify, 2021)

Positron emission tomography (PET) of prostate-specific membrane antigen (PSMA)-positive lesions in men with prostate cancer

Difelikefalin (Korsuva, 2021)

Pruritus associated with chronic kidney disease

9 Odevixibat (Bylvay, 2021)

Pruritus in patients aged over 3 months with progressive familial intrahepatic cholestasis

10 Setmelanotide (Imcivree. 2020)

Chronic weight management

11 64Cu-DOTATATE (Detectnet, 2020)

Scintigraphic imaging

12 68Ga-PSMA-11 (Detectnet, 2020)

Diagnosis of recurrent prostate carcinoma

13 Afamelanotide (Scenesse, 2019)

Erythropoietic protoporphyria

14 Semaglutide (Rybelsus. 2019)

Type 2 diabetes

15 Bremelanotide (Vyleesi, 2019)

Hypoactive sexual desire disorder (HSDD)

Source: PubMed Central, Secondary Research, Grand View Research

The growing interest in personalized medicine and biologically derived treatments has also contributed to expanding pharmaceutical pipelines featuring peptides. This has significantly increased the demand for high-purity, custom, and modified peptides, driving growth in both research- and production-scale synthesis. For instance, in February 2025, Granules India acquired Senn Chemicals AG. This strategic acquisition enables Granules to enter the rapidly growing peptide therapeutics market, including GLP-1 receptor agonists for diabetes and obesity. This move underscores the increasing interest in peptide-based therapies and the market's strong growth potential. As a result, the growing reliance on peptides for drug development is creating sustained and accelerating demand across the global peptide synthesis market.

Advancements in Biotechnology and Drug Development

Rapid advancements in biotechnology and drug development significantly accelerate demand within the peptide synthesis market. Modern peptide synthesis technologies, especially solid-phase peptide synthesis (SPPS), have made it possible to produce peptides more efficiently, with greater purity, and at lower cost. Innovations in automation, resin chemistry, coupling reagents, and purification techniques have reduced production time and improved scalability and consistency, making it feasible to produce complex or modified peptides for research and therapeutic use. These technological breakthroughs are particularly valuable for pharmaceutical companies developing peptide-based drugs, where precision and quality are critical.

Moreover, the rise of personalized medicine contributes to the growing demand for custom peptide synthesis. As drug development becomes more tailored to individual patient profiles, researchers and clinicians increasingly rely on customized peptides for diagnostics, targeted therapies, and vaccine design. For instance, in February 2022, a study published in Signal Transduction and Targeted Therapy highlighted significant advancements in peptide drug development. The study emphasized the evolution of production, modification, and analytical technologies that have enhanced the therapeutic potential of peptides. As a result, peptide synthesis providers offering flexibility, customization, and rapid turnaround are seeing increased demand from clinical researchers and commercial developers, strengthening the importance of biotechnological innovation as a key driver in this market.

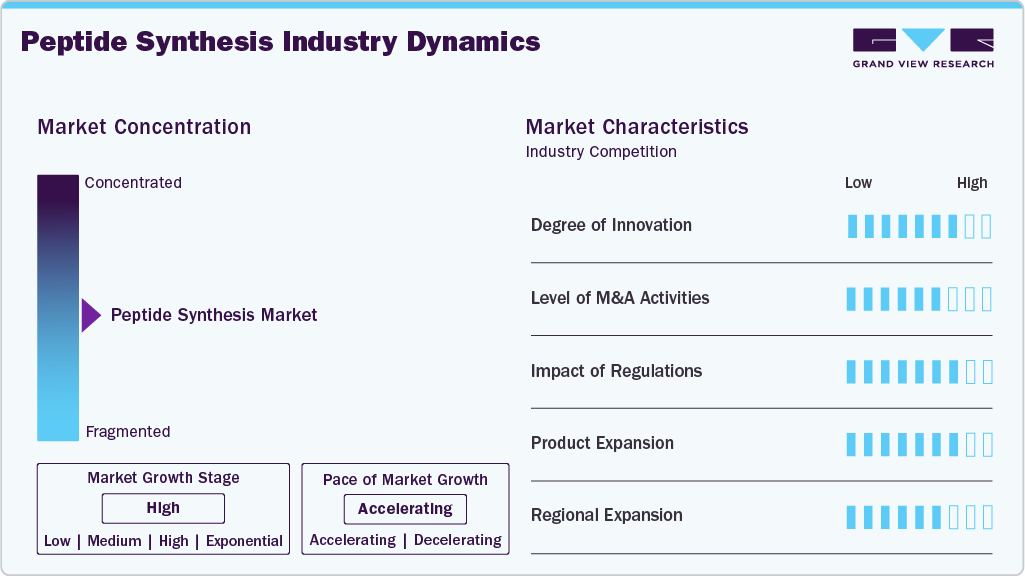

Market Concentration & Characteristics

The degree of innovation in the peptide synthesis industry is high, as advancements in synthesis techniques and drug delivery technologies enable the development of more complex, stable, and effective peptide-based therapeutics. Innovations such as automated solid-phase synthesis and incorporating non-natural amino acids have significantly improved production efficiency and expanded the range of synthesizable peptides. For instance, in November 2024, Asymchem achieved fully automated peptide drug production. The company addressed equipment scale-up challenges using advanced simulation techniques and experimental validation to finalize the solid-phase synthesizer design and define the stirring paddles' structural characteristics. These ongoing innovations enhance the therapeutic potential of peptides across various diseases and increase the need for advanced, customizable synthesis services, making innovation a central force in the growth of the peptide synthesis market.

The increasing level of mergers and acquisitions (M&A) in the peptide synthesis industry strongly indicates growing demand and market consolidation. Large pharmaceutical and biotechnology companies are actively acquiring or partnering with specialized peptide synthesis firms to strengthen their drug development pipelines, gain access to advanced synthesis technologies, and expand manufacturing capabilities. For instance, in April 2025, Granules India Limited successfully acquired Swiss-based Contract Development and Manufacturing Organization (CDMO) Senn Chemicals AG. This strategic acquisition enhances Granules' peptide development and manufacturing capabilities, particularly in Liquid-Phase Peptide Synthesis (LPPS) and Solid-Phase Peptide Synthesis (SPPS). These M&A activities are also driven by the need to secure intellectual property, reduce time-to-market, and improve competitive positioning in high-growth areas such as oncology, metabolic diseases, and personalized medicine.

Regulations play a dual role in shaping demand within the peptide synthesis industry by ensuring product safety and quality while influencing innovation and commercialization. FDA, EMA, and ICH require peptide manufacturers to comply with Good Manufacturing Practices (GMP), high-purity requirements, and robust quality control, driving demand for advanced synthesis technologies and certified production facilities. This regulatory support has encouraged greater investment in peptide drug development, increasing demand for custom synthesis, scale-up capabilities, and compliance-ready peptide suppliers.

Product expansion is a major factor driving demand in the peptide synthesis industry as companies continuously develop new and diverse peptide-based products for therapeutic, diagnostic, and cosmetic applications. Innovations in peptides expand the range of treatable conditions and applications. For instance, in January 2025, researchers introduced a rapid peptide synthesis method using a methylimidazolium sulfinyl fluoride salt. This approach enables the efficient formation of acyl fluorosulfite intermediates within 15 minutes, achieving dipeptide yields of 40-94% without epimerization or the need for column chromatography. This diversification of peptide products opens new market opportunities, encouraging both established pharmaceutical companies and emerging biotech firms to invest heavily in peptide synthesis, thereby fueling market growth.

Regional expansion is a significant demand driver in the peptide synthesis industry as pharmaceutical and biotech industries grow rapidly in emerging markets such as Asia-Pacific, Latin America, and the Middle East. These regions are witnessing increased healthcare expenditure, rising prevalence of chronic diseases, and growing investments in research and development, which are fueling the need for peptide-based drugs and diagnostics. Moreover, favorable government policies, improving regulatory frameworks, and establishing advanced manufacturing facilities attract global peptide synthesis companies to expand their presence in these high-growth markets, increasing the demand for peptide synthesis.

Product Insights

The reagents and consumables in the product segment dominated the peptide synthesis market with a revenue share of 47.97% in 2024, driven by their customization, flexibility, and wide range of products. They are crucial in peptide synthesis as essential components, including amino acids, coupling reagents, resins, solvents, and protecting groups. Their absence would render peptide synthesis impossible, making them a vital industry component.

The equipment segment is expected to register a significant CAGR during the forecast period, driven by its scalability and versatility. Depending on the level of specialization and experimental requirements, equipment can be tailored to meet specific needs. Its ability to produce high-quality peptides in large quantities while maintaining control over production volumes is critical in addressing the increasing demand for peptides across various applications, fueling the growth of the equipment segment.

Technology Insights

The technology segment's liquid phase peptide synthesis (LPPS) dominated the peptide synthesis market with a revenue share of 44.04% in 2024. The dominance is attributed to its efficiency, scalability, high purity and quality, flexibility, customization, and cost-effectiveness. LPPS yields high-quality peptides with fewer impurities, allowing precise control over reaction conditions. This results in superior product quality compared to other synthesis methods, making it the preferred choice for researchers and manufacturers seeking optimal results. For instance, in September 2024, Cambrex announced the development of a new liquid-phase peptide synthesis (LPPS) technology. This innovative approach utilizes traditional active pharmaceutical ingredient (API) batch reactors and continuous flow systems, eliminating the need for specialized solid-phase reactors. The LPPS technology significantly reduces solvent usage and the need for excess reagents compared to standard solid-phase peptide synthesis processes. Cambrex has developed unique peptide and protein crystallization capabilities, including a screening platform for discovering crystalline forms of peptides and proteins. This can enhance product quality and stability while reducing the need for time-consuming preparative chromatography and lyophilization.

The hybrid technology segment in the peptide synthesis market is expected to register the fastest CAGR during the forecast period due to technological advancements and the versatility of peptide synthesis technology, driving segment growth. Hybrid approaches enable high-purity and high-yield peptide production, which is critical in pharmaceutical applications where quality is paramount. Automation and continuous innovation have also improved synthesis speed and performance, making it a preferred choice for research institutions and industries. For instance, in April 2025, Sai Life Sciences inaugurated a dedicated Peptide Research Center at its integrated R&D campus in Hyderabad, India. Equipped with automation, advanced liquid handling, robotics, and high-tech systems, the center enhances precision, scalability, and efficiency in developing novel peptide-based therapeutics. These advancements and growing investments in peptide research and development position the hybrid technology segment as a key driver in the peptide synthesis market’s future growth, meeting the increasing demand for high-quality peptides in the pharmaceutical and biotech sectors globally.

Application Insights

Therapeutics dominated the market with a revenue share of 70.35% in 2024. The therapeutics application segment has experienced significant growth, driven by the demand for peptide therapeutics offering improved metabolic stability, target specificity, and affinity. For instance, in December 2023, researchers introduced a novel method for developing small cyclic peptides with oral bioavailability. Their approach combines combinatorial synthesis, sequential cyclization, and one-pot peptide acylation, enabling the simultaneous evaluation of activity and permeability. This advancement represents a promising approach toward developing orally available peptide drugs targeting complex and challenging diseases, highlighting the critical role of therapeutic applications in driving market growth.

The diagnosis application segment in the peptide synthesis market is expected to register the fastest CAGR during the forecast period. Peptides in diagnostic assays demonstrate exceptional specificity and sensitivity, enabling precise identification of targeted molecules. This precision is critical, as results inform essential treatment decisions. Advances in peptide synthesis have boosted yields and quantities, expanding their applications in diagnostics. For instance, in September 2021, a comprehensive review published in BioMed Research International examined recent advancements in peptide drug discovery. The study highlighted the evolution of peptide-based diagnosis, emphasizing their potential in targeting previously undruggable proteins. Enhanced availability and performance of diagnostic peptides drive innovation and adoption in the industry.

End-use Insights

Pharmaceutical and biotechnology companies led the market with a revenue share of 66.74% in 2024. These companies have established a robust infrastructure, expertise, and financial support for drug research and development. Equipped with specialized labs, skilled personnel, and advanced tools for peptide synthesis, they remain at the forefront of discovering new peptides with therapeutic potential. By prioritizing innovation, they aim to uphold their position as industry leaders in developing peptide-based drugs for diverse medical conditions.

The Contract Development & Manufacturing Organization & Contract Research Organization (CDMOs & CROs) in the end-use segment in the peptide synthesis industry are expected to register the fastest CAGR during the forecast period. CDMOs and CROs are service providers that offer specialized expertise and facilities needed by pharmaceutical and biotech companies and academic and research institutions to carry out drug development and production processes. The demand for CDMOs and CROs is increasing because they are well-equipped to handle outsourced contract work. One of the services these organizations provide is peptide synthesis, which is valuable for companies involved in drug development, manufacturing, and research.

Regional Insights

North America peptide synthesis dominated the global market with the largest revenue share of 38.95% in 2024. The dominance can be attributed to its highly developed pharmaceutical sector, well-developed technology, favorable regulations, and a greater focus on the biopharmaceutical industry. For instance, in May 2024, Donaldson Company and PolyPeptide Group AG announced a collaboration to develop a production-scale solvent recovery system to enhance sustainability in peptide manufacturing. This system, piloted at PolyPeptide’s Torrance, California facility, utilizes a patented three-step technology to reclaim and purify acetonitrile, a solvent commonly used in peptide purification. By removing water content from solvent mixtures, the system recycles acetonitrile to a purity level suitable for reuse, significantly reducing solvent consumption and waste generation while maintaining high product purity, further fueling the demand in the region.

U.S. Peptide Synthesis Market Trends

The peptide synthesis market in the U.S. dominated the North American peptide synthesis market in 2024. Several key factors aid market growth in the country. The increasing prevalence of chronic diseases such as diabetes and obesity drives demand for peptide-based therapeutics. Investments in research and development of personalized medicines and advanced synthesis technologies also contribute to the market’s growth. For instance, in July 2024, CordenPharma announced an investment to expand its peptide manufacturing capabilities in the U.S. and Europe. The U.S. expansion at the Colorado site includes constructing a new large-scale facility and increasing manufacturing capacity to meet the growing demand for GLP-1 peptides. These initiatives aim to position the U.S. as a leader in the peptide synthesis market.

Europe Peptide Synthesis Market Trends

The European peptide synthesis market is expected to grow in the forecast period. The biopharmaceutical industry, research institutes, and government support for scientific advancement have driven the demand for peptide synthesis. For instance, in May 2025, Asahi Kasei Bioprocess America (AKBA) and PeptiSystems announced an exclusive global partnership to enhance peptide manufacturing. AKBA will supply PeptiSystems, based in Uppsala, Sweden, with its THESYS ACS Ergo synthesis columns optimized for peptide processing. This collaboration combines AKBA's expertise in column technology with PeptiSystems' innovative flow-through synthesis systems, aiming to streamline peptide production processes, further driving the market expansion.

The peptide synthesis industry in the UK is expected to grow rapidly in the coming years due to significant investment in research and development activities. For instance, in September 2023, Biosynth, headquartered in Staad, Switzerland, acquired Pepceuticals, a UK-based producer of synthetic peptides. Moreover, factors such as urbanization growth, healthcare infrastructure improvements, and manufacturing segment diversification drive the country's demand.

Germany's peptide synthesis market held a substantial market share in 2024. Germany is a prominent player in the international pharmaceutical market, with well-developed research and production. The country is home to many large-scale pharmaceutical industries specializing in peptides and associated technologies, making it a leading market for peptide synthesis worldwide.

Asia Pacific Peptide Synthesis Market Trends

The peptide synthesis market in Asia Pacific is expected to register the fastest growth, with a CAGR of 9.33% during the forecast period. Manufacturing is cheaper in the Asian Pacific countries than in developed Western countries. This reduced cost has made pharmaceutical companies view outsourcing the synthesis of peptides as a means of cutting unnecessary expenses, hence the increased demand for CMOs in the region. For instance, in October 2024, Latham & Watkins advised Metsera Inc., a clinical-stage biopharmaceutical company, in its strategic collaboration with Amneal Pharmaceuticals. This partnership aims to develop and supply next-generation medicines for obesity and metabolic diseases. The collaboration leverages Metsera’s ultra-long-acting injectable and oral nutrient-stimulated hormone analogs, including its GLP-1 receptor agonist MET-097, which recently demonstrated promising Phase 1 clinical trial results. Such collaborations and cost advantages are expected to accelerate market growth further and solidify the Asia Pacific region’s position as a key hub for peptide synthesis.

China Peptide Synthesis Market Trends

The Chinese peptide synthesis market is expected to grow in the forecast period. Chinese companies have significantly increased their investments in synthesizing peptides and improving process technologies. For instance, in January 2025, BioDuro inaugurated a fully automated solid-phase peptide synthesis scale-up laboratory at its Shanghai Zhangjiang High-tech Park campus in China. This state-of-the-art facility has automated solid-phase peptide synthesizers, cleavage systems, and freeze-drying equipment, supporting peptide synthesis scale-up to 800 mmol. This expansion enhances BioDuro’s capabilities to meet the growing global demand for efficient and scalable peptide manufacturing and make peptide drugs available worldwide, driving market growth.

Japan Peptide Synthesis Market Trends

The Japan peptide synthesis market is witnessing significant growth over the forecast period, driven by advancements in pharmaceutical research, increased investment in biotechnology, and a growing focus on peptide-based therapeutics to address chronic and age-related diseases. For instance, in May 2023, SynCrest Inc., a joint venture between Otsuka Chemical Co., Ltd. and Yokogawa Electric Corporation, launched its Contract Research, Development, and Manufacturing Organization (CRDMO) services for peptide-based therapeutics. The company offers integrated support across the drug development value chain, utilizing advanced continuous flow synthesis with in-line measurement. The company's manufacturing facilities are located at the Naruto Plant in Tokushima, Japan, which is GMP-compliant for highly potent substances and includes both GMP and non-GMP areas to enable a diverse and flexible production system, further expanding production of peptides in the country.

MEA Peptide Synthesis Market Trends

The MEA peptide synthesis market is expected to grow exponentially over the forecast period. The region is witnessing significant growth due to increasing healthcare investments, expanding pharmaceutical manufacturing capabilities, rising prevalence of chronic diseases, and growing adoption of advanced biotechnologies. Moreover, supportive government initiatives and improving regulatory frameworks encourage local and international players to strengthen their presence in the MEA peptide synthesis market.

Kuwait Peptide Synthesis Market Trends

Kuwait’s peptide synthesis market is projected to grow steadily over the forecast period. It is supported by its increasing focus on biomedical research, rising demand for advanced therapeutics, and efforts to diversify its economy through investment in the life sciences sector.

Key Peptide Synthesis Company Insights

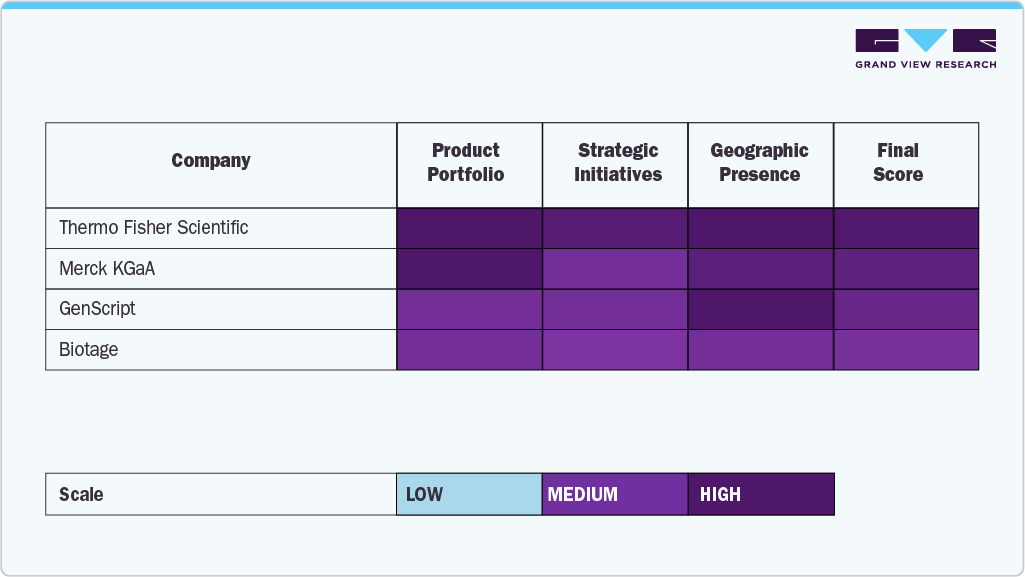

The peptide synthesis market is shaped by several established players maintaining strong market positions through robust product portfolios, continuous innovation, and strategic collaborations. Leading companies such as Thermo Fisher Scientific Inc., Merck KGaA, GenScript, Bachem Holding AG, and Biotage have built substantial market share by offering advanced synthesis technologies, broad application expertise, and end-to-end service capabilities that cater to pharmaceutical, biotechnology, and academic research sectors.

Companies like Bachem Holding AG, PolyPeptide Group, and GenScript are at the forefront of the industry, providing high-purity custom peptides and contract development and manufacturing (CDMO) services across therapeutic, diagnostic, and research applications. These firms offer integrated solutions encompassing peptide design, synthesis, modification, and scale-up for clinical and commercial production. Their strategic focus on innovation, automation, and regulatory compliance has positioned them as critical enablers in developing peptide-based drugs, vaccines, and diagnostics.

Organizations such as Syngene International Limited, Puresynth Research Chemicals Pvt Ltd., Creative Diagnostics, and Lonza are expanding their capabilities through targeted investments in R&D, automation, and peptide library technologies. These efforts support the growing demand for complex and modified peptides, particularly in oncology, metabolic disorders, and infectious diseases.

The peptide synthesis market is also witnessing a dynamic blend of established expertise and emerging innovation. Strategic mergers and acquisitions (M&A), partnerships with biopharma companies, and advances in solid-phase and hybrid synthesis methods are intensifying competition and enhancing the quality, scalability, and accessibility of peptide production. As personalized medicine and peptide therapeutics gain momentum, the market is increasingly driven by commitments to quality, speed, regulatory excellence, and affordability, which will continue to define leadership in this rapidly evolving landscape.

Key Peptide Synthesis Companies:

The following are the leading companies in the peptide synthesis market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- GenScript

- Bachem Holding AG

- Biotage

- Creative Diagnostics

- PolyPeptide Group

- Syngene International Limited

- Puresynth Research Chemicals Pvt Ltd.

- Lonza

Recent Developments

-

In May 2025, Bachem, a Swiss leader in peptide and oligonucleotide manufacturing, announced significant investments to expand production capacities across its global network. The company is enhancing facilities in Bubendorf, Switzerland; Vista, California; and St Helens, UK, to meet the increasing demand for peptide-based therapeutics.

-

In December 2024, Lonza announced a strategic restructuring of its Contract Development and Manufacturing Organization (CDMO) business. The company introduced the “One Lonza” strategy, consolidating its operations into integrated platforms: Integrated Biologics, Advanced Synthesis, and Specialized Modalities. This reorganization aims to streamline operations, enhance customer experience, and support future growth.

-

In June 2023, Biotage launched the Biotage PeptiPEC-96, an automated, high-throughput peptide purification system developed in collaboration with Gyros Protein Technologies. This system integrates Gyros' PurePep EasyClean (PEC) catch-and-release technology with the Biotage Extrahera workstation, simultaneously purifying up to 96 peptides. Compared to traditional reversed-phase high-performance liquid chromatography (RP-HPLC), the PeptiPEC-96 offers purification that is 75% faster and reduces solvent consumption by up to 98%. This advancement addresses the bottleneck in peptide synthesis workflows, facilitating more efficient screening and development of peptide-based therapeutics.

Peptide Synthesis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,016.4 million

Revenue forecast in 2033

USD 1,840.6 million

Growth rate

CAGR of 7.71% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; GenScript; Bachem Holding AG; Biotage; Creative Diagnostics; PolyPeptide Group; Syngene International Limited; Puresynth Research Chemicals Pvt Ltd.; Lonza

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Peptide Synthesis Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2021 to 2033. Grand View Research has segmented this study's global peptide synthesis market report based on product, technology, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Peptide Synthesizers

-

Lyophilizers

-

Chromatography Equipment

-

Others

-

-

Reagents & Consumables

-

Resins

-

Amino Acids

-

Coupling Reagents

-

Dyes & Fluorescent Labeling Reagents

-

Others

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Solid Phase Peptide Synthesis (SPPS)

-

Liquid Phase Peptide Synthesis (LPPS)

-

Hybrid Technology

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Therapeutics

-

Cancer

-

Metabolic

-

Cardiovascular Disorder

-

Respiratory

-

GIT (Gastrointestinal Disorders)

-

Infectious Diseases

-

Pain

-

Dermatology

-

CNS

-

Renal

-

Others

-

-

Diagnosis

-

Research

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

CDMOs & CROs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peptide synthesis market size was estimated at USD 961.5 million in 2024 and is expected to reach USD 1.02 billion in 2025.

b. The global peptide synthesis market is expected to witness a compound annual growth rate of 7.71% from 2025 to 2030 to reach USD 1.84 billion by 2030.

b. The liquid phase peptide synthesis technology held the largest share of 44.04% in 2024. This is attributed to the increasing adoption of liquid peptide synthesis technology in the development of shorter peptide sequences at larger volumes.

b. Some of the key players in the market include Genscript Biotech, Merck KGaA, Bachem Holdings, Biotage, CEM Corporation, Thermo Fisher, Creative Diagnostics, Polypeptide Group, Syngene, PuroSynth, Lonza, MP Biomedicals and Novo Nordisk A/S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.