- Home

- »

- Agrochemicals & Fertilizers

- »

-

Global Phosphate Rock Market Size Report, 2022-2030GVR Report cover

![Phosphate Rock Market Size, Share & Trends Report]()

Phosphate Rock Market Size, Share & Trends Analysis Report By Application (Fertilizers, Food & Feed Additives, Industrial), By Region (North America, Europe, APAC, South America, MEA), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-281-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

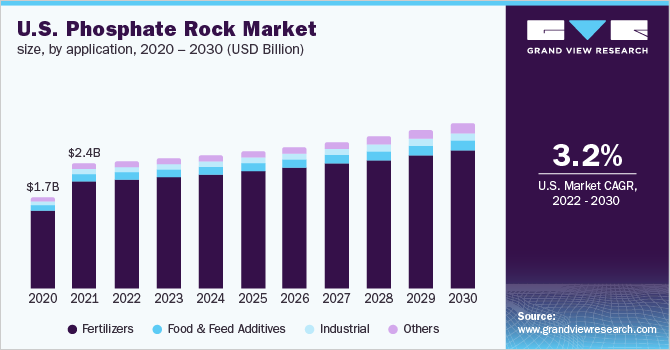

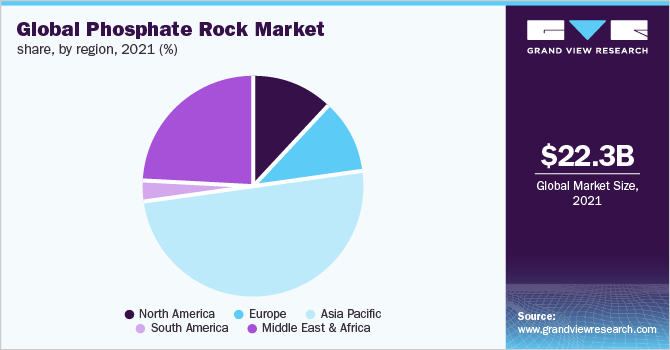

The global phosphate rock market size was valued at USD 22.30 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.2% from 2022 to 2030. Increasing demand from fertilizers is anticipated to boost the demand for phosphate rock over the forecast period. The rising global population, coupled with the growing food industry, is expected to drive the need for grains and cereals over the coming years.

According to the Food and Agriculture Organization, food production has to increase by 70% by 2050 in order to supply food for the global population. This is anticipated to boost the demand for fertilizers, which is expected to augment the market growth over the coming years. The demand for phosphate fertilizers is expected to be driven by an increase in food and feed production to meet the rising needs of livestock and humans. The U.S. is one of the largest producers of cereals, grains, and oilseeds. This is anticipated to drive the market over the forecast period.

According to data published by National Agricultural Statistics Service Information, the per capita consumption of poultry and red meat in the U.S. increased to 224.63 pounds per person from 224.10 pounds per person in 2019. The growing demand for high-quality meat is projected to boost the demand for animal feed with high nutrition, which, in turn, is expected to drive the market for phosphate rock over the coming years.

The outbreak of foot and mouth disease (FMD), highly pathogenic avian influenza (HPAI), and African Swine Fever (ASF) represents a significant threat to the animal feed industry and thus to the market for phosphate rock. Small and large outbreaks of such diseases rapidly affect the demand, where consumption and production witness a decline. Thus, the outbreak of such diseases is projected to affect the market dynamics of the phosphate rock industry.

Application Insights

The fertilizers segment accounted for the largest share of over 75.0% in 2021, in terms of revenue. The segment is projected to grow in the years to come owing to the increasing demand from the agricultural industry due to the growing population across the world. As per the data published by the Food and Agriculture Organization, the global demand for phosphorous as P2O5 in fertilizers is estimated to be 49 million tons in 2020, an increase from 45 million tons in 2018.

Meat and dairy are the major sources of protein to ensure healthy food for the ever-growing world population. The processed phosphoric acid and limestone are fed into a high-speed mixer to create a homogenous mixture, which is then dried and packed for the end-users. The major feed phosphates are monocalcium phosphate (MCP), dicalcium phosphate (DCP), and others. Phosphate feeds improve bone strength and fertility in animals.

Hydroponics has been gaining worldwide attention owing to the quality food production and proper resource management. Soil-based farming is facing challenges such as climate change, natural disasters, and declining fertility of the land. In such cases, hydroponics can be greatly beneficial as it involves cultivating plants in nutrient solutions. Countries such as Canada, the U.S., France, the U.K., Israel, the Netherlands, and France are likely to offer opportunities in hydroponics over the coming years.

Regional Insights

Asia Pacific accounted for the largest volume share of over 45.0% in 2021 due to diversified food needs in populous and emerging countries, such as India and China. The growing demand for food in the region is expected to fuel the utilization of fertilizers in order to increase the efficiency of crop production, which is anticipated to boost the demand for phosphate rock over the coming years. The demand for phosphate rock in Asia Pacific is primarily driven by population growth, government initiatives, prices, and production.

The agriculture sector in APAC is expanding and the population is mainly dependent on the domestic farming sector. These factors are encouraging farmers to increase land productivity by using several soil inputs, thus propelling the regional market growth. The Middle East and Africa region accounted for the second-largest share in 2021 and is projected to grow at a rate of 2.3% from 2022 to 2030, in terms of volume. Africa has the largest phosphate rock reserves in the world. According to the data published by the USGS, Morocco and Western Sahara together have over 70% of the world’s phosphate rock reserves.

Key Companies & Market Share Insights

The phosphate rock value chain consists of mining companies, distributors, manufacturers of phosphate rock-based products, and end users. About 70% of players in the market are vertically integrated and engaged in the mining of phosphate rock to the manufacturing of fertilizers. This scale of operations helps to lower logistics costs and address supply chain challenges such as delays in product delivery and high transport costs. At the same time, it assists for efficient monitoring and improvement of production quality.

In August 2021, Centrex Metals started a new mine project for phosphate rock in Ardmore, Northwest Queensland, Australia. This mine is likely to produce 800 kilotons of phosphate rock reach year, which can translate into 600 kilotons of phosphate fertilizers. Australia and New Zealand import million tons of phosphate rock each year from the Western Sahara region. This will provide an opportunity for Centrex Metals owing to a significant freight advantage compared to current suppliers. Some prominent players in the global phosphate rock market include:

-

OCP Group

-

The Mosaic Company

-

Ma’aden

-

PhosAgro

-

Guizhou Kailin Holdings (Group) Co., Ltd.

-

Yuntianhua Group

-

Misr Phosphate

-

Hubei Xingfa Chemicals

-

Wengfu Group

-

Yunnan Phosphate Haikou Co., Ltd. (YPH)

Phosphate Rock Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 22.75 billion

Revenue forecast in 2030

USD 29.73 billion

Growth Rate

CAGR of 3.2% from 2022 to 2030

Market demand in 2022

211,022.6 kilotons

Volume forecast in 2030

266,428.0 kilotons

Growth Rate

CAGR of 2.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, trade analysis, production analysis, price trends, growth factors, impact of COVID-19

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Germany; U.K.; Russia; China; India; Australia; Brazil; Saudi Arabia; Egypt; Morocco

Key companies profiled

OCP Group; Ma'aden; The Mosaic Company; Misr Phosphate; PhosAgro; Jordan Phosphate Mines Company (PLC); Guizhou Kailin Holdings (Group) Co Ltd; and Yuntianhua Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global phosphate rock market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Fertilizers

-

Food & Feed Additives

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

Egypt

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global phosphate rock market size was estimated at USD 22.30 billion in 2021 and is expected to reach USD 22.75 billion in 2022.

b. The global phosphate market is expected to grow at a compound annual growth rate of 3.2% from 2022 to 2030 to reach USD 29.73 billion by 2030.

b. Based on region, Asia Pacific was the largest market with a revenue share of nearly 50% in 2022, owing to the growing demand for food and to increase the efficiency of crop production in the region, which is expected to boost the fertilizer requirement.

b. The key players operating in the phosphate rock market include OCP Group, The Mosaic Company, Ma’aden, PhosAgro, Guizhou Kailin Holdings (Group) Co., Ltd, Yuntianhua Group, Misr Phosphate, and Hubei Xingfa Chemicals.

b. The key factor driving the phosphate rock market is the increasing demand for fertilizers for efficient food production to feed the growing population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."