- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyphenylene Sulfide Market Size, Industry Report, 2033GVR Report cover

![Polyphenylene Sulfide Market Size, Share & Trends Report]()

Polyphenylene Sulfide Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Linear PPS, Cured PPS, Branched PPS), By Application (Automotive, Electrical & Electronics, Industrial, Coatings), By Region, And Segment Forecasts

- Report ID: 978-1-68038-044-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyphenylene Sulfide Market Summary

The global polyphenylene sulfide market size was estimated at USD 1.67 billion in 2024 and is projected to reach USD 3.56 billion by 2033, growing at a CAGR of 8.7% from 2025 to 2033. The market is driven by growing use of PPS in high-voltage electrical components, where its reliability under thermal stress helps manufacturers improve product safety and extend component life.

Key Market Trends & Insights

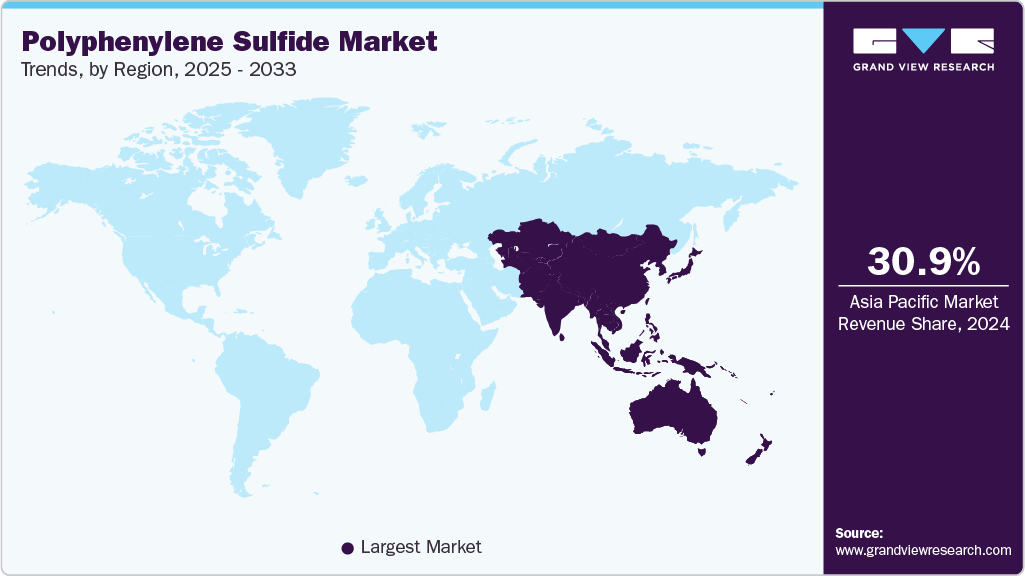

- Asia Pacific dominated the global polyphenylene sulfide industry with the largest revenue share of 30.93% in 2024.

- The polyphenylene sulfide industry in China is expected to grow at a substantial CAGR of 9.6% from 2025 to 2033.

- By product, the linear PPS segment is expected to grow at a considerable CAGR of 9.3% from 2025 to 2033 in terms of revenue.

- By application, the automotive segment is expected to grow at a considerable CAGR of 9.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.67 Billion

- 2033 Projected Market Size: USD 3.56 Billion

- CAGR (2025-2033): 8.7%

- Asia Pacific: largest market in 2024

Its compatibility with precision molding also allows producers to simplify assembly and reduce defect rates, supporting wider industrial adoption. Demand for polyphenylene sulfide (PPS) is shifting from niche industrial uses to high-volume applications in automotive electrification and advanced electronics. PPS is replacing metal and lower-performance plastics where thermal stability and chemical resistance are critical. This transition is driving higher-volume compound grades and film formats. Regional demand is strongest in Asia Pacific, led by China and India.

Drivers, Opportunities & Restraints

Manufacturers are choosing PPS because it combines continuous high-temperature performance, dimensional stability and inherent flame retardancy with low density. These properties enable weight reduction and part consolidation in under-hood, powertrain and connector components. Processors are also developing glass-filled and reinforced grades that meet automotive and industrial OEM specifications, accelerating qualified adoption.

Improvements in PPS resin formulations and film processing open new revenue streams beyond molded parts. High-performance PPS coatings and thin films can serve as electronic insulation, chemical-resistant linings and high-temperature barrier layers. Targeted investments in downstream compounding, specialty additives and localized capacity in Asia present an opportunity to capture higher value per kilogram and shorten qualification cycles for OEMs.

PPS production relies on commodity feedstocks and energy-intensive polymerization, making margins sensitive to feedstock price swings. The resin carries a price premium versus commodity engineering plastics, slowing substitution in cost-sensitive segments. Long OEM qualification times and limited global capacity for specialty grades further restrain near-term volume growth. Capacity additions will be required to mitigate supply bottlenecks.

Market Concentration & Characteristics

The growth stage of the polyphenylene sulfide industry is high, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies such as DIC CORPORATION, Solvay S.A., Lion Idemitsu Composites Co., Ltd, and among others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in PPS focuses on both resin chemistry and downstream processing to unlock new end uses. Developers are producing tailored PPS composites and filled compounds that boost thermal conductivity for EV thermal management and improve mechanical performance for structural electronics. Film and separator innovations use porous and solvent-free processes to meet battery insulation and high-temperature insulation needs. Surface modification and adhesion technologies are shortening OEM qualification cycles for coated and bonded assemblies.

PPS competes with a set of specialty polymers where buyers trade off cost against performance. PEEK and polyimides displace PPS when extreme temperature or mechanical strength is required, while PTFE is chosen for unmatched chemical resistance and low friction. Semi-crystalline nylons and PPA are lower-cost options that win when price and impact toughness matter. Material selection is therefore application specific and driven by temperature limits, chemical exposure and total part cost.

Product Insights

Linear PPS dominated the market across the type segmentation in terms of revenue, accounting for a market share of 60.06% in 2024 and is forecasted to grow at the fastest CAGR of 9.3% from 2025 to 2033. Linear PPS is the backbone grade for high-performance structural parts where stiffness and long-term creep resistance matter. Its higher molecular weight and crystalline morphology deliver superior mechanical strength and dimensional stability under prolonged thermal exposure. OEMs favor linear grades for metal-replacement components because they provide consistent processing and easier certification against automotive and industrial standards. Regional production and downstream compounding in Asia are reinforcing its market dominance.

The branched PPS segment is anticipated to grow at a substantial CAGR of 7.6% through the forecast period. Branched PPS offers a processing advantage through improved melt flow and faster cycle times. The branched architecture increases toughness and elongation, enabling designers to mould thin-walled and complex geometries with fewer defects. Suppliers position branched grades for applications where part complexity and impact resistance matter more than raw stiffness. Investment in tailored additives and reinforced compounds is making branched PPS more competitive for niche assembly- and design-led applications.

Application Insights

Automotive dominated the market across the application segmentation in terms of revenue, accounting for a market share of 34.27% in 2024 and is forecasted to grow at fastest CAGR of 9.0% from 2025 to 2033. PPS is primarily used in coatings to prevent corrosion on ferrous parts in the chemical and construction industries. Slurry coating, electrostatic coating on cold or hot surfaces, powder flocking, and fluidized bed coating are some methods that can be used to apply polyphenylene sulfide coatings. The enhancement in coating processes in developing countries such as U.S., China, and Brazil is expected to boost the PPS market in coating application.

The electrical and electronics segment is expected to grow at a substantial CAGR of 8.8% over the forecast period. The electrical and electronics segment is a rapid growth pocket for PPS driven by miniaturization and higher operating temperatures. PPS provides reliable dielectric insulation, low moisture uptake and dimensional precision needed for connectors, insulating films and coil bobbins. Manufacturers use glass-filled and flame-retardant PPS compounds to meet stringent safety and performance specifications in EVs, 5G infrastructure and power electronics. Qualification cycles remain rigorous, but successful approvals yield long product lifecycles and stable volume demand.

Regional Insights

Asia Pacific polyphenylene sulfide industry held the largest global market share of 30.93% in terms of revenue in 2024 and is expected to grow at the fastest CAGR of 9.2% over the forecast period. Asia Pacific is a volume growth engine driven by electronics manufacturing scale and rapid EV adoption across multiple markets. Large electronics OEMs and tier suppliers in the region are accelerating qualification of PPS for miniaturized connectors, insulating films and power modules. Local investment in compounding and regional capacity expansions is lowering costs and shortening time to market for new grades. This combination of scale and proximity is boosting regional PPS penetration.

China polyphenylene sulfide industry’s driver is deep OEM and connector manufacturing capability coupled with a fast-growing electric vehicle industry. Domestic demand for high-voltage connectors, power electronics and battery components is creating immediate off-take for specialty PPS compounds. Chinese producers are also expanding localized PPS capacity and downstream compounding to capture value and reduce import dependence. This inward-focused buildout is accelerating adoption across multiple industrial segments.

North America Polyphenylene Sulfide Market Trends

The North America polyphenylene sulfide industry demand is being driven by industrial automation and resilient supply chain strategies that favor local sourcing of high-performance polymers. Manufacturers in electronics, aerospace and industrial equipment are qualifying PPS to reduce part counts and extend service intervals. Investment in domestic compounding and specialty grade production is shortening lead times for OEMs. This structural shift supports steady volume growth for value-added PPS compounds.

U.S. Polyphenylene Sulfide Market Trends

The polyphenylene sulfide industry in the U.S. is primarily driven by vehicle electrification and the rapid expansion of high-voltage connector and battery systems. PPS is specified for connectors, housings and thermal management components because it meets insulation, temperature and flame-retardant requirements. Strong capex in EV component manufacturing and supplier qualification pipelines is converting demand into long-term contracts. This trend is elevating demand for glass-filled and flame-retardant PPS compounds.

Europe Polyphenylene Sulfide Market Trends

The European polyphenylene sulfide industry demand is shaped by regulatory pressure to cut emissions and by OEM programs for lightweighting and durability. Automakers and industrial customers choose PPS to meet stricter thermal and safety standards while reducing mass. Concurrently, buyers are pushing for recycled-content and low-carbon production methods, which is prompting suppliers to innovate in feedstock sourcing and process efficiency. These factors are steering procurement toward higher-performance, certificable PPS grades.

Key Polyphenylene Sulfide Company Insights

The polyphenylene sulfide industry is highly competitive, with several key players dominating the landscape. Major companies include DIC CORPORATION, Solvay S.A., Lion Idemitsu Composites Co., Ltd, Toray Industries, Inc., among others. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Polyphenylene Sulfide Companies:

The following are the leading companies in the polyphenylene sulfide market. These companies collectively hold the largest market share and dictate industry trends.

- DIC CORPORATION

- Solvay S.A.

- Lion Idemitsu Composites Co., Ltd

- Toray Industries, Inc.

- Tosoh Corporation

- SK chemicals

- Chengdu Letian Plastics Co., Ltd.

- Celanese Corporation

- TEIJIN LIMITED

- SABIC

- Zhejiang NHU Co., Ltd.

- LG Chem

- RTP Company

- Ensinger

- Polyplastics Co., Ltd.

Recent Developments

-

In April 2025, Syensqo launched a new Ryton PPS M2000 FP grade optimized for powder coatings, offering strong deposition per pass, lower volatile emissions, and high-temperature resistance up to 200 °C.

-

In January 2025, Envalior announced it is building a PPS compounding facility in Uerdingen, Germany, to locally produce its high-performance Xytron PPS for European and American customers.

Polyphenylene Sulfide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.82 billion

Revenue forecast in 2033

USD 3.56 billion

Growth rate

CAGR of 8.7% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK, Italy, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

DIC CORPORATION; Solvay S.A.; Lion Idemitsu Composites Co., Ltd; Toray Industries, Inc.; Tosoh Corporation; SK chemicals; Chengdu Letian Plastics Co., Ltd.; Celanese Corporation; TEIJIN LIMITED; SABIC; Zhejiang NHU Co., Ltd.; LG Chem; RTP Company; Ensinger; Polyplastics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyphenylene Sulfide Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the polyphenylene sulfide market report based on product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Linear PPS

-

Cured PPS

-

Branched PPS

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Electrical & Electronics

-

Industrial

-

Coatings

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyphenylene sulfide market size was estimated at USD 1.67 billion in 2024 and is expected to reach USD 1.82 billion in 2025.

b. The global polyphenylene sulfide market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2033 to reach USD 3.56 billion by 2033.

b. The automotive segment dominated the polyphenylene sulfide market with a share of 34% in 2024. Increasing requirements of weight reduction in cars to improve their efficiency and to reduce emissions has resulted in the need to replace heavy metal parts with lighter polymers.

b. Some key players operating in the polyphenylene sulfide market include Toray Industries, SK Chemicals, Solvay, Kureha Corporation, DIC, and Polyplastics Co., Ltd.

b. Key factors that are driving the market growth include increasing demand from various sectors including automotive, electronics, industrial, and aerospace.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.