- Home

- »

- Plastics, Polymers & Resins

- »

-

Specialty Polymers Market Size, Share, Industry Report 2033GVR Report cover

![Specialty Polymers Market Size, Share & Trends Report]()

Specialty Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Form (Solid, Liquid), By Product Type (Specialty Elastomers, Specialty Thermoplastics), By End Use (Building & Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-707-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Polymers Market Summary

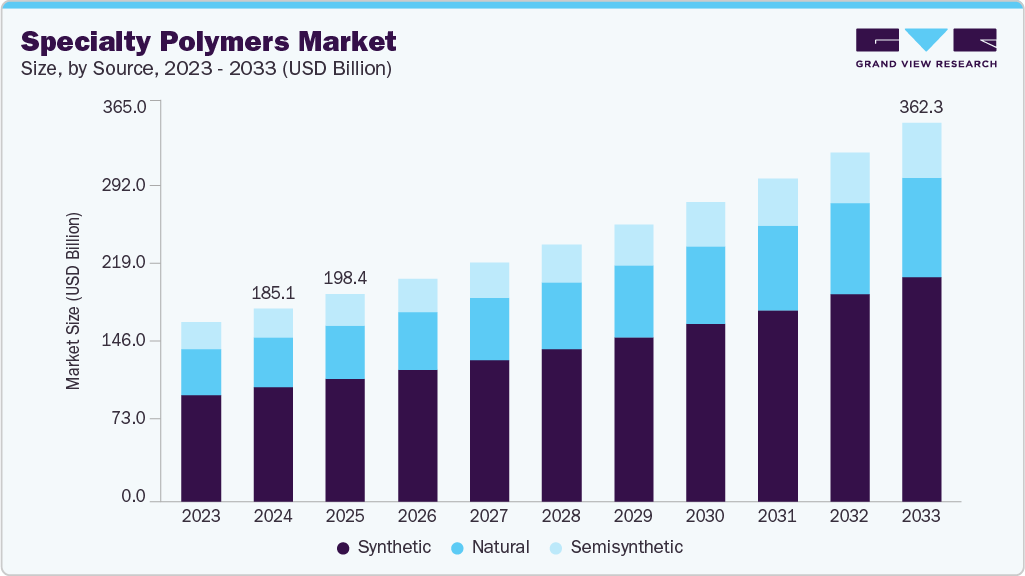

The global specialty polymers market size was estimated at USD 185.10 billion in 2024 and is projected to reach USD 362.31 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. Accelerated product development cycles and the need for faster time to market are pushing OEMs to source specialty polymers that shorten design validation and improve manufacturability.

Key Market Trends & Insights

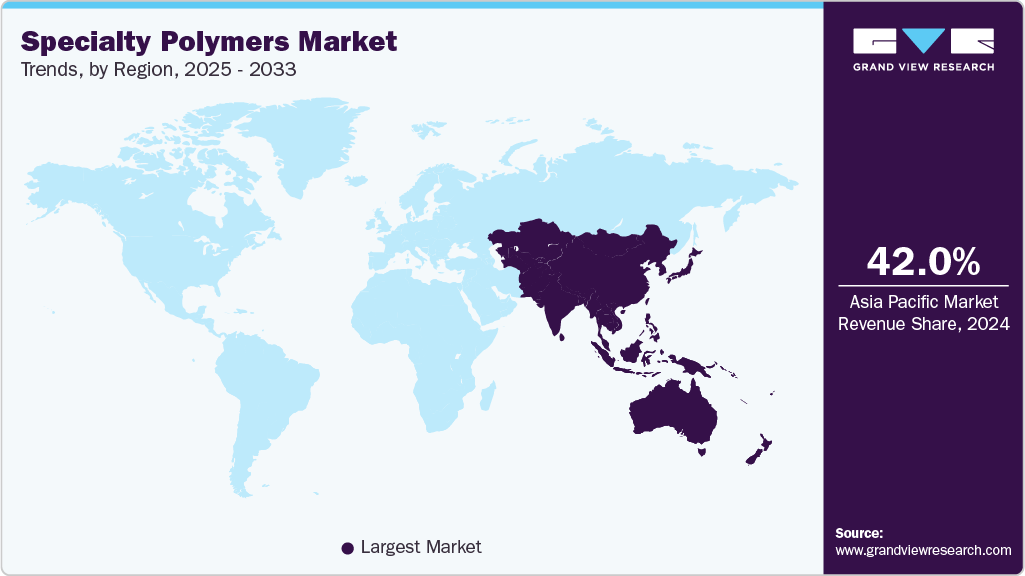

- Asia Pacific dominated the specialty polymers market with the largest revenue share of 42.02% in 2024.

- The specialty polymers industry in India is expected to grow at a substantial CAGR of 9.1% from 2025 to 2033.

- By source, the natural segment is expected to grow at a considerable CAGR of 8.1% from 2025 to 2033 in terms of revenue.

- By form, the solid segment is expected to grow at a considerable CAGR of 8.2% from 2025 to 2033 in terms of revenue.

- By product type, the specialty elastomers segment is expected to grow at a considerable CAGR of 8.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 185.10 Billion

- 2033 Projected Market Size: USD 362.31 Billion

- CAGR (2025-2033): 7.8%

- Asia Pacific: Largest market in 2024

Suppliers that offer rapid prototyping grades and dependable supply chain support gain a clear competitive edge. An accelerating trend in the specialty polymers industry is the migration from single-purpose materials to multifunctional, formulation-driven solutions. Customers increasingly demand polymers that combine mechanical strength, thermal stability, and chemical resistance while enabling weight reduction in end products. This is driving closer collaboration between polymer producers and system houses to deliver application-ready compounds and tailor-made additives. Simultaneously, sustainability is being integrated into product roadmaps through bio-based feedstocks and designs for recyclability.

Drivers, Opportunities & Restraints

Industrial electrification, miniaturization of electronics, and stricter safety and emissions regulations are primary demand drivers for specialty polymers. Automotive and electronics manufacturers are substituting metals and commodity plastics to improve energy efficiency and meet tighter tolerances. At the same time, end users are willing to pay a premium for performance that reduces the total cost of ownership through longer service life or lower maintenance. This willingness to pay supports higher margin specialty formulations and ongoing investment in application-specific R&D.

Commercial opportunities lie in scaling circular economy solutions and application development for advanced manufacturing. Investments in chemical recycling, compatibilizers, and design for recycling open pathways to capture value from post-consumer streams and create differentiated, closed-loop offerings. Additive manufacturing, medical devices, and high-performance coatings remain underpenetrated end markets where custom polymer chemistries can command premium pricing. Strategic partnerships with converters and OEMs that embed polymers as system-level enablers will unlock recurring revenue and higher lifetime margins.

The market growth is constrained by raw material price volatility and the capital intensity of scaling specialty chemistries to commercial volumes. Complex processing requirements and long validation cycles in heavily regulated sectors such as healthcare and automotive slow time to market and increase development costs. Fragmented recycling infrastructure and limited feedstock availability for bio-based alternatives impede sustainability claims at scale. In addition, competitive pressure from engineered thermoplastics and lightweight metals compresses pricing power in commoditizing segments.

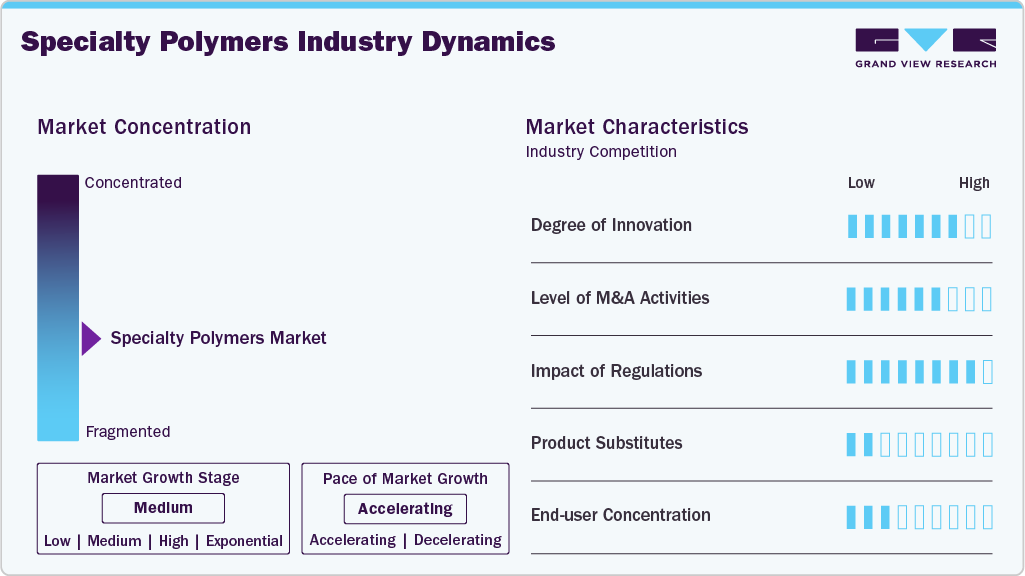

Market Concentration & Characteristics

The specialty polymers market growth stage is medium, and the pace is accelerating. The market exhibits significant fragmentation, with key players dominating the industry landscape. Major companies like Arkema; BASF SE; Evonik Industries AG; Covestro AG; Solvay SA; Dow Inc.; DuPont de Nemours, Inc.; SABIC; Celanese Corporation; Eastman Chemical Company; Mitsubishi Chemical Group Corporation; Toray Industries, Inc.; Kuraray Co., Ltd.; LG Chem; and Wacker Chemie AG; play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in specialty polymers today is concentrated at the intersection of circularity and functionality. Companies are investing in chemical recycling and mass balance methods to convert complex waste streams into feedstock while developing bio-based monomers that preserve performance but reduce lifecycle emissions. Simultaneously, advances in additive manufacturing and materials by design are enabling bespoke polymer chemistries for lightweighting, thermal management, and multi-functional parts, compressing development cycles and raising the technical bar for new entrants.

Regulation is reshaping product roadmaps by tightening constraints on legacy chemistries and by creating clear incentives for safer alternatives. Global moves to restrict PFAS and to limit intentionally added microplastics are forcing formulators to substitute or redesign materials, while U.S. regulatory scrutiny of flame retardants and certain plasticizers is increasing validation burdens and compliance costs. At the same time, regulators are beginning to set rules for chemical recycling and recycled content accounting, which will determine which circular technologies can be claimed commercially and how value flows through supply chains.

Source Insights

The synthetic segment dominated the specialty polymers market with a revenue share of 59.37% in 2024 and is forecasted to grow at a 7.8% CAGR from 2025 to 2033. Scale economics and feedstock security remain the primary drivers for synthetic specialty polymers. Large incumbent producers leverage established petrochemical feedstock streams and integrated manufacturing to underwrite extensive application development and global logistics. This scale enables rapid qualification with major OEMs and keeps synthetic grades competitive for high-volume transport and industrial uses.

The natural segment is anticipated to grow at the fastest CAGR of 8.1% over the forecast period. Growing regulatory pressure and corporate net zero commitments are accelerating demand for natural, bio-based specialty polymers as companies seek low-carbon alternatives. Brands in packaging, personal care, and medical devices are switching to renewable feedstocks to protect reputation and meet procurement ESG mandates, creating fast adoption pockets where performance tradeoffs are manageable.

Form Insights

The solid segment led the specialty polymers industry with the largest revenue share of 76.11% in 2024. Preference for solid formats such as pellets and powders is driven by manufacturing efficiency and tighter environmental rules on volatile organic compound emissions. Solid forms simplify dosing, enable automated handling on high-throughput lines, and reduce solvent use in formulations, so converters and large industrial users favor solids to improve throughput and compliance.

The liquid segment is anticipated to grow at a significant CAGR of 6.5% through the forecast period. Liquid specialty polymers gain traction where formulation flexibility and high surface performance matter, notably in coatings, adhesives, and casting. The driver here is faster formulation development and superior end-use aesthetics or bond strength, which makes liquids indispensable for premium finishes and specialty adhesive systems despite higher logistics complexity.

Product Type Insights

The specialty elastomers segment dominated the specialty polymers market with a revenue share of 28.01% in 2024 and is anticipated to grow at an 8.8% CAGR over the forecast period. This can be attributed to the electrification of transport and the evolving needs of advanced sealing and vibration management in electric vehicles. Specialty elastomers that sustain thermal cycling, resist new battery electrolytes, and provide long-term sealing reliability are being specified earlier in design cycles, giving elastomer suppliers pricing power and strategic partnership opportunities.

The specialty thermoplastics segment is anticipated to grow at a significant CAGR of 8.6% through the forecast period. Demand for lightweighting and recyclability is pushing the specification of high-performance thermoplastics over metals and composites in both consumer electronics and structural components. The driver is the combination of favorable cycle times for injection molding, improved mechanical performance at lower weight, and easier end-of-life sorting compared with many multi-material assemblies.

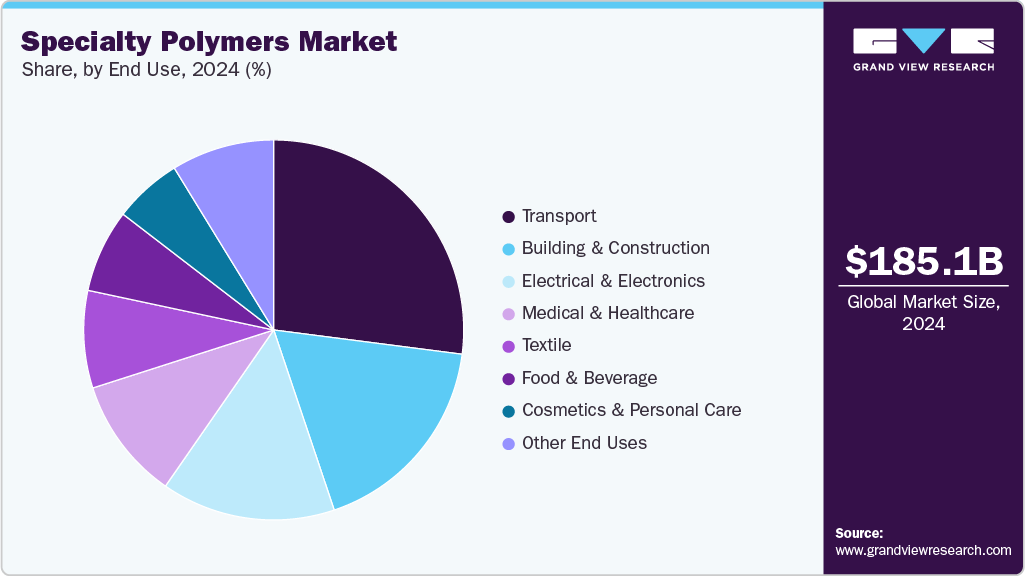

End Use Insights

The transport segment led the specialty polymers industry with a revenue share of 27.04% in 2024, and is expected to grow at a CAGR of 8.9% over the forecast period. Stringent fuel efficiency requirements and the shift to electric architectures are driving transport OEMs to adopt more specialty polymers as system enablers. Materials that reduce part count, integrate functions, and provide higher temperature resistance are being prioritized to improve vehicle efficiency and reduce lifetime service costs, which creates sustained, high-volume demand from Tier 1 suppliers.

The building & construction segment is expected to expand at a substantial CAGR of 9.0% through the forecast period. Rapid urbanization and a push for longer-lasting, low-maintenance infrastructure are driving faster uptake of specialty polymers in construction applications. Polymers that deliver weather resistance, lower life cycle costs, and compatibility with modular construction methods are being specified more often by developers and contractors, accelerating adoption in both new build and retrofit projects.

Regional Insights

The Asia Pacific specialty polymers market held the largest revenue share of 42.02% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The market is driven by industrial expansion and electronics manufacturing growth that together create high volume, application-diverse demand. Rapid capacity additions across polymers and intermediates, plus regional supply chain diversification by global OEMs, are increasing the need for regionally scaled specialty grades and faster technical support. The shift of some semiconductor and contract manufacturing capacity into Southeast Asia further underpins demand for high-performance formulations.

North America Specialty Polymers Market Trends

A twin focus on resilience and decarbonization drives the growth of the North America specialty polymers industry. Buyers across automotive, electronics, and industrial sectors are specifying higher-performance polymers that enable lightweighting and energy efficiency. At the same time, suppliers invest in lower-carbon feedstock and process electrification to meet corporate net-zero targets. At the same time, manufacturers are favoring supplier partners able to manage complex regulatory and ESG reporting requirements, making reliability and traceable sustainability credentials a procurement priority.

In the U.S. specialty polymers industry, the policy environment and public incentives are reshaping capital allocation toward domestic advanced materials capacity. Federal programs that support semiconductor fabs, clean energy projects, and strategic supply chain resilience are encouraging investment in specialty polymer grades needed for electronics, batteries, and medical manufacturing. This creates near-term pull for suppliers who can localize production, shorten qualification cycles, and offer integrated regulatory support.

Europe Specialty Polymers Market Trends

The demand in the Europe specialty polymers industry is steered by regulatory pressure and circularity mandates that force a reappraisal of material choices. Stricter chemical regulations, energy cost volatility, and the EU circular economy agenda are prompting end users to prefer polymers with recycled content, lower embedded emissions, and clear end-of-life pathways. For suppliers, this raises the bar on product documentation and drives premium for validated circular solutions even as some commodity capacity retreats from the region.

The China specialty polymers market is underpinned by an outsized electric vehicle and electronics manufacturing footprint is a direct growth engine for specialty polymers used in battery systems, thermal management, and high-performance housings. Domestic OEM volume growth, combined with policy support for new energy technologies, drives early specification of advanced polymer chemistries. At the same time, local capacity expansion and export orientation shape competitive pricing and supply dynamics across the region.

Key Specialty Polymers Company Insights

The specialty polymers market is highly competitive, with several key players dominating the landscape. It is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Specialty Polymers Companies:

The following are the leading companies in the specialty polymers market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema

- BASF SE

- Evonik Industries AG

- Covestro AG

- Solvay SA

- Dow Inc.

- DuPont de Nemours, Inc.

- SABIC

- Celanese Corporation

- Eastman Chemical Company

- Mitsubishi Chemical Group Corporation

- Toray Industries, Inc.

- Kuraray Co., Ltd.

- LG Chem

- Wacker Chemie AG

Recent Developments

-

In July 2025, AGC launched new grades in its AFLAS FFKM fluoroelastomer series that were made without the use of surfactants or fluorinated polymerization solvents, a first in the industry. These new products, called SF grades, maintained the high performance of conventional fluoroelastomers while addressing growing market demands for environmentally friendlier manufacturing processes.

-

In March 2025, Abu Dhabi National Oil Company (ADNOC) and OMV agreed to create a global polyolefins company by combining Borouge and Borealis into Borouge Group International, which will acquire Nova Chemicals for USD 13.4 billion.

Specialty Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 198.45 billion

Revenue forecast in 2033

USD 362.31 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Report segmentation

Source, form, product type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Arkema; BASF SE; Evonik Industries AG; Covestro AG; Solvay SA; Dow Inc.; DuPont de Nemours, Inc.; SABIC; Celanese Corporation; Eastman Chemical Company; Mitsubishi Chemical Group Corporation; Toray Industries, Inc.; Kuraray Co., Ltd.; LG Chem; Wacker Chemie AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Polymers Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the specialty polymers market report based on source, form, product type, end use, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Natural

-

Semisynthetic

-

Synthetic

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Solid

-

Liquid

-

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Specialty Elastomers

-

Fluoroelastomers

-

Fluorosilicone Rubber

-

Liquid Silicone Rubber

-

Natural Rubber

-

Others

-

-

Specialty Thermoplastics

-

Polyolefins

-

Polyimides

-

Vinylic Polymer

-

Polyphenyles

-

Others

-

-

Specialty Thermosets

-

Epoxy

-

Polyester

-

Vinyl Ester

-

Polyimides

-

Others

-

-

Biodegradable Polymers

-

Liquid Crystal Polymers

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Transport

-

Medical & Healthcare

-

Textile

-

Food & Beverage

-

Electrical & Electronics

-

Cosmetics & Personal Care

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global specialty polymers market size was estimated at USD 185.10 billion in 2024 and is expected to reach USD 198.45 billion in 2025.

b. The global specialty polymers market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 362.31 billion by 2033.

b. Synthetic dominated the specialty polymers market across the polymer type segmentation in terms of revenue, accounting for a market share of 59.37% in 2024 and is forecasted to grow at 7.8% CAGR from 2025 to 2033. Scale economics and feedstock security remain the primary driver for synthetic specialty polymers.

b. Some key players operating in the specialty polymers market include Arkema, BASF SE, Evonik Industries AG, Covestro AG, Solvay SA, Dow Inc., DuPont de Nemours, Inc., SABIC, Celanese Corporation, Eastman Chemical Company, Mitsubishi Chemical Group Corporation, Toray Industries, Inc., Kuraray Co., Ltd., LG Chem, and Wacker Chemie AG.

b. Accelerated product development cycles and the need for faster time to market are pushing OEMs to source specialty polymers that shorten design validation and improve manufacturability. Suppliers that offer rapid prototyping grades and dependable supply chain support gain a clear competitive edge.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.