- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyvinyl Butyral Market Size & Share, Industry Report, 2033GVR Report cover

![Polyvinyl Butyral Market Size, Share & Trends Report]()

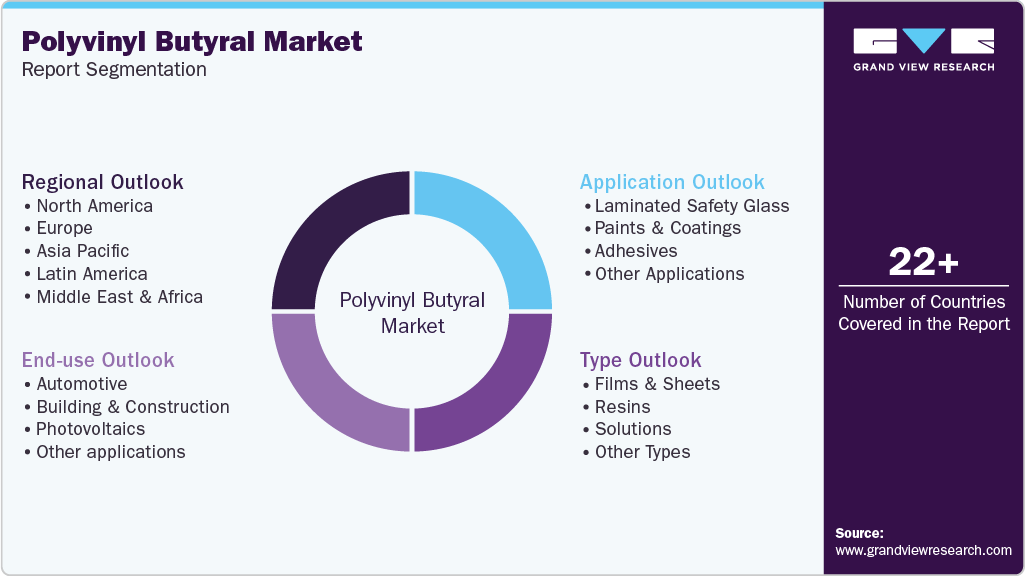

Polyvinyl Butyral Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Films & Sheets, Resins, Solutions), By Application (Laminated Safety Glass, Paints & Coatings), By End-use (Automotive, Photovoltaics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-184-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyvinyl Butyral Market Summary

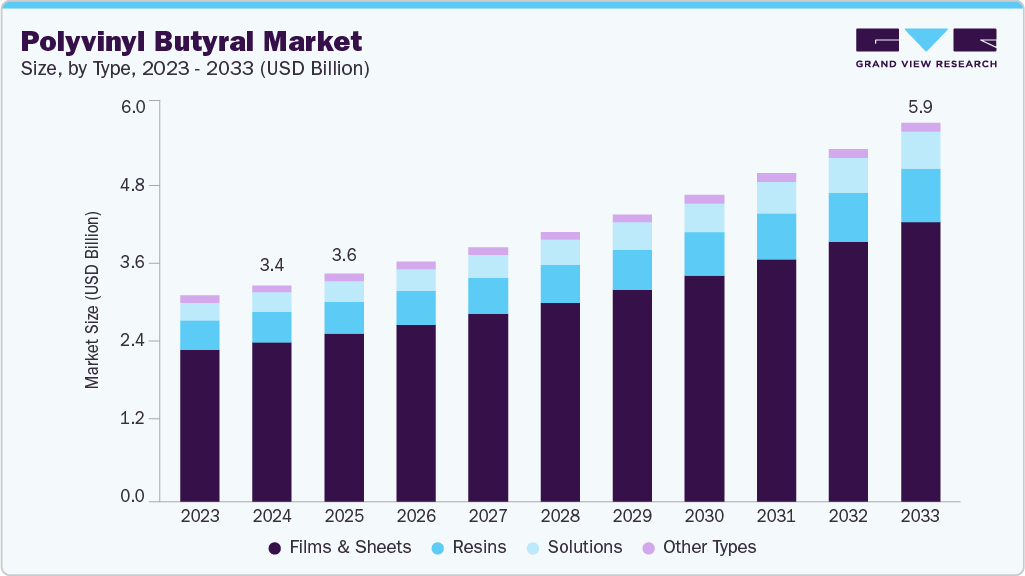

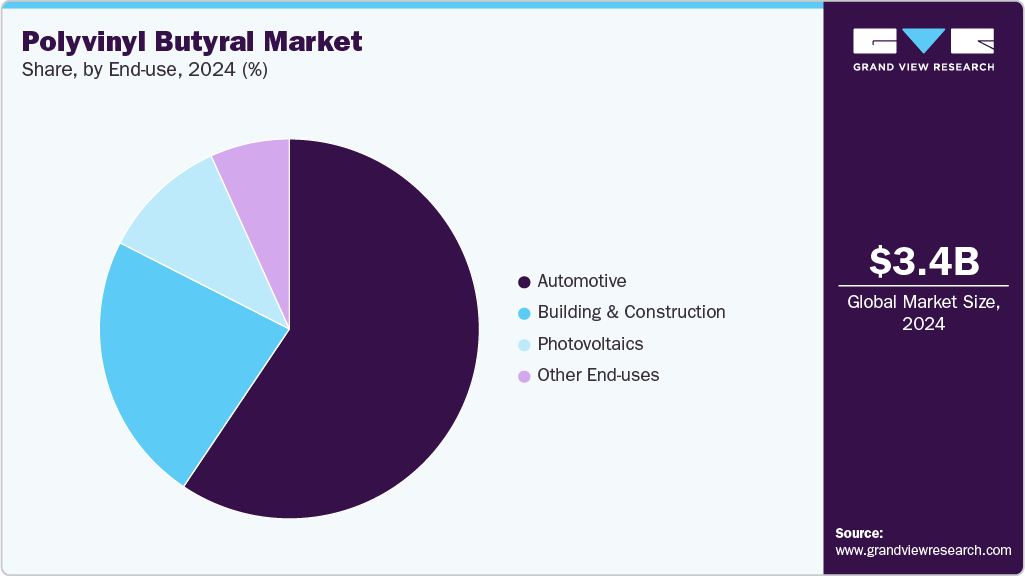

The global polyvinyl butyral market size was estimated at USD 3.39 billion in 2024 and is projected to reach USD 5.94 billion by 2033, growing at a CAGR of 6.6% from 2025 to 2033. Enhanced demand for lightweight vehicle designs is driving polyvinyl butyral (PVB) adoption as automakers seek thinner glazing solutions without compromising safety.

Key Market Trends & Insights

- Asia Pacific dominated the polyvinyl butyral market with the largest revenue share of 39.42% in 2024.

- The polyvinyl butyral market in India is expected to grow at a substantial CAGR of 7.4% from 2025 to 2033.

- By type, the solutions segment is expected to grow at a considerable CAGR of 7.8% from 2025 to 2033.

- By application, the paints & coatings segment is expected to grow at the fastest CAGR of 7.0% from 2025 to 2033.

- By end use, the photovoltaic segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3.39 billion

- 2033 Projected Market Size: USD 5.94 billion

- CAGR (2025-2033): 6.6%

- Asia Pacific: Largest market in 2024

Expansion of high‑end architectural projects in urban centers is boosting requirements for noise‑reducing laminated glass, further fueling PVB consumption. The polyvinyl butyral market is experiencing steady expansion driven by its pivotal role in laminated safety glass for automotive and architectural applications. Manufacturers are increasingly investing in advanced PVB formulations that offer enhanced clarity and acoustic insulation. This evolution reflects a shift toward premium vehicle cabins and modern building designs that prioritize both aesthetic appeal and occupant well‑being. As sustainability considerations gain prominence, recycled glass content blended with PVB is also emerging as a significant theme.

Drivers, Opportunities & Restraints

Regulatory emphasis on passenger safety and stringent glazing standards across major automotive markets is a primary catalyst for PVB consumption. Governments worldwide are mandating improved impact resistance and shatter retention in windshields and side windows. This has prompted OEMs to adopt multilayer glass assemblies with specialized PVB interlayers that absorb energy upon collision. In addition, building codes in urban centers now require laminated glass in high‑rise facades to mitigate hazards from glass breakage.

Rapid growth in the solar energy sector presents a compelling avenue for PVB film expansion beyond traditional safety glass. As photovoltaic installations proliferate in both utility‑scale and rooftop segments, demand is rising for durable encapsulants that protect solar cells from moisture and mechanical stress. PVB’s excellent light transmission and adhesion properties make it a strong candidate to replace older polymeric interlayers. Collaborative R&D initiatives between glass manufacturers and renewable energy developers could unlock novel PVB‑based solutions tailored to next‑generation solar modules.

Volatility in raw material availability and pricing poses a significant challenge for PVB producers. Key feedstocks such as polyvinyl alcohol and butyraldehyde are susceptible to fluctuations in petrochemical markets and supply chain disruptions. These cost pressures can erode profit margins and compel manufacturers to pass on higher prices to end users.

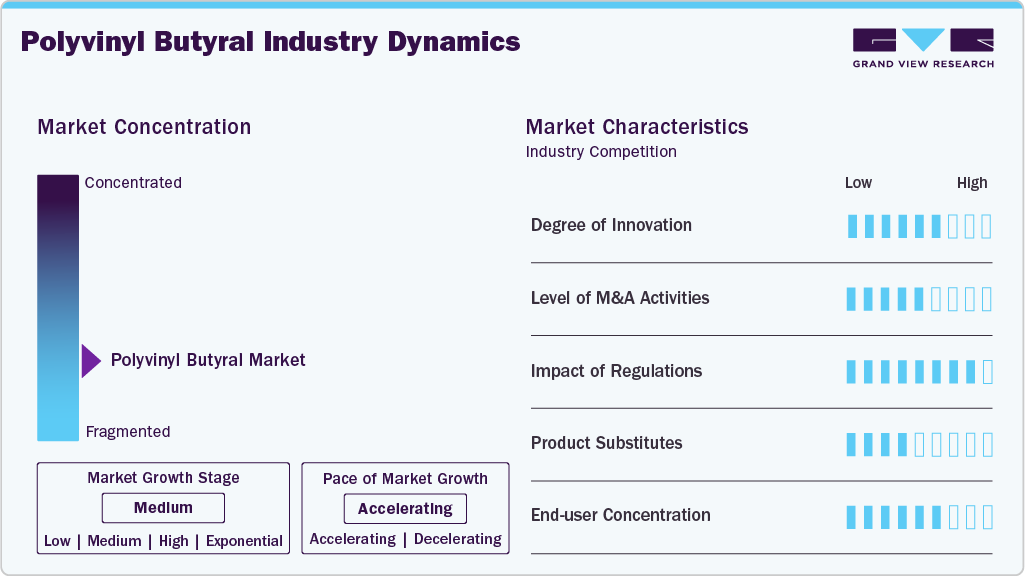

Market Concentration & Characteristics

The market growth stage of the polyvinyl butyral market is medium, and the pace is accelerating. The market exhibits slight concentration, with key players dominating the industry landscape. Major companies like Sekisui Chemical Co. Ltd., Kuraray Co. Ltd., Eastman Chemical Company, Hubergroup, Chang Chun Group, Anhui WanWei Bisheng New Material Co., Ltd., Everlam, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The polyvinyl butyral market is witnessing a wave of material breakthroughs that extend beyond traditional safety interlayers. Manufacturers are formulating next‑generation PVB grades with built‑in UV filtering and noise‑dampening additives to meet evolving consumer demands. Research partnerships between resin producers and glass fabricators are yielding low‑temperature lamination processes that cut energy consumption on the production floor. Concurrent advances in bio‑based feedstocks are also positioning PVB as a more sustainable choice without sacrificing performance. These innovations are reshaping how laminated glass products are designed and manufactured.

Global safety and environmental mandates continue to shape PVB market dynamics by setting stringent performance and processing benchmarks. In the automotive sector, compliance with windshield impact resistance standards and pedestrian safety regulations has driven universal adoption of laminated glazing. Meanwhile, building codes across major markets now require laminated glass in high‑occupancy structures to meet blast‑resistance and fire‑safety criteria. On the environmental front, solvent emission limits under regional air quality directives are compelling PVB producers to retrofit plants with advanced recovery and abatement systems. These regulatory pressures are reinforcing the strategic importance of PVB in both compliance‑driven and value‑added applications.

Type Insights

Films & sheets dominated the polyvinyl butyral market with a revenue share of 73.56%in 2024 and is forecasted to grow at 6.6% CAGR from 2025 to 2033. Rising investments in modern commercial and residential glazing projects are fueling demand for PVB films and sheets. Property developers value these interlayers for their ability to combine structural integrity with enhanced acoustic insulation. As urban centers prioritize energy efficiency, architects specify PVB films that support low‑emissivity glass assemblies. This sustained demand cements films and sheets as the cornerstone of the PVB industry.

The solutionssegment is anticipated to grow at the fastest CAGR of 7.8% through the forecast period. Custom PVB solution blends are gaining traction as manufacturers seek formulations tailored to specialized lamination processes. These liquid dispersions simplify application in complex production lines and reduce cycle times. Growing interest in seamless integration of PVB into automated lamination cells is accelerating the uptake of solution forms. As converters adopt Industry 4.0 practices, PVB solutions offer the flexibility required for next‑generation glass fabrication.

Application Insights

Laminated safety glass dominated the polyvinyl butyral market with a revenue share of 71.38% in 2024 and is anticipated to grow at 6.6% CAGR over the forecast period. Mandates for occupant protection in both automotive windshields and architectural barriers continue to elevate laminated safety glass usage. Glass fabricators increasingly rely on PVB interlayers to meet stringent impact and blast‑resistance standards. With heightened awareness of liability and insurance costs, clients are specifying laminated assemblies by default. This entrenched regulatory landscape ensures laminated safety glass remains the leading application driver.

The paints & coatings segment is anticipated to grow at the fastest CAGR of 7.0% through the forecast period. Demand for advanced protective coatings that adhere to complex substrates is opening new avenues for PVB resins. Coating formulators are leveraging PVB’s film‑forming capabilities to improve scratch and chemical resistance on metal and glass surfaces. Rapid expansion in industrial maintenance and marine coatings is pushing suppliers to incorporate PVB into their product portfolios. As end‑users seek longer‑lasting finishes, PVB‑enhanced coatings are becoming indispensable.

End-use Insights

Automotive led the polyvinyl butyral market with a revenue share of 59.41% in 2024 and is expected to grow at a CAGR of 6.6% through the forecast period. Continued rollout of autonomous‑ready and premium vehicle models is intensifying the need for sophisticated glazing solutions. Automakers specify PVB interlayers to achieve laminated panoramic roofs and side windows that offer both safety and noise dampening. With consumer expectations shifting toward ultra‑quiet cabins, PVB adoption in automotive glazing is on a firm growth trajectory. Regulatory frameworks further reinforce its position as the dominant end‑use segment.

The photovoltaics segment is expected to grow at a substantial CAGR of 7.4% through the forecast period. The rapid scaling of utility-scale solar farms and distributed rooftop projects is sparking higher demand for PVB as a reliable encapsulant in photovoltaic modules. Advances in perovskite tandem solar cells require interlayers that offer exceptional moisture resistance and adhesion to sustain long-term energy output.

Policy support through renewable energy auctions and incentive schemes across Europe and Asia is driving panel manufacturers to optimize their supply chains with PVB films. Collaborative development efforts between glass producers and resin formulators have yielded low-temperature lamination techniques that accommodate emerging thin film substrates. Together, these factors position PVB as a vital material to ensure durability and efficiency in the fastest-growing photovoltaic segment.

Regional Insights

The North American polyvinyl butyral market is driven by robust investments in chemical recycling infrastructure and stringent corporate sustainability targets. Leading converters are adopting next‑generation depolymerization techniques to meet regional circular economy goals while satisfying growing demand from the medical device and pharmaceutical packaging sectors. The recent rebound in U.S. residential construction is also fueling the use of polycarbonate and acrylic glazing for energy‑efficient windows, and Canada’s cold‑weather automotive components increasingly rely on impact‑resistant clear polymers.

U.S. Polyvinyl Butyral Market Trends

The U.S. polyvinyl butyral market is driven by the expansion of healthcare facilities and outpatient clinics, which is creating a surge in demand for high‑clarity, biocompatible plastics in diagnostic kits and surgical trays. Meanwhile, accelerated residential and commercial building activity is driving transparent polymer use in lightweight window systems and interior partitions. As of 2025, the American Hospital Association reports over 6,100 hospitals and 919,000 active construction sites, underscoring the sector’s role as a key growth engine for polyvinyl butyral.

Asia Pacific Polyvinyl Butyral Market Trends

Asia Pacific polyvinyl butyral market held the largest revenue share of 39.42% in 2024 and was the fastest growing market. Environmental regulations and financial incentives across China, Japan, South Korea, and India are accelerating the uptake of CO₂‑based and bio‑sourced transparent polymers. Public‑private partnerships and R&D consortia are scaling up carbon capture utilization (CCU) technologies to produce low‑carbon resins, while booming consumer electronics and packaging sectors drive volume growth. The region’s holistic policy frameworks and investment in sustainable feedstocks position it as the fastest‑growing polyvinyl butyral market.

China polyvinyl butyral market is underpinned by its vast electronics and electric vehicle industries. OEMs specify clear polycarbonate and PMMA for lightweight display covers, headlamps, and interior trim to improve energy efficiency and design flexibility. Concurrent infrastructure expansion, ranging from smart glazing in high‑rise buildings to clear plastic barriers in public transit,further cements domestic demand for advanced transparent resin grades.

Europe Polyvinyl Butyral Market Trends

Europe’s polyvinyl butyral landscape is shaped by aggressive circularity mandates, including the EU’s requirement for 25% recycled content in PET bottles by 2025. Governments are subsidizing AI‑driven sorting and advanced recycling facilities, enabling converters to supply certified recycled‑content grades for automotive headlamps and architectural façade systems. This policy‑backed momentum is complemented by rising demand for sustainable materials in high‑end packaging and electronics applications.

Key Polyvinyl Butyral Market Company Insights

The polyvinyl butyral market is highly competitive, with several key players dominating the landscape. Major companies include Sekisui Chemical Co. Ltd., Kuraray Co. Ltd., Eastman Chemical Company, Hubergroup, Chang Chun Group, Anhui WanWei Bisheng New Material Co., Ltd., and Everlam. The polyvinyl butyral market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Polyvinyl Butyral Companies:

The following are the leading companies in the polyvinyl butyral market. These companies collectively hold the largest market share and dictate industry trends.

- Sekisui Chemical Co. Ltd.

- Kuraray Co. Ltd.

- Eastman Chemical Company

- Hubergroup

- Chang Chun Group

- Anhui WanWei Bisheng New Material Co., Ltd.

- Everlam

Recent Developments

-

In January 2025, Maltha Glass Recycling, a European leader and subsidiary of Renewi, invested USD 3.14 million in polyvinyl butyral (PVB) recycling at its Lommel, Belgium site. This investment introduced new technology to recycle PVB resin from laminated glass used in automobile windshields, allowing extraction of more glass and reducing landfill waste.

-

In November 2024, Eastman Chemical Company announced that it invested to upgrade and expand its extrusion capabilities for Interlayers product lines at its manufacturing facility in Ghent, Belgium. The investment aimed to strengthen Eastman’s ability to meet growing regional and global demand for Saflex polyvinyl butyral (PVB) products in the automotive premium market and to position the site for future growth in automotive and architecture sectors.

Polyvinyl Butyral Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.57 billion

Revenue forecast in 2033

USD 5.94 billion

Growth rate

CAGR of 6.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, applications, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Sekisui Chemical Co. Ltd.; Kuraray Co. Ltd.; Eastman Chemical Company; Hubergroup; Chang Chun Group, Anhui WanWei Bisheng New Material Co., Ltd.; Everlam

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyvinyl Butyral Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polyvinyl butyral market report based on type, applications, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Films & Sheets

-

Resins

-

Solutions

-

Other types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Laminated Safety Glass

-

Paints & Coatings

-

Adhesives

-

Other applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Building & Construction

-

Photovoltaics

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyvinyl butyral market size was estimated at USD 3.39 billion in 2024 and is expected to reach USD 3.57 billion in 2025.

b. The global polyvinyl butyral market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 5.94 billion by 2033.

b. Films & sheets dominated the polyvinyl butyral market across the type segmentation in terms of revenue, accounting for a market share of 73.56% in 2024 and is forecasted to grow at 6.6% CAGR from 2025 to 2033. Rising investments in modern commercial and residential glazing projects are fueling demand for PVB films and sheets. Property developers value these interlayers for their ability to combine structural integrity with enhanced acoustic insulation.

b. Some key players operating in the polyvinyl butyral market include Sekisui Chemical Co. Ltd., Kuraray Co. Ltd., Eastman Chemical Company, Hubergroup, Chang Chun Group, Anhui WanWei Bisheng New Material Co., Ltd., and Everlam.

b. Enhanced demand for lightweight vehicle designs is driving polyvinyl butyral (PVB) adoption as automakers seek thinner glazing solutions without compromising safety. Expansion of high‑end architectural projects in urban centers is boosting requirements for noise‑reducing laminated glass, further fueling PVB consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.