- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Paints And Coatings Market Size, Industry Report, 2030GVR Report cover

![Paints And Coatings Market Size, Share & Trends Report]()

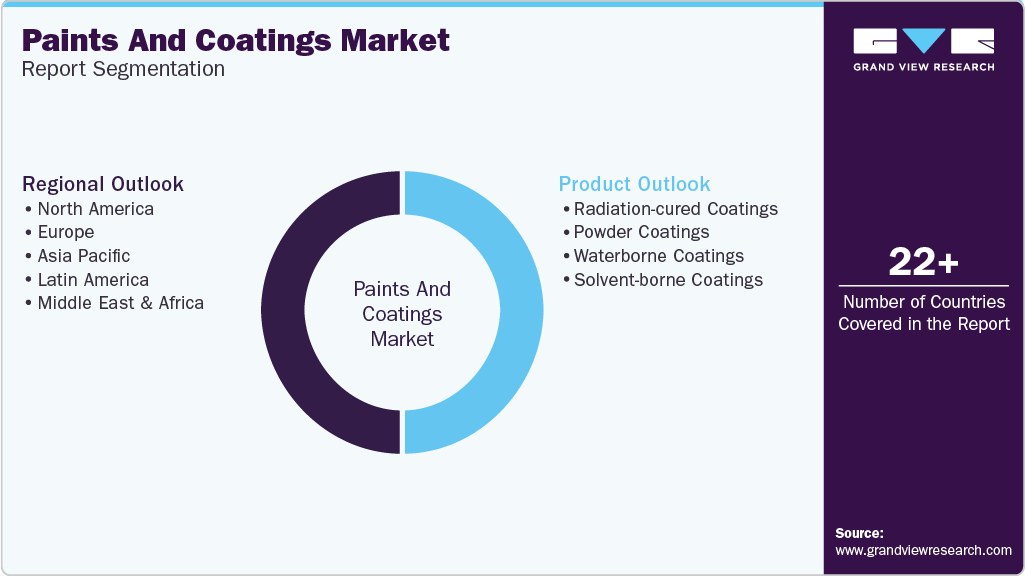

Paints And Coatings Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Radiation-cured Coatings, Powder Coatings, Waterborne Coatings, Solvent-borne Coatings), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-497-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Paints And Coatings Market Summary

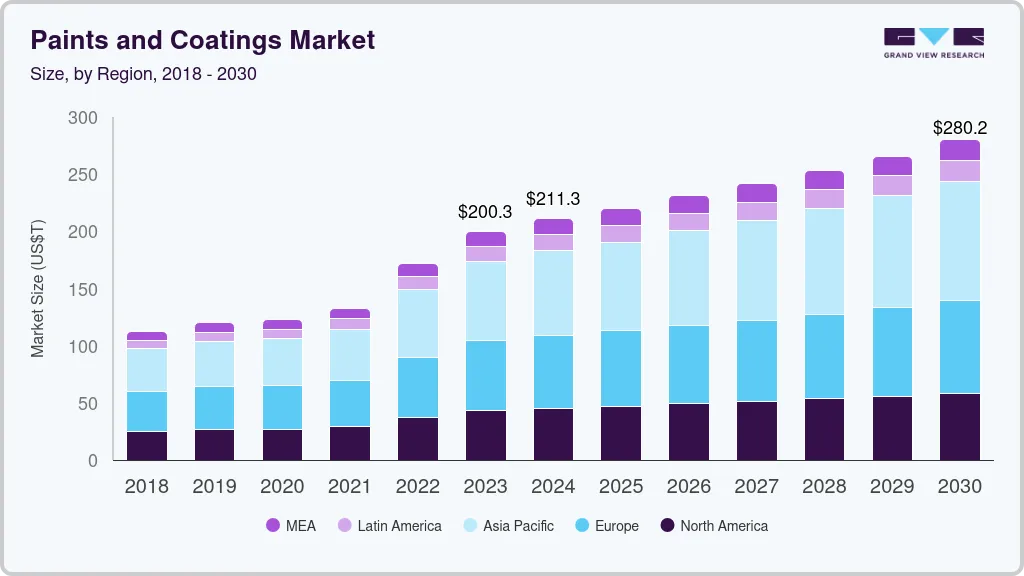

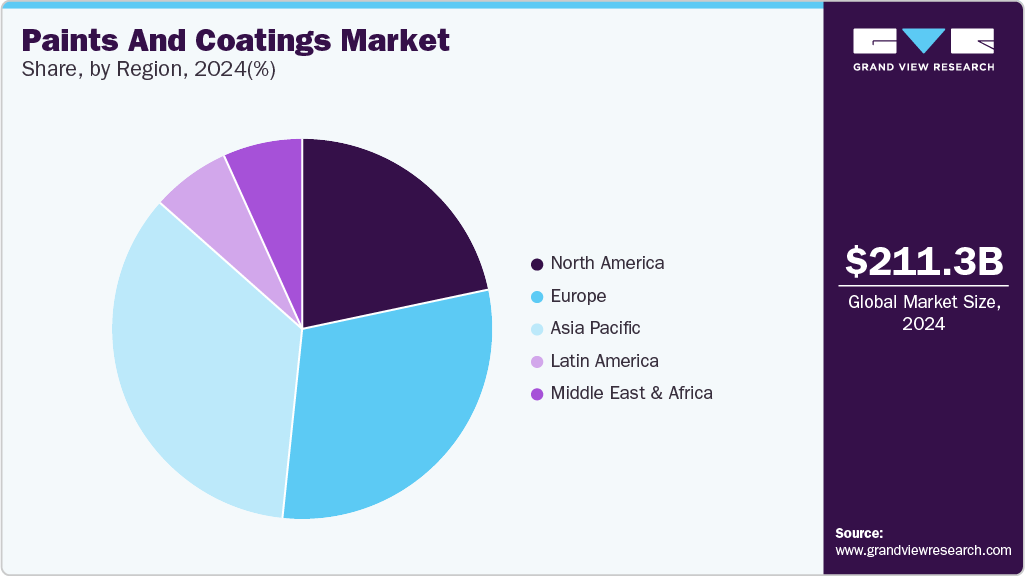

The global paints and coatings market size was estimated at USD 211.28 billion in 2024 and is anticipated to reach USD 280.19 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. The market is expected to witness substantial growth over the forecast period, owing to the increasing consumption of products in construction, automotive, and general industries.

Key Market Trends & Insights

- Asia Pacific dominated the paints and coatings market with a revenue share of 35% in 2024.

- China is expected to be one of the promising markets in the region.

- By product, the waterborne coatings segment dominated the industry with a revenue share of 40.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 211.28 Billion

- 2030 Projected Market Size: USD 280.19 Billion

- CAGR (2025-2030): 5.0%

- Asia Pacific: Largest market in 2024

Factors such as the rapid urbanization and industrialization in emerging countries, such as India, China, and those in Southeast Asia, are anticipated to fuel the demand for paints and coatings in construction applications. The global construction industry is one of the major consumers of the product across the world. It accounted for a share of more than 40% in terms of total global demand for the product in 2024. Ongoing urbanization and industrialization across the world have led to increased requirements for construction and infrastructure development, especially in emerging regions, such as Asia Pacific, Latin America, and the Middle East.

According to the International Trade Administration (ITA), the urbanization rate in China is the highest in the world. The American Institute of Architects (AIA) Shanghai reported in 2022 that China is expected to have construction activities equivalent to 10 New York-sized cities by 2025. As per the National Investment Promotion & Facilitation Agency, an estimated 600 million people are anticipated to be living in urban centers in the country by 2030, thereby creating a demand for 25 million additional mid-end and affordable housing units in China. This is anticipated to drive the demand for the product in the coming years.

In recent years, the paints and coatings industry has experienced growth, owing to the adoption of environment-friendly materials that align with sustainable or green chemistry principles. This shift is fueled by the rise in consumer consciousness toward sustainable products and the presence of stringent environmental regulations, which aim at reducing volatile organic compounds (VOC) emissions. Eco-friendly products have emerged as a significant trend in the global market, owing to their solvent-free nature. This results in minimal VOC emissions and combustion risk mitigation during their application and storage.

Stringent environmental regulations, particularly concerning air quality, in the U.S., China, and Western Europe are expected to influence the adoption of low-pollution coatings in the coming years. These regulations drive the transition from solvent-based paints & coatings to low-VOC or eco-friendly alternatives, such as high solids, powder coatings, water-based coatings, and UV-curable coatings. By containing a few solvents that evaporate during their application, these low-VOC products contribute to a green environment by minimizing or eliminating VOC emissions.

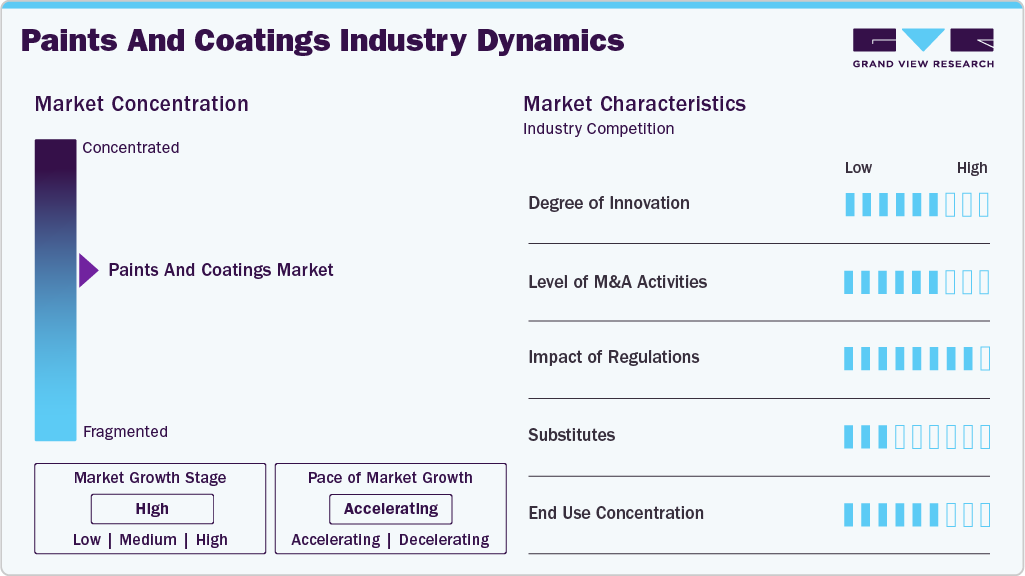

Drivers, Opportunities & Restraints

The global paints and coatings market is witnessing consistent expansion, primarily driven by robust demand across construction, automotive, industrial, and marine sectors. Rising urbanization, infrastructure development, and increased consumer spending on home improvement are key growth catalysts. These coatings play a critical role in enhancing durability, corrosion resistance, UV protection, and aesthetics. Advancements in waterborne technologies, low-VOC formulations, and high-performance functional coatings such as antimicrobial and self-cleaning variants are accelerating adoption, especially in regions with stringent environmental regulations.

Emerging opportunities lie in the development of sustainable, bio-based coating and smart coating technologies that deliver added value, such as energy efficiency and enhanced surface protection. Rapid industrialization in Asia-Pacific, particularly in China, India, and Southeast Asia, presents significant market expansion potential. Additionally, the rise of e-commerce platforms and digital sales channels is transforming product accessibility and reshaping traditional distribution models. Growth in niche applications such as aerospace, electronic coatings, and automotive refinishing further supports long-term industry prospects.

The market faces notable challenges. Volatile raw material prices-particularly for titanium dioxide, acrylics, and petrochemical-based resins-have intensified cost pressures. Environmental regulations targeting VOC emissions and hazardous ingredients are driving up compliance and reformulation costs, particularly for solvent-borne coatings. Competitive pressure from alternative technologies, coupled with supply chain disruptions and inflationary input costs, continues to impact profitability. These factors are prompting leading players to invest in supply chain resilience, green chemistry, and localized sourcing to maintain market competitiveness and regulatory alignment.

Market Concentration & Characteristics

The paints and coatings market is moderately fragmented, with players that aim to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, acquisitions, collaborations, partnerships, and investments in research & development. Manufacturers have anticipated a huge gap in product and product development; thus, they are investing in research & development to add new products to their portfolios and develop better technologies for various end use industries of the product.

PPG Industries, Inc.; The Sherwin-Williams Company; Axalta Coating Systems, LLC; and Akzo Nobel N.V. are among the top manufacturers in the product market. These companies have a stronghold in the emerging markets of Asia Pacific and the Middle East & Africa while exporting their products for various end use applications, such as architectural & decorative and protective & marine applications in these regions.

Product Insights

The waterborne coatings segment dominated the paints and coatings industry with a revenue share of 40.8% in 2024, owing to their wide usage in confined and poorly ventilated spaces. These coatings dry at a faster rate compared to solvent-based paints and coatings, due to the rapid evaporation of water from the coating layer, which results in faster drying without surface skin formation. Water-based paints and coatings are primarily used where solvent-based coatings are expected to react with the substrate. They are ideal primers, as they possess excellent thermal and corrosion resistance. In addition, they are flame-resistant and have low toxicity, owing to their low VOC content and low hazardous air pollutant emissions.

The use of water-based products is projected to increase, due to stringent legislations regarding the solvents present in paints & coatings in the U.S. and other mature European countries. Several companies in the market are working toward the development of new fast-drying paints and coatings. Companies, such as Alfa Laval and Hellenic Petroleum, are using fast-drying water-based products for heat exchangers, train wagons, piping, and tanks. This is expected to have a positive impact on the demand for water-based coatings over the forecast period.

Powder-based coatings are more durable and eco-friendly as compared to their counterparts. Powder-based products have negligible VOC content, due to the absence of solvents, and thus, they comply more efficiently and economically with the environmental protection regulations. Powder-based products are widely used in agricultural equipment, automotive, machine components, mechanical parts & building facades, and electrical fixtures to prevent corrosion and provide a thicker coating. Increasing demand for low-VOC or zero-emission coatings in the U.S., India, China, and European countries is expected to propel the demand for powder-based products over the forecast period.

Regional Insights

Asia Pacific dominated the paints and coatings market with a revenue share of 35% in 2024, which is attributed to rising construction activities and demand for paints and coatings from the automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.

The paints & coatings market in China is expected to be one of the promising markets in the region on account of the government’s support to promote investments in the manufacturing sector. Several companies are expanding or setting up new manufacturing facilities, owing to low labor costs and ease of raw material procurement in the country. The growing manufacturing sector is expected to propel the demand for the product in automotive, aerospace, construction, electrical & electronics, and other industries. India and China have witnessed a spike in automotive production. For instance, in September 2022, the California-India Zero Emission Vehicle (ZEV) Policy program was initiated by the Indian government to support and increase the development of ZEVs in the country.

North America Paints And Coatings Market Trends

The paints and coatings industry in North America is expected to witness significant growth over the coming years, owing to high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges. The implementation of the "Affordable Healthcare Act" in 2023 is expected to stimulate the construction of a greater number of healthcare units and hospitals, which, in turn, is expected to boost the demand for architectural and decorative paints & coatings in the region over the forecast period.

The U.S. paints and coatings industry is experiencing significant growth, driven by the rising construction sector in the U.S. at a significant rate, owing to positive market fundamentals for commercial real estate and a strong economy, along with rising state and federal funding for institutional buildings and public works. In March 2023, the U.S. government announced an investment worth USD 2 trillion as part of the coronavirus response for the development of infrastructure, including hospital buildings, roads, and other infrastructure.

Europe Paints And Coatings Market Trends

The Europe industry for paints and coatings has been very dynamic post-Brexit and is likely to be affected, as the UK has been one of the major markets for paints & coatings. Surging automobile production in Germany, Hungary, Romania, Austria, and the UK, along with strong manufacturing bases of companies such as Volkswagen AG, Chevrolet, Daimler-Chrysler, Mercedes-Benz, and Dodge, is expected to drive the product demand.

The Europe paints & coatings industry is expected to grow during the forecast period. The expanding construction sector in various countries, including the UK, the Netherlands, Germany, Hungary, Poland, Sweden, and Ireland, is expected to propel product demand over the forecast period. Increased funding from the EU, coupled with supportive measures, such as subsidies, tax breaks, and incentives taken by various governments, is anticipated to augment the growth of the construction sector in the region.

The paints & coatings market in Germany is expected to witness growth over the forecast period. According to Autobei Consulting Group, Germany dominates the automotive market in Europe with 41 engine production plants in 2023, and assembly plants that contribute to one-third of the total automobile production in the region. The sales of new vehicles are constantly increasing with the improvement in the economy, reflecting consumer confidence, which is expected to positively impact the market in the coming years. However, the sales of new cars have witnessed a small contraction, owing to the introduction of new WLTP emission control regulations, to promote vehicle quality by reducing emissions to a lower level possible, has caused several restrictions in new car registration. This is expected to create lucrative growth opportunities for the market in the coming years.

The UK paints & coatings market growth is primarily driven by the growing product demand from the aerospace sector, especially for component repairing applications. According to the International Trade Administration, the UK aerospace industry is the 2nd largest in the world after the U.S., with a turnover of around USD 32 billion in 2021. As of 2022, the country has more than 3,000 aerospace companies, including domestic companies such as Cobham, BAE Systems, GKN, Meggitt, and QinetiQ. The growing aerospace sector positively affects the market growth.

Latin America Paints And Coatings Market Trends

The paints & coatings market in Latin America is expected to witness substantial growth in the product demand over the forecast period, owing to the region’s economic growth in the past few years. Increasing disposable income of consumers has surged the demand for automobiles, which is expected to augment the demand for the product over the forecast period. Increasing automotive vehicle sales in Argentina, Brazil, and Colombia are also expected to have a positive impact on the market. Rising foreign investments in the automotive sector in the region are expected to open new growth avenues for paints & coatings over the forecast period.

The Brazil paints & coatings market is anticipated to grow from 2024 to 2030. Brazil is the leading producer of automobiles in Latin America and has emerged as the ninth-largest automobile producer in the world. According to the International Organization of Motor Vehicle Manufacturers, automotive production in Brazil witnessed an increase of 5% in 2022 compared to 2021.

Furthermore, in 2023, the Brazil automotive industry is projected to experience a 2.2% increase in automobile output, with approximately 2.42 million vehicles being manufactured. This growth is expected to be driven by a 4.2% rise in the production of cars and other light vehicles. As one of the fastest-growing economies, Brazil has become a global hub for manufacturers. Automotive manufacturers are focusing on increasing their customer base by entering new markets. Owing to the trends, the demand for paints & coatings is anticipated to rise in automotive applications over the forecast period.

Middle East & Africa Paints and Coatings Market Trends

The Middle East paints and coatings industry growth is likely to be driven by the expanding oil & gas industry and rising healthcare expenditure in the region. The Middle East oil & gas industry has been witnessing a major shift in recent years with rising investment in a diverse range of projects, including technical offshore and LNG projects. This trend is expected to continue in the coming years, as major players in the market are expanding their presence in the region and are engaged in long-term projects, such as Upper Zakum, a production capacity enhancement project in the UAE; Zubair Oil Field - Rehabilitation Phase and Enhanced Re-Development Phase in Iraq; and Yanbu, a crude oil-to-chemicals complex project in Saudi Arabia. This positive scenario of the oil & gas industry is expected to drive the demand for paints & coatings in the oil & gas industry over the forecast period.

Saudi Arabia paints & coatings market is projected to witness growth during the forecast period. The demand for paints & coatings in Saudi Arabia has been experiencing a significant rise, due to several factors. Firstly, the country's construction and architectural sector has witnessed substantial growth, driven by mega projects, such as the Red Sea Project and the Qiddiya entertainment city. These developments have increased the need for paints & coatings in various applications.

Key Paints And Coatings Company Insights

Some of the key players operating in the market are Jotun; The Sherwin-Williams Company; Akzo Nobel N.V.; Axalta Coating Systems, LLC; PPG Industries, Inc.; RPM International, Inc.; BASF SE; Henkel AG & Company, KGaA; and Contego International Inc.

-

AkzoNobel N.V.; The Sherwin-Williams Company; BASF SE; PPG Industries, Inc.; RPM International, Inc.; Nippon Paint Holdings Co., Ltd.; and Asian Paints are the top seven manufacturers in the global paints & coatings market and accounted for around 58% of the global market by the end of 2023.

-

These established players compete and outplay the regional players by strategically integrating across the value chain to ensure seamless supply chain activities and reducing the production & operating costs. In addition, companies involved in manufacturing paints & coatings develop new products and production technologies for paints & coatings to cater to the varied application needs of customers.

Key Paints And Coatings Companies:

The following are the leading companies in the paints and coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Jotun

- The Sherwin-Williams Company

- Axalta Coating Systems

- PPG Industries, Inc.

- RPM INTERNATIONAL, INC

- BASF SE

- Henkel AG & Company, KGaA

- Contego International Inc.

- Hempel A/S

- No-Burn Inc.

- Nullifire

- 3M

- Albi Protective Coatings

- Akzo Nobel N.V.

Recent Developments

-

In April 2025, Jotun, a global leader in advanced marine coatings, entered a strategic commercial agreement with Thoresen Shipping Singapore Pte. Ltd., a prominent shipowner operating across Singapore and Thailand, to implement its Hull Skating Solutions (HSS) technology on the bulk carrier Thor Brave. This agreement marks a significant step in accelerating the maritime industry's shift toward proactive hull maintenance and sustainability.

-

In January 2025, Axalta Coating Systems and Dürr Systems AG announced a strategic partnership to commercialize digital paint solutions for automotive OEMs by integrating Axalta’s NextJet™ precision paint application technology with Dürr’s advanced robotics systems. The collaboration aims to accelerate the adoption of overspray-free, maskless painting for tutone and vehicle graphic applications, enhancing design flexibility, reducing material waste, and streamlining production efficiency.

-

In March 2024, The Sherwin-Williams Company launched Repacor SW-1000, a breakthrough 100% solids, VOC-free coating system designed to streamline maintenance and repair of steel structures, particularly offshore wind turbines and onshore industrial assets. Developed over a three-year R&D initiative, Repacor SW-1000 simplifies application by eliminating multi-layer systems; it delivers full anti-corrosion protection in a single 500-micron coat using a standard sealant gun, without the need for mixing. The coating meets NORSOK M-501 standards, cures four hours faster than traditional aerosol systems, and reduces applicator risk by enabling faster, safer rope-access work with less waste.

Paints And Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 219.91 billion

Revenue forecast in 2030

USD 280.19 billion

Growth rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Costa Rica; Saudi Arabia; South Africa.

Key companies profiled

Jotun; The Sherwin-Williams Company; Axalta Coating Systems; PPG Industries, Inc.; RPM INTERNATIONAL, INC.; BASF SE; Henkel AG & Company, KGaA; Contego International Inc.; Hempel A/S; No-Burn Inc.; Nullifire; 3M; Albi Protective Coatings; Akzo Nobel N.V.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paints And Coatings Market Report Segmentation

This report forecasts volume and revenue and volume growth at the global, regional, and country levels. It provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global paints and coatings market report based on product and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Radiation-cured Coatings

-

Powder Coatings

-

Waterborne Coatings

-

Solvent-borne coatings

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global paints and coatings market was valued at USD 211.28 billion in 2024 and is expected to reach USD 219.9 billion in 2025.

b. The global paints and coatings market was valued at USD 211.28 billion in 2024 and is expected to reach USD 280.19 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030.

b. Water-borne coatings segment dominated the market with a share of 41%, in terms of revenue, in 2024. Strict governmental and environmental regulations, such as the Clean Air Act, the Occupational Safety and Health Administration (OSHA), and EU legislations, are propelling the adoption of water-borne coatings over solvent-borne coatings.

b. Some of the key players operating in the global paints & coatings market include 3M, Axalta Coating Systems, LLC, Nippon Paint Holdings Co., Ltd., The Sherwin Williams Company, PPG Industries, Inc., RPM International, Inc., and BASF SE.

b. Key factors driving the paints & coatings market growth include increasing construction activities in the countries U.S., China, and India coupled with increasing awareness regarding environmentally friendly and sustainable alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.