- Home

- »

- Automotive & Transportation

- »

-

Secure Logistics Market Size, Share & Growth Report, 2030GVR Report cover

![Secure Logistics Market Size, Share & Trends Report]()

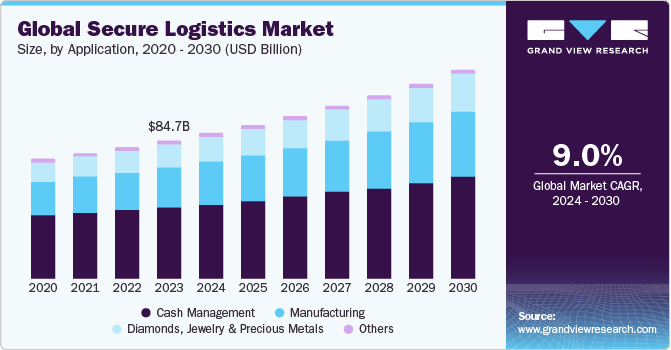

Secure Logistics Market Size, Share & Trends Analysis Report By Application (Cash Management, Diamonds, Jewelry & Precious Metal, Manufacturing), By Mode of Transport, By End-user, By Type (Static, Mobile), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-322-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Secure Logistics Market Size & Trends

The global secure logistics market size was valued at USD 84.71 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.0% from 2024 to 2030. Secure logistics involves secure storage, handling, and transportation of products, goods, and confidential information throughout the supply chain's journey from point of origin to point of destination. To minimize the risks involved in transportation, including theft, damage, loss, or unauthorized access, stringent security measures are required, including secure logistics tracking. The rising security concerns among corporates and banks have increased the requirement for secure movement and management services for currency. The European Union has established a structure for overcoming the constraints and facilitating the mobility of production factors, which include land, labor, and capital. The banking industry across the globe is transforming owing to the changes in technical innovation and deregulation of financial services.

Banking in emerging economies is traditionally a highly protected industry having regulated deposits and restrictions for domestic and foreign entry. However, technological advancements and macroeconomic pressures have forced the banking industry to open up the market to foreign competition. BRICS countries are also expected to have a large inflow of Foreign Direct Investments (FDIs) among other emerging economies. The growing skilled labor force, rapid globalization, and a rise in the number of young consumers have acted as the driving factors in these regions.

In addition, the increasing number of High Net-worth Individuals (HNIs) and the growing need for wealth management services are expected to influence the growth of the banking sector in the emerging market. High net-worth individuals will invest in cash deposits, real estate, debt portfolios, and equities. The State Bank of India (SBI), for instance, is focusing on wealth management, retail banking, and personal banking services.

The incorporation of advanced technology solutions has emerged as a crucial element in bolstering security measures across the supply chain. Notable examples include the adoption of blockchain for transparent and tamper-proof record-keeping, as well as the widespread use of the Internet of Things (IoT) devices for real-time tracking and monitoring. These technologies offer unparalleled visibility and accountability throughout the logistics process, ensuring the effectiveness of secure logistics tracking. Additionally, the field of secure logistics is experiencing a notable increase in the application of artificial intelligence and machine learning algorithms. These tools are employed to predict potential security threats and optimize risk management processes. Moreover, there is a growing emphasis on collaboration between logistics providers and governmental agencies to establish standardized security protocols, ensuring alignment with international regulations and fostering a more secure global supply chain.

Market Concentration & Characteristics

Advancements in technology have spurred an immense amount of innovation in the secure logistics market. Supply chain security has been transformed by the incorporation of cutting-edge technology like blockchain, IoT, and artificial intelligence. Logistics providers may now proactively address possible security issues thanks to these innovations' improved transparency, real-time monitoring, and predictive analytics. Ongoing expenditures in cutting-edge solutions are probably going to stay a major trend as long as the sector prioritizes security.

Recent years have seen a considerable increase in merger and acquisition (M&A) activity in the secure logistics business. Organizations are deliberately lining up in order to enhance their total market position, broaden their geographic reach, and combine their service offers. The necessity for complete, integrated security solutions and the goal of achieving economies of scale are what propel M&A activity. It is anticipated that the trend of consolidation will continue, reshaping the competitive environment and promoting a more strong and efficient secure logistics industry.

The market for secure logistics is significantly influenced by regulatory factors. Stricter rules are being implemented by governments and international organizations more often in an effort to improve the security of global supply chains. Adherence to these regulations has emerged as a crucial factor for logistics providers, impacting both operational procedures and technological expenditures. Businesses in the secure logistics industry must adjust to new regulatory frameworks in order to remain compliant, and this dynamic regulatory landscape is expected to spur additional advancements in security standards.

In the realm of secure logistics, there are limited direct substitutes for the specialized services provided by security-focused logistics companies. But new technology has also brought in other ways to secure cargo, such digital documentation and sophisticated tracking systems. The market continues to seek specialized secure logistics solutions, even if new technologies supplement existing secure logistics services rather than completely replacing the need for specialized secure transit, vaulting, and monitoring services.

In the secure logistics market, end-user concentration varies by industry, with some charging more for safe transport services. Certain industries, like medicines, high-end electronics, and precious metals, show a greater need for customized secure logistics solutions. Many safe logistics providers use industry diversification as a means of reducing the risks associated with end-user concentration. The market is expected to see a broadening of end-user concentration as industries realize the crucial relevance of secure supply chains, with an expanding number of sectors seeking specialized security solutions.

Application Insights

On the basis of applications, the global market has been further segmented into cash management, diamonds, jewelry & precious metal, manufacturing, and others. The others application segment includes retail and public infrastructure. The cash management segment led the industry in 2023 and accounted for the largest revenue share of more than 55.4%. The segment is expected to remain dominant even during the forecast period. This growth is attributed to the rapidly growing penetration of ATMs in emerging countries. The cash management segment includes cash-in-transit, cash processing, and ATM services.

Cash-in-transit involves picking up money from the banks and delivering it to the designated cash points, such as ATMs. The service providers utilize armored trucks to transport valuables that reduce risks and increase security by reducing the opportunity for theft. The carriers offer Automated Teller Machine (ATM) services in conjunction with the traditional cash-in-transit service and are regulated by regional, national, and local legislation. The responsible authorities for the industry include the Ministry of Justice, the Ministry of Interior, and the Police. The development of innovative and efficient goods is the primary focus of the market companies.

For instance, in 2022, Prosegur and Forética, a significant organization in corporate social responsibility and sustainability in Spain, signed a cooperation agreement to form alliances that will help speed the transition to a sustainable model. Furthermore, secure logistics companies are focusing on partnerships and collaborations to gain competitive advantages. For instance, in February 2022, Brink’s Inc. signed a partnership agreement with Courtyard, which is a physically-backed NFT platform. In 2018, Brink’s Inc.’s Canadian subsidiary had signed a multi-year collaboration with Canopy Growth Corp. Brink’s Inc. and Canopy Growth will build a cross-selling program that would allow Brink’s to provide solutions to Canopy Growth’s connected cultivators and retail clients.

Mode of Transport Insights

On the basis of mode of transport, the global market has been further segmented into road, rail, and air. The road segment accounted for the leading revenue share in 2023 and is expected to maintain its dominance across the forecast period. The flexibility and accessibility provided by road transport for the transit of safe shipments is the main factor driving this segment's growth. With the development of GPS technologies, vehicle tracking systems, and safe convoy protocols, road transport has emerged as the go-to option for secure logistics providers. The market for secure door-to-door transportation has grown even more as a result of consumer demand. Furthermore, the reliability and security of road transport for sensitive and high-value items are enhanced by investments in armored trucks, surveillance systems, and qualified personnel.

The air segment in the secure logistics market is anticipated to witness the fastest CAGR during the forecast period 2024 to 2030. The market is expanding due to the growing requirement for expensive goods to be moved quickly across the globe. Because of their efficiency and speed, flights are a crucial mode of transportation for industries like technology, banking, and pharmaceuticals. To meet the stringent security requirements of air cargo, secure logistics providers invest in state-of-the-art screening technologies, secure cargo facilities, and compliance with international standards for air transport security. Globalization is driving the need for swift and safe transportation solutions, and as a result, stable growth in the air segment of secure logistics is expected, fueled by ongoing advancements in aviation security.

End-User Insights

On the basis of end-user, the global market has been further segmented into financial institutions, retailers, government, and others. The financial institutions dominated the secure logistics market in 2023. Secure logistics companies are essential to guaranteeing the safe and secure transit of valuables because banks and other financial institutions regularly handle high-value cash, private papers, and valuable goods. The need for cash management solutions and specialized secure transit services, such as safe vaulting, has been growing. The secure logistics market for financial institutions is anticipated to grow steadily as long as financial institutions continue to place a high priority on security.

The retail sector is expected to witness the fastest growth during the forecast period 2024 to 2030. Retailers need dependable and safe shipping services to safeguard their valuable inventory, especially those who deal with expensive merchandise, jewels, and electronics. Secure logistics companies provide customized solutions, such as last-mile delivery, warehousing, and safe transportation. The retail secure logistics market is expected to grow steadily due to the growth of e-commerce and the growing requirement for end-to-end security in the supply chain.

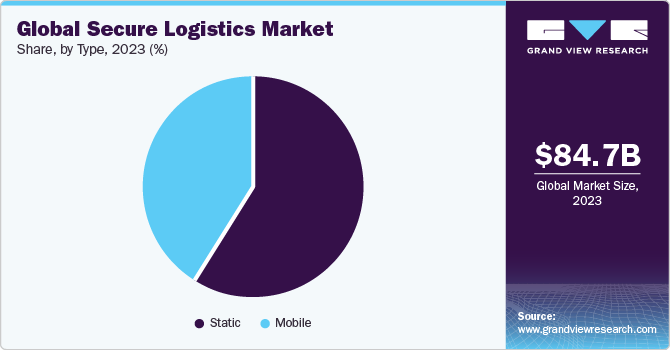

Type Insights

On the basis of types, the global market has been segmented into static and mobile. The static type segment registered the highest market share of over 59% in 2023 and is expected to retain its dominance over the forecast period. The segment is expected to remain dominant throughout the forecast period. For security purposes, manned guards are employed in the static type. The security guards stationed at various points aid in the logistics transportation’s security. For the market, several companies provide guarding services. These companies offer specialized logistics security solutions aimed at exposing security breaches, reducing shipment loss & damage, and preventing theft.

The mobile type segment, on the other hand, is expected to register the fastest growth rate of 10.3 % during the forecast period 2024 to 2030. This growth can be attributed to the increasing advancements in secure journey management services. The providers offer vehicles with electronic countermeasures as well as radio and satellite communication systems. Electronic safes are primarily used by financial institutions to reduce management downtime. Service providers partner with several safe manufacturers to offer a wide scope of electronic safe services of various sizes.

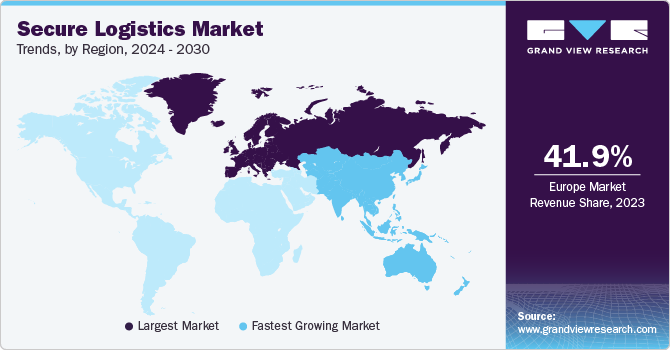

Regional Insights

North America's secure logistics market is witnessing robust growth driven by several factors, including increasing demand for cash management services, expansion of the e-commerce & retail industry, and stringent regulatory standards, among others. Heightened security threats, including theft, fraud, and cybercrime, have prompted businesses and organizations to prioritize secure transportation and storage of valuable assets. The need for robust security measures and advanced technology solutions to safeguard against potential risks is driving the demand for secure logistics services. Furthermore, the rapid growth of e-commerce and retail industries in North America has increased the demand for secure transportation and delivery services. E-commerce companies require secure logistics providers to ensure the safe and timely delivery of high-value goods to customers' doorsteps, thereby fueling market growth.

U.S. Secure Logistics Market Trends

The secure logistics market in the U.S. is expected to grow at a CAGR of 6.2% from 2024 to 2030. The key factors contributing to the growth are high cash usage, e-commerce growth, regulatory compliance, security concerns, and a diverse industry landscape. Despite the growth of digital payment methods, the U.S. still has a significant reliance on cash for transactions. This high cash usage fuels the demand for secure logistics services to transport, store, and manage cash securely.

Europe Secure Logistics Market Trends

Europe held the largest share of more than 41.9% of the global market in 2023 and has become one of the most influential markets. The increasing penetration of ATMs, coupled with the growing use of ATMs in emerging economies, is expected to spur regional growth. The rising rate of cash circulation and trade investments among European countries opens up a whole range of secure logistics opportunities. In the future, trade policies among countries, as well as Brexit difficulties, will have a significant impact on market shares. An article published by ATM marketplace in 2018 mentioned that few nations, such as Italy, the Netherlands, and Spain, are concentrating their efforts on limiting the number of ATMs and bank branches to reduce high operational costs and promote electronic payment systems.

The secure logistics market in the U.K. held over 39.0% share in the European market owing to several factors such as financial sector demand, cross-border trades, and e-commerce expansion, among others. London is a global financial hub that has a high concentration of banks, financial institutions, and businesses that require secure transportation and storage of cash, documents, and other valuables. Secure logistics providers play a crucial role in facilitating secure movement and management of assets within the financial sector, contributing to market growth.

Asia Pacific Secure Logistics Market Trends

The secure logistics market in Asia Pacific is expected to register the fastest CAGR of 12.3% during the forecast period 2024 to 2030. Asia Pacific is expected to grow significantly owing to factors such as rising demand for ATMs, expansion of financial institutions, and increasing theft of freight. The Australian Federal Police and customs made a joint venture to form the Reduce Aviation Freight Theft (RAFT) project to investigate aviation theft in Australia. The Transported Asset Protection Association (TAPA) forum was formed, which unites global freight carriers, manufacturers, law enforcement agencies, logistics providers, and other stakeholders with the aim of reducing losses from international supply chains. Moreover, emerging economies in the region, such as India, Indonesia, Vietnam, and the Philippines, offer significant growth opportunities for the secure logistics market. As these countries experience economic growth, urbanization, and increased consumer spending, there is a growing demand for secure transportation and storage services for valuable goods and assets.

India secure logistics market is anticipated to grow at a CAGR of 14.7% from 2024 to 2030. India is a cash-heavy economy where cash transactions are prevalent. This reliance on cash fuels the demand for secure logistics services to transport, store, and manage cash securely, particularly in the banking, retail, and government sectors.

Key Secure Logistics Company Insights

Some of the key companies operating in the secure logistics market include Brink’s Incorporated and CMS Info Systems (CMS) among others.

-

Founded in 1859, Brink's Incorporated has a long and illustrious history as a leading provider of secure logistics and security solutions worldwide. Focusing on offering safe transit and storage solutions for priceless items, Brink's has established itself as a reliable partner for banks, merchants, and a range of global sectors. The safe and effective transportation of valuable cargo is guaranteed by the company's vast network, cutting-edge technological integration, and fleet of secure cars. Brink is a key participant in securing the international transportation of goods because of its dedication to innovation and observance of the strictest security standards, which have cemented its position as a leading provider of secure logistics.

-

CMS Info Systems is a primary supplier of cash management and secure logistics solutions. Since its founding in 2009, CMS has quickly grown, providing a wide range of services like money processing, safe transportation, and ATM services. By utilizing cutting-edge technologies like sophisticated cash management systems and real-time tracking, CMS guarantees the safe and effective transfer of money and valuable goods. CMS has established itself as a dependable partner in the safe logistics ecosystem, serving financial institutions, retailers, and government agencies among its clientele.

CargoGuard and G4S Limited are some of the emerging companies in the secure logistics market.

-

CargoGuard was established as an emerging player in the safe logistics market and is establishing itself by radically enhancing cargo security. CargoGuard, a real-time tracking and monitoring solutions specialist, gives companies the resources they need to improve the security of valuable shipments all the way through the supply chain. The company is dedicated to innovation and wants to revolutionize the logistics sector by offering clients transparent and responsible solutions. CargoGuard presents itself as a dependable and technologically astute partner in the secure logistics space, providing cutting-edge solutions catered to the changing requirements of companies as they place an increasing priority on the safety of their assets in transit.

-

G4S Limited is an acknowledged player in the industry, providing a wide range of clients with cash management and secure transportation services in addition to comprehensive security solutions. The organization, which has operations in multiple nations, provides a wide range of security solutions, such as secure logistics for high-value items, cash-in-transit, and ATM management. G4S takes pride in its ability to adjust to the constantly changing security technology landscape and make sure that its services meet the most recent market standards. The company's standing as a major player in the secure logistics industry is cemented by its dedication to operational excellence, technical innovation, and serving the specific demands of its clients.

Key Secure Logistics Companies:

The following are the leading companies in the secure logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Brink’s Incorporated

- CargoGuard

- CMS Info Systems (CMS)

- G4S Limited

- GardaWorld

- Lemuir Group

- Loomis AB

- Maltacourt

- PlanITROI, Inc.

- Prosegur

- Allied Universal

- Securitas AB

Recent Developments

-

In May 2022, Brink's Incorporated partnered with METACO to elevate the landscape of institutional digital asset custody by seamlessly integrating METACO's services into the physical realm through Brink's internationally acclaimed secure logistics expertise and extensive global vault network. This strategic collaboration establishes a unique proposition for financial institutions, offering an unparalleled disaster recovery solution for critical private key backups.

-

In July 2022, Securitas AB acquired Stanley Security for USD 3.2 billion, demonstrating a strong belief in the electronic security services market. The collaboration with STANLEY Security and Healthcare enables Securitas AB to redefine the security industry by offering an integrated tech-enabled solutions portfolio, allowing clients to focus on their core business operations.

Secure Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 91.51 billion

Revenue forecast in 2030

USD 153.44 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Report updated

March 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, mode of transport, end-user, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; China; India; Japan; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Brink’s Inc.; CargoGuard; CMS Info Systems (CMS); G4S plc; GardaWorld; Lemuir Group; Loomis AB; Maltacourt; PlanITROI, Inc.; Prosegur; Allied Universal; Securitas AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Secure Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global secure logistics market report based on application, mode of transport, end-user, type, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Cash Management

-

Diamonds, Jewelry & Precious Metals

-

Manufacturing

-

Others

-

-

Mode of Transport Outlook (Revenue, USD Million, 2017 - 2030)

-

Road

-

Rail

-

Air

-

-

End-User Outlook (Revenue, USD Million, 2017 - 2030)

-

Financial Institutions

-

Retailers

-

Government

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Static

-

Mobile

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global secure logistics market size was estimated at USD 78.60 billion in 2022 and is expected to reach USD 84.71 billion in 2023.

b. The global secure logistics market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 153.44 billion by 2030.

b. Europe dominated the secure logistics market with a share of 42.14% in 2022. This is attributable to the increasing penetration of ATMs, coupled with the growing use of ATMs in the region.

b. Some key players operating in the secure logistics market include Brink’s (U.S.), Cargo Guard Secure Logistics (Germany), G4S Secure Solution (UK), and CMS Infosystem Pvt. Ltd. (India).

b. Key factors that are driving the secure logistics market growth include the increasing money circulation across the globe, rising security concerns among corporate and banks have increased the requirement for secure movement and management services for currency.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."