- Home

- »

- Next Generation Technologies

- »

-

Smart Electricity Meters Market Size & Share Report, 2030GVR Report cover

![Smart Electricity Meters Market Size, Share & Trends Report]()

Smart Electricity Meters Market (2023 - 2030) Size, Share & Trends Analysis Report By Phase (Single-phase, Three-phase), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-074-3

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Electricity Meters Market Summary

The global smart electricity meters market was valued at USD 11.65 billion in 2022 and is projected to reach USD 21.81 billion by 2030, growing at a CAGR of 7.6% from 2023 to 2030. The aging of the power grid infrastructure has led to a high degree of inefficiency in electricity systems. To overcome this, organizations across the globe have developed an innovative grid framework. This framework has led to the adoption of technologically advanced smart meters.

Key Market Trends & Insights

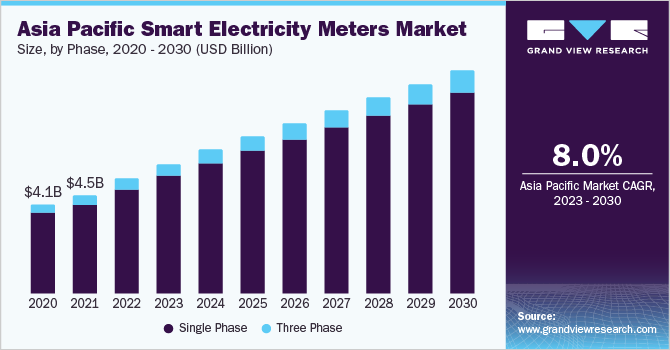

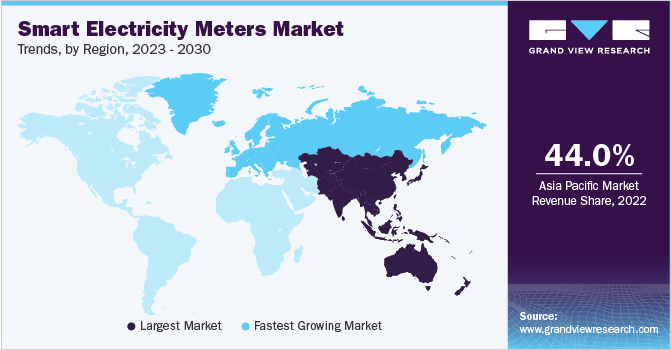

- Asia Pacific dominated the market in 2022, holding over 44% of the global revenue.

- Europe smart electricity meters market is anticipated to witness significant growth over the forecast period.

- By phase, the single-phase segment held the largest market share in 2022, accounting for over 91% of global revenue.

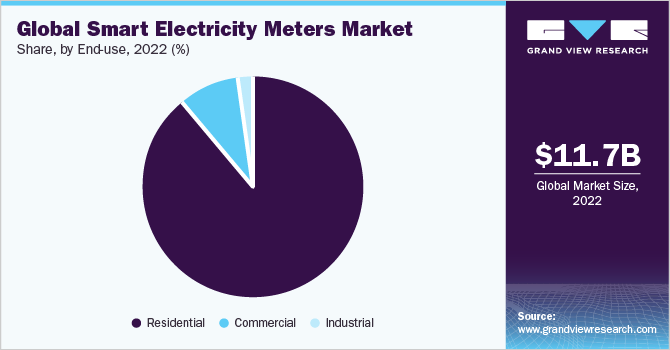

- By end use, the residential end-use segment led the market in 2022, with over 88% of the global revenue share.

Market Size & Forecast

- 2022 Market Size: USD USD 11.65 Billion

- 2030 Projected Market Size: USD 21.81 Billion

- CAGR (2023-2030):7.6%

- Asia Pacific: Largest market in 2022

The government and agencies have developed many regulations and policies to implement smart meters and drive their adoption. Increasing regulatory initiatives to install smart electricity meters are expected to drive market demand for smart electricity meters during the forecast period. Smart electricity metering mandates have been established for the European Union, with rollout plans set by the Commission for Energy Regulation, among other legislative bodies.

Smart meters today are incorporated with advanced technologies such as the Internet of Things (IoT) and blockchain to unlock their full potential and deliver high profits to customers. The IoT has enabled the electricity department to get an automated meter reading. It also allows the objects to be controlled or sense remotely, thereby increasing accuracy, and efficiency and provide economic benefits to users. Blockchain technology offers a security layer to users’ data by restricting direct access to meter data.

Vendors in the market focus on building, organizing, and upgrading the power grid in terms of quality, standards, infrastructure, reliability, availability, sustainability, and interconnectivity. They are launching new solutions as per government policies to cater to the public interest. Increasing deployment of advanced metering infrastructure, rising manufacturer investment, and increasing government investment in smart grid infrastructure are trending across the regions. In addition, attributes such as the integration of advanced technologies in smart electricity meters, a high level of control over consumption through records of customers’ consumption history, and smart meters can also ensure a better quality of electricity supply. This is because smart meters facilitate quicker detection of outages and eliminate billing errors and accessible collection of data from the user to the primary substation, which substantially reduces non-technical losses. The above attributes are expected to boost market growth.

Digitalization of meters introduces various possibilities for advancement, innovation, and new customer service. Installation of advanced metering infrastructure (AMI) smart meters has gained high traction in North American countries in the last few years. Advanced metering infrastructure deployment allows customers and utilities to support smart consumption applications using real- or near-time electricity data and provide information that consumers can use to manage their electricity usage. Furthermore, low voltage grid monitoring capability, theft detection, and outages are some of the key benefits of deploying smart meters. The capability of operational saving from the reduced number of truck rolls, remote connect, and disconnect are some of the reasons behind the high deployment of smart meters in the U.S.

Phase Insights

The single-phase segment led the market in 2022, accounting for over 91% share of the global revenue. Single-phase electricity meters refer to electronic devices used to measure energy consumption and its quality factor and provide methods to prevent tampering. The single-phase segment acquired significant revenues over the forecast period, owing to their suitability in high-capacity industrial facilities and utility-maintained power networks. Escalation in the rate of urbanization, combined with favorable regulatory policies intended for the upgradation of small-scale industries in emerging countries, will stimulate smart electric meter market growth from the segment.

The three-phase segment is anticipated to witness substantial growth over the forecast period. The 3-phase electric meter is generally used for calculating the power of a three-phase electrical source, and the most common application is in the commercial sector. The increasing demand for reliability in power supply for business processes such as logistics, hospitality, education, oil & gas, etc. will positively influence the implementation of three-phase smart electricity meter systems. The employment of smart and efficient control and monitoring devices is facilitating better billing accuracy in the service sector, in applications such as private offices, data centers, and government buildings, among others.

End-use Insights

The residential end-use segment led the market in 2022, accounting for over 88% of the global revenue share. Consistent expansion in residential establishments, on the back of surging populations and per capita incomes, is a vital influencing factor for the consumption of smart electric meters. The smart metering trend is gaining prominence in many countries such as Italy, Germany, Sweden, the U.S., Canada, and the U.K. For instance, as of January 2023, Germany announced the acceleration of the smart meter rollout. Berlin has launched a bid to accelerate the rollout of smart meters, allowing households to manage electricity consumption and sign up for flexible pricing contracts. The rollout of smart meters in Berlin is likely to be supported by government policies and funding and by the city's strong commitment to sustainability and reducing carbon emissions.

The commercial segment is anticipated to witness substantial growth over the forecast period. The commercial end-use segment includes commercial buildings and aligned infrastructures such as hotels, residential lodges, small to large shopping complexes, and offices. The rise in smart grid adoption proposals, coupled with administrative regulations and policy standardization by government authorities in developed countries in Europe and North America is expected to create significant opportunities in the commercial sector. The commercial sector is anticipated to emerge as the most remunerative segment for the smart electricity meter market over the coming years. Smart electricity meters empower the customers to make informed adoptions on the amount of energy in their usage. Utilities install shared communication systems that show precise, instantaneous information on electricity usage in the business, both the energy supplier and the consumer. Many customers, especially those with multiple locations, can realize significant service enhancements and cost savings by sourcing a national agreement.

Regional Insights

Asia Pacific dominated the market in 2022, accounting for over 44% share of the global revenue. Rapid demographic changes, increasing urban population, and swift growth in industrial activities create high growth virtues for the consumption of smart electricity meters over the forecast period. China is expected to hold a leading share in Asia Pacific smart electricity meter market. For instance, in July 2021, at Shanghai Environment and Energy Exchange, Xie Zhenhua, China's representative for climate change said that the country is undertaking certain R&D initiatives focused on smart grid, renewable energy, energy-storing, electric & hydrogen enabled vehicles, zero-emission technologies, and resource recycling.

Europe is anticipated to witness significant growth over the forecast period. The prime factor propelling the market growth in the region includes strong government initiatives related to the implementation of smart electricity metering. For instance, in February 2021, the European Investment Bank (EIB) announced that it would be offering € 200 million in loans to Belgian network operator Fluvius for the deployment of smart metering systems (electricity) in Flanders. The project includes the installation of smart meters for Flemish families and companies in 300 cities and municipalities. Additionally, as of November 2022, Trilliant, an advanced metering infrastructure solutions provider, partnered with Manx Utilities to roll out smart electricity meters to 8,000 prepayment customers across the Isle of Man. It is an essential step towards improving energy efficiency and reducing carbon emissions on the island.

Key Companies & Market Share Insights

The smart electricity meter market has a high growth rate. Highly differentiated products are further leading to increased competitive rivalry. The presence of prominent players, such as GE, ABB Ltd., and Schneider Electric, and the companies' strategic initiatives such as frequent partnerships, mergers, acquisitions, expansion, and strategic alliances, and increasing spending on R&D activities are increasing the competition in the industry. For instance, in February 2023, Itron Inc collaborated with SEW, a leading provider of cloud-based software solutions for the energy and water industries. The collaboration aims to develop new solutions that leverage Itron's OpenWay Riva IoT solution, which includes smart electricity meters and other smart grid technologies. Further, it would provide utilities with better insights into their customers' energy usage and help consumers better understand and manage their energy consumption. Some prominent players in the global smart electricity meters market include:

-

ABB Ltd.

-

General Electric

-

Holley Technology Ltd.

-

Elster Group SE

-

Iskraemeco D.D.

-

Itron, Inc.

-

Landis+Gyr

-

Schneider Electric SE

-

Siemens AG

Smart Electricity Meters Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.06 billion

Revenue forecast in 2030

USD 21.81 billion

Growth Rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, end-use, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Spain, Italy, Netherlands, China, Japan, South Korea, Brazil

Key companies profiled

ABB Ltd.; General Electric; Holley Technology Ltd.; Elster Group SE; Iskraemeco D.D.; Itron, Inc.; Landis+Gyr; Schneider Electric SE; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Electricity Meters Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart electricity meters market report based on phase, end-use, and region.

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Phase

-

Three-Phase

-

- End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

South Korea

-

China

-

Japan

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global smart electricity meters market size was estimated at USD 11.65 billion in 2022 and is expected to reach USD 13.06 billion in 2023.

b. The global smart electricity meters market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 21.81 billion by 2030.

b. Asia Pacific dominated the smart electricity meters market with a share of 45.0% in 2022. This is attributable to the increasing regulatory initiatives for the installation of smart electric meters in various countries in the region.

b. Some key players operating in the smart electricity meters market include ABB Ltd., General Electric, Holley Technology Ltd., Elster Group SE, Iskraemeco D.D., Itron, Inc., Landis+Gyr, Schneider Electric SE, and Siemens AG.

b. Key factors that are driving the smart electricity meters market growth include the rising need for energy efficiency & conservation, increased government initiatives to install smart electricity meters, growing adoption of smart grids by several regions, and the increasing need for energy security globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.