- Home

- »

- Smart Textiles

- »

-

Southeast Asia Personal Protective Equipment Market ReportGVR Report cover

![Southeast Asia Personal Protective Equipment Market Size, Share & Trends Report]()

Southeast Asia Personal Protective Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Head Protection, Eye Protection), By End-use (Construction), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-749-0

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

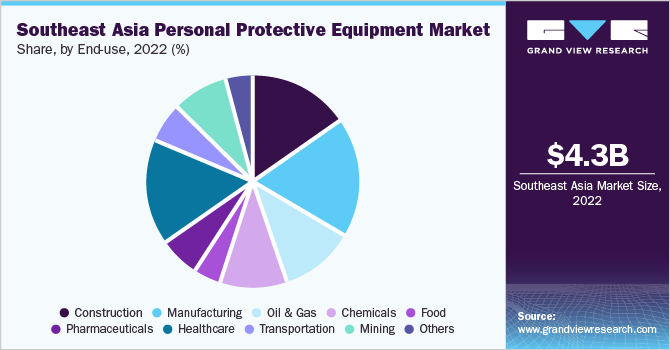

The Southeast Asia personal protective equipment market size was estimated at USD 4.25 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. Growing awareness regarding worker health and safety coupled with increasing industrial fatalities, primarily in the emerging economies, owing to lack of protective gear is also anticipated to steer the growth of the market for personal protective equipment (PPE). Additionally, regulatory agencies in Southeast Asia are enforcing stringent norms on employers in order to make it compulsory to ensure worker safety on account of increasing hazards in these regions. Southeast Asia's PPE market is expected to witness significant during the forecast period on account of growing demand from chemical and oil and gas industries.

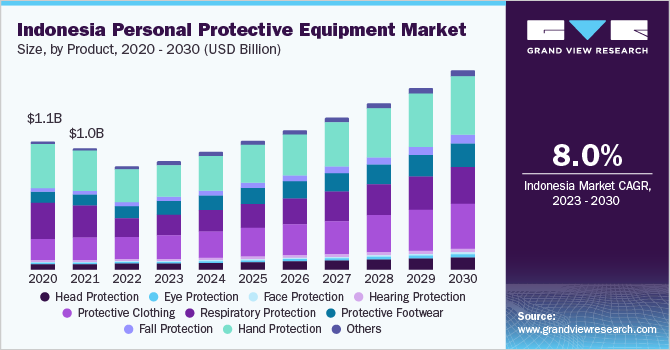

In Indonesia, the overall growth is projected to increase across all infrastructure sectors in the country. Indonesia planned to invest more than USD 400 billion for the period 2020 to 2024 for infrastructural developments. Thus, the construction and infrastructure industry anticipated significant growth in the country, which in turn, was projected to boost the demand for PPE in the country over the forecast period.

Safety regulations are expected to be the key factors driving the PPE market in Southeast Asia over the forecast period. Durable protective clothing such as flame retardant apparel, chemical defending garments, and mechanical protective clothing, are gaining importance in industries such as foundry, chemical processing, metal forming, construction, and oil and gas.

Technological advancements coupled with growing concern toward employee health and safety are anticipated to provide lucrative opportunities for market participants over the next few years. Product innovation and usage of sustainable raw materials for PPE manufacturing are further projected to positively impact market expansion over the forecast period.

Increasing eco-friendly products and cleaner process demand among personal protective equipment manufacturers is expected to lead to the development of innovative manufacturing processes. Furthermore, these initiatives are expected to increase the consumer rating of branded manufacturers committed to using environmentally preferable alternatives rather than petroleum-based plastics.

Product Insights

The hand protection product segment led the market in 2022 and accounted for 31.3% of the overall revenue share. Growing demand for the product in industrial manufacturing, chemical production, and building and construction industries is projected to drive the segment over the next few years. Hand protection is required to protect employees against hand injuries from splinters, sharp edges, blood, bodily fluids, hot objects, electricity, excessive vibrations, and cold.

Growing usage of durable protective clothing in core industries including construction, oil and gas, and mining is expected to boost the market over the forecast period. Furthermore, increasing demand for disposable protective clothing in industries including chemicals and healthcare where the protective clothing is not reused due to contamination is expected to complement the segment growth.

Southeast Asia's respiratory protective equipment market is estimated to expand at a CAGR of 8.5% from 2023 to 2030 on account of the growing demand for unpowered respirators predominantly in the petrochemical, mining, and oil and gas sectors. Respiratory protection protects employees against vapors, inhaling hazardous gases, chemical agents, particulates, radiological particles, and biological contaminants.

The fall protection product segment is projected to grow at an estimated CAGR of 8.8% from 2023 to 2030 owing to increasing awareness about employee safety norms across numerous industries including power generation, construction, and oil and gas is expected to fuel demand in this segment. The fall protection equipment includes a chest harness, suspension belts, body belts, full body harnesses, and safety nets.

End-Use Insights

Manufacturing was the largest end-use segment for personal protective equipment accounting for 18.2% of the market share in 2022. The growing manufacturing industry in Malaysia, Vietnam, and Indonesia is anticipated to augment the demand over the forecast period. Numerous primary and ancillary processes involved in the manufacturing sector including grinding, welding, and torch cutting may cause injuries to employees.

Personal protective equipment demand in the chemical industry in Southeast Asia is growing at an estimated CAGR of 9.2% from 2023 to 2030 owing to the significant growth of the chemical sector in countries such as Indonesia and Vietnam. Personal protective equipment used in the chemical industry includes aprons, overalls, gloves, respirators, face shields, and chemical-resistant glasses.

The penetration of personal protective equipment in the construction industry accounted for 14.9% of the overall revenue in 2022 owing to the Increasing demand for better public infrastructure, such as harbors, airports, roadways, and rail transport systems are projected to drive the construction industry across the region. PPE in the construction sector is used to safeguard employees from free falls and head, hand, and foot injuries.

The food industry is majorly dependent on quality control and hygiene on account of which the demand for personal protective equipment in the industry is expected to grow over the forecast period. Numerous processes in the food sector such as mixing, weighing, cutting, cleaning, dispensing, transportation, and warehousing may pose a great risk to the life of employees.

Regional Insights

Thailand dominated the market and accounted for over 21.0% share of overall revenue in 2022, owing to increasing occupational fatalities as well as growing requirements for protective gear in most of the core industries such as refining, oil and gas, automotive, and metal manufacturing. Growing concerns regarding public health and safety coupled with stringent regulatory norms are expected to drive PPE demand in the country over the forecast period.

Indonesia's personal protective equipment market is anticipated to expand at an estimated CAGR of 8.0% over the forecast period. Growing awareness of employee health and safety along with rising industrial fatalities across the industries due to lack of protective gear is projected to drive the market growth of PPE in the country during the forecast period.

Growing investment in the machinery, semiconductor, aeronautical, and textile sectors is expected to augment industrial growth in Malaysia. Rising concern towards safety norms in the Occupational Safety and Health Act 1994 of Malaysia along with heavy penalties for non-compliance with the norms is expected to drive PPE demand over the forecast period. Malaysia is the largest exporter of rubber gloves.

Vietnam's PPE market is projected to expand at a CAGR of 8.4% from 2023 to 2030. Growing investments in the electronics and textile industries are expected to remain a key driver for industrial growth in the region. Rising awareness regarding poor workplace conditions leading to workplace injuries and deaths is expected to drive PPE demand in various industrial sectors in the country.

Key Companies & Market Share Insights

The market comprises both global as well as regional players engaged in designing, manufacturing, and distributing personal protective equipment. PPE manufacturers are engaged in adopting various strategies including mergers and acquisitions, new product development, diversification, and geographical expansions. These strategies aid the companies in augmenting their market penetration and in catering to the changing technological demand of various end-use industries. Some prominent players in the Southeast Asia personal protective equipment market include:

-

DuPont

-

Ansell Ltd.

-

3M

-

Honeywell International, Inc.

-

Alpha Pro Tech Limited

-

Delta Plus Group

-

Uvex Safety Group

-

Mallcom (India) Ltd

-

Kimberly-Clark Corporation

-

Top Glove Corporation Bhd

-

Bullard

-

ATG - Intelligent Glove Solutions

-

Towa Corporation

-

Hartalega Holdings Berhad

Southeast Asia Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.43 billion

Revenue forecast in 2030

USD 8.12 billion

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

Southeast Asia

Country Scope

Singapore; Vietnam; Malaysia; Indonesia; Thailand

Key companies profiled

3M; Honeywell International, Inc.; Uvex Safety; Ansell Ltd; DuPont, Top Glove Corporation Berhad; Alpha Pro; ATG Lanka (Pvt.) Ltd.; Mallcom; and Kimberly-Clark Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Southeast Asia Personal Protective Equipment Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Southeast Asia personal protective equipment market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Head Protection

-

Eye Protection

-

Face Protection

-

Hearing Protection

-

Protective Clothing

-

Heat & flame protection

-

Chemical defending

-

Clean room clothing

-

Mechanical protective clothing

-

Limited general use

-

Others

-

-

Respiratory Protection

-

Air Purifying Respirator

-

Supplied Air Respirator

-

-

Protective Footwear

-

Leather

-

Rubber

-

PVC

-

Polyurethane

-

Others

-

-

Fall Protection

-

Hand Protection

-

Disposable Gloves

-

By Type

-

General Purpose

-

Chemical Handling

-

Sterile Gloves

-

Surgical

-

Others

-

-

By Material

-

Natural Rubber/Latex

-

Nitrile

-

Neoprene

-

Polyethylene

-

Other

-

-

-

Durable Gloves

-

By Type

-

Mechanical gloves

-

Chemical handling

-

Thermal/flame retardant

-

Others

-

-

-

-

Others

-

-

End-Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

Southeast Asia

-

Indonesia

-

Thailand

-

Malaysia

-

Singapore

-

Vietnam

-

-

Frequently Asked Questions About This Report

b. The Southeast Asia personal protective equipment market size was estimated at USD 4.25 billion in 2022 and is expected to reach USD 4.43 billion in 2023.

b. The Southeast Asia personal protective equipment market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 8.12 billion by 2030.

b. Hand protection was the major product segment in 2022 and accounted for 31.3% of the overall revenue share owing to growing demand for the product in chemical production, industrial manufacturing, and building and construction industries.

b. Some of the key players operating in the Southeast Asia Personal Protective Equipment market include HRS Heat Exchangers, Kelvion Holding GmbH, API Heat Transfer, Brask, Inc., Koch Heat Transfer Company, WCR, Inc., Alfa Laval, Manning and Lewis, Mersen, Barriquand Technologies Thermiques.

b. The key factors that are driving the Southeast Asia Personal Protective Equipment market include the increasing product demand from numerous end-use industries including power generation, chemicals, food & beverage, and petrochemical.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.