- Home

- »

- Advanced Interior Materials

- »

-

U.S. Heating Equipment Market Size & Share Report, 2030GVR Report cover

![U.S. Heating Equipment Market Size, Share & Trends Report]()

U.S. Heating Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Equipment (Heat Pumps, Furnaces, Boilers, Unitary Heaters, Others), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-418-5

- Number of Report Pages: 87

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

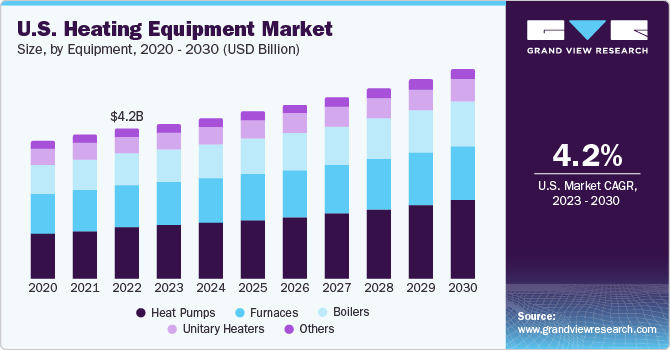

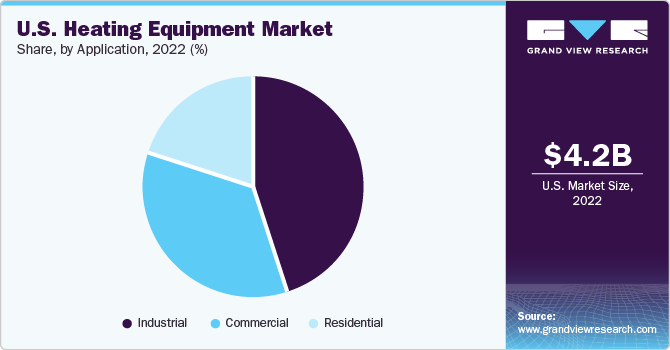

The U.S. heating equipment market size was valued at USD 4.21 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. Increasing investment in real estate and rapid industrialization is projected to drive demand over the forecast period. Growing preference for energy-efficient certified products is anticipated to be one of the major factors influencing growth over the forecast period. Rising energy consumption in the industrial and residential sectors is projected to drive the preference for solutions that reduce overall operational costs and improve energy savings.

As reported by the U.S. Census Bureau, construction expenditures in the U.S. amounted to USD 22.2 billion in 2022, exhibiting a growth from USD 19.8 billion in the preceding year. Growing construction spending coupled with increasing repair & replacement activities are predicted to boost heating solutions growth. The construction sector in the U.S. is focused on developing sustainable and energy-efficient structures. The Leadership in Energy & Environmental Design (LEED) is a recognized green building certification program that is established by the U.S. Green Building Council (USGBC).

LEED focuses on reducing energy consumption by designing and developing energy-efficient projects. HVAC systems must comply with the requirements outlined by New Buildings Institute, Inc.’s publication titled “Advanced Buildings: Energy Benchmark for High-Performance Buildings.” Such policies have further enabled the development and installation of environmentally sustainable solutions.

A noteworthy trend within the industry is the emergence of intelligent and interconnected heating systems. These advanced systems provide improved control and automation capabilities, empowering users to efficiently manage energy consumption and reduce expenses.

Application Insights

The industrial segment dominated the market and held the largest revenue share of 44.8% in 2022. Heating systems are widely used in the mining, automotive, and food & beverage industries. Increasing investment in developing the manufacturing sector of the U.S. is projected to influence demand over the coming years positively. According to an update from THE FINANCIAL TIMES LTD. in April 2023, companies have committed to investing over USD 200 billion in manufacturing projects within the U.S. since Congress granted significant subsidies in the previous year. These proactive initiatives and substantial investments are anticipated to be influential drivers of growth within this sector throughout the projected period.

The commercial segment is expected to grow at the fastest CAGR of 4.7% over the forecast period. Heating equipment in office buildings includes systems such as central heating, boilers, and furnaces. The growth of this segment is influenced by factors like new construction, renovation projects, and energy efficiency requirements.

U.S. Heating Equipment Market Trends

The U.S. heating equipment market is projected to grow on account of increasing construction growth and favorable repair and replacement activities. In the production and processing of ferrous and non-ferrous metals, mining, oil and gas, and the automotive industry, heating equipment is crucial. The demand for products that are certified as energy efficient drives the market growth in the U.S. The demand for solutions that reduce operating costs and improve energy savings is expected to increase as energy consumption in the industrial and residential sectors continues to rise.

The increasing growth of the housing and construction sectors for single and multi-unit dwellings is expected to boost the demand for heating equipment. In addition, higher consumer spending habits are projected to increase the revenue of restaurants and other commercial establishments, which is expected to drive the demand for heating equipment in the commercial sector.

Heat pumps, boilers, furnaces, and unitary heaters are among the heating appliances that are predicted to have rapid growth in the United States. One of the key reasons driving the expansion of this market is the combination of rapid industrialization and rising demand for more advanced equipment. The rising need for home heating solutions that are energy efficient is also anticipated to increase market demand in the coming years.

Growing disposable income coupled with cheaper financing options has given companies more cash in hand to upgrade their capital equipment in offices, production facilities, and stores. Consequently, it is easier to invest in expensive equipment upgrades while loan rates are low, and hence, it is predicted to augment the market growth for heating equipment in the U.S.

The cost of installation is accompanied by high labor costs and the cost of drilling & excavation. A heating system requires fine-tuning and custom fabrication of parts during installation to ensure that it works smoothly, or the system is likely to fail prematurely. The cost of replacing old heating equipment includes removal & disposal of the old unit, lines, ducts, and wiring needed for the new system to run properly, thus limiting the demand for heating equipment.

Several policies such as The Leadership in Energy & Environmental Design (LEED) is established by the U.S. Green Building Council (USGBC), which is a recognized green building certification program LEED focuses on reducing energy consumption by designing and developing energy-efficient projects. Such policies further enhance the development and installation of heating solutions.

Equipment Insights

The heat pumps segment accounted for the largest revenue share of 34.1% in 2022. Heat pumps are used for temperatures with moderate warming and cooling requirements. It can provide equivalent area conditioning at one-fourth the operating cost than conventional HVAC systems. With a growing emphasis on energy efficiency and sustainability, heat pumps have gained popularity due to their high energy efficiency ratings. Government regulations and incentives promoting energy-efficient technologies have also encouraged the adoption of heat pumps.

The boiler segment is expected to grow at a CAGR of 4.0% over the forecast period. Boilers are used for various applications such as water heaters, power generation, cooking, central heaters, and sanitation. They are extensively preferred in the commercial, institutional, industrial, as well as the educational sector.

Boilers are further segmented into two broad categories namely, water boilers and steam boilers. Hot water remains essential to daily requirements in kitchens and laundries. The increasing population & rapid development of housing projects are expected to augment the growth of water boilers over the coming years. Steam boilers have been gaining preference in the domestic and industrial segments owing to ample consumption of steam in the industrial and commercial sectors. Boilers with a capacity ranging from 10-50 MMBtu/hr are generally used in residential, commercial, and industrial applications. They find major applications in the food industry and other manufacturing units.

Key Companies & Market Share Insights

Companies have invested in expanding production capabilities and acquiring certifications to cater to increasing market demand. They also comply with various energy efficiency requirements stated by regulatory authorities. Companies are taking certain strategic initiatives to increase their equipment capacity and to enhance their equipment portfolio to cater to the growing demand.

Key U.S. Heating Equipment Companies:

- Ingersoll Rand

- Lennox International Inc.

- Burnham Holdings, Inc.,

- Johnson Controls

- Robert Bosch GmbH

- Honeywell International Inc

- Daikin Comfort Technologies North America, Inc.

- Emerson Electric Co.

- Rheem Manufacturing Company

- American Heating

Recent Developments

-

In March 2023, Mitsubishi Electric Trane HVAC US LLC launched a new intelli-HEAT Dual Fuel System. This cutting-edge solution from Mitsubishi Electric is designed to seamlessly integrate with any thermostatically controlled furnace, offering compatibility with both single-zone and multi-zone systems. By adopting intelli-HEAT, homeowners who currently utilize gas furnaces can enhance the comfort and sustainability of their homes through the utilization of an energy-saving, all-electric heat pump as their main heating source.

-

In November 2021, the Department of Energy (DOE) announced a strategic partnership with the heating industry. This collaborative effort aims to enhance the performance and energy efficiency of cold climate heat pumps, leveraging recent advancements in the industry. By joining forces, the DOE and the heating industry seek to accelerate the adoption of cleaner and more efficient cold-climate heat pumps in the market.

-

In June 2021, Enerquip Thermal Solutions acquired American Heating. The purpose of this acquisition is to harness the strengths and expertise of the company, enhance its product offerings, increase operational efficiency, and deliver enhanced value to its customers. This strategic move enables Enerquip Thermal Solutions to expand its product portfolio, access new customer segments, and capitalize on synergies between the two organizations.

-

In April 2021, Watsco, Inc. successfully acquired TEC. This strategic acquisition of TEC aligns with their long-term business objectives of driving innovation, improving operational efficiencies, and delivering value to their customers.

U.S. Heating Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.88 billion

Growth Rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Country scope

U.S.

Key companies profiled

Ingersoll Rand; Lennox International Inc.; Burnham Holdings, Inc.; Johnson Controls; Robert Bosch GmbH; Honeywell International Inc.; Daikin Comfort Technologies North America, Inc.; Emerson Electric Co.; Rheem Manufacturing Company; American Heating

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Heating Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. heating equipment market based on equipment, application, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Heat pumps

-

Furnaces

-

Boilers

-

The U.S. boilers market product outlook

-

Water boilers

-

Steam boilers

-

-

The U.S. boilers market size outlook

-

<10 MMBtu/hr

-

10-50 MMBtu/hr

-

50-100 MMBtu/hr

-

100-250 MMBtu/hr

-

>250 MMBtu/hr

-

-

The U.S. boilers market technology outlook

-

Water-tube boilers

-

Fire-tube boilers

-

-

-

Unitary heaters

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. heating equipment market size was estimated at USD 4.21 billion in 2022 and is expected to be USD 4,352.7 million in 2023.

b. The U.S. heating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 5.88 billion by 2030.

b. Heat pumps equipment segment dominated the market in 2022 by accounting for a share of 34.1% of the market. Heat pumps are used for temperatures with moderate warming and cooling requirements. It can provide equivalent area conditioning at one-fourth operating cost than conventional HVAC systems.

b. Some of the key players operating in the U.S. heating equipment market include United Technologies Corporation, Ingersoll-Rand plc, Lennox International, Inc., Burnham Holdings, Inc., Johnson Controls, Inc., Robert Bosch GmbH, Honeywell International, Inc., among others

b. Growing preference for energy-efficient certified products is anticipated to be one of the major factors influencing growth over the forecast period. Rising energy consumption in the industrial and residential sectors is projected to drive the preference for solutions that reduce overall operational costs and improve energy savings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.