- Home

- »

- Advanced Interior Materials

- »

-

HVAC Systems Market Size & Share, Industry Report, 2033GVR Report cover

![HVAC Systems Market Size, Share & Trends Report]()

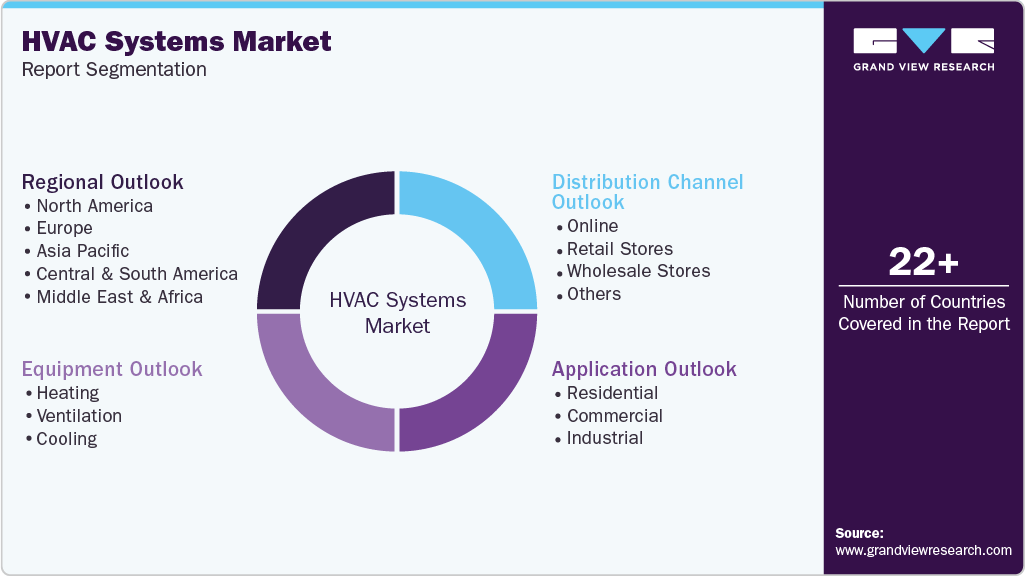

HVAC Systems Market (2026 - 2033) Size, Share & Trends Analysis Report By Equipment (Heating, Cooling, Ventilation), By Application (Residential, Commercial, Industrial), By Distribution Channel (Online, Retail Stores, Wholesale Stores), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-641-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

HVAC Systems Market Summary

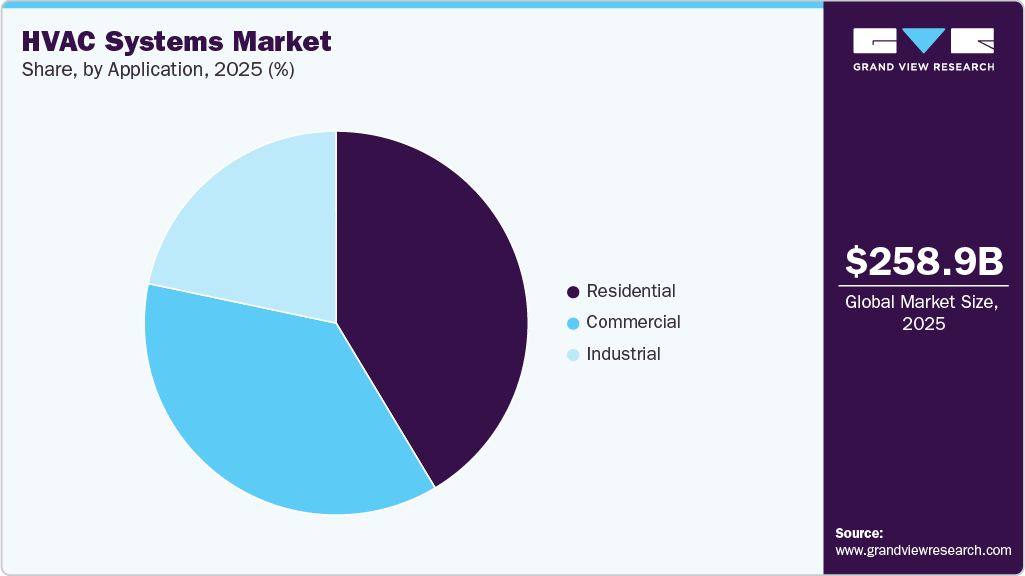

The global HVAC systems market size was estimated at USD 258.96 billion in 2025 and is projected to reach USD 445.73 billion by 2033, growing at a CAGR of 7.0% from 2026 to 2033. The global HVAC systems industry is expanding due to rising construction activities, urbanization, and an increasing need for thermal comfort in residential, commercial, and industrial buildings.

Key Market Trends & Insights

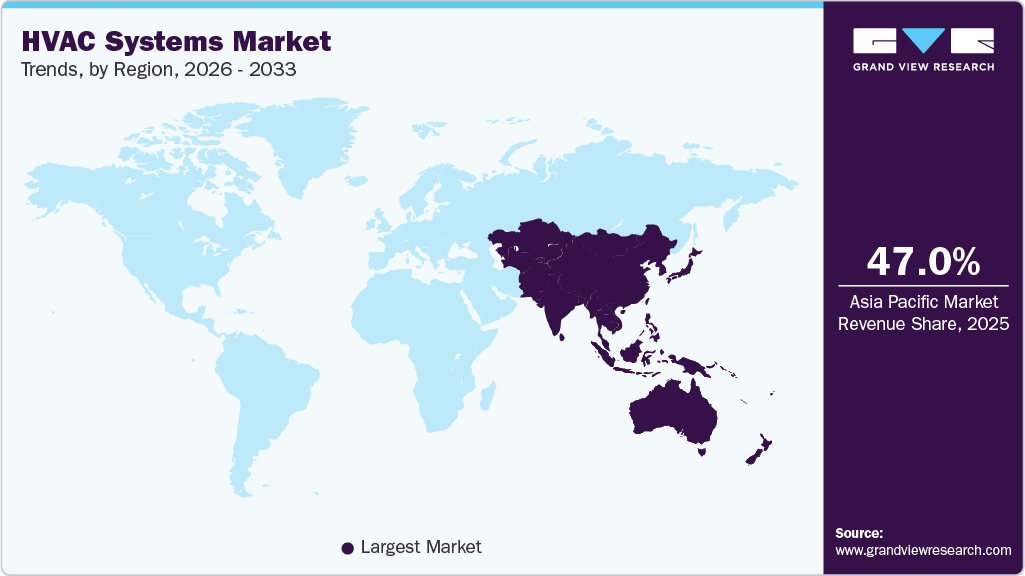

- Asia Pacific dominated the global HVAC systems industry with the largest revenue share of 47.0% in 2025.

- The HVAC systems industry in India is expected to grow at a rapid CAGR of 8.3% from 2026 to 2033.

- By equipment, the heating equipment segment is expected to grow at a considerable CAGR of 7.0% from 2026 to 2033 in terms of revenue.

- By application, the commercial segment is expected to grow at a significant CAGR of 7.5% from 2026 to 2033 in terms of revenue.

- By distribution channel, the online segment is expected to grow at a significant CAGR of 7.7% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 258.96 Billion

- 2033 Projected Market Size: USD 445.73 Billion

- CAGR (2026-2033): 7.0%

- Asia Pacific: Largest market in 2025

Energy efficiency regulations and government incentives for smart and sustainable HVAC systems are propelling demand. Technological advancements such as IoT-enabled monitoring, AI-driven optimization, and integration with renewable energy systems are further encouraging system upgrades and new installations. In addition, government initiatives, such as rebates, incentive plans, and clean heating & cooling equipment across North America & Europe, are expected to positively impact the demand for HVAC systems. Moreover, climate change and the growing popularity of improved indoor air quality are accelerating investments in air filtration and ventilation technologies.

Market Concentration & Characteristics

The global HVAC systems industry is moderately to highly fragmented, characterized by the presence of well-established multinational corporations, regional OEMs, and specialized system integrators. Major players such as Daikin, Johnson Controls, Trane Technologies, and Carrier dominate global operations in sectors requiring stringent performance and air-quality control, a dynamic that also influences the hospital HVAC systems industry. Regional companies remain essential in residential and mid-tier commercial applications. The market structure features strong competition across product categories such as chillers, rooftop units, air handling units, and VRF systems, with differentiation increasingly centered on energy efficiency, automation, and advanced control technologies.

Market dynamics are heavily influenced by increasing demand for sustainable, low-emission HVAC solutions, driven by the rising urgency around climate change mitigation and net zero commitments. Technological innovation is centered around inverter-driven compressors, heat pumps, demand-controlled ventilation, and AI-integrated building automation systems. Compliance with energy efficiency standards such as ASHRAE 90.1, EN 378, and local green building certifications (LEED, BREEAM) is increasingly non-negotiable, particularly in developed regions. Manufacturers are under growing pressure to deliver systems that not only meet performance requirements but also align with carbon reduction goals and refrigerant phase-down policies under the Kigali Amendment.

At the same time, the supply base for critical components such as high-efficiency compressors, electronic expansion valves, advanced filters, and low-GWP refrigerants is relatively concentrated, giving some upstream suppliers considerable bargaining power. This, combined with volatile input prices and semiconductor shortages, can constrain profit margins and affect lead times. However, strong demand across healthcare, residential retrofits, and data centers presents robust growth opportunities. To maintain competitive advantage, leading players are increasingly investing in modular, scalable, and smart HVAC solutions, while also leveraging IoT and remote diagnostics to offer predictive maintenance and lifecycle optimization.

Drivers, Opportunities & Restraints

The market is driven by the rising need for cost-effective and energy-efficient space cooling and heating applications in residential, commercial, and industrial sectors. In addition, stringent government regulations related to energy efficiency and environmental impact are prompting consumers to upgrade to eco-friendly HVAC technologies. Government incentives and subsidies for green building initiatives are also encouraging the adoption of advanced HVAC systems.

High upfront installation and long-term maintenance costs remain major barriers to the adoption of advanced HVAC systems, especially those incorporating smart sensors, inverter technology, and low-GWP refrigerants. These costs are compounded by a global shortage of skilled HVAC technicians, which can lead to delays in project execution and improper system installation. In many developing or price-sensitive regions, affordability challenges make it difficult for consumers and institutions to transition from traditional HVAC units to energy-efficient, environmentally compliant alternatives.

The global shift toward decarbonization, driven by climate commitments and stricter emissions regulations, is opening up vast opportunities for innovation in HVAC technology. Demand is rising for systems using low-GWP refrigerants, integrated energy recovery ventilators, and intelligent building management platforms that reduce carbon footprints while optimizing indoor comfort. With both public and private sectors investing in sustainable construction and net-zero targets, manufacturers and service providers have a growing incentive to scale up R&D and deployment of green HVAC solutions across residential, commercial, and institutional applications.

Equipment Insights

The heating equipment segment dominated the market in 2025 accounting for 51.5% of the market share driven by rising demand for energy-efficient and sustainable heating solutions, especially in colder regions across North America, Europe, and parts of Asia. The transition from conventional fossil fuel-based heating systems to electric and hybrid heat pumps is accelerating due to stricter building energy codes and emissions regulations. Government incentives and subsidies aimed at promoting heat pump adoption, such as those under the EU’s Green Deal or the U.S. Inflation Reduction Act, are encouraging retrofits in residential and commercial buildings.

The cooling equipment segment is expected to grow at a CAGR of 6.9% from 2026 to 2033 in terms of revenue, due to rising ambient temperatures, growing urban populations, and the global demand for thermal comfort, especially in the Asia-Pacific, the Middle East, and parts of Latin America. In the HVAC systems industry, this has translated into higher adoption of advanced air conditioning systems with inverter technology, climate-adaptive controls, and low-GWP refrigerants. Increasing construction of data centers, hospitals, and temperature-sensitive industrial spaces has also fueled the demand for precision and industrial cooling systems. The integration of cooling units into smart grid systems, along with the push for peak-load reduction, is further propelling innovation in the segment.

Distribution Channel Insights

The retail stores segment dominated the market in 2025, accounting for 40.5% of the market share, supported by the expansion of multi-brand outlets, big-box stores, and dealer networks that offer bundled installation services and localized after-sales support. Many end-users, especially in the residential and light commercial segments, prefer the assurance of face-to-face transactions and localized service availability, which retail formats continue to provide effectively. Moreover, retail stores often benefit from promotional tie-ups with HVAC brands, seasonal discounts, and demo units, which further boost foot traffic and impulse purchases during peak demand seasons.

The online segment is expected to grow at a CAGR of 7.7% from 2026 to 2033 in terms of revenue, due to the convenience of remote product discovery, comparison, and ordering, particularly in the residential and light commercial segments. Growth is fueled by the increasing digitalization of B2B procurement processes, the expansion of e-commerce platforms into heavy-duty equipment categories, and better integration of logistics and after-sales service networks. For customers in mature markets, online platforms offer access to energy ratings, customer reviews, and compatibility tools that guide decision-making. HVAC manufacturers are also investing in direct-to-consumer e-commerce portals, offering customization options, live chat support, and AR-based product visualization tools.

Application Insights

The residential segment dominated the market in 2025 accounting for a 41.4% market share driven by a rise in global housing construction, higher disposable incomes in emerging markets, and consumer awareness of indoor air quality and energy efficiency. Demand is especially strong for ductless mini-splits and integrated HVAC systems that support zoning and remote management through smart thermostats. Regulatory incentives for energy-efficient appliances and green home certifications are boosting the replacement rate of older residential HVAC systems. In addition, the increase in home renovation and smart home adoption trends is accelerating upgrades in both developed and developing regions.

The commercial segment is expected to grow at a significant CAGR of 7.5% from 2026 to 2033 in terms of revenue, due to the increasing construction and refurbishment of office complexes, hotels, hospitals, retail spaces, and educational institutions. The demand for high-performance HVAC systems in commercial buildings is being driven by regulations focused on indoor air quality, energy performance certifications (like LEED or WELL), and rising ESG investment criteria.

Regional Insights

The Asia Pacific HVAC systems market dominated the global revenue share accounting for 47.0% of the market in 2025. Rapid urbanization, population growth, and expanding middle-class housing are fueling robust HVAC demand in the Asia Pacific region, especially in China, India, and Southeast Asia. Rising temperatures and increasing adoption of air conditioning in residential and institutional settings are driving volume sales. In parallel, supportive government initiatives and green building codes in countries like Japan and South Korea are accelerating the uptake of energy-efficient and smart HVAC technologies.

The HVAC systems industry in China is projected to expand at a CAGR of 7.9% over the forecast period due to urbanization, rising middle-class incomes, and government-led initiatives for green buildings and sustainable urban planning. The introduction of stricter national standards for energy efficiency in both residential and commercial construction is encouraging the deployment of modern HVAC systems.

The HVAC systems industry in India is projected to expand at a CAGR of 8.3 % over the forecast period. In India, growing urbanization, rising disposable incomes, and increasing adoption of air conditioning in both residential and commercial spaces are major growth drivers.

North America HVAC Systems Market Trends

The HVAC systems industry in North America is driven by strict regulatory mandates promoting the adoption of low-global-warming-potential (GWP) refrigerants and high-efficiency equipment. Retrofit demand is rising across healthcare, educational, and commercial buildings due to aging infrastructure and rising energy costs. The region’s transition toward connected, automated climate-control technologies is also strengthening momentum in the North America market. In addition, government incentives under programs like the Inflation Reduction Act in the U.S. continue to encourage upgrades to energy-efficient HVAC systems, especially in public institutions and green building projects.

U.S. HVAC Systems Market Trends

The U.S. HVAC systems industry is projected to expand at a CAGR of 6.9% over the forecast perioddriven by stringent energy-efficiency regulations such as those mandated by the U.S. Department of Energy and ENERGY STAR programs, which push both residential and commercial buyers toward high-efficiency upgrades.

The HVAC systems industry growth in Mexico is driven by expanding construction activity, rising demand for modern climate-control solutions, and a national shift toward lower-consumption building technologies. Regulatory emphasis on energy efficiency and the replacement of outdated equipment continue to strengthen interest in high-performance systems, supporting steady expansion of the Mexico energy efficient HVAC systems industry as end users prioritize lower operating costs and improved environmental performance.

Europe HVAC Systems Market Trends

The Europe HVAC systems industry is being propelled by the region’s strong climate agenda, which includes the EU Green Deal and national targets for carbon neutrality. Such an environment orients the country’s market towards a more energy efficient HVAC systems industry. Demand for heat pumps, ventilation systems with heat recovery, and hydronic systems is rising, particularly in countries with cold climates and aging housing stocks. Strict building energy performance regulations (such as the EPBD) are compelling widespread system upgrades in both residential and commercial buildings.

The HVAC systems industry in the UK is expected to grow at a CAGR of 7.3% over the forecast period propelled by the country’s legally binding net-zero targets for 2050, which are accelerating the phase-out of older, inefficient heating systems and encouraging the adoption of low-carbon HVAC technologies like heat pumps and hybrid systems.

The France HVAC systems industry is expected to grow at a CAGR of 6.6% over the forecast period.The country’s HVAC systems industry benefits from strong government incentives under its energy transition laws, including financial support for replacing fossil-fuel-based heating systems with renewable alternatives.

Latin America HVAC Systems Market Trends

The Latin America HVAC systems industry is driven by the growing construction activity in commercial and healthcare sectors, especially in urban centers of Brazil, Mexico, and Colombia, which are boosting HVAC installations. Rising concerns over indoor air quality and the need for temperature control in new healthcare and hospitality projects are key drivers. Although regulatory frameworks remain less stringent than in developed regions, the market is gradually embracing energy-efficient technologies supported by global OEMs expanding their regional footprint.

The HVAC systems industry in Brazil is projected to grow at a CAGR of 6.2% over the forecast period primarily driven by its tropical and subtropical climate, which sustains year-round demand for air conditioning. Growth is further supported by rising construction activity in the residential and commercial sectors, especially in urban centers.

Middle East & Africa HVAC Systems Market Trends

The MEA HVAC systems industry is witnessing strong HVAC demand due to extreme climatic conditions, a booming construction sector, and the development of large-scale infrastructure and healthcare projects in the Gulf Cooperation Council (GCC) countries. Mega events like Expo 2020 and Saudi Arabia’s Vision 2030 are accelerating demand for modern cooling systems. In addition, water-cooled and district cooling solutions are gaining traction in urban projects due to high ambient temperatures and sustainability-focused urban planning.

The HVAC systems industry in Saudi Arabia is projected to expand at a CAGR of 7.7% over the forecast period, due to high cooling needs driven by extreme desert temperatures and massive infrastructure investments under the Saudi Vision 2030 initiative. Projects such as NEOM and large-scale urban developments require advanced HVAC installations with a focus on energy efficiency and sustainability.

Key HVAC Systems Company Insights

Some of the key players operating in the market include Carrier Corporation and Daikin Industries, Ltd among others.

-

Carrier Corporation provides heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and foodservice sectors. It was acquired by United Technologies Corporation in 1979; however, it was separated into a separate business in April 2020.

-

Daikin Industries, Ltd. offers air-conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key HVAC Systems Companies:

The following are the leading companies in the HVAC systems market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier Corporation

- DAIKIN INDUSTRIES Ltd.

- Fujitsu

- Haier Group

- Panasonic Corporation

- AAON

- Johnson Controls

- LG Electronics

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- SAMSUNG

- Trane

- Midea

- Danfoss AS

- Munters

- Frigidaire HVAC

- Bosch Group

- STULZ Air Technology Systems, Inc.

- Honeywell International Inc.

Recent Developments

-

In February 2025, Midea finalized its purchase of ARBONIA climate to expand its reach in the European HVAC market. By combining ARBONIA climate with its existing subsidiary, Clivet, Midea is creating a new entity called MBT Climate. This new group will capitalize on ARBONIA climate's expertise in sustainable heating and cooling technologies and Midea's robust R&D to offer a wider range of localized HVAC solutions.

-

In February 2025, Carrier Ventures made a strategic investment in ZutaCore, a company specializing in liquid cooling systems for data centers. The collaboration focuses on improving cooling efficiency for high-density computing, especially as AI demands grow. ZutaCore’s technology supports energy savings and increased server performance, helping to reduce data center emissions.

HVAC Systems Market Report Scope

Report Attribute

Details

Market size in 2026

USD 277.79 billion

Revenue forecast in 2033

USD 445.73 billion

Growth rate

CAGR of 7.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Türkiye; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Carrier Corporation; DAIKIN INDUSTRIES Ltd.; Fujitsu; Haier Group; Panasonic Corporation; AAON; Johnson Controls; LG Electronics; Lennox International Inc.; Mitsubishi Electric Corporation; Rheem Manufacturing Company; SAMSUNG; Trane; Midea; Danfoss AS; Munters; Frigidaire HVAC; Bosch Group; STULZ Air Technology Systems, Inc.; Honeywell International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HVAC Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc has segmented the global HVAC systems market report based on equipment, application, distribution channel, and region:

-

Equipment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Heating

-

Heat Pump

-

Furnace

-

Unitary Heaters

-

Boilers

-

Electric Baseboards

-

Heating Cables

-

Others

-

-

Ventilation

-

Air Purifier

-

Dehumidifier

-

Air Handling Units

-

Ventilation Fans

-

Others

-

-

Cooling

-

Air Conditioning

-

Chillers

-

Cooling Towers

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

By Equipment

-

-

Commercial

-

By Equipment

-

-

Industrial

-

By Equipment

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

Türkiye

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global HVAC systems market size was estimated at USD 258.96 billion in 2025 and is expected to reach USD 277.79 billion in 2026

b. The global HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.0% from 2026 to 2033 to reach USD 445.73 Billion by 2033.

b. The residential segment dominated the market in 2025 accounting for a 41.4% market share driven by a rise in global housing construction, higher disposable incomes in emerging markets, and consumer awareness of indoor air quality and energy efficiency. Demand is especially strong for ductless mini-splits and integrated HVAC systems that support zoning and remote management through smart thermostats.

Which region held the largest share in the Heating, Ventilation and Air conditioning Systems Market?b. The market in Asia Pacific dominated the market in 2025 accounting for 47.0% of the global revenue share due to rapid urbanization, rising construction activity, and increasing demand for energy-efficient systems across residential and commercial sectors. Government initiatives promoting green buildings and stricter environmental regulations are further accelerating adoption in key markets like China, India, and Southeast Asia. .

b. Key factors driving the HVAC systems market include increasing demand for energy-efficient and sustainable climate control solutions, and rising construction activities across residential, commercial, and industrial sectors. Technological advancements and supportive government policies further fuel market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.