- Home

- »

- Next Generation Technologies

- »

-

U.S. Industrial Automation And Control Systems Market Report 2030GVR Report cover

![U.S. Industrial Automation And Control Systems Market Size, Share & Trends Report]()

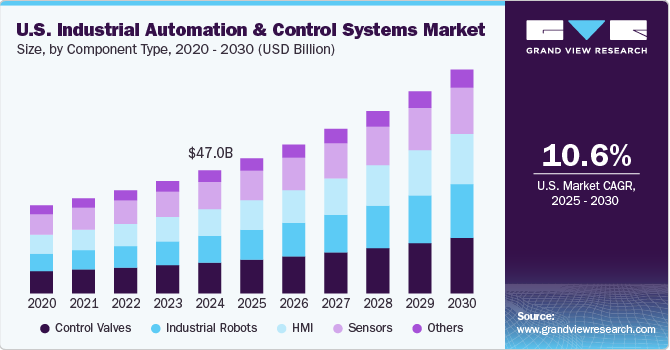

U.S. Industrial Automation And Control Systems Market Size, Share & Trends Analysis Report By Component Type (Industrial Robots, Control Valves), By Control System (DCS, PLC, SCADA), By Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-201-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Technology

Market Size & Trends

The U.S. industrial automation and control systems market size was valued at USD 42.87 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2024 to 2030. Due to the continual introduction of sophisticated technologies such as robotics and AI, the industrial sector has been evolving rapidly. Automation enables swift operations of manufacturing and material handling with the use of intelligent manufacturing infrastructure. Industries are deploying industrial automation and control systems in order to increase productivity and reduce labor costs. With the advent of Industry 4.0, the manufacturing sector has been experiencing rapid adoption of new systems and augmented networking architectures, which is projected to provide significant opportunities for market.

The automation systems range from small independent units to numerous interlinked large-scale work cells spread across the factory floor. Every system is designed for a particular task, resulting in cost reduction, improved quality, improved operator safety, and enhanced production. Technologies including analytics, cloud, and mobility, are aiding organizations to attain their targets efficiently. In addition, the penetration of Internet of Things (IoT) in factory automation is driving the growth for smart manufacturing to embrace and adopt the advantages of internet connectivity.

Furthermore, factory automation is determined by technology growth, increasing economic and infrastructure opportunities, and rising demand for operational efficiency. Automation is expected to enhance countries and companies by introducing a new phase of economic growth. It is expected to significantly impact a wide range of businesses, shareholders, business models, and favorable government regulations to promote the adoption across industries worldwide. The automation sector is expected to witness a surge during the forecast period owing to the growing awareness on the usage of cloud computing platforms and technological progressions in semiconductors and electronic devices.

COVID-19 resulted in firm reliance on automation among important end-user businesses, reducing operational and other long-term economic impacts. As workforces were unable to function due to government-issued lockdowns, manufacturers had to adapt automated processes to avoid foreclosures. Market participants from around the world began automation in their processes to some extent on their own or in way of partnerships. For instance, in March 2020, Epson Robots partnered with Air Automation Engineering (AEE) to provide technical support and service in the Midwest of the U.S.

Moreover, the upsurge in investment and ongoing development in the manufacturing sector is anticipated to propel the growth of the market in the coming years. Industries, including automotive, aerospace, and heavy engineering, are increasingly digitalizing and transforming their manufacturing process. Incorporating IIoT at manufacturing plants plays a vital role in connecting systems and devices with a network. Technologies, including AI, machine learning, cloud computing, and others are aiding new automation developments, which are anticipated to boost the market growth over the forecast period.

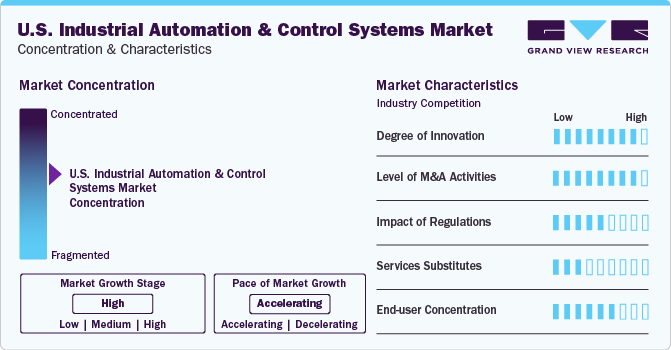

Market Concentration & Characteristics

The market is characterized by a high degree of innovation. Companies are investing significant capital in joint ventures, research, and development in modern technologies. For instance, in March 2021, Suez, an American water-service company, and Schneider Electric partnered for the development of a joint venture to deliver innovative digital solutions for water cycle management. This is expected to combine SUEZ's technical expertise in the water business with EcoStruxure. Similarly, in May 2022, Emerson Electric Co. launched their new automation solution, TopWorx DX Partial Stroke Test with HART 7, which increases safety and automation by facilitating a discrete emergency shutdown valve.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in September 2021, Rockwell Automation, Inc. announced the acquisition of Plex Systems. Plex Systems is a leading cloud-native smart manufacturing platform that offers the only single-instance, multi-tenant Software-as-a-Service (SaaS) manufacturing platform. Similarly, in April 2021, Accenture plc completed the acquisition of Pollux, an industrial automation solution provider. This acquisition is in line with Accenture plc’s aim to leverage Pollux’s experience and expertise in automation and robotics solutions.

The market also experiences industry competition influenced by the impact of regulations. The market is characterized by numerous manufacturing companies leveraging factory automation systems, and due to considerable government assistance, the region is a pioneer of industrial automation. The rules & regulations have driven businesses to implement technologies to enhance their production capacity while adhering to regulatory requirements.

For instance, the government has adopted policies such as ‘Make in America’ and ‘Bipartisan Innovation Act’ to boost the industrial economy by increased manufacturing and investment in technological aspects in the country. This is expected to boost demand for industrial automation and control systems in manufacturing units and factories. Moreover, COVID-19 has resulted in firm reliance on automation among important end-user businesses, reducing operational and other long-term economic impacts.

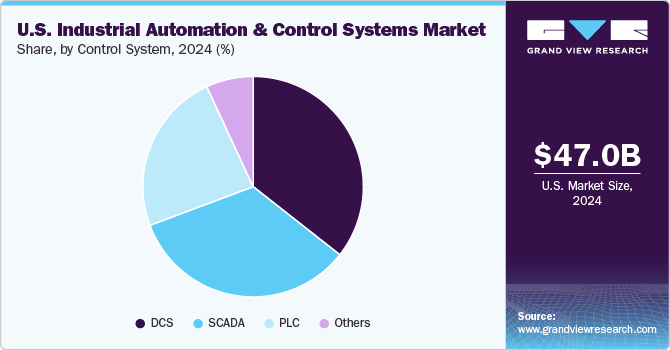

Control System Insights

The distributed control systems (DCS) segment dominated the market and accounted for the largest revenue share of 35.0% in 2023. This segment is growing as a result of the fast pace of adoption of IIOT preference of industrialists to deploy automated control systems. Additionally, the advent of 5G and its adoption in the power generation sector is expected to boost the integration of IoT and DCS using 5G technology for better output efficiency.

The supervisory control and data acquisition (SCADA) control system segment is anticipated to grow at the highest CAGR during the forecast period owing to the increase in adoption of industry 4.0. The SCADA control system is used across various industry verticals such as aerospace & defense, automotive, chemical, energy & utilities, manufacturing, and healthcare, among others due to its ability to gather data in real-time and feed it instantly to the controller systems. The growth in demand of manufacturers for smart and digitized production processes for increasing production efficiency is also expected to drive the segment growth further.

Vertical Insights

The healthcare segment is expected to grow with the highest CAGR over the forecast period owing to the consultation and services offered in order to treat patients’ health issues such as curative, palliative, rehabilitative, and curative. Automation and control improve operational costs, supply chain errors, and improve customer center, which accounts for better care and treatment of patients. Automation has also enabled doctors to conduct surgeries remotely or with minimal human interference for added precision and safety, which is anticipated to drive the segment growth.

The manufacturing segment recorded the largest market share in 2023 owing to the ongoing trend of autonomous processes in factories and industries using automated processes and systems. The segment is anticipated to grow at a CAGR of over 10% over the forecast period from 2023 to 2030. Manufacturers are able to reduce process time and error rates in factory processes with automated systems. These systems are software or technology operated which allow little to no human intervention. This, in turn, is anticipated to boost the segment growth over the forecast period.

Component Type Insights

The industrial robots segment is expected to grow with the highest CAGR over the forecast period. This growth can be attributed to the manufacturing companies’ extensive use of industrial robots and state-of-the-art machinery to optimize operations that require speed, strength, and accuracy. Industrial automation through robots reduces raw material waste, labor requirements, and energy usage and also ensures a smooth and continuous workflow in the manufacturing process, which is expected to drive segment growth.

The sensors component type segment recorded a significant revenue share in 2023 owing to its use and need in automation and control system functioning and processes. Sensors are small in size and offer instant and accurate data and readings which are vital in automation processes. The different type of sensors includes temperature sensors, humidity sensors, torque sensors, and more. These sensors assist industrial automation robots in making the manufacturing process and operation smart and efficient, which is expected to fuel the market growth further.

Key U.S. Industrial Automation And Control Systems Market Company Insights

Some of the key players operating in the market include Honeywell International, ABB ltd. and Emerson Electric.

-

Honeywell is a pioneer in automation control, instrumentation and services. The company delivers software and services in process control, monitoring, and safety systems and instrumentation that provide optimized operations and maintenance efficiencies to meet diverse automation needs. Its key areas include oil and gas, refining, energy, pulp & paper, industrial power generation, chemicals & petrochemicals, biofuels, life sciences, and metals, minerals, and mining industries.

-

Rockwell Automation, Inc. and Schneider Electric are some other participants in the U.S. industrial automation and control systems market.

-

Schneider Electric helps machine builders, original equipment manufacturers (OEMs), integrators, and end-users to implement end-to-end integrated multi-robotics solutions. It provides platforms, including robotics, simulation, automation control, software, and digital services.

Key U.S. Industrial Automation And Control Systems Companies:

The following are the leading companies in the U.S. industrial automation and control systems market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. industrial automation and control systems companies are analyzed to map the supply network.

- ABB Ltd.

- Dwyer Instruments

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

Recent Developments

-

In July 2023, ABB launched ABB Ability Symphony Plus distributed control system (DCS) to support digital transformation for power generation and water industries. It will support customers’ digital journey through a simplified and secure OPC UA1 connection to the Edge and Cloud. It also enables users to access process and alarm data from mobile devices through the ABB Mobile Operations application.

-

In June 2022, Dwyer Instruments launched the Series 685 differential pressure transmitter which can be used to measure differential pressure and vacuum. Applications of the product include building automation systems, clean room monitoring, valve and flap control, filter monitoring, and air flow control.

U.S. Industrial Automation And Control Systems Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 85.25 Billion

Growth rate

CAGR of 10.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component Type, Control System, Vertical

Regional scope

U.S.

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Honeywell International, Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation

Rockwell Automation, Inc.; Schneider Electric

Siemens AG; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Automation And Control Systems Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial automation and control systems market report on the basis of component type, control system, vertical:

-

Component Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

HMI

-

Industrial Robots

-

Control Valves

-

Sensors

-

Others

-

-

Control System Outlook (Revenue, USD Billion, 2018 - 2030)

-

DCS

-

PLC

-

SCADA

-

Others

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. industrial automation and control systems market size was valued at USD 42.87 billion in 2023 and is expected to reach USD 46.87 billion in 2024.

b. The U.S. industrial automation and control systems market is expected to grow at a compound annual growth rate (CAGR) of 10.5% from 2024 to 2030 to reach USD 85.25 billion by 2030.

Which segment accounted for the largest U.S. industrial automation and control systems market share?b. The DCS control system segment dominated the U.S. industrial automation and control systems market with a share of over 35% in 2023. This segment is growing as a result of the fast pace of adoption of IIOT preference of industrialists to deploy automated control systems.

b. Some key players operating in the U.S. industrial automation and control systems market include ABB Ltd.; Emerson Electric Co.; Honeywell International, Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens AG; Yokogawa Electric Corporation.

b. The factors driving the U.S. industrial automation and control systems market include the introduction of sophisticated technologies such as robotics and AI, the advent of Industry 4.0, and the penetration of the Internet of Things (IoT) in factory automation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."