- Home

- »

- Communications Infrastructure

- »

-

Distributed Control Systems Market, Industry Report, 2030GVR Report cover

![Distributed Control Systems Market Size, Share & Trends Report]()

Distributed Control Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Application (Continuous Process, Batch Process), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-159-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Distributed Control Systems Market Summary

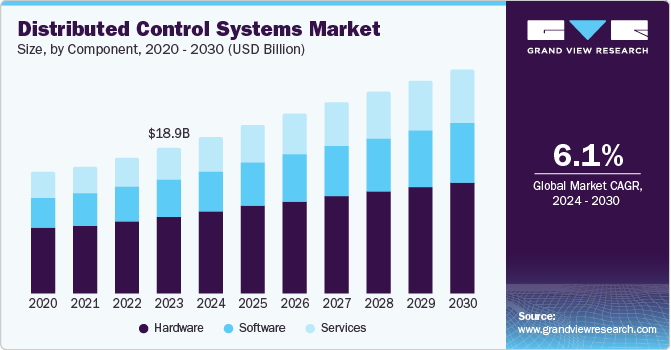

The global distributed control systems market size was valued at USD 18.99 billion in 2023 and is projected to reach USD 29.19 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The market growth is attributed to the increasing adoption of automation and the need for enhanced operational efficiency in various industries.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share of 37.5% in 2023.

- By component, the hardware segment accounted for a leading revenue share of 52.6% in 2023.

- By application, the continuous process segment accounted for a larger revenue share in 2023.

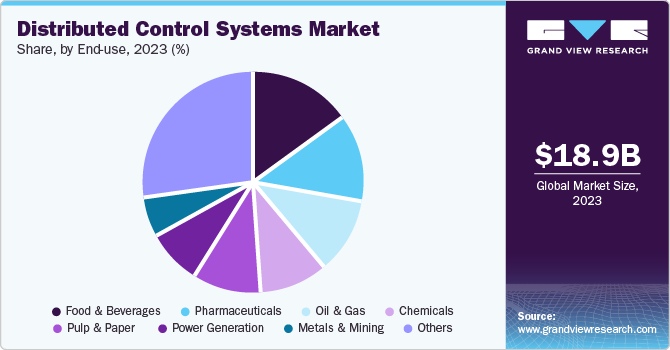

- By end use, the food & beverages segment accounted for the leading market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 18.99 Billion

- 2030 Projected Market Size: USD 29.19 Billion

- CAGR (2024-2030): 6.1%

- Asia Pacific: Largest market in 2023

The increasing adoption of automation and the need for enhanced operational efficiency in various industries are major drivers of this market. In the power generation industry, the growing demand for renewable energy and stringent environmental regulations are expected to present a sizeable growth opportunity for distributed control system providers.

Industries such as oil and gas, power generation, and water treatment are increasingly adopting automation to enhance efficiency, safety, and productivity across different processes. A distributed control system (DCS) enables centralized monitoring and control of complex industrial processes, reducing human intervention and minimizing the risk of errors. A steady shift towards smart factories is expected to drive the adoption of DCS further, as these systems are integral to implementing advanced manufacturing technologies. For instance, in April 2024, Valmet launched its next-generation DCS solution, the Valmet DNAe. The system is designed to deliver a state-of-the-art user experience and cybersecurity and comes with control software and hardware, cybersecure system architecture, and engineering and analytics tools. Other companies aim to develop advanced products that can offer automation solutions to diverse process industries worldwide, driving industry expansion.

Distributed control systems are widely used in renewable power generation plants to ensure robust, reliable, and efficient control of geographically dispersed assets. As investments in renewable energy infrastructure continue to grow, the demand for DCS solutions in this sector is anticipated to rise significantly. Moreover, integrating distributed control systems with advanced software solutions allows seamless data flow across different enterprise levels, enabling better coordination, visibility, and operational control. Additionally, distributed control systems provide real-time insights, enhance decision-making, and streamline workflows, thus improving overall efficiency and productivity. For instance, in February 2023, ABB launched its latest version of ABB Ability Symphony Plus distributed control system (DCS) to accelerate digital transformation in process automation for water and power generation industries. The system includes an SD Series e-Class process controller that enables plant-wide digitalization. It minimizes the impact on system infrastructure and process operations during digital transformation.

Component Insights

The hardware segment accounted for a leading revenue share of 52.6% in 2023. Advanced hardware components include high-performance controllers, I/O modules, and communication devices that handle complex processes, support many I/O points, and enable seamless integration with other systems. Innovations in processors, sensors, and communication devices enhance the performance, reliability, and efficiency of the distributed control system’s hardware. These advancements allow for improved control strategies and better system responsiveness, crucial for modern industrial applications. This growing demand for enhanced performance, reliability, and scalability in distributed control systems is expected to maintain a strong demand for these components.

The services segment is expected to register the fastest CAGR during the forecast period. The increasing complexity of industrial processes and the need for seamless integration of various control systems are driving the demand for system integration services in the global market. Organizations require expert services to integrate new DCS solutions with existing systems, ensuring efficient data flow. System integrators provide technical expertise to design, implement, and optimize integrated control systems that enhance overall operational efficiency. Older control systems often require the capabilities of modern DCS solutions, such as advanced analytics, real-time data processing, and integration with IoT and digital technologies. Updating these systems involves upgrading hardware components, enhancing software functionalities, and improving cybersecurity measures. For instance, in October 2023, Emerson released the DeltaV Version 15 Feature Pack 1, an update to its DeltaV distributed control system. This update includes new technological enhancements that improve the control system’s situational awareness, connectivity, and performance while ensuring operational sustainability and efficiency.

Application Insights

The continuous process segment accounted for a larger revenue share in 2023. Due to their 24/7 running processes, continuous process industries demand high reliability and stability. Any disruption leads to significant financial losses and safety hazards. Distributed control systems are designed to provide reliable control, with built-in redundancy and fail-safe mechanisms to ensure uninterrupted operation. Their strong reliability makes them an essential part of continuous process industries, as they aid in preventing costly downtimes and help maintain operational integrity. Additionally, these systems enable precise and real-time monitoring and control to maintain product quality and minimize downtime. For instance, Schneider Electric’s EcoStruxure Foxboro DCS features advanced operational technologies such as dynamic SAMA, situation awareness and visualization capabilities, and latest analytics and cloud technologies to ensure seamless operations in continuous process industries.

On the other hand, the batch process segment is expected to register the fastest CAGR from 2024 to 2030. The growing demand for industrial automation in various sectors, such as food and beverages, pharmaceuticals, and chemicals, is driving the adoption of batch-oriented DCS systems. These systems aid in automating and optimizing batch processes, leading to improved quality and reduced production costs. Moreover, these systems aid in optimizing energy consumption and improving process efficiency, which is critical for industries with high energy requirements. Technological advancements have resulted in the ability to capture every aspect of batch automation solutions in a single DCS data model, resulting in tighter batch cycles, faster batch execution, and higher throughput.

End-use Insights

The food & beverages segment accounted for the leading market revenue share in 2023. Distributed control systems enable manufacturers to optimize production processes, reduce waste, and improve process efficiency. By automating routine tasks and providing real-time data analytics, DCS enhances production, minimizes downtime, and ensures consistent product quality. The ability to control multiple aspects of production simultaneously in the food & beverage industry, such as mixing, blending, and packaging, contributes to operational efficiency. Manufacturers are launching new product lines to address constant technological advances in this industry. For instance, in January 2024, ABB launched the ABB Ability BeerMaker for the cold block stage of beer brewing. The solution makes use of the ABB Ability System 800xA DCS and is designed to improve and optimize processes, reduce energy and water consumption, and increase brewery productivity.

The pharmaceuticals segment is anticipated to register the fastest CAGR over the forecast period. Automated control systems in pharmaceutical manufacturing streamline workflows, reduce downtime, and enhance equipment effectiveness. Advanced analytics and predictive maintenance capabilities enable proactive problem-solving and continuous improvement initiatives. The deployment of a DCS allows the central monitoring and control of various aspects of the production line. By implementing DCS solutions, pharmaceutical companies can achieve significant operational efficiencies, reduce manufacturing costs, and maintain steady profitability in a competitive market environment.

Regional Insights

Asia Pacific accounted for the largest revenue share of 37.5% in 2023. The fast pace of industrialization and implementation of modern processes has necessitated the demand for DCS solutions to manage complex processes, ensure operational reliability, and optimize energy production and distribution. Integrated DCS systems enable seamless control and monitoring of critical assets, supporting grid stability and enhancing energy efficiency. The transition towards cleaner energy sources and integration of smart grid technologies further drive the demand for advanced DCS solutions in the Asia Pacific energy sector.

India Distributed Control Systems Market Trends

The fast pace of industrialization in India has led to advancements in several industries, such as power generation, oil & gas, mining, and food & beverages. Consequently, the need for process automation in these sectors to ensure optimum efficiency, minimize the risk of performance losses, and increase productivity has necessitated the presence of advanced distributed control systems. Enterprises increasingly utilize solutions provided by industry leaders such as Honeywell, Emerson Electric, and Yokogawa, encouraging frequent innovations in the countrywide market.

North America Distributed Control Systems Market Trends

The North American region accounted for a substantial revenue share in 2023. Advanced analytics and learning algorithms enable predictive maintenance, asset performance management, and operational insights that drive efficiency gains and cost savings among economic enterprises. IoT sensors and smart devices collect real-time data from industrial equipment, which DCS systems analyze to optimize processes and improve decision-making. Integrating DCS with digital technologies supports manufacturing practices, enhances operational stability, and accelerates innovations in North American industries. The region's proactive approach to digitization promotes a favorable environment for expanding this industry.

U.S. Distributed Control Systems Market Trends

The U.S. accounted for the largest revenue share in the regional market in 2023. The economy is witnessing significant expansion and modernization of its energy infrastructure, including oil and gas refineries, power plants, and renewable energy installations. For instance, in July 2023, the U.S. began operations at a nuclear reactor in Augusta, Georgia, aiming for safer and more efficient power generation. Distributed control systems are vital in managing complex processes in such facilities, ensuring operational reliability, and enabling optimum energy production and distribution. Integrated DCS allows centralized control, real-time monitoring, and predictive maintenance, supporting grid stability and enhancing energy efficiency. The rapid transition towards renewable energy sources, such as wind and solar, further accelerates the adoption of DCS technologies to integrate and manage decentralized energy systems across the U.S.

Europe Distributed Control Systems Market Trends

The Europe distributed control system market is expected to witness significant growth over the forecast period. Europe faces substantial energy consumption, pollution, and environmental sustainability challenges. Government initiatives and regulatory measures prioritize energy efficiency improvements and reductions in industry emissions. Distributed control systems play a crucial role in achieving these objectives by optimizing energy usage, monitoring emissions, and implementing sustainable manufacturing practices. Advanced control systems enable real-time data analysis, predictive maintenance, and process optimization, supporting Europe's transition towards cleaner energy sources and sustainable development goals.

The UK distributed control system market is expected to witness strong growth from 2024 to 2030. The economy's manufacturing sector is characterized by its advanced capabilities in food & beverages, pharmaceuticals, and electronics industries, which rely on distributed control systems for optimizing production processes. Distributed control systems solutions enable automation, real-time monitoring, and data-driven decision-making, enhancing operational efficiency, reducing costs, and ensuring consistency in product quality. Integrated control systems support agile manufacturing practices, facilitate predictive maintenance, and enable seamless coordination across production lines. These advanced capabilities are driving market growth in the UK.

Key Distributed Control Systems Company Insights

Key players involved in the distributed control system (DCS) market include ABB, Emerson Electric Company, General Electric Company, Honeywell International, and Valmet, among others.

-

Honeywell International Inc. is a multinational company that offers diversified technology and manufacturing expertise across aerospace, building technologies, performance materials, and safety and productivity solutions. It provides distributed control system solutions under its control and supervisory systems product division. The company’s purpose-built Experion LX DCS has been designed for batch and continuous process control applications. It also offers a unified architecture through Experion PKS to improve process performance and asset management.

-

Emerson Electric Co. is a global technology and engineering company focused on providing innovative solutions in automation, commercial and residential solutions, and climate technologies. Through the DeltaV platform, Emerson is a leading provider of Distributed Control System (DCS) solutions in its industrial automation segment. DeltaV offers integrated control and safety systems that enable real-time control, monitoring, and optimization of processes across various industries, including oil and gas, chemicals, pharmaceuticals, and power generation.

Key Distributed Control Systems Companies:

The following are the leading companies in the distributed control systems market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Azbil Corporation

- Emerson Electric Co

- General Electric Company

- Honeywell International Inc.

- Valmet

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- NovaTech, LLC

- OMRON Corporation

- Rockwell Automation

- Schneider Electric

- Siemens

- Toshiba International Corporation

- Yokogawa Electric Corporation

Recent Developments

-

In February 2024, LyondellBasell announced that it had selected Emerson to modernize the former's control systems and software at the company's Wesseling facility in Germany. The deployment of cutting-edge automation technology is expected to enable the company to improve operations of a butadiene production and ethylene cracker plant. The ethylene cracker will be operated using Emerson's DeltaV DCS and DeltaV Live software, while AMS Device Manager will support the start-up process. Operator training will be provided using the process simulation software MIMIC to familiarize them with the new control system.

-

In February 2024, BASF announced that it had selected ABB to provide its Distributed Control System (DCS) for BASF’s first-ever European greenfield Ethernet Advanced Physical Layer project. Performance tests were carried out in March 2023, which were conducted using ABB Ability System 800xA equipment in practical production equipment environments.

Distributed Control SystemsMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.49 billion

Revenue forecast in 2030

USD 29.19 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

ABB; Azbil Corporation; Emerson Electric Co.; General Electric Company; Honeywell International Inc.; Valmet; MITSUBISHI HEAVY INDUSTRIES, LTD.; NovaTech, LLC; OMRON Corporation; Rockwell Automation; Schneider Electric; Siemens; Toshiba International Corporation; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Control Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global distributed control systems market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Continuous Process

-

Batch Process

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemicals

-

Metals and Mining

-

Oil & Gas

-

Pharmaceuticals

-

Power Generation

-

Pulp & Paper

-

Food & Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.