- Home

- »

- Next Generation Technologies

- »

-

U.S. Wearable Technology Market, Industry Report, 2030GVR Report cover

![U.S. Wearable Technology Market Size, Share & Trends Report]()

U.S. Wearable Technology Market Size, Share & Trends Analysis Report By Product (Head & Eyewear, Wristwear), By Application (Consumer Electronics, Healthcare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-211-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Wearable Technology Market Trends

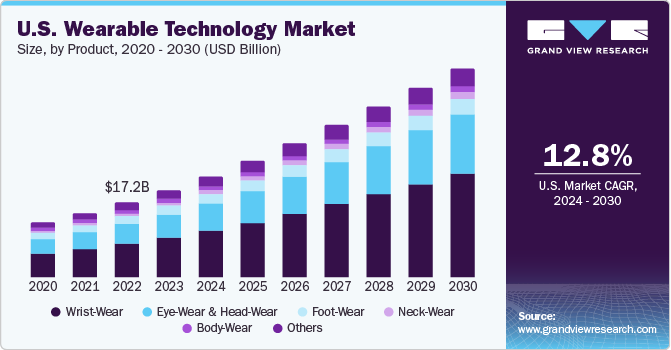

The U.S. Wearable Technology Market size was valued at USD 19.92 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 12.8% from 2024 to 2030. The U.S. accounted for 27.7% of the global wearable technology market. Increasing demand for wearable technologies has contributed to the rapid growth of smart device users in the United States. The development of the market is being driven by the rise in health consciousness and demand for entertainment. Companies such as Apple, Alphabet, and Fitbit provide advanced devices with cutting-edge technology. For instance, healthcare wrist-worn devices can measure vital signs such as heart rate, oxygen level, and blood pressure. As a result, wearable technology is expected to be adopted more widely and attract more consumers, thereby driving the growth of the U.S. market.

Since the pandemic, people in the United States have become more concerned about their health, increasing demand for wearable technology-based products such as Fitbit Versa 4, Airpods Max, Nike + Sportswatch GPS, and others. As a result, several technology companies have entered the wearable technology market to meet the needs of US consumers. Additionally, people have become more aware of the importance of wearable technology and its benefits. Wearable tech products are a cheaper alternative to frequent doctor visits and spending money on physicians. Therefore, end-users can opt for wearable products for cost-effective solutions where users can monitor and address their health concerns on their own.

Similarly, U.S. consumers are fond of technology in entertainment and personal care. Therefore, demand for earphones, earbuds, Smartwatches, and smart shoes is attracting a wide user base. U.S.-based target consumer base includes sports persons such as athletes and adventurers, among others. For instance, fitness-friendly wearable technologies encourage consumers to manage their day-to-day activities such as sleep hours, calorie intake, oxygen level, water intake, and steps counting to maintain a healthy lifestyle by collecting information. This technology enables seamless user experience, which propels the growth of the U.S. wearable technology market over the forecast period.

However, wearable technologies are not limited to health & lifestyle, text messaging, alarm clock, gaming, and music control. The technology is helpful in multiple industries, such as Medical care, sports and fitness, outer space missions, and industrial and enterprise sectors. As a result, wearable technology is gaining traction in a number of industries, which is expected to drive market growth over the forecast period. There is a greater scope for innovations in this domain.

In addition, The U.S. wearable technology is expected to pose a challenge to the market presence of counterfeit products. The rise of China-made products with cheaper rates in the U.S. market is competing with the brands that are prominent in this wearable technology industry. The market witnesses the existence of low-cost manufacturing entities and low-budget fraudulent devices with identical similarities which restrains market growth as customers usually prefer products with similar features and capabilities at considerably lower prices. To differentiate themselves from counterfeit products, key market players must differentiate their products with brand identity.

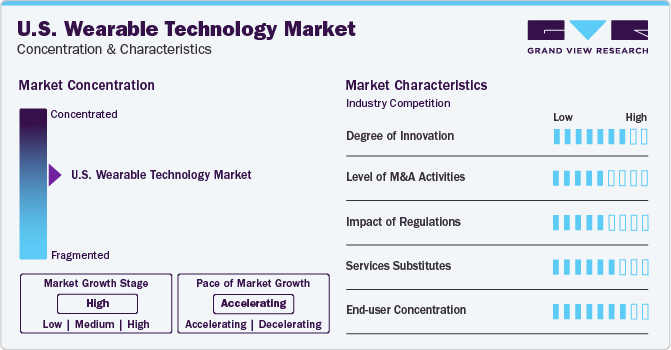

Market Concentration & Characteristics

The Increased smartphone usage, video gaming, and web surfing culture drive the U.S. wearable technologies market growth. The U.S.-based wearable device producers are prevalent among U.S. consumers. However, high-cost products and the presence of global wearable tech brands in the U.S. wearable technology market display that it is a reasonably competitive & fragmented market.

The U.S. Wearable Technology solutions are adopted across various industries, including sports, healthcare, manufacturing, and Telecom & IT. There is a large scope of innovation in wearable technologies, especially in the health and fitness industry. Moreover, the COVID-19 pandemic propelled several firms to adopt new technologies for healthcare-concerned people, work-from-home employees, and models, which opened new avenues for market growth.

The wearable technologies market in the U.S. is seeing a surge in participants, both startups and established tech giants, offering innovative products. The industry's U.S-based business entities and global market players are focusing on strategic initiatives, such as partnerships, mergers and acquisitions, and new product launches, which could lead to more consolidation in the future. This consolidation will help companies expand their customer base, improve their products, and add new features to stay ahead in the market.

End-users concentration in the U.S. wearable technology market include individuals engaged in fitness & sports, lifestyle followers, gamers, students, and professionals, among others. Most of these customers are either loyal to their brands or follow cheaper products without paying attention to brand identity. However, other end-users from industries such as logistics, media & infotainment, sports, and outer space missions offer plenty of lucrative opportunities for the U.S. wearable technology market.

Product Insights

Wrist wear segment led the market and accounted for the highest revenue of USD 9.13 billion in 2023. The U.S. is witnessing demand for wrist-wear devices, and it is constantly increasing in health and fitness, entertainment, gaming, and other areas. Post-pandemic, smartwatches are not limited to sharing and receiving text messages and notifications; they are now being actively used for health monitoring, calling, and music-controlling purposes. With the introduction of advanced technologies in U.S. wearable devices, key players are offering users information on health updates, fitness monitoring, and performance tracking when engaged in sports, gaming, music, and other related activities. Furthermore, the U.S. wearable technologies market is growing due to the adoption of wearable devices on smartphones for keeping track of children's health, current locations, and daily activities.

However, the eyewear and headwear segment is anticipated to witness a significant CAGR of 13.9% from 2024 to 2030 in the U.S. market. Eyewear & Headwear, wearable devices such as smart sunglasses, headbands, and helmets are designed to monitor and track users' biometric data such as body temperature, brainwave, body pressure, and heart rate. Similarly, smart helmets help sports enthusiasts, including swimmers, riders, hikers, and travelers, gain insights, capture moments, and share real-time location updates with others. Furthermore, smart eyewear devices offer features to control music and take calls via intuitive and simple gesture controls, which is anticipated to foster market share in the forecasted period.

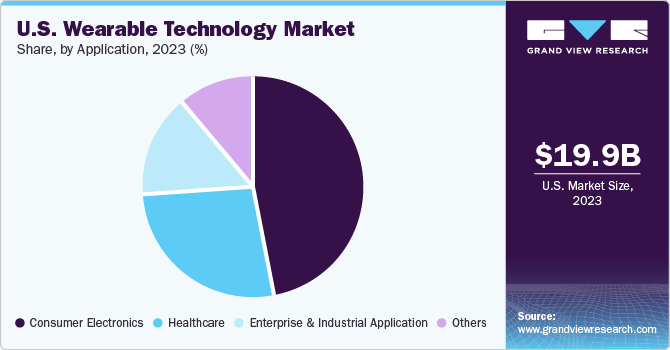

Application Insights

Consumer electronics segment led the market and accounted for revenue of USD 9.29 billion of the revenue in 2023. Customers are crucial to deciding whether to buy wearable devices, which depends on factors such as brand, price, features, durability, and the latest innovations. Therefore, companies in the U.S. market target various customer groups looking for specifications, including brand name, affordability, durability, features, technology, and the latest product offerings. In addition, other essential factors that key wearable device manufacturers offer can be comfort, style, appearance, color, and design. However, tech innovations such as artificial intelligence (AI) and the Internet of Things (IoT) can boost the market in the near future, which is anticipated to foster market share in the forecasted period.

Healthcare segment is anticipated to witness significant CAGR of 13.1% from 2024 to 2030 in the U.S. wearable technology market. Key market players in U.S. are focusing on innovating and introducing breakthrough wearable technologies for monitoring everyday consumer health, including blood sugar, heart, oxygen, and stress levels. Furthermore, post-COVID-19, the U.S. market witnessed a surge in innovations in wearable rings, bodywear, and wristwear devices to gain real-time health updates, early detection, and prevention. In this way, consumers prefer healthcare wearable devices to advancements in healing, which, in turn, drives the growth of this segment over the forecast period.

Key U.S. Wearable Technology Market Company Insights

Some of the key companies operating in the U.S. market include Apple Inc, Alphabet Inc. and Garmin Ltd.

-

Alphabet Inc parent company of Google LLC Google LLC is a technology company specializing in providing internet-related services and products. The company operates through two segments, namely Google Cloud and Google Services. The Google Cloud segment includes Cloud Platform and Google Workspace, whereas the Google Services segment includes platforms, such as Android, Chrome, Google Ads, Google Drive, Gmail, Google Maps, Google Play, and YouTube. The company offers wearable technology devices through its subsidiary Fitbit, Inc. which offers various wearables, including watches and trackers, along with other related services.

-

Apple Inc. established in 1976 which designs, manufactures, and markets personal computers, smartphones, wearables, tablets, and accessories. The company has categorized its products under iPhone, Mac, iPad, and Wearables, Home, and Accessories, with the last category covering the company's wearables, including the AirPods line of wireless headphones and the Apple Watch line of smartwatches based on the company’s watchOS operating system. The company also offers a variety of related services categorized under Advertising, AppleCare, Cloud Services, Digital Content, and Payment Services.

-

Garmin Ltd. is engaged in designing, developing, manufacturing, and distributing a range of navigation, communication, and information devices. The company offers various products, including smartwatches, accessories, maps, and others. The company operates its business through five business segments, namely Fitness, Outdoor, Aviation, Auto, and Marine. The company's Fitness segment offers a broad range of products designed for use for fitness and lifestyle purposes. The products offered by the segment are further categorized under running & multisport watches, cycling products, activity tracking & smartwatch devices, Garmin connect & Garmin connect mobile, and connect IQ.

Nike Inc., Diffco, and Cala Health, are some of the new participants in the U.S. Wearable Technology Market.

-

Nike, Inc. is involved in shoemaking, but now they have entered wearable technologies and focusing on designing, development, marketing, and sales of footwear, apparel, equipment, and accessories. The company offers various products, including socks, bags, sports balls, eyewear, timepieces, bats, gloves, digital devices, footwear, protective equipment, and other equipment. The company offers its products under various brand names, including Jordan, Converse, Nike Skateboarding, Nike Mercurial Vapor, Nike Free, and Nike Air Max, among others.

-

Diffco is a company that specializes in custom software development. The company creates and evolves wearable solutions by utilizing decades of industry experience and understanding of global markets. Their unmatched technology expertise specializes in wearable technologies, web service platforms, mobile apps, SaaS, AI, and others.

-

Cala is powering their products to propel a paradigm shift in healthcare. The aim is to produce next-generation devices to deliver, such as TAPS therapy and Cala kIQ. For instance, kIQ is used for the treatment of active hand tremors in patients diagnosed with ET and Parkinson’s disease. Such new products will revolutionize the U.S. market.

Key U.S. Wearable Technology Companies:

- 3M

- Adidas AG

- Alphabet Inc.

- Apple Inc.

- Cala Health

- Diffco

- Fitbit, Inc.

- Garmin Ltd.

- Huawei Technologies Group Co., Ltd.

- Magic Leap

- Microsoft

- Nike, Inc.

- Samsung Electronics Co., Ltd.

- Sony Corp.

- Xiaomi Corp.

Recent Developments

-

In September 2023, Apple Inc. announced the launch of its latest smartwatch, the Apple Watch Series 9. The new wearable device comes with innovative features that will make it easier for users to monitor their health, fitness, and safety. The company expects that this latest smartwatch will be a game-changer and help millions of people across the globe, including the U.S.

-

In April 2023, Garmin Ltd. announced a new product Dexcom Connect IQ apps in multiple geographic regions, to identify Type 1 and Type 2 diabetes to use the Dexcom G6 or Dexcom G7 Continuous Glucose Monitoring (CGM) System to monitor their glucose levels and trends on their compatible Garmin cycling computers and smartwatches during the workout.

U.S. Wearable Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.07 billion

Revenue forecast in 2030

USD 47.51 billion

Growth Rate

CAGR of 12.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

3M; Adidas AG; Alphabet Inc.; Apple Inc.; Cala Health; Diffco; Fitbit, Inc.; Garmin Ltd.; Huawei Technologies Group Co., Ltd.; Magic Leap; Microsoft; Nike, Inc.; Samsung Electronics Co., Ltd.; Sony Corp.; Xiaomi Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wearable Technology Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Wearable Technology Market report based on product, and application.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wrist-Wear

-

Eye-Wear & Head-Wear

-

Foot-Wear

-

Neck-Wear

-

Body-wear

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Healthcare

-

Enterprise & Industrial Application

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. wearable technology market size was estimated at USD 19.92 billion in 2023 and is expected to reach USD 23.07 billion by 2024.

b. The U.S. wearable technology market is expected to grow at a compound annual growth rate of 12.8% from 2024 to 2030 to reach USD 47.51 billion by 2030.

b. The wrist wear segment accounted for the largest market share of over 46.4% in 2023 in the cyber security training market. The U.S. is witnessing demand for wrist-wear devices, and it is constantly increasing in health and fitness, entertainment, gaming, and other areas.

b. Some key players operating in the U.S. wearable technology market are 3M; Adidas AG; Alphabet Inc.; Apple Inc.; Cala Health; Diffco; Fitbit, Inc.; Garmin Ltd.; Huawei Technologies Group Co., Ltd.; Magic Leap; Microsoft; Nike, Inc.; Samsung Electronics Co., Ltd.; Sony Corp.; Xiaomi Corp.

b. Increasing demand for wearable technologies has contributed to the rapid growth of smart device users in the United States. The development of the market is being driven by the rise in health consciousness and demand for entertainment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."