- Home

- »

- Medical Devices

- »

-

Vascular Closure Devices Market Size & Share Report, 2030GVR Report cover

![Vascular Closure Devices Market Size, Share & Trends Report]()

Vascular Closure Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Active Approximators, Passive Approximators), By Application (Cardiac, Cerebrovascular), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-275-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vascular Closure Devices Market Summary

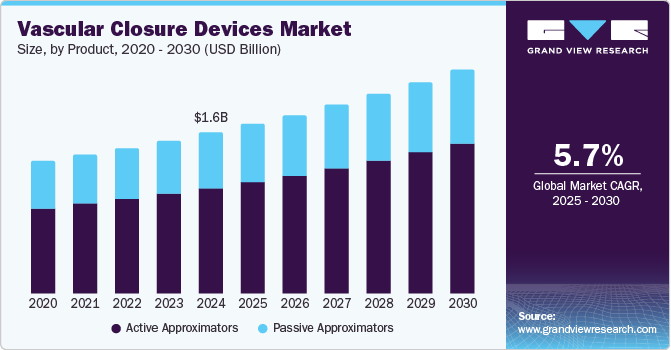

The global vascular closure devices market size was valued at USD 1.56 billion in 2024 and is projected to reach USD 2.17 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. This growth is driven by the increasing prevalence of cardiovascular diseases (CVDs), necessitating more vascular procedures, which in turn boosts the demand for these devices.

Key Market Trends & Insights

- The North America vascular closure devices market dominated the revenue share with 44.4% in 2024.

- The U.S. contributed the largest revenue share in the North American market in 2024.

- By product, the active approximators segment accounted for 65.7% of the total revenue generated in the global vascular closure device market in 2024.

- By application, the peripheral vascular interventions segment is projected to grow at the second fastest rate over the forecast period.

- By end-use, the hospitals and clinics segment dominated the market in terms of revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.56 Billion

- 2030 Projected Market Size: USD 2.17 Billion

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

Technological advancements in vascular closure devices (VCDs) have also played a significant role, making procedures more efficient and safer. The aging population is also more prone to vascular conditions, further driving the market. Favorable reimbursement policies for interventional radiology procedures have encouraged healthcare providers to adopt vascular closure devices more widely. For instance, in the U.S., Medicare's comprehensive coverage for outpatient vascular procedures has driven hospitals to utilize these devices more frequently. Also, rising healthcare expenditures in developing countries are enabling better access to advanced medical devices, including vascular closure devices.

Product Insights

The active approximators accounted for 65.7% of the total revenue generated in the global vascular closure device market in 2024. The segment growth is fueled by the increasing demand for minimally invasive procedures and the rising prevalence of cardiovascular diseases, which necessitate frequent catheterization procedures. Additionally, passive approximators are often preferred in patients with specific clinical conditions where active devices may not be suitable.

The passive approximators segment is expected to grow at a CAGR of 5.1% over the forecast period driven by the increasing number of approvals for these devices and their ease of use. Passive approximators are favored for their simplicity and reduced complication rates, which make them suitable for a wide range of vascular procedures.

Application Insights

The cardiac interventions segment dominated the global vascular closure device market in 2024 largely due to the high prevalence of cardiovascular diseases worldwide, which necessitates frequent cardiac catheterization procedures. Cardiac interventions, including angioplasty and stent placements, require efficient vascular closure to minimize complications such as bleeding and hematoma formation. The effectiveness of VCDs in achieving rapid hemostasis and facilitating early ambulation has made them indispensable in cardiac procedures.

The peripheral vascular interventions segment is projected to grow at the second fastest rate over the forecast period. This growth can be attributed to the rising incidence of peripheral artery disease (PAD) and other peripheral vascular conditions, which require interventions such as angioplasty and atherectomy. The demand for VCDs in peripheral interventions is driven by the need to reduce recovery times and hospital stays, thereby improving patient throughput in healthcare facilities.

End-use Insights

The hospitals and clinics dominated the market in terms of revenue share in 2024 attributed to the high volume of vascular procedures performed in these settings, including cardiac catheterizations, angioplasties, and other interventional procedures. Hospitals and clinics are equipped with advanced medical infrastructure and skilled healthcare professionals, which are essential for performing complex vascular interventions. The preference for VCDs in these settings is driven by their ability to reduce hemostasis time, minimize complications, and facilitate early patient ambulation, thereby improving overall patient outcomes and operational efficiency. Additionally, the increasing prevalence of cardiovascular diseases and the rising number of interventional procedures globally have further bolstered the demand for VCDs in hospitals and clinics.

The Ambulatory Surgical Centers (ASCs) segment is projected to grow at the fastest CAGR from 2025 to 2030. ASCs offer a cost-effective and convenient alternative to traditional hospital settings for performing outpatient surgical procedures. The growth of this segment is fueled by several factors, including the increasing shift towards minimally invasive procedures, advancements in medical technology, and favorable reimbursement policies. ASCs are becoming increasingly popular due to their ability to provide high-quality care with shorter recovery times and reduced healthcare costs. The rising number of ASCs and their expanding capabilities to perform a wide range of vascular procedures are expected to drive the demand for VCDs in this segment. Moreover, the growing emphasis on patient-centered care and the need to enhance patient throughput is likely to further accelerate the adoption of VCDs in ASCs.

Regional Insights

The North America vascular closure devices market dominated the revenue share with 44.4% in 2024, driven by a high prevalence of cardiovascular diseases and a well-established healthcare infrastructure. The region’s advanced medical facilities and the high adoption rate of innovative medical technologies have significantly contributed to the market’s growth. In addition, the increasing number of catheterization procedures and the rising demand for minimally invasive surgeries have further propelled the market in North America.

U.S. Vascular Closure Devices Market Trends

The U.S. contributed the largest revenue share in the North American market in 2024 attributed to the high incidence of cardiovascular diseases, a large patient population, and substantial healthcare spending. The presence of major market players and continuous advancements in VCD technology have also played a crucial role in the market’s expansion. Furthermore, favorable reimbursement policies and regulatory approvals have supported the widespread adoption of VCDs in the U.S.

Asia Pacific Vascular Closure Devices Market Trends

The vascular closure device market in Asia Pacific is expected to grow at a CAGR of 7.1% from 2025 to 2030 driven by the increasing prevalence of cardiovascular diseases, rising healthcare expenditure, and improving healthcare infrastructure in emerging economies such as India and China. The growing awareness about the benefits of VCDs and the increasing adoption of minimally invasive procedures are also contributing to the market’s expansion in this region.

China accounted for a substantial revenue share of the Asia Pacific vascular closure devices market in 2024. China accounted for a substantial revenue share of the Asia Pacific vascular closure devices market in 2024. The country’s large population, coupled with a high incidence of cardiovascular diseases, has created a significant demand for VCDs. Additionally, the rapid development of healthcare infrastructure and the increasing number of catheterization procedures have further fueled the market’s growth. China’s focus on advancing medical technology and increasing healthcare investments are expected to continue driving the market in the coming years.

Europe Vascular Closure Devices Market Trends

The vascular closure devices market in Europe is expected to grow steadily over the forecast period. The region’s growth is supported by the high prevalence of cardiovascular diseases, an aging population, and the increasing adoption of minimally invasive procedures. The presence of well-established healthcare systems and the continuous introduction of advanced VCD technologies are also contributing factors.

Key Vascular Closure Devices Company Insights

Some of the key companies in the vascular closure device market include Abbott, Cardinal Health, Medtronic, Merit Medical, Teleflex Incorporated, and others.

-

Amcor offers a wide range of packaging solutions for the food, beverage, and pharmaceutical industries. The company’s Vascular Closure Devices products include cartons, pouches, and bottles.

-

Robert Bosch GmbH is a significant player in the Vascular Closure Devices market, known for its advanced packaging technology solutions. The company offers a range of aseptic filling and packaging machines that cater to the food and beverage industry.

Key Vascular Closure Devices Companies:

The following are the leading companies in the vascular closure device market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Cardinal Health

- Medtronic

- Merit Medical

- Teleflex Incorporated

- Terumo Medical Corporation

- Meril Life

- Haemonetics

Recent Developments

-

In July 2024, Cordis received FDA clearance for the MYNX control venous vascular closure device, further broadening Cordis' range of extravascular closure solutions with this innovative product.

-

In June 2024, Haemonetics Corporation unveiled the limited market debut of its VASCADE MVP XL mid-bore venous closure device. This latest offering from Haemonetics’ VASCADE portfolio utilizes the company’s advanced collapsible disc technology and a unique resorbable collagen patch to expedite rapid hemostasis in venous access sites.

Vascular Closure Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.64 billion

Revenue forecast in 2030

USD 2.17 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

Abbott, Cardinal Health, Medtronic, Merit Medical, Teleflex Incorporated, Terumo Medical Corporation, Meril Life, Haemonetics

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vascular Closure Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vascular closure devices market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Passive Approximators

-

Collagen Pugs

-

Sealant or Gel-based Devices

-

Compression-assist Devices

-

-

Active Approximators

-

Suture-based Devices

-

Clip-based Devices

-

External Heomostatic Devices

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Interventions

-

Cerebrovascular Interventions

-

Peripheral Vascular Interventions

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Ambulatory Surgical Centers

-

Cardiac Catherization Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.