- Home

- »

- Pharmaceuticals

- »

-

Women’s Health Market Size & Share, Industry Report, 2030GVR Report cover

![Women’s Health Market Size, Share & Trends Report]()

Women’s Health Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Contraceptives, Menopause), By Drug Class (Hormonal Therapies, Pain And Symptom Management), By Age (50 Years And Above), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-634-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Women’s Health Market Summary

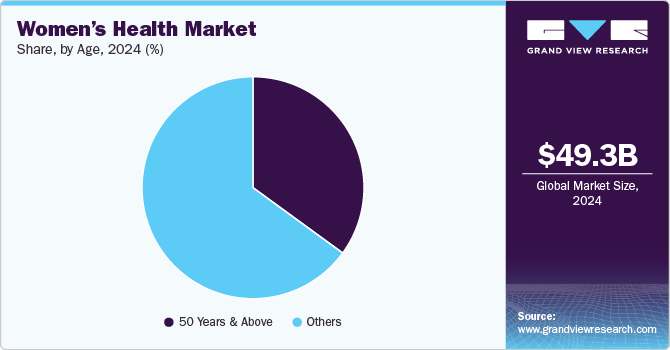

The global women’s health market size was estimated at USD 49.33 billion in 2024 and is projected to reach USD 68.53 billion by 2030, growing at a CAGR of 5.1% from 2025 to 2030. Market growth can be attributed to the increase in the geriatric population of women and the introduction of new advanced therapeutic products for women’s health, such as Relugoliz and Orilissa.

Key Market Trends & Insights

- The North America women’s health market dominated the global market with a share of 43.04% in 2024.

- The women’s health market in the U.S. is expected to grow over the forecast period attributed to launch of projects and initiatives focused on improving the health of women is further anticipated to drive market.

- By drug class, hormonal therapies segment led the market in 2024 and is expected to grow at fastest growth rate over the forecast period.

- By application, the contraceptives segment held the highest revenue share of more than 35.07% of the global revenue in 2024.

- By age segment, the others (below 50 years) segment dominated the market in 2024 and is expected to sustain the position for the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 49.33 Billion

- 2030 Projected Market Size: USD 68.53 Billion

- CAGR (2025-2030): 5.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, favorable policies initiated by governments to improve women’s health and raise awareness are likely to drive market growth during the forecast period. The market exhibited slower growth during the pandemic. Contraceptives play an important role in preventing unwanted pregnancies. Currently, there are no Over-the-counter (OTC) pills available in the U.S. for controlling pregnancy. Thus, introducing OTC contraceptive pills in the U.S. is expected to contribute to industry growth positively. For instance, In July 2023, the U.S. FDA granted approval for Opill (norgestrel) tablets developed by Laboratoire HRA Pharma to be sold over the counter as a daily oral contraceptive to prevent pregnancy. This marks the first time a progestin-only oral contraceptive is available in the U.S. without a prescription. Consumers can now purchase this birth control pill at drugstores, grocery stores, convenience stores, and online, providing greater accessibility to contraception. The successful approval of Opill and available OTC without prescription in the U.S., driving the industry growth.

Various initiatives undertaken by countries in Asia Pacific, such as Japan, India, China, Singapore, and Australia, are likely to boost the market over the forecast period. For instance, in January 2023, Australia’s Ministry of Health announced funding USD 24 million for medical and health research activities focusing on women’s health to develop novel treatments & improve patient outcomes. In addition, in May 2024, the Australian government announced an investment of USD 160 million in activities to improve women’s health as part of its 2024-2025 budget.

These factors are anticipated to fuel industry growth. According to the Society of Family Planning's #WeCount Report, in the U.S., from July 2022 to June 2023, the average monthly number of abortions was 82,298. Owing to the high unmet need for publicly funded contraceptive services and products, federal & state governments are actively working toward improving family planning services and improving access to modern contraceptives. Market players are adopting various market strategies, such as collaboration and awareness and marketing campaigns, to increase their market penetration in the country. For instance, in October 2022, Abbott conducted a survey in partnership with Ipsos to raise awareness and support women during the menopause phase. Moreover, Abbott is planning to launch, The Next Chapter campaign, to raise awareness among women with menopause

According to the United Nations Population Fund's (UNFPA) article published in September 2023, philanthropies and governments invest in family planning supplies. The Bill & Melinda Gates Foundation invested up to USD 100 million in the UNFPA Supplies Partnership. The Government of Germany invested USD 50.5 million to support the UNFPA Supplies Partnership. Furthermore, agencies such as USAID conduct family planning & reproductive health programs in more than 30 countries, including South Africa & other African countries, where there is a high unmet need for contraception. However, there are various complications and negative effects of the continuous use of contraceptives, which lead to an increase in the adoption of traditional contraceptive methods.

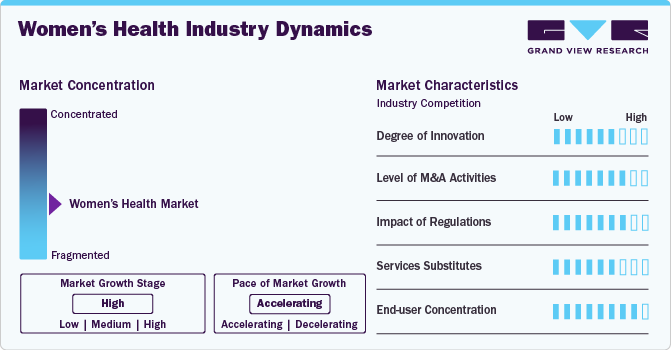

Market Concentration And Characteristics

The market growth stage is high, and the pace is accelerating. The women’s healthcare industry is characterized by a high degree of innovation due to rapid technological advancements driven by next-generation contraceptives, artificial intelligence (AI) powered ultrasounds, and future-ready diagnostics tools. Furthermore, in September 2023, according to the National Institutes of Health’s study, AI and machine learning (ML) can effectively detect PCOS.

The industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new AI technologies and talent, need to consolidate in a rapidly growing market, and increasing strategic importance of AI, and more.

The industry is also subject to increasing regulatory scrutiny. For instance, the unfavorable regulations regarding abortion in the U.S. have a significant impact on the market. Rising emphasis on personalized medicine for women is one of the major trends for market growth.Advancements in medical technology, such as telehealth & genetic testing, offer avenues for enhanced accessibility and tailored treatments. The expanding focus on mental health within women's healthcare further opens doors for novel interventions.Emerging markets and a growing trend toward preventive care create a favorable landscape for industry players.

The market has a presence of several players catering to different areas in the women’s health market. Furthermore, the players actively develop and launch products to treat various women’s health issues and other business initiatives to strengthen their position in the market. Hence, it has promoted strong competition in the market globally.

End user concentration is a significant factor in the industry. Since there are several end user industries that are driving demand for women’s healthcare facilities. The concentration of demand of end-user industries creates opportunities for companies that focus on developing women’s health solutions for these industries. However, it also creates challenges for companies that are trying to compete in the industry.

Application Insights

The contraceptives segment held the highest revenue share of more than 35.07% of the global revenue in 2024, spurred by rising awareness of family planning and ongoing technological advancements in contraceptive methods. This growth is further supported by favorable government policies, such as in the U.S., where federal regulations ensure that all female-controlled contraceptive methods, including counseling and related services, are covered without out-of-pocket expenses for patients. In September 2024, the European Union (EU) and the Bill & Melinda Gates Foundation announced a partnership to enhance access to contraceptive and maternal health products in low- and middle-income countries.

The menopause segment is expected to grow at the highest CAGR from 2025 to 2030. The growth can be attributed to the increasing population of women reaching menopause and issues and the launch of new products for these conditions. For instance, in December 2023, Astellas Pharma Inc. announced the approval of VEOZA (fezolinetant) 45 mg to treat vasomotor symptoms caused by menopause.

Drug Class Insights

Hormonal therapies segment led the market in 2024 and is expected to grow at fastest growth rate over the forecast period. Key drivers for this growth include an increasing global demand for family planning solutions, rising awareness about reproductive health, and the aging population in many regions, particularly in North America and Europe. Combined hormonal contraceptives (CHCs) continue to dominate the market due to their broad usage and high effectiveness in preventing pregnancy while also offering additional benefits like menstrual regulation

Pain and Symptom Management segment is expected to grow at the lucrative CAGR from 2025 to 2030, driven by increasing global prevalence of chronic pain conditions, aging populations, and growing awareness of pain management options. The segment is expected to continue expanding during the forecast period, with significant contributions from both pharmaceutical innovations and the increasing adoption of multi-modal treatment approaches to address various types of pain and related symptoms.

Age Segment Insights

The others (below 50 years) segment dominated the market in 2024 and is expected to sustain the position for the forecast period. Women aged below 50 years are more likely to face issues associated with fertility, such as endometriosis, hormonal infertility, and polycystic ovary syndrome. According to the UNICEF, in 2023, there are around 1.16 billion females below 18 years old globally. Hence, the significant population is prone to several women’s health issues, thereby promoting the market.

The 50 years & above age segment is expected to register the fastest growth rate FROM 2025 to 2030 as an increase in life expectancy is boosting the overall menopausal population across the globe. In addition, with a rise in the geriatric population, diseases, such as postmenopausal osteoporosis are also increasing. According to an article published in NCBI, the prevalence of postmenopausal osteoporosis in women aged 60 to 69 is around 10.95% and about 26.45% in women aged 70 & above. Other women’s health issues, such as endometriosis, are more likely to occur in reproductive age groups; however, it also affects a small percentage of postmenopausal women. All these factors are expected to drive the growth of this segment in the years to come.

Regional Insights

The North America women’s health market dominated the global market with a share of 43.04% in 2024. This growth was attributed to the favorable reimbursement policies, approval & commercialization of products, supportive government laws, and high awareness about the importance of maintaining good health. For instance, in July 2023, Canada announced funding to promote women's health and rights at the 2023 Women Deliver Conference. The country allocated USD 10 million for the "Advancing Sexual and Reproductive Health and Rights project" under Canada's SheSOARS initiative. Moreover, in May 2023, U.S. Department of Health and Human Services announced over USD 65 million to 35 HRSA-funded health centers to address the maternal mortality crisis.

U.S. Women’s Health Market Trends

The women’s health market in the U.S. is expected to grow over the forecast period attributed to launch of projects and initiatives focused on improving the health of women is further anticipated to drive market. For instance, in April 2024, Cleveland Clinic announced the launch of new women’s health comprehensive health and resource center, with an aim to improve and address the unique health needs of women during their midlife period.

Europe Women’s Health Market Trends

Europe women’s health market was identified as a lucrative region in this industry. The increasing number of market players involved in manufacturing women's health products in European countries and the growing prevalence of various women’s health issues, such as postmenopausal symptoms, PCOS, & infertility, are anticipated to boost the market.

The women’s health market in UK is growing primarily due local presence of key players, such as Pfizer Inc., AbbVie Inc., and Merck & Co. Inc., providing women’s healthcare products. Rising women’s health issues related to fertility in the UK are expected to drive the market.

Germany women’s health market is expected to grow over the forecast period attributed to high prevalence of menopause-related conditions, such as hot flashes, and key market players focusing on strategic initiatives to gain higher market share. For instance, in September 2024, Theramex announced the first commercial launch of Yselty (linzagolix) a drug used for the treatment of uterine fibroids in Germany.

The women’s health market in France is expected to grow at a lucrative rate over the forecast period owing to the availability of major players in the country. This includes players such as Abbott; Dr. Reddy's Laboratories Ltd.; Pfizer, Inc.; GSK plc; Sun Pharmaceutical Industries Ltd.; AbbVie, Inc.; Bayer AG; and Johnson & Johnson Services, Inc. Moreover, increasing market penetration of local players is anticipated to support market expansion in the coming years.

Asia Pacific Women’s Health Market Trends

The Asia-Pacific women’s health market is expected to witness the fastest CAGR of over the projected period owing to the presence of a large population and an increase in the demand for contraceptives. In Asia Pacific, India and China are highly populated countries. The rise in government initiatives undertaken to control their population growth is expected to positively impact the women’s health industry.

The women’s health market in Japan is expected to grow over the forecast owing to increase in the prevalence of endometriosis and postmenopausal osteoporosis. Moreover, favorable initiatives undertaken by government bodies are supporting market growth. For instance, in March 2024, Astellas Pharma Inc. announced the dosing of the first patient in the STARLIGHT 2 Phase 3 pivotal study for fezolinetant, an investigational oral, non-hormonal compound being studied for the treatment of vasomotor symptoms (VMS) associated with menopause in Japanese women.

Latin America Women’s Health Market Trends

Latin America women’s health market was identified as a lucrative region in this industry. Increasing R&D activities and rapid technological advancements in the region are anticipated to fuel market growth. Increasing government spending, growing investments by major pharmaceutical & biopharmaceutical companies, and the presence of major academic research institutes are among the factors likely to promote regional growth.

The women’s health market in Brazil is expected to grow over the forecast period owing to technological advancement in field of women’s health services. For instance, in April 2024, FertGroup Medicina Reproductiva, a leading network of fertility clinics in Brazil announced a partnership with Future Fertility to integrate VIOLET and MAGENTA, two innovative oocyte assessment software solutions, into our expanding clinic network.

MEA Women’s Health Market Trends

MEA women’s health market was identified as a lucrative region in this industry. The market in this region is driven by growing prevalence of infertility and other gynecological disorders. The adoption of modern contraceptives is comparatively lower than traditional ones in the MEA. However, several governments in this region are actively undertaking initiatives to promote the use of modern contraceptives.

The women’s health market in Saudi Arabia is expected to grow over the forecast period attributed to government and nongovernment bodies are collaborating to increase awareness related to women’s health among the target population. For instance, in February 2023, King Faisal Specialized Hospital and Research Centre organized a Women’s Health Awareness Day to spread awareness about osteoporosis, menopause issues, and other women’s health issues.

Key Women’s Health Company Insights

Some key players operating in the women’s health industry are Amgen, Inc., AbbVie, Inc., Bayer AG, Organon & Co., and Pfizer, Inc., among others. New players are entering the market with innovative products, whereas major players are collaborating with small companies for product development. These players have wide range of product portfolio by key players, covering a wide range of women’s health solutions to serve diverse consumer pool further increasing the competition among leading players. However, this increase in competition among the players results in decreasing profitability.

Key Women’s Health Companies:

The following are the leading companies in the women’s health market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie, Inc.

- Bayer AG

- Organon & Co.

- Pfizer, Inc.

- Theramex

- Agile Therapeutics

- Amgen, Inc.

- Apothecus Pharmaceutical Corp.

- Blairex Laboratories, Inc.

- Ferring

Recent Developments

-

In September 2024, Organon announced acquisition of Dermavant, a subsidiary of Roivant focused on developing and commercializing novel treatments in immuno-dermatology.

-

In March 2024, Insud Pharma announced the successful acquisition of Viatris' Women’s Healthcare division, which focuses on oral and injectable contraceptives. This strategic move strengthens Insud Pharma's industrial footprint in India by adding two manufacturing facilities located in Sarigam and Ahmedabad.

-

In March 2024, The U.S. FDA granted approval to ELAHERE, developed by AbbVie Inc., for the treatment of adult patients with folate receptor alpha (FRα)-positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer, who have previously undergone up to three lines of therapy.

-

In December 2023, Theramex completed the acquisition of the Femoston and Duphaston in Europe from Viatris. The company acquired these products for the consolidation of its menopause portfolio.

Women’s Health Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 53.48 billion

Revenue forecast in 2030

USD 68.53 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, age, drug class, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; Pfizer, Inc; Teva Pharmaceutical Industries Ltd.; Agile Therapeutics; Amgen, Inc; Apothecus Pharmaceutical Corp.; Blairex Laboratories, Inc.; and Ferring B.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Women’s Health Market Report Segmentation

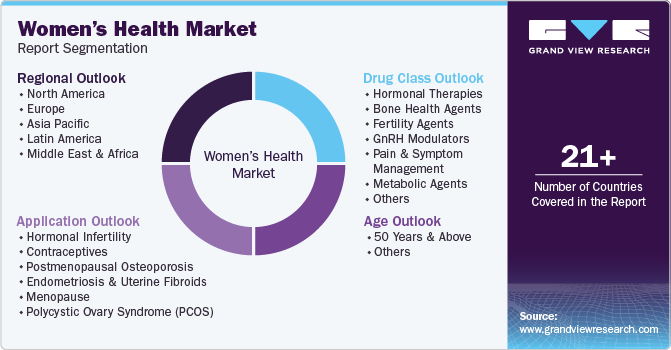

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global women’s health market report based on the application, drug class, age, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Infertility

-

Contraceptives

-

Postmenopausal Osteoporosis

-

Endometriosis & Uterine Fibroids

-

Menopause

-

Polycystic Ovary Syndrome (PCOS)

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Hormonal Therapies

-

Bone Health Agents

-

Fertility Agents

-

GnRH Modulators

-

Pain and Symptom Management

-

Metabolic Agents

-

Others

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

50 years and above

-

Postmenopausal Osteoporosis

-

Endometriosis & Uterine Fibroids

-

Menopause

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global women's health market size was estimated at USD 49.33 billion in 2024 and is expected to reach USD 53.48 billion in 2025.

b. The global women's health market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 68.53 billion by 2030.

b. The contraceptives segment accounted for the largest share of more than 35.07% of the women’s health market in 2024, due to the growing awareness regarding the usage of contraceptives, favorable reimbursement policies, and rising government and non-profit organization initiatives.

b. Some of the key players operating in the women’s health market are AbbVie, Inc.; Bayer AG; Merck & Co., Inc.; Pfizer; Teva Pharmaceuticals; Agile Therapeutics; Amgen, Inc.; AstraZeneca; Bristol-Myers Squibb; and Ferring B.V.

b. An increase in the population of women aged over 60, a rise in unhealthy lifestyle habits, the introduction of novel medicines for women's health, and the impending approval of pipeline products are some of the factors that drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.