- Home

- »

- Pharmaceuticals

- »

-

Contraceptive Market Size, Share And Growth Report, 2030GVR Report cover

![Contraceptive Market Size, Share, & Trends Report]()

Contraceptive Market (2024 - 2030) Size, Share, & Trends Analysis Report By Product (Contraceptive Devices, Contraceptive Drugs), By Region, And Segment Forecasts

- Report ID: 978-1-68038-448-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Contraceptive Market Summary

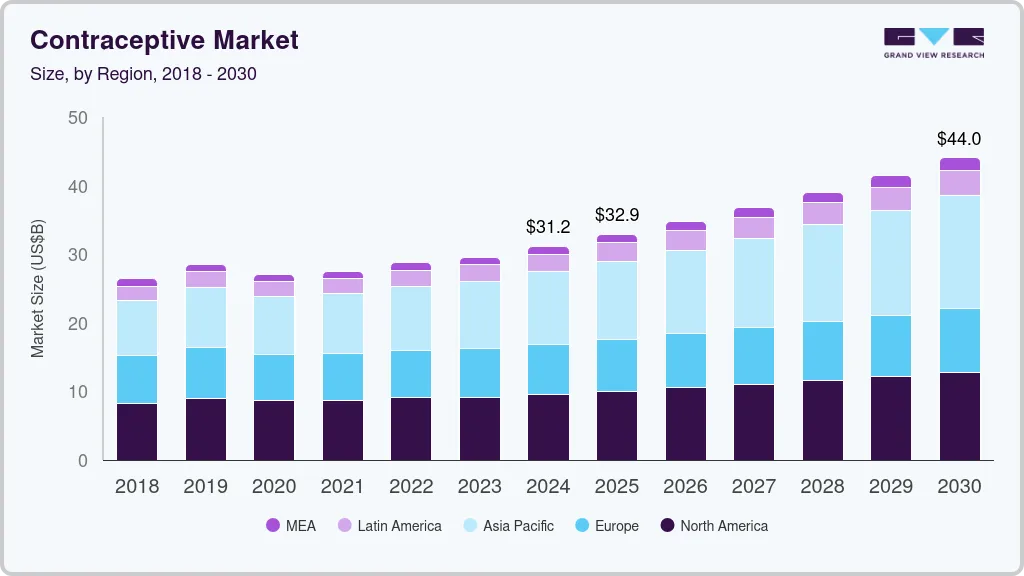

The global contraceptive market size was estimated at USD 31,178.9 million in 2024 and is projected to reach USD 44,039.4 million by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The increasing prevalence of Sexually Transmitted Diseases (STDs), the growing need for contraceptive drugs and devices among women, and the rising adoption of contraception among young women, coupled with higher educational achievements, are contributing to the growth of the market.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Norway is expected to register the highest CAGR from 2025 to 2030.

- In terms of product, contraceptive devices accounted for a revenue of 68% in 2024.

- Contraceptive Devices is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 31,178.9 Million

- 2030 Projected Market Size: USD 44,039.4 Million

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

In addition, health concerns associated with teenage pregnancies, greater awareness of modern contraception methods, and the increasing preference for oral contraceptives as a primary means of preventing unplanned pregnancies are expected to boost the growth of the market over the forecast period.

Implementing programs aimed at reducing unwanted pregnancies and related healthcare costs and increasing user awareness levels are anticipated to propel the industry's growth during the forecast period. According to the State of World Population 2022 report by UNFPA, the United Nations sexual and reproductive health agency, nearly 121 million pregnancies globally each year-almost half of the total-are unintended.

Government in developing countries are undertaking steps for more awareness and access to contraceptives. For instance, in July 2023, the Karnataka Health Department in India introduced two new contraceptive methods for women as part of the National Family Planning Programme. The sub-dermal implant and subcutaneous injection were introduced in government-run health centers to promote reproductive and sexual health by increasing the gap between two births. Such measures are expected to promote the use of contraception in developing countries and contribute to the market's growth.

Both the private sector (pharmacy/drug shop, general store, private clinics, and NGOs or Faith-based organizations) and the public sector are the key providers of contraceptives globally. The private sector is primarily utilized for short-acting resupply contraceptive methods, such as condoms and pills, and has captured and maintained a relatively stable share of the industry. According to the article published in 2022 in the Global Health: Science and Practice journal, around 41% of females who use contraceptives in Asia obtain them from private-sector sources, and around 56% of females use public sources. In the total average of 36 countries evaluated in the Low- and Middle-income Countries (LMIC), around 63% of women obtain it from public-sector sources, and around 34% use private-sector sources.

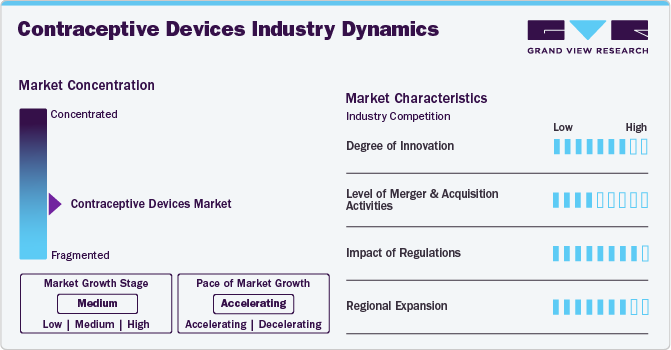

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaboration activities, degree of innovation, and regional expansion. For instance, the industry is fragmented, with many providers entering the industry. The degree of innovation is high, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is high.

The industry is experiencing high innovation as manufacturers are introducing new products to meet the growing demand for products. For instance, in July 2023, the U.S. Food and Drug Administration approved Opill (norgestrel) tablets for nonprescription use as a daily oral contraceptive. This marks the first approval in the U.S. This means that consumers can now purchase this progestin-only oral pill OTC at various retail outlets, including drug stores, convenience stores, grocery stores, and online platforms. Moreover, innovations in hormonal contraceptives have led to the development of lower-dose formulations, extended-release methods such as implants and patches, and novel delivery systems such as vaginal rings.

The level of mergers and acquisitions in the industry is moderate due to the stringent regulations and approvals required for contraceptive products to expand their industry presence. However, companies leverage M&A to access new distribution channels, strengthen research and development capabilities, and consolidate market positions. For instance, in December 2022, Linden Capital Partners acquired LifeStyles Healthcare, a sexual health and wellness platform provider, from stakeholders, including Humanwell Healthcare and Trustar Capital. This acquisition is significant for Linden, a Chicago-based private equity firm specializing in the healthcare industry.

The impact of regulations is high on the industry, spanning from product approval, market access, clinical trials, reproductive health policies, and safety standards. Regulatory bodies such as the FDA in the U.S. impose stringent requirements to ensure the safety, efficacy, and quality of products before they reach consumers. Changes in regulatory frameworks impact product development timelines, market entry strategies, and compliance costs for manufacturers. Moreover, government policies on reproductive health, including insurance coverage and family planning initiatives, shape demand dynamics and access to contraception globally.

The level of regional expansion in the industry is high due to the growing number of unintended pregnancies, which is experiencing significant growth. For instance, in August 2020, Cupid Limited expanded its market presence with approval from the U.S. FDA for the marketing of male condom variants in the U.S. In regions with rapidly growing populations and increasing awareness of reproductive health, such as parts of Asia, Africa, and Latin America, there is a notable growth in demand for contraceptives. International organizations and non-profits play a crucial role in expanding access to contraceptives in these countries through education, distribution programs, and policy advocacy.

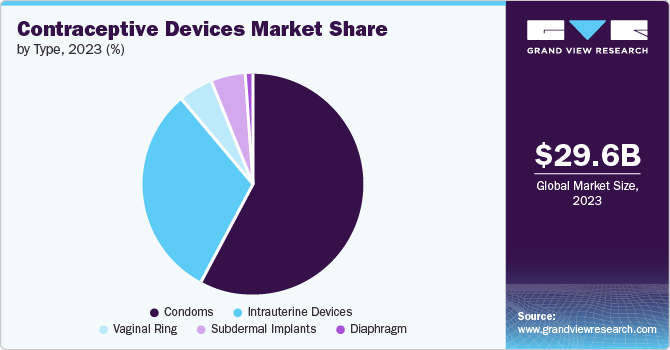

Product Insights

Based on product, the contraceptive devices segment dominated the industry with the largest revenue share of 67.98% in 2023 and is expected to witness the fastest growth over the forecast period. This is attributed to an increase in the awareness level of STDs and the efficiency of condoms to prevent infections, including HIV. The contraceptive device segment is further sub-segmented into condoms, subdermal implants, IUDs, vaginal rings, and diaphragms.

The condom segment held the largest market share in 2023 owing to the increase in awareness of condoms & their effectiveness, measures to reduce the spread of HIV & other Sexually Transmitted Infections (STIs), and the easy accessibility of condoms. The growth can also be attributed to the demand from the public sector source. According to the Family Planning Report 2021 report, around 378.1 million units of condoms were supplied by the Department of Health & Family Welfare in India.

The contraceptive drugs segment is expected to witness lucrative growth during the forecast period. The segment is further sub-segmented into contraceptive pills, patches, and injectables. The contraceptive pill segment held the largest share of the segment in 2023. The growth is attributed to the increased procurement volumes by public-sector organizations. As per the Family Planning 2023 report by Clinton Health Access Initiative, the total public sector industry volumes for contraceptive pills, including combined hormonal and progestin-only pills, accounted for around 147 million in 2022 in 84 countries considered in the scope of the study. These pills are more affordable compared to devices. The convenience and effectiveness of contraceptive pills as a non-invasive, easily accessible method of birth control contribute to their high market share. In addition, a study published by the National Library of Medicine in January 2023 estimated that around 36.2% of the women used contraceptive pills as the preferred method of contraception.

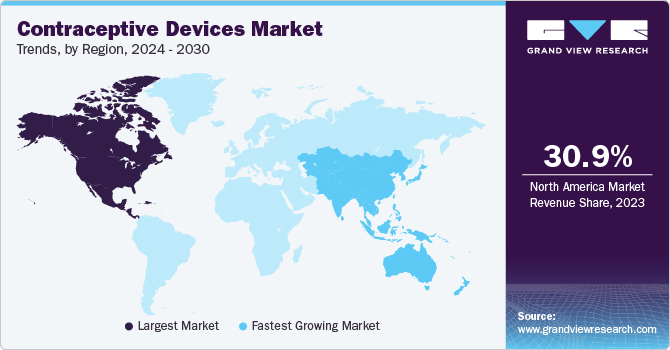

Regional Insights

The North America contraceptive market held the largest global revenue share of 30.98% in 2023. This can be attributed to the preference for sexual activities among the young population and the high awareness of reproductive health and contraception in the region. In addition, the introduction and expansion of affordable generic drugs and devices have contributed to a higher demand for contraceptives among teenagers in the region.

U.S. Contraceptive Market Trends

The contraceptive market in the U.S. held the largest revenue share in the North America region in 2023. This large share is due to the increase in the use of modern contraceptives, the rise in initiatives by social organizations to improve access to contraception, and the growing number of publicly funded family planning services. Government policies and programs, such as Title X and the Affordable Care Act, which mandate insurance coverage for contraceptive methods, have significantly improved access to and affordability of these products.

Europe Contraceptive Market Trends

The contraceptive market in Europe is anticipated to grow significantly due to the increasing cases of STDs reported in many European countries and the rise in unintended pregnancies leading to abortions, increasing the demand for contraceptives. Moreover, growing investment by companies to improve access to modern contraception in the country is expected to contribute to the growth of the market. For instance, in September 2023, Bayer opened a new manufacturing & production facility in Finland with a USD 267.5 million (Euro 250 million) investment to increase the production capacity of LARCs such as hormonal IUDs and implants in Europe.

The UK contraceptive market is expected to grow significantly over the forecast period. This can be attributed to the rapidly increasing prevalence of STDs in the country and growing awareness to avoid STIs and prevent unplanned pregnancies. According to the UK Health Security Agency (UKHSA), 392,453 cases of STI were diagnosed in England in 2022, indicating a 24% rise from 2021. Government policies, such as the National Health Service (NHS) providing free contraception, significantly enhance access to a wide range of contraception methods for all age groups.

The contraceptive market in Germany held the largest share in the European region in 2023, owing to the changing lifestyles and preferences, with more women delaying pregnancy and opting for smaller families, and the increasing prevalence of HIV in the country. As per the Robert Koch Institute (RKI), around 90,000 or more people in Germany were living with HIV at the end of 2021, with about 9,000 individuals being unaware of their condition.

Asia Pacific Contraceptive Market Trends

The Asia Pacific contraceptive market is expected to witness the fastest growth over the forecast period. The growth can be attributed to the rising number of government initiatives, growing demand for population control, and decreased unintended pregnancy rates. According to the Center for Reproductive Rights, around 53.8 million unintended pregnancies occur every year in Asia. The contraception usage rate among married adolescents in Asia is around 41%.

The contraceptive market in China held the largest share in 2023. The introduction of the two-child policy has shifted family planning dynamics, leading to a greater focus on contraceptive options that allow for better family planning and spacing between children. Government initiatives and public health campaigns continue to promote the benefits of contraception, contributing to higher acceptance and usage rates.

The India contraceptive market is expected to witness significant growth over the forecast period. Government programs such as the National Family Planning Program and initiatives under the Ministry of Health and Family Welfare have significantly promoted the use of contraceptives, providing free or subsidized options to a large portion of the population. These efforts aim to control population growth, improve maternal and child health, and empower women with better family planning choices are expected to drive the market’s growth.

Latin America Contraceptive Market Trends

Latin America contraceptive market is anticipated to grow significantly. Social changes, including increasing urbanization, higher levels of female education, and greater workforce participation by women, have contributed to the demand for effective contraceptive methods. Moreover, cultural shifts towards smaller family sizes and the delay of marriage and childbearing are further driving market growth.

The contraceptive market in Brazil is anticipated to grow significantly due to the high prevalence of HIV infection. This is attributed to various factors, such as inconsistent use of condoms by sex workers and MSM. In addition, market growth is driven by manufacturers' efforts to establish and strengthen their presence in the market through obtaining marketing approvals for their products or acquiring local manufacturers.

Middle East & Africa Contraceptive Market Trends

The contraceptive market in the Middle East & Africa is expected to grow significantly due to the increasing need for population control and the rising incidence of STIs & HIV. Several international brands are collaborating with the WHO, UNFPA, NGOs, and non-profit organizations to promote product usage in high-risk countries in Africa.

South Africa contraceptive market is anticipated to grow significantly due to the rising risk of STI transmission, including HIV, syphilis, gonorrhea, & chlamydia, and unintended pregnancies among sex workers, MSM, and adolescents, and government initiative to distribute contraceptives, mainly condom which is an economical option for contraception for the majority of the population.

Key Contraceptive Company Insights

The market is highly fragmented, with the presence of many prominent manufacturers and a rise in investment in R&D by manufacturers driving the market growth. To stay ahead of the competition, companies are adopting various strategies such as collaborations, acquisitions, partnerships, and launching new products. Some of the emerging players include Evofem Biosciences, Inc., Jems and Slipp, Get Down and Jonny, and others.

Key Contraceptive Companies:

The following are the leading companies in the contraceptive market. These companies collectively hold the largest market share and dictate industry trends.

- Abbvie, Inc.

- Afaxys, Inc.

- Agile Therapeutics

- Bayer AG

- China Resources (Group) Co., LTD.

- Church & Dwight Co., Inc.

- Cupid Limited

- Helm AG

- Johnson & Johnson Services, Inc.

- Organon Group of Companies

- Pfizer Inc.

- Veru, Inc.

- Viatris Inc.

Recent Developments

-

In March 2024, Perrigo Company plc announced the availability of its oral contraceptive pill, Opill, without a prescription in the U.S. It is also available for sale online on the company's website.

-

In October 2023, Xiromed launched a generic version of Nuvaring, a vaginal ring, EnilloRing. The launch of this product offers an additional contraceptive option to patients in the U.S.

-

In March 2023, NEXT Life Sciences, Inc., a medical device company, launched a new contraceptive product for men to market, Plan A. The development of this product is to offer fully reversible birth control, safe and effective for men.

-

In April 2023, Veru Inc. entered into an agreement with Afaxys Group Services, LLC (AGS) to distribute FC2 Female Condom of Veru with the support of AGS's Group Purchasing Organization (GPO). This partnership aims to support over 31 million individuals who depend on public health and community centers for essential healthcare services, benefiting both men and women.

Contraceptive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.18 billion

Revenue forecast in 2030

USD 44.04 billion

Growth rate

CAGR of 5.92% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, South Africa, UAE, and Kuwait

Key companies profiled

Abbvie, Inc., Afaxys, Inc., Agile Therapeutics, Bayer AG, China Resources (Group) Co., LTD., Church & Dwight Co., Inc., Cupid Limited, Helm AG, Johnson & Johnson Services, Inc., Organon Group of Companies, Pfizer Inc., Veru, Inc., Viatris Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contraceptive Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global contraceptive market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contraceptive Drugs

-

Contraceptive Pills

-

Patch

-

Injectables

-

-

Contraceptive Devices

-

Condom

-

Male Condom

-

Female Condom

-

-

Subdermal Implants

-

Intrauterine Devices (IUDs)

-

Copper IUDs

-

Hormonal IUDs

-

-

Vaginal Ring

-

Diaphragm

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global contraceptive market was estimated at USD 29.57 billion in 2023 and is expected to reach USD 31.18 billion in 2024.

b. The global contraceptive market is expected to grow at a compound annual growth rate of 5.92% from 2024 to 2030 to reach USD 44.04 billion by 2030.

b. The contraceptive devices segment dominated the contraceptives market with the highest share of 67.98% in 2023. This is attributable to the availability of more advanced and long-lasting contraceptive devices in the market.

b. Key players operating in the contraceptives market include Abbvie, Inc., Afaxys, Inc., Agile Therapeutics, Bayer AG, China Resources (Group) Co., LTD., Church & Dwight Co., Inc., Cupid Limited, Helm AG, Johnson & Johnson Services, Inc., Organon Group of Companies, Pfizer Inc., Veru, Inc., Viatris Inc.

b. Key factors that are driving the market growth include easy availability of contraceptive products and a rising number of government initiatives to spread awareness regarding contraceptive use.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.