- Home

- »

- Organic Chemicals

- »

-

1,4 Butanediol Market Size & Share, Industry Report, 2030GVR Report cover

![1,4 Butanediol Market Size, Share & Trends Report]()

1,4 Butanediol Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Tetrahydrofuran (THF), Polybutylene Terephthalate (PBT), Polyurethane), By, Drivers, By Opportunities & Restraints, By Region, And Segment Forecasts

- Report ID: 978-1-68038-084-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

1,4 Butanediol Market Summary

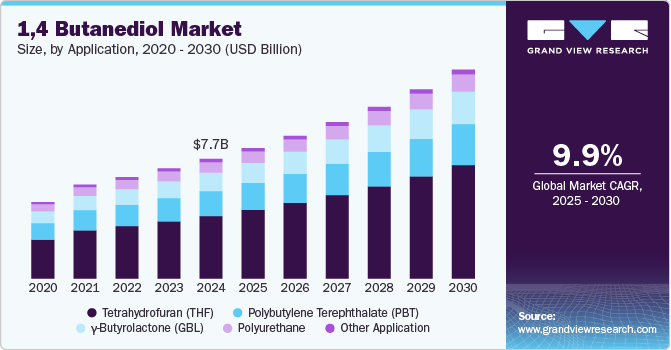

The global 1,4 butanediol market size was estimated at USD 7,684.4 million in 2024 and is projected to reach USD 13,407.6 million by 2030, growing at a CAGR of 9.9% from 2025 to 2030. The market growth is primarily attributed to the applications of polybutylene terephthalate (PBT), tetrahydrofuran (THF), and polyurethane (PU) in various industrial processes, as well as the increasing demand for spandex in textiles.

Key Market Trends & Insights

- The 1-4-butanediol market in North America is anticipated to grow at the fastest CAGR during the forecast period.

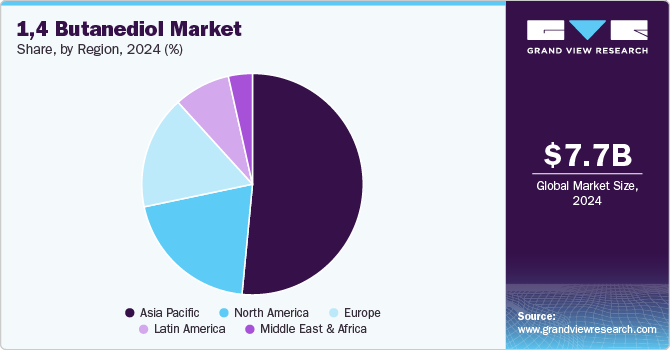

- Asia Pacific 1-4-butanediol market dominated the global market with the largest revenue share of 81.1% in 2024.

- Based on application, the THF segment led the market with the largest revenue share of 51.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7,684.4 Million

- 2030 Projected Market Size: USD 13,407.6 Million

- CAGR (2025-2030): 9.9%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

This colorless liquid is one of the most stable isomers of butanediol derived from butane. The most common method for producing 1,4 butanediol (BDO) is the Reppe process, which involves the reaction of acetylene with formaldehyde. This method is widely utilized by major industry players such as DuPont and BASF. In addition, suppliers of 1,4 BDO have begun to integrate backward into the supply chain by starting their production of the necessary raw materials.

This strategy significantly reduces logistics costs and procurement challenges for companies over the long term. Consumers are becoming increasingly aware of the benefits and technologies of products. As a result, suppliers are maintaining quality throughout the production process. The growing global focus on green chemistry has prompted major market players, such as BioAmber, Genomatica, and Myriant, to develop alternative bio-based processing technologies, likely to drive market growth during the forecast period. In addition, increasing investments in sustainable technologies are expected to enhance existing processes and improve overall efficiency.

The Davy process technology, also known as the Maleic anhydride-based process, has gained popularity recently due to its reduced complexity, equipment requirements, and capital costs. In this process, maleic anhydride is converted into an ester, which then undergoes fixed-bed hydrogenolysis to produce a mixture of 1,4-butanediol (1,4 BDO), tetrahydrofuran (THF), and gamma-butyrolactone (GBL). BASF has integrated the Davy process with Huntsman Mars V/VI in Kuantan, Malaysia, to lower production costs and penetrate the lucrative Asia-Pacific market. Recent technological advancements—such as the hydrogenation of succinic acid, fermentation of sugars, and esterification—have also transformed the 1,4 BDO industry.

Biological methods for producing 1,4 BDO offer significant opportunities for new participants in the chemical market. Furthermore, government agencies like the U.S. Environmental Protection Agency (EPA) are incorporating the principles of green chemistry into chemical production and promoting renewable feedstock, further driving market growth.

The COVID-19 outbreak severely impacted the market by disrupting the supply chain of chemical products, leading to raw material price hikes. The global lockdown during the pandemic forced chemical manufacturers to halt their operations for an extended period in 2020, adversely affecting global market growth.

Drivers, Opportunities & Restraints

The increasing demand for 1,4-butanediol (BDO) is significantly influenced by its applications in producing tetrahydrofuran (THF) and polyurethane, which are experiencing robust growth across various industries. Tetrahydrofuran, a solvent and precursor for polymers, is essential in manufacturing spandex fibers and other elastomers widely used in textiles and automotive sectors. The rising popularity of lightweight and durable materials has further propelled the demand for THF. Concurrently, polyurethanes—known for their versatility are utilized in many applications ranging from foams and coatings to adhesives and sealants. The construction, automotive, and furniture industries are particularly driving this demand, seeking high-performance materials that offer durability and energy efficiency.

The increasing production of bio-based 1,4-butanediol (BDO) presents a significant opportunity within the BDO market, driven by rising environmental concerns and the demand for sustainable alternatives to petrochemical-derived products. Bio-based BDO is produced from renewable resources such as sugars derived from biomass, reducing reliance on fossil fuels and lowering greenhouse gas emissions associated with traditional production methods. As industries seek to enhance their sustainability profiles and comply with stricter environmental regulations, the shift towards bio-based chemicals is becoming more pronounced.

The health concerns associated with 1,4-butanediol (BDO) significantly impact its market dynamics. BDO is known to be metabolized in the body to gamma-hydroxybutyric acid (GHB), a substance that has the potential for abuse and addiction. This conversion raises alarms regarding its safety profile, particularly in recreational contexts where it may be misused for its psychoactive effects. In addition, exposure to BDO can lead to various adverse health effects such as respiratory depression, dizziness, nausea, and, in severe cases, unconsciousness or death.

Application Insights

Based on application, the THF segment led the market with the largest revenue share of 51.6% in 2024. This substantial share is primarily attributed to the increased use of THF in producing poly-tetramethylene glycol (PTMEG), a polymer widely used to manufacture urethane elastomers and fibers. The demand for PTMEG has surged due to its superior properties, including exceptional flexibility and elasticity.

The PBT segment accounted for the second-largest revenue share of 20.8% in 2024. This growth is linked to the rising consumption of plastics in automotive applications, driven by a strong demand for lightweight vehicles. This trend is expected to boost PBT demand during the forecast period further. Other significant growth drivers for PBT consumption include replacing conventional metals in the automotive and electronics industries, introducing new-generation PBT grades, and developing bio-based PBT. In addition, the demand for polyurethane (PU) is anticipated to grow, fueled by the increasing emphasis on lightweight and durable products in sectors such as automotive, construction, and electronics, particularly in Asia.

Regional Insights

The 1-4-butanediol market in North America is anticipated to grow at the fastest CAGR during the forecast period. The market is significantly influenced by the increasing demand for this chemical in various end-use industries. The automotive sector, in particular, is experiencing a surge in demand for lightweight materials that enhance fuel efficiency and reduce emissions. As manufacturers strive to meet stringent environmental regulations and consumer preferences for sustainable products, the demand for BDO-derived materials is expected to rise.

U.S. 1,4 Butanediol Market Trends

The 1-4-butanediol market in the U.S. is primarily driven by its increasing demand in key industrial applications, particularly in producing plastics, resins, and synthetic fibers. As the demand for products like spandex, polyurethane, and plastics continues to rise across various industries such as automotive, construction, textiles, and electronics, the need for high-quality BDO as a versatile chemical building block also expands.

Asia Pacific 1,4 Butanediol Market

Asia Pacific 1-4-butanediol market dominated the global market with the largest revenue share of 81.1% in 2024. The growing automotive, construction, and electronics industries in countries such as China, India, and Japan are major contributors to the demand for BDO. The rise in consumer demand for lightweight and durable materials in these sectors has spurred the need for advanced polymers and coatings, where BDO plays an essential role. Moreover, the shift toward bio-based BDO production methods is gaining traction, providing an added growth avenue for the market as manufacturers look to meet sustainability goals.

Europe America 1,4 Butanediol Market

The 1-4-butanediol market in Europe has made significant strides in advancing chemical recycling and green chemistry initiatives, which has helped improve the overall cost-effectiveness of BDO production processes. As Europe continues to focus on decarbonization and achieving its climate goals, BDO is increasingly being produced via bio-based and low-carbon processes, aligning with the region's commitment to a circular economy.

Latin America 1,4 Butanediol Market Trends

The 1-4-butanediol market in Latin America is anticipated to grow at a significant CAGR during the forecast period. As Latin American economies continue to industrialize and consumer purchasing power improves, the need for high-performance materials in manufacturing processes is rising, further boosting BDO demand. In addition, the electronics industry's rapid expansion, especially in Brazil and Mexico, contributes to the demand for BDO in producing electronic components and consumer goods, further driving market growth.

Middle East & Africa 1,4 Butanediol Market Trends

The 1-4-butanediol market in the Middle East & Africa is expected to grow at a significant CAGR during the forecast period. The region’s expanding manufacturing sector, especially in countries like Saudi Arabia and the UAE, fosters a higher consumption of BDO as it is integral to producing materials such as polyurethane and polybutylene terephthalate (PBT). In addition, the rise in automotive production and construction activities across these regions further propels the need for BDO-based products, which are essential for enhancing durability and performance.

Key 1,4 Butanediol Company Insights

Some of the key players operating in the market include BASF SE, Ashland, and Evonik Industries AG.

-

BASF SE is a chemical production company. It has more than 340 production facilities worldwide and conducts business through subsidiaries and joint partnerships in over 80 countries. The company also offers a variety of system solutions and services. These include products for the automotive, chemical, construction, agriculture, oil, electrical, plastics, electronics, furniture, and paper sectors.

-

Ashland is engaged in manufacturing and distributing specialty chemicals to several end-use industries, including architectural coating, adhesives, automotive, construction, food & beverage, pulp & paper, energy, pharmaceuticals, and personal care. It operates through three business segments, namely, specialty ingredients, composites, and intermediates & solvents. The specialty ingredients segment includes cellulose ethers, vinyl pyrrolidone, and biofunctionals.

Key 1,4 Butanediol Companies:

The following are the leading companies in the 1,4 butanediol market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Ashland

- DCC

- Mitsubishi Chemical Group Corporation

- Evonik Industries AG

- LyondellBasell Industries Holdings B.V.

- Sipchem Company

- SINOPEC (China Petrochemical Corporation)

- Genomatica, Inc.

Recent Developments

-

In September 2023, BASF agreed with Qore LLC to secure long-term access to QIRA's bio-based 1,4-butanediol. This strategic move supports BASF's expansion of its bio-based derivatives portfolio, including tetrahydrofuran and polytetrahydrofuran, with commercial quantities anticipated by Q1 2025.

-

In October 2022, BASF SE announced the manufacturing of 1,4-butanediol through renewable feedstock, which includes Genomatica's patented GENO BDO technology. The moves toward bio-based technologies for producing 1,4-butanediol align with BASF SE and Genomatica, Inc. goal of promoting sustainable development in the industry.

1,4 Butanediol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8,378.7 million

Revenue forecast in 2030

USD 13,407.6 million

Growth rate

CAGR of 9.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Russia; China; India; Japan; South Korea; Australia; Vietnam; Brazil; Argentina; Saudi Arabia; and South Africa.

Key companies profiled

BASF SE; Ashland; DCC; Mitsubishi Chemical Group Corporation; Evonik Industries AG; LyondellBasell Industries Holdings B.V.; Sipchem Company; SINOPEC (China Petrochemical Corporation); Genomatica, Inc.; Taiyo Nippon Sanso Corporation.

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 1,4 Butanediol Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 1,4 Butanediol market report based on the application, and region.

-

Application Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

Tetrahydrofuran (THF)

-

γ-Butyrolactone (GBL)

-

Polybutylene Terephthalate (PBT)

-

Polyurethane

-

Other Application

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific dominated the 1,4 butanediol market with a share of 81.1% in 2024. This is attributable to rapidly expanding industries, a wide consumer pool with growing income levels, and the presence of low-cost labor & resources.

b. Some key players operating in the 1,4 butanediol market include BASF SE, Ashland, DCC, Mitsubishi Chemical Group Corporation, Evonik Industries AG, LyondellBasell Industries Holdings B.V., Sipchem Company, SINOPEC (China Petrochemical Corporation), Genomatica, Inc.

b. Key factors that are driving the 1,4 butanediol market growth include growing applications of tetrahydrofuran (THF), polybutylene terephthalate (PBT), and polyurethane (PU) in various industrial processes along with the growing demand for spandex in textiles.

b. The global 1,4 butanediol market size was estimated at USD 7,684.4 million in 2024 and is expected to reach USD 8,378.7 million in 2025.

b. The global 1,4 butanediol market is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2030 to reach USD 13,407.6 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.