- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyurethane Market Size, Share & Growth Report, 2030GVR Report cover

![Polyurethane Market Size, Share & Trends Report]()

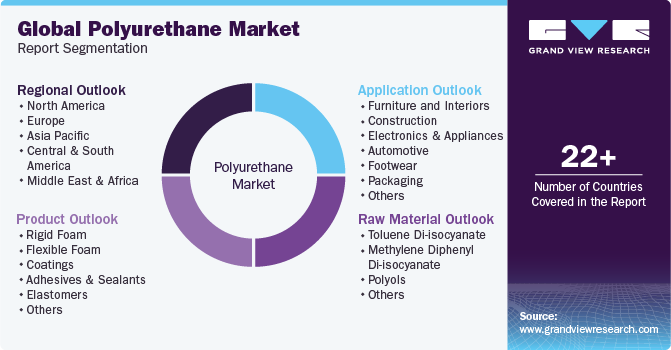

Polyurethane Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (Toluene Di-isocyanate, Methylene Diphenyl Di-isocyanate, Polyols), By Product, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-262-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyurethane Market Summary

The global polyurethane market size was estimated at USD 75,525.9 million in 2024 and is projected to reach USD 119,996.4 million by 2030, growing at a CAGR of 8% from 2025 to 2030. Increasing demand for building insulation in light of sustainability concerns is expected to escalate the demand for polyurethane over the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the market and held a revenue share of over 68.0% in 2023.

- Europe is likely to grow at a CAGR of over 3.5% from 2024 to 2030.

- By raw material, the polyols material segment held the largest share of over 30.0% in 2023.

- By product, rigid foam product accounted for a revenue share of 31.42% in 2023 and is likely to dominate the market over the forecast period.

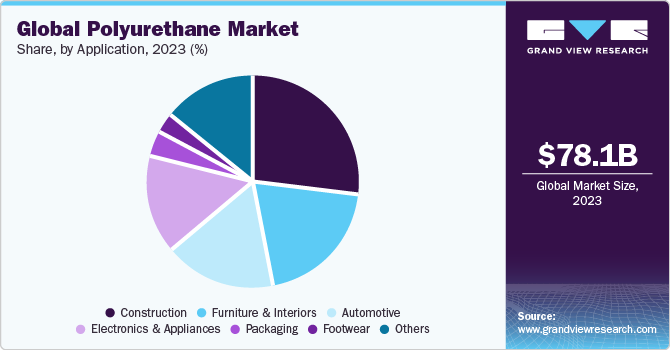

- By application, The construction segment dominated the market and accounted for the largest revenue share of over 26% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 75,525.9 Million

- 2030 Projected Market Size: USD 119,996.4 Million

- CAGR (2025-2030): 8%

- Asia Pacific: Largest market in 2023

Sustainability in building developments is a vast field and encompasses several steps that must be implemented in the primary construction stages since their potential environmental impact is quite significant.

The rising demand for the product from the automotive, construction, packaging sectors in the country is expected to drive the market over the forecast period. The construction sector in the U.S. is expanding at a significant rate owing to positive market fundamentals for commercial real estate along with rising state and federal funding for institutional buildings and public works. Moreover, the ongoing construction projects such as the construction of South San Francisco Civic Center campus, LaGuardia Airport Construction Project, O’Hare Airport Construction Project, and Second Avenue Subway Construction Project is expected to fuel the demand for the product in construction applications, thus boosting the U.S. Polyurethane Market.

The rising demand for the product from the automotive, construction, packaging sectors in the U.S. is expected to drive the market over the forecast period. The U.S. automotive industry has been witnessing growth in automobile production in the past few years. Major players in the market are entering into joint ventures and forming an alliance to increase their production and their reach in the country. For instance, in December 2023, Mobis North America, a Tier 1 automotive supplier, announced plans to build manufacturing operations in Toledo, Ohio. The USD 13.8 million project is estimated to generate 185 employment. Capacity expansion in the countries by major players is expected to positively impact the demand for polyurethane types in the coming years.

Polyurethane market prices are highly influenced by factors such as shipping & labor costs, currency fluctuations, and trade-related tariffs due to diminishing crude oil reserves and civil unrest in the Middle East have. Moreover, increasing demand from end-user industries, technological advancements, and regulatory support have added to the growth opportunities.

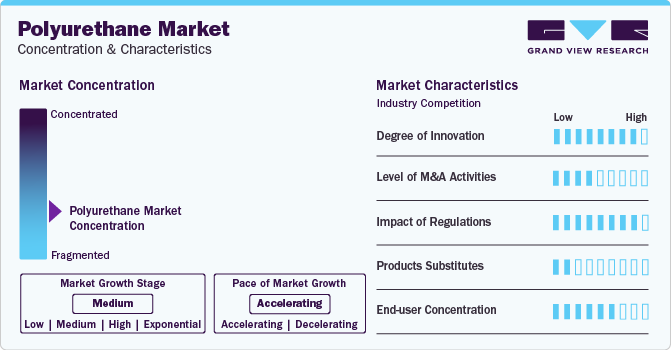

Market Concentration & Characteristics

Market growth is driven by high demand for building insulationin light of sustainability concerns for residential and non-residential sector. Sustainability in building developments is a vast field and encompasses several steps that must be implemented in the primary construction stages since their potential environmental impact is quite significant.

With growing demand patterns, companies such as China National Building Material Industry Corporation and Sika AG are increasing their production capacities. Moreover, the industry is largely characterized by dominance of regional players, leading within their respective regional markets.

Green buildings are increasingly entering the construction market owing to the increasing investments in smart energy-efficient commercial and residential buildings. These buildings offer profitable opportunities along with environmental and federal regulations, providing a meaningful response to growing consumer expectations for sustainability.

In addition, polyurethane manufacturers are largely supported by their local governments. Controlled studies have demonstrated that polyurethane adhesives used with mechanical fasteners in house framing can provide good resistance during severe weather events. Increased effectiveness in building materials has ultimately generated higher demand for polyurethane in the building & construction industry.

Raw Material Insights

The polyols material segment held the largest share of over 30.0% in 2023. Polyols are compounds with multiple hydroxyl functional groups. Polyester polyols is the most common polyurethane raw material. They are employed in the manufacturing of several polymers including polyurethane which finds application in the building, automotive, furniture, and other industries. The polyols-based polyurethane market is influenced by various drivers that contribute to its growth and development.

Duplex Polyurethane Market segment is anticipated to grow at a significant CAGR from 2024 to 2030, in terms of Polyurethane Market value. TDI is a critical component in the production of polyurethane which are used in several industries including automotive & building & construction. The market for toluene di-isocyanate (TDI)-based polyurethane is influenced by various drivers that impact demand and shape industry dynamics. TDI is also employed in the formulation of polyurethane adhesives and sealants. These materials offer strong bonding capabilities and are used in various industries for joining and sealing applications.Moreover, the automotive sector is a significant driver for TDI-based polyurethane as it is commonly used in automotive applications, particularly in the production of flexible foams for seating and interior components.

Product Insights

Rigid foam product accounted for a revenue share of 31.42% in 2023 and is likely to dominate the market over the forecast period. Rigid foam polyurethane types are high-performance closed-cell plastics utilized in end-use industries, such as transportation, packaging, and industrial insulations and appliances, owing to their structural stability, which assists manufacturers to design thermally insulating products. Rigid foams possess sound insulation properties, higher mechanical strength, and thermal resistance making them highly suitable for extreme weather conditions and harsh environments.

Moreover, the polyurethane-based flexible foams is expected to grow significantly in the coming years. They are a type of polymer foam that is widely used in various applications due to its flexibility, resilience, and comfort. TDI and MDI are the most commonly used isocyanates in the production of polyurethane-based flexible foams. The automotive industry uses flexible foams extensively in seating, headrests, and interior components. Urbanization and rising automotive trends influence the demand for PU-based flexible foam products in the automotive industry.

Application Insights

The construction segment dominated the market and accounted for the largest revenue share of over 26% in 2023. The demand for polyurethane in construction end-use is expected to witness significant growth over the forecast period owing to various beneficial characteristics of polyurethane foam including excellent thermal insulation, lightness, chemical inertness, and bacterial and pest resistance. Growing urbanization and industrialization, especially in emerging economies, such as China and India, and the rising infrastructure development activities in the Middle East are expected to fuel the growth of the construction industry, in turn, creating demand for polyurethane foam and insulation.

The furniture and interiors segment also observed a significant decline in 2020, in terms of automotive production and sales. Flexible foam is used for cushioning in a variety of consumer and commercial products such as furniture, bedding, carpet cushion, fibers, and textiles. Foams and other PU products are expected to gain significance in the region on account of the rising consumer awareness regarding the sustainability of lightweight and low-cost polyurethane. Growing residential construction and infrastructure activities are also fueling the rigid polyurethane foam demand in Mexico.

Regional Insights

Asia Pacific dominated the market and held a revenue share of over 68.0% in 2023 The market is driven by the growth of the major end-use industries such as automotive, electronics and appliances, packaging, furniture and interior, and construction. The Asia Pacific region is characterized by a large amount of skilled labor and low costs, along with the easy availability of land. A shift in the production landscape toward emerging economies, particularly China and India, is expected to positively influence the Asia Pacific Polyurethane market growth over the forecast period. Per capita consumption in India, Vietnam, Thailand, and Indonesia is gradually increasing, which is likely to remain a key contributing factor for market growth. Traditionally, China polyurethane market was driven by high demand in infrastructure applications, increasing usage in the production of automotive components, electronics and consumer products.

In terms of revenue, Europe is likely to grow at a CAGR of over 3.5% from 2024 to 2030. The increasing infrastructure spending and the rising number of government initiatives, such as smart cities and subsequent FDI in the construction and development sector are propelling the growth of the construction industry. The furniture and construction industries in Europe have witnessed significant growth owing to a stringent regulatory framework to reduce greenhouse gas (GHG) emission levels. This factor has resulted in increased investments in rigid PU foam by regional automotive manufacturers.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In December 2023, Pearl Polyurethane Systems, which is known for polyurethane (PU) insulation solutions and other PU-based applications, opened a distribution center in Maharashtra, India. The new site is an important milestone in the company's ambition to expand its reach and better serve clients across the Indian subcontinent.

-

In June 2023, Recital NV/SA launched the latest range of polyurethane insulation boards comprising 25% bio-circular raw materials for the purpose of reducing carbon dioxide emissions by 43%.

-

In June 2023, DIC Corporation has introduced the HYDRAN GP series of waterborne polyurethane resins that are environment friendly, and provides an alternative to solvent-based polyurethane resins

- In May 2023, Covestro AG inaugurated the latest production line, and launched Desmopan® UP thermoplastics polyurethane (TPU) series for providing paint protection film in the wind and automotive industry.

Key Polyurethane Companies:

- Dow, Inc.

- BASF SE

- Covestro AG

- Huntsman International LLC

- Eastman Chemical Company

- Mitsui & Co. Plastics Ltd.

- Mitsubishi Chemical Corporation

- Recitel NV/SA

- Woodbridge

- DIC Corporation

- RTP Company

- The Lubrizol Corporation

- RAMPF Holding GmbH & Co. KG

- Tosoh Corporation

Polyurethane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 80,590.0 million

Revenue forecast in 2030

USD 119,996.4 million

Growth rate

CAGR of 8% from 2025 to 2030

Historical data

2020 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Singapore; Taiwan; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; and South Africa

Key companies profiled

Dow, Inc.; BASF SE; Covestro AG; Huntsman International LLC; Eastman Chemical Company; Mitsui & Co. Plastics Ltd.; Mitsubishi Chemical Corporation; Reticel NV/SA; Woodbridge; DIC Corporation; RTP Company; The Lubrizol Corporation; RAMPH Holding GmbH & Co. KG; and Tosoh Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurethane Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyurethane Market report based on raw material, product, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Toluene Di-isocyanate

-

Methylene Diphenyl Di-isocyanate

-

Polyols

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Rigid Foam

-

Flexible Foam

-

Coatings

-

Adhesives & Sealants

-

Elastomers

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Furniture and Interiors

-

Construction

-

Electronics & Appliances

-

Automotive

-

Footwear

-

Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Singapore

-

Taiwan

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyurethane market size was estimated at USD 75.19 billion in 2022 and is expected to reach USD 78.06 billion in 2023.

b. The global polyurethane market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 105.29 billion by 2030.

b. Asia Pacific dominated the polyurethane market with a share of 45.10% in 2022. This is attributable to the developing automotive industry and increasing polymer consumption.

b. Some key players operating in the polyurethane market include BASF SE; Covestro; Huntsman Corp.; Eastman Chemical Co.; Mitsui Chemicals, Inc.; Mitsubishi Chemical Corp.; Nippon PU Industry Corp. Ltd; RTP Company; Lubrizol Corp.; and Rampf Holding GmbH & Co. KG.

b. Key factors that are driving the polyurethane market growth include increasing demand for lightweight and durable products in the automotive, construction, and electronics industries and PU applications for insulation purposes in various end-use industries.

b. The construction application segment led the global polyurethane market in 2022 and accounted for a revenue share of more than 26.75%.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.