- Home

- »

- Agrochemicals & Fertilizers

- »

-

Biofertilizers Market Size, Share And Growth Report, 2030GVR Report cover

![Biofertilizers Market Size, Share & Trends Report]()

Biofertilizers Market Size, Share & Trends Analysis Report By Product (Nitrogen Fixing, Phosphate Solubilizing, Others), By Application, By Crop Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-038-5

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Biofertilizers Market Size & Trends

The global biofertilizers market size was valued at USD 1.5 billion in 2022 and is expected to grow expand at a compound annual growth rate (CAGR) of 12.8% from 2023 to 2030. The increasing usage of microbes in biofertilizers proves the potential for sustainable farming methods and food safety. The increasing concern with respect to food safety is expected to drive the market for biofertilizers over the forecast period. The EU “Common Agricultural Policy” promotes the use of bio-based products along with organic farming and provides up to 30.0% of the budget as direct green payment to farmers complying with sustainable agricultural practices. A favorable regulatory scenario, especially in North America and Europe is expected to be a key driving factor for the market for biofertilizers over the next couple of years across these regions.

The global agriculture industry is a fast-moving sector with dynamic changes on various levels across all economies of the world. With the intervention of digital farming and precision farming practices prevailing in all countries, the growing economic regions are adapting to technological reforms to sustain the ecosystem. Technological adaptability comes with high investments, which in turn, affects the overall return on investments. This is a key factor that puts an entry barrier to small agricultural entrepreneurs and medium-scale farmers to penetrate the global competitive environment.

With multiple million-dollar companies working towards developing high-performance agricultural inputs such as fertilizers, and various pesticides, the need for alternative environment-friendly products is at its peak. With decades of traditional cultivation practices using synthetic products for aggressive crop yields globally, there has been a massive impact on the underground water reserves and soil fertility worldwide. These factors have led to increasing penetration of organic farming products as well as organic cultivation practices globally, backed by consumer awareness of human health effects coupled with environmentalists acting upon the environmental hazards caused in the past decades.

According to European Biomass Industry Association, the market is anticipated to witness significant growth over the forecast period as biofertilizers have the ability to create a physical barrier between plants and crops against pests and simultaneously boost healthy plant growth. Biofertilizers enhance the absorption of phosphorus and zinc by plants as well as resist pathogen attacks on plants. Furthermore, the use of bio-based fertilizers in agricultural fields significantly helps in the decomposition of organic residue and aids in the overall development of plants and crops.

Also, rising prices of synthetic fertilizers globally backed by consumers’ response toward rising prices for synthetically cultivated food products are projected to remain a key factor boosting the consumption of biofertilizers in the coming years. With a rapidly rising global population, food scarcity remains a critical issue for governments around the globe. This has led to innovations in terms of product development in the bio-based fertilizer sector and the promotion of environment-friendly agricultural solutions to the major agrarian economies. This, in turn, is anticipated to augment the demand for biofertilizers across all agricultural economies over the forecast period.

Biofertilizers Market Trends

The organic food & beverage industry is one of the fastest growing sectors worldwide, which is supported by multiple government incentives across the globe and the rising inclination of consumers toward non-synthetically grown food products. Significant agricultural reforms were realized worldwide after recognizing the hazards associated with synthetic fertilizers and crop care chemicals.

The environmental hazards include soil contamination due to the use of synthetic chemicals for prolonged periods, underground water reserve contamination, soil fertility loss, and more, whereas human damages include loss of nutrients in food and long-term deterioration of health due to excessive chemical intake. These factors have led to a steady preference toward bio-based solutions for fertilizers globally.

During the last couple of decades, organic farming has reached acceptance among policymakers, farming communities, market actors, and customers globally. As of 2017, it was noted that more than 70 million hectares of agricultural land across the globe were utilized for organic farming practices, which accounts for over 1.4% of the overall farming area worldwide.

With this trend in place, the availability of farmland for organic farming in the U.S., Australia, and Argentina, among other nations, has compelled various agencies and governments to frame supportive policies to increase the production output of organic foods. Currently, it is observed that the European Union nations and the U.S. are the largest organic farming communities globally followed by China among other Asia Pacific countries.

Agricultural growth in China, Brazil, and India due to the rising demand for food, backed by favorable government initiatives and incentive structures, is expected to reflect positive growth trends in the foreseeable future. Rising demand for these products on account of increasing awareness of the hazardous nature of chemicals is expected to propel market growth over the forecast period. Hostile response from consumers toward the use of chemical products owing to environmental concerns is likely to fuel the market growth of biofertilizers, especially the in Asia Pacific over the predicted years.

In 2010, the European Heads of State and Government (the European Council) finalized 20% reduction in greenhouse gases and 20% energy to be derived from renewable sources as part of their Europe 2020 strategy. This initiative significantly boosted the demand for bio-based alternatives including biofertilizers across European countries. Furthermore, the European Commission and EPA have framed favorable regulations to enhance the production of naturally derived agricultural products to mitigate the growing concerns regarding GHG emissions.

The large market for synthetic fertilizers is expected to be one of the major barriers for the biofertilizers market. Synthetic fertilizers are substances that are applied to the soil to increase quality and yield in crops, especially during unfavorable harsh weather conditions. They are water-soluble and easily absorbed by plants. They are fast-acting and available in various forms including pellets, liquid, granules, and spikes. Furthermore, the expansion of natural gas and crude oil industry in North America is expected to fuel the growth of the synthetic fertilizer market, thus restricting the demand for biofertilizers over the forecast period.

Product Insights

Nitrogen-fixing biofertilizers product dominated the market with a revenue share over 74% in 2022. This is attributable to the correction of heavily contaminated soil and water reserves caused by the usage of synthetic fertilizers for decades globally. Plant growth demands high phosphorus content in the soil, fixed nitrogen presence, and several other essential minerals in the soil, which are sufficed by the utilization of biobased fertilizers. Furthermore, the use of various biofertilizers depending on the soil and crop type promotes the healthy development of plants without any adverse effect on human health as well as on the environment.

Nitrogen-fixing bacteria are the most commonly utilized biofertilizers as plants do not have the ability to convert atmospheric nitrogen into fixed nitrogen, which is essential for their growth and development. Azotobacter, Rhizobium, and Azospirillum are the majorly used bacteria for nitrogen fixation in seed and soil treatment applications. Nitrogen-fixing Rhizobium has the ability to develop an endosymbiotic association with the roots of legumes, which paves its way for use as biofertilizers in the cultivation of leguminous crops. Aerobic nature of Azotobacter along with its neutrality in alkaline soil has increased its application scope in the cultivation of crops including maize, wheat, cotton, mustard, and potato.

However, Bacillus, Pseudomonas, and Aspergillus are the majorly used bacteria for providing phosphorous macronutrients to plants. These biofertilizers have the ability to hydrolyze organic as well as inorganic phosphates from insoluble compounds through the involvement of soluble bacteria. Across Asia Pacific, countries such as India, Australia, China, and Thailand have been predominantly reliant on synthetically formulated phosphate fertilizers. Major agricultural input companies have their decades-old facilities in the region serving the region’s local farming base with synthetic fertilizers, which slightly act as a restraining factor for phosphate solubilizing products across Asia Pacific.

Apart from nitrogen-fixing biofertilizers and phosphate solubilizing products, which are the two majorly demanded products worldwide, multinational companies working in the spectrum are also focusing on mass commercializing potassium mobilizing biofertilizers, zinc solubilizing products, and NPK consortia liquid products. Silicate bacteria are among the most common potassium-solubilizing bacteria, which include Bacillus glucanolyticus, B. mucilaginous, B. circulans, and B. edaphicus.

Crop Type Insights

The cereals and grains application segment held the largest revenue share over 38% in 2022. Cereals and grains production demand a substantial quantity of biofertilizers for healthy development. Studies conducted worldwide indicated that cereal and grain crops reflected high development and growth with Azotobacter inoculation which aided in reducing nitrogen requirement by crops. Further, for healthy development of wheat, phosphate solubilizing bacteria and Azoteobacter inoculation proved highly efficient biofertilizers in terms of crop yield. Utilization of these for cereal and grain cultivation results in high vegetation growth, and high photosynthesis activity.

Oilseeds and pulses are anticipated to record the fastest growth, in terms of volume, with CAGR of 13.0% in the biofertilizers market from 2023 to 2030. Growing demand for soybean, sunflower, and groundnuts across the globe is considered to be the key benefiting factor behind the product’s application in the oilseeds and pulses sector. Further, with multiple microbiological advancements in determining the suitable composition of biofertilizers for application in wheat cultivation among major cereals & grains cultivation, the demand is projected to reflect high growth over the forecast period worldwide.

Biofertilizer consumption in oilseeds and pulses was recorded the highest in North America and Asia Pacific regions due to increasing demand for soybean, groundnut, sesamum, and sunflower. Biofertilizer compositions with phosphorus solubilizing bacteria, rhizobium, plant growth-promoting rhizobacteria, and vesicular arbuscular mycorrhiza have been proven to be most effective for a range of pulses and oilseed cultivation globally.

Application Insights

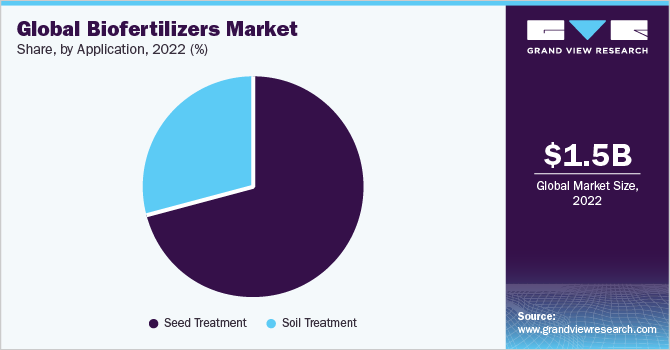

The seed treatment application dominated the market with a revenue share of over 71% in 2022. This is attributed to the benefits of induced nutritional values in the seeds. Aggressive consumption of synthetic fertilizers and a multitude of other crop care chemicals such as pesticides and insecticides over the past couple of years have led to a substantial deterioration in soil quality across all major agrarian economies. However, several governments have imposed regulations on the agricultural sector across all developing and developed economies taking into consideration the environmental hazards caused due to excessive use of chemical products in farming, which is projected to reflect a positive growth trend for biofertilizers in various seed and soil applications across the globe.

Seed inoculation or seed treatment is one of the most significant points of application globally. Seed treatment includes dipping of the desired seeds in a mixture of phosphorus and nitrogen fertilizers. Later, the seeds are sun-dried and subsequently sown in the fields. The inoculant coating made on the seeds enables quick and healthy growth of the plants. The key objective of incorporating biofertilizers during seed treatment is majorly to induce essential nutrients such as sulfur, zinc, nitrogen, and phosphorus, which enhance the nutritional value of vegetables & fruits and cereals & grains.

Also, biofertilizers play a key role in soil treatment application as they significantly improve the soil condition and make it more convenient for plants to absorb essential minerals from the soil. When applied to the soil, they fix the nitrogen present in the soil and root nodules. They also aid in scavenging phosphate in the soil and make it readily available for plant intake. In addition, it also significantly improvises soil mineralization by decomposing the available organic substances in the soil, thereby, enhancing soil properties for cultivation. These characteristics portrayed by biofertilizers on soil application reflect a substantial enhancement of around 15% to 25% in crop yield.

Regional Insights

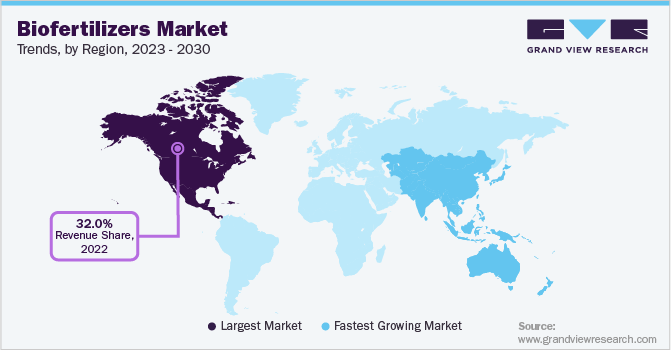

North America dominated the market with a share of over 32%, in terms of revenue, in 2022. According to The World of Organic Agriculture in 2017, around 0.8% of the total agricultural land was used for organic farming in North America, which further reached around 5% by the end of 2020. Increasing government interventions in farming practices held in the region led to significant changes in agricultural trends & methods across the U.S. and Canada. With stringent regulations in place, over 19,017 farming communities are practicing organic farming in the region to ensure sustainable long-term business.

The development of organic farmland grew exponentially in the region due to increasing awareness among consumers about the benefits associated with organic food consumption and awareness among farming committees about the long-term positive effects of switching from chemical-based crop care products to organic counterparts. With the advancement in microbiology through research & development activities conducted by various agricultural institutions and multinational manufacturers in the region, the U.S. is gradually turning into a hub for organic farming.

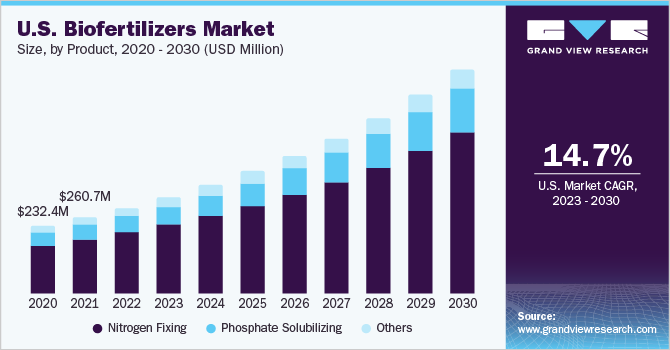

The U.S. is a majority stakeholder in the North American organic farming industry. The country recorded a whopping 56% rise in organic farmlands from 2011 to 2016, as cited by the National Agricultural Statistics Services of the U.S. Department of Agriculture. Along with the growing trend of practicing organic harvesting in the country, the U.S. population also reflected a parallel trend of adopting organic food products. The sales of organic food products in the country was marked at USD 7.6 billion in 2016, which is approximately double the sales in 2011, which was valued at USD 3.5 billion.

Asia Pacific region is a hub for majority of the agrarian economies including India, Thailand, Japan, Malaysia, South Korea, Philippines, and more which are shifting their paradigm towards a more sustainable form of agriculture.

This trend is backed by increasing consumer preference towards consuming organic food, coupled with regulatory initiatives and agricultural reforms undertaken by various governments of various Asian countries. Growth of the biofertilizers industry is growing parallelly with the rise in organic farming practices. Latin America reflected the second-highest growth rate of 12.9% over the forecast period due to sustainable agricultural practices adopted by farming communities across Brazil and Argentina.

In terms of organic agricultural practices, 21 countries in the Asia Pacific have implemented organic harvesting national standards and regulations, with 5 other Asian countries, including Nepal, Bangladesh, Pakistan, Kyrgyzstan, and Jordan, which are in the process of drafting such regulations. As of 2017, Asia Pacific comprised over 9% of the worldwide organic farming land, out of which arable crops consumed over 45% of the total farming land area, followed by permanent crops with a share of 18%.

According to the European Union, the region is the second-largest market, globally in terms of organic food sales, accounting for sales of over USD 36.90 billion in 2017. The largest retail market for organic produces in Europe was Germany, followed by France, Italy, and the UK, with Germany recording an average growth rate of 10%, followed by France, Italy, and the UK at 22%, 14%, and 7%, respectively.

Germany is one of the major European markets, in terms of organic farming, with over 1,373 thousand hectares of farmland in 2017 used solely for organic cultivation practices. As cited by the European Union Agricultural Department, there were 15,019 food processors and over 29,764 organic food producers spread across the country in 2017. Wheat is one of the highest-grown crops in Germany, wherein organic farmers receive a 150% premium price for their harvest compared to conventional growers. This trend has led to increasing adoption of organic farming practices for all major cereals & grains and fruits & vegetables grown in the country

India biofertilizers market is expected to be the fastest growing in the Asia Pacific, with a CAGR of 14.2% from 2023 to 2030. This growth is largely supported by increasing awareness amongst farmers regarding its benefits on soil health along with the central government’s push to organize the biofertilizers sector in the country by taking them under the purview of fertilizer regulations. Other government efforts contributing to the growth momentum include the provision of subsidies to farmers, the establishment of task forces aimed at easing logistical constraints and providing incentives/subsidies to manufacturers under its National Mission of Sustainable Agriculture

Key Companies & Market Share Insights

The market for biofertilizers is fragmented with a large number of domestic companies focusing on regional markets. The market leaders are companies that have initially established a significant presence in the global industry. In their quest to develop products with new natural ingredients, the companies have developed product formulations that are well-accepted and have established a significant geographical presence. With significant sales figures, they have cemented their position in the market for biofertilizers.

Emerging players in the market for biofertilizers have integrated manufacturing and distribution along with a focus on product innovation. The key companies have developed processes and formulated products to adopt the product differentiation strategy. These companies also work with farmers to develop customized products.

CBF China bio-fertilizer is one of the significant market players with a large geographical presence. The company has made significant inroads into China which has shown the potential to become a major market in the coming years. The significant investment in new product development and geographical expansion is expected to cement its market position. Some prominent players in the global biofertilizers market include:

-

CBF China Biofertilizers

-

Novozymes A/S

-

AgriLife

-

Mapleton Agri Biotec

-

Biomax

-

Rizobacter Argentina SA

-

Symborg S.L.

-

National Fertilizers Ltd.

-

Antibiotice S.A.

-

Lallemand Inc.

-

Labiofam SA

-

Sigma Agri-Science, LLC

-

Agrinos Inc.

-

Fertilizers USA LLC

-

Kiwa Bio-Tech Products Group Corporation

Biofertilizers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.66 billion

Revenue forecast in 2030

USD 3.9 billion

Growth Rate

CAGR of 12.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD Million, Volume in Kilotons and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company market positioning, competitive landscape, growth factors, and trends

Segments covered

Product, application, crop type, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina

Key companies profiled

CBF China Biofertilizers; Novozymes A/S; AgriLife; Mapleton Agri Biotec; Biomax; Rizobacter Argentina SA; Symborg S.L.; National Fertilizers Ltd.; Antibiotice S.A.; Lallemand Inc.; Labiofam SA; Sigma Agri-Science, LLC; Agrinos Inc.; Fertilizers USA LLC; Kiwa Bio-Tech Products Group Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase option

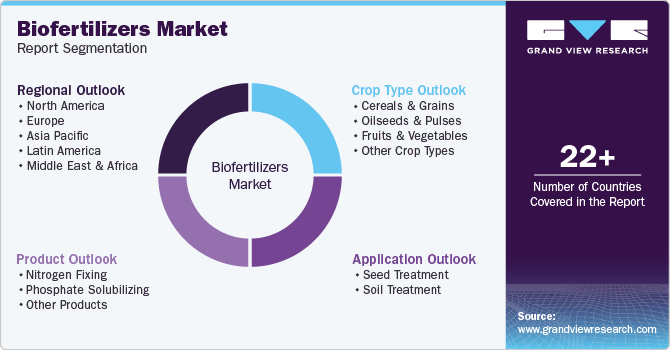

Global Biofertilizers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biofertilizers market report on the basis of product, crop type application and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nitrogen Fixing

-

Phosphate Solubilizing

-

Others

-

-

Application (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Seed Treatment

-

Soil Treatment

-

-

Crop Type (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global biofertilizers market size was estimated at USD 1.50 billion in 2022 and is expected to reach USD 1.66 billion in 2023.

b. The global biofertilizers market is expected to grow at a compound annual growth rate of 12.8% from 2023 to 2030 to reach USD 3.9 billion by 2030.

b. Seed treatment applications dominated the market with a share of 71.1% in 2022. This is attributable to the benefits of induced nutritional values in the seeds.

b. Some key players operating in the biofertilizers market include CCBF China Biofertilizers, Novozymes A/S, AgriLife, Mapleton Agri Biotec, Biomax, Rizobacter Argentina SA, Symborg S.L., National Fertilizers Ltd., Antibiotice S.A., Lallemand Inc., Labiofam SA, Sigma Agri-Science, LLC, Agrinos Inc., Fertilizers USA LLC, Kiwa Bio-Tech Products Group Corporation

b. Key factors that are driving the biofertilizers market growth include increasing awareness and adoption of organically produced food products across emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."