- Home

- »

- Automotive & Transportation

- »

-

Automotive Collision Repair Market Size, Share Report, 2030GVR Report cover

![Automotive Collision Repair Market Size, Share & Trends Report]()

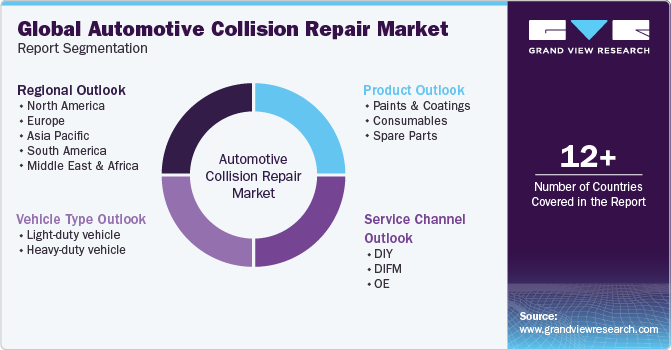

Automotive Collision Repair Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Paint & Coatings, Consumables), By Vehicle Type (Light-duty Vehicle, Heavy-duty Vehicle), By Service Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-444-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Collision Repair Market Summary

The global automotive collision repair market size was estimated at USD 199.56 billion in 2023 and is projected to reach USD 227.60 billion by 2030, growing at a CAGR of 1.9% from 2024 to 2030. The increase in the number of subscriptions of automobile insurance and technological advancements in the automobile sector are expected to further propel the market growth.

Key Market Trends & Insights

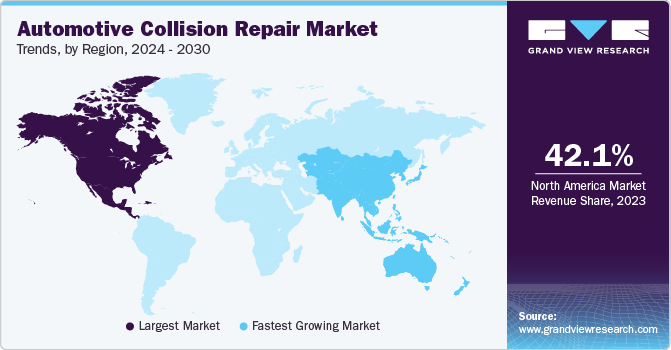

- North America accounted for a significant revenue share of the global market in 2023.

- The U.S. automotive collision repair market was valued at USD 36.66 billion in 2023.

- By product, the spare parts segment dominates the market, with a revenue share of 64.0% in 2023.

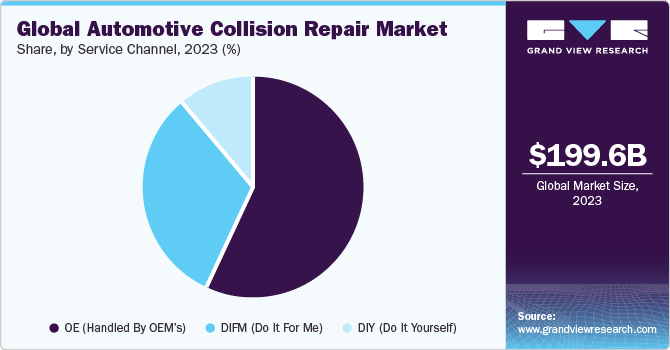

- By service channel, the OE (handled by OEM's) segment dominates the market in terms of revenue share in 2023.

- By vehicle type, the light-duty segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 199,56 Billion

- 2030 Projected Market Size: USD 227.60 Billion

- CAGR (2024-2030): 1.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growing number of road accidents and fatalities worldwide drives the market growth. Moreover, many automobile retailers sell Do-It-Yourself (DIY) kits to consumers who prefer to repair their cars at home without assistance. This trend is observed in many South American and Asia Pacific suburban parts.OEMs have developed several channels to distribute their branded parts to different service departments. The rising demand for hybrid and electric cars is expected to further increase the demand for specific tools and spare parts used in such vehicles. This is anticipated to improve the demand for the automotive collision repair. In addition, the vehicle owner is obligated to get a notice that the warranties that apply to the non-OEM and nonstandard parts will not be provided by the manufacturer of the vehicle but by the manufacturer or distributor of the parts.

Technological advancement has brought a number of benefits to the organizations. Furthermore, digitalization has allowed all of us to experience a more personalized service, quicker delivery, and instant access to support, thus enhancing automotive collision repair technology. There are a number of advantages associated with inspection and repair by a collision repair specialist. Furthermore, the collision repair specialist’s service is used to analyze vehicles’ problems and find the best solution possible with new parts with significant research. For instance, in July 2023, Palladium Equity Partners launched the Collision Auto Parts platform by acquiring NAP San Diego, National Auto Parts, USA, and National Auto Parts-Oakland. The company intends to utilize non-organic growth strategies to enhance the presence and product offerings of these entities, positioning itself as a prominent distributor of value-added collision repair parts.

The companies support customers from repairing and diagnosing issues on vehicles to provide and service preventative maintenance. Customers are often concerned about the vehicles after the collision and are unable to get specialist services at a low cost. Additionally, auto collision repair shops are equipped with modern repair equipment and staffed by collision repair experts. Automotive collision repair services have a number of disadvantages such as boosting car safety, maintaining the value of the vehicle, lowering the company’s cost, and others.

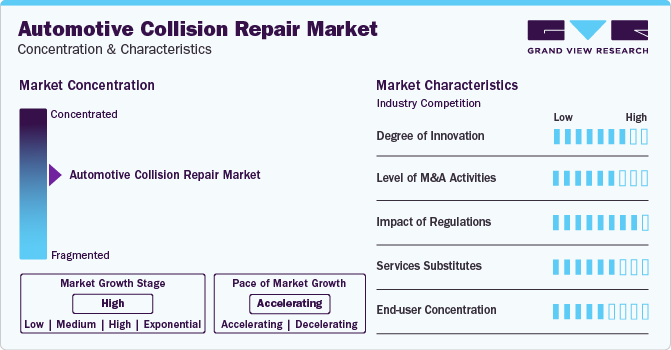

Market Concentration & Characteristics

The automotive collision repair market witnessed prominent innovations, steered by advancements in technology, materials, and repair processes. Repair shops are increasingly adopting advanced tools and techniques, such as paintless dent repair and augmented reality for diagnostics, to enhance the efficiency and quality of services.

The market also encounters a notable level of mergers and acquisitions (M&A) activities as companies seek strategic partnerships and acquisitions to enhance their solution & service portfolios, leverage synergies, and expand the channel reach in untapped markets across the regions.

The impact of regulatory compliance has a substantial influence on the automotive collision repair market. The stringent safety and environmental standards compel market companies to implement improved repair practices and materials used. Additionally, there is a growing focus on sustainable and eco-friendly repair solutions.

The end-user concentration in the market is notable, with some regions experiencing a more dispersed customer base and others with a higher concentration of consumers. While few major insurance companies and automotive manufacturers exert significant influence and shape collision repair industry dynamics through partnerships and collaborations.

Product Insights

The spare parts segment dominates the market, with a revenue share of 64.0% in 2023. The spare parts used in automobile service delivery include crash parts, repair materials, supplementary mechanical parts, restoration materials, and tools. The high number of road accidents leading to the damage of integral elements such as grilles, bumpers, fenders, dents, and scratches are fueling the demand for replacement spare parts. The increasing consumer awareness of the importance of maintenance and repair in improving vehicle performance and lifecycle is driving the growth of the spare parts segment.

The paints & coatings segment is expected to grow at the fastest CAGR of 2.7% from 2024 to 2030. The rapidly evolving paints & coatings technology, which meets the latest protective automobile materials and aesthetic demands, is the key reason for the growth of the segment in the automotive industry. Paints & coatings are anticipated to witness higher adoption in high-volume markets over the forecast period, owing to the surging environmental concerns about the use of detrimental synthetic coatings and refinishing materials. The paints and coatings segment is projected to grow steadily during the forecast period because of the environmental and health risks associated with automotive body paint materials.

Service Channel Insights

The OE (handled by OEM's) segment dominates the market in terms of revenue share in 2023. The DIY (Do It Yourself) segment, on the other hand, is expected to grow at the fastest CAGR of 2.5% from 2024 to 2030. Globally, people have been retaining their car usage for longer periods, which has supported the demand for replacement parts. The automotive collision repair industry will continue to significantly grow, which is attributed to its robust demand from emerging economies. The DIY segment is expected to grow at the highest CAGR in the Asia Pacific region from 2024 to 2030, followed by South America. Manufacturers in the automotive industry are gradually shifting their focus to vehicle modification, where they can customize the vehicle to meet the needs of the customer rather than purchasing new vehicles.

The future of the collision repair industry is with DIY kits. Thus, several companies have initiated the production of complete kits that provide DIY solutions to users. The increased preference of customers for warranty is one of the major factors that support the dominance of OE in the market. OEMs offer products with benefits such as longer product lifecycles, reliability, and better performance. The abovementioned factors are expected to strengthen the position of OEMs in the market from 2024 to 2030.

Vehicle Type Insights

The light-duty segment dominated the market in 2023. The light-duty vehicles segment comprises hatchbacks, sedans, SUVs, and crossover cars. The demand for alternative transportation options, government initiatives for improving fuel economy, and the availability of alternative fuel vehicles are expected to increase the sales of light-duty vehicles in the coming years. Furthermore, vehicle sales in the industry are anticipated to be primarily driven by the adoption of vehicles that require alternative fuels and vehicles with several levels of drivetrain electrification.

The heavy-duty vehicles segment is expected to grow at a CAGR of 1.5% from 2024 to 2030. The heavy-duty vehicles segment includes commercial and multi-axle vehicles such as trucks and buses. Heavy-duty vehicles are anticipated to be used for the transportation of bulk products within any country or region. Increasing trade activities are expected to augment the demand for heavy-duty vehicles equipped with the latest technologies for hauling and loading.

Regional Insights

North America accounted for a significant revenue share of the global market in 2023. The region has a higher technology adoption rate, which will result in the faster and higher adoption of hybrid electric automobiles in the region as compared to other geographies. Due to this trend, the region is anticipated to witness a growing proportion of specialized automotive collision repair centers that are dedicated to servicing the vehicles of a particular make, such as alternate fuel powered vehicles

U.S. Automotive Collision Repair Market Trends

The U.S. automotive collision repair market was valued at USD 36.66 billion in 2023. The U.S. market is undergoing a major transformation. This is due to two things: the increasing use of technology and the growing demand for convenient car repair services. As a result, many new businesses have started offering easy and accessible repair options, whether for everyday maintenance or after an accident.

Europe Automotive Collision Repair Market Trends

Europe dominated the global market in 2023. The region is expected to witness a steady CAGR from 2024 to 2030, owing to the penetration of vehicles with enhanced safety features and stagnated sales. Moreover, rising metal part replacements and damaged plastics are expected to boost the regional market growth.

The UK automotive collision repair market is adapting to a changing landscape. The rise of electric vehicles demands specialized repair expertise, while advancements like 3D printing and AI are streamlining processes. To stay competitive, shops are prioritizing customer experience with convenient booking and clear communication, while also embracing eco-friendly practices.

Asia Pacific Automotive Collision Repair Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 3.5% from 2024 to 2030. The increasing number of vehicle sales is leading to significant growth of the regional industry. An upsurge in vehicular damage due to lack of stringent driving regulations in Asia Pacific is further driving the regional market growth. The region is perceived to be a source of components for local companies and multinationals, who aim to supply low-cost components to prominent vehicle manufacturers.

The China automotive collision repair market is experiencing significant growth, propelled by rising vehicle ownership and an increase in traffic accidents. Factors such as expanding urbanization and disposable incomes are further boosting the market growth. Moreover, the government's focus on improving vehicle safety standards is influencing demand for high-quality collision repair.

Key Automotive Collision Repair Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is on developing new products and collaboration among the key companies. In February 2023, Classic Collision LLC, a U.S.-based auto repair center, acquired Gale’s Auto Body, a motor vehicle manufacturer in the Blaine. Through this acquisition, Classic Collision intends to extend its presence in Minnesota and provide improved customer service during the repair process.

Key Automotive Collision Repair Companies:

The following are the leading companies in the automotive collision repair market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Automotive Technology Products LLC (subsidiary of Lodi Group of Monterrey)

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

- Mann+Hummel Group

- Martinrea International Inc.

- Mitsuba Corporation

- Robert Bosch GmbH

- Takata Corporation ODU GmbH & Co.KG

Recent Developments

-

In July 2023- BMW North America joined Sustaining Partner Program by I-CAR. The program helps fund support initiatives and collision repair education that reduce training redundancies. It is also designed for partners to demonstrate advocacy and provide funding for industry-wide efforts by I-CAR.

-

In July 2023, Classic Collision announced the acquisition of the Dayton Collision Center in Dayton, Tennessee, enabling the company to expand its operations in the state. This follows the company’s successful operational expansion in other states, including Minnesota, Georgia, Texas, Colorado, and Florida, in 2023

-

In March 2023, DENSO Products and Services Americas, Inc. announced the expansion of its aftermarket ignition coils range with the addition of nine new part numbers covering over 9 million vehicles in operation. With this launch, DENSO has expanded its offering of high-quality replacement ignition coils for various Buick, BMW, Cadillac, GMC, Infiniti, Lincoln, Ford, Nissan, Chevrolet, and Volvo models

-

In September 2022, the Bosch Automotive Aftermarket division introduced several products for the workshop industry at the Automechanika trade fair. Notable ones included the DAS 3000 for precise calibration and adjustment of vehicle sensors & camera systems that support modern driver assistance systems; the DCU 120 diagnostic control unit for reliable and convenient mobile workshop usage; and the availability of ‘Bosch Automotive Training Solutions’ platform for planning and administering technical training courses, among others

-

In April 2022, 3M announced the acquisition of the technology assets of LeanTec, which provides digital inventory management solutions for the automotive aftermarket sector in the U.S. and Canada. The development showcases 3M’s commitment to its "connected bodyshop” platform, with LeanTec’s technology complementing ‘3M RepairStack Performance Solutions’, a hardware and software system that ensures on-hand material availability for reliable and safe repairs

Automotive Collision Repair Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 203.85 billion

Revenue forecast in 2030

USD 227.60 billion

Growth rate

CAGR 1.9% of from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Market revenue in USD billion & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle type, service channel, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; China; India; Japan; Brazil

Key companies profiled

3M; Automotive Technology Products LLC; Continental AG; Denso Corporation; Faurecia; Federal-Mogul LLC; Honeywell International, Inc.; International Automotive Components Group; Johnson Controls, Inc.; Magna International Inc.; Mann+Hummel Group; Martinrea International Inc.; Mitsuba Corporation; Robert Bosch GmbH; Takata Corporation ODU GmbH & Co.KG; QPC FIBER OPTIC, LLC; Smiths Interconnect; Souriau; Stäubli International AG; Stran Technologies; TE Connectivity; Teledyne Defense Electronics; TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION; X-BEAM TECH CO, LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Automotive Collision Repair Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive collision repair market report based on product, vehicle type, service channel,and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Paints & coatings

-

Consumables

-

Spare parts

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Light-duty vehicle

-

Heavy-duty vehicle

-

-

Service channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

DIY

-

DIFM

-

OE

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global automotive collision repair market size was estimated at USD 199.56 billion in 2023 and is expected to reach USD 203.85 billion in 2024.

b. The global automotive collision repair market is expected to grow at a compound annual growth rate of 1.9% from 2024 to 2030 to reach USD 227.60 billion by 2030.

b. In terms of market size, Europe dominated the automotive collision repair market with a revenue share of 42.0% in 2023. This is due to the stringency of roads and vehicle safety standards and increased demand for luxury vehicles.

b. Some key players operating in the automotive collision repair market include 3M; Automotive Technology Products LLC; Continental AG; Denso Corporation; Faurecia; Federal-Mogul LLC; Honeywell International, Inc.; and International Automotive Components Group.

b. Key factors that are driving the automotive collision repair market growth include advancements in auto parts fabrication and the surge in consumer and passenger automobile production.

b. In terms of market size, the spare parts segment dominated the automotive collision repair market with a revenue share of 64.0% in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.