- Home

- »

- Next Generation Technologies

- »

-

3D Printing Market Size And Share, Industry Report, 2033GVR Report cover

![3D Printing Market Size, Share & Trends Report]()

3D Printing Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Printer Type (Desktop 3D Printer, Industrial 3D Printer), By Technology, By Software, By Application, By Vertical, By Material, By Region, And Segment Forecasts

- Report ID: 978-1-68038-000-2

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printing Market Summary

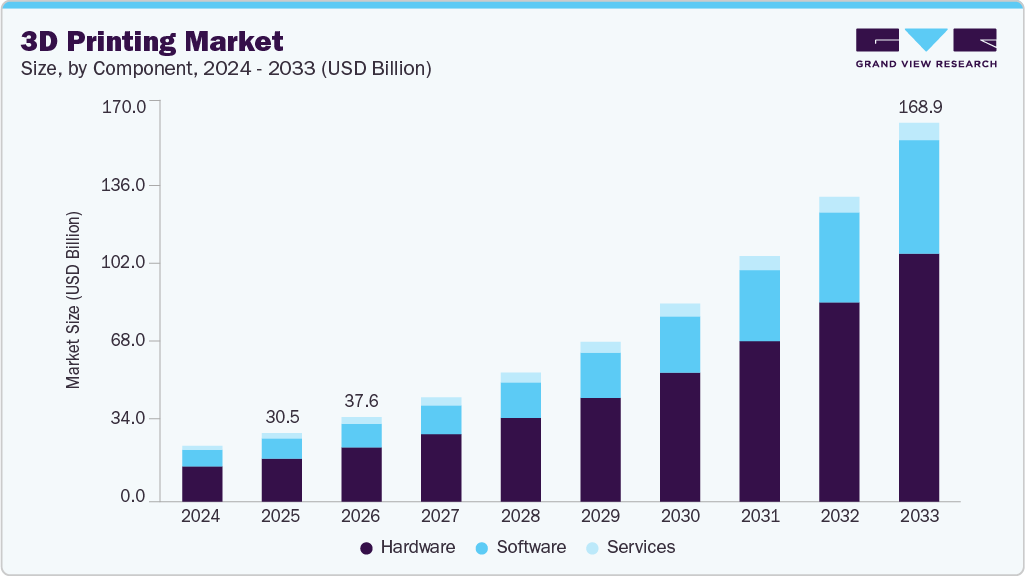

The global 3D printing market size was estimated at USD 30.55 billion in 2025 and is projected to reach USD 168.93 billion by 2033, growing at a CAGR of 23.9% from 2026 to 2033. The aggressive research & development in three-dimensional printing and the growing demand for prototyping applications from various industry verticals, particularly healthcare, automotive, and aerospace & defense, are expected to drive the growth of the market.

Key Market Trends & Insights

- North America dominated the 3D printing industry and accounted for a share of 32.8% in 2025.

- The 3D printing market in the U.S. held a dominant position in the region in 2025.

- Based on component, the hardware segment dominated the market in 2025 and accounted for the largest share of 62.6%.

- Based on technology, the stereolithography segment dominated the market in 2025.

- Based on software, the design segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 30.55 Billion

- 2033 Projected Market Size: USD 168.93 Billion

- CAGR (2026-2033): 23.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

A major driver of the industry is the increasing demand for customized products across industries such as healthcare, automotive, aerospace, and consumer goods. 3D printing enables highly tailored production without the cost and time constraints of traditional manufacturing methods. Companies can rapidly design and deliver unique parts, prototypes, or end-use products to meet customer-specific requirements. This shift toward personalization is pushing organizations to adopt additive manufacturing as a core part of their production strategy.

Continuous improvements in printer hardware, software, and printing materials are propelling market growth. Innovations such as multi-material printing, metal additive manufacturing, faster print speeds, and higher precision systems are expanding the capabilities of 3D printers. At the same time, the development of advanced materials, like high-performance thermoplastics, biocompatible resins, and lightweight metals is enabling 3D printing to be used in applications that require durability, flexibility, or medical compatibility. These advancements make 3D printing more efficient, scalable, and commercially viable.

Industries are increasingly integrating 3D printing into their production processes for rapid prototyping, tooling, and mass customization. Key sectors such as aerospace, automotive, and industrial machinery are adopting additive manufacturing to shorten development cycles. This technology enhances design flexibility and helps reduce costs compared to traditional manufacturing methods. The ability to create complex geometries and lightweight structures provides companies with a competitive advantage, driving deeper adoption of 3D printing in industrial workflows.

One of the key restraints in the industry is the high initial cost associated with advanced printers, materials, and skilled labor required for efficient operation. Many small and medium-sized enterprises find it challenging to justify these expenses, especially when transitioning from traditional manufacturing. Additionally, limitations in material availability, inconsistent product quality for certain applications, and slower production rates for large-scale manufacturing hinder widespread adoption. Regulatory hurdles, especially in highly controlled sectors like healthcare and aerospace, further slowdown commercialization, making market expansion more gradual than expected.

Component Insights

The hardware segment dominated the market in 2025 and accounted for the largest share of 62.6%. The hardware segment has benefited significantly from the rising need for rapid prototyping and advanced manufacturing practices. Its growth is driven by factors such as rapid industrialization, increasing penetration of consumer electronics, and expanding civil infrastructure. Additionally, rapid urbanization and optimized labor costs continue to strengthen demand for hardware solutions across industries.

The software segment is expected to witness the fastest CAGR over the forecast period. The segment growth is driven primarily by the growing need for advanced design, inspection, and scanning tools that optimize the additive manufacturing workflow. As 3D printing becomes more complex with multi-material, high-precision, and industrial-grade applications, companies increasingly rely on sophisticated software for CAD modeling, slicing, topology optimization, and real-time print monitoring. The integration of AI and machine learning into software platforms is further enhancing automation, improving print accuracy, reducing material waste, and minimizing errors, thereby driving segment growth.

Technology Insights

The stereolithography segment dominated the market in 2025.Stereolithography is one of the oldest and most established 3D printing technologies. While its advantages and operational simplicity continue to support its adoption, the technology landscape is rapidly evolving. Ongoing advancements and intensive R&D efforts are creating opportunities for more efficient and reliable alternative printing technologies.

The digital light processing (DLP) segment is expected to witness a notable CAGR over the forecast period. The segment’s growth is driven by its ability to deliver high-resolution prints with faster build speeds compared to traditional stereolithography. DLP uses a digital light projector to cure entire layers of photopolymer resin at once, enabling precise detailing and smoother surface finishes, making it ideal for applications in dentistry, jewelry, medical devices, and consumer products. Its efficiency, combined with lower maintenance requirements and improved material options, is attracting both small businesses and large manufacturers seeking cost-effective, high-quality additive manufacturing solutions.

Software Insights

The design software segment dominated the market in 2025. It is expected to continue dominating the market during the forecast period. Based on software, the 3DP industry has been segmented into design software, inspection software, printer software, and scanning software. Design software is used for constructing the designs of the object to be printed, particularly in automotive, aerospace and defense, construction, and engineering verticals. Design software acts as a bridge between the objects to be printed and the printer’s hardware.

The scanning software segment is expected to witness the fastest CAGR over the forecast period.The demand for scanning software is rising due to the increasing trend of scanning objects and storing their digital versions. This capability allows users to preserve high-quality scans of objects regardless of size or dimensions. As a result, the ability to reproduce these objects through 3D printing whenever needed is expected to drive strong growth in the scanning software segment over the forecast period.

Application Insights

The functional parts segment dominated the industry in 2025.Functional parts include smaller joints and other metallic hardware connecting components. The accuracy and precise sizing of these functional parts are of paramount importance while developing machinery and systems. The growth of the segment is driven by the rising demand for durable, end-use components across industries such as aerospace, automotive, healthcare, and industrial manufacturing.

The prototyping segment is expected to grow at a significant CAGR owing to an extensive adoption of the prototyping process across several industry verticals. The automotive, aerospace and defense verticals mainly use prototyping to design and develop parts, components, and complex systems precisely.Prototyping allows manufacturers to achieve higher accuracy and develop reliable end products. Hence, the prototyping segment is expected to continue dominating the market during the forecast period.

Vertical Insights

The automotive segment dominated the market in 2025. Based on vertical, the industry has been segmented into separate verticals for desktop and industrial 3D printing. The verticals considered for industrial 3DP comprise automotive, aerospace and defense, healthcare, consumer electronics, industrial, power and energy, and others. The aerospace and defense, healthcare, and automotive verticals are anticipated to contribute significantly to the growth of industrial additive manufacturing during the forecast period, owing to the active adoption of technology in various production processes associated with these verticals. In 3D printing in healthcare market, AM helps in the development of artificial tissues and muscles, which replicate the natural human tissues and can be used in replacement surgeries. These capabilities are expected to help in driving the adoption of 3DP across the healthcare vertical and contribute significantly to the growth of the industrial 3D printing market.

The verticals considered for desktop 3DP comprise educational purposes, fashion, jewelry, objects, dental, food, and others. The dental, fashion and jewelry, and food verticals are anticipated to contribute significantly to the growth of the desktop 3DP segment during the forecast period. The dental 3D printing segment dominated the market in 2025, and it is expected to continue dominating the market during the forecast period. The adoption of 3D printing in manufacturing imitation jewelry, miniatures, art and craft, and clothing and apparel is also gaining traction.

Material Insights

The metal segment dominated the 3D printing materials market in 2025.The metal material segment is experiencing strong growth in the 3D printing market as industries increasingly adopt metal additive manufacturing for high-performance and end-use applications. Metals such as titanium, stainless steel, aluminum, and nickel alloys are widely used due to their strength, durability, and heat resistance, making them ideal for aerospace, automotive, medical implants, and industrial tooling.The ability to produce complex geometries, lightweight structures, and customized metal components gives companies a significant competitive advantage over traditional manufacturing.

The polymer segment is expected to grow at a significant CAGR over the forecast period. The segment’s growth can be attributed to its affordability, versatility, and compatibility with a broad range of printing technologies such as FDM, SLA, and SLS. The polymer segment continues to expand as innovations in engineering-grade and high-performance polymers enhance durability, flexibility, chemical resistance, and temperature tolerance. With ongoing advancements in material formulations and the growing use of polymer 3D printing across industries, this segment is expected to remain dominant in both prototyping and production-grade applications.

Printer Type Insights

The industrial printer segment held the largest market share in 2025. The large share of industrial 3D printers can be attributed to the extensive adoption of industrial printers in heavy industries, such as automotive, electronics, aerospace and defense, and healthcare. Prototyping, designing, and tooling are some of the most common industrial applications across these industry verticals. Extensive adoption of 3D printing for prototyping, designing, and tooling is contributing to the growing demand from the industrial sector. Hence, the industrial printers segment is expected to continue dominating during the forecast period.

The desktop 3D printer segment is expected to grow at a significant CAGR during the forecast period. The adoption of desktop 3D printers was initially limited to hobbyists and small enterprises. However, they are being increasingly used for household and domestic purposes nowadays. The 3D printing education market, which comprises schools, educational institutes, and universities, is also deploying desktop printers for technical training and research purposes. Small businesses are particularly adopting desktop printers and diversifying their business operations to offer 3D printing and other related services. For instance, the concept of ‘fabshops’ is gaining popularity in the U.S. These fabshops offer on-demand 3D printing of parts and components as per the designs and requirements provided by the customers. Hence, the demand for desktop printers is expected to rise significantly during the forecast period.

Regional Insights

North America dominated the 3D printing industry and accounted for a share of 32.8% in 2025. This can be attributed to the extensive adoption of additive manufacturing in the region. North American countries, such as the U.S. and Canada, have been among the prominent and early adopters of these technologies in various manufacturing processes.

U.S. 3D Printing Market Trends

The 3D printing market in the U.S. held a dominant position in the region in 2025.The growth of the 3D printing market in the U.S. is propelled by the technology's ability to facilitate rapid prototyping and product development is driving adoption across various industries, including aerospace, automotive, healthcare, and consumer goods.

Europe 3D Printing Market Trends

The 3D printing market in Europe is expected to register a moderate CAGR from 2026 to 2033. The 3D printing market in Europe is growing due to strong manufacturing heritage, government support for innovation, collaboration between research institutions and companies, diverse industry adoption in aerospace, automotive, healthcare, and consumer goods, and increasing awareness of sustainability benefits.

The UK 3D printing market is expected to grow at a notable CAGR from 2026 to 2033. The 3D printing market in the UK is fueled by a robust ecosystem of startups and established players, supported by government funding for research and development, a strong focus on fostering innovation, and partnerships between academia and industry.

The 3D printing market in Germany held a substantial market share in 2025. The 3D printing market in Germany is growing due to its strong manufacturing industry, emphasis on precision engineering, robust research and development ecosystem, adoption by automotive and aerospace industries, and potential for personalized healthcare solutions.

Asia Pacific 3D Printing Market Trends

The 3D printing market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This rapid adoption of AM in the Asia Pacific can be attributed to the developments and upgrades across the manufacturing industry within the region. The Asia Pacific region is also emerging as a manufacturing hub for the automotive and healthcare industries. A stronghold on the production of consumer electronics, coupled with rapid urbanization, is also contributing to the region's rising demand for three-dimensional printing.

Japan 3D printing market is expected to grow at a significant growth rate during the forecast period. Japan's 3D printing market expansion is driven by a strong focus on innovation, particularly in sectors like automotive and electronics, coupled with significant investments in additive manufacturing technologies by both government and private entities.

The 3D printing market in China held a substantial market share in 2025. The growth of the 3D printing market in China is propelled by government initiatives promoting advanced manufacturing, substantial investments in research and development, and a burgeoning demand for customized products across various industries.

Key 3D Printing Company Insights

Key players operating in the 3D printing market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

- 3D Systems, Inc. is the U.S.-based technology company. The company is involved in the development of Desktop 3D printing products and services such as 3D printers, materials, software, 3D scanners and virtual surgical simulators and haptic design tools. Additionally, the company serves its customers with 3D solutions to manufacture and design complex and unique parts, produce parts locally to reduce the lead time, and eliminate expensive tooling, among others. The company caters to numerous industries and verticals such as aerospace & defense, automotive, healthcare, educational, durable goods, and entertainment.

- Materialise is a Belgium-based technology company operating in the additive manufacturing industry. The company is actively involved in the field of Desktop 3D printing to develop a broad range of software solutions, Desktop 3D printing services, and engineering. The company primarily caters to the industries such as healthcare, aerospace, automotive, consumer goods, and art & design.

Key 3D Printing Companies:

The following are the leading companies in the 3D printing market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Systems, Inc.

- Stratasys Ltd.

- Proto Labs, Inc.

- Materialise NV

- Nano Dimension Ltd.

- Shapeways, Inc.

- EOS (Electro Optical Systems) GmbH

- GE Additive

- HP Inc.

- Voxeljet AG

Recent Developments

-

In November 2025, BCN3D, Barcelona-based company unveiled the BCN3D Omega I60 G2, a 3D printer. The model features AI-powered XYZ calibration for improved print accuracy, redesigned G2 printheads, a 450 x 300 x 450 mm build volume, and a heated chamber equipped with an integrated camera for real-time monitoring. It also includes an active spool control system that automatically feeds or retracts material as needed, along with an upgraded feeder mechanism featuring three sensors for precise material flow.

-

In April 2025, Stratasys Ltd. introduced the Neo®800+, a next-generation stereolithography 3D printer designed for large-format, high-precision applications in the automotive, aerospace, and industrial sectors.

3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 37.64 billion

Revenue forecast in 2033

USD 168.93 billion

Growth rate

CAGR of 23.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, printer type, technology, software, application, vertical, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Singapore; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

3D Systems, Inc.; Stratasys Ltd.; Proto Labs, Inc.; Materialise NV; Nano Dimension Ltd.; Shapeways, Inc.; EOS (Electro Optical Systems) GmbH; GE Additive; HP Inc.; Voxeljet AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

3D Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global 3D printing market report based on component, printer type, technology, software, application, vertical, material, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Printer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Desktop 3D Printer

-

Industrial 3D Printer

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Stereolithography

-

Fuse Deposition Modeling

-

Selective Laser Sintering

-

Direct Metal Laser Sintering

-

Polyjet Printing

-

Inkjet printing

-

Electron Beam Melting

-

Laser Metal Deposition

-

Digital Light Processing

-

Laminated Object Manufacturing

-

Others

-

-

Software Outlook (Revenue, USD Million, 2021 - 2033)

-

Design Software

-

Inspection Software

-

Printer Software

-

Scanning Software

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Prototyping

-

Tooling

-

Functional Parts

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial 3D Printing

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Consumer Electronics

-

Power & Energy

-

Others

-

-

Desktop 3D Printing

-

Educational Purpose

-

Fashion & Jewelry

-

Objects

-

Dental

-

Food

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Polymer

-

Metal

-

Ceramic

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Singapore

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D printing market size was estimated at USD 30.55 billion in 2025 and is expected to reach USD 37.64 billion in 2026.

b. The global 3D printing market is expected to grow at a compound annual growth rate of 23.9% from 2026 to 2033 to reach USD 168.93 billion by 2033.

b. The metal segment dominated the market in 2025. The metal material segment is experiencing strong growth in the 3D printing market as industries increasingly adopt metal additive manufacturing for high-performance and end-use applications.

b. Some key players operating in the 3D printing market include 3D Systems, Inc., Stratasys Ltd., Proto Labs, Inc., Materialise NV, Nano Dimension Ltd., Shapeways, Inc., EOS (Electro Optical Systems) GmbH, GE Additive, HP Inc., and Voxeljet AG.

b. The aggressive research & development in three-dimensional printing and the growing demand for prototyping applications from various industry verticals, particularly healthcare, automotive, and aerospace & defense, are expected to drive the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.