- Home

- »

- Plastics, Polymers & Resins

- »

-

Automotive Plastics Market Size, Share, Trends Report, 2030GVR Report cover

![Automotive Plastics Market Size, Share & Trends Report]()

Automotive Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (ABS, PP, PU, PVC, PE, PC, PMMA, PA), By Process (Injection Molding, Blow Molding, Thermoforming), By Application, By Regions, And Segment Forecasts

- Report ID: 978-1-68038-193-1

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Plastics Market Summary

The global automotive plastics market size was estimated at USD 30.44 billion in 2023 and is projected to reach USD 43.77 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. The expansion of the market is being fueled by the increasing demand for lightweight materials in vehicle manufacturing, driven by the pursuit of enhanced fuel efficiency and reduced emissions.

Key Market Trends & Insights

- Asia Pacific dominated global automotive plastics market in 2023 with a market share of above 46.0%.

- Rapidly evolving automotive industry is driving the growth of automotive plastics market in China.

- By process, injection molding segment dominated in 2023 with a significant revenue share of above 56.0%.

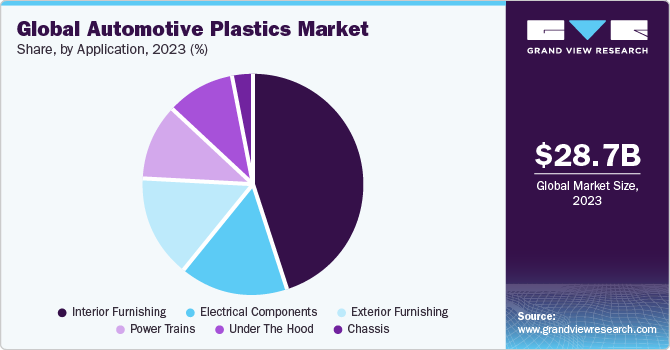

- By application, interior furnishing segment dominated for 2023 in terms of revenue share above 44.0%.

- By product, polypropylene (PP) resin segment dominated in 2023 with a significant revenue share of above 32.0%.

Market Size & Forecast

- 2023 Market Size: USD 30.44 Billion

- 2030 Projected Market Size: USD 43.77 Billion

- CAGR (2024-2030): 5.3%

- Asia Pacific: Largest market in 2023

Growing awareness of environmental sustainability is a key trend, pushing automakers toward eco-friendly and recyclable plastic solutions. Additionally, advancements in polymer technology and a rising focus on interior aesthetics are expected to contribute to the projected growth of the market. The rapidly evolving automotive industry in China is driving the demand for automotive plastics, as manufacturers strive to comply with environmental standards and governmental regulations pertaining to vehicle weight and emission levels. Plastics are increasingly being utilized in vehicles to reduce weight, promote fuel savings, and enhance efficiency.

The market in China is also poised to benefit from the government's substantial subsidies to manufacturers and favorable discounts and incentives for customers who purchase electric cars. This trend is particularly promising, given the rising popularity of electric vehicles and their potential to revolutionize the automotive industry.

China is extremely rich in resources, such as petrochemical reserves, and is characterized by the availability of highly skilled labor. Major automotive plastics players are shifting their manufacturing facilities to China on account of rising demand for the product coupled with a favorable business environment.

Market Concentration & Characteristics

Market growth stage is high, and pace of market growth is accelerating owing to moderately consolidated market. Automotive plastic manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, new product launches, production expansion, among others.

The global Automotive Plastics Market is marked by the significant level of innovation, as plastics are witnessing an increasing demand owing to their properties, including lightweight, versatility, and flexibility, which allow technological innovations and design freedom. These properties provide technological innovation with cost-efficiency and sustainability. Also, as the automotive industry navigates economic challenges and cost pressures, thermoforming remains a key component in the quest for efficient and economical manufacturing solutions, ensuring continued growth and innovation within the automotive plastics market.

Furthermore, the impact of regulations on market have been medium as vehicle weight regulations and standardization of emission norms are anticipated to impact the market growth positively and Favorable federal regulations laid down by agencies such as the Environmental Protection Agency (EPA) and National Highway Traffic Safety Administration (NHTSA) regarding carbon emissions, along with the EU initiatives to develop plastics applications for the creation of light and fuel-efficient cars, are likely to boost the growth of the global market.

In addition to that, End-user concentration is a significant factor market. Since there is a diverse end-user base with varying degrees of concentration. Understanding these demographics and their motivations is crucial for manufacturers and retailers to develop effective marketing strategies and target specific customer segments.

Product Insights

Polypropylene (PP) resin dominated product segmentation in 2023 with a significant revenue share of above 32.0%. The product finds application in both rigid and flexible packaging owing to its physical and chemical properties. PP offers excellent chemical and electrical resistance at very high temperatures. It is semi-rigid, translucent, and provides integral hinge property. PP is quite light weighted as compared to other plastics and is widely used in automotive sector.

Followed by polyvinyl chloride (PVC) at a market revenue share of above 18.0% in 2023. Polyvinyl Chloride (PVC) is a prominent automotive plastic, playing a crucial role in enhancing the durability and functionality of various vehicle components. PVC is widely used in automotive interiors for manufacturing dashboards, door panels, and seat coverings, due to its exceptional resistance to wear, chemicals, and sunlight. Its ability to withstand harsh environmental conditions makes it a preferred choice for exterior applications as well, including window seals, weather stripping, and under-the-hood components.

Process Insights

Injection molding dominated process segmentation in 2023 with a significant revenue share of above 56.0%. This plastic is one of the most used methods for molding plastic in the automobile industry. It involves pumping molten plastic material under intense pressure into a metal mold to create personalized plastic parts and fittings. The injection molding technique has become increasingly important in the mass manufacture of intricate plastic molds due to modern improvements aimed at reducing error rates.

The volatile prices of key raw materials such as ethylene, benzene, styrene, and propylene as well as growing environmental concerns regarding their disposal, are likely to hamper growth in the adoption of injection molding process over the forecast period. Companies are focused on developing injection molded plastics using bio-based counterparts to address these challenges.

Application Insights

Interior furnishing dominated application segmentation for 2023 in terms of revenue share above 44.0%. Automotive plastics find extensive use in car interiors, encompassing body and light panels, seat covers, steering wheels, and fascia systems. High-performance plastics like GMT and ABS composites are increasingly replacing traditional rubber, metal, and other materials in the construction of internal components such as load floors, seat bases, rear package shelves, and headliners.

Rising digitalization has fostered the demand for automotive electronics integrated into car dashboards with highly advanced technology & features. Safety concerns and high electrical insulation properties of plastics have fostered their demand for such instrument panels containing advanced electronic systems.

Exterior furnishings represent a crucial aspect where plastics, such as polycarbonate and polypropylene, play a significant role in improving the visual appeal and functionality of vehicles. Plastics offer a lightweight alternative to traditional materials, contributing to improved fuel efficiency and overall vehicle performance. From sleek body panels to durable bumpers, plastics are pivotal in creating exterior components that not only enhance the aesthetic appeal of automobiles but also provide crucial impact resistance and durability in various weather conditions. The versatility of plastics allows for innovative designs and intricate detailing in exterior furnishings, contributing to the dynamic and ever-evolving landscape of automotive aesthetics.

Vehicle Type Insights

Passenger cars dominated the global automotive plastics market in 2023, with growth driven by recovery of the global production environment, as well as rising sales of electric vehicles. The shift from combustion engines to electric motors has drastically changed the architecture & platform framework of passenger car manufacturing. This has led to a shift in demand patterns of plastics.

Automotive OEMs are increasing procuring plastics that present higher thermal insulation properties, are lightweight, and demonstrate higher tolerance to wear & tear. These requirements from OEMs are paving way for the development of new plastics grades and also changing the point-of-applications of plastics to better suit the electric vehicle architecture.

Regional Insights

Asia Pacific dominated global automotive plastics market in 2023 with a market share of above 46.0% and is characterized by the availability of cheap labor, land, and resources. The growing automotive industry, especially in emerging economies such as India, China, Vietnam, Indonesia, and Thailand, is expected to positively influence the growth of automotive plastics market over the forecast period.

Expanding manufacturing base and increasing investments in technological advancements pertaining to vehicle production process are expected to positively influence the automotive sector. Automotive plastics exhibit superior properties including toughness, recyclability, durability, thermal stability, design flexibility, corrosion resistance, and resilience, as well as are lightweight. These plastics are widely used in automobiles in exterior, interior, chassis, and engine components to reduce the overall weight of the vehicle, thereby increasing fuel efficiency.

Rapidly evolving automotive industry in China is driving the demand for automotive plastics, as manufacturers strive to comply with environmental standards and governmental regulations pertaining to vehicle weight and emission levels. Plastics are increasingly being utilized in vehicles to reduce weight, promote fuel savings, and enhance efficiency. The market in China is also poised to benefit from the government's substantial subsidies to manufacturers and favorable discounts and incentives for customers who purchase electric cars. This trend is particularly promising, given the rising popularity of electric vehicles and their potential to revolutionize the automotive industry.

China Automotive Plastics Market

Rapidly evolving automotive industry is driving the growth of automotive plastics market in China, as manufacturers strive to comply with environmental standards and governmental regulations pertaining to vehicle weight and emission levels. Plastics are increasingly being utilized in vehicles to reduce weight, promote fuel savings, and enhance efficiency. The market in China is also poised to benefit from the government's substantial subsidies to manufacturers and favorable discounts and incentives for customers who purchase electric cars. This trend is particularly promising, given the rising popularity of electric vehicles and their potential to revolutionize the automotive industry.

Europe Automotive Plastics Market

The demand for plastics in automotive applications is characterized by the presence of globally leading automotive OEMs in the region and heavy R&D activities undertaken by these entities. As one of the automotive innovation hubs, the region dictates the trajectory of plastics usage patterns in the manufacturing of various components. In 2023, the region’s automotive production increased by 7%, momentarily indicating a rebound after multiple disruptions in the form of pandemic-induced lockdowns, chip shortages, regional conflicts, and disturbances in maritime trade routes; however, emergence of Asia Pacific as a key production base and weaker macroeconomic indicators paints a grim picture of the future demand for automotive polymers in the region. Europe accounted for over 30% of the global automotive plastics market revenue in 2023, with its market share expected to decline over the forecast period.

Key Companies & Market Share Insights

Most of key players operating in market have integrated their raw material and distribution operations to maintain additive quality and expand their regional presence. This provides companies a competitive advantage in form of cost benefits, thus increasing profit margins. Companies are undertaking research and development activities to develop new industrial plastics to sustain market competition and changing end-user requirements.

Research activities focused on development of new materials, which combine several properties, are projected to gain wide acceptance in this industry in coming years. Furthermore, active players implement strategic initiatives for maintaining competitive environmental. For instance, in March 2023, BASF SE partnered with Zhejiang REEF Technology to create advanced recyclate formulations for the automotive, packaging, and consumer sectors. BASF will provide IrgaCycle solutions and technical assistance for recycled polymer formulations, which will be tested at BASF's facilities.

Key Automotive Plastics Companies:

- Akzo Nobel N.V.

- BASF SE

- Covestro AG

- Evonik Industries AG

- Adient plc

- Magna International, Inc.

- Momentive Performance Materials, Inc.

- SABIC

- Dow, Inc.

- Borealis AG

- Hanwha Azdel Inc.

- Grupo Antolin

- Lear Corporation

- Owens Corning

- Quadrant AG

- Royal DSM N.V.

- TEIJIN LIMITED

Recent Developments

-

In June 2023, Borealis AG acquired Rialti S.p.A., a leading polypropylene (PP) compounding company specializing in recyclates in the Varese region of Italy. This strategic move enhances Borealis' position by adding substantial expertise and production capacity to its PP compounding business. The acquisition specifically emphasizes expanding the volume of PP compounds derived from mechanical recyclates. The increased capacity is expected to fortify Borealis' specialized and circular portfolios. This enables the company to respond effectively to growing market demands for an extensive array of sustainable and high-performance solutions.

-

In May 2023, Lear, a leading automotive technology company, intends to establish a connection systems facility in Morocco dedicated to producing components for automakers, suppliers, and its E-systems and seating units.

-

In November 2022, Covestro AG and HASCO Vision partnered to recycle post-industrial plastics. Covestro collects used plastics from HASCO's production facilities, transforms them into high-quality post-industrial recycled polycarbonates and polycarbonate blends, and then provides them to HASCO to manufacture new automotive components.

Automotive Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.63 billion

Revenue forecast in 2030

USD 43.77 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in kilotons, revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, process, application, vehicle type and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Southeast Asia; Australia; Malaysia; Brazil

Key companies profiled

Akzo Nobel N.V.; BASF SE; Covestro AG; Evonik Industries AG; Adient plc; Magna International, Inc.; Momentive Performance Materials, Inc.; SABIC; Dow, Inc.; Borealis AG; Hanwha Azdel Inc.; Grupo Antolin; Lear Corporation; Owens Corning; Quadrant AG; Royal DSM N.V.; TEIJIN LIMITED

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Plastics Market Report Segmentation

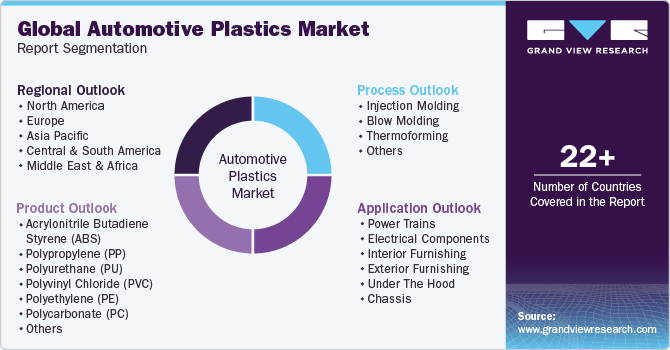

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Automotive Plastics market report based on product, process, application, vehicle type and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylonitrile butadiene styrene (ABS)

-

Polypropylene (PP)

-

PP LGF 20

-

PP LGF 30

-

PP LGF 40

-

Others

-

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Rigid PVC

-

Flexible PVC

-

-

Polyethylene (PE)

-

High-density Polyethylene (HDPE)

-

Other PE Grades

-

-

Polybutylene Terephthalate (PBT)

-

Polycarbonate (PC)

-

Polymethyl methacrylate (PMMA)

-

Polyamide (Nylon 6, Nylon 66)

-

Others

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Blow Molding

-

Thermoforming

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powertrains

-

Electrical Components

-

Interior Furnishing

-

IMD or IML

-

Others

-

-

Exterior Furnishing

-

Under the hood

-

Chassis

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Internal Combustion Engine (ICE) Vehicles

-

Electric Vehicles

-

Battery Electric Vehicles (BEV)

-

Plug-in Hybrid Electric Vehicles (PHEV)

-

Fuel Cell Electric Vehicles (FCEV)

-

-

-

Light Commercial Vehicles

-

Medium & Heavy Commercial Vehicles

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive plastics market size was estimated at USD 30.44 billion in 2023 and is expected to reach USD 31.63 billion in 2024.

b. The global automotive plastics market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 43.44 billion by 2030.

b. The polypropylene segment led the global automotive plastics market and accounted for the largest revenue share of more than 32.30% in 2023.

b. The injection molding segment led the global automotive plastics market and accounted for the largest revenue share of more than 56.15% in 2023.

b. The interior furnishings segment led the global automotive plastics market and accounted for the largest revenue share of more than 44.25% in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.