- Home

- »

- Advanced Interior Materials

- »

-

Injection Molding Market Size, Share, Industry Report, 2033GVR Report cover

![Injection Molding Market Size, Share & Trends Report]()

Injection Molding Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Plastics, Metals), By Application (Packaging, Consumables & Electronics, Automotive & Transportation), By Region And Segment Forecasts

- Report ID: GVR-4-68039-916-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Injection Molding Market Summary

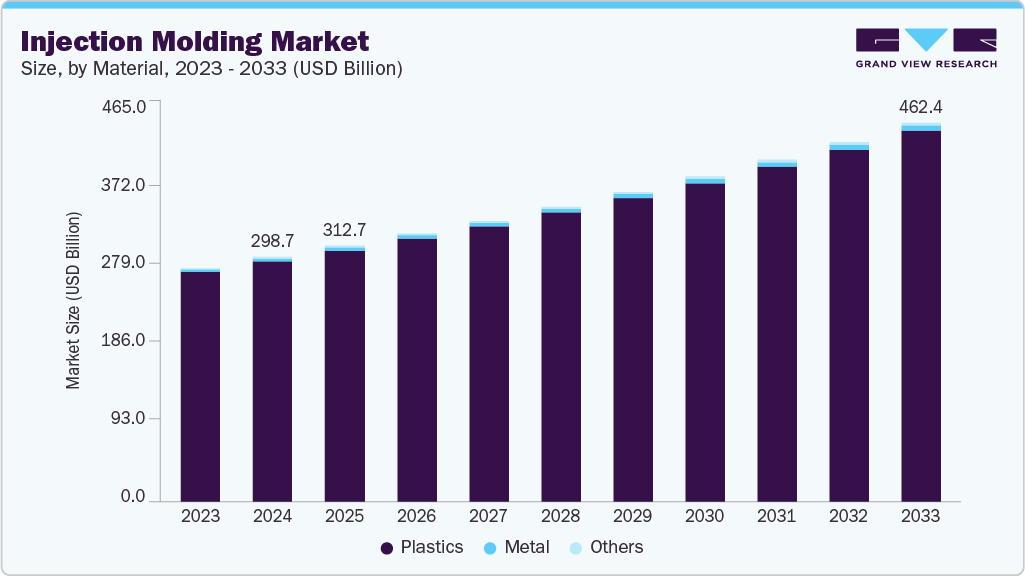

The global injection molding market size was estimated at USD 298,717.5 million in 2024 and is projected to reach USD 462,437.7 million, growing at a CAGR of 5.0% from 2025 to 2033. The growing demand for lightweight and durable plastic products across the automotive, packaging, and consumer goods sectors is fueling the injection molding market.

Key Market Trends & Insights

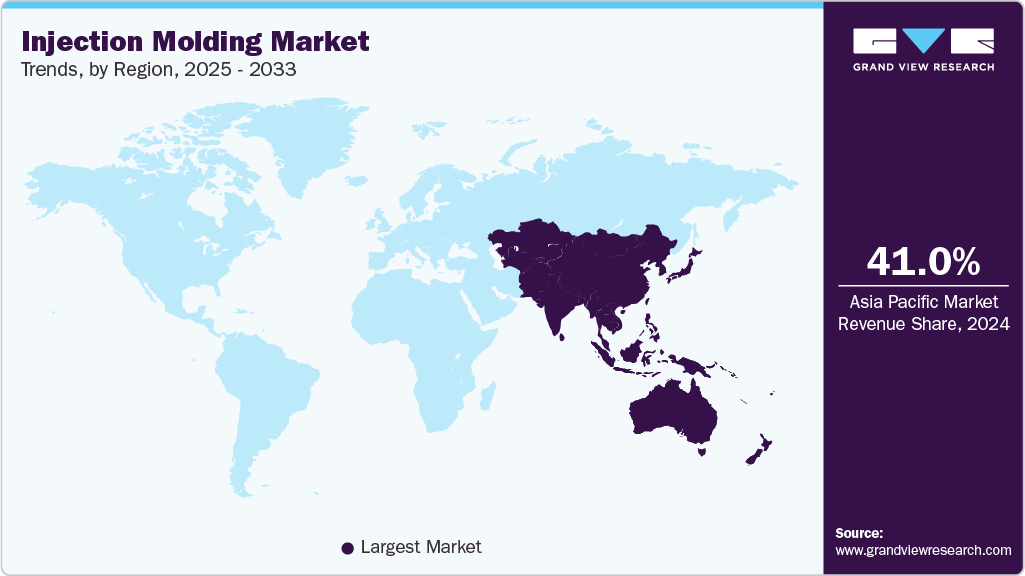

- Asia Pacific dominated the injection molding market with the largest revenue share of 41.0% in 2024.

- The injection molding market in the India is expected to grow at a substantial CAGR of 6.3% from 2025 to 2033.

- By material, the metal segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By application, the medical equipment segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 298,717.5 Million

- 2033 Projected Market Size: USD 462,437.7 Million

- CAGR (2025-2033): 5.0%

- Asia Pacific: Largest market in 2024

Advancements in high-precision molding technology allow manufacturers to produce complex components efficiently. Rising adoption of automation and robotics in production lines enhances speed and reduces labor costs.

Increasing use of bio-based and recycled plastics supports sustainability initiatives, driving market growth. The expansion of end-use industries in emerging economies boosts the demand for cost-effective molding solutions. Continuous innovation in materials, including engineering plastics, enables versatile product applications. Growing e-commerce and packaging requirements further create a steady demand for injection-molded components globally.

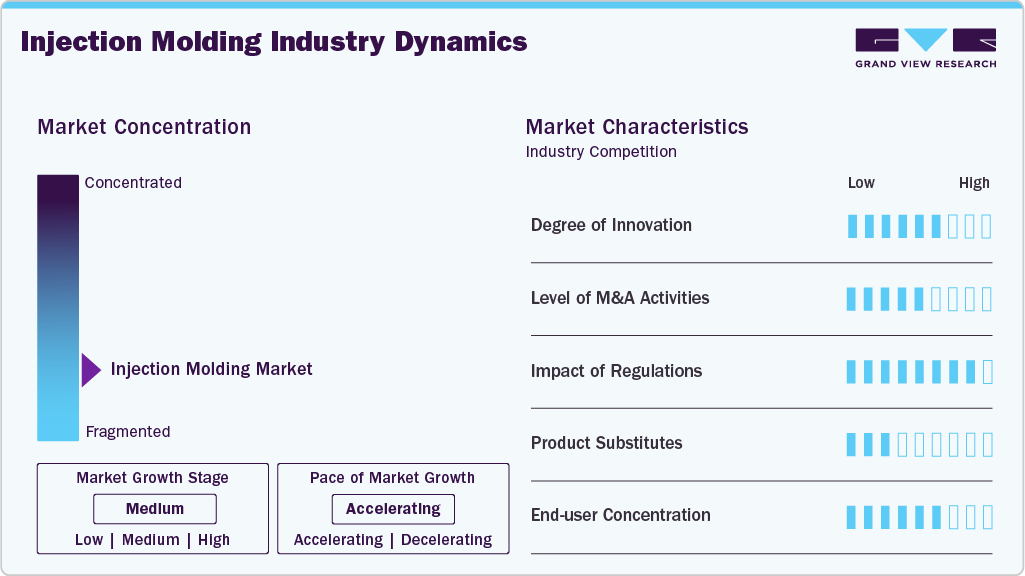

Market Concentration & Characteristics

The global injection molding machine market is highly fragmented, with a large number of regional and international players competing across different geographies. While a few leading companies hold notable shares through advanced technology, global distribution networks, and strong brand recognition, the presence of numerous small and medium-sized manufacturers intensifies competition. This results in a diverse and fragmented industry landscape, where innovation, pricing, and service capabilities play critical roles in market positioning.

The injection molding industry demonstrates a moderate to high degree of innovation, driven by advancements in automation, robotics, and precision molding technologies. Companies continuously develop new materials, energy-efficient processes, and complex product designs. Innovations in additive manufacturing and smart factory integration are also shaping the market. This focus on R&D enables manufacturers to meet evolving customer demands and industry standards.

The market experiences a steady level of mergers and acquisitions, primarily aimed at expanding product portfolios, geographic reach, and technological capabilities. Leading players often acquire specialized firms to enhance their expertise in medical, automotive, or high-precision molding segments. These transactions strengthen competitive positioning and operational efficiency. M&A activity also accelerates market consolidation in key regions.

Strict regulatory standards, particularly in the medical, pharmaceutical, and food packaging sectors, heavily influence market operations. Compliance with ISO, FDA, and REACH regulations is essential for product approval and market entry. Companies must invest in certified facilities, quality control, and documentation processes. Regulatory oversight ensures product safety but can increase operational complexity and costs.

Drivers, Opportunities & Restraints

Rising demand for lightweight, durable, and cost-effective plastic products across automotive, packaging, and consumer goods sectors fuels market growth. Advancements in precision molding, automation, and robotics improve production efficiency and quality. Expansion in emerging economies drives regional demand for injection-molded components. Sustainability initiatives, including recycled and bio-based plastics, further support industry adoption.

Growing applications in medical devices, electronics, and high-tech industries present new revenue streams. Integration of Industry 4.0 technologies, smart factories, and additive manufacturing opens avenues for innovation. Increasing e-commerce and packaging needs create a steady demand for molded components. Strategic partnerships, collaborations, and expansion in untapped markets provide growth potential.

High initial investment and operational costs for advanced machinery can limit market entry for smaller players. Fluctuating raw material prices and supply chain disruptions affect production stability. Stringent regulatory compliance, especially in the medical and food sectors, increases operational complexity. Environmental concerns and pressure to reduce plastic waste pose challenges to sustainable growth.

Material Insights

Plastics remain the dominant material in injection molding and accounted for a 98.2% share in 2024, due to their lightweight, versatile, and cost-effective properties. They are widely used across automotive, packaging, consumer goods, and medical sectors. Advanced polymers and engineered plastics allow for complex designs and high-performance applications. Ongoing innovations in recyclable and bio-based plastics further strengthen their market position.

Metal injection molding (MIM) is emerging as the fastest-growing segment, driven by demand for high-strength, precision components. It is increasingly applied in medical devices, electronics, and aerospace industries. MIM enables complex shapes and high-volume production with excellent dimensional accuracy. Growth is supported by technological advancements and increasing adoption in specialized applications.

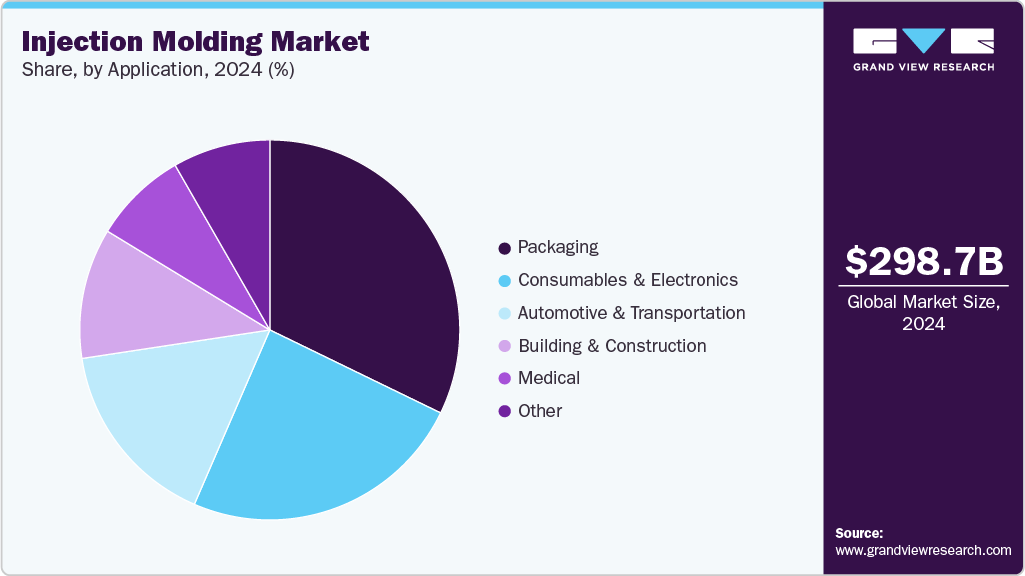

Application Insights

Packaging remains the largest application segment in injection molding and accounted for a 32.2% share in 2024, driven by demand for lightweight, durable, and cost-effective solutions. Plastics are extensively used for food, beverage, and consumer product packaging. High-speed production and customizable designs make injection molding ideal for mass-market packaging needs. Sustainability trends, including recyclable and biodegradable materials, further support this segment.

The medical sector is the fastest-growing application area due to the increasing demand for precision components and disposable devices. Injection molding is widely used for syringes, diagnostic devices, surgical instruments, and drug delivery systems. Regulatory compliance, biocompatible materials, and high-quality standards drive specialized production. Technological advancements and rising healthcare expenditure continue to fuel growth in this segment.

Regional Insights

North America growing at a significant CAGR of 4.2% in the injection molding market, driven by high-precision manufacturing and technological innovation. Strong demand from the medical, automotive, and packaging industries supports market expansion. Adoption of automation and smart factory solutions enhances production efficiency. Strict regulatory standards ensure quality and reliability in manufactured components.

U.S. Injection Molding Market Trends

The U.S. dominates the North American injection molding market and accounted for 81.7% share, due to advanced manufacturing infrastructure and technological expertise. Strong demand from automotive, medical, and packaging sectors drives production. High adoption of automation and precision molding enhances efficiency and quality. Regulatory compliance and innovation in materials further strengthen market leadership.

Mexico is experiencing significant growth as a manufacturing hub for cost-effective injection-molded components. Expansion in automotive, electronics, and consumer goods industries fuels regional demand. Proximity to the U.S. market supports exports and supply chain integration. Investments in modern facilities and skilled labor contribute to steady market expansion.

Europe Injection Molding Market Trends

Europe’s market grows due to advanced engineering capabilities and a focus on sustainable production practices. The automotive and medical device sectors are key contributors to demand. Investment in Industry 4.0 technologies and high-quality manufacturing drives competitiveness. Regulatory compliance and innovation in materials further support growth.

Germany dominates the European injection molding market due to its strong industrial base and advanced engineering capabilities. High demand from the automotive, medical, and packaging sectors drives production. Investment in automation, precision molding, and Industry 4.0 technologies enhances efficiency and product quality. Regulatory standards and innovation in materials further reinforce Germany’s market leadership.

Italy is experiencing steady growth in injection molding, supported by the automotive, consumer goods, and packaging industries. Small and medium-sized enterprises play a key role in regional production. Adoption of modern manufacturing technologies improves productivity and precision. Government support and increasing exports contribute to Italy’s expanding market presence.

Asia Pacific Injection Molding Market Trends

Asia Pacific is the dominating region and accounts for 41.0% share in 2024 of the global injection molding market, driven by strong industrial growth, large-scale manufacturing, and a growing automotive and consumer goods sector. Countries like China and India drive demand with cost-effective production capabilities and abundant labor. Rapid urbanization and expanding infrastructure further boost market growth. Advanced manufacturing technologies and government support also reinforce the region’s dominance.

China dominates the Asia Pacific injection molding market due to its large-scale manufacturing capabilities and cost-effective production. Strong demand from the automotive, electronics, and consumer goods sectors drives growth. Rapid industrialization and urbanization further boost the need for molded components. Investments in advanced machinery and automation enhance efficiency and product quality.

India is witnessing significant growth in injection molding, driven by expanding automotive, packaging, and consumer goods industries. Increasing foreign investment and the establishment of modern manufacturing facilities support market expansion. Adoption of advanced technologies, including automation and precision molding, improves productivity. Rising domestic demand and exports contribute to India’s growing market presence.

Middle East & Africa Injection Molding Market Trends

The Middle East and Africa market is growing due to industrialization, energy, and the construction sector demand. Healthcare and automotive applications are driving the adoption of molded components. Investment in automation and advanced manufacturing enhances production efficiency. Regional infrastructure development and industrial diversification support market growth.

Saudi Arabia dominates the Middle East & Africa injection molding market due to rapid industrialization and investments in advanced manufacturing. Strong demand from the construction, automotive, and energy sectors drives growth. Adoption of automation and precision molding technologies enhances production efficiency. Government initiatives and infrastructure development further support market expansion in the region.

Latin America Injection Molding Market Trends

Latin America shows increasing demand driven by industrial expansion and rising consumer product consumption. Automotive and packaging industries are major end-users of injection-molded components. Investments in modern facilities and machinery improve production capacity. The region benefits from growing urbanization and supportive government initiatives.

Brazil dominates the Latin American injection molding market due to its well-established industrial base and strong manufacturing capabilities. High demand from the automotive, packaging, and consumer goods sectors fuels market growth. Investment in modern machinery and automation enhances production efficiency and product quality. Supportive government policies and growing domestic consumption further strengthen Brazil’s market position.

Key Injection Molding Company Insights

Some of the key players operating in the market include C&J Industries, All-Plastics, and Biomerics.

-

C&J Industries specializes in high-precision plastic injection molding and contract manufacturing, serving diverse sectors such as medical devices, pharmaceuticals, telecommunications, industrial, consumer products, and transportation. The company is FDA registered and ISO 13485:2016 certified, ensuring compliance with stringent medical device manufacturing standards. Their capabilities include high cavitation molds, overmolding, and complex assemblies, catering to both low and high-volume production needs. C&J Industries also offers comprehensive services like product validation, sterilization packaging, and cleanroom manufacturing. Their expertise extends to producing components like syringes, bone graft filters, and pipette holders, demonstrating versatility across various applications.

-

All-Plastics is a Texas-based custom injection molder focusing on precision and scientific molding techniques. The company serves key industries including pharmaceuticals, medical devices, industrial, consumer products, and packaging. Their services encompass product and mold design, prototyping, tool building, and precision molding, utilizing advanced technologies like RJG eDART Quality Molding. All-Plastics has enhanced its capabilities with the addition of new injection molding machines, robots, and a white room for micro-component molding. The company emphasizes cost-effective solutions and on-time delivery, aiming to reduce manufacturing costs while improving product quality.

Key Injection Molding Companies:

The following are the leading companies in the injection molding market. These companies collectively hold the largest market share and dictate industry trends.

- C&J Industries

- All-Plastics

- Biomerics

- HTI Plastics

- The Rodon Group

- EVCO Plastics

- Majors Plastics, INC

- Proto Labs

- Tessy Plastics

- Currier Plastics, Inc.

- Formplast GmbH

- H&K Müller GmbH & Co. KG

- Hehnke GmbH & Co KG

- TR PLAST GROUP

- D&M Plastics, LLC

Recent Developments

-

In May 2025, HTI Plastics will showcase its pharmaceutical injection molding expertise at CPHI North America 2025. The company specializes in high-precision, quality components for pharmaceutical applications. Their services include design, prototyping, and manufacturing of critical drug delivery and medical device parts. Attendees can visit Booth 1741 to explore HTI Plastics’ advanced capabilities.

-

In April 2025, C&J Industries increased its medical-grade plastic injection molding capacity by adding a 12,000-square-foot Class 8 cleanroom. The facility features all-electric Toshiba molding presses and automated 3-axis robots for efficient production and inspection. This expansion significantly boosts the company’s ability to supply high-quality medical components to meet growing demand.

-

In October 2024, Biomerics launched Metal Injection Molding (MIM) services, offering precision metal components for medical devices. The company provides end-to-end solutions, from design and prototyping to full-scale production. This expansion enhances quality, reduces lead times, and strengthens Biomerics’ capabilities for the medical industry.

Injection Molding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 312,660.6 million

Revenue forecast in 2033

USD 462,437.7 million

Growth rate

CAGR of 5.0% from 2024 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE.

Key companies profiled

C&J Industries; All-Plastics; Biomerics; HTI Plastics.; The Rodon Group; EVCO Plastics; Majors Plastics, INC; Proto Labs; Tessy Plastics; Currier Plastics, Inc.; Formplast GmbH; H&K Müller GmbH & Co. KG; Hehnke GmbH & Co KG; TR PLAST GROUP; D&M Plastics, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Injection Molding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global injection molding market report based on material, application and region.

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Metal

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Consumables & Electronics

-

Automotive & Transportation

-

Building & Construction

-

Medical

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global injection molding market size was estimated at USD 298,717.5 million in 2024 and is expected to be USD 312,660.6 million in 2025.

b. The global injection molding market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 462,437.7 million by 2033.

b. Plastics remain the dominant material in injection molding and accounted for 98.2% share in 2024, due to their lightweight, versatile, and cost-effective properties. They are widely used across automotive, packaging, consumer goods, and medical sectors. Advanced polymers and engineered plastics allow for complex designs and high-performance applications.

b. Some of the key players operating in the global injection molding market include C&J Industries, All-Plastics, Biomerics, HTI Plastics., The Rodon Group, EVCO Plastics, Majors Plastics, INC, Proto Labs, Tessy Plastics, Currier Plastics, Inc., Formplast GmbH, H&K Müller GmbH & Co. KG, Hehnke GmbH & Co KG, TR PLAST GROUP, D&M Plastics, LLC.

b. Rising demand for high-performance, durable, and lightweight chemical-resistant components drives market growth. Advancements in precision molding, automation, and specialized materials enhance efficiency and product quality. Expanding applications across automotive, healthcare, and industrial sectors further fuel global adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.