- Home

- »

- Smart Textiles

- »

-

Ballistic Protective Equipment Market, Industry Report, 2033GVR Report cover

![Ballistic Protective Equipment Market Size, Share & Trends Report]()

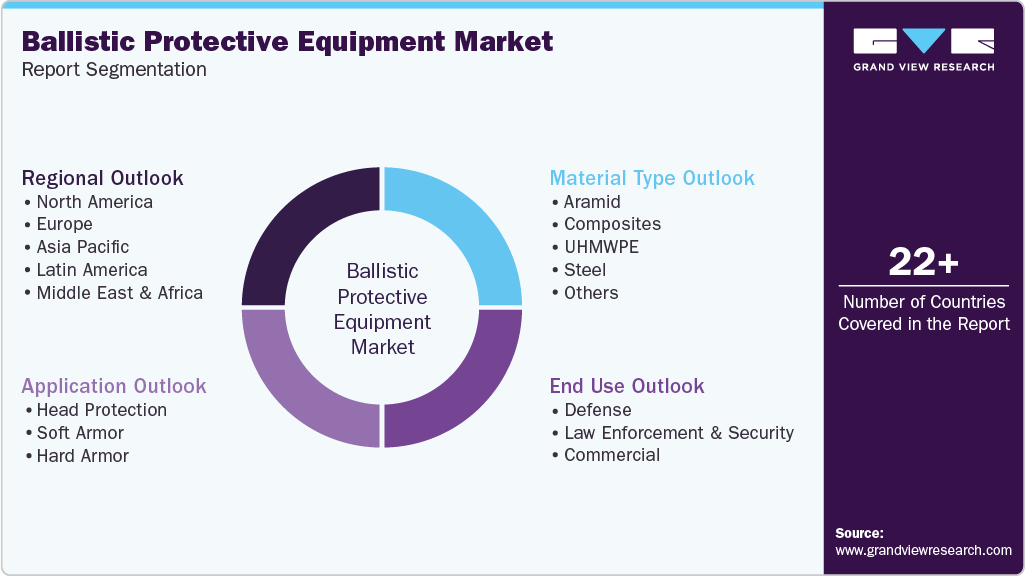

Ballistic Protective Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Head Protection, Soft Armor, Hard Armor), By Material (Aramid, Composites, UHMWPE, Steel), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-242-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ballistic Protective Equipment Market Summary

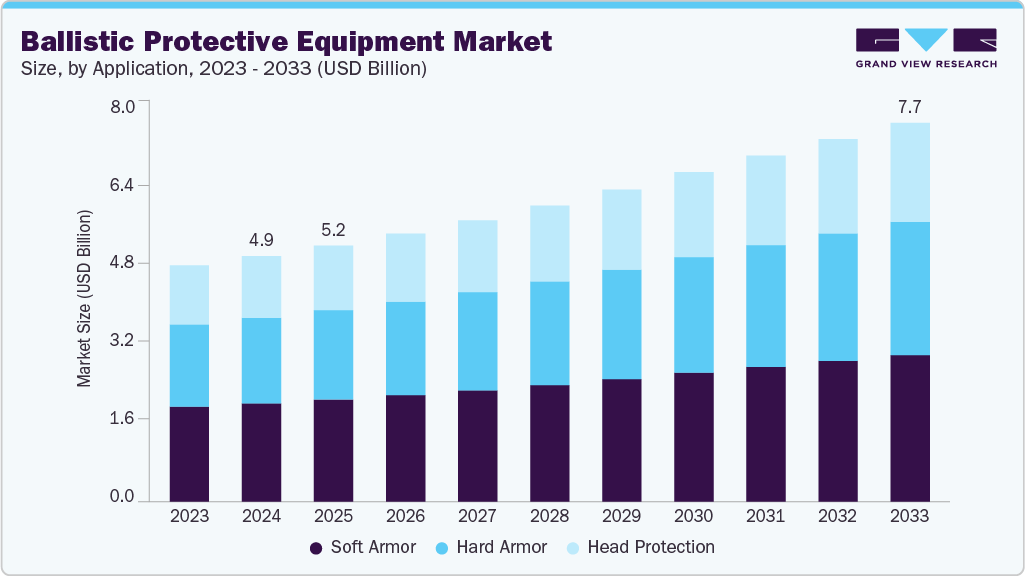

The global ballistic protective equipment market size was estimated at USD 4,990.6 million in 2024 and is projected to reach at USD 7,701.0 million by 2033, growing at a CAGR of 5.0% from 2025 to 2033. The market is experiencing steady growth, driven by rising demand from sectors such as defense, law enforcement, and security agencies worldwide.

Key Market Trends & Insights

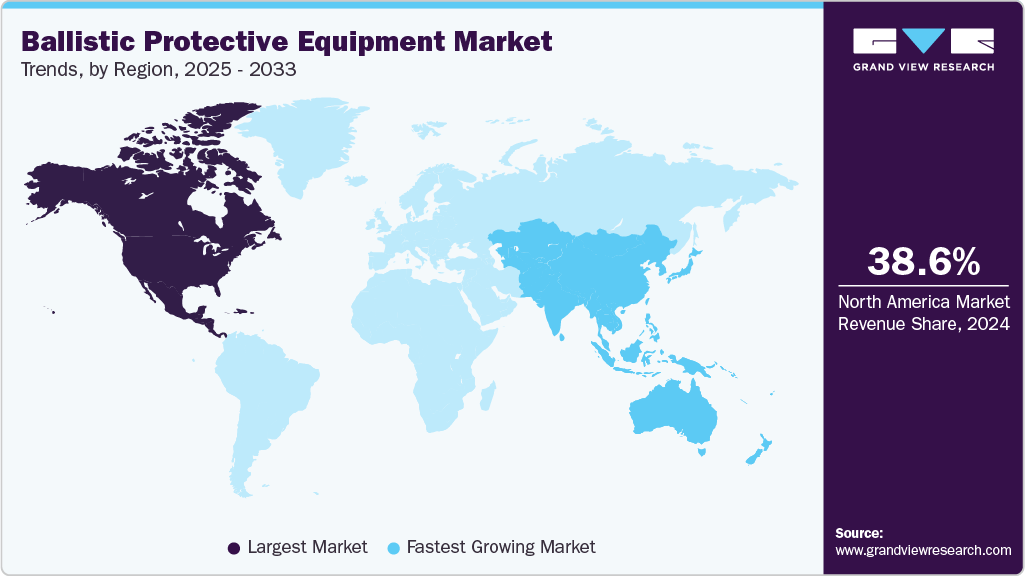

- North America dominated the ballistic protective equipment market with the largest revenue share of approximately 38.6% in 2024.

- By application, the soft armor segment captured the largest share of the global ballistic protective equipment market in 2024.

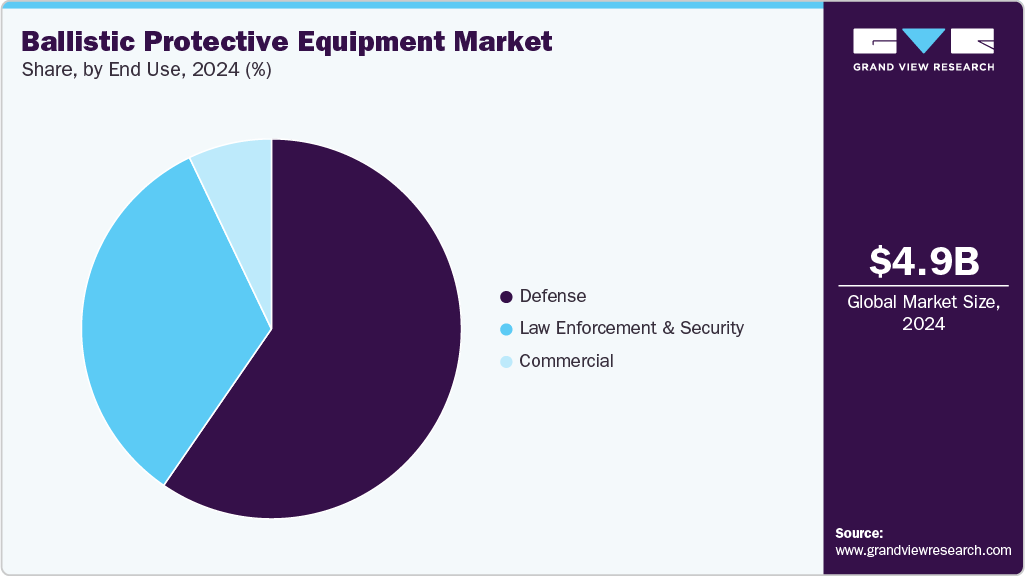

- By end use, the defense segment dominated the market in 2024 with a 59.5% share.

- Based on material, the aramid segment accounted for a market share of 33.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,990.6 Million

- 2033 Projected Market Size: USD 7,701.0 Million

- CAGR (2025-2033): 5.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Ongoing geopolitical tensions, increasing investments in modernization of protective gear, and the need for lightweight, high-performance materials are fueling market expansion. Organizations are increasingly prioritizing ballistic equipment upgrades to enhance personnel safety and operational efficiency.

Another significant driver of the ballistic protective equipment market is the increasing preference for technologically advanced and lightweight protective gear. Manufacturers are introducing next-generation materials such as ultra-high-molecular-weight polyethylene (UHMWPE) and aramid composites that offer superior ballistic resistance while reducing soldier fatigue. In addition, modernization programs across defense and law enforcement sectors emphasize equipment upgrades to meet evolving threat profiles. The demand for modular, multifunctional, and ergonomic designs aligns with operational flexibility and enhanced tactical performance.

Market Concentration & Characteristics

The global ballistic protective equipment market is moderately fragmented, with a range of multinational corporations and numerous regional manufacturers and suppliers. While larger companies command notable market shares due to their R&D capabilities and extensive distribution, many small and medium-sized firms contribute to localized customization and innovation.

This competitive landscape fosters continuous application advancements, price competitiveness, and tailored solutions addressing specific end use needs across defense, law enforcement, and commercial security segments. Innovation in material science and digitized manufacturing processes drives new application introductions, although large-scale application upgrades are mostly led by industry leaders. Regional specialization and compliance with local ballistic standards further diversify the market.

Government and international regulations significantly impact the ballistic protective equipment market. Standards set by agencies such as the U.S. National Institute of Justice (NIJ) and NATO define performance criteria that manufacturers must meet, influencing application design and lifecycle.

Increased enforcement of protection standards in military and law enforcement procurement incentivizes ongoing upgrades and modernization of ballistic gear. Regulatory pressure also encourages the adoption of environmentally safer materials and manufacturing processes. Non-compliance with these evolving standards can limit application acceptance and restrict sales, particularly in global markets with stringent certification requirements

Drivers, Opportunities & Restraints

The demand for lightweight, flexible, and high-performance ballistic protective equipment in defense and law enforcement is a crucial growth driver. Rising global security concerns and ongoing conflicts intensify the need for effective personal protection. Technological advancements in composite materials and modular armor systems further augment this demand by enhancing comfort and operational capabilities.

There are growing prospects in emerging economies investing in defense modernization and security infrastructure. Adoption of next-generation materials such as UHMWPE and hybrid composites presents manufacturers with innovation opportunities. Integration of smart sensors and IoT-enabled status monitoring in ballistic gear is an emerging trend, potentially transforming maintenance and operational efficiencies. Expanding private security sectors and demand for civilian protection in high-risk regions also offer notable market potential.

High costs of advanced ballistic materials and application technologies can limit accessibility, especially for smaller law enforcement agencies and commercial enterprises. Complex certification processes and regional regulatory disparities may delay application introductions. Supply chain challenges for specialty raw materials and geopolitical uncertainties can restrict timely deliveries and procurement cycles.

Application Insights

The soft armor segment captured the largest share of the global ballistic protective equipment market in 2024, accounting for 40.0% share. Its dominance is underpinned by widespread adoption across defense, law enforcement, and private security sectors. Soft armor’s lightweight, flexible design makes it highly suitable for extended wear in urban policing, routine law enforcement duties, and crowd control, as well as among private security operators.

The head protection segment is expected to grow at a significant CAGR of 5.5% from 2025 to 2033 in terms of revenue. Head protection, encompassing advanced ballistic helmets, is expected to gain strong growth momentum amid defense modernization and urban counterterrorism operations. The proliferation of modular communication systems, integrated heads-up displays, and adaptable accessories is raising the value proposition of new-generation helmets. Adoption is also expanding among specialized police and tactical teams, driven by increased awareness of brain injury risks in dynamic combat and riot-control scenarios.

Material Insights

The aramid segment accounted for a market share of 33.4% in 2024, maintaining its relevance due to its tensile strength and widespread deployment in both soft and hard armor configurations. Its durability, combined with excellent resistance to impact and penetration, ensures aramid remains a trusted material for protective equipment across military, law enforcement, and security applications. However, the transition toward lighter-weight, multi-hit capable solutions is fueling rapid adoption of UHMWPE, especially for military contracts and high-mobility tactical units.

The UHMWPE segment is gaining rapid traction in the ballistic protective equipment market, driven by its exceptional lightness and strength, which enhance user mobility without sacrificing protection. Military and law enforcement agencies increasingly prefer UHMWPE-based armor for its superior multi-hit resistance, durability, and comfort during extended operations.Advancements in manufacturing processes are making these materials more accessible and cost-effective, further accelerating adoption.

End Use Insights

The defense segment dominated the market in 2024 with a 59.5% share, as ongoing military modernization and active global conflicts drive procurement of large volumes of ballistic protective equipment. Ongoing investment in upgrading soldier kits, along with changing multi-threat demands, maintains strong demand for advanced and emerging defense markets.

Law enforcement & security is the fastest-growing segment in the ballistic protective equipment market in 2024. Rising civil unrest, elevated urban crime rates, and the increasing frequency of domestic counterterrorism initiatives propel this rapid expansion. Consequently, governments and private security entities are prioritizing the enhanced protection of personnel, which has led to greater deployment of ballistic equipment-including body armor, helmets, and shields-to police forces, border control units, and special response.

Regional Insights

The North America ballistic protective equipment market dominated the global revenue share in 2024 accounting for 38.6% of the share. The market is anticipated to achieve steady growth through the forecast period due to persistent investments in defense modernization, large-scale law enforcement procurement, and heightened focus on domestic security infrastructure. Demand remains robust across both U.S. and Canada, with procurement cycles responding to upgrades in military and police protective gear, ongoing technological improvements, and increasing requirements for advanced modular systems.

U.S. Ballistic Protective Equipment Market Trends

U.S. remains the global leader in the ballistic protective equipment market, driven by high defense budgets, large-scale military modernization, and substantial law enforcement procurement. Market growth is supported by consistent government initiatives for upgrading personal protection of both military and police forces, strong domestic manufacturing, and a robust innovation landscape focused on lighter, modular, and high-performance gear.

Europe Ballistic Protective Equipment Market Trends

Europe is poised for steady growth in the ballistic protective equipment market, driven by stringent safety regulations, NATO modernization programs, and increased demand from law enforcement and special forces. The Russia-Ukraine war has significantly accelerated defense spending and procurement across the region, further boosting market momentum. Furthermore, urban security initiatives, cross-border cooperation, and the adoption of next-generation materials continue to support growth.

Germany ballistic protective equipment market is expected to exhibit robust growth due to heightened defense and security investment, modernization of armed and police forces, and the adoption of advanced material technologies. The market is characterized by strong regulatory frameworks, a competitive industrial base, and development of export-oriented protective solutions. Rising concerns over regional security and participation in multinational peacekeeping initiatives further accelerate demand. Projections indicate a consistent and healthy annual growth trajectory for Germany’s ballistic protection industry.

The ballistic protective equipment market in the UK is expanding notably, propelled by increased political unrest, higher defense spending, and investments in advanced personal protective gear for both military and specialized law enforcement units. Market momentum is supported by modernization programs, contracts for state-of-the-art ballistic systems, and growing civilian security needs. The UK is emphasizing supplier collaboration and continual innovation to satisfy stringent safety regulations in defense and homeland security applications.

Asia Pacific Ballistic Protective Equipment Market Trends

The Asia Pacific ballistic protective equipment market is forecast to be the fastest-growing regional market, fueled by rising defense budgets, extensive police modernization across emerging economies, and a growing emphasis on equipping personnel with lightweight, high-performance body armor. The shift toward localized manufacturing and operational readiness continues to drive strong demand in countries such as China, India, and South Korea.

China ballistic protective equipment market is experiencing strong growth, driven by rapid military modernization, expansion of law enforcement agencies, and rising demand for advanced protective material in response to regional security challenges. Significant government investment in soldier survivability, R&D in next-generation materials, and aggressive scaling of domestic production fuel the market. Local manufacturers benefit from public procurement programs and growing internal demand across defense, police, and commercial sectors.

Ballistic protective equipment market in India continues to expand, fueled by rising defense expenditures ongoing border tensions, and the modernization of both military and paramilitary forces. The need for ballistic protection is propelled by internal security issues, insurgency, and terrorism threats, prompting continual upgrades in protective equipment for armed personnel. The emergence of domestic manufacturers and incentives for local procurement align with government priorities for self-reliance and export growth, supporting a dynamic market environment.

Middle East & Africa Ballistic Protective Equipment Market Trends

The Middle East & Africa region is expected to maintain a positive growth trajectory in the ballistic protective equipment market, driven by persistent geopolitical tensions, including the Iran-Israel and Israel-Palestine conflicts. Ongoing defense procurement cycles and rising urban security threats continue to fuel demand. Regional conflicts and international donor-backed stabilization efforts further reinforce investments in multi-threat protection for military, law enforcement, and border security forces.

Saudi Arabia ballistic protective equipment market is experiencing substantial expansion as defense and law enforcement agencies prioritize personnel safety amid evolving regional security threats. Investments in advanced body armor, vehicle protection, and tactical gear are prevalent, with a focus on lightweight, multi-level protective solutions. The sector is characterized by collaboration with global suppliers and efforts to localize key aspects of protective material, ensuring resilience and capability growth within the Kingdom’s security strategy.

Latin America Ballistic Protective Equipment Market Trends

The Latin American market is experiencing stable growth, supported by the expansion of public security programs and a gradual modernization of defense infrastructure. Regional instability and increased attention to peacekeeping, border security, and counter-crime efforts continue to encourage investment in body armor and protective solutions for both state forces and private security sectors.

The Brazil ballistic protective equipment market is supported by increasing investments in defense infrastructure, modernization of law enforcement agencies, and government initiatives targeting organized crime and urban violence. Growing civilian demand for personal protection in high-risk areas and opportunities for local manufacturing encourage sustained market expansion. Challenges include regulatory compliance and workforce specialization, but the sector is positioned for solid growth as national security priorities advance.

Ballistic Protective Equipment Company Insights

Some of the key players operating in the market include Atlas Copco, OTC Industrial Technologies, and United Rental Inc.

-

BAE Systems is a prominent player in the ballistic protective equipment market, known for producing lightweight, high-performance body armor used extensively by the U.S. military, with over 1.25 million hard armor inserts delivered since 1998. The company continuously innovates to reduce weight while maintaining superior ballistic protection, exemplified by its latest contracts for advanced torso and side body armor plates.

-

Honeywell International Inc. is a diversified American multinational conglomerate headquartered in Charlotte, North Carolina. The company stands out for its development of advanced ballistic materials such as Gold Shield and Spectra Shield, which provide multi-threat protection in vests and helmets. Honeywell’s materials are widely recognized for combining high durability with lightweight comfort, driving innovation in soldier and law enforcement protective gear worldwide.

Key Ballistic Protective Equipment Companies:

The following are the leading companies in the ballistic protective equipment market. Collectively, they hold the largest market share and dictate industry trends.

- Seyntex N.V.

- BAE Systems, Plc

- Rheinmetall AG

- Honeywell International, Inc.

- Point Blank Enterprise, Inc.

- Morgan Advanced Materials

- ArmorSource LLC

- Craig International Ballistics

- Survitec Group Ltd

- Safe Life Defense

- Tactical Assault Gear (TAG)

- Hellweg International Pty. Ltd

- MKU Limited

- Mehler Vario System

Recent Developments

-

In January 2024, DuPont and Point Blank Enterprises formed an exclusive partnership to offer body armor made with DuPont Kevlar EXO fiber, designed specifically for North American state and local law enforcement. Kevlar EXO is a breakthrough aramid fiber that provides an exceptional balance of lightweight, flexibility, and high-level ballistic protection, improving comfort and mobility without sacrificing safety. This collaboration allows the creation of body armor that meets the latest stringent NIJ standards while offering better fit and flexibility, helping officers perform more effectively.

-

In November 2023, MKU Limited unveiled its Kavro Doma 360 ballistic helmet. MKU claims this helmet offers excellent protection against lethal rifles. It can also be customized with various accessories like night vision devices, communication equipment, and masks, enhancing its functionality for diverse operational needs.

Ballistic Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,205.2 million

Revenue forecast in 2033

USD 7,701.0 million

Growth rate

CAGR of 5.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Application, material, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Poland; Russia; Ukraine; China; Japan; India; Australia; South Korea; Taiwan; Singapore; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Qatar; Israel

Key companies profiled

Seyntex N.V.; BAE Systems, Plc; Rheinmetall AG; Honeywell International, Inc.; Point Blank Enterprise, Inc.; Morgan Advanced Materials; ArmorSource LLC; Craig International Ballistics; Survitec Group Ltd; Safe Life Defense; Tactical Assault Gear (TAG); Hellweg International Pty. Ltd; MKU Limited; Mehler Vario System

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ballistic Protective Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ballistic protective equipment market report based on application, material, end use and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Head protection

-

Soft armor

-

Hard armor

-

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Aramid

-

Composites

-

UHMWPE

-

Steel

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Defense

-

Law enforcement & security

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Poland

-

UK

-

Russia

-

Ukraine

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Taiwan

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Qatar

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global ballistic protective equipment market size was estimated at USD 4,990.6 million in 2024 and is expected to reach USD 5,205.2 million in 2025.

b. The global ballistic protective equipment market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 7,701.0 million by 2033.

b. The North America ballistic protective equipment market led the market in 2024 accounting for 38.6% in 2024, driven by increased defense spending and rising demand for advanced protective gear across military and law enforcement sectors. Technological advancements and heightened security concerns further bolster market expansion in the region.

b. Some of the key players operating in the ballistic protective equipment market include Seyntex N.V., BAE Systems, Plc, Rheinmetall AG, Honeywell International, Inc., Point Blank Enterprise, Inc., Morgan Advanced Materials, ArmorSource LLC, Craig International Ballistics, Survitec Group Ltd, Safe Life Defense, Tactical Assault Gear (TAG), Hellweg International Pty. Ltd, MKU Limited, and Mehler Vario System.

b. Increasing concerns about improving army survival are expected to benefit market growth. Additionally, rising defense spending as a result of expanding regional economies, as well as increased competition among governments to demonstrate their power, are expected to fuel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.