- Home

- »

- Plastics, Polymers & Resins

- »

-

Ultra-high Molecular Weight Polyethylene Market Report, 2030GVR Report cover

![Ultra-high Molecular Weight Polyethylene Market Size, Share & Trends Report]()

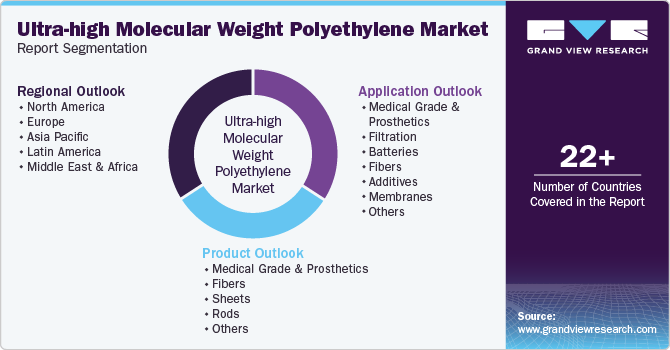

Ultra-high Molecular Weight Polyethylene Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Medical Grade & Prosthetics, Fibers, Sheets, Rods, Others), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-506-9

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ultra-high Molecular Weight Polyethylene Market Summary

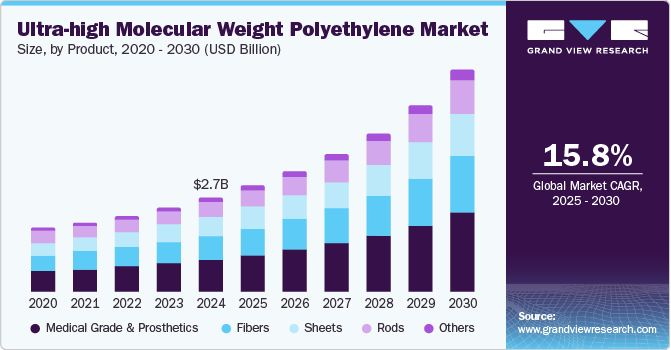

The global ultra-high molecular weight polyethylene market size was valued at USD 2.69 billion in 2024 and is projected to reach USD 6.31 billion by 2030, growing at a CAGR of 15.8% from 2025 to 2030. Significant utilization of the thermoplastic polymer in industries such as automotive, manufacturing, medical equipment, mining, and recreational equipment is primarily driving the growth. It is extensively used for making conveyor belt components, gear, guidelines, wear plates, cutting boards, seals, and others.

Key Market Trends & Insights

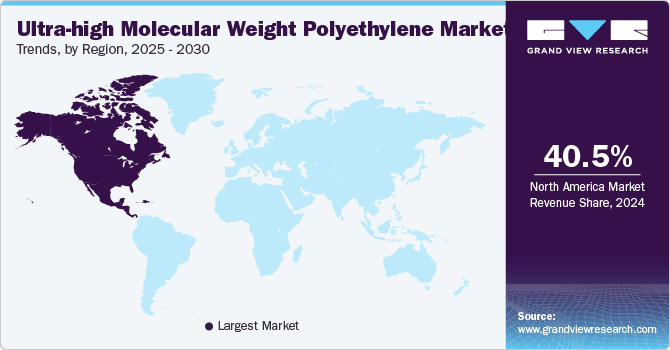

- North America led the ultra-high molecular weight polyethylene led with a revenue share of 40.5% in 2024.

- Asia Pacific ultra-high molecular weight polyethylene industry is expected to grow at the fastest CAGR from 2024 to 2030.

- By product, the medical grade & prosthetics segment held the largest revenue share of 34.3% in 2024.

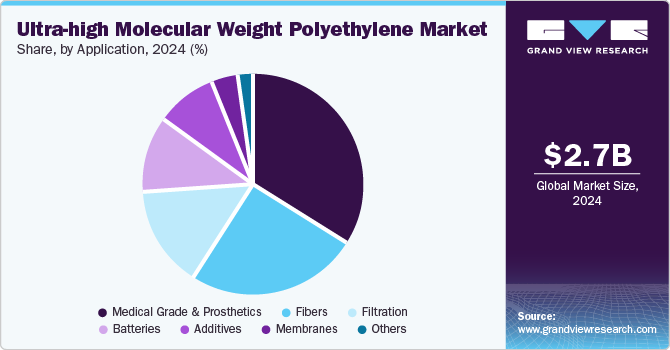

- By application, the medical grade & prosthetics applications segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.69 Billion

- 2030 Projected Market Size: USD 6.31 Billion

- CAGR (2025-2030): 15.8%

- North America: Largest market in 2024

An increasing number of market participants from the chemical industry are entering the ultra-high molecular weight polyethylene market (UHMWPE) manufacturing business, considering the lucrative growth opportunities presented by the market. Growing investments in the market are also adding to the potential growth. For instance, in September 2024, Braskem was selected by the U.S. Department of Energy’s Office of Manufacturing and Energy Supply Chains for negotiating terms regarding the award of USD 50 million facilitated by Bipartisan Infrastructure Law. The funding is expected to expand and strengthen the company’s UHMWPE production in its La Porte, Texas facility. This is further expected to boost the lithium-ion battery separator (LIBS) industry.

In recent years, the FDA-compliant nature of the UHMWPE has significantly increased its utilization in the development of multiple products, including line hoppers, chutes, railcars, dump trucks, slide plates, PVC windows, cabinetries, fishing lines, medical devices, and more. It is also one of the key materials used to produce ballistic protection products, cut-resistant textiles, adhesive tapes, and more. Newer investments and technology advancements are also contributing to the growth of this market.

For instance, SRTX, a North American materials industry company, secured USD 25 million from Investissement Québec. SRTX, a holding company for rip-resist tights brand Sheertex Inc., has been investing in capabilities to develop apparel-grade UHMWPE materials and yarns through its facility in Montreal.

Rising support provided by various industries to UHMWPE manufacturers for the availability of suitable, flexible, affordable, and compliant material has been influencing the growth experienced by this market. Multiple industries, such as textile, fashion, defense, machinery, mining, manufacturing, and others, have been adding strength to the industry.

Product Insights

The medical grade & prosthetics segment dominated the global ultra-high molecular weight polyethylene industry with a revenue share of 34.3% in 2024. This is attributed to the characteristics of the resin, such as strength, resistance to chemical reactions, lower friction, less moisture absorption, and more. UHMWPE (Ultra-High Molecular Weight Polyethylene) provides manufacturers with an odorless, non-toxic, and regulation-compliant material alternative. Biocompatibility and higher wear resistance capacity are expected to drive growing demand for UHMWPE-based prosthetic products.

The fibers segment is anticipated to experience significant growth during the forecast period. This segment is primarily influenced by factors such as increasing utilization in the development of security and defense-related products such as combat helmets, body armor, vehicle armor, and others. High strength combined with lower weight makes this one of the most preferred choices for defense and military.

Application Insights

The medical grade & prosthetics applications segment held the largest revenue share of the global ultra-high molecular weight polyethylene industry in 2024. This is attributed to factors such as the increasing focus of multiple manufacturers on the development of durable and affordable products, suitability of the material, ease of availability, and high strength characteristics offered by the material. Growing cases of trauma injuries and increasing demand for prosthetics in multiple regions are adding to the growth experienced by the segment. Additionally, concessions, financial grants, and public funding programs associated with prosthetics facilitate growth.

The Membrane application segment is projected to experience significant growth from 2025 to 2030. The development of this segment is primarily influenced by the growing utilization of UHMWPE-based membranes in multiple applications such as biomedical, orthopedic implants, and more. Utilization of UHMWPE-based membranes is increasingly preferred due to its properties such as chemical inertness, impact resistance, higher absorption capacities, low friction, lubricity, and others.

Regional Insights

North Americaultra-high molecular weight polyethylene market held a 40.5% revenue share in 2024. This market is primarily driven by factors such as the presence of multiple UHMWPE manufacturers in the region and the increasing utilization of UHMWPE in the growing healthcare and medical devices industry. Owing to its higher strength and resistance capacities, UHMWPE is extensively preferred in manufacturing medical devices and accessories. Numerous medical device companies in the region also contribute to the growth.

U.S. Ultra-high Molecular Weight Polyethylene Market Trends

The U.S. ultra-high molecular weight polyethylene market held the largest revenue share of the regional industry in 2024. This market is mainly influenced by factors such as growing utilization by the defense and textile industry for the development of products such as combat helmets, protective wear, etc., and the significant presence of medical device manufacturers in the country. Factors such as biocompatibility, higher impact resistance capabilities, and enhanced strength offered by the materials to finished products stimulate the growing utilization of UHMWPE in the development of medical devices such as artificial joints, surgical implants, polyethylene sutures, and more.

Europe Ultra-high Molecular Weight Polyethylene Market Trends

Europe ultra-high molecular weight polyethylene market was identified as a key global industry region in 2024. This is attributed to increasing demand for strong wear-resistance materials in the surgical implants sector and growing utilization in automotive applications such as manufacturing for bumpers, guide rails, and others. The presence of multiple chemical industry participants in the region also contributes to the growth experienced by the regional market.

Germany ultra-high molecular weight polyethylene market dominated the regional industry in 2024. This market is driven by the increasing utilization of UHMWPE in manufacturing automotive parts. UHMWPE is increasingly used as a binder in separators of lead-acid batteries. Starting-lighting-ignition (SLI) applications of UHMWPE-based separators are expected to fuel the growth of this market. Manufacturers prefer the utilization of UHMWPE for its high resistance to sulfuric acid electrolytes.

Asia Pacific Ultra-high Molecular Weight Polyethylene Market Trends

Asia Pacific ultra-high molecular weight polyethylene industry is anticipated to experience the highest CAGR during the forecast period. This market is highly influenced by multiple industry manufacturers in the region, such as automotive, medical devices, packaging machinery, composite fibers, and industrial products. Expansions of the medical sector in the region, rapid growth industrialization, and increasing demand for high-performance materials from various industries are expected to add lucrative growth opportunities for this market.

China held the largest revenue share of the Asia Pacific ultra-high molecular weight polyethylene industry in 2024. A large number of chemical industry participants in the country, extensive utilization by industrial parts manufacturers, and increasing demand from the automotive industry are expected to drive the growth of this market. Multiple companies develop products such as chain-grade rails, custom CNC machining UHMWPE plastic parts, and others in China. Large-scale production of electric vehicles also contributes to the growing demand for UHMWPE in the country.

Key Ultra-high Molecular Weight Polyethylene Company Insights

Key companies in the global ultra-high molecular weight polyethylene industry include Koninklijke DSM N.V., Honeywell International Inc., DuPont de Nemours, Inc., Beijing Tongyizhong Specialty Technology & Development Co., Ltd., and others. Technology advancements in manufacturing processes, securing investments from governments and private investors, production capacity enhancements, and acquisitions and mergers are some of the key strategies embraced by multiple market participants.

-

Honeywell International Inc. specializes in performance materials and technologies and offers a wide range of UHMWPE-based products. These include medical-grade fiber, industrial-grade fiber, and more. The Spectra ultra-high molecular weight polyethylene-based fiber range comprises Spectra MG50 BIO 50, Spectra MG43 BIO 435, Spectra MG27 BIO 275, Spectra MG13 BIO 130, Spectra MG10 BIO 100, Spectra MG21 BIO 215, and others.

-

DuPont de Nemours, Inc., a multinational chemical company, specializes in multiple products and materials. Its portfolio includes brands such as Tyvek, Tychem, Nomex, ProShield, Kevlar, and more. Tensylon, a UHMWPE-based high-performance material offered by DuPont, is extensively suitable for manufacturing military body armor, vehicle armor, vehicle armor made with Kevlar fiber, and other products.

Key Ultra-high Molecular Weight Polyethylene Companies:

The following are the leading companies in the ultra-high molecular weight polyethylene market. These companies collectively hold the largest market share and dictate industry trends.

- dsm-firmenich

- Honeywell International Inc.

- Beijing Tongyizhong Specialty Technology & Development Co., Ltd.

- Dongyang MFG Co., Ltd.

- Sinty Sci-Tech Co., Ltd.

- DuPont

- Apex Polymers

- Avient Corporation

- Celanese Corporation

- JP FIBRES

Recent Developments

-

In October 2024, Honeywell International Inc., one of the participants in the global materials market, announced that it plans to spin off and aim for individual growth of its advanced materials business. The company intends to shape itself into a publicly traded U.S. company with a targeted approach to completing the process by the end of 2025 or early months of 2026.

-

In January 2024, Asahi Kasei and its affiliated company acquired certification for the ISCC PLUS various products, including thermoplastic elastomers, engineering plastics, and rubbers. This certification verifies the sustainable management of biomass and recycled materials throughout the supply chain, aligning with Asahi Kasei's commitment to a carbon-neutral material value chain. The company aims to enhance collaboration and sustainability initiatives as part of its medium-term management plan for fiscal 2024.

Ultra-high Molecular Weight Polyethylene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.03 billion

Revenue forecast in 2030

USD 6.31 billion

Growth rate

CAGR of 15.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, China, India, Japan, Indonesia, Thailand, Brazil, Saudi Arabia

Key companies profiled

dsm-firmenich; Honeywell International Inc.; Beijing Tongyizhong Specialty Technology & Development Co., Ltd.; Dongyang MFG Co., Ltd.; Sinty Sci-Tech Co., Ltd; DuPont; Apex Polymers; Avient Corporation; Celanese Corporation; JP FIBRES

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultra-high Molecular Weight Polyethylene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global ultra-high molecular weight polyethylene market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Medical Grade & Prosthetics

-

Fibers

-

Sheets

-

Rods

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Medical Grade & Prosthetics

-

Filtration

-

Batteries

-

Fibers

-

Additives

-

Membranes

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.