- Home

- »

- Advanced Interior Materials

- »

-

Body Armor Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Body Armor Market Size, Share & Trends Report]()

Body Armor Market (2022 - 2030) Size, Share & Trends Analysis Report By Protection Level (Level II, Level IIA, Level III, Level IIIA, Level IV), By End-user, By Type (Vest, Helmet), By Style (Covert, Overt), By Region, And Segment Forecasts

- Report ID: 978-1-68038-938-8

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Body Armor Market Summary

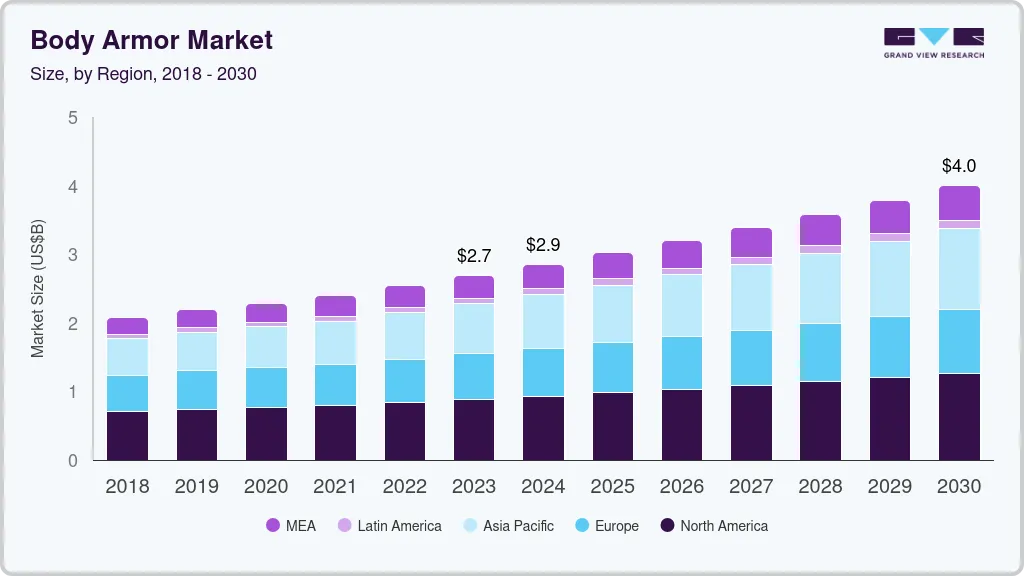

The global body armor market size was estimated at USD 2,693.4 million in 2023 and is projected to reach USD 4,007.1 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Technological proliferation is steadily transforming the armor industry which will drive market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Russia is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, level iv accounted for a revenue of USD 708.1 million in 2023.

- Level II is the most lucrative protection level segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2,693.4 Million

- 2030 Projected Market Size: USD 4,007.1 Million

- CAGR (2024-2030): 5.8%

- North America: Largest market in 2023

The impact of the COVID-19 pandemic and the containment measures were felt in various industries, leading to severe downturns in the world’s economic output. However, through the pandemic, global expenditure on military products increased steadily. Moreover, due to the political and border dispute, governments kept on spending on military products, including safety gear, despite the pandemic.

The growing awareness about commercial security in the U.S. is driving the demand for body armor. Furthermore, as threats become more prevalent, worries about security in commercial areas such as retail security, healthcare security, and transportation security are growing rapidly. As a result, demand for this product is expected to rise over the forecast period.

Modern-day warfare practices include counterinsurgency, counter-terrorism, and guerrilla warfare operations that may injure soldiers, causing fatal injuries. Similar scenarios exist in the law enforcement field wherein criminals, felons, and law offenders can fatally injure corresponding officers, thus necessitating investment in personal body armor and related equipment.

Body armor is specifically developed to shield the wearer from the effect of firearm rounds on human organs. Body armor saves a number of lives. It also provides additional protection during car accidents and other assaults on police officers. The majority of the law-enforcement body armor and helmets are designed to defeat attacks from handgun firing.

The global demand for body armor is also fueled by the rising awareness of workplace safety. As threats increase, security concerns including those related to retail, healthcare, and transportation are intensifying quickly. The growing government expenditure on defense is another factor fueling market growth.

Protection Level Insights

Level III protection accounted for 25.0% of the global revenue share in 2021.Level III vests are lighter, more flexible, and concealable under clothing, they can defeat a wider range of ammunition. They also provide greater blunt force protection than IIA. The level III product is suitable for council employees, officers, and even civilians and is the widely used protection armor.

The Level II segment is expected to grow at a CAGR of 7.0% over the forecast period. Level II protection armor protects a common handgun round and is lightweight, concealable, and comfortable to wear. Compared to level IIA, level II provides greater protection against blunt force trauma.

Level IIIA is a soft armor category. The materials utilized to make the Level IIIA and Level III choices are not the same. The Level IIIA product can also be used in conjunction with other protective panels, by giving maximum protection. This type of body armor can be worn overtly as well as covertly. Some manufacturers also offer IIIA+ products to protect against shotgun shells such as 9 mm civil defense rounds.

The level IV product offers protection from AP bullets of 30 calibers. This armor is made for use in military contexts and offers the maximum level of protection. In comparison to Level III & III+ product that is offered on the market, this gear is also pricey and bulky.

End-user Insights

The defense segment led the market and accounted for 58.9% of the global revenue share in 2021. This can be attributed to the progression of battlefield threats such as bone-breaking batons or shrapnel in improvised explosive devices; this has led to the adoption of new tactical ballistic vest protection and pioneering body armor.

The law enforcement segment is expected to witness a CAGR of 7.4% over the forecast period. Security personnel and first respondents are likely to boost demand for this product over the projected period as they carry out their duties to ensure safety and security and to detect, prevent, and prosecute offenses. Increasing government expenditure for internal safety and control in the country across the world is also likely to propel the growth of the segment.

The enormous weight of the body armor makes it difficult for military men to wear and move freely on the battlefield. As a result, firms and governments worldwide are investing in the development of new lightweight vests with increased mobility through the integration of advanced technologies such as 3D printing and the use of composite materials. For instance, DRDO announced in April 2021, the development of a lightweight bulletproof with the implementation of new technology.

According to the National Institute of Justice (NIJ), law enforcement officers face various kinds of threats, in which firearms are one of the most dangerous threats. Further, the law enforcement officer’s profession requires several performances of arduous occupation tasks while fetching an external load. This is attributed to the substantial demand for lightweight shields with stringent quality control and fast turnaround for law enforcement agencies.

Type Insights

The vest segment of the global body armor market accounted for a significant revenue share, with 55.4% in 2021. The vest products consist of bulletproof vests and stab-resistant vests that protect against attack on the vital organs of the body, hence providing optimum safety in close combat situations and frontline defense battles. There are different levels of flexibility provided by the overt and covert vests depending on the situation and end-user category.

The helmet segment is expected to register a CAGR of 6.5% over the forecast period. A ballistic helmet can be found in several shapes and sizes. Most helmets are classified into three types based on their design: Full-cut, mid-cut, and high-cut. Level II ballistic helmets are the most widely utilized by law enforcement and police officers. They are light and comfortable and protect from shrapnel, blunt force, and handguns.

Soft product provides highly flexible and comfortable protection against pistol ammo and is used by law enforcement officers, first respondents, and for covert operations. While hard product uses durable materials, such as ceramics, ceramic composites, steel, polyethylene, and occasionally, materials like Kevlar.

Other segments consist of safety gear such as eye protection, neck guard, joint guards, groin protection, and gloves. Military combat eye protection and transition combat eye protection are some of the safety gear for the eyes. In November 2019, the U.S. army’s new protective lenses have the features to react within a short time to the changing light, transitioning within seconds.

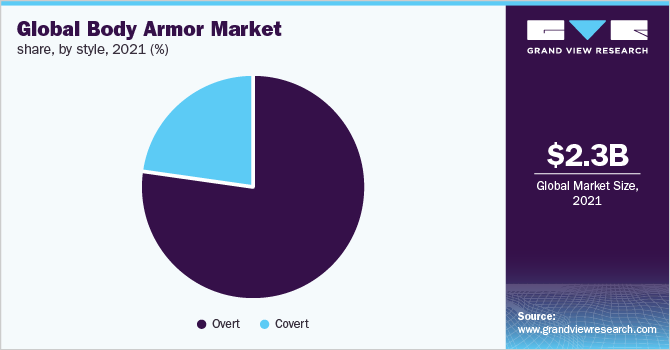

Style Insights

The overt segment accounted for the largest revenue share of 77.7% in 2021. This can be attributed to a higher level of protection from large spikes/blades and heavy gunfire. Overt body armors are worn on top of the clothing and are often bulkier and heavier as they are engineered using various Kevlar layers.

Overt vests are available for all levels of protection and can be used to protect against majority kinds of weapons including bullets and knives. They have the extra advantage of being customizable by adding pockets for spare equipment or by adding protection for other parts such as the neck or arm.Overt armor vests are made of sturdier bulletproof panels and are preferred by personnel in high-risk fields, such as military operations, riot control, and warzone journalism.

The covert type is expected to witness a CAGR of 6.9% over the forecast period. Compared with the overt kind, covert armor can be worn beneath regular clothing or a standard uniform comfortably. This benefit makes it ideal for use by a very important person (VIP) and security staff who do not prefer showcasing the armor.

Typically produced in light colors, covert body armor is designed to be as thin as possible so that it is not visible when worn under clothing. Covert vests can be worn under a standard uniform while retaining flexibility for daily activities and routines. Some models can even be fitted with extra SAPI plates that provide an extra layer of protection in a high levels of danger and serious situations.

Regional Insights

Asia Pacific accounted for 43.9% of the global revenue share in 2021, owing to increased military spending in the region. India, China, and Japan are among the prominent countries with large military troops credited for significant expenditure on military gear. Growing instances of warfare and border disputes coupled with an increase in the insurgency in the region are expected to propel the demand for body armor.

The U.S. accounted for a significant revenue share in 2021. The U.S has expanded its military spending to offset the aggressiveness of its strategic competitors, such as China and Russia. In addition, the United States has been aggressively supplying Ukraine with military help to combat Russia. This is also anticipated to increase demand for this product in the coming months.

Europe is expected to witness a CAGR of 6.7% over the forecast period. The increased spending is attributed to military upgradation in terms of personal safety and weapons upgrades. European nations such as France, Germany, and Italy contribute a part of their defense spending to NATO which is likely to boost the demand for this product over the forecast period.

The existence of ISIS in the Middle East & Africa, the ongoing crisis in Yemen, and the emergence of far-right terrorism have presented a threat to regional security. Nigeria is seeing the creation of new fronts, the reactivation of dormant fronts, and the incapacity of its state security apparatus to combat the fast diversification of violence. This has led to increased military spending in the region, which has favorably impacted the growth of this industry.

Key Companies & Market Share Insights

The market is highly consolidated and characterized by intense competition. Key players are focusing actively on expanding their customer base and increasing market share. Companies pursue various strategies, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development to strive and excel on a global scale.

For instance, in April 2020, planarTECH LLC partnered with IDEATI S.A. to distribute its bullet-proof vest and ballistic plate products entering into Thailand body armor market. Furthermore, in December 2021, Alexium International Group Limited, an Australian-based company announced the commercial launch of the Eclipsys-based body armor products, manufactured by Premier Body Armor.Some prominent players in the global body armor market include:

-

Safariland, LLC

-

Point Blank Enterprises, Inc.

-

Elmon SA

-

Ballistic Body Armor Pty

-

Pacific Safety Products Inc.

-

EnGarde Body Armor

-

Hellweg International Pty Ltd.

-

BAE Systems plc

-

Ceradyne Inc.

-

Avon Protection plc

-

Sarkar Tactical Ltd.

-

Craig International Ballistics Pty Ltd.

-

Armored Republic LLC

Body Armor Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.5 billion

Revenue forecast in 2030

USD 4.1 billion

Growth rate

CAGR of 6.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Protection level, end-user, type, style, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Australia; Brazil; Argentina, Saudi Arabia; UAE

Key companies profiled

Safariland, LLC; Point Blank Enterprises, Inc.; Elmon SA; Ballistic Body Armor Pty; Pacific Safety Products Inc.; EnGarde Body Armor; Hellweg International Pty Ltd.; BAE Systems plc; Ceradyne Inc.; Avon Protection plc; Sarkar Tactical Ltd.; Craig International Ballistics Pty Ltd.; Armored Republic LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Body Armor Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global body armor market report based on protection level, end-user, type, style, and region:

-

Protection Level Outlook (Revenue, USD Billion, 2017 - 2030)

-

Level II

-

Level IIA

-

Level III

-

Level IIIA

-

Level IV

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Defence

-

Law Enforcement & Security Personnel

-

Civilians

-

-

Product Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Vest

-

Helmets

-

Others

-

-

Product Style Outlook (Revenue, USD Billion, 2017 - 2030)

-

Covert

-

Overt

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global body armor market size was estimated at USD 2.3 billion in 2021 and is expected to be USD 2.5 billion in 2022

b. The global body armor market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.6% from 2022 to 2030 to reach USD 4.1 billion by 2030

b. The Asia Pacific dominated the body armor market with a revenue share of 43.9% in 2021. The growing border disputes and increasing expenditure on military and law enforcement in the region is credited for the market growth

b. Expansion of key players, product development, increasing government military expenditure and rising geopolitical tension is driving the global body armor market growth over the forecast period

b. Some of the key players operating in the body armor market include: Safariland, LLC; Point Blank Enterprises, Inc.; Elmon SA; Ballistic Body Armor Pty; Pacific Safety Products Inc.; EnGarde Body Armor; Hellweg International Pty Ltd.; BAE Systems plc; Ceradyne Inc.; Avon Protection plc; Sarkar Tactical Ltd.; Craig International Ballistics Pty Ltd.; and Armored Republic LLC

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.