- Home

- »

- Automotive & Transportation

- »

-

Bicycle Frames Market Size, Share & Growth Report, 2030GVR Report cover

![Bicycle Frames Market Size, Share & Trends Report]()

Bicycle Frames Market Size, Share & Trends Analysis Report By Material (Aluminum, Steel, Carbon Fiber, Titanium), By Frame Type (Mountain, Hybrid, Electric, Road), By Sales Channel, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-634-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Bicycle Frames Market Size & Trends

The global bicycle frames market size was estimated at USD 24.20 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The market is projected to experience growth owing to the rising global consumer interest in sports activities. The increasing popularity of sports like mountain biking and road bicycle racing is driving the demand for bicycle frames. For instance, according to the World Economic Forum, by the year 2050, the global bike population will exceed five million. Such projections are anticipated to drive the market growth over the forecast period.

Moreover, the bicycle frame serves as the fundamental backbone of a bicycle, playing crucial roles in both design and safety. It forms the bedrock of the bicycle's core structure and significantly contributes to its safety and aesthetics. The growing interest in recreational cycling is predicted to drive market expansion, thanks to the increasing embrace of leisure activities. Additionally, the inclination towards bicycles as a convenient tool for exercise in support of a healthier lifestyle while addressing concerns like obesity is projected to invigorate market growth further. It's worth noting that bicycle sales are intricately tied to overall product demand, and the increasing prevalence of bicycles is set to play a substantial role in propelling the market growth.

Moreover, increasing environmental consciousness is driving a notable shift towards bicycle adoption, thereby spurring demand. A substantial portion of the populace is favoring bicycles as their preferred mode of transportation for daily commuting. The growing issue of traffic congestion and the scarcity of parking facilities, particularly in urban centers, are motivating individuals to embrace bicycle commuting for short trips as a time-saving solution. Furthermore, numerous governments are actively investing in the infrastructure necessary to facilitate bicycle commuting. For instance, the U.K. is in the process of establishing a novel governmental body dedicated to the advancement of cycling and pedestrian initiatives. With a substantial budget of USD 2.57 million allocated for the next five years, the U.K. is preparing to introduce "Active Travel England" to finance the enhancement of cycling and pedestrian infrastructure throughout the nation.

COVID-19 Impact

The outbreak of the COVID-19 pandemic has had a significant impact on various industries, including the bicycle industry. The bicycle frames market is no exception, experiencing both challenges and opportunities in the wake of the global health crisis. One of the most prominent effects of the pandemic was a surge in the demand for bicycles and related components, including frames. Lockdowns and restrictions on public transportation prompted more people to turn to cycling as a safe and socially distant mode of transportation and recreation.

Furthermore, the increasing awareness of health and fitness has led to a rise in the number of people participating in cycling during the pandemic. This has created a demand for high-quality bicycle frames that can withstand rigorous use and provide optimal performance. Bicycle Frames have played a crucial role in facilitating the growing use of bicycles among consumers during the pandemic, leading to increased demand for bicycle frames.

Material Insights

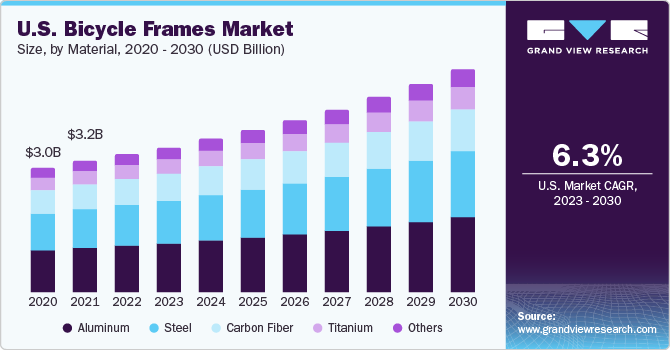

Based on the material, the market is classified into aluminum, steel, carbon fiber, titanium, and others. The aluminum segment dominated the market with a revenue share of 36.1% in 2022. The segment is anticipated to be driven by the associated benefits such as lightweight and durability, which makes it an optimum choice for the manufacturers. Additionally, aluminum frames are relatively more affordable compared to other materials, such as carbon fiber. This cost-effectiveness makes aluminum frames accessible to a wider range of consumers, contributing to their popularity in the market.

The carbon fiber segment is anticipated to grow at the fastest CAGR of 8.0% over the forecast period. The segment is expected to be driven by the technological advancements in the carbon fiber manufacturing techniques. Innovations, such as enhanced resin systems, advanced layup techniques, and the use of carbon fiber composites, have yielded bicycle frames that are not only lighter but also more robust and long-lasting. These developments have significantly enhanced the attractiveness of carbon fiber frames in the market, leading to increased demand.

Distribution Channel Insights

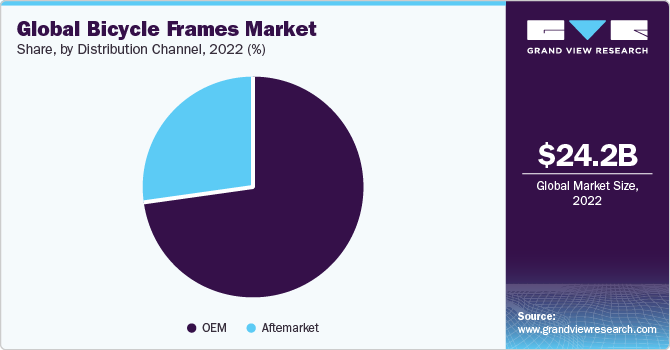

Based on the distribution channel, the segment is bifurcated into OEM and aftermarket. The OEM segment dominated the market with a revenue share of 73.2% in 2022. Bicycle frames at the OEM level are manufactured in significant quantities, which results in cost advantages through efficient production processes. Bicycle makers can capitalize on these cost efficiencies by procuring frames directly from OEM suppliers. This OEM sector provides bicycle manufacturers with cost-effective pricing choices, assisting them in sustaining profitability and a competitive edge within the market.

The aftermarket segment is anticipated to grow at a faster CAGR of 7.1% from 2023 to 2030. Increasing demand for customization and personalization of bicycle frames among consumers is attributing to the growth of this segment. The aftermarket sector provides cyclists with the ability to tailor and personalize their bicycles to align with their individual preferences and particular requirements. Within this segment, cyclists have access to a diverse selection of aftermarket bicycle frames that cater to various riding styles, materials, designs, and functionalities. The desire for distinct and customized biking experiences propels the demand for aftermarket frames.

Frame Type Insights

Based on the frame type, the market is classified into mountain bicycles, hybrid bicycles, electric bicycles, road bicycles, and others. The road bicycle segment dominated the market with a revenue share of 33.1% in 2022. This dominance can be attributed to the fact that road bikes represent the most straightforward category of bicycles, requiring minimal if any, intricate accessories compared to mountain bikes or other specialized bike types. Moreover, innovations in frame design, aerodynamics, carbon fiber construction, and component integration have improved the performance and efficiency of road bicycles. The availability of advanced features and cutting-edge technology attracts cyclists looking for the latest advancements in the market.

The mountain bicycle segment is anticipated to grow at a significant rate with a CAGR of 6.4% from 2023 to 2030. The segment growth can be attributed to consumers, particularly the millennial demographic, consistently choosing mountain biking as a recreational and adventurous pursuit. Furthermore, mountain bicycles are designed to withstand the rugged and challenging conditions encountered during off-road riding. These bicycles require frames that are durable, strong, and capable of handling rough terrains, jumps, and obstacles. The demand for high-performance and durable bicycle frames drives the growth of the mountain bicycle segment.

Sales Channel Insights

Based on the sales channel, the market is bifurcated into online and offline. The offline sales channel segment dominated the market with a revenue share of 62.5% in 2022. Many consumers show a preference for purchasing bicycle frames through authorized local brand outlets. These stores provide a wide array of frame options, along with personalized service and the opportunity for hands-on product inspection prior to purchase. This allows consumers to thoroughly examine and assess various features to meet their specific needs, facilitating well-informed decision-making.

The online segment is anticipated to grow at the fastest CAGR of 7.7% from 2023 to 2030. Transparent The seamless shopping process and convenient payment options are anticipated to draw a larger consumer base towards online distribution channels. Furthermore, these e-commerce platforms are witnessing a substantial surge in popularity among the working demographic due to the accessibility and convenience they provide in comparison to brick-and-mortar outlets. Leading industry players also operate their online platforms, allowing direct engagement with consumers to comprehend their needs better and gather feedback.

Regional Insights

Asia Pacific accounted for the highest revenue share of 40.2% in 2022. The regional market is anticipated to grow at the fastest CAGR of over 7.8% from 2023 to 2030. The growing trend of cycling for recreation, fitness, and environmentally friendly commuting has resulted in a substantial increase in the demand for bicycles. Consequently, this heightened demand is a driving force for the bicycle frame market in the Asia Pacific region. Additionally, as cities become more congested, there is a growing emphasis on promoting cycling as a sustainable mode of transportation. Governments and urban planners are investing in cycling infrastructure, such as dedicated bike lanes and bike-sharing programs.

The Europe region is anticipated to grow at a significant rate of 6.7% from 2023 to 2030. The European market has experienced a notable uptick in cycling's appeal, particularly during the COVID-19 pandemic. Both governments and individuals are now acknowledging cycling as a practical and eco-friendly transportation option. This surge in cycling interest has, in turn, resulted in increased demand for bicycles and bicycle frames throughout Europe. As per data from the European Cyclists’ Federation (ECF), European cities allocated USD 1.18 million toward cycling initiatives related to the COVID-19 pandemic in 2020. This funding was used to develop approximately 600 miles (1,000 kilometers) of bicycle lanes, implement traffic management measures, and designate car-free zones within urban areas.

Key Companies & Market Share Insights

Prominent manufacturers strategically uphold their brand reputation by sourcing frames from various Original Equipment Manufacturers (OEMs). Furthermore, the extensive range of available frames offers cycling enthusiasts the opportunity to craft bespoke bicycles, making customized frames increasingly popular among both professional cyclists and hobbyists in recent years. Furthermore, players are launching new frames in order to enhance their product portfolio. For instance, in February 2021, Giant Manufacturing Co., Ltd., announced the launch of a new frameset XTC Advanced SL 29.

As competition intensifies, companies are directing their efforts towards establishing strong product differentiation to enhance their market presence. Key industry players boast robust distribution networks and employ diverse strategies to maintain their competitive edge and capture a larger market share. This includes pursuing mergers and acquisitions, forming strategic partnerships, and entering into contractual agreements to expand their market footprint. In addition, companies are channeling resources into research and development activities aimed at introducing fresh and distinctive products.

Key Bicycle Frames Companies:

- ADK Technology Limited

- Advanced International Multitech Co. Ltd.

- Topkey Corporation

- Dengfu Sports Equipment Co. Ltd.

- Ideal Bike Corporation

- Giant Manufacturing Co Ltd.

- Cicli Pinarello SRL

- Quest Composite Technology Corporation

- Specialized Bicycle Components Inc

- SCOTT Sports SA

- Velocite Tech Co Ltd.

Bicycle Frames Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 25.63 billion

Revenue forecast in 2030

USD 40.62 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, frame type, sales channel, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

ADK Technology Limited; Advanced International Multitech Co. Ltd.; Topkey Corporation; Dengfu Sports Equipment Co. Ltd.; Ideal Bike Corporation; Giant Manufacturing Co Ltd.; Cicli Pinarello SRL; Quest Composite Technology Corporation; Specialized Bicycle Components Inc; SCOTT Sports SA; Velocite Tech Co Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bicycle Frames Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bicycle frames market report based on material, frame type, sales channel, distribution channel, and region:

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Aluminum

-

Steel

-

Carbon Fiber

-

Titanium

-

Others

-

-

Frame Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Mountain Bicycle

-

Hybrid Bicycle

-

Electric Bicycle

-

Road Bicycle

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bicycle frames market size was estimated at USD 24.20 billion in 2022 and is expected to reach USD 25.63 billion in 2023.

b. The global bicycle frames market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 40.62 billion by 2030.

b. Asia Pacific dominated the bicycle frames market with a share of 40.2% in 2022. This is attributable to the increasing popularity of sports activity such as mountain and road bicycle racing in the region.

b. Some key players operating in the bicycle frames market include ADK TECHNOLOGY CO., LTD, Advanced International Multitech Co. Ltd., TOPKEY CORPORATION, Dengfu Sports Equipment Co. Ltd., Ideal Bike Corporation and Giant Manufacturing Co Ltd. among others.

b. Key factors that are driving the market growth include rising number of people choosing for bicycling as a form of leisure, and inclination towards bicycle as a convenient form of exercise to ensure a healthy lifestyle, among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."