- Home

- »

- Automotive & Transportation

- »

-

Bicycle Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Bicycle Market Size, Share & Trends Report]()

Bicycle Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Mountain Bikes, Hybrid Bikes, Road Bikes, Cargo Bikes), By Technology (Electric, Conventional), By End Use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-490-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bicycle Market Summary

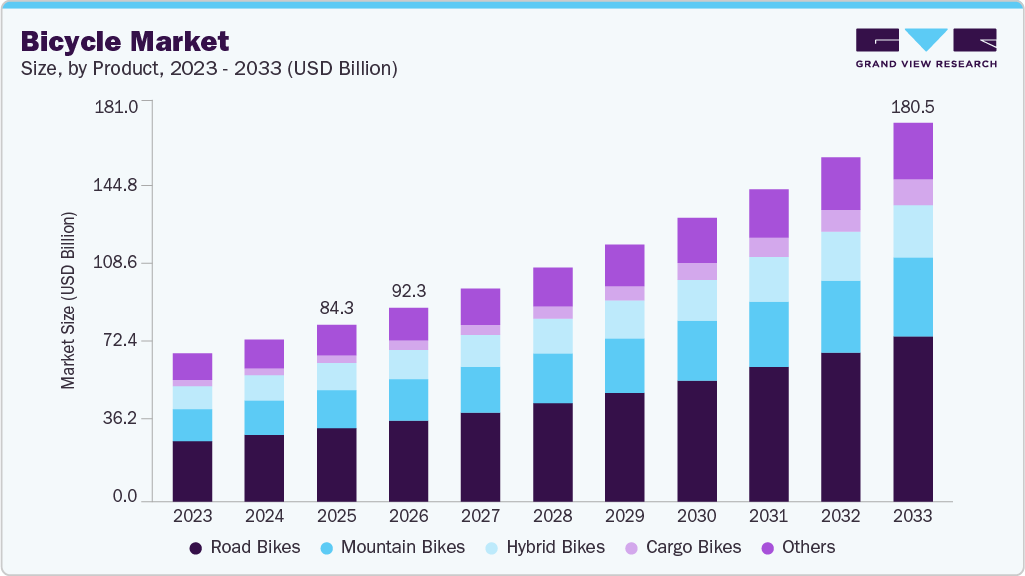

The global bicycle market size was estimated at USD 84.25 billion in 2025, and is projected to reach USD 180.53 billion by 2033, growing at a CAGR of 10.1% from 2026 to 2033.The bicycle market is gaining momentum, driven by increasing adoption of cycling for daily mobility, fitness, and short-distance commuting.

Key Market Trends & Insights

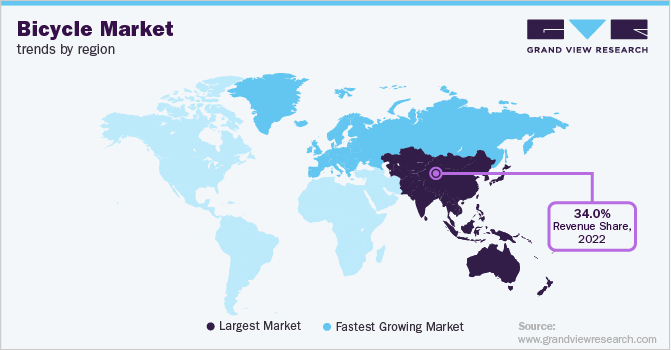

- Asia Pacific bicycle market held a significant share of around 34.6% in 2025.

- By product, the road bicycle segment accounted for the largest share of 41.3% in 2025.

- By technology, the conventional segment held the largest market share in 2025.

- By distribution channel, the offline distribution channel segment dominated the market in 2025.

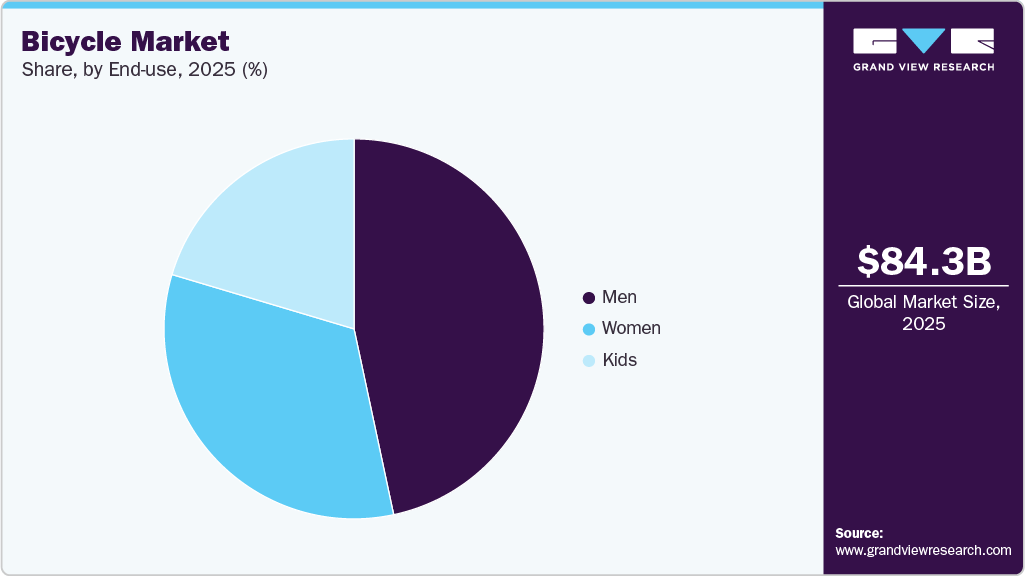

- By end-user, the men segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 84.25 Billion

- 2033 Projected Market Size: USD 180.53 Billion

- CAGR (2026-2033): 10.1%

- Asia Pacific: Largest market in 2025

- Europe: Fastest growing market

Rising investments in dedicated cycling infrastructure, including protected lanes and urban bike-sharing systems, are enabling safer and more accessible riding environments, which is further supporting market uptake. The rapid shift toward e-bikes is adding strong propulsion to the industry as commuters seek cost-efficient, low-emission alternatives to cars and public transport. Advancements in lightweight materials, battery efficiency, and connected features such as GPS tracking and app-enabled diagnostics are enhancing overall user convenience and performance.However, high upfront costs for premium bicycles and e-bikes, along with inadequate infrastructure in suburban and rural regions, continue to pose challenges for broader market penetration.

Preference for bicycles as a convenient form of exercise to ensure a healthy life, free from obesity and other disorders, is expected to further drive the market expansion. The popularity of dockless bicycle-sharing systems has been rising lately. This system allows users to locate a bicycle nearby and unlock it electronically. Incepted originally in Europe, dockless bicycle-sharing systems are gaining popularity, particularly in Asian nations such as India and China.

Furthermore, recent advancements in mobile app development and Global Positioning System (GPS) have resulted in app-based dockless bicycle-sharing systems. Moreover, the growing adoption of such dockless bicycle-sharing systems is anticipated to fuel the demand for cycles significantly. Chinese bicycle-sharing companies are particularly investing and expanding their operations aggressively in European nations to capitalize on the market opportunities. This is expected to boost market growth further in the forthcoming years.

People have started realizing the importance of staying fit and having a healthy life. They have also started realizing that regular bicycling can keep disorders, such as obesity, at bay. The market is likely to grow as more and more people are resorting to bicycling as a regular form of exercise. Events, such as Tour de France and Ronde van Vlaanderen, are further adding to the popularity of these vehicles. Meanwhile, a rise in bicycling events being organized in various countries from Asia, Africa, and the Middle East is fueling the sales of mountain as well as road bicycles.

The growing traffic congestion and shortage of parking space, particularly in metropolitan cities, is prompting people to consider bicycle commuting for short distances to save time. At the same time, various governments are aggressively rolling out the infrastructure necessary to support bicycle commutation, thereby encouraging people to opt for bicycles. However, the looming lack of the infrastructure necessary to support and encourage bicycle commutation, particularly in developing economies such as India, is anticipated to hinder the growth of the bicycle market. Similarly, lightweight bicycles made using composite materials make them expensive, which does not bode well for market expansion.

Urbanization has led to increased demand for commuter-friendly bicycles, particularly in congested metropolitan areas. Commuter bicycles, often designed for ease of use, efficiency, and low maintenance, are appealing to consumers seeking to avoid traffic, reduce Mountain Bikes costs, and minimize environmental impact. Furthermore, cargo bicycles have gained traction as more businesses adopt eco-friendly delivery methods. In urban areas, cargo bikes are increasingly used by courier services, food delivery companies, and small businesses. Major cities in Europe and North America have been particularly supportive of this trend, with city councils incentivizing the use of cargo bikes for commercial purposes.

Product Insights

The road bicycle segment accounted for the largest share of 41.3% in 2025. The segment growth can be attributed to the fact that these are the most basic vehicles, which do not need any sophisticated accessories, such as those required by racing, mountain, or other special-purpose bicycles. The growing trend among people to customize road bicycles for specific purposes is also expected to contribute to the segment growth in the forthcoming years.

The mountain bicycle segment is expected to register notable growth from 2025 to 2030 as consumers, particularly millennials, continue to opt for mountain bicycling as a form of leisure and adventure. Furthermore, the number of women and kids entering sports is increasing steadily and is likely to influence segment growth across the globe. Besides, the establishment of new mountain bicycling circuits coupled with growing media coverage for such events is expected to further fuel segment growth.

Moreover, the cargo bikes segment is also expected to emerge as the fastest-growing segment from 2025 to 2030. The segment growth can be attributed to users seeking ways of replacing motorized transport for short-distance commercial applications. Brands, such as Benno and Larry & Harry are monetizing the high potential of cargo bikes by investing in ways of increasing the positive perception of cargo bikes and promoting them through various role models.

Technology Insights

The conventional segment accounted for the largest share in 2025. The high market share is attributable to various factors, such as lower repair and maintenance costs of conventional bicycles as compared to electric bicycles. Also, while bicycles have been a convenient mode of transport, bicycling has been emerging as a leading sporting and leisure activity, especially in the women segment, over the past few decades. At present, conventional bicycles for women are dominating the global market in terms of technology.

The electric segment is expected to register the highest CAGR from 2025 to 2030. Electric bicycles can also ensure faster journeys as compared to their conventional counterparts. Moreover, technological improvements in battery and motor efficiency have been crucial for the electric bicycle segment. For instance, Lithium-ion batteries have enabled longer ranges and shorter charging times, making electric bicycles a viable alternative for longer commutes. As a result, more consumers are opting for electric bicycles as a convenient and eco-friendly option for their daily commute.

Distribution Channel Insights

The offline distribution channel segment accounted for the largest revenue market share in 2025. The high market share is attributed to the presence of a large number of consumers opting to purchase from offline channels/stores due to the availability of test-drive options. Offline stores also offer personalized/customized buying options, wherein consumers can choose their personalized/customized bicycle designs and colors. Also, it allows customers to get the product instantly. Moreover, the availability of various branded bicycles in local supermarkets or other stores is likely to drive this channel's demand in the forthcoming years.

The online distribution channel is expected to emerge as the fastest-growing segment from 2026 to 2030. The growing penetration of smartphones and the Internet in emerging economies, including Brazil, China, India, and Mexico, will further boost consumer engagement in online stores. Moreover, the internet's increasing penetration is also encouraging vendors to sell their products in the untapped market through online platforms such as Ali Express, Amazon, and Flipkart. Besides, online channels provide attractive discounts on every product, which attracts consumers to purchase online.

End Use Insights

The men segment accounted for the largest revenue market share of 46.7% in 2025. It is also expected to emerge as the fastest-growing segment over the forecast period as the number of men riding bicycles continues to be higher than the number of women and kids. Men have historically outnumbered women in the use of bicycles for commuting. As per statistical data presented by the Department for Transport UK, in 2019, on average, the UK men population made 25 cycling trips in a year as compared to 10 cycling trips by the women population in the same year.

However, the women segment is anticipated to expand at a CAGR of 10.0% over the forecast period as bicycle makers are continuously simplifying the cycling mechanism and installing efficient gear systems and shock absorbers. Such developments are particularly enticing women to opt for bicycling for leisure. Women have also been participating aggressively in bicycling events for the past few years. As a result, this segment is projected to witness steady growth.

Regional Insights

With the rising awareness of health and wellness, North American bicycle market consumers are increasingly turning to cycling as a means of staying active. As a result, recreational and fitness biking has surged, with mountain and road bikes becoming popular choices for those seeking outdoor exercise. Several North American cities, such as New York, San Francisco, and Toronto, have implemented bike-sharing programs to promote sustainable urban mobility. The pandemic intensified the need for contactless, solo Mountain Bikes modes, boosting the popularity of these programs.

U.S. Bicycle Market Trends

The bicycle market in the U.S. has seen an increase in online bicycle purchases as consumers seek convenience and access to a wide variety of models. This trend has been fuelled by advancements in logistics, allowing consumers to order customized bikes and have them delivered to their homes.

Asia Pacific Bicycle Market Trends

Asia Pacific bicycle market held a significant share of around 34.6% in 2025. Countries such as China, Japan, and Singapore emphasize rolling out the infrastructure necessary to encourage and support bicycle commuting. Some of the cities in Asia, such as Tokyo, are known for their lowest accident rates and are hence considered ideal cities for urban bicycling. Moreover, Chinese bicycle-sharing companies are aggressively targeting countries, such as India and Australia, to expand their operations. As a result, the demand for bicycles is expected to rise in the forthcoming years.

The China bicycle market held a substantial market share in 2025. The bicycle market in China is experiencing rapid growth, driven by the expansion of national low-carbon mobility policies that encouraged cycling lanes, public bike-sharing fleets, and green commuting subsidies. Demand was further influenced by the integration of smart and connected bicycle technologies, as Chinese manufacturers increasingly embedded GPS tracking, app-enabled locks, and health-monitoring features to attract younger riders. Market expansion was also enabled by the surge in e-commerce penetration, where premium bicycles and e-bikes were being marketed through Tmall, JD.com, and brand-owned digital channels. For instance, large-scale procurement programs by cities such as Shenzhen and Hangzhou for shared e-bike fleets accelerated domestic production. These developments indicate that both lifestyle upgrades and policy incentives were instrumental in shaping market momentum.

The Japan bicycle market held a significant share in 2025. In Japan, the bicycle market is influenced by stable domestic cycling culture, aging-population mobility needs, and strong government support for low-emission transport. Growth was sustained by the rising adoption of electrically assisted bicycles, which were increasingly preferred by senior citizens for daily commuting, shopping, and wellness activities. The market was additionally shaped by Japan’s focus on compact urban planning, where narrow streets and short-distance travel made bicycles an efficient and reliable mode of transport. The expansion of cycling tourism routes in regions such as Shimanami Kaido further encouraged demand for hybrid and road bikes. Industry development was also strengthened through quality-focused manufacturing, with Japanese brands emphasizing lightweight frames, quiet motors, and precision engineering. These factors collectively positioned bicycles as both a mobility tool and a lifestyle choice in Japan.

Europe Bicycle Market Industry Trends

The bicycle market in Europe is expected to witness the highest growth over the forecast period. Europe is home to some of the cities that are considered ideal for bicycle commuting. Some of the most popular bicycling events, such as Tour de France and Ronde van Vlaanderen, are also organized in Europe region. European nations, including Belgium, Denmark, France, and Italy, are aggressively rolling out the infrastructure to support and encourage bicycle commutation and are contributing significantly towards the growth of the regional market.

The German bicycle market was shaped by increasing environmental awareness, rapid e-bike penetration, and strong federal mobility initiatives in 2025. Growth was driven by Germany’s Energiewende-linked transport goals, which prioritized cycling over short-distance car usage and encouraged cities to add segregated cycling lanes and safe parking stations. The industry was further supported by rising consumer investment in performance and premium e-bikes, particularly among commuters seeking cost-efficient alternatives to rising fuel prices. For instance, the extension of commuter tax incentives for bicycle and e-bike travel strengthened corporate fleet adoption. Germany’s established engineering base enabled continuous innovation in mid-drive motors, battery efficiency, and lightweight frames. These trends indicate that sustainability objectives and high-specification product development remained central to market expansion.

The UK bicycle market in 2025 was shaped by the expansion of active-travel funding, rising health-conscious lifestyles, and a growing preference for last-mile electric mobility. Demand was supported by government programs that allocated capital toward protected cycling corridors, shared bicycle schemes, and rural mobility routes. The market was also influenced by the increasing use of bicycles for fitness and recreational purposes, especially as consumers continued post-pandemic outdoor activity habits. E-bike adoption was accelerated by rising congestion charges and restricted low-emission zones across major cities such as London, Manchester, and Birmingham, which encouraged commuters to shift from private cars. Retailers benefited from a shift toward premium and cargo e-bikes, used for household transport and logistics micro-mobility. These conditions reinforced bicycles as a practical, health-aligned, and cost-efficient mobility option in the UK

Key Bicycle Company Insights

Some of the key players operating in the market include Merida Industry Co., Ltd and Giant Bicycles, Inc., among others.

-

Merida Industry Co., Ltd designs, manufactures, and markets bicycles. The company is also involved in trading bicycle frames, electric bikes, and other related components. The company's key product offerings include complete suspension bikes, hardtail bikes, women's bikes, youth bikes, e-bikes, bags, apparel, bike equipment, tools, trailers, and other accessories. The company has a market presence in over 77 countries, including Argentina, Australia, Austria, Belgium, Brazil, China, Finland, Germany, Korea, the Netherlands, the Russian Federation, Switzerland, Taiwan, and the UK The company is listed on the Frankfurt Stock Exchange and Taiwan Stock Exchange (9914).

-

Giant Bicycles, Inc. designs and manufactures women's bicycles, road bicycles, mountain bicycles, lifestyle bicycles, and kid's bicycles. It is a subsidiary of Giant Manufacturing Co. Ltd, a Taiwanese bicycle manufacturer. Giant Bicycle, Inc. also provides apparel such as shirts, cycling clothing, as well as gloves, hats, socks, caps, and helmets; indoor cycling products, including trainers/components and accessories; and various accessories, including pumps, bags, lights, locks, cages, and bike covers. The company also offers tricycles, jog strollers, child seats, and trailer bikes. Its geographical presence spans various regions, including North America, Europe, Asia Pacific, and Oceania.

Specialized Bicycle Components, Inc. and SCOTT Sports SA are some emerging participants in the target market.

-

Specialized Bicycle Components, Inc. designs, manufactures, markets, and sells bicycle products and accessories. The company markets and sells its offerings under the brand name Specialized. The company’s key product offerings include mountain bikes, road, active fitness, kids, and electric bikes. The company also provides products for cyclists, such as jerseys, bibs and shorts, jackets and vests, base layers, gloves, shirts, hats, and hoodies. The company also provides bicycle components and accessories such as tires and tubes, wheels, saddles, power meters, drivetrains, handlebars, pedals, seat posts, stems, and suspensions.

-

SCOTT Sports SA designs and manufactures bicycles, motorsports gear, winter equipment, and sportswear. The company is a subsidiary of Youngone Corporation. The company’s key product offerings include road bikes, mountain bikes, city and urban bikes, trekking bikes, junior bikes, e-bikes, and framesets. SCOTT Sports SA also offers goggles, helmets, sunglasses, backpacks and bags, shoes, body protection products, probes and shovels, and apparel, including shirts and jerseys, vests, jackets, bibs, tights, shorts, knickers, pants, gloves, and other accessories. The company also provides off-road and snowmobile motorsports products.

Key Bicycle Companies:

The following are the leading companies in the bicycle market. These companies collectively hold the largest Market share and dictate industry trends.

- Accell Group

- Atlas Cycles (Haryana) Ltd.

- Avon Cycles Ltd.

- Cervelo

- Dorel Industries Inc.

- Giant Bicycles

- Merida Industry Co., Ltd

- Specialized Bicycle Components, Inc.

- SCOTT Sports SA

- Trek Bicycle Corporation

- Orbea

- BH Bikes

- Axalko Bikes

- Hagen Bikes

- Mammoth bikes

- Egurra Bikes

- Garri Bike

Recent Developments

-

In September 2024, Stryder Cycle Pvt. Ltd. launched Voltic GO and Voltic X for urban mobility. The e-bikes are equipped with splash-proof and fast chargeable 48V battery. The e-bikes provide a range of up to 40 km per charge. The e-bikes are suitable for light off-road and city streets, catering to urban commuters.

-

In October 2023, Merida Industry Co., Ltd. launched the all-new Silex gravel bike, which aims to improve comfort, speed, and handling across all types of terrain. This second-generation Silex gravel bike features revised geometry, increased tire clearance, and a focus on backpacking and multi-surface adventure riding. The updated Silex range includes six models, including carbon fiber and aluminum options.

Bicycle Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 92.30 billion

Revenue forecast in 2033

USD 180.53 billion

Growth rate

CAGR of 10.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, technology, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Accell Group; Atlas Cycles (Haryana) Ltd.; Avon Cycles Ltd.; Cervelo; Dorel Industries Inc.; Giant Bicycles; Merida Industry Co., Ltd; Specialized Bicycle Components, Inc.; SCOTT Sports SA; Trek Bicycle Corporation; BH Bikes; Axalko Bikes; Hagen Bikes; Mammoth bikes; Egurra Bikes; Garri Bike

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bicycle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global bicycle market report based on product, technology, distribution channel, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mountain Bikes

-

Hybrid Bikes

-

Road Bikes

-

Cargo Bikes

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Men

-

Women

-

Kids

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bicycle market size was estimated at USD 84.25 billion in 2025 and is expected to reach USD 180.53 billion in 2033.

b. The global bicycle market is expected to grow at a compound annual growth rate of 10.1% from 2026 to 2033 to reach USD 180.35 billion in 2033.

b. Asia Pacific held a significant share of around 34.6% in 2025. Countries such as China, Japan, and India, emphasize rolling out the infrastructure necessary to encourage and support bicycle commutation. Some of the cities in Asia, such as Tokyo, are known for their lowest accident rates and are hence considered ideal cities for urban bicycling.

b. Some key players operating in the bicycle market include Accell Group, Dorel Industries Inc., Avon Cycles Ltd., Giant Bicycles, Merida Industry Co., Ltd, SCOTT Sports SA, and Trek Bicycle Corporation.

b. Key factors that are driving the bicycle market growth include increasing adoption of cycling for daily mobility, fitness, and short-distance commuting. Rising investments in dedicated cycling infrastructure, including protected lanes and urban bike-sharing systems, are enabling safer and more accessible riding environments, which is further supporting market uptake

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.