- Home

- »

- Pharmaceuticals

- »

-

Global Biodefense Market Size, Share & Growth Report, 2030GVR Report cover

![Biodefense Market Size, Share & Trends Report]()

Biodefense Market Size, Share & Trends Analysis Report By Product (Anthrax, Smallpox, Botulism, Radiation/Nuclear), By Region (North America, Europe, APAC), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-313-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

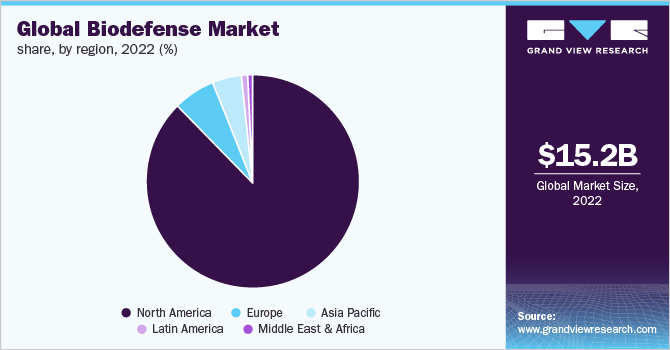

The global biodefense market size was valued at USD 15.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. Biodefense is a set of medical or military measures. These are taken in response to the demand for restoring the biosecurity of a country against biological toxins or infectious agents. The agents can be used with the intent to kill or infect humans, animals, or the environment and to instigate biological warfare. Biological agents used during bioterrorism are usually living organisms. These can include bacteria, viruses, fungi, or toxins that are deliberately used to sicken and kill creating social and economic turmoil. Factors such as the presence of favorable government initiatives in the U.S., growing investment from private players, increased government focus and funding towards biodefense strategies, and the growing prevalence of various agents such as the Ebola virus, Zika virus, and flu are driving the overall market growth.

The advent of technological advancements in the field of genetic engineering and biotechnology in the last decades has offered ease in modification of these fatal, and naturally occurring viruses which can be re-engineered to cause devastation. Moreover, these organisms can be easily obtained which makes biodefense a crucial aspect for countries around the world. Biological agents that have been used as a carrier for bioterrorism in the past include anthrax, botulism, and chemical & nuclear agent. This led to serious economic loss.

These instances drove governments around the world to engage in biodefense acts, treaties, and policies to counter biological threats, reduce risks, and prepare for, respond to, and recover from bioterrorism incidents. Since the anthrax bio-terrorism act that was carried out in 2001 through the mail, the National Institute of Infectious disease has played a vital role in developing medical products and strategies to counter bioterrorism and emerging and re-emerging infectious diseases by carrying out continuous research to diagnose, treat, and prevent them, whether deliberate or naturally occurring.

Governments of many countries remain committed to collaboration with several international partners to support response activities and increase preparedness. For instance, an experimental single-dose Ebola vaccine manufactured by Merck [rVSV-ZEBOV-GP] has been authorized for safe use by the World Health Organization and DRC MoH. As of November 17, 2019, approximately 250,000 persons at risk for Ebola have been vaccinated.

Developed economies are sending aid to countries with weak medical infra and low research capabilities many companies like Bavarian Nordic and Ology Bioservices are researching Ebola and Zika virus. The introduction of the Project BioShield Act was a strategic decision to increase funding for procuring, developing, and utilizing medical countermeasures against biological, chemical, radiological, and nuclear (CBRN) warfare agents. These above-mentioned factors and the rising risk of prevalence of the infectious disease is expected to boost the market growth.

Product Insights

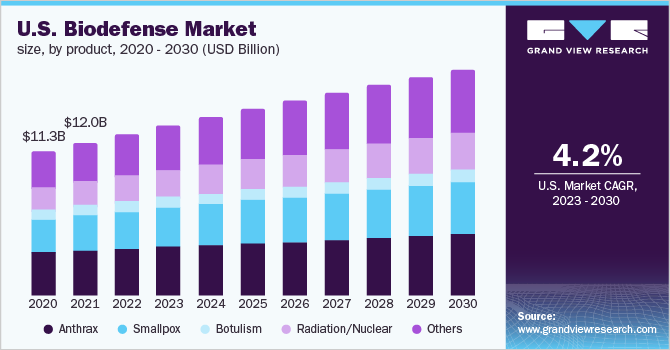

The anthrax segment held the largest market share of 28.4% in 2022 and is expected to grow at a significant CAGR over the forecast period. Based on products, the market is segmented into anthrax, smallpox, botulism, radiation/ nuclear, and others. Bacillus anthracis is a gram-positive bacterium that causes anthrax. It is one of the most likely to be used potential weapons for a bioterrorist attack. These spores are mostly preferred as they can be easily released into the environment by placing them in food, water, powder, and sprays.

They can last for a long time in the environment and are easily found in nature (soil, plants, or water). According to NCBI, anthrax bacteria is categorized as a tier-1 biological agent as it can be easily transmitted from one person to another and holds the potential for a major public health tragedy. Countermeasures against anthrax remain one of the key areas for countermeasures. It has received major funding for vaccine development. This includes project bioshield, which has witnessed over USD 50 billion in funding since the September 11 attack in the United States. Many companies have their vaccine for anthrax in clinical trials.

The other product segment is expected to be the fastest-growing segment with a 6.2% CAGR over the forecast period. It includes viruses like include viral hemorrhagic fever, brucellosis, cholera, influenza, plague, food poisoning, tularemia, Zika, Ebola, and many others. The National Institute of Allergy and Infectious Diseases (NIAID) has a Vaccine Research Centre (VRC), which is working on VHF vaccines since 2003, especially against Ebola and Marburg viruses. The University of Texas at San Antonio (UTSA) has been awarded a contract from the U.S. Department of Defense (DoD) to develop a vaccine against tularemia. Tularemia being highly infectious and at times fatal in nature is a potential option for a bioweapon.

Recently many countries are witnessing rising infection cases due to the zika and ebola viruses and therefore many companies are competing to develop its vaccine. MVA-BN Filo, manufactured by Bavarian Nordic, is a vaccine against two filoviruses, Ebola, and Marburg’s diseases, and is currently under phase 3 clinical trials and has collaborated with the U.S. NIAID for the same.

Regional Insights

North America dominated the Biodefense market capturing an 86.1% market share in 2022 and is expected to showcase a significant CAGR in the forecast period. This is attributed to the presence of high federal funding, technological advancements, and growing awareness among the population. The presence of major players in this region is also a favorable prospect for the biodefense market in 2022.

Based on Federal Research and Development (R&D) in the fiscal year 2017, out of the total federal R&D funding that was received by eight federal agencies, 96.3% of it was received by the Department of Defense (39.3%) and the Department of Health and Human Services (27.3%) combined accounting for more than two-thirds of all federal R&D funding.

This percentage of funding to DoD is proposed to increase to 48.4% in 2019. The introduction of the National Biodefense Strategy in 2018, with the purpose to detect and contain biothreats at their source. The policy also aims to support and promote biomedical innovation, and improve emergency response in case of biological outbreaks. These are some of the factors contributing to the high market growth in the region.

Asia Pacific is expected to witness the highest CAGR of 9.1% over the forecast period due to surging investments in R&D. The growing significance of biodefense, and the rising threat of harmful biological materials that engender emergencies is driving the market growth. Australia and Japan are two of the most mature Asia Pacific biodefense industry as it has well-established vaccine production facilities in the country.

This coupled with the presence of sophisticated healthcare infrastructure in the country contributes to its market position. Countries like India and China are rigorously expanding their R&D capabilities to cater to biological threats in the future. China is the second country after the U.S to spend the largest percentage of its GDP on R&D. These are the factors that are expected to boost the biodefense industry in the region

Key Companies and Market Share Insights

The global market is highly competitive and includes players such as XOMA corporation, Altimmune Inc., Emergent Biosolutions Inc., Dynavax Technologies Corporation, SIGA Technologies, Elusys Therapeutics Inc., Ichor Medical Systems, Dynport Vaccine Company, Cleveland Biolabs, Bavarian Nordic, Ology Bioservices, and Alnylam Pharmaceuticals Inc.

One of the key factors driving competitiveness among market players is the rapid adoption of advanced technology to develop vaccines and drugs.

Moreover, a prominent number of these players are rapidly opting for strategic collaborations with governments to gain bulk orders and increase the total sale volumes in emerging and economically favorable regions. Many companies are partnering with each other to develop drugs to introduce their products faster in the market.

For instance, in March 2019, Ichor Medical Systems, Inc. which is a privately-held biotech company announced that it had entered into a collaboration and research license agreement with AstraZeneca for the development and clinical assessment of plasmid DNA constructs (recombinant monoclonal antibody). Under the terms of the agreement, Ichor will receive upfront and annual payments along with developmental milestones. Some prominent players in the global biodefense market include:

-

XOMA corporation

-

Altimmune Inc.

-

Emergent Biosolutions Inc.

-

Dynavax Technologies Corporation.

-

SIGA Technologies.

-

Elusys Therapeutics Inc.

-

Ichor Medical Systems.

-

Dynport Vaccine Company.

-

Cleveland Biolabs.

-

Bavarian Nordic.

-

Ology Bioservices.

-

Alnylam Pharmaceuticals Inc

Biodefense Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.1 billion

Revenue forecast in 2030

USD 22.8 billion

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Brazil; Mexico; Argentina; China; India; Japan; Australia; Thailand; South Korea; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

XOMA corporation; Altimmune Inc. Emergent Biosolutions Inc.; Dynavax Technologies Corporation; SIGA Technologies; Elusys Therapeutics Inc.; Ichor Medical Systems; Dynport Vaccine Company; Cleveland Biolabs; Bavarian Nordic; Ology Bioservices; Alnylam Pharmaceuticals Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biodefense Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biodefense market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Anthrax

-

Smallpox

-

Botulism

-

Radiation/Nuclear

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biodefense market size was estimated at USD 15.2 billion in 2022 and is expected to reach USD 16.1 billion in 2022.

b. The global biodefense market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 22.8 billion by 2030.

b. North America dominated the biodefense market with a share of 86.1% in 2022. This is attributable to Significant funding by the U.S. military and civilian agencies for biodefense.

b. Some key players operating in the biodefense market include Emergent BioSolutions, Inc.; Xoma Corporation; PharmAthene, Inc. (Altimune, Inc.); SIGA Technologies, Inc.; Dynavax Technologies Corporation; Elusys Therapeutics, Inc.; Cleveland Biolabs; Ichor Medical Systems; Dynport Vaccine Company LLC; Achaogen, Inc.; Bavarian Nordic; Nano therapeutics, Inc.; and Alnylam Pharmaceuticals, Inc.

b. Key factors that are driving the biodefense market growth include Rising government initiatives aimed at enhancing the preparedness against Chemical, Biological, Radiological, and Nuclear (CBRN) threats.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."