- Home

- »

- Biotechnology

- »

-

Biotechnology Market Size And Share, Industry Report, 2030GVR Report cover

![Biotechnology Market Size, Share & Trend Report]()

Biotechnology Market (2024 - 2030) Size, Share & Trend Analysis By Technology (Nanobiotechnology, DNA Sequencing, Cell-based Assays), By Application (Health, Bioinformatics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-134-4

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biotechnology Market Summary

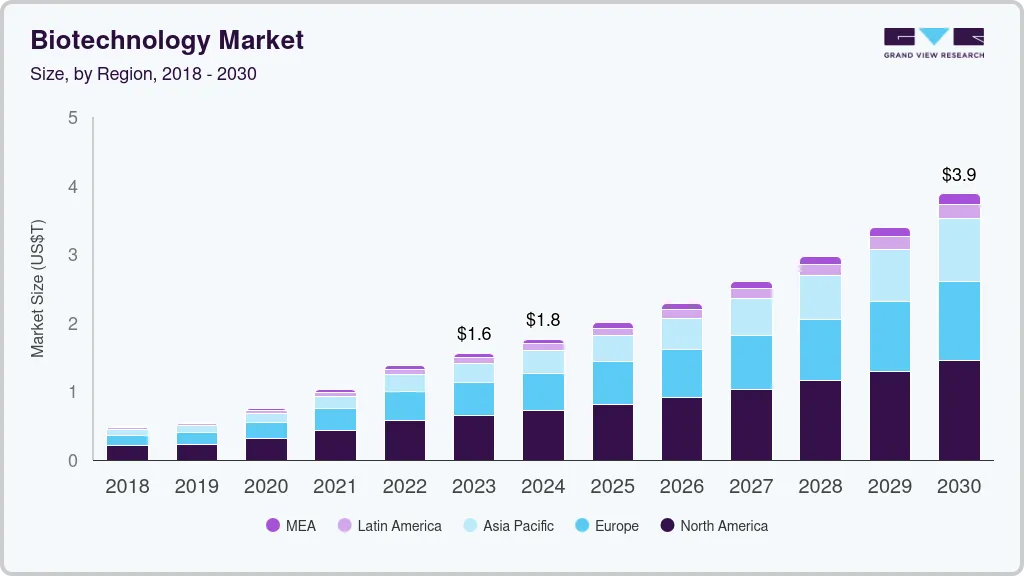

The global biotechnology market size was estimated at USD 1.55 trillion in 2023 and is projected to reach USD 3.88 trillion by 2030, growing at a CAGR of 13.96% from 2024 to 2030. The growth of big data, artificial intelligence (AI), and machine learning (ML) technologies is fueling demand for scalable and high-performance cloud infrastructure.

Key Market Trends & Insights

- North America accounted for the largest share of 41.37% in 2023.

- Asia Pacific is expected to expand at the fastest growth rate from 2024 to 2030.

- Based on technology, DNA sequencing held a significant market share of 17.43% in 2023

- Based on application, the health application segment accounted for the largest share in 2023.

Market Size & Forecast

- 2024 Market Size: USD 1.55 Trillion

- 2030 Projected Market Size: USD 3.88 Trillion

- CAGR (2024-2030): 13.96%

- North America: Largest market in 2023

- Asia-Pacific: Fastest growing market

The growing foothold of personalized medicine and an increasing number of orphan drug formulations are opening new avenues for biotechnology applications and are driving the influx of emerging and innovative biotechnology companies, further boosting the market revenue.

The COVID-19 pandemic has positively impacted the biotechnology market by propelling a rise in opportunities and advancements for drug development and manufacturing of vaccines for the disease. For instance, in 2021, over 11 billion doses of COVID-19 vaccine were produced globally, resulting in vaccination of about half of the world’s population within a year. Furthermore, the success of mRNA vaccines and accelerated approval processes have led to a surge in vaccine-related revenues, as evident by a combined revenue generation of around USD 31 billion in 2021 from Moderna, Pfizer/BioNTech, and Johnson & Johnson vaccines.

Expanding demand for biotechnology tools for agricultural applications including micro-propagation, molecular breeding, tissue culturing, conventional plant breeding & development of genetically modified crops, among others, have boosted the market growth. Moreover, genetically modified crops and herbicide-tolerant & insect resistant seeds are witnessing an increasing popularity and are contributing to the market growth. Rise in adoption of tissue culture technology for production of novel rice variants and disease- & pest-free banana varieties in regions of South Asia and Africa, and use of the technology for cloning of disease-free and nutritious plant varieties have propelled the agricultural applications for biotechnology.

The market is also driven by the presence of strong clinical trial pipeline and funding opportunities available in tissue engineering and regeneration technologies. As per the Alliance for Regenerative Medicine, companies developing cell and gene therapies raised over USD 23.1 billion investments globally in 2021, an increase of about 16% over 2020’s total of USD 19.9 billion. Clinical success of leading gene therapy players in 2021, such as promising results from an in vivo CRISPR treatment for transthyretin amyloidosis, developed by Intellia Therapeutics and Regeneron, are significantly affecting the market growth.

Rising demand for clinical solutions for the treatment of chronic diseases such as cancer, diabetes, age-related macular degeneration, and almost all forms of arthritis are anticipated to boost the market. Major firms are investigating and developing pipeline products for diabetes and neurological disorders, such as Parkinson’s & Alzheimer’s diseases, various types of cancers and cardiovascular diseases. For instance, according to clinicaltrials.gov, as of January 2021, there were 126 agents in clinical trials for the treatment of Alzheimer's disease, with 28 treatments in phase III trials.

Life sciences and healthcare sectors are experiencing a widespread use of fermentation technology and have positively impacted the market growth. Several modifications and advancements in the conventional bioreactors, such as introduction of simplified bioreactors and vortex bioreactors have led to improvements in the fermentation technology and growth in its adoption. Furthermore, vortex bioreactors have also been improvised for wastewater processing, to offer an enhanced operational feasibility. These modifications and improvement in fermentation technology are expected to accelerate market growth in the near future.

CAR T and TCR T-cell therapies are being explored as potential treatment options against chronic viral infections, such as HIV, hepatitis B, and SARS-CoV-2. For instance, scientists at Duke-NUS Medical School are evaluating the use of T-cell therapy in combating the COVID-19 infection. The scientists have demonstrated that TCR-redirected T cells exhibit a functional profile comparable to that of SARS-specific CD8 memory T cells obtained from patients who have recovered from the infection. Such investigations are anticipated to spur further research prospects in this domain and drive the market growth.

Biotechnological techniques including stem cell technology, DNA fingerprinting, and genetic engineering, among other, are gaining significant traction since past few years. Technological advancement in stem cell therapeutics, increasing demand for biologics, and a growing focus on the development of personalized medicines have resulted in a growing market for stem cell technologies. DNA fingerprinting applications are on the rise in forensic science, and for investigation of family relationships in animal populations as well as measurement of the extent of inbreeding. Similarly, genetic engineering and cloning techniques are being increasingly used in animal breeding and for manufacturing of complex biological substances.

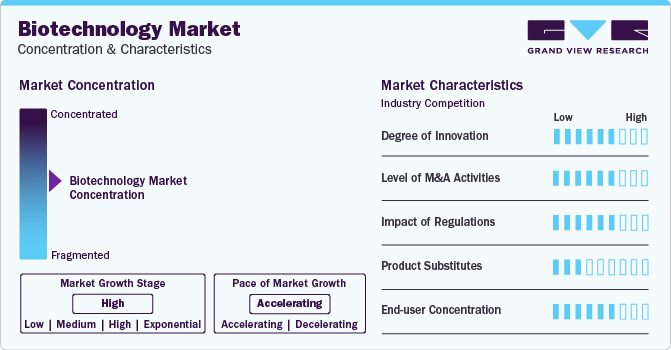

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The biotechnology market is characterized by a high degree of innovation due to rapid advancements in genomics, molecular biology, cellular & tissue engineering, bioimaging, novel drug discovery, and delivery methodologies. Such advancements are anticipated to generate prospects for enhancing diagnostic capacities & broadening treatment alternatives.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in October 2023, Amgen announced that it has completed its acquisition of Horizon Therapeutics plc. Horizon Therapeutics is a biopharmaceutical company focused on developing and commercializing therapies for rare genetic and autoimmune diseases.

There are several regulatory barriers to clinical applications in regenerative medicine, tissue engineering, and stem cells. Stem cell-based therapies are regulated differently in all the countries around the world. Gaining approval for stem cell-based therapies from regulatory authorities is one of the most significant challenges market players face. For instance, stringent norms must be followed to conduct research on embryonic stem cells and introduce changes in gene regulation in humans.

Due to the requirement of heavy investment for the successful development of diagnostic technologies, therapies for the treatment of major diseases, and the increasing biopharmaceutical research is anticipated to lower the risk of product substitution.

Technology Insights

DNA sequencing held a significant market share of 17.43% in 2023 which can be attributed to declining sequencing costs and rising penetration of advanced DNA sequencing techniques. Government funding in genetic research has enabled a rise in applications of sequencing for better understanding of diseases. For instance, in May 2021, a USD 10.7 million NIH grant was awarded to the University of Pittsburgh Graduate School of Public Health and Washington University School of Medicine in St. Louis, for investigation of the genetic basis of Alzheimer’s disease.

Nanobiotechnology is expected to grow at a significant growth rate from 2024 to 2030 owing to an increase in nanomedicine approvals and the advent of advanced technology. For instance, applications of theranostics nanoparticles have gained impetus for enabling prompt diagnosis and customization of treatment options for multiple disorders at once. Factors such as low toxicity, smaller size, and chemical plasticity of nanoparticles have proved to be beneficial for overcoming the limitation associated with conventional routes of generic drug administration. Furthermore, tissue engineering and regeneration medicine held a significant share due to government and private investments in the field, along with high healthcare spending and presence of significant number of mature and emerging players in this space. These factors are expected to drive the segment growth over the forecast period.

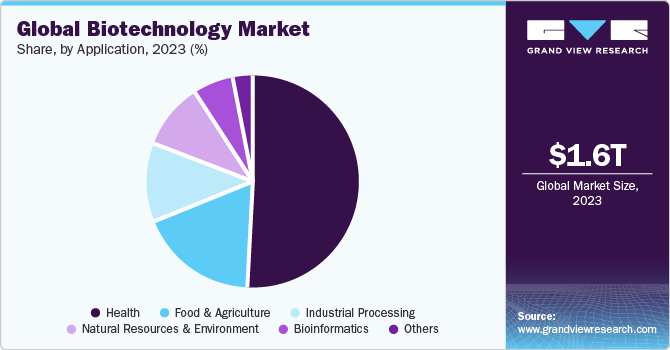

Application Insights

The health application segment accounted for the largest share in 2023. Growing disease burden, increasing availability of agri-biotech & bio-services, and technological developments in bio-industrial sector are expected to drive the segment growth. In addition, the segment growth is also fueled by significant advancements in the fields of Artificial Intelligence (AI), machine learning, and big data, which are expected to increase penetration of bioinformatics applications, especially in industries such as food and beverages.

Moreover, collaborative efforts and partnerships aimed at development and commercialization of new therapeutic platforms and molecules are anticipated to drive the market growth. For instance, in January 2021, Novartis collaborated with Alnylam for exploring the application of the latter’s siRNA technology for development of targeted therapy for restoration of liver function. Similarly, in September 2021, AstraZeneca and VaxEquity collaborated for development and commercialization of self-amplifying RNA therapeutics platform to explore novel therapeutic programs. Furthermore, growing demand for biosimilars and rising applications of precision medicine are expected to boost segment growth during the forecast period.

Regional Insights

North America accounted for the largest share of 41.37% in 2023. The regional market is witnessing growth due to several factors, such as the presence of key players, extensive R&D activities, and high healthcare expenditure. The region has a high penetration of genomics, proteomics, and cell biology-based platforms that is accelerating the adoption of life sciences tools. Furthermore, rise in prevalence of chronic diseases and rising adoption of personalized medicine applications for the treatment of life threatening disorders is expected to positively impact the market growth in the region.

Asia Pacific is expected to expand at the fastest growth rate from 2024 to 2030. The growth of the regional market can be attributed to increasing investments and improvement in healthcare infrastructure, favorable government initiatives, and expansion strategies from key market players. For instance, in February 2022, Moderna Inc. announced its plans for a geographic expansion of its commercial network in Asia through opening of four new subsidiaries in Malaysia, Singapore, Hong Kong, and Taiwan. In addition, biopharmaceutical collaborations, such as Kiniksa Pharmaceuticals and Huadong Medicine’s strategic collaboration for development and commercialization of Kiniksa’s ARCALYST and mavrilimumab in the Asia-Pacific region are expected to drive the market growth.

- The biotechnology market in India is majorly driven by the application of biotechnology in the healthcare sector, which majorly includes recombinant therapeutics and vaccines. According to Biospectrum, in December 2023, India was a global supplier of BCG, DBT, and measles vaccines, making it a prominent player in the biotechnology market.

Key Companies & Market Share Insights

The biotechnology market is currently observing a trend where-in companies are joining forces through business collaborations, partnership, and development agreements etc. These strategic initiatives are mainly driven by the need to develop novel therapeutics in a collaborative manner for better outcomes as well as reduced overheads.

Key Biotechnology Companies:

- AstraZeneca

- Gilead Sciences, Inc.

- Bristol-Myers Squibb

- Sanofi

- Biogen

- Abbott Laboratories

- Pfizer, Inc.

- Amgen Inc.

- Novo Nordisk A/S

- Merck KGaA

- Johnson & Johnson Services, Inc.

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Lonza

Recent Developments

-

In October 2023, Gilead Sciences, Inc. and Assembly Biosciences collaborated to create advanced therapeutics for severe viral diseases.

-

In October 2023, Gilead's subsidiary, Kite and Epicrispr Biotechnologies, announced a research collaboration and licensing agreement to utilize Epic Bio's gene regulation platform in developing advanced cancer cell therapies.

-

In September 2023, Merck KGaA announced collaborations with BenevolentAI and Exscientia, leveraging artificial intelligence for drug discovery in oncology, neurology, and immunology, with the potential to produce innovative candidates for clinical development.

-

In July 2023, Alexion and AstraZeneca Rare Disease announced an agreement with Pfizer Inc. to procure preclinical gene therapy programs, solidifying their dedication to advancing next-generation genomic medicines by incorporating complementary assets and cutting-edge technologies.

-

In June 2023, Lonza acquired Synaffix B.V., a biotechnology company specializing in advancing its clinical-stage technology platform for ADC development. The revenues and margins of Synaffix were expected to be incorporated into Lonza's business accounts starting from the acquisition date.

-

In January 2023, Anima Biotech collaborated with AbbVie to accelerate the development of novel mRNA biology modulators for the treatment of various oncology and immunology targets. Some of the key players in the global biotechnology market include:

-

In December 2022, Merck KGaA announced a collaboration with Mersana Therapeutics to advance the development of antibody-drug conjugates (ADCs), specifically focusing on novel STING-agonist ADCs targeting up to two distinct targets. This collaboration aimed at harnessing the potential of ADCs for therapeutic innovation.

Biotechnology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.76 trillion

Revenue forecast in 2030

USD 3.88 trillion

Growth rate

CAGR of 13.96% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Thailand; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb, Biogen, Abbott Laboratories, Amgen Inc., Novo Nordisk A/S, Merck KGaA., Johnson & Johnson Services, Inc., Novartis AG, Sanofi, F. Hoffmann-La Roche Ltd., Pfizer, Inc., Lonza

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biotechnology Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the biotechnology market on the basis of technology, application and regions

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Nanobiotechnology

-

Tissue Engineering and Regeneration

-

DNA Sequencing

-

Cell-based Assays

-

Fermentation

-

PCR Technology

-

Chromatography

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Health

-

Food & Agriculture

-

Natural Resources & Environment

-

Industrial Processing

-

Bioinformatics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biotechnology market size was estimated at USD 1.37 trillion in 2022 and is expected to reach USD 1.55 trillion in 2023.

b. The global biotechnology market is expected to grow at a compound annual growth rate of 13.96% from 2023 to 2030 to reach USD 3.88 trillion by 2030.

b. Health-related applications dominated the biotechnology market with a share of 50.69% in 2022 owing to the high penetration of biotechnology solutions in healthcare systems and commercial success of molecular diagnostics in disease management.

b. Some key players operating in the biotechnology market include Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd, Pfizer, Merck & Co., Abbott, Amgen, Merck & Co., Johnson & Johnson Services, Inc., and Sanofi.

b. Key factors that are driving the biotechnology market growth include favorable government initiatives, plummeting sequencing prices, growing market demand for synthetic biology, and rising R&D investment by the public as well as private agencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.