- Home

- »

- Medical Devices

- »

-

Bone Grafts And Substitutes Market Size, Share Report 2030GVR Report cover

![Bone Grafts And Substitutes Market Size, Share & Trends Report]()

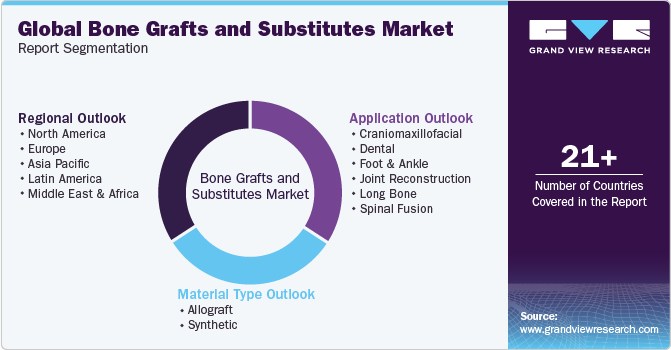

Bone Grafts And Substitutes Market (2025 - 2030) Size, Share & Trends Analysis Report By Material Type (Allograft, Synthetic), By Application (Spinal Fusion, Dental), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-154-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bone Grafts And Substitutes Market Summary

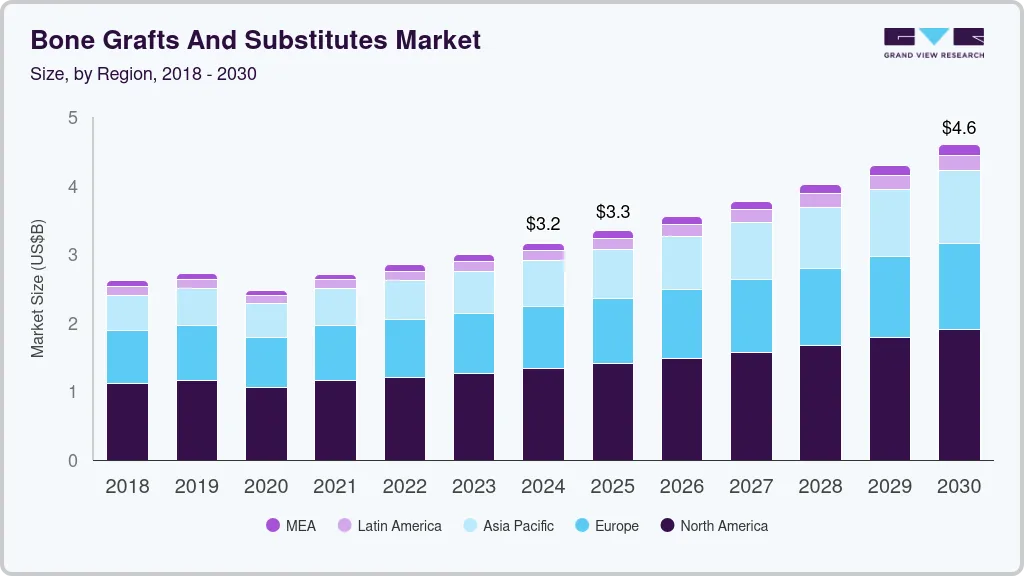

The global bone grafts and substitutes market size was estimated at USD 3.16 billion in 2024 and is projected to reach USD 4.60 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. Increasing demand for synthetic substitutes and a rising number of product approvals by regulatory authorities in various regions is anticipated to fuel market growth during the forecast period.

Key Market Trends & Insights

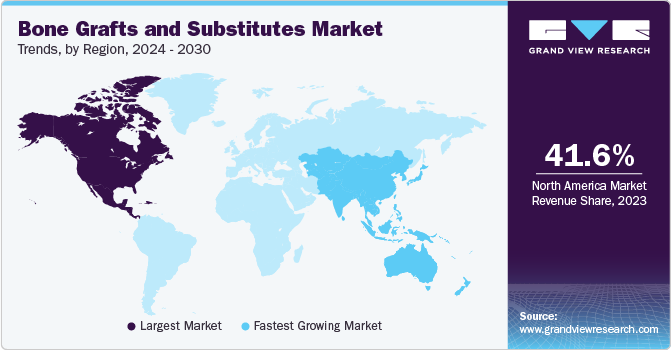

- North America bone grafts and substitutes market dominated the global market in 2024 and accounted for the largest revenue share of 42.1%.

- The bone grafts & substitutes market in the U.S. is anticipated to grow at a significant rate during the forecast period.

- By material type, the allograft segment held the largest revenue share of 60.2% in 2024.

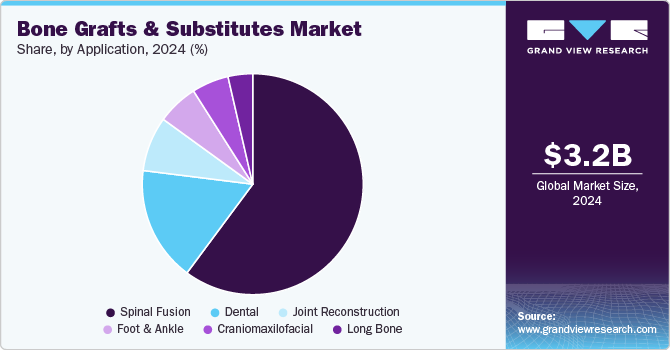

- By application, the spinal fusion segment held the largest market share of 60.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.16 Billion

- 2030 Projected Market Size: USD 4.60 Billion

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, in October 2023, Orthofix Medical Inc., a prominent company specializing in spine and orthopedic solutions, revealed the 510k clearance and complete commercial introduction of OsteoCove, a sophisticated bioactive synthetic graft. Similarly, in July 2020, Baxter received U.S. FDA clearance for its Altapore Shape Bioactive Bone Graft. This expanded the company’s Altapore bone graft substitute lineup. Furthermore, various benefits and advantages from bone grafts and substitutes, such as biocompatibility, safety, and osteoconductivity to fractured bones, have propelled the adoption of these products in recent years.The increasing use of bone grafts in dentistry is propelling the industry. The bone grafts are mostly used as a scaffold and filler to facilitate bone formation and promote healing. Dental implant surgery has become very popular with advanced surgical techniques, such as bone grafts and bone regeneration. Moreover, dental implants are becoming the favored solution for individuals experiencing tooth loss as both practitioner skills and the technology supporting dental implants continue to evolve. According to a WHO report published in 2023, the global average prevalence of total tooth loss is nearly 7% for individuals aged 20 years and older. For those aged 60 years & older, the estimated global prevalence is significantly higher at 23%. Thus, increasing cases of tooth loss are supplementing market growth.

Furthermore, a supportive regulatory framework and growing efforts from market participants to develop new products with better bioactivity, biocompatibility, and suitable mechanical properties is further driving market expansion. For instance, in March 2022, Molecular Matrix, Inc. announced the commercial launch of the Osteo-P Synthetic Bone Graft Substitute for use in the musculoskeletal system. This product is developed by using HCCP technology which is very beneficial in bone regeneration and repair. Similarly, in October 2020, Graftys received Medical Device Single Audit Program (MDSAP) certification for its Sterile Calcium Phosphate Resorbable Bone Void Fillers and related delivery systems in Australia, Brazil, Canada, and the U.S.

The rising adoption of minimally invasive procedures is further escalating the demand for bone grafts and substitutes. Surgeons are choosing minimally invasive procedures instead of open or traditional approaches owing to various benefits associated with MIS such as quick procedure procedures, less recovery time, shorter hospital stays, and fewer incisions. According to data from the American Academy of Orthopedic Surgeons (AAOS), the number of minimally invasive orthopedic procedures performed in the U.S. has been increasing steadily over the years. Some of the commonly performed minimally invasive orthopedic procedures in the U.S. are, arthroscopy, spine surgeries, fracture repair, and joint replacement procedures. Thus, the rising number of MIS is anticipated to drive the global bone grafts and substitutes market at a significant pace.

The increasing incidence of bone disorders due to road accidents and sports injuries is driving the bone grafts and substitutes industry. Bone grafts can be used for the following purposes:

-

To repair a broken bone

-

To repair previously injured bone that has not healed.

-

Spinal fusion (in case of an unstable spine)

-

Bone regeneration

-

To heal the bone around surgical implantation (joint & knee replacement)

Spinal fusion surgery is mostly performed among all the above-mentioned bone grafting procedures. According to a study published by NCBI in October 2022, the prevalence of Adult Spinal Deformities (ASD) is around 68% in the geriatric population. The burden of ASD is higher in people as compared to other chronic conditions such as diabetes, arthritis, chronic lung disease, and congestive heart failure. The common causes of spinal fusion injury are trauma, falls, collisions, and road traffic accidents. According to the American Association for the Surgery of Trauma, more than 3 million nonfatal injuries are reported in the U.S. every year. An increase in trauma incidents is anticipated to contribute to the market growth during the forecast period.

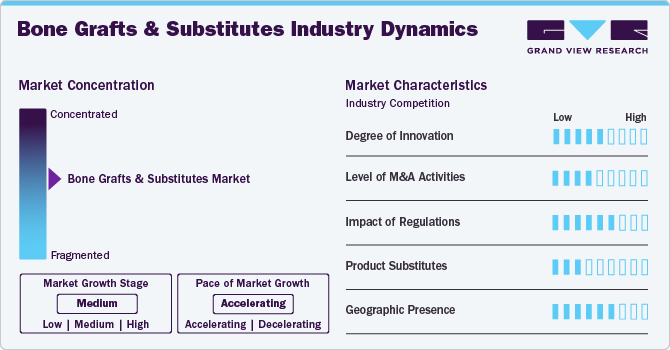

Market Concentration & Characteristics

The global market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. For instance, in June 2023, BONESUPPORT, a leading company in orthobiologics for treating bone injuries, announced the introduction of the latest version of the company's innovative antibiotic-releasing bone graft substitute, CERAMENT G. Enhancements to CERAMENT G have been implemented to enhance usability and minimize environmental footprint.

Several market players engage in mergers and acquisitions to strengthen their position in the industry. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. Key players engaging in this growth strategy include Baxter International Inc., Medtronic, and Smith & Nephew, among others. In June 2023, Biocomposites, a global company specializing in medical devices for bone regeneration and infection management, revealed its purchase of Artoss GmbH (Artoss), a company that specializes in creating advanced bone graft substitutes for orthopedics, spinal, foot, and ankle, and dental applications.

Stringent regulatory guidelines issued by various regulatory agencies, such as the U.S. FDA, limit the market growth. For instance, in March 2022, the U.S. FDA rejected OsteoLife Biomedical LLC’s Flexo-Membrane, Freeze-Dried Particulate Bone products, and Flexo-Plate. The FDA found significant contamination due to the presence of Bacillus, Stenotrophomonas maltophilia, and Pseudomonas aeruginosa post-processing.

Various companies in the market are adopting this strategy to maintain a competitive edge and to be ahead of the newly evolving landscape in the market. For instance, in August 2024, LifeNet Health, a regenerative health company, revealed the introduction of its latest bone allograft, created in partnership with the healthcare leader Johnson & Johnson MedTech, as the company prepares to enter the demineralized bone matrix (DBM) market.

Major industry players are adopting various strategies including partnerships, collaborations, mergers, and acquisitions to expand their footprints in global markets. For instance, in August 2022, Orthofix Medical, Inc. entered a partnership with CGBio for the commercialization and development of Novosis rhBMP-2 for Canada and U.S. markets.

Material Type Insights

The allograft segment held the largest revenue share of 60.2% in 2024 and is anticipated to witness significant growth opportunities during the forecast period. The allograft adoption is significantly increasing owing to its properties such as osteoconductivity, and immediate structural support. In addition, positive patient outcomes with allograft products and various recent launches of allografts have supported the segment expansion. Also, allografts do not require other surgery to harvest bone, which results in rapid wound healing, lesser surgery time, and higher success rates. For instance, according to a study published by NCBI in February 2022, bone fusion with allograft showed a success rate between the range of 87% and 94.3%.

The synthetic segment is projected to exhibit the fastest growth from 2025 to 2030. The robust growth of the segment is owing to the products’ lesser risk of disease transmission, better biocompatibility, and better acceptance among patients when compared to allografts. The synthetic segment is further classified into ceramic, composite, polymers, and BMP. The segment is also expected to be driven by the rising burden of orthopedic disorders coupled with increasing demand for synthetic products in developed countries.

Application Insights

In the application segment, the spinal fusion sub-segment held the largest market share of 60.1% in 2024. The increasing adoption of bone graft materials for spondylosyndesis and the rising geriatric population prone to a number of orthopedic ailments are responsible for higher revenue share of the segment. The geriatric population is steadily increasing. According to the U.S. Census Bureau, in 2022, the country had a geriatric population of around 56 million, accounting for 16.9% of the country’s total population, and this number is projected to surpass 73.1 million in 2030. This indicates that more than one in five people will be of retirement age. Thus, the high number of elderly populations is fueling demand for orthopedic solutions.

The rising adoption of grafts for dental procedures is likely to provide lucrative opportunities for the dental segment throughout the forecast period. The grafts are usually used as scaffolds and filler to facilitate bone formation as well as to promote healing. The increasing acceptance of dental implant surgical procedures along with advanced techniques such as bone grafts and bone regeneration are projected to boost market growth. Moreover, the rising success rates of dental implants are also resulting in the high demand for bone grafts & substitutes.

Regional Insights

North America bone grafts and substitutes market dominated the global market in 2024 and accounted for the largest revenue share of 42.1%. The rising geriatric population and increasing incidence of sports injuries & fatal accidents are among the key factors boosting the demand for bone grafts and substitutes in North America. In addition, the presence of well-established healthcare infrastructure, supportive reimbursement policies, and presence of large number of orthopedic surgeons performing surgeries with bone grafts are further fueling adoption of such products in the region. For instance, according to Definitive Healthcare, LLC, U.S. currently has 24,350 orthopedic surgeons.

U.S. Bone Grafts And Substitutes Market Trends

The bone grafts & substitutes market in the U.S. is anticipated to grow at a significant rate during the forecast period. Increasing sports injuries will supplement the demand for bone graft and substitutes. For instance, in the U.S., approximately 30 million kids and teenagers engage in various organized sports, resulting in over 3.5 million injuries annually.

Canada bone grafts & substitutes market is anticipated to grow at a significant rate soon. Healthcare funding in the country has increased, accounting for 11.5% of the total GDP in 2022. The easy availability of advanced products and the presence of wide distribution networks of international players in Canada are among the factors anticipated to boost the market. Moreover, an increase in the incidence of sports-related injuries is expected to boost the market in the coming years.

Europe Bone Grafts And Substitutes Market Trends

The bone grafts and substitutes market in the Europe is projected to witness the significant growth over the forecast period from 2025 to 2030. The increasing prevalence of orthopedic conditions and road accidents that require bone grafts and substitutes are fostering market growth. In Italy, the year 2022 saw a 9.9% increase in road accident fatalities, with 3,159 people losing their lives. The number of injuries also rose by 9.2% to reach 223,475, and the total number of road accidents was 165,889.

Germany bone grafts & substitutes market is anticipated to grow at a significant rate during the forecast period. Growing cases of bone fracture in the region are fostering market growth. According to a report by the International Osteoporosis Foundation, Germany experiences over 831,000 fragility fractures every year, which is equal to 95 broken bones per hour.

Asia Pacific Bone Grafts And Substitutes Market Trends

The bone grafts and substitutes market in the Asia Pacific is projected to witness the fastest growth over the forecast period from 2025 to 2030. The presence of a larger patient pool with a range of orthopedic conditions, and rising investments by market participants to expand their presence in the region are expected to drive the APAC market. For instance, in October 2021, CoreBone raised USD 3.7 million in investment to expand its activity in China and commercialize bioactive bone graft material for orthopedic and dental treatments.

China bone grafts and substitute market is expected to have the largest geriatric population in the world in the near future owing to the rapidly aging population in the country. As a result, the prevalence of orthopedic diseases is expected to increase rapidly in China. Furthermore, a less stringent regulatory framework for product approval is resulting in easy entry of advanced products into the market. In addition, the availability of resources that enable the development of advanced technology at a cheaper cost is resulting in an increased number of manufacturing facilities in the country. For instance, in October 2021, CoreBone raised USD 3.7 million in investment to expand its activity in China and commercializing bioactive bone graft material for orthopedic and dental treatments.

Latin America Bone Grafts And Substitutes Market Trends

The bone grafts and substitute market in Latin America is projected to witness significant growth over the forecast period from 2025 to 2030. An increasing geriatric population coupled with rising orthopedic diseases is anticipated to boost market growth.Latin America and the Caribbean have 88.6 million people aged 60 years and over as of 2022, comprising 13.4% of the total population. This proportion is projected to reach 16.5% by 2030, which is expected to drive the demand for orthopedic treatments in turn driving the demand for the market.

Brazil bone grafts & substitutes market is anticipated to grow at a significant rate during the forecast period. An increasing number of joint replacements and fractures in Brazil will supplement the market growth. As per a 2023 publication by the National Library of Medicine, the occurrence of hip fractures rises significantly with age, and women aged 70 and above have a risk about 50% higher than men of the same age.

Middle East & Africa Bone Grafts And Substitutes Market Trends

The bone grafts and substitute market in the Middle East & Africa is projected to witness the fastest growth over the forecast period from 2025 to 2030. Increasing dental procedures and growing sports participation in the region are supplementing regional growth. Furthermore, the increasing prevalence of orthopedic diseases will further escalate market growth.

South Africa bone grafts and substitute market is projected to witness the fastest growth over the forecast period from 2025 to 2030. The increasing prevalence of orthopedic conditions including osteoporosis is escalating market growth. According to the NOFSA (National Osteoporosis Foundation of South Africa), in South Africa, it is estimated that one out of every three women and one out of every five men may develop osteoporosis during their lifetime.

Key Bone Grafts And Substitutes Company Insights

The industry is marked by the presence of various large and small business operators. It is competitive and dominated by participants such as Orthofix, Stryker, Nuvasive, Medtronic, DePuy Synthes, and Wright Medical, among others. Key players are emphasizing executing innovative strategies such as market penetration, mergers and acquisitions, partnerships, and distribution agreements to bolster their revenue.

Key Bone Grafts And Substitutes Companies:

The following are the leading companies in the bone grafts and substitutes market. These companies collectively hold the largest market share and dictate industry trends.

- AlloSource

- DePuy Synthes (Johnson & Johnson)

- Baxter

- NuVasive, Inc.

- Smith + Nephew

- Medtronic

- Orthofix Medical, Inc.

- OST Laboratories

- Zimmer Biomet

- Geistlich Pharma AG

- Stryker

- Biobank

Recent Developments

-

In April 2024, Geistlich Holding signed the agreement to acquire Bionnovation Biomedical, a medical technology company in Brazil, to expand its regenerative product portfolio in Latin America and other emerging markets.

-

In May, Medtronic received U.S. FDA clearance for its Infuse bone graft with an intervertebral fusion device for transforaminal lumbar interbody fusion (TLIF) surgical procedures.

-

In October 2023, Orthofix Medical Inc. announced the 510k approval and full commercial launch of OsteoCoveTM, an innovative bioactive synthetic graft. OsteoCove, which comes in putty and strip form, offers exceptional bone-forming qualities for various orthopedic and spine procedures.

-

In February 2022, Orthofix Medical Inc. unveiled Opus BA, a synthetic bioactive bone graft solution designed for lumbar and cervical spine fusion surgeries.

Bone Grafts And Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.34 billion

Revenue forecast in 2030

USD 4.60 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, application, region

Regions covered

North America; Europe;, Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark, Norway, Sweden, Japan; China; India; South Korea; Australia, Brazil; Mexico; Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

AlloSource; Baxter; DePuy Synthes; Medtronic; NuVasive, Inc.; Orthofix Medical, Inc.; Smith + Nephew; Stryker.; OST Laboratories; Zimmer Biomet; Geistlich Pharma AG; Biobank

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bone Grafts And Substitutes Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global bone grafts and substitutes market based on the material type, application, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allograft

-

Demineralized Bone Matrix

-

Others

-

-

Synthetic

-

Ceramics

-

HAP

-

β-TCP

-

α-TCP

-

Bi-phasic Calcium Phosphates (BCP)

-

Others

-

-

Composites

-

Polymers

-

Bone Morphogenic Proteins (BMP)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Craniomaxillofacial

-

Dental

-

Foot & Ankle

-

Joint Reconstruction

-

Long Bone

-

Spinal Fusion

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bone graft and substitutes market size was estimated at USD 3.16 billion in 2024 and is expected to reach USD 3.34 billion in 2025.

b. The global bone graft and substitutes market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 4.60 billion by 2030.

b. The allograft material type segment dominated the bone graft and substitutes market in 2024. This is attributable to properties such as immediate structural support and osteoconductivity. Moreover, allografts do not require another surgery to harvest bone, which results in reduced surgery time and rapid wound healing.

b. Some key players operating in the bone graft and substitutes market include DePuy Synthes; Medtronic PLC; Nuvasive, Inc.; Orthofix Holdings, Inc.; Wright Medical Group N.V.; AlloSource, Inc.; and Stryker Corp.

b. Key factors that are driving the bone graft and substitutes market growth include the increasing number of spinal fusion surgeries, target population, and adoption of allografts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.