- Home

- »

- Medical Devices

- »

-

Dental Implants Market Size & Share, Industry Report, 2033GVR Report cover

![Dental Implants Market Size, Share & Trends Report]()

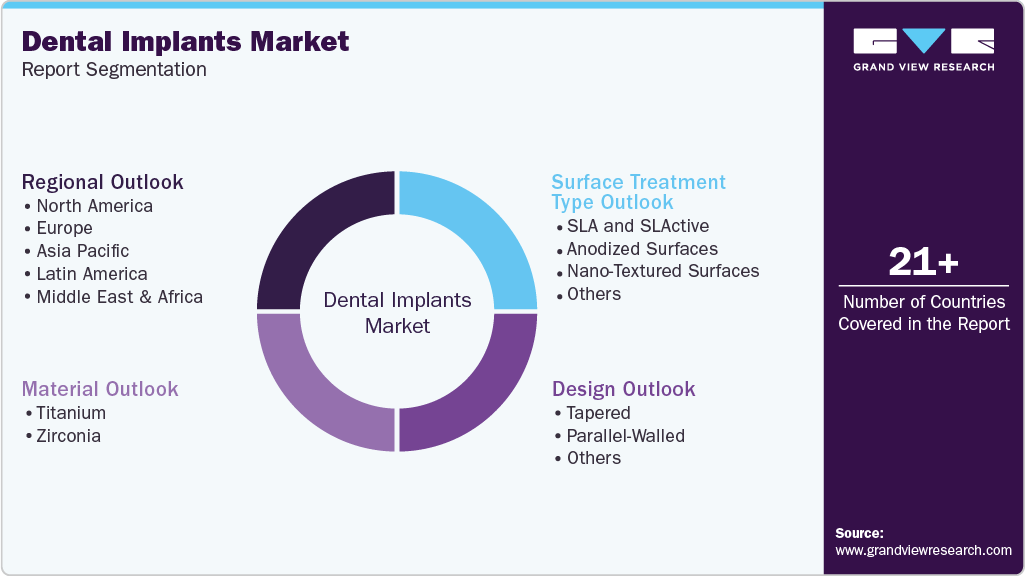

Dental Implants Market (2026 - 2033) Size, Share & Trends Analysis Report By Surface Treatment Type (SLA and SLActive, Anodized Surfaces, Nano-Textured Surfaces), By Material (Titanium, Zirconia), By Design (Tapared), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-566-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Implants Market Summary

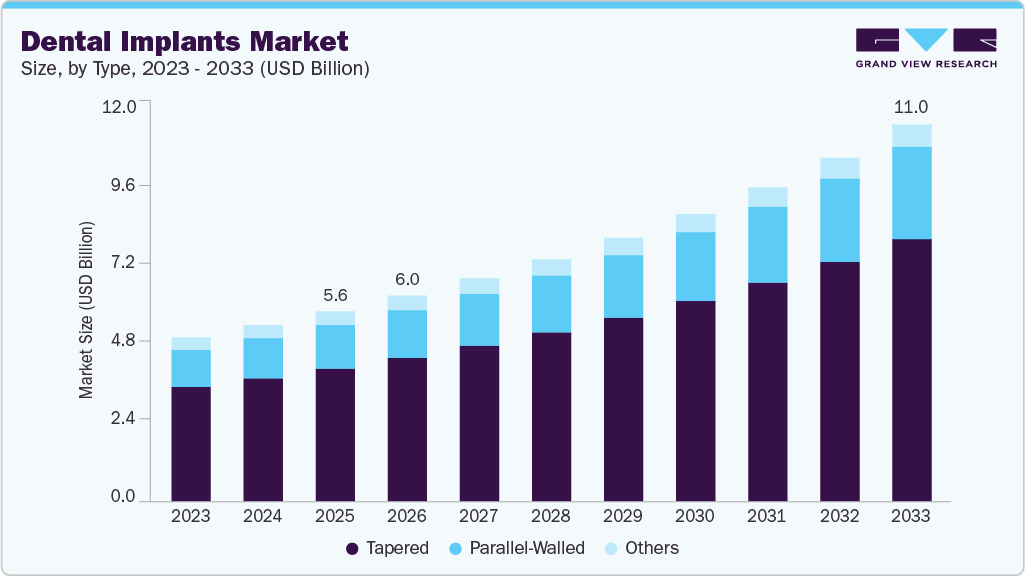

The global dental implants market size was estimated at USD 5.56 billion in 2025 and is projected to reach USD 11.02 billion by 2033, growing at a CAGR of 9.02% from 2026 to 2033. The dental implants industry is driven by increasing demand for precise and advanced implant solutions, rising prevalence of tooth loss and oral disorders, and continuous innovations in implant materials and surface technologies.

Key Market Trends & Insights

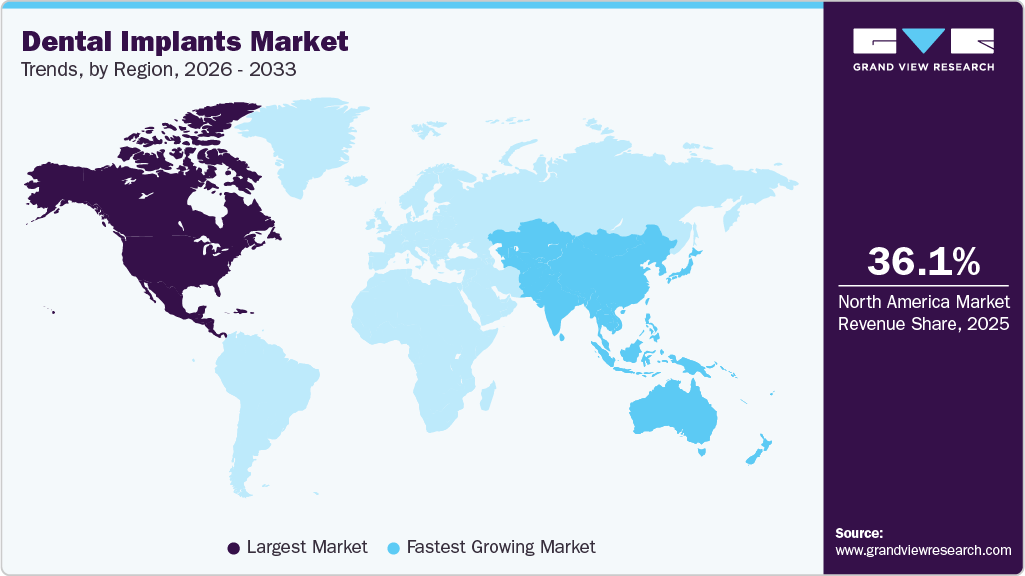

- North America dominated the dental implants market with the largest revenue share of 36.05% in 2025.

- The U.S. dental implants market is growing, primarily driven by the rising incidence of oral cavity and oropharyngeal cancers, resulting in tooth loss, jawbone deterioration, and oral tissue damage.

- By surface treatment type, the nano-textured surfaces segment is anticipated to witness at the fastest CAGR of 10.63% during the forecast period.

- By material, the zirconia segment is anticipated to register at the fastest CAGR of 10.55% from 2026 to 2033.

- By design, the tapered segment accounted for the largest market revenue share of 69.84% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.56 Billion

- 2033 Projected Market Size: USD 11.02 Billion

- CAGR (2026-2033): 9.02%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

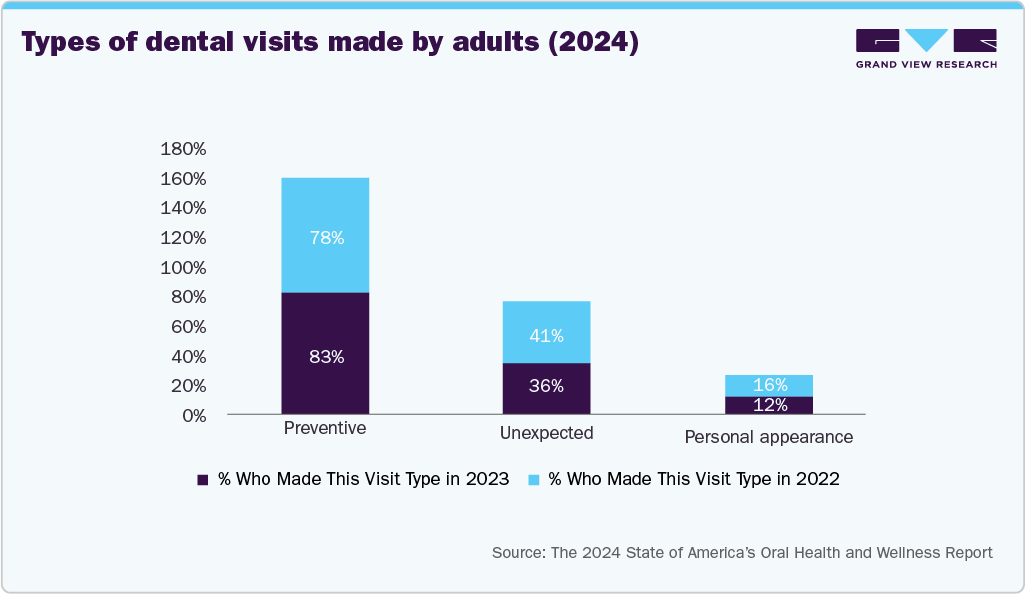

Growing awareness of oral health, expanding dental tourism, and advancements in surgical techniques enhance treatment outcomes and patient satisfaction, fueling market growth. In addition, digital implant planning and guided surgery systems improve procedural accuracy, reduce treatment time, and increase overall efficiency.

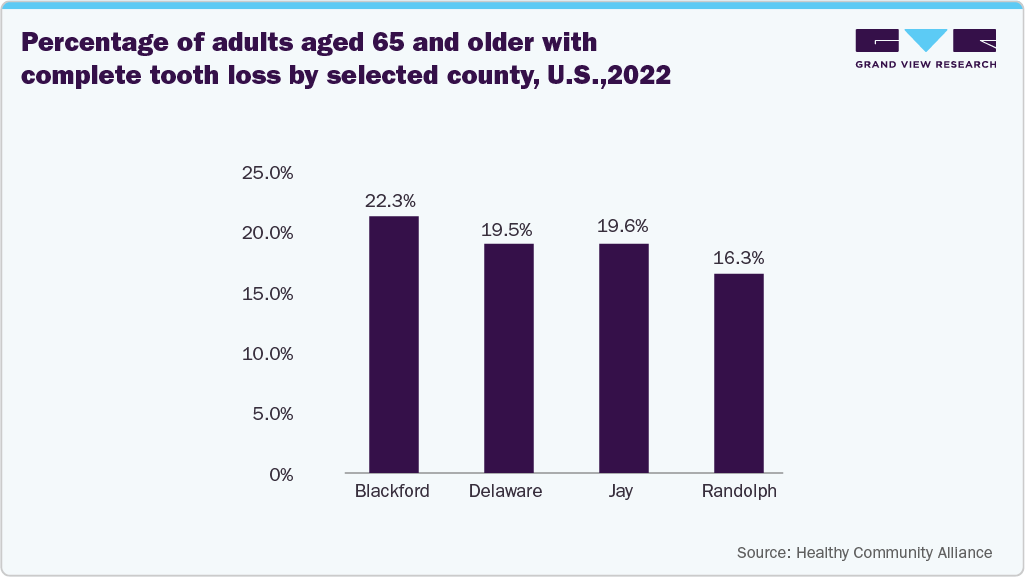

The growing prevalence of oral disorders, including tooth loss, tooth decay, and tooth extraction, is anticipated to propel the demand for dental implants. The data published by the WHO in March 2025 reports that approximately 7% of adults aged 20 and above, and around 23% of those aged 60 and above, experience complete tooth loss, underscoring the need for implants. The increasing burden of oral diseases, including cavities, tooth loss, and gum disease, is expected to raise the demand for dental implants significantly.

Furthermore, the burden of tooth loss is significant among the older population, which underscores the growing demand for dental implants among these patients. In addition, supportive policies contribute to the increased adoption of dental implants. For instance, a study published by the National Library of Medicine in September 2024 found that expanding dental care coverage for older adults in Korea led to a 13.5% increase in partial denture use and a 60.5% rise in dental implants among individuals aged 65 and older. Therefore, these factors, along with the rising prevalence of dental disorders in this demographic, are expected to drive market growth.

The introduction of innovative dental implant technologies continues to play a pivotal role in driving the growth of the dental implant industry. Industry players are actively launching advanced implant systems to improve clinical outcomes and procedural efficiency.

For instance, in April 2025, ZimVie Inc. launched its Immediate Molar Implant System in the U.S. market. This new system features specially engineered instrumentation to streamline site preparation following molar extraction, enabling a more controlled and predictable surgical procedure. It also includes optimized wide-diameter implants that provide a better fit within the molar socket, offering superior primary stability. Notably, the system incorporates ZimVie's proprietary DAE coronal surface technology, which may potentially reduce the risk of peri-implantitis by up to 20%. Moreover, unlike traditional treatment protocols that typically require a healing period of several months after molar extraction before implant placement, this system enables immediate placement and restoration, cutting treatment time by nearly half. The result is a simplified, efficient, and more predictable clinical workflow.

“The launch of our Immediate Molar Dental Implant System marks a significant milestone in our commitment to advancing dental technology. We have expanded the offering of our implant systems to address the unique challenges of molar tooth restoration and provide patients with shorter and more cost-effective treatment while delivering a more predictable, lasting outcome,” said ZimVie CEO Vafa Jamali.

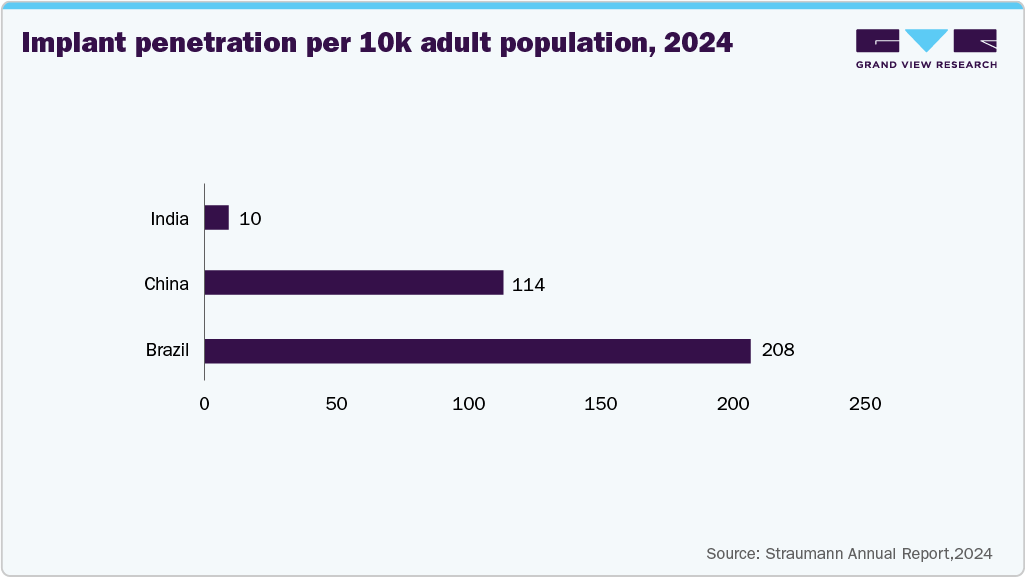

The rising burden of dental disorders in emerging economies such as China, India, and Brazil is creating substantial growth opportunities for the dental implants industry. According to data published by The Hindu in March 2025, nearly 60% of India's population is affected by dental caries, and approximately 85% suffer from gum disease. In China, data from the National Library of Medicine in March 2025 reveals that in 2021, the country accounted for 14.10% of global incident cases, 16.25% of prevalent cases, and 18.93% of YLDs (Years Lived with Disability) related to oral disorders. Similarly, Brazil is facing a significant economic impact, with the data published by the European Federation of Periodontology in March 2024 reporting that direct treatment costs for dental caries reached USD 36.23 billion among individuals aged 12-65. Some major causes of tooth loss include gum disease, cavities, and dental trauma, among others. Thus, the substantial population with risk factors for tooth loss is anticipated to drive the demand for implants among emerging markets.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The dental implants industry is characterized by significant growth owing to the rising demand for restorative dentistry procedures, growing developments of innovative products, and increasing clinical trials.

The degree of innovation in the dental implant industry is notably high, driven by rapid advancements in digital dentistry, biomaterials, and precision manufacturing technologies. Companies integrate computer-aided design and manufacturing (CAD/CAM), 3D printing, and AI-powered treatment planning to enhance implant accuracy and customization. Innovations in surface modification and nanotechnology are enhancing osseointegration and improving healing outcomes, while smart implants equipped with sensors are emerging to monitor implant stability and bone health in real-time. In August 2025, Dentsply Sirona launched its digital Product Selection Guide on its U.S. e-commerce platform. The new tool simplifies implant selection by providing clinicians with personalized product recommendations and a streamlined, user-friendly purchasing journey.

Regulations play a critical role in shaping the dental implant industry, ensuring patient safety, product efficacy, and quality compliance. Stringent standards set by authorities such as the U.S. FDA, European MDR, and other regional regulatory bodies have increased the need for robust clinical evidence and post-market surveillance. While this raises entry barriers for smaller players, it also enhances product reliability and market transparency. The focus on traceability, biocompatibility, and digital workflow integration under evolving frameworks encourages manufacturers to invest in R&D and quality assurance, ultimately driving innovation and patient trust.

The dental implant industry has seen significant mergers and acquisitions (M&A) in recent years, driven by the need for portfolio expansion, technological integration, and market consolidation. Leading companies have actively acquired innovative startups and regional manufacturers to strengthen their global presence and digital capabilities. These strategic moves enable access to new technologies, such as 3D printing, AI-based planning systems, and regenerative biomaterials, while broadening the geographic reach. In February 2025, Medtronic acquired key nanosurface technology assets from Nanovis, a leader in biologic fixation solutions for spine, orthopedic, and dental implants. The acquisition also included intellectual property rights related to Sites Medical's OsteoSync titanium pads.

Surface Treatment Type Insights

The SLA AND SLActive segment accounted for the largest market revenue share in 2024, driven by their superior surface technology that enhances osseointegration and accelerates healing time. These advanced surface treatments provide enhanced bone-to-implant contact, stability, and improved long-term success rates, making them the preferred choice among clinicians for both immediate and delayed loading procedures. Their strong clinical track record and proven reliability have positioned SLA and SLActive implants as the gold standard in modern implant dentistry.

The nano-textured surfaces segment is expected to register at the fastest CAGR over the forecast period, driven by its ability to significantly enhance osseointegration, cellular response, and long-term implant stability. Nano-textured implants feature surface modifications at the nanometer scale that mimic the natural structure of bone tissue, promoting superior osteoblast adhesion, proliferation, and differentiation. This results in faster healing and stronger bone-to-implant integration than conventional surface treatments. In addition, advancements in nanotechnology and surface engineering have enabled manufacturers to develop implants with improved biocompatibility, antibacterial properties, and mechanical strength, thereby reducing the risk of peri-implantitis and implant failure. The growing clinical preference for implants that ensure early loading and high success rates, combined with increasing R&D investment in next-generation surface modification techniques, is expected to drive the rapid growth of the nano-textured surfaces segment over the forecast years.

Design Insights

The tapered design segment accounted for the largest market revenue share in 2025, capturing the most significant share owing to its superior primary stability and versatility in various bone conditions. Tapered implants closely mimic the natural shape of a tooth root, allowing for better adaptation in narrow ridges and extraction sockets, which enhances placement precision and load distribution. Their design facilitates immediate implantation and loading, reducing treatment time and improving patient outcomes. In addition, the growing adoption of minimally invasive and digitally guided implant procedures has further bolstered clinicians' preference for tapered implants.

The parallel-walled segment is expected to grow at the fastest CAGR over the forecast period, driven by its predictable load distribution, ease of placement, and suitability for dense bone structures. Parallel-walled implants offer a larger surface area for bone contact, promoting excellent osseointegration and long-term stability, particularly in cases that require multiple implants or complex restorations. Their uniform shape enables greater surgical flexibility and consistency in achieving optimal insertion torque, thereby reducing the risk of micro-movements and implant failure. The increasing adoption of computer-guided and digitally planned implant procedures has also enhanced the precision and efficiency of parallel-walled implant placement. As clinicians seek reliable, stable, and versatile implant options, the parallel-walled segment is poised for rapid growth in the forecast years.

Material Insights

The titanium segment led the market with the largest revenue share of 90.99% in 2025, due to its exceptional biocompatibility, mechanical strength, and corrosion resistance. Dental professionals widely prefer titanium implants as they offer excellent osseointegration, ensuring long-term stability and durability within the jawbone. Their proven clinical success, extensive research support, and cost-effectiveness compared to newer materials have further strengthened their market position. Moreover, the development of titanium alloys and surface-treated variants has enhanced their performance, promoting faster healing and reduced implant failure rates. These advantages continue to make titanium the material of choice for most dental implant procedures worldwide.

The zirconia segment is expected to grow at the fastest CAGR over the forecast period, driven by rising demand for metal-free, highly aesthetic, and biocompatible alternatives to traditional titanium implants. Zirconia implants offer a superior tooth-colored appearance, making them ideal for patients with thin gingival tissue or high esthetic expectations. In addition, their excellent corrosion resistance, low plaque accumulation, and non-allergenic properties make them suitable for individuals with metal sensitivities. Advances in material processing and surface modification technologies have significantly improved zirconia’s mechanical strength and osseointegration capabilities, addressing earlier concerns about brittleness. The growing shift toward minimally invasive and aesthetically pleasing dental restorations, combined with increasing clinical validation of zirconia’s long-term performance, is expected to propel the segment’s rapid expansion in the forecast years.

Regional Insights

North America dominated the dental implants market with the largest revenue share of 36.05% in 2025, driven by the strong presence of leading manufacturers, advanced healthcare infrastructure, and high adoption of digital dentistry technologies. The region benefits from a large pool of trained dental professionals, the widespread use of CAD/CAM systems, 3D printing, guided implant surgery, and increasing patient awareness about aesthetic and restorative dental procedures. Favorable reimbursement policies, rising dental expenditure, and high prevalence of oral diseases and tooth loss further support market growth. Furthermore, continuous product innovations by key players such as Dentsply Sirona, Zimmer Biomet, and Straumann contribute to technological leadership in the region. North America remains the global hub for research, product development, and adoption of advanced dental implant solutions.

U.S. Dental Implants Market Trends

The dental implants market in the U.S. is growing, primarily driven by the rising incidence of oral cavity and oropharyngeal cancers, resulting in tooth loss, jawbone deterioration, and oral tissue damage. Patients undergoing cancer treatments such as surgery or radiation frequently require oral rehabilitation to restore function and aesthetics, creating a strong demand for advanced dental implant solutions. Modern implants, supported by digital imaging, guided surgery, and bone regeneration techniques, have enabled precise, long-term restorative outcomes for post-cancer patients. In addition, growing awareness about quality-of-life improvement and expanding insurance coverage for reconstructive dental procedures further support market growth. As the prevalence of head and neck cancers continues to rise, the demand for durable, biocompatible, and aesthetic dental implant systems in the U.S. is expected to increase significantly.

According to CDC, 2024 Oral Health Surveillance Report

-

Ages 2-5: 11% had untreated decay; higher in Mexican American (18.5%) and high-poverty (18%) groups. Avg: 1.8 decayed, 2.6 filled teeth.

-

Ages 6-8: 18% had untreated decay; prevalence was higher in high- (24.6%) and middle-poverty (24.8%) vs. low-poverty (11.6%). Avg: 0.9 decayed, 3.2 filled teeth.

-

Ages 6-9:

50% had cavities; 17% untreated decay. High-poverty (26.3%) and middle-poverty (23.4%) > low-poverty (10%). Mexican American (70.3%) > White (43.4%).

The American Cancer Society’s most recent estimates for oral cavity and oropharyngeal cancers in the U.S. are for 2025:

-

About 59,660 new cases of oral cavity or oropharyngeal cancer

-

About 12,770 deaths from oral cavity or oropharyngeal cancer

Europe Dental Implants Market Trends

The dental implants market in Europe is witnessing growth driven by the increasing prevalence of tooth loss, rising awareness of oral rehabilitation, and advancements in digital dentistry. The region benefits from a strong base of practicing dentists and well-established clinical infrastructure, particularly in countries such as the UK, Germany, Italy, Spain, and France. The growing number of dental practitioners supported by expanding dental service organizations and group practices has significantly enhanced access to implant procedures across the region. In addition, increasing adoption of computer-guided surgery, CAD/CAM systems, and digital imaging has improved treatment precision and efficiency, further boosting implant demand. The rising preference for aesthetic restorations and the aging population continue to support market growth, making Europe one of the most technologically advanced and mature regions in the global dental implant landscape.

Dentists Practicing, 2022

Country

Dentists (number)

Dentists (per 100,000)

Denmark

4,205

71.8

Germany

71,297

85.1

Spain

28,833

60.4

France

45,989

67.6

Italy

52,559

89.1

Norway

4,792

87.8

Source: Eurostat

The UK dental implants market is primarily driven by the growing incidence of tooth extractions and dental caries. The high prevalence of dental decay, resulting from poor oral hygiene, unhealthy dietary habits, and lifestyle factors, has increased the need for tooth replacement solutions. As more patients undergo extractions due to untreated cavities or advanced periodontal diseases, the demand for long-term restorative options such as dental implants continues to rise. In addition, increasing awareness about implants' functional and aesthetic advantages over traditional dentures and bridges influences patient preference and clinical practice. The National Health Service (NHS) and private dental clinics are witnessing a rise in implant procedures, supported by advancements in digital dentistry, improved implant materials, and a growing population seeking permanent tooth replacement solutions.

As per the Office for Health Improvement & Disparities UK, in May 2023

-

42,180 total hospital episodes of tooth extractions were recorded for children and young people aged 0-19 years.

-

26,741 episodes (63%) had a primary diagnosis of dental caries (tooth decay).

-

There was an 83% increase in caries-related tooth extraction episodes compared to 2020-2021.

-

Highest rates: Yorkshire and the Humber - 378 per 100,000 population

-

Lowest rates: East Midlands - 71 per 100,000 population

-

England average: 205 per 100,000 population

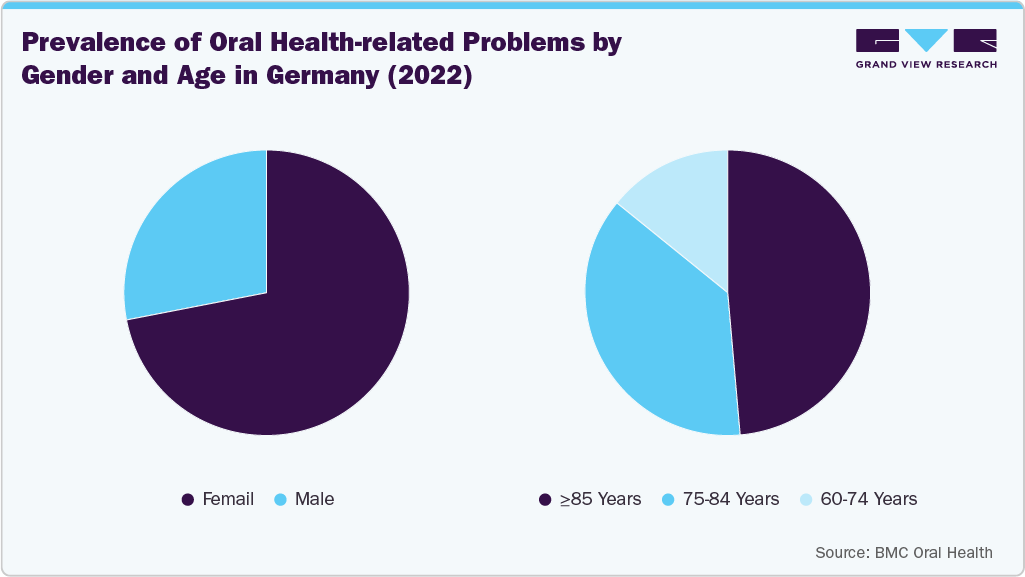

The dental implants market in Germany is experiencing growth driven by the increasing prevalence of oral cancers and other health-related issues. A significant portion of the German population suffers from conditions such as periodontitis, tooth loss due to decay, and complications from oral cancer treatments that often result in the need for tooth replacement. The growing number of oral cancer cases, particularly among aging adults and smokers, has increased the demand for advanced restorative and reconstructive dental solutions. Dental implants are preferred for post-oncological rehabilitation, as they restore functionality and aesthetics, improving patients’ quality of life after surgery or radiation therapy. Moreover, Germany’s well-established dental infrastructure, high number of practicing dentists, and strong emphasis on preventive and restorative dental care support the adoption of implant therapies.

Asia Pacific Dental Implants Market Trends

The dental implants market in the Asia-Pacific region is experiencing rapid growth, driven by rising oral health awareness, an expanding elderly population, and increasing disposable incomes across emerging economies, including China, India, and Thailand. The growing incidence of tooth loss, dental caries, and periodontal diseases is boosting the demand for long-term restorative solutions. In addition, the region’s improving healthcare infrastructure, the growing number of skilled dental professionals, and the surge in dental tourism, particularly in countries like India and South Korea, are making implant treatments more accessible and affordable. Adopting advanced technologies such as digital dentistry, CAD/CAM systems, and guided implant surgery further enhances clinical precision and treatment efficiency. Moreover, favorable government initiatives, the expansion of private dental chains, and the introduction of cost-effective implant materials, such as zirconia, are strengthening market growth.

The India dental implants market is witnessing growth, primarily driven by the increasing burden of oral health problems across the country. A large segment of the population continues to experience oral diseases such as dental caries, periodontal disease, tooth decay, and tooth loss conditions exacerbated by poor oral hygiene practices, high sugar intake, and widespread tobacco use. These issues have significantly increased the need for effective restorative dental solutions. Dental implants are the preferred treatment option due to their superior durability, functionality, and natural appearance compared to traditional dentures or bridges. In addition, growing awareness of oral health, rising disposable incomes, and improved access to advanced dental care, especially in urban centers, are accelerating market adoption. The rapid expansion of private dental clinics, greater availability of cost-effective implant systems, and the presence of both domestic and global dental manufacturers are further strengthening market growth.

Oral Health Burden in India (2022)

Oral Health Condition

Number of Cases in India

Percentage of Global Cases (%)

Caries of Permanent Teeth

366,858,183

18.1

Severe Periodontal Disease

221,084,427

20.3

Caries of Deciduous Teeth

98,199,025

18.9

Edentulism

34,905,533

9.9

Lip and Oral Cavity Cancer

327,648

23.4

Source: Global Oral Health Status Report (GOHSR)

The dental implants market in China is experiencing growth, driven by a rising oral health awareness, increasing disposable incomes, and expanding access to advanced dental care. A growing prevalence of oral diseases such as tooth decay, periodontal disorders, and tooth loss, particularly among the aging population, has significantly increased the demand for restorative dental procedures. Government initiatives promoting oral health, such as the “Healthy China 2030” plan, further enhance public awareness and encourage preventive dental care. Moreover, the expansion of dental clinics, the modernization of dental hospitals, and the increasing adoption of digital dentistry technologies such as CAD/CAM systems and 3D printing transform treatment practices and improve procedural outcomes. Domestic manufacturers are also playing a key role by offering affordable implant systems tailored to local market needs.

Middle East and Africa Dental Implants Market Trends

The dental implants market in the Middle East and Africa is experiencing growth, driven by improvements in healthcare infrastructure, rising awareness of oral health, and increasing demand for advanced restorative dental solutions. The growing prevalence of tooth loss, periodontal diseases, and dental caries, combined with an increasing geriatric population, has significantly increased the adoption of dental implants across the region. Countries such as the UAE, Saudi Arabia, and South Africa are leading the market, supported by well-established dental care facilities, strong government healthcare initiatives, and a growing focus on aesthetic dentistry. In addition, the rise of dental tourism, particularly in the Gulf region, and the increasing disposable income of the middle-class population are fueling market expansion.

Key Dental Implants Company Insights

Industry players are focusing on expanding their product portfolio by launching innovative products. In addition, they are adopting advanced technologies and acquiring other players to strengthen their position in the market.

Key Dental Implants Companies:

The following are the leading companies in the dental implants market. These companies collectively hold the largest market share and dictate industry trends.

- BioHorizons

- Nobel Biocare (Envista)

- ZimVie Inc.

- Osstem Implant

- Institut Straumann AG

- Bicon, LLC

- Leader Medica

- Dentsply Sirona

- Dentis

- Dentium Co., Ltd.

- T-Plus Implant Tech Co. Ltd.

- Kyocera Medical Corp

- Double Medical Technology Inc.

- Bioconcept Dental Implants

- Neoss Ltd.

- Southern Implants

Recent Developments

-

In July 2025, ZimVie Inc. announced a strategic distribution partnership with Osstem Implant Co., Ltd. (“Osstem Implant”), a prominent provider of high-quality dental implants and integrated dental technologies worldwide. This collaboration aims to strengthen ZimVie's global footprint by expanding into the rapidly growing Chinese implant market, which is estimated to exceed 10 million units sold annually, and to improve customer access to its innovative range of implant solutions.

-

In June 2025, INSTITUT STRAUMANN AG will invest USD 76 to 102 million on the Villeret site in Switzerland over the next five years. Villeret will continue to focus on the production of high-value-added products, including the newly launched iEXCEL high-performance implant system.

-

In March 2025, Dentsply Sirona announced its participation in the Academy of Osseointegration’s (AO) Annual Meeting 2025, scheduled for March 27-29 in Seattle, WA. At the event, the company showcased its newest innovation, the MIS LYNX implant, and hosted a Corporate Forum centered on the continued evolution of implant dentistry.

Dental Implants Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 6.02 billion

Revenue forecast in 2033

USD 11.02 billion

Growth rate

CAGR of 9.02% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Surface treatment type, material, design region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa ; Saudi Arabia; UAE; Kuwait

Key companies profiled

BioHorizons; Nobel Biocare (Envista); ZimVie Inc.; Osstem Implant; Institut Straumann AG; Bicon, LLC; Leader Medica; Dentsply Sirona; Dentis; Dentium Co., Ltd.; T-Plus Implant Tech Co. Ltd.; Kyocera Medical Corp; Double Medical Technology Inc.; Bioconcept Dental Implants; Neoss Ltd.; Southern Implants

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global dental implants market report based on surface treatment type, material, design, and region:

-

Surface Treatment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

SLA and SLActive

-

Anodized Surfaces

-

Nano-Textured Surfaces

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Titanium

-

Zirconia

-

-

Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Tapered

-

Parallel-Walled

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental implants market size was estimated at USD 5.56 billion in 2025 and is expected to reach USD 6.02 billion in 2026.

b. The global dental implants market is expected to grow at a compound annual growth rate of 9.02% from 2026 to 2033 to reach USD 11.02 billion by 2033.

b. North America dominated the dental implants market with the largest revenue share of 36.05% in 2025. The aging population is prone to tooth loss and tooth decay due to various medications prescribed to them. Hence, the region is expected to influence the dental implant market to a large extent due to its high geriatric population demanding oral care services.

b. The dental implant market is dominated by key industry players such as BioHorizons, Nobel Biocare (Envista), Zimmer Biomet Holdings, Inc., Osstem Implant, Institut Straumann AG, Bicon, LLC, Leader Medica, Dentsply Sirona, Dentis, Dentium Co., Ltd., T-Plus Implant Tech Co., Ltd., Kyocera Medical Corp, Double Medical Technology Inc., Bioconcept Dental Implants, Neoss Ltd., and Southern Implants.

b. Increasing applications of dental implants in various therapeutic areas along with increasing demand for prosthetics are some of the key factors expected to boost the market growth.

b. The titanium segment dominated the dental implant market, accounting for the largest revenue share in 2025, due to the widespread use of titanium dental implants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.