- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Carbon Fiber Reinforced Plastic Market Size Report, 2033GVR Report cover

![Carbon Fiber Reinforced Plastic Market Size, Share & Trends Report]()

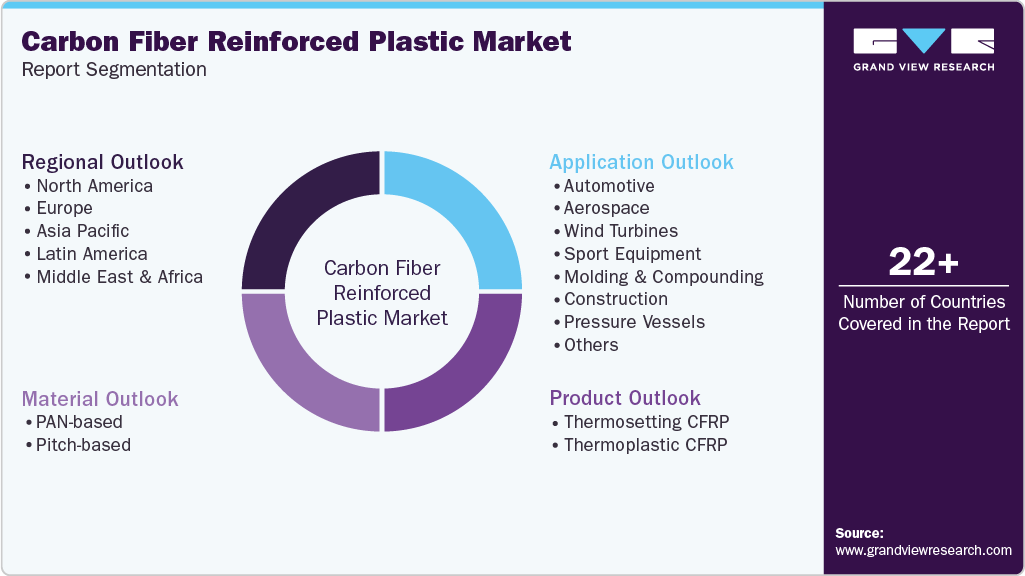

Carbon Fiber Reinforced Plastic Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (PAN-based, Pitch-based), By Product (Thermosetting, Thermoplastic), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-378-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Fiber Reinforced Plastic Market Summary

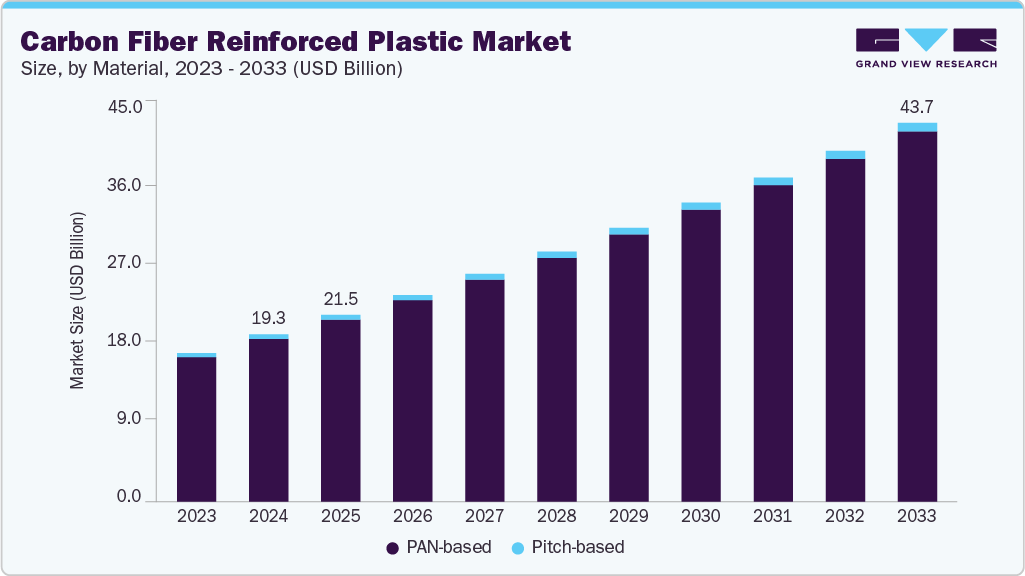

The global carbon fiber reinforced plastic market size was estimated at USD 19.27 billion in 2024 and is projected to reach USD 43.66 billion by 2033, growing at a CAGR of 9.2% from 2025 to 2033. Increasing demand for carbon fiber reinforced plastic (CFRP) from the automotive and aerospace industries, growing need for fuel-efficient vehicles, and government regulations to curb vehicular pollution are expected to drive market growth.

Key Market Trends & Insights

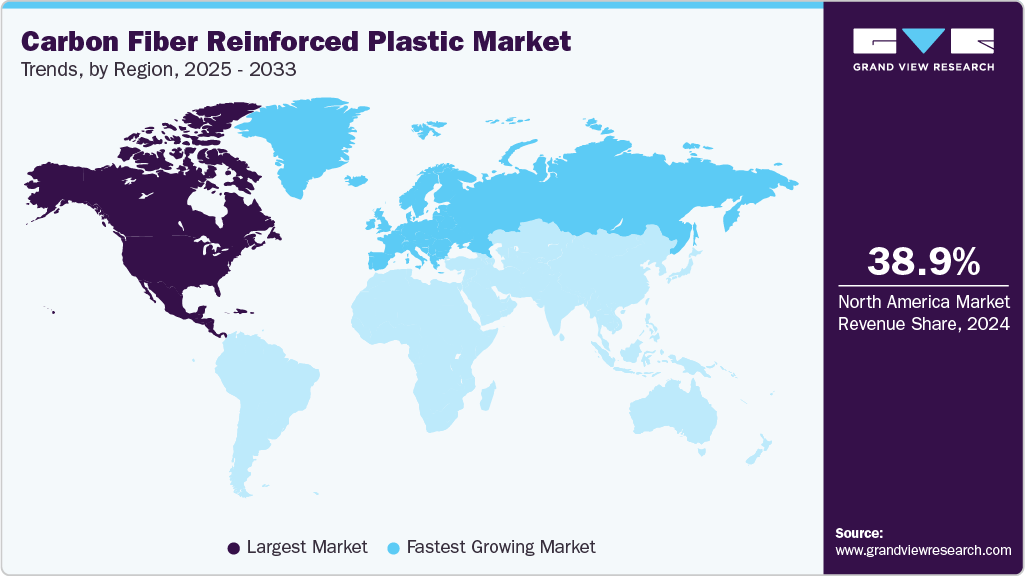

- North America dominated the carbon fiber reinforced plastic industry with the largest revenue share of 38.98% in 2024.

- The carbon fiber reinforced plastic industry in Mexico is expected to grow at a substantial CAGR of 10.2% from 2025 to 2033.

- By product, the thermoplastic CFRP segment is expected to grow at a considerable CAGR of 10.3% from 2025 to 2033 in terms of revenue.

- By material, the PAN-based segment is expected to grow at a considerable CAGR of 9.3% from 2025 to 2033 in terms of revenue.

- By application, the automotivesegment is expected to grow at a considerable CAGR of 10.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 19.27 Billion

- 2033 Projected Market Size: USD 43.66 Billion

- CAGR (2025-2033): 9.2%

- North America: Largest market in 2024

- Europe: Fastest growing market

The rise in demand for lightweight vehicles is projected to propel market growth in the coming years. Numerous government organizations, coupled with the favorable regulatory framework, facilitated the manufacturers to invest and enhance the research and development capabilities, quality, and automation in the process.

Carbon fiber reinforced plastic is transitioning from a niche high-performance material to a broader industrial technology as manufacturers blend technical innovation with scale economics. Investment is shifting toward automation in preform layup, automated fiber placement, and faster cure technologies to reduce cycle time and improve repeatability. At the same time, value chain participants are pursuing vertical integration and localized production to shorten lead times and respond to OEM qualification needs. This movement is enabling new applications beyond traditional aerospace and sporting goods into larger volumes segments such as automotive and wind energy.

Drivers, Opportunities & Restraints

A primary commercial driver is the relentless demand for weight reduction across sectors where power efficiency and range matter, notably automotive electrification and aerospace fuel efficiency. Carbon fiber delivers a superior strength to weight ratio, which directly supports lower energy consumption and improves performance metrics that OEMs prize. Regulatory pressure for lower emissions and customer expectations for efficiency are aligning procurement strategies with advanced composite adoption. As a result, procurement teams and design engineers are prioritizing materials that deliver measurable system-level gains rather than component-level savings.

There is a significant opportunity to capture value by rethinking the carbon fiber lifecycle through recycling, reuse, and new precursor chemistries that lower cost while maintaining performance. Companies that can commercialize economically viable recycling streams or scalable, low cost precursor routes will unlock broader market segments and create new revenue streams from reclaimed fiber. Additional upside exists in hybrid architectures that combine carbon fiber with lower cost materials to hit target performance at lower system cost, enabling uptake in mass market applications. Strategic partnerships between material suppliers, toolmakers, and OEMs to co-develop qualification pathways can also compress time to market and create a durable competitive advantage.

High production cost and the energy intensity of carbon fiber manufacture remain the single largest barrier to mass adoption in cost-sensitive markets. Long and expensive qualification cycles for safety-critical industries increase entry costs and favor incumbent suppliers with proven track records. Limited recycling infrastructure and challenging material recovery economics further constrain the total cost of ownership and corporate sustainability claims.

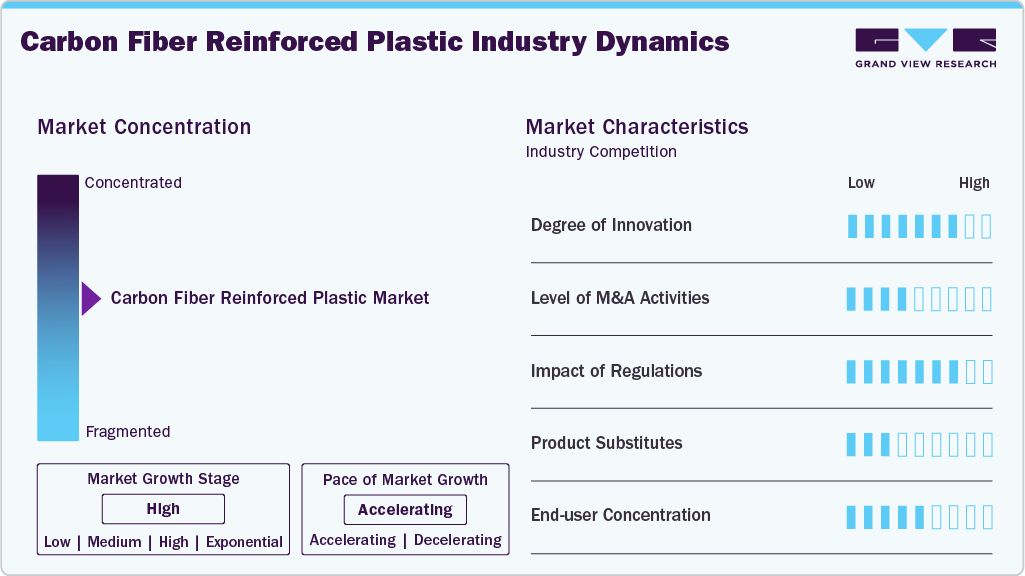

Market Concentration & Characteristics

The market growth stage of the carbon fiber reinforced plastic industry is high, and its pace is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies like DowAksa, Cytec Solvay Group, Toray Industries, Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in the carbon fiber reinforced plastic sector today is focused on closing the gap between laboratory promise and factory throughput. Advances in automated fiber placement and tape laying are raising production repeatability and enabling complex part geometries at lower labor cost, while fast cure resins and thermoplastic matrix systems are shortening cycle times and supporting repairable or recyclable architectures.

R&D into low cost precursors such as lignin and scalable recycling processes is diversifying feedstock choices and lowering entry barriers for new suppliers. Together, these technical shifts are moving the industry from bespoke, low-volume builds toward modular, higher volume manufacturing strategies that appeal to automotive, wind, and industrial OEMs.

Regulatory pressure is reshaping demand signals and forcing material choices to be judged by full life cycle performance rather than first cost alone. Tightening CO2 targets for passenger cars and heavy vehicles in Europe and similar fuel economy and greenhouse gas rules elsewhere are creating explicit lightweighting mandates that favor CFRP where system-level gains justify premium material cost.

EU circular economy and waste policy, plus public funding programs for circular manufacturing, are increasing the value of proven recycling streams and accountable end-of-life solutions, pushing OEMs to include recyclability in supplier qualification criteria. This combination raises compliance and qualification costs for suppliers while opening differentiated opportunities for firms that can certify low carbon, circular supply chains.

Material Insights

The PAN-based segment dominated the market across the material category in terms of revenue, accounting for a market share of 97.38% in 2024, and it is anticipated to grow at a 9.3% CAGR over the forecast period. The primary commercial driver for PAN based carbon fiber is its established compatibility with high volume structural applications where consistent mechanical performance and predictable processing matter.

Improvements in precursor manufacturing and stabilized supply chains have made PAN the default choice for automotive lightweighting programs and many industrial uses because it combines reliable tensile properties with qualification pathways familiar to OEMs.

The pitch-based segment is anticipated to grow at a significant CAGR of 7.5% through the forecast period. Pitch based carbon fiber is driven by demand for extreme stiffness, thermal conductivity and high modulus performance that substitutes for metals in niche aerospace, defense and thermal management applications.

Mesophase pitch routes enable fibers with a unique crystallographic order that deliver the stiffness and conductivity profile required by high end rotorcraft components, missile structures and heat spreaders for electronics.

Product Insights

Thermosetting CFRP dominated the market across the product segmentation in terms of revenue, accounting for a market share of 74.43% in 2024. Established qualification pathways in aerospace and industrial markets reward the material for its predictable long term mechanical properties and proven fatigue resistance, which makes it the default choice where regulatory and life cycle risk must be minimized.

Recent manufacturing innovations that enable faster in situ curing and tool free additive processes are reducing cycle time and narrowing the cost gap with lower cost alternatives, reinforcing thermosets as the preferred solution when performance certainty outweighs first cost.

The thermoplastic CFRP segment is anticipated to grow at the fastest CAGR of 10.3% through the forecast period. Thermoplastic carbon fiber composites are gaining a unique commercial edge from their assembly and circularity advantages that suit high volume production. The ability to reheat, weld and rapidly join thermoplastic parts transforms assembly economics by replacing mechanical fasteners and complex bonding steps, which shortens manufacturing takt and lowers total installed cost.

At the same time thermoplastic matrices enable simpler repair and material recovery pathways that align with OEM sustainability targets and help reduce end-of-life liabilities, making them especially attractive to automotive and next generation aerostructure programs focused on scale.

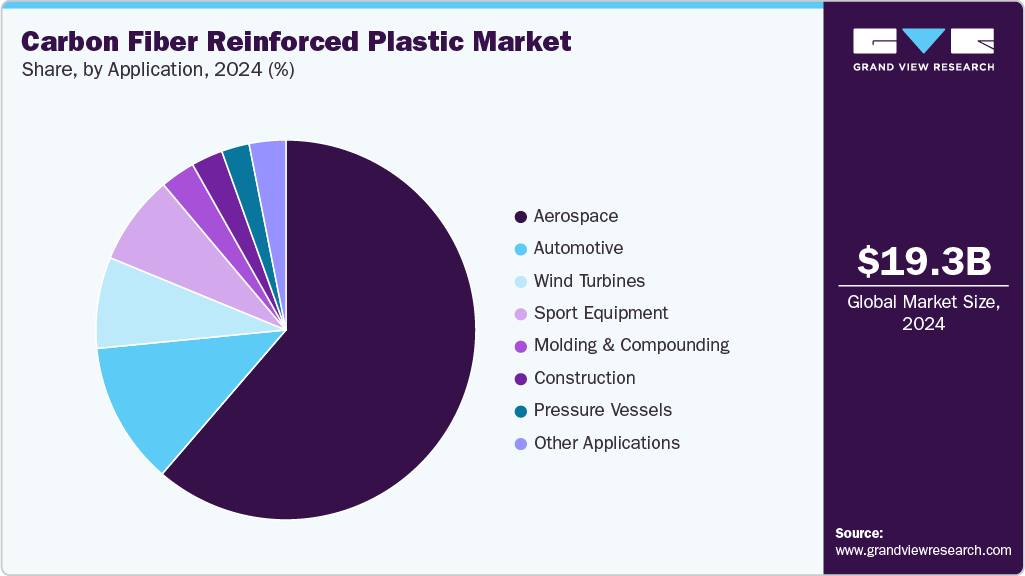

Application Insights

Aerospace dominated the market across the application segmentation in terms of revenue, accounting for a market share of 61.30% in 2024 and is anticipated to grow at 9.9% CAGR over the forecast period. The segment is expected to witness significant growth on account of increasing demand for lightweight and fuel-efficient aircraft. Technological developments in carbon-fiber-reinforced plastic can help reduce the high cost of aerospace-grade CFRP as compared to other grades in the market.

The automotive segment is expected to grow at a substantial CAGR of 10.3% through the forecast period. The automotive pollution control norms have forced automotive manufacturers to cut down automotive curb weight for reducing pollution. Rising fuel prices have driven the need for fuel-efficient vehicles, which has further compelled automotive manufacturers to incorporate carbon fiber-reinforced plastic in automotive production.

Regional Insights

North America carbon fiber reinforced plastic industry emerged as the largest regional market and accounted for a 38.98% revenue share in 2024. North America’s CFRP demand is being driven by a convergence of sectoral needs and a strategic push to onshore critical supply chains. Aerospace recovery and modernization programs are renewing structural CFRP orders while electric vehicle programs are specifying increased composite content to hit stringent efficiency targets, prompting OEMs to lock in domestic suppliers. Wind energy developers are also specifying longer, carbon rich blades to improve energy capture, creating scale demand that justifies local investment in fiber and prepreg capacity.

The growth of the automotive and aerospace and defense industries in the U.S., along with stringent government regulations regarding automotive pollution, is expected to drive the North American market. Technological advancements and government regulations on energy-efficient and environmentally friendly products are expected to drive product demand in this region.

U.S. Carbon Fiber Reinforced Plastic Market Trends

In the U.S. carbon fiber reinforced plastic industry, the unique growth vector is a blend of defense and civilian procurement that accelerates qualification and capital deployment for advanced composites. Defense platforms and next generation aircraft require certified, high performance laminates, and these programs often underwrite the long lead engineering and testing timelines that suppliers need to scale.

Europe Carbon Fiber Reinforced Plastic Market Trends

The Europe carbon fiber reinforced plastic industry is anticipated to grow at the fastest CAGR of 9.8% over the forecast period. The presence of key aircraft and automotive manufacturers in the region has fueled the product demand in Europe. The upsurge in demand from aerospace, defense, wind energy, and other end-users is expected to drive market growth. Moreover, it is a homeland for various important aircraft composite producers, such as SGL Carbon and Solvay. The growing Airbus craft services are significantly increasing CFRP demand in Europe.

Asia Pacific Carbon Fiber Reinforced Plastic Market Trends

Asia Pacific’s carbon fiber reinforced plastic industry momentum is defined by scale economics and a rapid industrialization cycle that spans China, Japan, South Korea and India, each with different adoption pathways. China’s large manufacturing base and investment in wind and EV supply chains create high volume demand that supports new precursor and fiber capacity, while Japan and Korea emphasize process innovation and high value applications in mobility and electronics. Regional policy support for renewable infrastructure and transport electrification accelerates specification of carbon rich architectures, and manufacturers there are increasingly focused on cost reduction through precursor diversification and localized recycling trials to capture lower price tiers.

Key Carbon Fiber Reinforced Plastic Company Insights

The carbon fiber reinforced plastic industry is highly competitive, with several key players dominating the landscape. Major companies include DowAksa, Cytec Solvay Group, Toray Industries, Inc., among others. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Carbon Fiber Reinforced Plastic Companies:

The following are the leading companies in the carbon fiber reinforced plastic market. These companies collectively hold the largest market share and dictate industry trends.

- DowAksa

- Cytec Solvay Group

- Toray Industries, Inc.

- SGL Group

- Hexcel Corporation

- Teijin Limited

- Mitsubishi Rayon Co., Ltd.

- Hyosung Corporation

- Gurit Holding AG

Recent Developments

-

In March 2025, the Mercedes-AMG PETRONAS Formula 1 Team announced that for the 2025 season they would qualify and use innovative sustainable carbon fiber composites on their W16 race car. This marked the first time sustainable carbon fibre would be applied in Formula 1. The goal was to integrate these eco-friendly materials without compromising on performance or safety. The composites, which make up about 75% of the car's material, involve both the fibers and resin system components, and the team has projects underway addressing each part.

-

In September 2024, Union Textiles of India announced that India would begin producing carbon fiber domestically by 2025-26, a significant shift from its current total dependence on imports from the US, France, Japan, and Germany. This strategic move is timely as the European Union plans to implement its Carbon Border Adjustment Mechanism in 2026, which will tax carbon-intensive imports.

Global Carbon Fiber Reinforced Plastic Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.51 billion

Revenue forecast in 2033

USD 43.66 billion

Growth rate

CAGR of 9.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

DowAksa; Cytec Solvay Group; Toray Industries Inc., SGL Group; Hexcel Corporation; Teijin Limited; Mitsubishi Rayon Co., Ltd.; Hyosung Corporation; Gurit Holding AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Fiber Reinforced Plastic Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global carbon fiber reinforced plastic market report based on product, material, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Thermosetting CFRP

-

Thermoplastic CFRP

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

PAN-based

-

Pitch-based

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Aerospace

-

Wind Turbines

-

Sport Equipment

-

Molding & Compounding

-

Construction

-

Pressure Vessels

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global carbon fiber reinforced plastic market size was estimated at USD 19.27 billion in 2024 and is expected to reach USD 21.51 billion billion in 2025.

b. The global carbon fiber reinforced plastic market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2033 to reach USD 43.66 billion by 2033.

b. PAN-based dominated the carbon fiber reinforced plastic market across the raw material segmentation in terms of revenue, accounting for a market share of 97.38% in 2024 and is anticipated to grow at 9.3% CAGR over the forecast period. The primary commercial driver for PAN based carbon fiber is its established compatibility with high volume structural applications where consistent mechanical performance and predictable processing matter.

b. Some key players operating in the carbon fiber reinforced plastic market include DowAksa, Cytec Solvay Group, Toray Industries, Inc., SGL Group, Hexcel Corporation, Teijin Limited, Mitsubishi Rayon Co., Ltd., Hyosung Corporation, and Gurit Holding AG.

b. Increasing demand for carbon fiber reinforced plastic (CFRP) from the automotive and aerospace industries, growing need for fuel-efficient vehicles, and government regulations to curb vehicular pollution are expected to drive the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.