- Home

- »

- Network Security

- »

-

Cloud Security Market Size And Share, Industry Report, 2030GVR Report cover

![Cloud Security Market Size, Share, & Trends Report]()

Cloud Security Market (2025 - 2030) Size, Share, & Trends Analysis Report By Component (Solution, Services), By Deployment (Private, Public), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-328-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Security Market Summary

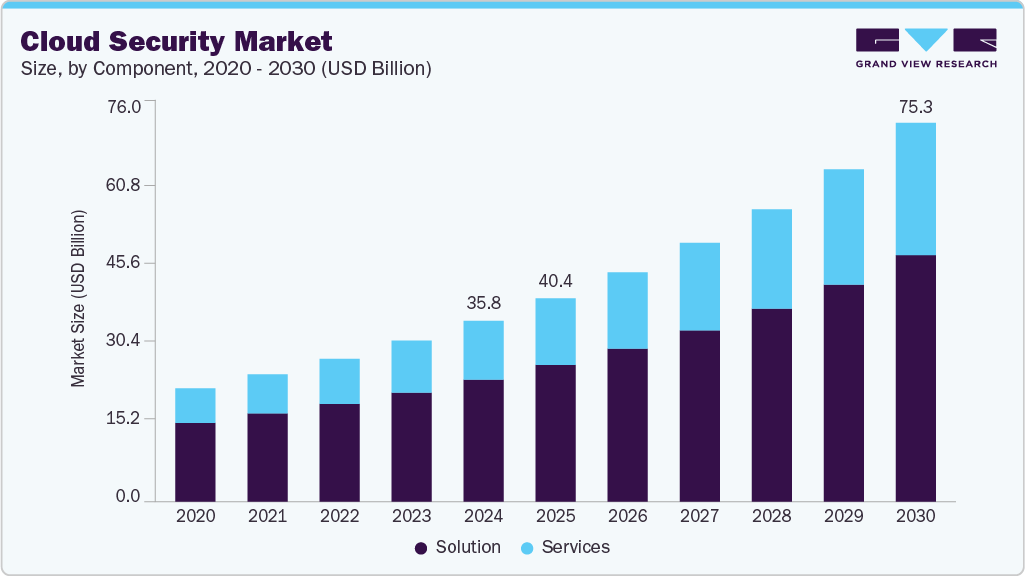

The global cloud security market size was estimated at USD 35.84 billion in 2024 and is projected to reach USD 75.26 billion by 2030, growing at a CAGR of 13.3% from 2025 to 2030. Driven by the accelerating global adoption of cloud computing across enterprises of all sizes.

Key Market Trends & Insights

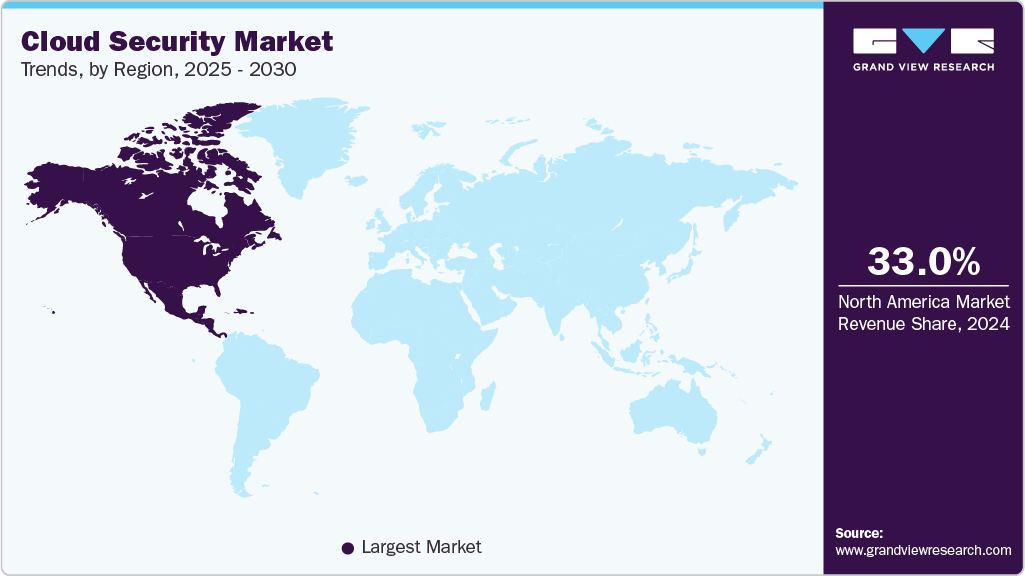

- North America dominated the market with a revenue share of over 33.0% in 2024.

- The cloud security market in the U.S. is expected to grow significantly at a CAGR of 10.6% from 2025 to 2030.

- By component, the solution segment dominated the market and accounted for the revenue share of over 67.0% in 2024.

- By deployment, the private segment dominated the market and accounted for the revenue share of over 48.0% in 2024.

- By enterprise size, the large enterprises segment dominated the market and accounted for the revenue share of over 74.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.84 Billion

- 2030 Projected Market Size: USD 75.26 Billion

- CAGR (2025-2030): 13.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As organizations increasingly migrate critical workloads and data to public, private, and hybrid cloud environments, the need to secure these assets has become paramount. This transition has elevated cloud security from a secondary IT concern to a central strategic imperative. Moreover, the proliferation of remote work models and hybrid workplace environments has expanded the threat surface, necessitating more sophisticated security frameworks and controls tailored to cloud infrastructure.The rising frequency and sophistication of cyber threats targeting cloud-based assets also contributes to the growth of cloud security industry. High-profile data breaches and ransomware attacks have underscored the vulnerabilities inherent in cloud platforms, prompting both regulatory scrutiny and heightened enterprise investments in cloud-native security solutions. In response, vendors are innovating rapidly, developing tools that incorporate advanced technologies such as artificial intelligence (AI), machine learning (ML), and automation to deliver real-time threat detection, automated incident response, and behavioral analytics. These innovations are enhancing the effectiveness and appeal of modern cloud security solutions. According to the Thales Cloud Security Study 2024, stated that cloud data encryption remains low, with fewer than 10% of enterprises encrypting 80% or more of their cloud data, despite 44% reporting cloud security incidents and 14% experiencing breaches in the past year.

Moreover, increasing regulatory mandates such as the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and industry-specific compliance frameworks are compelling organizations to implement rigorous cloud security measures. These compliance requirements are particularly critical in sectors such as healthcare, banking, and government, where data sensitivity is high. Furthermore, the growth of multi-cloud and hybrid cloud strategies is adding complexity to cloud environments, thereby fueling demand for unified, policy-driven security architectures that ensure consistency across platforms.

Component Insights

The solution segment dominated the market and accounted for the revenue share of over 67.0% in 2024, driven by the increasing complexity and scale of cloud environments that demand robust, scalable, and integrated security tools. As enterprises migrate diverse workloads to cloud platforms, spanning Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), the need for specialized security solutions such as cloud access security brokers (CASBs), cloud workload protection platforms (CWPPs), cloud security management (CSPM), and identity and access management (IAM) has intensified. These solutions help organizations gain visibility, enforce policies, manage configurations, and detect vulnerabilities across multi-cloud ecosystems.

The services segment is anticipated to grow at the highest CAGR of 14.7% during the forecast period driven byincreasing need for specialized expertise and ongoing support to secure complex, multi-layered cloud environments. As organizations adopt hybrid and multi-cloud strategies, they often encounter challenges in managing cloud configurations, maintaining consistent security policies, and ensuring regulatory compliance. This has led to a surge in demand for professional services, including risk assessment, compliance advisory, cloud security architecture design, and implementation support.

Deployment Insights

The private segment dominated the market and accounted for the revenue share of over 48.0% in 2024. Technological advancements in virtualization and software-defined infrastructure are making private cloud deployments more scalable and cost-efficient, further supporting their adoption. Enterprises are increasingly leveraging on-premises private clouds or hosted private clouds operated by third-party vendors, combining the benefits of cloud computing with enterprise-grade security controls. This hybrid approach allows businesses to maintain strict security standards while enjoying the flexibility of modern IT infrastructure.

The hybrid segment is expected to grow at CAGR of 13.7% over the forecast period owing tothe rising importance of business continuity and disaster recovery is influencing hybrid cloud growth. Many organizations prefer hybrid models for their ability to seamlessly failover from private to public clouds or vice versa in the event of a system outage or cyber incident. Security solutions that support hybrid deployments are now being designed with built-in redundancy, backup encryption, and cross-environment monitoring, making them essential components of resilient cloud strategies.

Enterprise Size Insights

Thelarge enterprises segment dominated the market and accounted for the revenue share of over 74.0% in 2024. The acceleration of remote and hybrid workforces has introduced new security challenges for large organizations. With thousands of endpoints and users accessing enterprise resources from diverse locations and devices, the attack surface has expanded dramatically. In response, large enterprises are increasingly adopting Zero Trust architectures and cloud-native security technologies such as Secure Access Service Edge (SASE), Cloud Access Security Brokers (CASB), and Identity and Access Management (IAM) to secure user access and data across distributed environments. These investments are driving the need for scalable, interoperable, and AI-driven cloud security platform.

The SMEs segment is expected to grow at a significant CAGR during the forecast period due tothe increasing availability of managed security services lowering the barrier to entry for SMEs. Managed Security Service Providers (MSSPs) offer continuous monitoring, incident response, and threat intelligence as part of cost-efficient packages, allowing SMEs to outsource critical security functions. This is particularly attractive for small businesses that lack the personnel or budget to maintain an in-house security team. These service-based models not only improve security resilience but also allow SMEs to scale their protection in line with business growth.

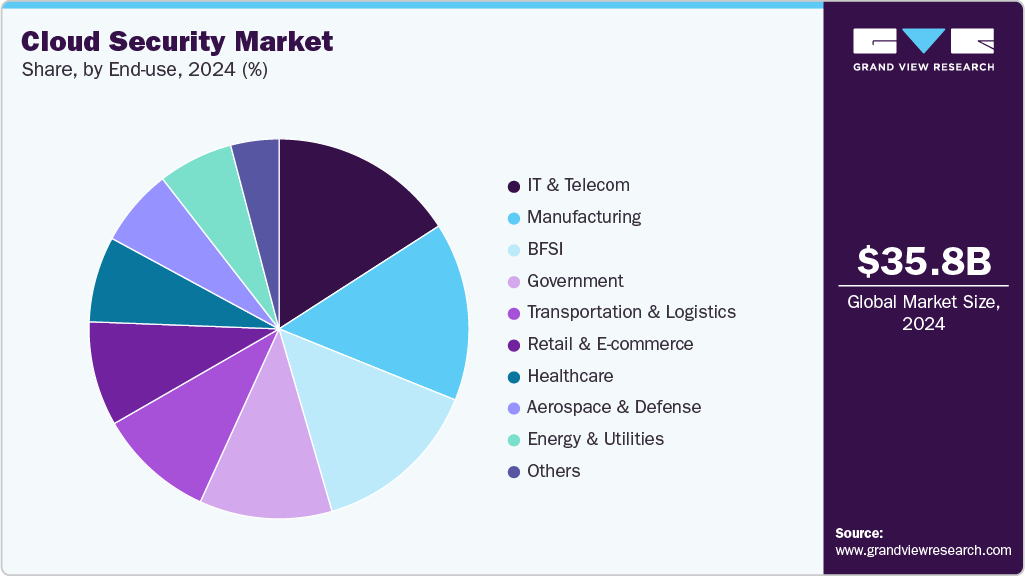

End Use Insights

The IT & telecom segment dominated the market and accounted for the revenue share of nearly 16.0% in 2024. As core facilitators of cloud infrastructure, telecom operators and IT service providers are at the forefront of cloud adoption and innovation. They operate complex, high-volume networks that handle sensitive customer data, large-scale communications, and mission-critical applications, making them prime targets for cyberattacks. The need to ensure data privacy, service availability, and compliance is pushing this sector to invest heavily in robust cloud security solutions that provide comprehensive protection against threats such as distributed denial-of-service (DDoS) attacks, data breaches, and insider threats.

The healthcare segment is expected to grow at a significant CAGR over the forecast period due tothe rapid digital transformation of healthcare services and the rising adoption of cloud-based electronic health records (EHR), telemedicine, and health information exchange (HIE) platforms. These technologies have enabled healthcare providers to enhance patient care, operational efficiency, and data accessibility. However, they also introduce significant cybersecurity risks due to the sensitive nature of personal health information (PHI) and the industry's status as a high-value target for cybercriminals.

Regional Insights

North America dominated the market with a revenue share of over 33.0% in 2024, driven by its mature cloud adoption ecosystem and a high incidence of sophisticated cyberattacks. The region hosts many of the world’s largest cloud service providers and digital-first enterprises, creating significant demand for advanced security solutions. Enterprises across sectors are investing in next-generation security tools such as Zero Trust architectures, Extended Detection and Response (XDR), and cloud workload protection platforms (CWPP).

U.S. Cloud Security Market Trends

The cloud security market in the U.S. is expected to grow significantly at a CAGR of 10.6% from 2025 to 2030 driven by the growing digital transformation across federal, state, and enterprise-level operations. Critical infrastructure sectors, including healthcare, finance, and energy, are moving core workloads to the cloud, which elevates the need for stringent cloud security measures. Another key driver is the legal landscape, with mandates such as HIPAA, SOX, and FedRAMP pushing cloud providers and users to adopt auditable and compliant security practices.

Europe Cloud Security Market Trends

The cloud security market in Europe is anticipated to register a considerable growth from 2025 to 2030, driven by strong regulatory pressure and a rising demand for data sovereignty. The General Data Protection Regulation (GDPR) has had a profound impact on how data is stored, processed, and secured in the cloud, compelling both domestic and international firms to adopt cloud security solutions that ensure compliance.

The UK cloud security market is expected to grow rapidly in the coming years. The shift toward digital government services and NHS modernization programs is significantly boosting the adoption of cloud security tools.British enterprises are particularly focused on securing customer trust, and this has driven adoption of advanced threat detection, encryption, and identity management tools.

The cloud security market in Germany held a substantial market share in 2024,driven by its industrial sector’s digital transformation under initiatives such Industry 4.0. Manufacturing companies adopting Industrial Internet of Things (IIoT) and cloud-based automation platforms face unique security challenges, particularly around securing operational technology (OT).

Asia Pacific Cloud Security Market Trends

Asia Pacific is expected to be the fastest growing region, registering the highest CAGR of 15.0% from 2025 to 2030, due to increased cloud adoption among SMEs, digitization efforts by governments, and rising cybersecurity awareness. Markets such as Australia, South Korea, and India are investing heavily in cyber resilience as digital infrastructure expands.

The Japan cloud security market is expected to grow rapidly in the coming years driven by its government’s "Digital Agency" initiatives, which aim to modernize public services through cloud migration. These efforts are accompanied by strict information security protocols, pushing public and private sector organizations to invest in robust cloud security frameworks.

The cloud security market in China held a substantial market share in 2024, due to strong government mandates around cybersecurity and cloud computing. The introduction of the Cybersecurity Law and Data Security Law imposes stringent requirements on both domestic and foreign cloud providers operating in China, prompting significant investments in localized cloud security solutions.

Key Cloud Security Company Insights

Key players operating in the cloud security industry are Palo Alto Networks, Inc., Amazon Web Services, Inc. (AWS), Cisco Systems, Inc., Fortinet, Inc., and Zscaler, Inc. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, Palo Alto Networks unveiled Cortex Cloud, the latest evolution of Prisma Cloud. This enhanced platform integrates advanced cloud detection and response (CDR) with top-tier native application protection (CNAPP) capabilities on the unified Cortex system. Leveraging AI and automation, Cortex Cloud empowers security teams to move beyond conventional cloud defense strategies, enabling real-time threat prevention and faster attack mitigation.

-

In January 2025, Zscaler, Inc. introduced its Zero Trust Network Access (ZTNA) service, integrated within SAP's RISE. Delivered via the Zscaler Zero Trust Exchange platform, Zscaler Private Access (ZPA) for SAP helps customers with on-premises ERP systems streamline and secure their cloud migration, eliminating the complexities and risks linked to traditional VPN solutions.

-

In October 2024, Fortinet, Inc. launched Lacework FortiCNAPP, a unified AI-powered platform designed to secure the entire cloud environment from code to runtime through a single vendor. This new solution builds on Lacework’s existing strengths by adding automated threat remediation and blocking active runtime attacks, along with improved visibility into FortiGuard Outbreak Alerts, delivering critical insights on emerging threats and their potential impact on organizational security.

Key Cloud Security Companies:

The following are the leading companies in the cloud security market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Broadcom, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Extreme Networks, Inc.

- Fortinet, Inc.

- F5, Inc.

- Forcepoint

- IBM Corporation

- Imperva

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trellix

- Zscaler, Inc.

Cloud Security Market Report Scope

Report Attribute

Details

Market size in 2025

USD 40.36 billion

Revenue forecast in 2030

USD 75.26 billion

Growth rate

CAGR of 13.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Broadcom, Inc.; Check Point Software Technologies Ltd.; Cisco Systems, Inc.; Extreme Networks, Inc.; Fortinet, Inc.; F5, Inc.; Forcepoint; IBM Corporation; Imperva; Palo Alto Networks, Inc.; Proofpoint, Inc.; Sophos Ltd.; Trellix, Zscaler, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cloud security market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

CASB

-

CDR

-

CSPM

-

CIEM

-

CWPP

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private

-

Hybrid

-

Public

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Retail & E-commerce

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Government

-

Aerospace & Defense

-

Energy & Utilities

-

Transportation & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the cloud security market include Amazon Web Services, Inc., Broadcom, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Extreme Networks, Inc., Fortinet, Inc., F5, Inc., Forcepoint, IBM Corporation, Imperva, Palo Alto Networks, Inc., Proofpoint, Inc., Sophos Ltd., Trellix, Zscaler, Inc.

b. The growth of the cloud security market is driven by the accelerating global adoption of cloud computing across enterprises of all sizes. As organizations increasingly migrate critical workloads and data to public, private, and hybrid cloud environments, the need to secure these assets has become paramount. This transition has elevated cloud security from a secondary IT concern to a central strategic imperative.

b. The global cloud security market size was estimated at USD 35.84 billion in 2024 and is expected to reach USD 40.36 billion in 2025.

b. The global cloud security market is expected to grow at a compound annual growth rate of 13.3% from 2025 to 2030 to reach USD 75.26 billion by 2030.

b. IT & telecom end-use segment held the largest market share of nearly 16.0% in 2024. The need to ensure data privacy, service availability, and compliance is pushing this sector to invest heavily in robust cloud security solutions that provide comprehensive protection against threats such as distributed denial-of-service (DDoS) attacks, data breaches, and insider threats.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.