- Home

- »

- Network Security

- »

-

Identity And Access Management Market Share Report, 2030GVR Report cover

![Identity And Access Management Market Size, Share & Trends Report]()

Identity And Access Management Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (BFSI, Education), By Component (Directory Service, Provisioning), By Deployment (Cloud, On-premise), And Segment Forecasts

- Report ID: 978-1-68038-564-9

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Identity And Access Management Market Summary

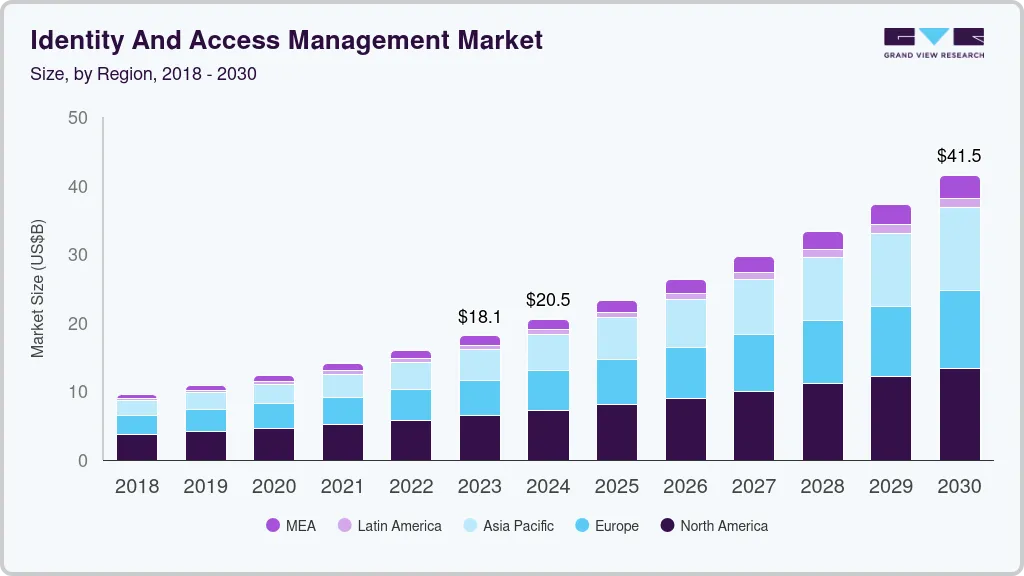

The global identity and access management market size was estimated at USD 15.93 billion in 2022 and is projected to reach USD 41.52 billion by 2030, growing at a CAGR of 12.6% from 2023 to 2030. Identity and access management (IAM) assures that the appropriate person and job position (identities) in an organization have access to the tools they need to perform their duties.

Key Market Trends & Insights

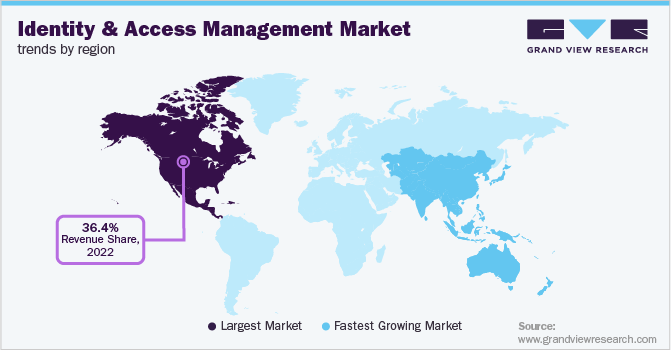

- North America dominated the global industry in 2022 and accounted for the largest share of more than 36.45% of the overall revenue.

- On the basis of components, provisioning sub-segment dominated the industry in 2022 and accounted for the largest share of more than 29.70% of the overall revenue.

- On the basis of deployment modes, on-premise deployment sub-segment led the market in 2022 and accounted for the largest share of more than 50.45% of the overall revenue.

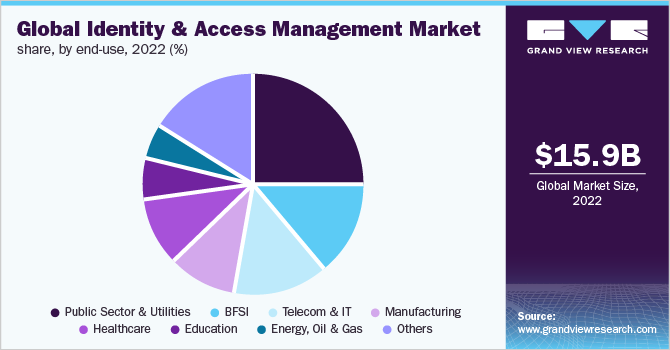

- On the basis of end-uses, public sector & utilities segment dominated the industry in 2022 and accounted for the maximum share of more than 25.00% of the overall revenue.

Market Size & Forecast

- 2022 Market Size: USD 15.93 Billion

- 2030 Projected Market Size: USD 41.52 Billion

- CAGR (2023-2030): 12.6%

- North America: Largest market in 2022

Identity management and access systems allow companies to administer employee apps without logging in as an administrator to each app. Advances in the internet of things (IoT) and artificial intelligence (AI), rising awareness about regulatory compliance management, increasing reliance on digital platforms & automation, and growing adoption of cloud technologies across industries are estimated to drive the market over the forecast period.

The rising cases of fraudulent and cybercrime activities are driving organizations to implement IAM systems as a result of the rapid adoption of the cloud and the advancement of new technologies. IAM uses identity analytics and intelligence to monitor unusual user account activity. In addition, it allows for the deletion of inactive accounts, the detection of policy violations, and the removal of inappropriate access privileges. Hence, the rising enterprise identity and security concerns drive the growth of the industry. Moreover, lower production costs make application administration effortless; the centralizing process time for connectivity and identity modifications increases user reliability, provides easier access to sign-in, signup, and user management processes for application holders, and implements procedures and policies related to user verification and prerogatives.

Furthermore, the integration of the IAM solution and mobile device Management (MDM) may utilize IAM more efficiently and enable the organization’s security and control. MDM is a critical component of IAM as it allows one to control apps and users on the device. Because IAM can be used on multiple devices, extending IAM to mobile devices is a must for any business. MDM is an essential component of IAM as it provides security and the ability to provision apps to devices. MDM collaborates with IAM to help protect each device and, as a result, create security for the user. Both IAM and MDM are critical to each other. MDM allows businesses to easily use identity and access management, while also providing control and security.

Businesses that choose this system will benefit, but they must be aware that to avoid vulnerable points, biometric solutions must be compatible with any smartphone. However, failure to store data, such as personal information and authentication credentials, may result in data breaches and digital identity fraud. Enterprise bring-your-own-device (BYOD) policies have made IAM systems more complicated. Furthermore, the high installation costs of these systems are expected to stifle the growth of the industry over the forecast period. The industry is adopting the latest IAM business technologies as capital technology. These technologies have increased market opportunities for IAM, which have been purchased and implemented in recent years.

IAM contracts' market revenue necessitates extensive implementation. Hence, cloud-based IAM services and technologies are becoming more accessible. These factors are estimated to create lucrative growth opportunities in the global market. The COVID-19 outbreak impacted several business sectors, including the access industry and individuals. Since COVID-19, internet services have played a significant role. Internet services made the population reliant on the growth of the IAM market. During the pandemic, access management software had a critical role in the growth of the overall industry.

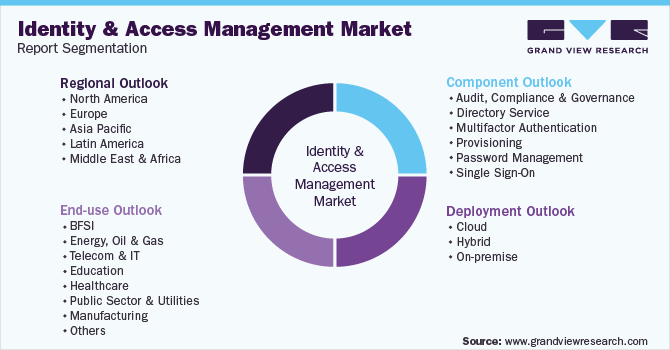

Component Insights

On the basis of components, the global industry has been further categorized into audit, compliance & governance, directory service, multifactor authentication, provisioning, password management, and single sign-on. The provisioning sub-segment dominated the industry in 2022 and accounted for the largest share of more than 29.70% of the overall revenue. Identity management as a service provides an additional layer of security by identifying, validating, and granting individuals access to a company's information systems.

Hence, this promotes segment growth. The multifactor authentication sub-segment is anticipated to advance at the fastest CAGR over the forecast period. This sub-segment adds multi-layer security by requiring users to provide multiple identifying credentials and a user ID to access applications. The added layer of security enhances the overall security, which has resulted in the high adoption of multifactor authentication among various businesses operating in different industries, thereby driving the growth of the segment.

Deployment Insights

On the basis of deployment modes, the global industry has been further classified into cloud, hybrid, and on-premise. The on-premise deployment sub-segment led the market in 2022 and accounted for the largest share of more than 50.45% of the overall revenue, due to the functionality of the solution without the need for an external network connection and access through Wide-Area Network (WAN) too. The cloud-based sub-segment is anticipated to register the highest CAGR over the forecast period.

Cloud computing has many benefits for any business, such as controlling IT systems and lowering costs for repairing, faster access to data for continuing business as regular operations with fewer interruptions & productivity losses, and ensuring data backup & storage in a secure and safe location. For instance, in March 2021, according to ForgeRock, 80.0% of IT decision-makers have adopted, expanded, or plan to adopt cloud-based solutions. Thus, the rising adoption of cloud-based solutions by SMEs drives segment growth.

End-use Insights

On the basis of end-uses, the industry has been further classified into BFSI; energy, oil & gas; telecom & IT; education; healthcare; public sector & utilities; manufacturing; and others. The public sector & utilities end-use segment dominated the industry in 2022 and accounted for the maximum share of more than 25.00% of the overall revenue. Rising digitalization adoption, increased investment in public sector applications, and the presence of a large amount of public data that are to be stored are the factors driving the segment growth.

The BFSI segment is estimated to expand at the fastest CAGR over the forecast period. The growing popularity of online payments, e-wallets, and digital/retail banking is expected to increase the adoption of these types of solutions across the BFSI sector to ensure appropriate access to the right people, manage risks, and comply with security regulations. Manufacturing, education, IT & telecom, retail & consumer packaged goods, and energy & utilities are all expected to grow significantly over the forecast period.

Regional Insights

On the basis of geographies, the industry has been further categorized into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. North America dominated the global industry in 2022 and accounted for the largest share of more than 36.45% of the overall revenue. Increased cases of cyber-attacks faced by firms due to increased internet penetration are among the key driving factors for regional growth.

The rising demand for cybersecurity management and data safety is further expected to boost the region’s growth over the coming years. On the other hand, Asia Pacific is expected to register the fastest growth rate over the forecast period. Rising internet penetration, rapid digital infrastructure development, the presence of a large number of SMEs adopting such systems, and growing operational digitalization are all contributing to the development of the IAM market in the Asia Pacific region.

Key Companies & Market Share Insights

The global industry is highly competitive. Key players undertake various strategies, such as M&A, business expansions, and product portfolio expansions, to gain a higher market share. For instance, in May 2022, Microsoft announced the launch of a family of IAM named Entra. Entra includes its existing tools, such as Azure AD, with its new product, Decentralized Identity and Cloud Infrastructure Entitlement Management (CIEM). Entra is intended to safeguard access to any resource or application by allowing security professionals to detect and manage permissions in multi-cloud environments, allowing them to secure digital identities from end to end. Some of the prominent players in the global identity and access management market include:

-

Amazon Web Services, Inc.

-

Broadcom

-

One Identity LLC.

-

ForgeRock

-

HID Global Corp.

-

IBM

-

McAfee, LLC

-

Microsoft

-

Okta

-

OneLogin

-

Oracle

-

Ping Identity

-

SecureAuth

-

Evidian

-

Intel Corp.

Identity And Access Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.09 billion

Revenue forecast in 2030

USD 41.52 billion

Growth rate

CAGR of 12.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Broadcom; One Identity LLC.; ForgeRock; HID Global Corp.; IBM; McAfee, LLC; Microsoft; Okta; OneLogin; Oracle; Ping Identity; SecureAuth; Evidian; Intel Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Identity And Access Management Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global identity and access management market report on the basis of component, deployment, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Audit, Compliance & Governance

-

Directory Service

-

Multifactor Authentication

-

Provisioning

-

Password Management

-

Single Sign-On

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

Hybrid

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Energy, Oil & Gas

-

Telecom & IT

-

Education

-

Healthcare

-

Public Sector & Utilities

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The global Identity And Access Management market size was estimated at USD 15.93 billion in 2022 and is expected to reach USD 18.09 billion in 2023.

b. The global Identity And Access Management market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 41.52 billion by 2030.

b. North America dominated the Identity And Access Management market with a share of 36.49% in 2022. This is attributable to the favorable regulatory scenario in the region.

b. Some key players operating in the Identity And Access Management market include Oracle Corporation, IBM Corporation, CA Technologies, NetIQ Corporation (Micro Focus), HID Global Corporation.

b. Key factors that are driving the market growth include increasing implementation of IAM solution for business facilitation, improving operational efficiency, and increasing security concerns among organizations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.