- Home

- »

- Next Generation Technologies

- »

-

Digital Transformation Market Size, Industry Report, 2030GVR Report cover

![Digital Transformation Market Size, Share & Trends Report]()

Digital Transformation Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Solution, Service), By Deployment (Hosted, On-premise), By Enterprise Size (SME, Large Enterprises), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-851-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Transformation Market Summary

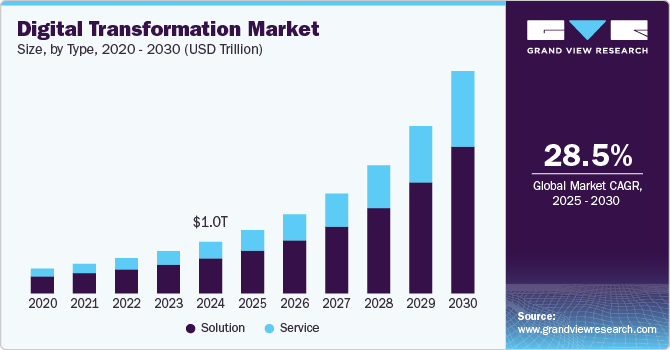

The global digital transformation market size was estimated at USD 1,070.43 billion in 2024 and is projected to reach USD 4,617.78 billion by 2030, growing at a CAGR of 28.5% from 2025 to 2030. The increasing adoption of cloud computing is driving market growth. Cloud-based solutions enable businesses to scale their operations efficiently, reduce IT costs, and enhance agility.

Key Market Trends & Insights

- North America digital transformation market dominated the global industry with a revenue share of over 43.0% in 2024

- The digital transformation industry in U.S. dominated the regional market in 2024.

- Based on type, the solution segment accounted for the highest revenue share of over 67.0% in 2024.

- Based on deployment, the hosted segment led the market with the largest revenue share of 51.6% in 2024.

- Based on the enterprise size, the large organization segment dominated the market and accounted for a revenue share of over 57.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,070.43 Billion

- 2030 Projected Market Size: USD 4,617.78 Billion

- CAGR (2025-2030): 28.5%

- North America: Largest market in 2024

Enterprises are moving away from legacy systems to embrace cloud-native applications, Software-as-a-Type (SaaS) platforms, and hybrid cloud models. Cloud computing facilitates seamless data access, real-time collaboration, and remote work capabilities, which became even more critical following the COVID-19 pandemic. Major cloud service providers such as Amazon Web Types (AWS), Microsoft Azure, and Google Cloud are fueling digital transformation by offering AI-powered analytics, cybersecurity solutions, and automation tools to businesses worldwide.The integration of artificial intelligence (AI) and machine learning (ML) is another significant driver of digital transformation. AI is revolutionizing industries such as healthcare, finance, manufacturing, and retail by enabling intelligent automation, predictive analytics, and real-time decision-making. Businesses are using AI-powered tools for fraud detection, supply chain optimization, robotic process automation (RPA), and customer service automation. AI-driven digital transformation is not only improving efficiency but also reducing operational costs and enhancing innovation capabilities.

The rise of the Internet of Things (IoT) and edge computing is also accelerating digital transformation. IoT devices are generating vast amounts of data that businesses can analyze to improve operations, enhance productivity, and optimize asset management. Industries such as smart manufacturing, healthcare, transportation, and energy are leveraging IoT-enabled sensors, real-time monitoring, and automation to streamline processes. Additionally, edge computing solutions enable faster data processing by reducing latency and improving real-time analytics, making digital transformation more effective in mission-critical applications. According to a survey by Toptal, a technology services provider, 85% of organizations undergoing digital transformation reported enhanced operational efficiency. Additionally, 76% experienced higher customer satisfaction, while 68% saw revenue growth.

The increasing need for cybersecurity and data protection is another crucial driver. As businesses adopt digital technologies, they also face growing cyber threats and data breaches. Companies are investing heavily in cybersecurity solutions, data encryption, and compliance frameworks to protect sensitive information and maintain customer trust. Governments are implementing strict regulations such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), compelling businesses to adopt secure digital transformation strategies.

Additionally, the expansion of 5G networks is enabling faster and more reliable digital connectivity, further accelerating digital transformation efforts. 5G technology supports high-speed internet, low-latency applications, and seamless IoT connectivity, making it a crucial enabler for industries such as autonomous vehicles, smart cities, and telemedicine. With faster connectivity, businesses can deploy advanced automation, cloud-based applications, and immersive digital experiences, further driving market growth.

Type Insights

Based on type, the industry is segmented into solution and service. The solution segment accounted for the highest revenue share of over 67.0% in 2024. The rapid digitalization of the financial sector drives the demand for digital transformation solutions. Banks, insurance firms, and financial institutions are undergoing massive transformations to meet the evolving needs of digitally savvy customers. The adoption of fintech solutions, blockchain technology, and AI-powered fraud detection systems is revolutionizing the way financial services are delivered. Digital transformation solutions enable financial institutions to offer seamless online banking experiences, automate compliance processes, and enhance risk management capabilities. With growing concerns over cybersecurity and regulatory compliance, organizations are integrating secure payment solutions, AI-based authentication, and cloud-based financial management systems to enhance transparency and efficiency.

The service segment is expected to register a significant CAGR during the forecast period. The rising adoption of cloud-based services is driving the segment growth. Businesses are rapidly transitioning from on-premise systems to cloud platforms, such as Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). However, migrating to the cloud involves strategic planning, risk assessment, and ongoing management. Service providers offer cloud consulting, deployment, and optimization services to help businesses maximize the benefits of cloud computing while minimizing disruptions. Additionally, managed cloud service providers help organizations monitor cloud environments, enhance security, and optimize costs, further fueling demand for cloud-focused digital transformation services.

Deployment Insights

Based on deployment, the hosted segment led the market with the largest revenue share of 51.6% in 2024. This growth can be attributed to the increasing use of mobile devices and advancements in information-sharing technologies. Cloud-based digital transformation solutions allow End-use industries effective and efficient ways to adapt to evolving markets. Simultaneously, increasing private and public investments in cloud-based technology are anticipated to create a lucrative environment for segment growth in the forecast period.

On-premise deployment is expected to register a CAGR of 24.6% during the forecast period. On-premises solutions offer high-level data security, which makes end users companies easily adopt with various government regulations. Similarly, various on-premises digital transformation solutions offer businesses better control over their sensitive data. However, end use companies are focusing on implementing cloud-based digital transformation solutions owing to their diverse subscription plans and low operating costs. This is expected to restrict the market growth in the forecast period.

Enterprise Size Insights

Based on the enterprise size, the large organization segment dominated the market and accounted for a revenue share of over 57.0% in 2024. Large enterprises are focusing on digital transformation since it provides cost-effectiveness and seamless business process execution. Large businesses require data safety, enhanced adaptability, and straightforward framework coordination. Due to their greater ability to allocate financial resources, large businesses are better able to implement new strategies throughout the entire organization and increase profitability.

The small & medium enterprise (SME) segment is expected to grow at the highest CAGR over the forecast period. Digitization at a rapid pace, increased company scalability, and improved customer experience are driving the adoption of digital transformation solutions in SMEs. Additionally, there is a growing need for cloud-based solutions due to their greater accessibility and cheaper prices. These factors will drive market growth in the coming years.

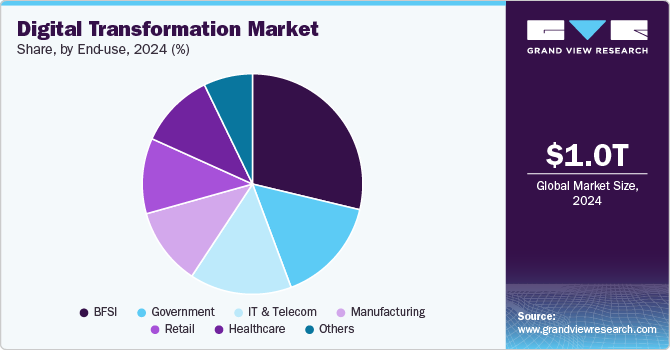

End-use Insights

Based on end use, the BFSI segment led the market with the largest revenue share of over 28.0% in 2024 as banks and financial institutions are focusing on offering enhanced consumer experiences to improve their brand identity and improve their overall customer base. The rising focus of financial institutions on providing support to improve the overall customer retention rate and provide seamless technical support is driving segment growth. The growing popularity of remote work has fueled the market growth in the BFSI industry.

The healthcare segment is anticipated to grow at a significant CAGR over the forecast period. The healthcare segment is expected to witness significant growth over the forecast period. Digital transformation in healthcare can produce beneficial results in marketing and sales while providing a holistic view of each patient. Hence, the key market players are concentrating on modernizing their solutions by integrating advanced technologies, such as ML, AI, and big data, across their business portfolios. Further, digitalization in healthcare enables organizations to deliver contextual and predictive offerings to their customers.

Regional Insights

North America digital transformation market dominated the global industry with a revenue share of over 43.0% in 2024, owing to the high adoption of different types of online payment modes and the rapid adoption of cloud computing technologies. Further, the growing consumer preference for digital media to post reviews and share experiences is prompting brands and enterprises to adopt digital transformation solutions and develop a customer-centric business model. Enterprises in the U.S. and Canada are spending aggressively and allocating a dedicated budget for marketing and digital channels, supporting the industry trend.

U.S. Digital Transformation Market Trends

The digital transformation industry in U.S. dominated the regional market in 2024. The country has a well-developed IT infrastructure, including robust data centers and high-speed networks, which are essential for efficient container deployment and management. A thriving venture capital landscape in the U.S. has fueled innovations in the container technology space, with substantial investments in startups developing cutting-edge container solutions. Moreover, the presence of mature players such as Google, Amazon Web Types (AWS), and others is driving the country's market growth.

Europe Digital Transformation Market Trends

The digital transformation market in Europe is anticipated to grow at a notable CAGR from 2025 to 2030. Various factors, such as growing social media penetration, expanding 5G network coverage, rising penetration of smartphones, and development of advanced payment methods, are some of the major factors driving the adoption of these solutions in Europe.

The UK digital transformation market held a major revenue share in the European market. Aggressive investments to implement digital transformation initiatives, such as Industry 4.0, coupled with the growing use of process automation tools powered by the latest technologies, such as artificial intelligence (AI) and machine learning (ML), are expected to drive the need for solutions to automate processes, minimize variations, and improve customer experience across the UK.

The digital transformation market in Germany is expected to witness a high growth rate during the forecast period. In Germany, several industries, including financial services, manufacturing, and information technology, are focusing on digitizing their business operations, thereby creating growth opportunities for digital marketing software in the country.

France digital transformation market is expected to grow at a CAGR of 29.0% during the forecast period. Increasing the adoption of digital technologies by various end use industries to enhance efficiency and improve the overall customer experience will help in the market growth.

Asia Pacific Digital Transformation Market Trends

The digital transformation market in Asia Pacific is anticipated to register significant growth with a CAGR of 31.2% due to the rising adoption of digital transformation solutions in SMEs. The growing adoption of advanced AI-driven analytics tools to offer personalized services for both B2B and B2C consumers is one of the major factors impacting the growth of the regional market. A large proportion of smartphone users in the Asia Pacific region are accessing social media through their mobile phones. Therefore, the region offers enormous opportunities for digital transformation solutions.

China digital transformation market held a major market share in the Asia Pacific region. In China, organizations are increasingly adopting big data for various business processes. At the same time, the government supports digitization of the workplace, thereby encouraging enterprises to adopt EDM solutions.

The digital transformation market in India is anticipated to witness a high growth rate during the forecast period. In countries such as India, the number of Small & Medium Enterprises (SMEs) is rising rapidly, and these SMEs are putting a strong emphasis on implementing digital transformation solutions as part of the efforts to drive their regional and global businesses.

Japan digital transformation market is expected to grow at a significant CAGR during the forecast period. In Japan, the advanced information technology infrastructure has enabled high-speed digital connectivity, which is allowing vendors to provide both on-premise and hosted digital transformation solutions. The high rate of adoption of mobile phones and other connected devices is also making it easier for organizations in Japan to draft innovative marketing strategies and boost sales.

Middle East & Africa (MEA) Digital Transformation Market Trends

The digital transformation market in the Middle East & Africa is expected to grow at a significant CAGR from 2025 to 2030. Initiatives undertaken by governments and corporations to promote advanced technologies, such as machine learning, business analytics, and Al, coupled with continuous adoption of cloud-based technologies, are anticipated to fuel the demand for implementing digital transformation across business processes in Middle Eastern countries.

Saudi Arabia digital transformation market is anticipated to grow significantly during the forecast period. Infrastructure developments in Saudi Arabia are likely to produce a large volume of data, particularly across the BFSI, retail & consumer goods, healthcare, and utility sectors, which will increase the demand for digital transformation solutions over the forecast period.

Key Digital Transformation Company Insights

The market has a consolidated competitive landscape featuring several global and regional players. Industry players are undertaking strategies such as new developments related to product launches, product updates, partnerships, mergers & acquisitions, and collaborations to survive the highly competitive environment and expand their business footprints.

Some of the key players operating in the market include Adobe Systems Inc., Accenture, and Broadcom, Inc., among others.

-

Adobe Systems Inc. has developed a diverse portfolio of products, including applications like Photoshop, Illustrator, and Acrobat, serving industries such as graphic design, photography, video editing, and digital marketing. The company introduced Adobe Sensei, an AI and machine learning framework, to power intelligent features across its software suite, streamlining workflows and enabling users to achieve more efficient and innovative results.

-

Accenture is a global professional services company specializing in consulting, technology, and outsourcing services. The company offers a wide range of services across various industries, including strategy and consulting, interactive technology, and operations, helping clients improve their performance and create sustainable value. Accenture's commitment to digital transformation is further exemplified by its partnership with Nvidia to promote corporate adoption of AI technologies. This collaboration includes training 30,000 Accenture employees using Nvidia's AI software and establishing a dedicated Nvidia business division. The initiative, Accenture AI Refinery, aims to reimagine business processes and scale AI solutions across enterprises, highlighting the potential of generative AI agents in transforming various business functions.

Happiest Minds and Kellton Tech Solutions Ltd.are some of the emerging market participants in the target market.

-

Perforce Software, Inc. is a U.S. company specializing in the development of software solutions that support application development and management. The company's flagship product, Perforce Helix Core, is a version control system that efficiently handles large codebases, supporting both centralized and distributed workflows. Perforce offers a comprehensive suite of tools encompassing web-based repository management, developer collaboration, application lifecycle management, web application servers, debugging tools, platform automation, and agile planning software. These integrated solutions cater to diverse industries, including gaming, automotive, financial services, and healthcare, facilitating streamlined development processes and enhanced operational efficiency.

Key Digital Transformation Companies:

The following are the leading companies in the digital transformation market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Adobe Systems Inc.

- Broadcom, Inc.

- Cisco Systems, Inc.

- Dell EMC

- Dempton Consulting Group

- Google Inc.

- Happiest Minds

- Hewlett Packard Enterprise Co.

- IBM

- Kellton Tech Solutions Ltd.

- Microsoft Corporation

- Salesforce, Inc.

- SAP SE

- TIBCO Software

Recent Developments

-

In April 2024, Happiest Minds acquired PureSoftware Technologies Private Limited, enhancing its expertise in the Banking, Financial Services, and Insurance (BFSI) sector, as well as Healthcare and Life Sciences. This acquisition strengthens its domain capabilities and expands its geographic footprint. Along with increasing its presence in the U.S. and UK, Happiest Minds will gain a near-shore presence in Mexico and establish offices in Singapore, Malaysia, and Africa.

-

In January 2024, Google LLC partnered with Worldline in order to boost its digital transformation initiatives and streamline its operations. Worldline will use Google's cloud-based technologies to enhance its digital payment for customers across Europe.

-

In January 2024, Microsoft signed a 10-year partnership agreement with Vodafone to enhance their customer experience services using generative AI technologies from Microsoft. The companies will develop financial and digital services for SMEs across Africa and Europe.

Digital Transformation Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1,316.62 billion

Revenue forecast in 2030

USD 4,617.78 billion

Growth rate

CAGR of 28.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion/trillion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

IBM; Amazon Web Types Inc.; Microsoft; Google LLC; Broadcom; Joyent; Rancher; SUSE; Sysdig Inc.; Perforce Software Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Digital Transformation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital transformation market report based on type, deployment, enterprise size, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Analytics

-

Cloud Computing

-

Mobility

-

Social media

-

Others

-

-

Service

-

Professional Services

-

Implementation & Integration

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hosted

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Government

-

Healthcare

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital transformation market size was estimated at USD 1,070.43 billion in 2024 and is expected to reach USD 1,316.62 billion in 2025.

b. The global digital transformation market is expected to grow at a compound annual growth rate of 27.6% from 2024 to 2030 to reach USD 4,617.78 billion by 2030.

b. The analytics segment accounted for the largest market share, more than 33.9% in 2024, attributable to the analytical solutions' ability to support a broad range of applications across various end-use industries and growing demand by end-use firms to gain powerful insights from enormous data volumes.

b. The hosted segment accounted for the market share of 51.6% in 2024. This growth can be attributed to the increasing use of mobile devices and advancements in information-sharing technologies Cloud-based digital transformation solutions allow End-use industries, effective and efficient ways to adapt to evolving markets.

b. The large organization segment holds the largest market share of 57.3% in 2024. Large enterprises are focusing on digital transformation since it provides cost-effectiveness and seamless business process execution.

b. The key players in the digital transformation market are Accenture plc; Adobe Systems Inc.; Broadcom, Inc.; Cisco Systems, Inc.; Dell EMC; Dempton Consulting Group; Google Inc.; Happiest Minds; Hewlett Packard Enterprise Co.; International Business Machines Corporation; Kellton Tech Solutions Ltd.; Microsoft Corporation; Salesforce, Inc.; SAP SE; and TIBCO Software among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.