- Home

- »

- Automotive & Transportation

- »

-

Cold Storage Market Size & Share, Industry Report, 2033GVR Report cover

![Cold Storage Market Size, Share & Trends Report]()

Cold Storage Market (2026 - 2033) Size, Share & Trends Analysis Report By Storage Type (Facilities/Services, Equipment), By Temperature Range (Chilled, Frozen, Deep-frozen), By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-225-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Storage Market Summary

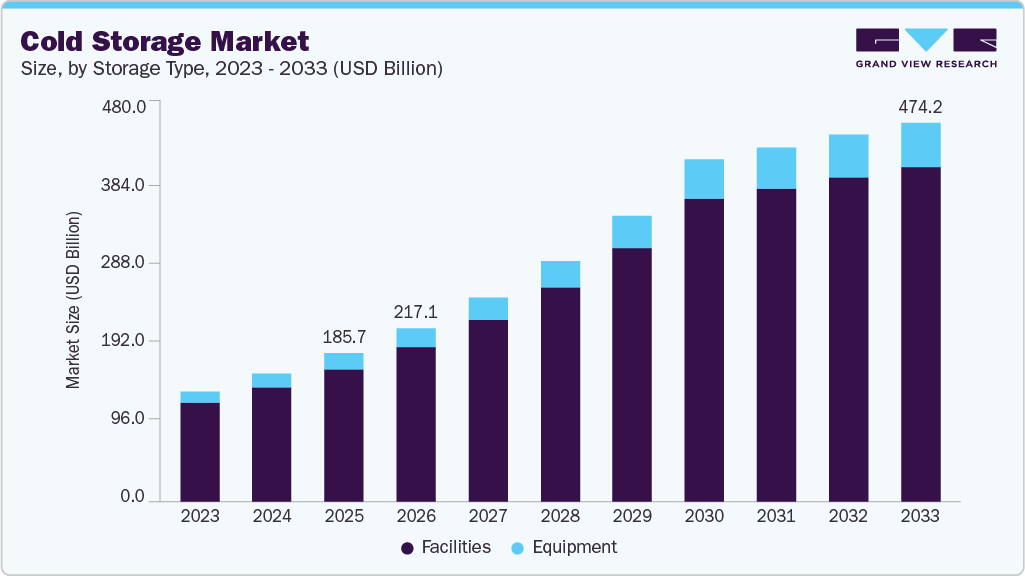

The global cold storage market size was estimated at USD 185.75 billion in 2025 and is projected to reach USD 474.21 billion, growing at a CAGR of 11.8% from 2026 to 2033. The market has benefited significantly from the strict regulations governing the supply and production of temperature-sensitive products.

Key Market Trends & Insights

- The North America cold storage market held the largest revenue share of more than 33.0% in 2025.

- The U.S. cold storage industry’s growth is driven by the rising demand for temperature-controlled food, expanding e-commerce, and increasing focus on supply chain efficiency and food safety.

- By type, the facilities/services segment dominated the market with a revenue share of 89.3% in 2025.

- By temperature range, the frozen (-18°C to -25°C) segment dominated the overall market in 2025.

- By application, the food & beverages segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 185.75 Billion

- 2033 Projected Market Size: USD 474.21 Billion

- CAGR (2026-2033): 11.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The industry is expected to grow significantly over the forecast period, driven by the expansion of organized retail sectors in developing economies. Moreover, the rising automation in refrigerated warehouses is projected to boost the demand for cold storage further. Warehouse automation encompasses cloud technology, conveyor belts, robots, energy management, and truck loading automation. Refrigerated storage has become integral to supply chains when storing and transporting temperature-sensitive products. In addition, the growing perishable product trade is also expected to boost the demand for refrigerated storage solutions over the next few years.Companies in the cold storage industry are adopting low-carbon designs and investing in environmental auditing and innovative construction methods. A low-carbon design that minimizes energy consumption can lead to more sustainable and environmentally friendly warehouses. The use of energy-efficient technologies, such as intelligent automation and control systems, can reduce energy costs and lower the carbon footprint of these facilities.

The need for a high initial investment to establish a cold storage facility is one of the key factors hampering the growth of the market. Cold storage facilities require significant investment to construct the unit, install the necessary equipment, and maintain and repair the infrastructure. This cost can be especially high for companies just starting in the market, as they need to invest in high-quality infrastructure, refrigeration systems, and insulation to ensure proper temperature control and energy efficiency.

The insufficient strategies to tackle the coronavirus spread across the globe increased the pandemic's impact on several industries, and cold storage is no exception. With the lockdowns in place, the online buying channels saw a sudden boost in demand. The combined effect of lockdowns and the fear of contracting the virus prompted people to adjust their purchasing patterns and shift to online channels for buying products, including medicines, groceries, and other food items.

In March 2020, the U.S. Department of Homeland Security classified cold storage facilities as essential infrastructure, enabling continuous operations during the ongoing COVID-19 pandemic. As a result, the demand for e-commerce services increased, particularly from the retail sector. Although the economy is returning to normalcy, people are still inclined towards online purchasing. Increased online purchasing for food items will require more cold storage space, boosting the market growth.

The e-commerce companies are also increasing their efforts to develop strategies for capturing the market demand by leveraging the increased online purchasing habits of the people. These market players are focusing on reducing order fulfillment time, especially for groceries. For instance, in April 2023, Amazon.com, Inc., a U.S.-based e-commerce company, announced that it reorganized its U.S. fulfillment network from a national to a regional model to reduce delivery times. Evolving consumer behavior and increased preference for online channels are anticipated to boost market growth over the forecast period.

Furthermore, the pharmaceutical industry is also highly impacted by the spread of the novel coronavirus. Though medical supplies fall under the essential category and were largely immune from the impact of the lockdown, the government guidelines to ensure sufficient supplies across the nation have also escalated the requirement for robust temperature-controlled facilities to ensure timely and effective supply. The increasing trend of consuming processed food products is also a key factor driving the global market for cold storage.

Storage Type Insights

The facilities/services segment dominated the cold storage market, accounting for an 89.3% revenue share in 2025. Based on facilities/services, the market has been segmented into refrigerated warehouses and cold rooms. According to the United States Department of Agriculture, in October 2021, the public warehouse capacity accounted for around 71% of the gross refrigerated storage capacity in the U.S. A public warehouse is operated as an independent business that offers various services, such as transportation, storage, and handling for a variable or fixed fee. The growing availability and automation of refrigerated warehouse facilities by numerous market players drive the segment's growth.

The equipment segment is anticipated to grow at the fastest CAGR in 2025. Factors such as shifting food preferences, evolving lifestyles, and the rise of online food delivery services are driving the global demand for frozen food. Cold storage equipment stores various perishable food items within the specified temperature ranges to avoid spoilage and increase shelf life. The use of such equipment aids in reducing food wastage as the equipment can store food for a longer duration, driving segment growth.

Temperature Range Insights

The frozen (-18°C to -25°C) segment dominated the cold storage industry, gaining a revenue share of more than 63.0% in 2025. Rising consumption of frozen foods in emerging markets, such as China and India, is driving the segment growth. Warehouses in this segment are used to store frozen fruits, vegetables, fish, meat, seafood, and other perishable products. Changing consumer preferences and the growing consumption of ready-to-cook meals due to convenience is expected to boost the frozen (-18°C to -25°C) segment growth. The proliferation of organized retail chains, including supermarkets and hypermarkets, is also triggering the demand for such products in emerging economies.

The chilled (0°C to 15°C) segment is anticipated to grow at a considerable CAGR from 2026 to 2033. Warehouses falling under the chilled segment are used to store fresh fruits & vegetables, eggs, dairy products, dry fruits, and dehydrated foods, among others. The chilled temperature range is that of a standard refrigerator, which prevents the growth of harmful bacteria on perishable food products and prevents decomposition. The need to store and extend the shelf life of temperature-sensitive products is driving segment growth.

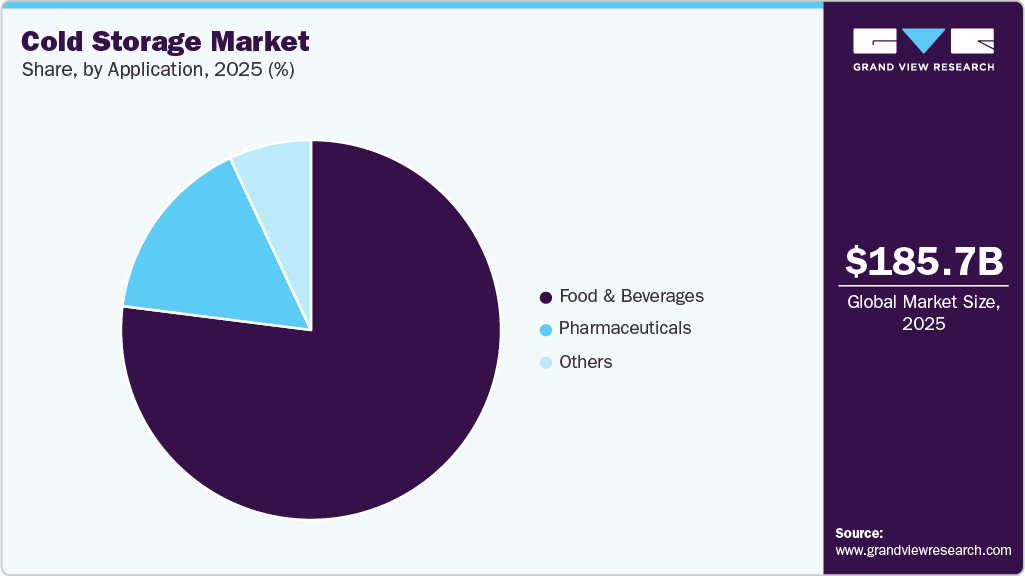

Application Insights

The food & beverages segment dominated the overall cold storage market, gaining a revenue share of more than 76.0% in 2025. Refrigerated storage solutions remain vital for safeguarding food items, such as milk and dairy products, against spoilage. Hence, principles governing the deterioration of food substances due to bacterial growth need to be adhered to while storing dairy products in refrigerated warehouses. The need to maintain food quality and prevent deterioration is driving the growth of the food & beverages segment.

The pharmaceuticals segment is expected to grow at the fastest CAGR from 2026 to 2033. Strict government regulations regarding the manufacturing and distribution of pharmaceutical products are driving the adoption of cold storage solutions. Pharmaceutical products must be preserved in a specific temperature range to maintain efficacy and adhere to temperature regulations. As a result, the demand for cold chain storage & equipment is rising in the pharmaceutical industry. The optimal temperature range for storing and transporting vaccines is 2°C to 8°C. Some equipment to facilitate this includes cold boxes, ice packs, and refrigerators.

Regional Insights

The North America cold storage market led globally and accounted for a 33.6% revenue share in 2025. The proliferation of connected devices and the presence of a large consumer base are the major factors propelling the region’s growth. The presence of prominent market players, including U.S.-based LINEAGE LOGISTICS HOLDING, LLC; Americold Logistics, Inc.; United States Cold Storage; and Canada-based CONESTOGA COLD STORAGE, is aiding the regional market growth. According to the United States Department of Agriculture, in October 2021, the gross refrigerated warehouse capacity in the U.S. was 3.73 billion cubic feet.

U.S. Cold Storage Market Trends

The cold storage industry in the U.S. is expected to grow at a significant CAGR from 2026 to 2033. The U.S. market is poised for substantial growth, driven by increasing demand for fresh and frozen food products. The country's robust economy, advanced infrastructure, and stringent food safety regulations are key factors contributing to market expansion. Moreover, the growing popularity of online grocery shopping and the need for efficient supply chain management are further propelling market growth.

Asia Pacific Cold Storage Market Trends

The Asia Pacific cold storage industry is expected to grow at the significant CAGR over the forecast period. Advancements in warehouse management and refrigerated transportation, coupled with government subsidies to develop the cold chain industry, enable service providers to tap into these emerging markets by leveraging innovative solutions that can overcome the complexities associated with transportation. Developing technological infrastructure and the presence of market players such as India-based Blue Star Limited and Japan-based NICHIREI CORPORATION are driving the segment growth. According to the Global Cold Chain Alliance (GCCA), in March 2023, NICHIREI CORPORATION ranked fifth in temperature-controlled space operated among GCCA members.

The cold storage market in China is expected to grow at a significant CAGR from 2026 to 2033. China's burgeoning middle class and rising disposable incomes are driving demand for high-quality, fresh food products. The country's expanding retail sector and e-commerce industry are further fueling the need for efficient cold storage solutions. In addition, government initiatives to modernize the food supply chain and reduce food waste are expected to stimulate market growth.

The Japan cold storage market is expected to grow at a significant CAGR from 2026 to 2033. Japan's aging population and increasing health consciousness are driving demand for fresh and frozen food products. The country's well-developed food distribution network and stringent quality standards are contributing to market growth. Furthermore, the growing popularity of convenience stores and online grocery shopping is expected to boost demand for cold storage facilities.

The cold storage market in India is expected to grow at a significant CAGR from 2026 to 2033. India's rapidly growing population and rising disposable incomes are driving demand for processed and packaged food products. The country's burgeoning retail sector and e-commerce industry are further fueling the need for efficient cold storage solutions. In addition, government initiatives to modernize the food supply chain and reduce food loss and waste are expected to stimulate market growth.

Europe Cold Storage Market Trends

The cold storage industry in Europe is expected to grow at a significant CAGR from 2026 to 2033. Europe's well-established food retail sector, combined with increasing consumer demand for convenience foods, is driving the demand for cold storage solutions. The region's stringent food safety regulations and emphasis on sustainability are further driving market growth. In addition, the growing popularity of online grocery shopping is expected to boost demand for cold storage facilities.

The cold storage market in Germany is expected to grow at a significant CAGR from 2026 to 2033. Germany's strong economy and well-developed food retail sector are driving demand for cold storage solutions. The country's focus on food safety and quality, coupled with increasing consumer preference for convenience foods, is further contributing to market growth. The growing popularity of online grocery shopping is also anticipated to fuel the market growth.

Middle East and Africa (MEA) Cold Storage Market Trends

The cold storage industry in the Middle East and Africa (MEA) is expected to grow at a significant CAGR from 2026 to 2033. The region's growing population, rising disposable incomes, and urbanization are driving demand for processed and packaged food products. The region's expanding retail sector and e-commerce industry are further fueling the need for efficient cold storage solutions. In addition, government initiatives to modernize the food supply chain and reduce food waste are expected to stimulate market growth.

The cold storage market in the UAE is expected to grow at a significant CAGR from 2026 to 2033. The country’s strong economy, growing population, and increasing tourism industry are driving demand for high-quality, fresh food products. The country's well-developed logistics infrastructure, combined with its focus on food safety and quality, as well as the growing popularity of online grocery shopping, is contributing to market growth.

Key Cold Storage Company Insights

Some of the key companies operating in the cold storage industry include Americold Logistics, Inc., LINEAGE LOGISTICS HOLDING, LLC, and Burris Logistics, among others.

-

Americold Logistics is a leading global provider of temperature-controlled warehousing and logistics services. The company operates a vast network of warehouses across North America, Europe, Australia, and New Zealand. Americold's competitive advantage lies in its extensive network, advanced technology, and strong customer relationships. The company focuses on providing customized solutions for a diverse range of customers, including retailers, food producers, and distributors.

-

Lineage Logistics is a major player in the temperature-controlled logistics industry. The company offers a comprehensive range of services, including warehousing, transportation, and value-added services. Lineage's competitive advantage stems from its focus on innovation, technology, and sustainability. The company invests heavily in automation and digital solutions to optimize operations and reduce costs. Additionally, Lineage's strong emphasis on sustainability positions it as a leader in the industry.

-

Burris Logistics is a family-owned and operated company that provides temperature-controlled warehousing and transportation services. The company serves a wide range of customers, including food producers, distributors, and retailers. Burris Logistics' competitive advantage lies in its strong customer focus, commitment to quality, and personalized service. The company's experienced team and dedicated workforce enable it to deliver reliable and efficient solutions.

Key Cold Storage Companies:

The following are the leading companies in the cold storage market. These companies collectively hold the largest market share and dictate industry trends.

- Americold Logistics, Inc.

- LINEAGE LOGISTICS HOLDING, LLC

- United States Cold Storage

- Burris Logistics

- NewCold

- NICHIREI CORPORATION

- Tippmann Group

- CONESTOGA COLD STORAGE

- FreezPak Logistics

- Confederation Freezers

Recent Developments

-

In March 2025, Americold announced the acquisition of a 10.7-million-cubic-foot cold-storage facility in Houston, Texas, for a total investment of USD 127 million, including planned expansion and equipment upgrades. The facility will add approximately 35,700 pallet positions to Americold’s portfolio, supporting a major new grocery retail contract awarded by one of the world’s largest retailers. The acquisition strengthens Americold’s presence in the high-turn retail cold storage segment, where it already holds the highest market share. The site also includes 16 acres of adjacent land for potential future expansion as part of Americold’s disciplined growth strategy. Americold expects the acquisition’s returns to align with those of past deals and reaffirms its long-term commitment to customer service, operational excellence, and shareholder value.

-

In April 2025, Lineage announced a major expansion of its U.S. cold-storage network through new acquisitions, greenfield developments, and automation initiatives in partnership with longtime customer Tyson Foods. The company will acquire four existing cold-storage warehouses from Tyson Foods for $247 million, adding 49 million cubic feet and 160,000 pallet positions, while onboarding over 1,000 Tyson employees. In parallel, Lineage will enter a multi-year agreement to design, build, and operate two fully automated warehouses in major U.S. markets, with Tyson as the anchor customer. These greenfield facilities will add 80+ million cubic feet and 260,000 pallet positions, leveraging Lineage’s LinOS technology for next-generation automated cold-chain operations.

-

In September 2024, BGO and Yukon Real Estate Partners collaborated to build a new, sustainable cold storage warehouse in New Century, Kansas. This 291,000-square-foot facility, leased by CJ Logistics America, will primarily serve Flora Food Group and is designed to meet the growing demand for modern cold storage solutions. The warehouse will feature advanced refrigeration systems, rail service, and sustainable design, aiming to reduce its environmental impact.

Cold Storage Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 217.10 billion

Revenue forecast in 2033

USD 474.21 billion

Growth rate

CAGR of 11.8% from 2026 to 2033

Base year for estimation

2025

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/Million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, temperature range, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; Norway; Netherlands; Switzerland; Russia; China; Japan; India; Singapore; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Americold Logistics, Inc.; LINEAGE LOGISTICS HOLDING, LLC; United States Cold Storage; Burris Logistics; NewCold; NICHIREI CORPORATION; Tippmann Group; CONESTOGA COLD STORAGE; FreezPak Logistics; Confederation Freezers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Storage Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cold storage market report based on type, temperature range, application, and region:

-

Type Outlook (Revenue, USD Million; 2021 - 2033)

-

Facilities/Services

-

Refrigerated Warehouse

-

Private & Semi-Private

-

Public

-

-

Cold Room

-

-

Equipment

-

Blast freezer

-

Walk-in Cooler and Freezer

-

Deep Freezer

-

Others

-

-

-

Temperature Range Outlook (Revenue, USD Million; 2021 - 2033)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen (Below -25°C)

-

-

Application Outlook (Revenue, USD Million; 2021 - 2033)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Norway

-

Netherlands

-

Switzerland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold storage market size was estimated at USD 185.75 billion in 2025 and is expected to reach USD 217.10 billion in 2026.

b. The global cold storage market is expected to grow at a compound annual growth rate of 11.8% from 2026 to 2033 to reach USD 474.21 billion by 2033.

b. North America dominated the cold storage market with a share of 33.6% in 2025. This is attributable to the strengthening network of warehouses and rising investments in the development of the logistics infrastructure in the region.

b. Some key players operating in the cold storage market include Cloverleaf Cold Storage (U.S.), Agro Merchants Group (U.S.), Burris Logistics (U.S.), Americold Logistics LLC (U.S.), and Wabash National Corporation (U.S.).

b. Key factors that are driving the cold storage market growth include low-carbon design, environmental auditing, and crafty construction of cold storage warehouses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.