- Home

- »

- Next Generation Technologies

- »

-

Collaborative Robot Market Size, Share, Industry Report 2033GVR Report cover

![Collaborative Robot Market Size, Share & Trends Report]()

Collaborative Robot Market (2026 - 2033) Size, Share & Trends Analysis Report By Payload Capacity (Up to 5kg, Up to 10kg) By Application (Handling, Packaging, Assembly), By Industry Vertical (Automotive, Food & Beverage, Electronics, Pharma), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-371-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Collaborative Robot Market Summary

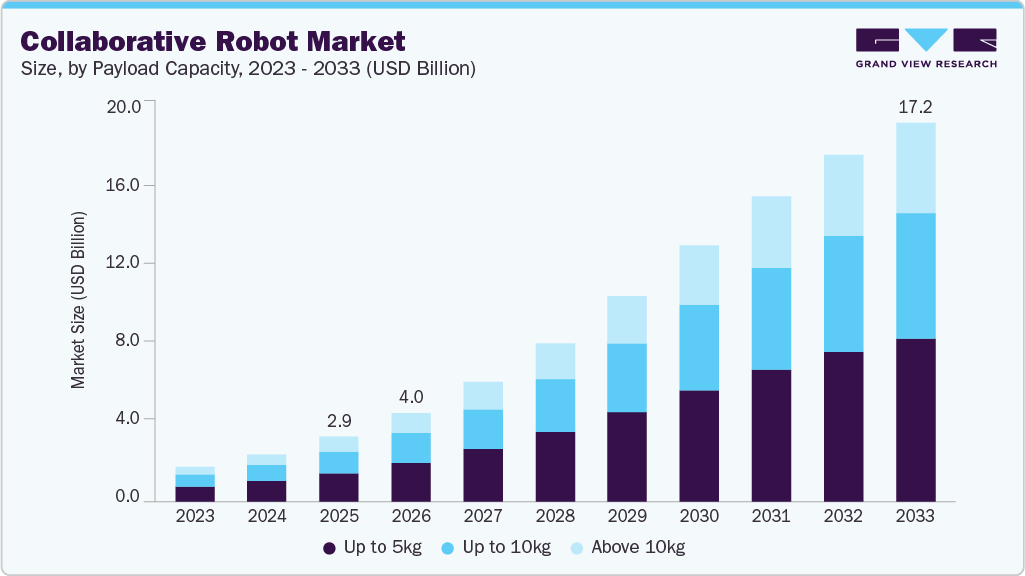

The global collaborative robot market size was estimated at USD 2,951.7 million in 2025 and is projected to reach USD 17,227.4 million by 2033, growing at a CAGR of 23.1% from 2026 to 2033. The market is primarily driven by the increasing demand for automation across various industries, including manufacturing, healthcare, automotive, and logistics.

Key Market Trends & Insights

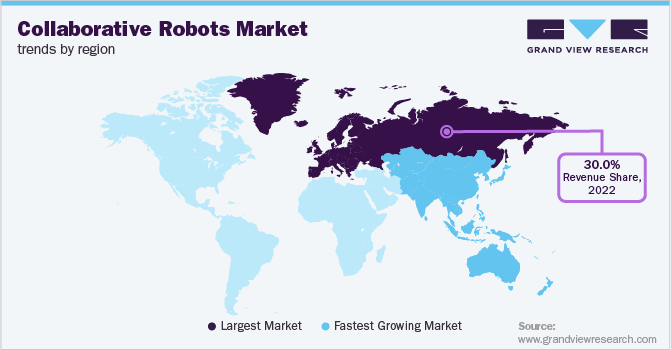

- Asia Pacific dominated the global collaborative robot market with the largest revenue share of over 51% in 2025.

- The collaborative robot market in China held a substantial market share in 2025.

- By payload capacity, the up to 5 kg segment led the market and held the largest revenue share of over 44% in 2025.

- By application, the assembly segment led the market and held the largest revenue share of over 23% in 2025.

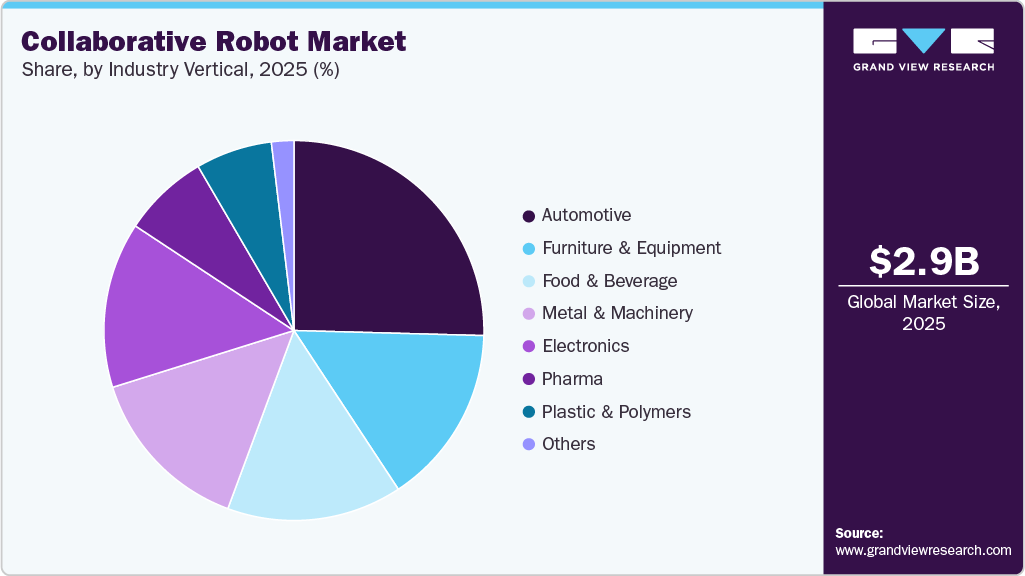

- By industry vertical,the automotive segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,951.7 million

- 2033 Projected Market Size: USD 17,227.4 million

- CAGR (2026-2033): 23.1%

- Asia Pacific: Largest market in 2025

Companies are seeking cost-effective and flexible automation solutions to increase productivity and reduce human errors. Collaborative robots offer a unique advantage by working alongside humans, enhancing efficiency without the need for expensive safety barriers. This factor is encouraging the wider adoption of collaborative robot (cobots) across various industries, which is expected to fuel market growth in the coming years.The collaborative robot (cobots) offer a higher return on investment (ROI) than traditional industrial robots, making them attractive for businesses of all sizes. The lower upfront costs associated with cobots, along with their ease of programming and deployment, allow companies to realize financial benefits quickly. This factor is particularly appealing for small and medium-sized enterprises (SMEs), which may have limited budgets but seek automation solutions that enhance productivity without significant capital expenditure. These factors are driving the adoption of collaborative robots across various industries, thereby driving the collaborative robot industry expansion.

In addition, growing advancements in technology are driving market growth. The increasing adoption of artificial intelligence (AI), machine learning, and the integration of 5G technology are enhancing the capabilities of cobots. These technologies enable them to perform complex tasks more accurately and efficiently, while also enhancing their ability to work safely alongside human operators, thereby expanding the collaborative robot industry.

Furthermore, the increasing emphasis on workplace safety has become a key driver for the adoption of collaborative robots. Cobots are designed with built-in safety features that allow them to operate safely alongside humans without the need for extensive safety barriers. This capability not only enhances worker safety but also improves ergonomics by taking over physically demanding or monotonous tasks, thereby reducing the risk of injury among employees. This trend is expected to further boost market growth in the coming years.

Moreover, the market is witnessing increased adoption across various industries, including automotive, electronics, healthcare, and food processing. Each sector recognizes the potential benefits of integrating cobots into their operations-whether it’s improving assembly line efficiency in automotive manufacturing or enhancing quality control processes in electronics production. This broad applicability is driving collaborative robot growth ascompanies seek tailored automation solutions that fit their specific needs.

Payload Capacity Insights

The up to 5kg segment accounted for the largest market share of over 44% in 2025. The growth is attributable to the increasing demand for enhanced in-building wireless connectivity, catalyzed by the burgeoning number of smartphone users and data-intensive applications. As buildings become smarter and more connected, the requirement for seamless indoor Payload Capacity has become paramount. Indoor DAS solutions address these needs by providing reliable wireless Payload Capacity within these buildings.

The above 10kg segment is expected to witness the fastest CAGR of 24.3% from 2026 to 2033, driven by the growing demand for Collaborative Robot capable of handling heavier tasks. These cobots are essential for applications that require high precision and reliability in managing bulky components, such as in automotive assembly and metalworking processes. The adoption of collaborative robot weighing over 10kg is expected to surge as industries seek to improve operational efficiency and reduce the risks associated with manual labor, particularly in heavy lifting. This trend reflects a broader shift toward automation in sectors that require robust solutions for heavy-duty applications, which is further expected to propel the segment’s growth in the coming years significantly.

Application Insights

The assembly segment accounted for the largest market shareof over 23% in 2025, driven by the increasing adoption of cobots for tasks such as nut driving, bolting, and part fitting. This growth is largely attributed to the rising demand for automation in various industries, particularly in automotive and electronics manufacturing, where cobots enhance productivity and reduce the risk of workplace injuries. This trend is expected to contribute significantly to the segment's growth.

The gluing & welding segment is expected to register the fastest CAGR from 2026 to 2033. This growth can be attributed to the growing need for automation in the logistics and manufacturing sectors. The rise of e-commerce has significantly increased the demand for efficient material handling solutions, where pick and place operations are critical. As companies continue to seek ways to enhance productivity and reduce operational costs, the adoption of cobots in pick and place applications is projected to surge, positioning this segment for substantial growth in the coming years. Further contributing to this segment's robust growth during the forecast period.

Industry Vertical Insights

The automotive segment dominated the market in 2025, owing to its extensive adoption of automation technologies. Collaborative robots are particularly valuable in this sector for tasks such as assembly, welding, and painting, where they enhance productivity and ensure precision. The ability of cobots to work alongside human operators without extensive safety barriers enables automotive manufacturers to optimize workflows, reduce production downtime, and lower costs. Furthermore, the automotive industry's continuous push for innovation and efficiency further drives the demand for Collaborative robots, solidifying their role as essential tools in modern manufacturing environments, thereby driving segmental growth.

The electronics segment is expected to register a significant CAGR from 2026 to 2033. This growth can be attributed to the increasing complexity of electronic manufacturing processes that require high precision and repeatability. Collaborative robots excel in tasks such as dispensing, labeling, and assembly of intricate components, which are critical in the electronics industry. In addition, ongoing advancements in cobot technology, such as improved sensors and AI capabilities, enable these robots to handle more sophisticated tasks efficiently.

Regional Insights

The collaborative robot market in the Asia Pacific region accounted for the largest revenue share of over 51% in 2025. The increasing growth of the manufacturing industry in countries of the region, such as China and Japan, and heavy investments in automation to maintain competitive advantages, are driving the market growth.

Japan Collaborative Robot Market Trends

Japan collaborative robot marketis expected to grow rapidly in the coming years, characterized by its advanced robotics technology and high levels of automation in industries such as automotive and electronics. The country's aging workforce drives the need for more efficient production methods, leading to increased investment in Collaborative Robot that can work safely and effectively alongside human operators.

The collaborative robot market in China held a substantial market share in 2025. The growth of the market can be attributed to the increasing demand for cost-effective automation solutions and the rise of e-commerce logistics. Furthermore, the shift towards high-tech manufacturing, driven by initiatives such as China's "Made in China 2025" policy, enhances the adoption of Collaborative Robot across various sectors, thereby driving regional growth.

North America Collaborative Robot Market Trends

The North America collaborative robot market accounted for a revenue share of over 20% in 2025. The growth can be attributed to the high labor costs and a strong emphasis on workplace safety. Companies are increasingly adopting Collaborative Robots to enhance productivity while ensuring compliance with safety regulations. The region's advanced manufacturing sector, particularly in the automotive and electronics industries, also contributes to the rising demand for automation solutions, making Collaborative Robots an attractive option for enhancing operational efficiency.

U.S. Collaborative Robot Market Trends

The collaborative robot market in the U.S. held a dominant position in 2025. Government support for automation through various initiatives is fostering growth in the U.S. market. Programs aimed at promoting industrial automation and technological innovation provide businesses with the resources and incentives needed to invest in robotic solutions. This support is critical for driving the evolution of robotics within the U.S. economy.

Europe Collaborative Robot Market Trends

The collaborative robot market in Europe is expected to grow at a significant CAGR of over 23% from 2026 to 2033, driven by government initiatives promoting industrial automation and sustainability. The region's focus on Industry 4.0 technologies encourages manufacturers to integrate Collaborative Robot into their processes, which is expected to stimulate market growth further.

The UK collaborative robot market is expected to grow rapidly in the coming years, driven by a growing emphasis on innovation and productivity enhancement across various industries. The government's support for advanced manufacturing technologies promotes investment in automation solutions, including Collaborative Robot, which are increasingly seen as essential for maintaining competitive advantage in global markets.

The collaborative robot market in Germany held a substantial market share in 2025. Germany’s commitment to enhancing wireless infrastructure and the rapid deployment of 5G networks is boosting the market growth. DAS rollouts are becoming more crucial to cater to the increasing demand for uninterrupted high-speed mobile data services across commercial spaces, healthcare establishments, and educational campuses, thereby driving market growth in the coming years.

Key Collaborative Robot Company Insights

Some of the key players operating in the market include ABB Group and KUKA AG.

-

ABB Group operates in power, robotics, and automation technology. It has four business divisions, including electrification products, discrete automation and motion, process automation, and power grids. The company’s product offering includes a series of Collaborative Robot such as YuMi, GoFa, and SWIFTI. It has a vast geographic presence across North America, South America, Asia Pacific, Europe, and the Middle East and Africa.

-

KUKA AG is a German supplier of intelligent automation solutions, involved in the development, production, and sales of industrial robots, controllers, and related software. The company specializes in industrial robotics, service robotics, automation, software, and controllers. Its major business units include KUKA Industries, KUKA Robotics, KUKA Systems, and Swisslog.

Energid Technologies Corporation and Fanuc Corporation are some of the emerging market participants.

-

Energid Technologies Corporation (acquired by Teradyne, Inc. is a prominent developer of advanced robotic systems and related software. The company emphasizes its services to the aerospace, agricultural, industrial, transportation, defense, and medical markets. Energid’s patented software solution is referred to as Actin, developed especially for commercial, industrial, and mission-oriented robots.

-

Fanuc Corporation is a provider of automation products as well as services such as robots, robot machines, computerized numerical control (CNC), servo motors, and laser products. It emphasizes the production and selling of robots & robotic products and CNC on a wide scale.

Key Collaborative Robot Companies:

The following are the leading companies in the collaborative robot market. These companies collectively hold the largest Market share and dictate industry trends.

- ABB Group

- DENSO Corporation

- Epson America Inc.

- AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD

- Comau S.p.A.

- Energid Technologies Corporation

- Fanuc Corporation

- KUKA AG

- Rethink Robotics GmbH

- Robert Bosch GmbH

- Techman Robot Inc

- Universal Robots

- Yaskawa Electric Corporation

- Precise Automation, Inc.

- MRK-Systems GmbH

Recent Developments

-

In June 2025, ABB Robotics expanded its large industrial robot portfolio with the launch of the IRB 6730S, IRB 6750S, and IRB 6760 models at Automatica in Munich, Germany.

-

In May 2025, Schneider Electric displayed its Lexium cobot family, including RL 3, RL 12, and the newly extended RL 18 model with an 18kg payload, at Automate 2025 in Detroit.

-

In September 2024, ABB Robotics (ABB Group) launched its new Ultra Accuracy feature for the GoFa collaborative robot family, achieving over ten times greater path accuracy than other cobots on the market, with a precision of 0.03 mm. This advancement addresses the growing demand for high precision in industries such as electronics, automotive, aerospace, and metal fabrication, where exact positioning is crucial for maintaining product quality.

Collaborative Robot Market Report Scope:

Report Attribute

Details

Market size value in 2026

USD 4,027.6 million

Revenue forecast in 2033

USD 17,227.4 million

Growth rate

CAGR of 23.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Payload capacity, application, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

ABB Group; DENSO Corporation; Epson America Inc.; AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD; Comau S.p.A.; Energid Technologies Corporation; Fanuc Corporation; KUKA AG; Rethink Robotics GmbH; Robert Bosch GmbH; Techman Robot Inc.; Universal Robots; Yaskawa Electric Corporation; Precise Automation, Inc.; MRK-Systems GmbH

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Collaborative Robot Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest application trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global collaborative robot market report based on payload capacity, application, industry vertical, and region:

-

Payload Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 5Kg

-

Up to 10Kg

-

Above 10Kg

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Assembly

-

Pick & Place

-

Handling

-

Packaging

-

Quality Testing

-

Machine Tending

-

Gluing & Welding

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Food & Beverage

-

Furniture & Equipment

-

Plastic & Polymers

-

Metal & Machinery

-

Electronics

-

Pharma

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global collaborative robot market size was estimated at USD 2,951.7 million in 2025 and is expected to reach USD 4,027.6 million in 2026.

b. The global collaborative robot market is expected to grow at a compound annual growth rate (CAGR) of 23.1% from 2026 to 2033, reaching USD 17,227.4 million by 2033.

b. The Asia Pacific dominated the collaborative robots market with a share of over 51% in 2025. This is attributable to the enormous application of co-bots in different verticals, such as electronics, logistics, and inspection in the region.

b. Some key players operating in the collaborative robot market include ABB Group; DENSO Robotics; EPSON Robots; Energid Technologies Corporation; F&P Robotics AG; Fanuc Corporation; KUKA AG; MRK-Systeme GmbH; Precise Automation, Inc.; Rethink Robotics, Inc.; Robert Bosch GmbH; Universal Robots A/S; Yaskawa Electric Corporation; MABI AG; Techman Robot by Quanta Storage, Inc.; Franka Emika GmbH; AUBO Robotics Inc.; and Comau S.p.A.

b. Key factors that are driving the market growth include increasing investments for automation in the manufacturing processes, higher return on investment (RoI) and lower price of collaborative robots, growing opportunities for robot installations in various industry verticals, and increasing demand in the logistics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.