- Home

- »

- Medical Devices

- »

-

Dermatology Devices Market Size & Share Report, 2030GVR Report cover

![Dermatology Devices Market Size, Share & Trends Report]()

Dermatology Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Diagnostic Devices, Treatment Devices), , By Application, By End Use (Hospitals, Clinics, Others), And Segment Forecasts

- Report ID: GVR-1-68038-781-0

- Number of Report Pages: 129

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dermatology Devices Market Summary

The global dermatology devices market size was estimated at USD 13.9 billion in 2023 and is projected to reach USD 34.34 billion by 2030, growing at a CAGR of 12.6% from 2024 to 2030. The increasing prevalence of skin cancer and other skin diseases is contributing largely to the high demand for the skin care instruments market.

Key Market Trends & Insights

- North America accounted for the largest share of 43.00% in terms of revenue in 2023.

- The U.S. dermatology device market is expected to continue growing in the coming years.

- By product, the treatment devices segment held the largest market share of about 79.77% in 2023.

- By application, the hair removal application segment held the largest market share in 2023.

- By end use, the hospital segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.9 Billion

- 2030 Projected Market Size: USD 34.34 Billion

- CAGR (2024-2030): 12.6%

- North America: Largest market in 2023

Furthermore, growing awareness among people about the aesthetic appeal and technological advancements in skin care instruments are also increasing the adoption of these devices significantly. The rise in disposable income is also considered as one of the important factors driving the market growth of dermatology devices. Skin cancer prevalence is increasing, with melanoma and non-melanoma skin cancers rising. The Skin Cancer Foundation reports that every year in the U.S., approximately 10,130 people die due to melanoma. Additionally, according to the International Agency for Research on Cancer, globally, the number of new melanoma skin cancer is estimated to increase from 324,635 in 2020 to 413,132 by 2030. As a result, there is a growing demand for quick and accurate diagnosis of skin disorders, and it is expected to boost the market in forecast years.

The COVID-19 pandemic has affected various industries. Due to the pandemic, there has been a decrease in the number of patients visiting hospitals and clinics for non-essential medical procedures, including those related to dermatology. This has led to a decline in the demand for dermatological instruments, such as laser therapy and microdermabrasion instruments. However, the market for dermatological devices has seen a V shape recovery. With the successful rollout of vaccines in all regions, the volume of dermatological tools is beginning to recover to its pre-pandemic levels. In 2021, the market has witnessed high demand due to the backlog of 2020 and increased interest from people related to dermatological procedures. The dermatological devices market has witnessed high volatility during the past few months and is expected to return to its normal growth trend by 2023.

The dermatology devices market is developing rapidly due to growing aesthetic awareness. In the current scenario, people of all age groups are increasingly concerned about enhancing their aesthetic appeal. Complete skin rejuvenation improves the aesthetic appeal of a person. There has been a noticeable trend towards utilizing technologically advanced equipment in the field of dermatology. These devices help diagnose and treat various skin diseases accurately and improve one's overall appearance. The advent of non-invasive laser therapies has particularly led to a surge in demand for such advanced equipment.

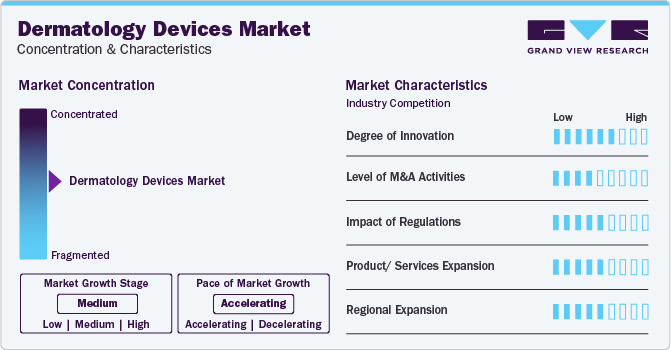

Market Characteristics

Innovations in imaging technologies have revolutionized dermatological diagnostics. High-resolution imaging devices, such as confocal microscopy and optical coherence tomography, provide detailed insights into skin structures, enabling more accurate and early detection of skin abnormalities. This has significantly improved diagnostic precision and streamlined treatment planning.

Mergers and acquisitions have contributed to the consolidation of the dermatology sales companies. Larger companies seeking to strengthen their market position and broaden their product portfolios have engaged in acquisitions to gain access to innovative technologies, intellectual property, and established customer bases.

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), set stringent requirements for the approval and clearance of dermatology devices. Manufacturers must adhere to predefined standards and undergo rigorous testing to demonstrate the safety and efficacy of their products before they can enter the market.

Substitute services often encompass non-invasive or minimally invasive treatment modalities that offer alternatives to conventional dermatological devices. Procedures such as chemical peels, microdermabrasion, and certain light therapies provide effective treatment options with reduced discomfort and downtime compared to some device-based interventions.

End-user concentration varies geographically, with certain regions having a higher concentration of dermatology practices or healthcare facilities equipped with dermatological devices. Manufacturers need to adapt their market approach based on regional variations in end-user concentration, considering factors such as population density, healthcare infrastructure, and regulatory environments.

Product Insights

The treatment devices segment held the largest market share of about 79.77% in 2023 and is also expected to show the highest CAGR over the forecast period. This is mainly due to the availability of wide applications of dermatology treatment. In addition, the launch of novel technologies in the laser device category is also attributed to the high segment growth. The low market share for diagnostic devices can be attributable to less awareness level pertaining to the various novel instruments. However, the rising prevalence of skin cancer is anticipated to drive this segment growth in the future.

Among the treatment devices, the laser product held the largest market share in 2023 and is also expected to show the highest growth over the forecast period owing to its wide adoption. On the other hand, dermatoscopes dominated the diagnostic devices segment in 2023 due to the availability of advanced technologies.

The dermatology diagnostic devices market is anticipated to show significant growth over the forecast period due to the increasing prevalence of dermatological conditions globally. The rising incidence of skin disorders, coupled with growing awareness about early diagnosis and treatment, has elevated the demand for advanced diagnostic devices market share in the dermatology devices market.According to the 2022 statistics from the American Cancer Society, around 99,780 new skin melanoma cases were anticipated to be diagnosed in the United States that year. Among these cases, 57,180 were expected among males, ad 42,600 among females. This surge in the incidence of skin cancer, alongside other dermatological conditions, significantly drove the heightened demand for dermatology devices.

Application Insights

The hair removal application segment held the largest market share in 2023. The treatment application segment is bifurcated into hair removal, skin rejuvenation, acne, psoriasis, and tattoo removal, wrinkle removal and skin resurfacing, body contouring and fat removal, cellulite reduction, vascular and pigmented lesion removal and others.

Hair removal devices particularly laser devices have been proved to be safer for all skin tones & hair color and facilitate less painful treatment procedures, thereby propelling the market. A rise in demand for cosmetic laser treatments like tattoo removal, skin resurfacing and skin tightening has significantly increased the adoption of dermatology devices. According to the International Society of Aesthetic Plastic Surgery, plastic surgeons worldwide have reported a significant increase in the number of procedures performed in 2022. The figures show a rise of 11.2% in overall procedures, with more than 14.9 million surgical and 18.8 million non-surgical procedures conducted globally.

This indicates that the demand for aesthetic treatments is increasing and will directly impact the adoption of technologically advanced and efficient dermatology devices.

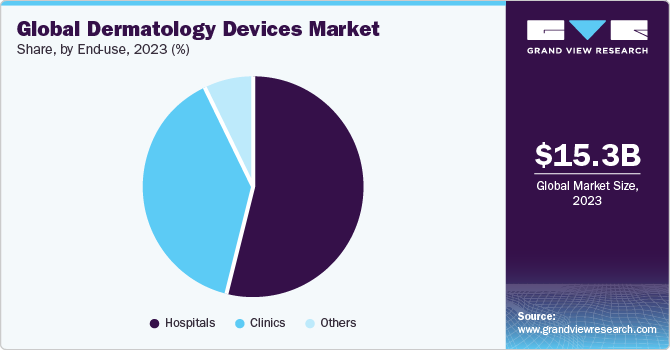

End-Use Insights

The hospital segment held the largest market share in 2023 owing to the presence of advanced dermatology equipment in hospital settings. In addition, the availability of wide treatment options in such facilities has also increased the number of visits for skin disease diagnosis and treatments in these facilities.

With the need for specialized skin care treatments, patients tend to visit specialty dermatology clinics for rapid and effective service, which has led to the high growth of the clinic segment. Moreover, the global rise in the prevalence of skin cancer and melanoma coupled with an increasing number of clinics offering skin care services has led to an increase in the number of patients visiting dermatology clinics for treatment and care.

Clinics are cosmetic and medical facilities that focus on diagnosis and treatment of skin conditions. In clinics, both surgical and nonsurgical services are offered by certified plastic surgeons. According to TripleTree, as of 2020, there were 9,000 dermatology practices and 14,000 dermatologists in the U.S. Among the total number of practices, 34% were solo practices and 48% practices include three or more physicians.

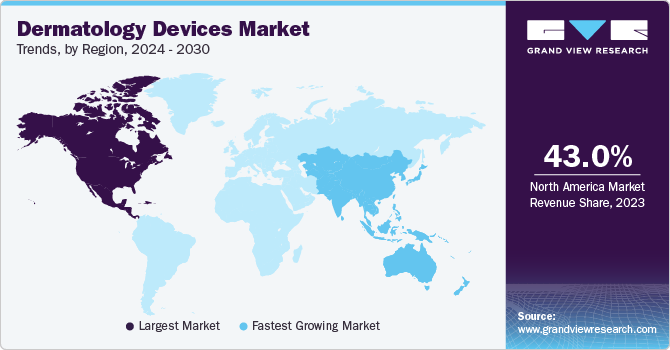

Regional Insights

In 2023, North America accounted for the largest share of 43.00% in terms of revenue in the market. The increasing prevalence of skin cancer and other skin diseases such as acne, eczema & rosacea and increasing adoption of cosmetic procedures are some of the major factors contributing to the growth of the market in this region.

The U.S. dermatology device market is expected to continue growing in the coming years, driven by increasing demand for non-invasive and minimally invasive treatments, as well as advancements in technology, the development of new devices and increasing prevalence of skin care diseases. According to CDC, Acne vulgaris affects 80% of the U.S population at some time during their lives 20% of which suffer from severe acne, which can result in permanent physical and mental scarring.

High medical tourism in the Asia Pacific region due to affordable treatment options is expected to increase the market growth. An increase in the number of major multinational companies investing in research & development in these regions has proved to be a major factor driving the growth of industries in the region. The rising beauty consciousness amongst men and women alike is also anticipated to drive the regional market. China is one of the major countries in this industry.

China's growing aesthetic industry is a major driver of the dermatology device market. Laser therapy devices, particularly for hair removal and scar reduction, are in high demand due to their minimally invasive nature and quick recovery times. The Chinese population's rising disposable income translates to increased spending on beauty and personal care is expected to propel market growth.

India's dermatology devices market size is experiencing rapid expansion, particularly in major metropolitan areas across various states. This growth is primarily attributed to the growing demand for beauty enhancement treatments. For instance, as per the International Society of Aesthetic Plastic Surgery Report 2022, the year saw a total of 711,922 aesthetic procedures in India. These included 387,767 surgical procedures and 324,155 non-surgical procedures. The country's substantial volume of aesthetic procedures is anticipated to drive the demand for the India dermatology devices market.

Key Dermatology Devices Company Insights

Some of the key players operating in the market include Alma Lasers GmbH, Syneron Medical Ltd., Solta Medical, Inc., Cynosure, Ifnc., Cutera, Inc.

-

Alma Lasers is a company providing light-based, laser, ultrasound, and radiofrequency solutions in surgical and aesthetic fields. The company is present in over 80 countries across the globe. It operates through three major business segments: Surgical, beauty solutions, and medical aesthetic solutions.

-

Cynosure, Inc. is a manufacturer of light-based systems used in medical and aesthetic procedures. The company’s products are used in procedures such as body contouring, skin rejuvenation, hair removal, and scar reduction. It holds 37 patents and has its own distribution channel with subsidiaries in over 60 countries across the globe.

3Gen, Aesthetic Group, Ambicare Health, Image Derm, Inc are some of the emerging market participants in the dermatology devices market.

-

3Gen is a medical devices company engaged in manufacturing and marketing of DermLite. The company offers a wide range of dermatoscopes for diagnosis of various skin care conditions and diseases. Majority of the company’s products are used for skin cancer detection.

-

Image Derm, Inc. is a medical devices company engaged in manufacturing and marketing of microdermabrasion devices. The company offers products for crystal microdermabrasion, diamond microdermabrasion, and serum infusion. It offers its diverse products for various end-use settings such as beauty salons, dermatology clinics, and spas.

Key Dermatology Devices Companies:

The following are the leading companies in the dermatology devices market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these dermatology devices companies are analyzed to map the supply network.

- Alma Lasers GmbH

- Cynosure, Inc.

- Solta Medical, Inc.

- Cutera, Inc.

- Syneron Medical Ltd.

- Canfield Scientific, Inc.

- 3Gen

- Aesthetic Group

- Ambicare Health

- Image Derm, Inc

Recent Developments

-

In July 2023, Canfield Scientific had announced the 25th World Congress of Dermatology, which was held from the 4th to the 7th of July at the Suntec Singapore Convention & Exhibition Centre. It comprised in-person demonstrations of its advanced and latest dermatology devices and solutions, including IntelliStudio, VEOS, DermaGraphix, and VECTRA WB360.

-

In April 2023, Canfield Scientific was certified to both ISO 9001:2015 and ISO 13485:2016 standards for its quality management system.

-

In February 2023, Candela Corporation, a global manufacturer of medical aesthetic devices announced that the dual-wavelength Frax Pro non-ablative fractional laser platform and the Nordlys multi-application platform with Selective Waveband Technology (SWT) were licensed and made available by Health Canada.

Dermatology Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.81 billion

Revenue forecast in 2030

USD 34.34 billion

Growth Rate

CAGR of 12.6%

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, End-use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Sweden; Norway; Denmark; Netherlands; Belgium; Switzerland; China; Japan; India; Australia; South Korea; Thailand; Malaysia; Singapore; Indonesia; Philippines; Brazil; Mexico; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Israel; Turkey; Kuwait

Key companies profiled

Alma Lasers GmbH; Cynosure, Inc.; Solta Medical, Inc.; Cutera, Inc.; Syneron Medical Ltd.; Canfield Scientific, Inc.; 3Gen; Aesthetic Group; Ambicare Health; and Image Derm, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

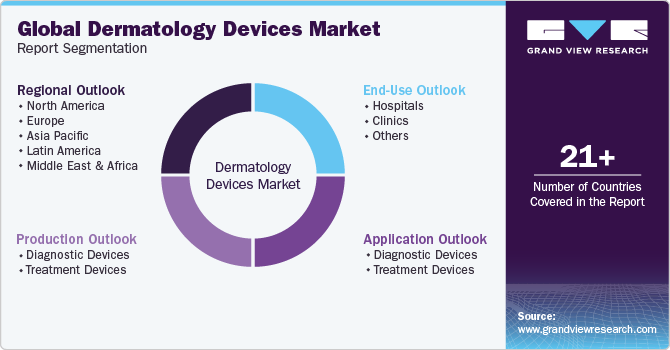

Global Dermatology Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dermatology devices market report based on product, application, end-use, and region.

-

Production Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Devices

-

Dermatoscopess

-

Microscopes

-

Other Imaging Devices

-

Biopsy Devices

-

-

Treatment Devices

-

Light Therapy Devices

-

Lasers

-

Electrosurgical Equipment

-

Liposuction Devices

-

Microdermabrasion Devices

-

Cryotherapy Devices

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnostic Devices

-

Skin Cancer Diagnosis

-

Other

-

- Treatment Devices

- Hair Removal

- Skin Rejuvenation

- Acne, Psoriasis, and Tattoo Removal

- Wrinkle Removal and Skin Resurfacing

- Body Contouring and Fat Removal

- Cellulite Reduction

- Vascular and Pigmented Lesion Removal

- Others

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

Belgium

-

Switzerland

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Philippines

-

Indonesia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

Kuwait

-

Israel

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global dermatology devices market size was estimated at USD 13.9 billion in 2022 and is expected to reach USD 15.2 billion in 2023.

b. The global dermatology devices market is expected to grow at a compound annual growth rate of 12.3% from 2023 to 2030 to reach USD 34.3 billion by 2030.

b. North America dominated the dermatology devices market with a share of 43.0% in 2022. This is attributable to the Increasing prevalence of skin cancer and other skin diseases such as eczema and rosacea and the rising adoption of cosmetic dermatology procedures.

b. Some key players operating in the dermatology devices market include Alma Lasers GmbH; Cynosure, Inc.; Solta Medical, Inc.; Cutera, Inc.; Syneron Medical Ltd.; Canfield Scientific, Inc.; 3Gen; Aesthetic Group; Ambicare Health; and Image Derm, Inc.

b. Key factors that are driving the dermatology devices market growth include the Increasing prevalence of skin cancer and other skin diseases, growing awareness of cosmetic procedures to improve the aesthetic appeal, and technological advancements in dermatology devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.